Credible Review: Is Credible Labs Legit?

If you’re searching for debt consolidation, student loan refinancing, or a personal loan, review Credible Labs! Credible is #1 rated for personal loans out of over 150+ direct lenders and banks. We’ll tell you exactly why this free online loan marketplace is so highly rated and give you the keys to finding a low-interest loan no matter what your credit score is.

Who is Credible Labs?

Credible Labs (Credible), established in 2012, is a consumer finance marketplace for debt consolidation and personal loans. Credible’s online loan application makes it easy for consumers to compare pre-qualified loan rates. Credible also offers student loans, credit cards, and mortgages from a diverse pool of top-rated lenders. Backed by major media conglomerate Fox Corporation (Ticker Symbol: FOXA), known for brands like FOX News, FOX Sports, and FOX Entertainment, Credible brings stability and corporate strength to the fintech landscape. (2)

Credible Labs is a team of data scientists and financial technology experts specializing in loan comparison algorithms, led by their CEO, Stephen Dash. Credible’s team focuses on building cutting-edge tools that empower you to find the best loan options faster, saving you time and money. Credible Labs utilizes proprietary technology to personalize user experiences and provide accurate rates. The platform’s loan interface is directly linked to lenders and credit bureaus, ensuring consumers receive the most accurate and up-to-date loan offers, with rapid responses to inquiries.

Offering a carefully vetted list of approximately twenty top-rated lenders, including Zable, Upstart, LendingTree, PenFed, LightStream, Upgrade, and Discover, Credible prioritizes quality over quantity, avoiding the overwhelming “solicitation” feel of some online loan marketplaces. This approach delivers a highly effective, personalized experience for users seeking the right loan, whether for refinancing credit cards, student loans, mortgages, funding home renovations, or making other large purchases. If you’re in the market for a personal loan, Credible.com should be one of your first stops.

Review on Credible’s Personal Loans & Debt Consolidation Options

Are you ready to bypass the tedious process of filling out numerous loan applications, all to secure a single low-interest loan? Ditch the hassle with Credible, our top-ranked personal loan pick for 2023 and 2024. This free platform brings 18-20 top lenders head-to-head, letting you compare rates, terms, and features in minutes. No more endless applications or guesswork: find your perfect loan, whether it’s for debt consolidation, a dream vacation, or anything in between.

This Credible review dives deep into everything you need to know: loan options, real-time rate comparisons, credit score requirements, and customer reviews. And speaking of benefits, Credible also offers a best-rate guarantee. We’ll show you exactly how it all works.

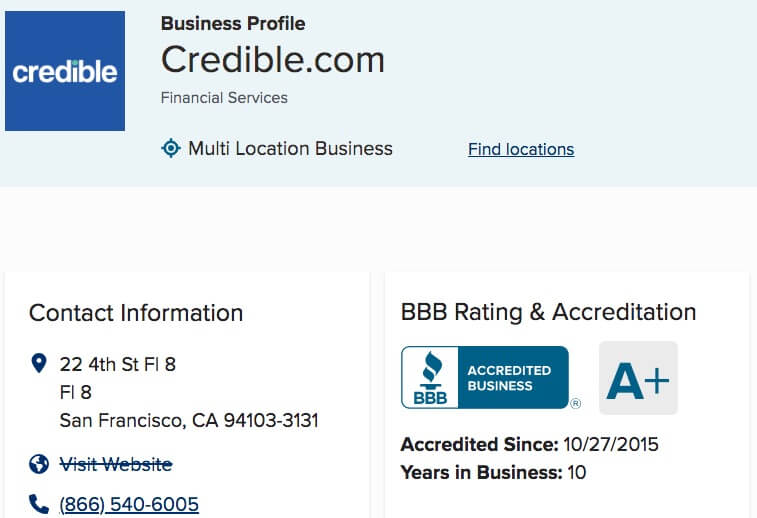

Credible personal loan reviews are excellent, receiving high ratings from reliable sources such as the Better Business Bureau (BBB) and regulatory agencies.

