What is the Best Stairlift for Seniors? Review the Top Choices for 2024!

Looking for the best stairlift for seniors? We’ll give you our top picks for the most luxurious, heavy-lifting, straight, curved, and standing stairlifts for seniors. For those of you on a fixed income and budget, we’ll also give you the most affordable stairlift! Our industry expert is a registered nurse, Tammy McKinney, who carefully selected these companies and products.

A senior stairlift, also called a “staircase elevator,” “mobility stairlift,” or “electric stairlift,” is an electric or battery-powered chair attached to rails that runs up a staircase, allowing a person unable to walk up and down stairs to ride instead. For seniors and individuals facing mobility challenges, products such as stairlifts, medical alert systems, hearing aids, and walk-in tubs can offer a pathway to independence and the ability to continue living at home for many years to come.

When shopping for a senior stairlift, you may have many questions, such as:

- How much does a stairlift cost?

- Can I rent a stairlift?

- Can I use a stairlift if I can’t sit down?

- What kind of warranty will I get with my stairlift?

We’ll provide you with all the answers you need to select the best senior stairlift.

Tammy McKinney–Registered Nurse and Product Researcher

RN-Registered Nurse

- 39 Years in Business

- A+ BBB Rated and Accredited

- Delivery and Installation Included

- Limited Lifetime Warranty

- Rentals Available

- Financial Assistance for Seniors

- High Weight Capacity (300 and 400 pounds)

- Table of Contents

#1 Rated Stair Lift or Seniors in 2024

- Reasonable Prices (Starting at $3,800)

- Delivery and Installation Included

- Limited Lifetime Warranty

- Rentals Available

- Financial Assistance for Seniors

- Financing Options

- High Weight Capacity (300 and 400 pounds)

2

- A+ BBB Rating and Accreditation

- Discounted Refurbished Stairlifts Available

- Stairlift Rental Options for Seniors

- Stand-Up Chair Lifts Offered

- Home Elevators Also Available

- Average customer review rating at BBB of 3.5/5

AmeriGlide offers one of the cheapest stair lifts!

- Afforable stair lift prices, starting at $1,999

- Provides indoor curved and outdoor styles

- Stair lift financial assistance is offered

- Stair lifts can carry up to 350 pounds

- Designed for easy installation

- Offers self-installation options for straight lifts

4

Best stair lift for heavy person (carries up to 600 pounds)!

- Harmar has an A+ rating from the BBB

- Extremely durable stair lifts

- Carries up to 600 pounds

- Offers customizable lift chairs for elderly

- Its batteries power 60 rides during a power outage

- Extra safety features: seatbelt, swivel seats, sensors

- Excellent ratings on TrustPilot, Consumer Affairs, and Retirement Living

- Limited lifetime warranty on all Handicare indoor stairlifts

- Affordable stairlift prices, starting at $2,500

- Exceptional lifting power, carrying up to 440 pounds

- Full-service customer service departments all across the U.S.

- A+ BBB rated and accredited since 2003

- Acorn BBB reviews are excellent

- The starting price for Acorn Lifts is $3,000

- Repairs and maintenance performed by Acorn-trained technicians

#1 Best Senior Stair Lift Company: Bruno

Bruno Independent Living Aids, Inc. is a renowned manufacturer of Bruno stair lifts and a leading provider of mobility solutions for individuals with limited mobility, physical disabilities, and the elderly. While stair lifts are a significant part of their product range, Bruno offers a comprehensive line of accessibility products, including vertical platform lifts and wheelchair vehicle lifts.

Here are 5 reasons why Bruno stands out as our top choice for the overall best stairlift company:

- Established Reputation: With almost 40 years of experience, Bruno has built a strong presence as a USA-based, veteran-owned business, dedicated to serving the public.

- Affordable and Comprehensive: Bruno offers stairlifts at a reasonable cost, starting at $3,800, which includes delivery, installation, and a limited lifetime warranty. Their commitment to providing a complete solution sets them apart.

- Rental Options: Some Bruno dealers offer stairlift rentals for short-term use, providing flexibility and convenience to those who may only temporarily require a stairlift. For stairlift rentals, you must visit a Bruno local dealer directly and inquire with them about rental options.

- Financing Assistance: Bruno manufactures stairlifts that it sells to its dealers, who may then offer financing options to qualified buyers. Based on customer reviews and research, some Bruno dealers offer financing with low monthly payments ranging from $56 to $78, providing accessible solutions for those who need funding assistance.

- Robust Lift Capacity: Bruno lifts are designed to handle substantial weight, with each lift capable of transporting between 300 and 400 pounds. This feature ensures reliability and accommodates a wide range of users.

