Best Personal Loans by Credit Score (Fair, Good, Excellent)

Are you searching for the best place to get a personal loan with a low rate and affordable monthly payment?

Look no further! We’ve mapped out the best personal loans for fair credit, good credit, and excellent credit, including loans with no origination fee and to help build credit.

Easily compare rates, terms, and loan requirements to find the right loan for your situation. Compare top lenders side-by-side and find your perfect match today!

Our Top Pick for December

A+ BBB Rated & Accredited

- Compare Rates for Free

- Loans up to $200,000

- Receive Funds by Tomorrow*

- Top-Rated Lenders Available

Find a Lender You Can Trust

To assist you, we’ve organized our guide into four distinct categories:

1. Best Personal Loans for Fair Credit (with the lowest rates and fees)

2. Best Place to Get a Personal Loan for a Credit Score Under 600

3. Top Lenders for Good to Excellent Credit Scores

4. Personal Loans with No Origination Fee

Our rating criteria, developed with Deane Biermeier’s expertise as a finance industry researcher, assess company reputation, customer reviews, payment flexibility, rates, origination fees, qualification requirements, and loan accessibility.

1

Our Top Pick

- A+BBB Rated

- Compare Rates for Free

- Fair to Excellent Credit Acceptable

- Loans up to $200,000

- Receive Funds as Soon as Tomorrow*

2

- No Minimum Credit Score

- Borrow up to $50,000

- Short Credit History OK

- Receive Funds by 24-Hours

- No Credit Effect to Check Rates

Via Credible.com

NMLS #1136

3

- BBB “A+” Rated & Accredited

- Minimum Credit Score: 600

- Soft Credit Check to Pre-Qualify

- Offers Home Equity Loans

- Excellent Customer Reviews

- Loans up to $50,000

- A Direct Lender

- Also a Bank

- Lower Rates With a Co-Borrower

Via Credible.com

5

- Get up to $50,000

- Low Fixed-Rates

- No Prepayment Fees

- Minimum Credit Score: 600

Compare Rates for Personal Loans and Prequalify for Free

Why is Credible the best place to get a personal loan for fair credit?

Credible is the best place for fair credit applicants to get a personal loan because they offer you quick access to top-rated loans. Credible’s loan application interface is connected to approximately twenty of the best direct lenders, financial technology companies (FinTechs), banks, and credit bureaus. Consequently, they can retrieve accurate and up-to-date information from lenders and credit reporting agencies at near lightning speed.

It’s fast and easy and offers consumers a high approval rate for personal loan applicants with fair credit. What is the credit score requirement for personal loans for fair credit? According to Experian, fair credit is a FICO® Score☉of 580 to 669 or a VantageScore® score of 601 to 660. Therefore, personal loans are available even if your credit score is under 600. Personal loans for just about any credit score are available through Credible because some lenders, such as Upstart, look at more than just your credit score.

Based on your eligibility, you can compare each loan’s rates and terms: LendingClub vs. Best Egg, SoFi vs. LightStream, Upstart vs. Upgrade, Discover vs. PenFed, and several other lenders of this caliber. Happy Money, OneMain Financial, Axos Bank, Zable, and Discover loans are also available. Credible is selective in the lenders it allows into its marketplace to ensure consumers have the best choices for personal loans. At TrustedCompanyReviews.com, we’ve tested and tried Credible, and it works.

What’s the cost of a personal loan at Credible?

Let’s now address the big elephant in the room. What’s the catch, and how much does it cost?

You’ll be pleasantly surprised to hear that Credible is free for you to use regardless of your credit score. Credible gets paid by the lenders if you end up getting a loan. It’s performance-based. That means they only get paid if they perform for you and get you that loan.

If you choose to get a loan, each lender charges interest and some charge loan origination fees. However, whether you visit a lender directly or through Credible, the lenders’ rates and costs for personal loans are the same regardless. Credible illustrates each loan’s rates, payment options, and terms clearly for you to see – and in an unbiased way and without a high-pressured salesperson on the line trying to sell you! This gives you the level of transparency that you need to make an informed choice.