- Credible has an impressive A+ rating and accreditation from the BBB, receiving only a handful of complaints annually.

- The NMLS, the regulatory agency overseeing licensing and registrations for personal loan providers, illustrates zero complaints against Credible.

- Credible’s average customer review rating is 4.6/5 stars, based on over 5,340 Trustpilot reviews.

Read on to learn why Credible should be your first stop for personal loans. Credible pros and cons will be highlighted next!

Check Credible Personal Loan Rates for Free!

Pros

Quickly Compare Personal Loans from Top-Rated Lenders: Credible.com helps you compare personal loan rates and monthly payments in as quickly as 5 minutes or less.

Reputable Lenders: Credible personal loans are already vetted and include top-rated lenders. They did the due diligence that would have taken you weeks to complete.

No Negative Effect on Credit: The pre-qualification process allows borrowers to check loan rates at Credible.com/Personal-Loan/ without a hard inquiry on their credit report, avoiding any negative impact on credit scores.

Innovative Technology: Credible’s technology makes it simple to find the best personal loan for you. It is tailored to your financial situation and needs. Best of all, their services are completely free of charge.

Credible’s “Guaranteed Best Rate” offer: Credible offers a $200 gift card to guarantee the best rates. If you are pre-approved for a loan elsewhere at a better rate, they will give you $200.

Personal loans for bad credit: Credible offers a unique evaluation process for high-risk and bad credit personal loans. Consequently, applicants with a low credit score are more likely to qualify for a loan at Credible. Bad credit applicants can check if they’re eligible for a loan with any of the top-rated lenders by answering a few simple questions.

Cons

Disqualify for loan forgiveness: Federal student loans may include income-based repayment plans. However, these options will no longer be available after refinancing a federal student loan with Credible private student loans.

Lack of access to all lenders: You’ll only have access to lenders that work with Credible. As of 2024, they have around 20 partner lenders.

Credible can’t guarantee approval: Credible can pre-qualify you for a loan. However, pre-qualification is not the same as getting approved. There is a chance the direct lender will reject you for a loan.

Loan origination fees: Some lenders charge up-front fees that can be rolled into the loan or subtracted from the amount disbursed.

How do Credible loans work?

- For free, you can compare lenders, rates, and personal loans.

- Credible lets you get pre-approved loan offers within minutes, whether you have poor to fair credit or good to excellent credit. Personal loans of all types are available.

- Borrow anywhere from $600 to $100,000, with interest rates starting as low as 6.40% as of February 2024. Credible loan rates can change from month to month. However, you can check loan rates for free above for the most up-to-date information.