Choose Bruno for trusted and reliable stairlifts. Whatever your situation may be, Bruno can assist you in finding the perfect stairlift. They provide a comprehensive range of stairlift options, suitable for both straight and curved staircases, with the capacity to carry up to 400 pounds. Whether you need an indoor or outdoor solution, Bruno has you covered. Begin by identifying a local Bruno stairlift dealer.

Visit Bruno’s website, click on the page labeled “Stairlift Dealers Near Me” and enter your zip code to easily locate a nearby dealer.

Bruno’s Elan Stair Lift Review

Why is Bruno’s Elan Stair Lift a Top Choice?

When it comes to choosing the best stairlift for seniors, Bruno’s Elan stairlift stands out as a top choice. Here’s why–

- Comfortable and secure: Bruno stair lifts are designed with a padded, generously-sized seat and extra padding, ensuring a comfortable and secure experience for seniors during their ascent or descent.

- Convenient accessibility: The flip-up arms, seat, and footrest of Bruno stair lifts provide convenient access to the lift, making it easy for seniors to navigate their stairs with confidence.

- Safety features: Bruno stair lifts are equipped with obstruction safety sensors, ensuring that any obstacles on the stairs are detected and preventing accidents or damage.

- Personalization options: Seniors can customize their stair lifts with features like adjustable width armrests, allowing them to find the perfect fit for their individual needs.

- Continuously Charging and Long-lasting Batteries: Bruno Elan straight stair lifts are equipped with 12V batteries that charge continuously. This means that even during power outages, older individuals can rely on their Bruno stairlift for at least 10 round trips, offering them peace of mind.

- Extended warranty: Bruno provides a gold warranty, offering coverage for major components for a lifetime and parts and batteries for two years, ensuring that seniors are protected and supported.

- Professional installation: Bruno stair lifts are installed and delivered by factory-trained and certified technicians, guaranteeing a seamless and reliable installation process.

- Financing options: Bruno stair lifts are available with flexible financing options, including a monthly payment purchase option, making them more accessible for qualified buyers.

- Additional services: Lifeway Mobility, the provider of Bruno stair lifts, offers free assessments to evaluate seniors’ specific needs, local showrooms and service departments for easy access to support, as well as options for pre-owned lifts and monthly rentals.

By considering all these factors, it becomes evident why Bruno stair lifts are the top choice for seniors seeking a safe, comfortable, and reliable solution to maintain their independence and mobility at home.

Bruno Elan Stair Lift Pricing

The brand new Bruno Elan stair lift (SRE-3050) is priced at $4,369.99 when purchased directly from the manufacturer, Bruno Independent Living Aids. Additionally, you can find 2022 versions of the Bruno Elan stair lift on sites like USA Medical Supply for under $4,000.

Renowned as Bruno’s top-selling lift, the Bruno Elan stair lift has garnered excellent reviews from satisfied customers.

For a more budget-friendly option, consider exploring refurbished Bruno Elan stair lifts available on platforms like eBay and USA Medical Supply. These refurbished units are priced between $2,800 and $3,895.

Top Category Picks

Most Affordable Stair Lift for Seniors: AmeriGlide

For consumers on a budget, AmeriGlide comes in number 1.

With average stairlift prices starting at $2,500, AmeriGlide has found a way to offer models starting at only $1,500. How? Self-Installation. AmeriGlide is the only stairlift company that promotes do-it-yourself installation with its products.

Consumers can purchase a stairlift kit that is shipped to their home, complete with all necessary instructions for installation. While their stairlifts are a great money-saving option, they still offer many of the same options as other lifts, such as a folding seat and armrest, swivel seat, constant pressure controls, and battery backup to run the lift during a power outage.

Some of their models are inappropriate for self-installation, and you will incur an additional stair lift installation cost.

Best Lifting Power Stair Lift: Harmar

Consumers who require a lift capacity over 400 pounds will find that Harmar’s SL600HD Pinnacle stairlift has the highest lift rating on the market.

Able to safely and comfortably transport up to 600 pounds, this power stair lift offers strength and a high back and padded seat. This lift is created for straight staircases only, however, and cannot be customized for curved stairs.

Harmar’s Helix Curved Stairlift is the highest-rated lift for those needing a customizable, curved lift with heavy-duty lifting power, safely transporting up to 350 pounds, even around curves.

Handicare Stairlift Wins the Best Warranty

If you’re looking for the best warranty options, you’ll find that Handicare and Bruno are unmatched by their competitors. Offering almost identical warranty options, Handicare and Bruno offer Limited Lifetime warranties on all indoor stairlifts.

Ten years is considered a “lifetime,” and the warranty is void if the lift is installed by anyone other than a certified technician from the company where it was purchased. The warranty covers all major parts for two years. It continues coverage of the gearbox and motor for the lifetime of the stair lift.