Fair Credit Personal Loan Qualification Requirements

| Lender | Fixed (APR) | Loan Amounts |

Minimum Credit Score

|

| Upstart Personal Loan | 6.40% to 35.99% | $1,000 to $50,000 | 620 |

| LightStream Personal Loan | 7.49% to 25.49% | $5,000 to $100,000 | 700 |

| Discover Personal Loan | 7.99% to 24.99% | $2,500 to $40,000 | 660 |

| PenFed Credit Union Loan | 8.49% to 17.99% | $600 to $50,000 | 700 |

| Upgrade Personal Loan | 8.49% to $35.99% | $1,000 to $50,000 | 600 |

| Sofi Personal Loan | 8.99% to 25.81% | $50,000 to $100,000 |

Does Not Disclose

|

| Best Egg Personal Loan | 8.99% to 35.99% | $20,000 to $50,000 | 600 |

| LendingClub Personal Loan | 9.57% to 35.99% | $1,000 to $40,000 | 660 |

| Avant Personal Loan | 9.95% to 35.99% | $20,000 to $35,000 | 550 |

| Universal Credit Personal Loan | 11.69% to 35.99% | $1,000 to $50,000 | 560 |

| OneMain Financial Personal Loan | 18% to 35.99% | $1,500 to $20,000 |

Does Not Disclose

|

| Zable Personal Loans | 8% to 30% | $1,000 to $25,000 | 600 |

| Happy Money Debt Consolidation Loan | 11.72% to 24.67% | $3,000 to $40,000 | 640 |

Fair credit? Click here to get pre-approved Credible personal loan offers now.

Best Personal Loans for Credit Scores Under 600

The best personal loans for credit scores under 600 can be found through Avant, Universal Credit, LendingTree, Upstart, Upgrade, and OneMain Financial. However, there is no guarantee these lenders will approve you for a personal loan with a credit score of that low. Other factors that will be considered include debt, income and credit history.

| Lender | Fixed (APR) | Loan Amounts |

Minimum Credit Score

|

| Avant Personal Loan | 9.95% to 35.99% | $20,000 to $35,000 | 550 |

| Universal Credit Personal Loan | 11.69% to 35.99% | $1,000 to $50,000 | 560 |

| Upgrade Personal Loan | 8.49% to $35.99% | $1,000 to $50,000 | 600 |

| Best Egg Personal Loan | 8.99% to 35.99% | $20,000 to $50,000 | 600 |

| Upstart Personal Loan | 6.40% to 35.99% | $1,000 to $50,000 | 620 |

| LendingTree | starting at 6.99% | up to $50,000 | 580 |

| OneMain Financial | 18% – 35.99% | $1,500 to $20,000 | no minimum credit score |

Best Personal Loan for Building Credit:

Upstart personal loans can be a valuable tool for building credit, especially for those with limited or fair credit (typically 580-740).

You can gradually improve your credit score by making consistent, on-time monthly payments. Late payments can negatively impact your credit, so responsible borrowing is key.

As long as the loan company reports your positive payment history to the credit reporting agencies as you make monthly payments, the loan will help your credit score improve. Therefore, always verify that your payment history will be reported monthly to the credit bureaus, especially if you want to get a personal loan to build good credit.

Explore Upstart’s options and compare them with other credit-building loans to find the best fit for your needs. Credit builder cards designed for fair or bad credit, where responsible use gradually increases your score, can also be a solid option if Upstart doesn’t work for you.

Final points to consider for applicants with low credit scores:

- Upgrade has no minimum income requirements.

- Upstart uses AI and other methods to judge a borrower’s creditworthiness beyond just basing it solely on credit scores.

- LendingTree offers a wide range of loan terms and options.

- OneMain Financial has no minimum credit score.

Best Personal Loans for Good to Excellent Credit

Wells Fargo Bank, PNC, and PenFed also provide attractive options with no origination fees but require excellent credit for approval.

Rather than applying directly through these lenders, we recommend using Credible to compare your options before getting locked in on a loan.

What are personal loan origination fees?

Most lenders charge a loan origination fee for fair credit personal loans. This up-front fee usually comes from the loan before it hits your bank account.