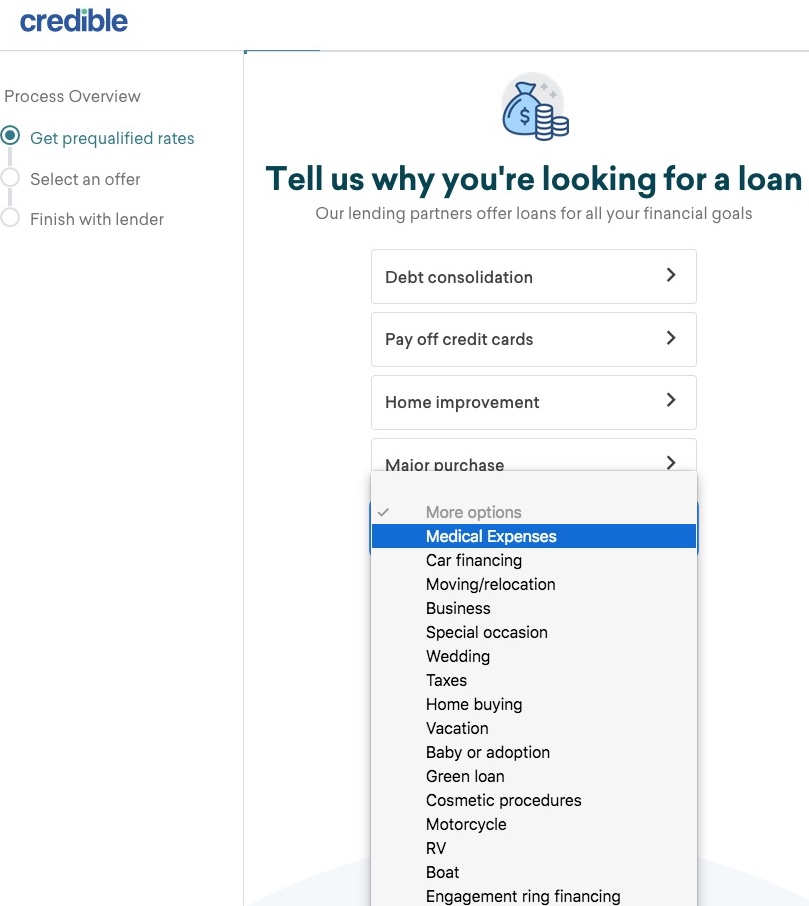

What can you use Credible personal loans for?

Credible’s personal loans can be used for various purposes, including:

- Paying for a wedding

- Medical expenses

- Consolidating credit cards with a low-interest loan

- Home renovation or improvement projects

- Buying or refinancing a car

- Starting a business

- Covering emergency expenses

- Taxes

- Adoption

- Cosmetic procedures

- RV and Boat

- Engagement ring financing

- Moving costs

- Dealing with unexpected emergencies

- Financing a vacation

- Student loans and student loan refinancing

- Combine your debts into a single Credible personal loan

Compare Credible’s Top-Rated Personal Loans for Fair Credit

| Lender | Fixed (APR) | Loan Amounts |

Minimum Credit Score

|

| Upstart Personal Loan | 6.40% to 35.99% | $1,000 to $50,000 | 620 |

| LightStream Personal Loan | 7.49% to 25.49% | $5,000 to $100,000 | 700 |

| Discover Personal Loan | 7.99% to 24.99% | $2,500 to $40,000 | 660 |

| PenFed Credit Union Loan | 8.49% to 17.99% | $600 to $50,000 | 700 |

| Upgrade Personal Loan | 8.49% to $35.99% | $1,000 to $50,000 | 600 |

| Sofi Personal Loan | 8.99% to 25.81% | $50,000 to $100,000 |

Does Not Disclose

|

| Best Egg Personal Loan | 8.99% to 35.99% | $20,000 to $50,000 | 600 |

| LendingClub Personal Loan | 9.57% to 35.99% | $1,000 to $40,000 | 660 |

| Avant Personal Loan | 9.95% to 35.99% | $20,000 to $35,000 | 550 |

| Universal Credit Personal Loan | 11.69% to 35.99% | $1,000 to $50,000 | 560 |

| OneMain Financial Personal Loan | 18% to 35.99% | $1,500 to $20,000 |

Does Not Disclose

|

| Zable Personal Loans | 8% to 30% | $1,000 to $25,000 | 600 |

| Happy Money Debt Consolidation Loan | 11.72% to 24.67% | $3,000 to $40,000 | 640 |

Source: Top 5 Best Personal Loans for Fair Credit, Good Credit and Excellent Credit