Make sure you incorporate this origination fee into the equation when doing the math and adding up the total cost of borrowing.

Loan origination fees can be flat fees of anywhere from $25 to $500 or are often based on a percentage of your loan amount. On average, percentage-based loan origination fees are between 1% and 10% of your loan amount, varying by lender.

Best Personal Loans with No Origination Fee

For borrowers with excellent credit, direct lenders like Discover, SoFi, and LightStream offer personal loans with no origination fee or prepayment penalties, allowing you to access competitive rates without additional costs.

SoFi, Lightstream, Discover and other top-rated lenders for good and excellent credit scores are available through Credible.

Examples of Personal Loans with Average Origination Fees

- PenFed Credit Union charges a 0.50% loan origination fee, which is capped at $2,500.

- Upstart personal loan origination fees cost 0% to 8% of the loan amount.

- OneMain Financial’s loan origination fee is 5% to 10% of the loan amount.

- Upgrade’s loan origination fee is between 2.9% and 8% of the loan amount.

Examples of Personal Loans with High Loan Origination Fees

- LendUp’s loan origination fee is between 10% to 20% of the loan amount.

- Spotloan’s loan origination fee is 15% to 30% of the loan amount.

- OppLoans loan origination fee is 5% – 35% (variable).

- CashNetUSA personal loans have a loan origination fee of 11.99% – 27.99%.

Examples of Personal Loans with No Origination Fees

- LightStream personal loans have no loan origination fees.

- SoFi personal loans have no loan origination fees.

- Discover personal loans have no origination fees.

Here are some tips for finding a personal loan with a lower origination fee:

- Use Credible’s free personal loan marketplace to compare rates from multiple lenders.

- Look for lenders with no-origination-fee options.

- Negotiate the origination fee with the lender.

- Borrow a smaller amount of money to reduce the amount of the origination fee.

Is a Personal Loan Program Right for Me?

A personal loan can help you consolidate high-interest debt into an affordable fixed-rate loan, simplifying your monthly bills and potentially saving you money. Personal loans can also be used to pay for medical bills, home improvement projects, credit card refinancing, and other large purchases.

Do the Math and Compare Cost of Borrowing

Add up the cost of what you plan to use the personal loan to pay. For example, if you’re planning to purchase a new walk-in bathtub.

First, calculate the total cost of the tub, including installation, plumbing adjustments, and any additional features. Then, subtract your available savings to determine the loan amount needed.

Next, consider your financing options. Credit cards are convenient but have high-interest rates. The company’s preferred lender may offer tailored plans, but interest rates might still be high. Your chosen lender, including a personal loan from our top-rated personal loans list, offers more options and potentially lower rates.

Choose the option that fits your budget and helps you achieve your dream.

Unsecured Loans

Unsecured loans offer fast funding without collateral. They can be right for consumers who need to fund a large purchase.

Debt Consolidation Loans

A debt consolidation loan could help you consolidate debt for a lower interest rate and enjoy a simplified repayment plan. They can be a good option for consumers who qualify.

Using a Personal Loan vs. Credit Card for Large Purchase

Should you use a credit card or a personal loan for that big purchase?

Here’s a quick breakdown to help you decide:

| Feature | Credit Card | Personal Loan |

| Pros | Widely accepted, rewards, easier to qualify |

Fixed rate, predictable payments, larger loan amounts

|

| Cons | High interest rates, snowballing debt, impacts credit utilization |

Requires good credit, prepayment penalties, origination fees

|

Should you use a personal loan or credit card to purchase a $1200 bathtub?

Hypothetically speaking, let’s suppose you have good credit. Upstart and LendingTree are offering you personal loans with around a 9% interest rate. Your other option is to use your credit card which has an interest rate of 24%.

Let’s do the math:

- Credit Card (24% APR, 24 months): $63.45 monthly payment, $322.69 total interest, $1522.69 total cost

- Personal Loan (9% APR, 48 months): $29.86 monthly payment, $233.38 total interest, $1433.38 total cost

Takeaway:

With a personal loan, you can save $89.31 on this purchase.

Understanding Personal Loan Rates (APR)

This section helps you navigate the world of personal loan Annual Percentage Rates (APR), empowering you to make informed decisions. Understanding the factors influencing APRs allows you to compare lenders and secure the most advantageous loan for your needs.

Rates: A Glimpse into Each Lender’s Offer:

- Credible: 6.40% – 35.99% APR, 12 – 84 months

- LendingTree: 5.20% – 35.99% APR, 12 – 144 months

- Upstart: 4.90% – 35.99% APR, 4 – 84 months

- Prosper: 7.95% – 35.99% APR, 36 – 60 months

- LendingClub: 9.57% – 35.99% APR, 2 – 5 years

- Upgrade: 6.55% – 35.97% APR, 24 – 84 months

- OneMain Financial: 18.00% – 35.99% APR, 2 – 5 years

Explaining the Secrets of Your APR:

- Credit Score: This reigns supreme. A stellar credit score unlocks lower interest rates, while a lower score translates to higher rates.

- Loan Term: Shorter loan terms typically come with lower interest rates compared to longer ones.

- Loan Amount: Larger loan amounts may attract lower interest rates compared to smaller ones.

- Debt-to-Income Ratio: This reflects your ability to manage debt. A lower ratio indicates better financial health, potentially leading to lower interest rates.

- Lender’s Risk Assessment: Each lender has its own criteria for evaluating risk, which can influence the offered interest rate.

Key Takeaways: to help you get the best APR and Rate.

- Advertised APRs are for qualified borrowers with excellent credit. Your actual rate may vary based on your individual circumstances.

- Analyze the total cost of the loan, including origination fees, prepayment penalties (if applicable), and interest charges.

- Leverage comparison tools like Credible and LendingTree to compare rates and terms from multiple lenders.

- Contact lenders directly for personalized quotes and clarify any doubts you may have.

Putting It All Together:

Consider borrowing $10,000 with a 36-month repayment term and an 18.49% APR (including a 5% origination fee). You would receive $9,500, and your monthly payments would be $346.65. Over the loan term, you would pay back a total of $12,479.52.

Remember, this is just an example, and your actual rate and total cost may differ.

Armed with this knowledge, you can confidently navigate the personal loan landscape and secure the best possible loan for your financial journey.