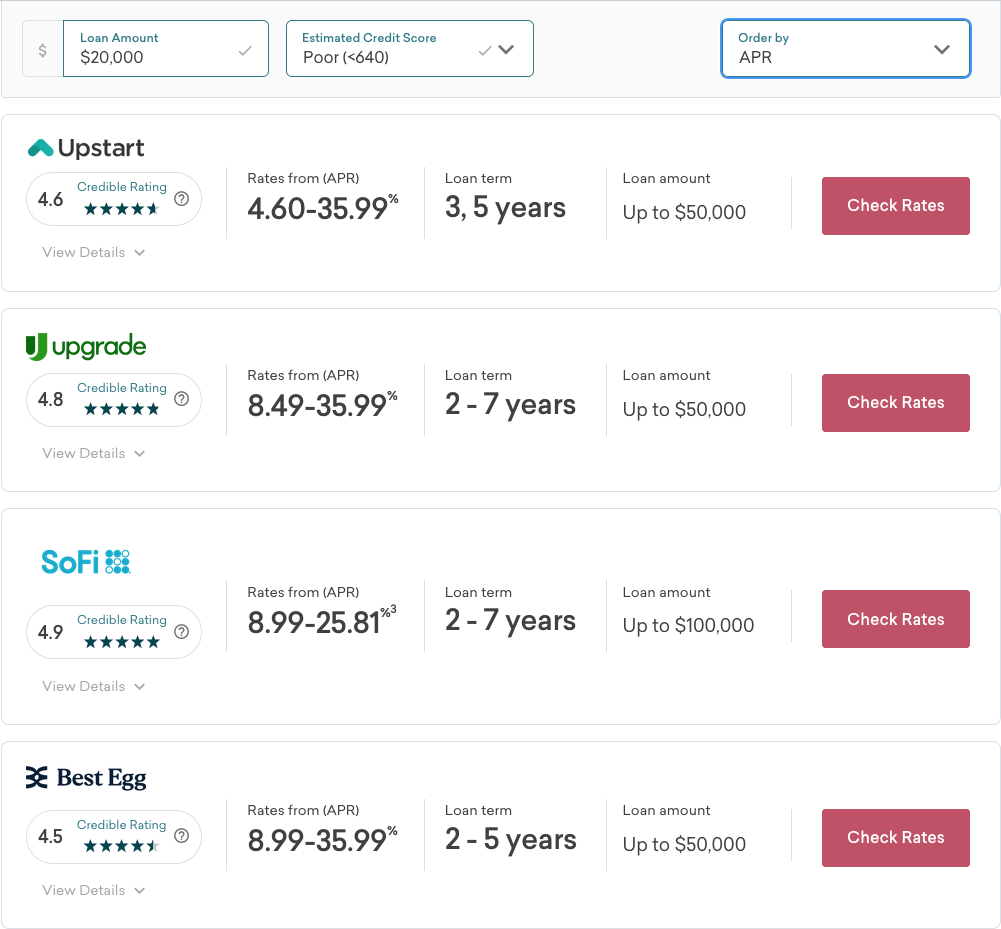

Credible’s Best Personal Loans and APR (for Bad Credit)

For applicants with a low credit score, apply at Credible here.

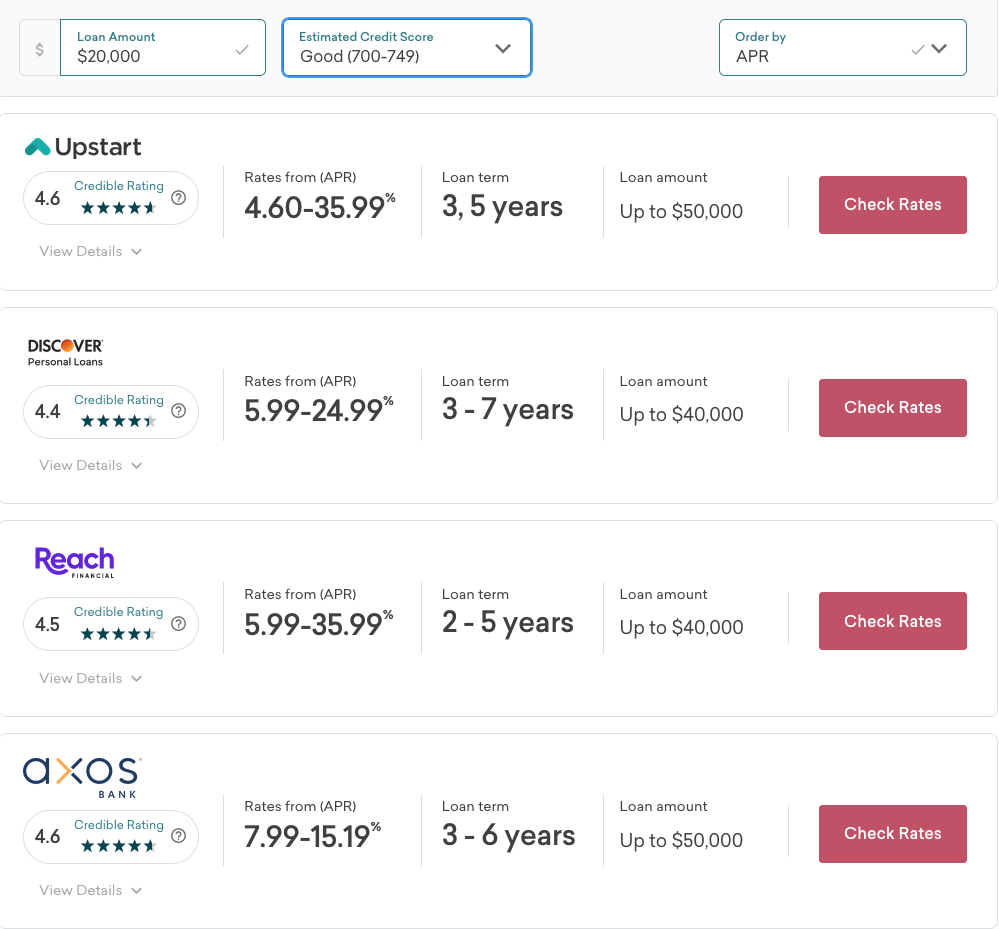

Credible’s Best Personal Loans and APR (for Good Credit)

Credible Personal Loans vs. Bank Loans

- Beyond the Banks: Credible partners with lenders like Zable, specializing in loans for those with imperfect credit histories. Qualify with a FICO score as low as 600! Secure your loan in one business day, a pace most banks can’t match.

- Smarter Credit Checks: Credible’s application process is streamlined and utilizes Artificial Intelligence (AI) for expedited loan underwriting, surpassing the efficiency of most banks. However, speed is not the only advantage. Lenders, such as Upstart, employ alternative qualification methods, moving beyond credit score-only models to assess borrowers’ eligibility for a loan.

- Unlocking Value: Credible’s risk assessment methods see what banks often miss. This translates to more borrowers accepted, even those deemed “high-risk” by traditional lenders.

However, your brick-and-mortar bank, where you have your checking and savings account, may offer you a low rate on a personal loan. So, it’s worth checking with your bank for loan rates. Between your bank and Credible, you can get multiple loan offers from the best banks and lenders on the market. By getting multiple offers, you can use them as leverage to force each lender to compete with each other and give you the lowest rate.

Who is Credible, the loan company?

Credible Labs Inc., operating under the name Credible, is a reputable financial technology company headquartered in San Francisco, California. Credible’s parent company is Fox Corporation (i.e., the same company that owns Fox News). Credible was acquired by Fox in 2019.

Credible is licensed by the California Department of Business Oversight and is A+ BBB rated and accredited. Furthermore, Credible maintains Mortgage, Financing, and Loan Broker licenses at NMLS, with no listed complaints against the company as of February 2024.

Credible.com is one of the best places for consumers to compare personal loan rates among various lenders. Additionally, you can use Credible for home loans and student loan refinancing. Students can also use the company to shop for student loans. Offering student loans was the company’s first financial product.

Like Amazon in the e-commerce industry, Credible acts as a centralized marketplace but for ” financial products.” However, unlike Amazon, Credible only accepts highly qualified and top-rated sellers.

Source: NMLS, Credible Operations, Inc., https://www.nmlsconsumeraccess.org/EntityDetails.aspx/COMPANY/1681276

How does Credible get paid?

If Credible’s services are free, how do they make money to stay in business?

After you qualify and get the funds deposited into your account for a personal loan, Credible gets paid directly by the lender.

Customers don’t pay Credible anything; their services are absolutely free to the consumer.

Credible has a vested interest in helping customers find the right personal loan options. Your success is their success.

Is Credible a Good Option for Personal Loans?

Credible is an excellent platform for comparing personal loans. It’s a fast, secure, and user-friendly loan comparison tool. Best of all, it’s completely free for consumers to use, with no hidden fees.