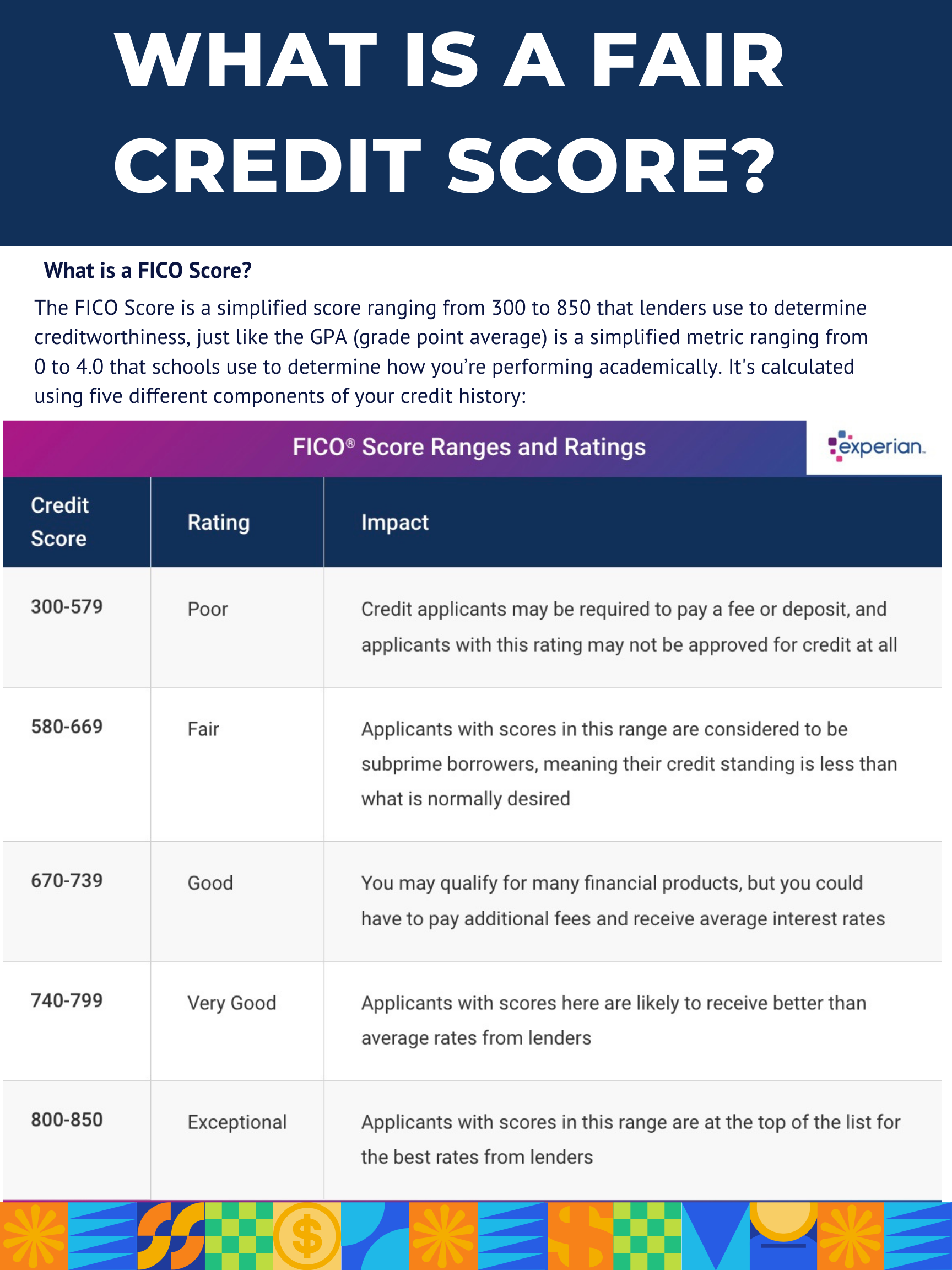

What is considered a fair FICO score by lenders?

What Is Considered Fair Credit? Fair credit is typically defined as having a FICO® Score ranging from 580 to 669 or a VantageScore® score between 601 and 660.

FICO, which stands for The Fair Isaac Corporation, is the scoring system used by 90% of lenders to assess loan eligibility. In the remaining 10% of cases, lenders may use your VantageScore to make credit approval decisions.

Editor’s Verdict

Credible: #1 Rated Personal Loan for Fair Credit (and Beyond)

Our #1 pick, Credible, shines for fair credit borrowers with its diverse selection of top-rated lenders (think Upstart, LendingClub, Discover, Upgrade, SoFi, and LightStream).

- Pre-qualify and compare rates in minutes.

- All for free

- High approval rate

- No impact on your credit score

- You will not get spammed by many lenders

Their strict vetting process and tech-driven approach make finding the perfect loan a breeze.

Upstart Consolidation Loans–Best for Credit Card Refinancing:

Upstart uses AI to consider factors beyond just credit scores, opening doors for borrowers with a low FICO score or limited credit history. Upstart’s consolidation loans are an excellent choice if you want to refinance credit card debt.

Get personalized rates and flexible repayment options, making Upstart a strong contender for alternative scoring models.

(BONUS: They’re also part of Credible’s network – APPLY NOW)

LendingTree partners with more lenders, giving you more options to consider:

LendingTree offers a diverse range of options for all credit levels. While the sheer volume of lenders to choose from might require extra research, it also increases your chances of finding the best fit. Plus, they offer additional loan types like home equity loans.

Best Direct Lender–LendingClub:

LendingClub has the highest rating for direct lenders. Personal loans are distributed directly from LendingClub to you, with fixed rates for the life of the loan.

However, be mindful of potential downsides:

LendingClub personal loan origination fees can exceed 5%, and pre-qualification and final approval require hard credit checks, versus Credible and Upstart using soft credit checks.

Additionally, compared to Credible, Upstart, and LendingTree, you might have fewer offers to compare and choose from.