However, it’s important to evaluate the lenders available through Credible and not solely rely on Credible’s reputation. In the following paragraphs, we will guide you through researching both Credible’s customer reviews and the credentials of their lenders.

Let’s begin by examining Credible’s customer reviews and then delve into the credentials of their lenders.

Credible Customer Reviews:

- At TrustPilot.com, Credible boasts an impressive average customer rating of 4.7/5 based on 5,340 customer reviews.

- Additionally, at ConsumerAffairs.com, Credible has received a customer rating of 3.8/5 from over 130 reviews.

Several common themes emerge when analyzing customer reviews about Credible personal loans from Trustpilot and Consumer Affairs. These themes provide insights into the experiences and opinions of customers who have used the company’s services.

Common Themes Found in Credible Customer Reviews:

- Easy and streamlined process: Many customers praised Credible for its user-friendly platform and simple application process, highlighting that it made borrowing money hassle-free and convenient.

- Competitive rates and offers: Several reviewers mentioned that Credible provided them with competitive loan rates and attractive offers compared to other lenders, enabling them to secure favorable terms.

- Transparent and informative: Customers appreciated the transparency and clear information provided by Credible throughout the loan application process. They noted they were well-informed about each loan offer’s terms, fees, and repayment options.

- Quick and efficient service: Numerous reviewers commended Credible for its fast and efficient service, emphasizing that they received prompt responses, quick approvals, and timely fund disbursements.

- Excellent customer support: Many customers highlighted the helpful and responsive customer support provided by Credible. They felt that their questions and concerns were addressed promptly, resulting in a positive overall experience.

- Trustworthy and reliable: Several reviewers expressed confidence in Credible as a trustworthy platform for finding personal loans. They appreciated the security measures implemented by the company to protect their personal and financial information.

- Multiple lender options: Customers liked having access to a wide range of lenders through Credible, allowing them to compare and choose the best loan option for their needs.

Credible’s BBB Review and Rating:

Credible’s A+ rating with the Better Business Bureau (BBB) is a testament to its unwavering commitment to delivering quality service.

Since earning accreditation in 2015, Credible has consistently demonstrated high customer satisfaction and a remarkably low number of BBB complaints.

Credible received less than ten customer complaints submitted to the BBB over the last three years, further attesting to its exceptional credentials.

Reviews on Credible’s Personal Loan Partners:

Customer reviews for Credible’s personal loan lenders are overwhelmingly positive.

Credible’s personal loan lenders’ reviews and credentials:

- Avant: WalletHub rating of 4.3/5 stars with over 3,000 customer reviews, A+ rated by BBB.

- Allied Mortgage Group: Average BBB customer review rating of 4.76/5 from 46 reviews, A+ rated and accredited.

- Citizens Bank: Rating of 3.9/5 stars from 4,700+ customer reviews.

- Discover personal loans: One of the best personal loan lenders for 2023, with a perfect 5/5 star rating at NerdWallet.

- LendingClub: Average customer rating of 4.5/5 from 6,766 reviews at Credit Karma.

- Marcus by Goldman Sachs: Rated 4/5 stars by Bankrate.com.

- New American Funding: Average customer review rating of 4.5/5 stars at NerdWallet.

- NBKC bank: Average BBB customer review rating of 4.86/5 from over 1,500 reviews, A+ rated and accredited by BBB.

- Prosper Loans: This lender has a reputation rating of 4.4/5 stars on Credit Karma. It has an A+ rating and is accredited by the Better Business Bureau (BBB).

- Upgrade: Rated 4.5/5 stars by NerdWallet and 4.7/5 stars by Forbes.

- LightStream: Average customer review rating of 4/5 stars on Forbes, A+ rated and accredited by BBB.

- SoFi: Average customer review rating of 5/5 stars on NerdWallet, A+ rated by BBB.

- Upstart: This lender has a 4.5/5 star rating on NerdWallet and an average customer review rating of 4.8 on Credit Karma. It has an A+ rating and is accredited by the Better Business Bureau.

- Zable Loans: Zable’s average customer review rating is 4.7/5 stars, derived from 2,861 customer reviews on Trustpilot. Many of these reviews on Zable shed light on customers’ experiences, detailing their ability to apply for a loan and receive the funds within the same day (i.e., 24 hours.) Zable offers loans to individuals with credit scores as low as 600, all while maintaining interest rates that outperform those offered by comparable lenders.

- Rocket Mortgage: A+ rated and accredited by BBB.

- Homefinity: Average customer review rating of 4.1/5 stars based on U.S. News and A+ rated by BBB.

- Sallie Mae: A+ rated and accredited by BBB.

Loan Terms and Conditions: Flexible Repayment Periods and Transparent Fees

You may get various personal loan offers to choose from, which all come with different terms and conditions. One lender may offer you a five-year term. Another loan offer may allow the payment term to go out for six years, offering a lower monthly payment.

You can choose a personal loan with the best terms and conditions. This is very beneficial for borrowers. Do you prefer a lower payment or a faster repayment period to save money?

Repayment periods can vary depending on the type of loan and the lender you choose. This allows you to find a repayment schedule that aligns with your budget and financial goals.

Credible is committed to transparency, providing detailed information on potential penalties or fees associated with loans. They ensure borrowers can clearly see each loan’s terms and conditions, including the cost of each personal loan.

Additionally, Credible offers a loan calculator on their website. This tool lets you estimate your monthly payments based on different loan amounts, interest rates, and loan terms. It helps you understand the financial impact of various loan options before applying.

Real-Life Scenarios: Examples of How Credible Benefits Customers

Quickly accessing capital through Credible’s platform can bring significant value. Here are a few hypothetical scenarios that illustrate this:

Emergency Car Repair: Your car breaks down unexpectedly, and you need immediate funds for the repair costs. Credible’s personal loan marketplace lets you quickly compare offers from multiple lenders, finding competitive interest rates and favorable terms. With Credible’s assistance, you can swiftly get your car repaired and back on the road.

Consolidate Your Bills: Tracking payment due dates and managing your finances effectively can be challenging if you have several credit cards and different types of debt. Credible’s platform simplifies the process by presenting you with a low-interest loan to consolidate your bills into one. Combining your debts into a single loan with a potentially lower interest rate simplifies managing your monthly payments and allows you to save money by reducing interest payments.

Home Renovation: Planning a home renovation but lacking the upfront funds? You can explore loan options tailored to home improvements through Credible, offering competitive rates and flexible repayment periods. Credible’s platform enables you to find the right loan to fund your renovation and enhance your home’s value.

How to choose from Credible’s personal loan offers:

- Carefully review each loan offer’s terms and conditions before proceeding.

- Assess loan options carefully. Pay attention to interest rates, fees, and repayment terms. Consider any conditions that may affect the cost and repayment period of the loan.

- Also, check for loan origination fees that can add to the loan cost.

Credible Personal Loan Rates (averages)

Credible’s personal loan rates can vary depending on several factors, including credit score, income, and the chosen lender.

As mentioned earlier, Credible’s interest rates for personal loans range from 4.6% to 35.99%. Your individual rate will depend on your creditworthiness and the lender’s assessment. Other factors affecting the rate you get on a loan include your credit score and debt-to-income ratio.

The average interest rate on a personal loan at Credible.com is 14.43%.

Average APRs on personal loans through Credible.com based on credit scores:

- Credit Score 780 or Higher: Average APR = 8.92%

- Credit Score 720 to 779: Average APR = 12.50%

- Credit Score 680 to 719: Average APR = 8.92%

- Credit Score 640 to 679: Average APR = 24.70%

- Credit Score 600 to 639: Average APR = 29.64%

- Credit Score Less Than 600: Average APR = 32.06%

How to Secure the Lowest Interest Rate on Personal Loans:

You can employ several effective strategies to ensure you obtain the lowest interest rate on personal loans through Credible.

- Improve your credit utilization ratio by paying down credit card balances. Lowering this ratio can positively impact your credit score, potentially leading to lower interest rates.

- Utilize Credible’s user-friendly platform to compare loan offers from different lenders. This enables you to select the loan with the lowest interest rate and most favorable terms. Remember to consider the total cost of the loan over the entire repayment period, as shorter repayment periods often result in less interest.

- Check rates at your local brick-and-mortar bank or credit union. Your personal checking account bank may offer special rates for their customers. You can challenge Credible’s personal loan rate guarantee if you find a lower rate elsewhere.

- Military members and veterans should explore options like Navy Federal Credit Union and other credit unions, which often offer attractive rates and specialized services.

- Negotiate with the lender for a discount. For example, some lenders offer a 0.25% discount for borrowers who set up automatic bill pay.

Credible Personal Loan Requirements:

What Information Does Credible Require for Pre-Approval of Personal Loan Rates?

To get pre-qualified for a loan within as fast as two minutes, you may be curious about the information Credible needs. Rest assured, they won’t ask you to provide excessive personal information.

Basic requirements to get pre-qualified for personal loans at Credible include,

- Personal Information: This includes your name, address, date of birth, and Social Security number. You must provide a government-issued photo ID, such as a driver’s license.

- Financial Information: Credible will ask for details about your employment status, annual income, and debt-to-income (DTI) ratio.

- Loan Amount Details: You must provide information about the desired loan amount, specifying how much you want to borrow.

Meeting these requirements doesn’t guarantee loan approval since each lender has their own criteria. Lenders want to be confident that they will get paid back in full and that you won’t default on the monthly payments. Consequently, they consider factors like your credit score, income, and personal details.

Is Credible a Safe Place to Apply for Personal Loans?

Credible takes the following measures to protect borrowers:

- Their online application employs TLS encryption, the same security protocol used by major banks.

- They do not sell your information to third parties. You can trust that your personal details will remain confidential and won’t be used for unwanted marketing purposes.

- Partner lenders undergo a rigorous due diligence screening process to ensure they are reputable and trustworthy.

Overall, Credible’s commitment to privacy, data security, and their thorough selection of partner lenders make them a safe and dependable platform for applying for personal loans. You can confidently explore loan options through Credible, knowing that your information is protected and you’ll be working with reputable lenders.

Does TrustedCompanyReviews.com recommend Credible for personal loans?

Initially, we had concerns that a platform like Credible could result in consumers getting bombarded with solicitations, as that’s the case with some of its top competitors. However, our research has proven otherwise.

Compare LendingTree vs. Credible Complaints:

Our worries about unsolicited calls and the sale of customer information were unfounded. Unlike LendingTree, which has over 250 BBB complaints, many of which are related to overwhelming lender phone calls, Credible takes a different approach.

They carefully select lending partners and prioritize customer privacy. With Credible, you can experience a focused and personalized lending process free from overwhelming solicitations.

Rest assured, Credible maintains an unwavering commitment to upholding high standards for a secure and seamless lending experience. Credible is the platform to consider when seeking reliable and credible personal loans.

Don’t forget to check other reputable sites for Credible reviews and client testimonials. Reddit, BBB, and Google all offer access to Credible’s customer reviews and insights.

Frequently Asked Questions

What credit score do you need for a loan through Credible?

What lenders offer the lowest rates?

Does Credible hurt your credit?

How much does it cost to get a loan through Credible?

Why use Credible vs. direct lenders?

Are there other lenders or places similar to Credible for personal loans?

Source

Sources:

- PR Newswire, Fox Corporation Completes Acquisition of 67% of Equity of Credible Labs, https://www.prnewswire.com/news-releases/fox-corporation-completes-acquisition-of-67-of-equity-of-credible-labs-300940531.html.

- Crunchbase, https://www.crunchbase.com/organization/credible

- Wikipedia, Credible Labs, https://en.wikipedia.org/wiki/Credible_Labs

- Nationwide Mortgage Licensing System, (NMLC), https://mortgage.nationwidelicensingsystem.org/Pages/default.aspx

- Credible.com website,

- Better Business Bureau (BBB), Credible BBB review, https://www.bbb.org/us/ca/san-francisco/profile/financial-services/crediblecom-1116-544253