Like all manufacturers and dealers, Handicare and Bruno only cover the lift for the original owner, not allowing a warranty transfer. Outdoor stairlifts are limited to a 5-year warranty.

Best Service Plan for Senior Stair Lifts: Acorn

In addition to a 1-year warranty on their stairlifts, a service plan is available for only $200/year. The service plan includes yearly servicing. If you need assistance with your lift, technicians will come to your home and make any necessary repairs at no cost.

Also notable is that Acorn is the clear leader when considering stair lift reviews.

Stannah Wins Best Standing Stairlift for Seniors

For consumers with mobility challenges in their knee, hip, or back that make sitting and standing from a sitting position difficult, a standing stairlift is the answer. Stannah’s Sadler Indoor Stairlift can be custom fitted to a straight or curved staircase.

A near-standing position ensures comfort for the patient, and the immobilizer seat belt ensures safety during the journey. This lift is also the best option for narrow staircases.

What to look for when buying a stairlift?

When shopping for your stairlift, there are some basic features that you can expect to find in most models.

- All stairlift models will attach directly to your staircase, not your surrounding walls.

- Each stairlift model will feature a backup battery. While the stairlift runs on your home’s electrical power via a standard plug, the batteries remain charged in case of a power outage.

- Some models will retain more power than others, offering enough reserves for anywhere from 10 trips on the Acorn lifts to 60 trips on some AmeriGlide models.

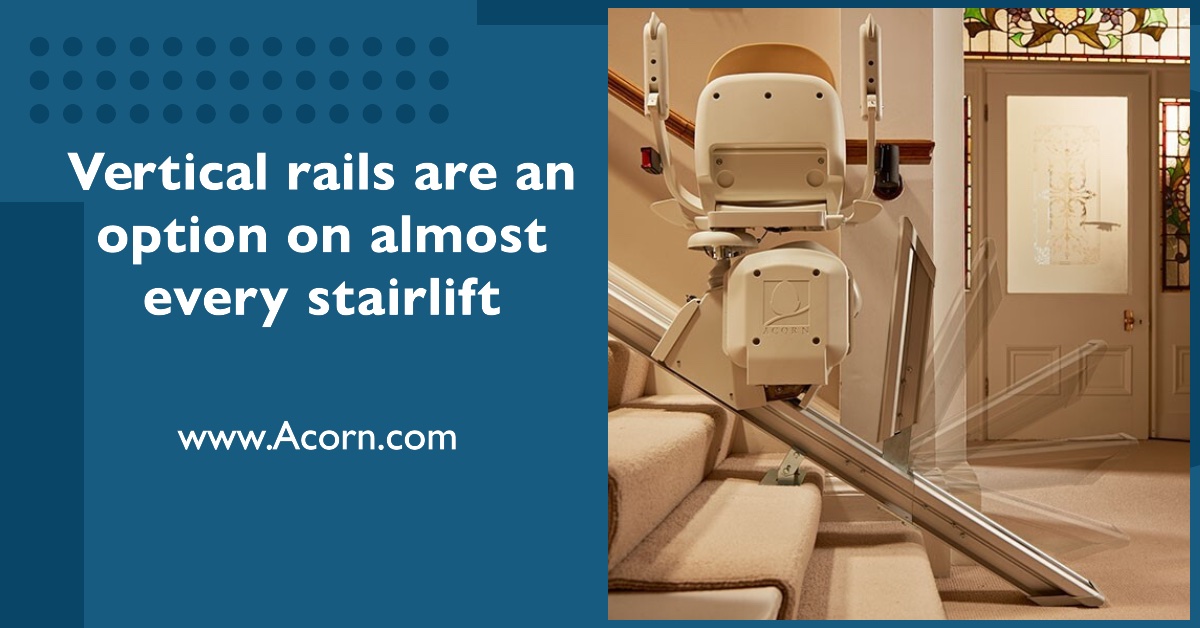

Vertical rails are an option on almost every stairlift.

This additional rail at the bottom of the lift extends the rail past the last step to allow for a safe exit. This rail section is folded manually or automatically to keep it up and out of the way when not in use.

- Folding footrests, folding seats, and folding armrests are standard on some models and optional on others. These features keep the lift folded out of the way when not in use, allowing others in the home to pass by easily.

- Call remotes, whether wireless or attached to the lift itself, allow you to “call” the lift to the top or bottom of the stairs, even when no rider is on it. This allows the lift to be used by multiple members of the household.

- Key locks are included with many models as a way to ensure that unauthorized users cannot access the lift. The key lock is a great safety feature if you purchase your stairlift for a church, business, or public location!

Types of Stairlifts for Seniors

Several styles of residential stair lifts are available, each with unique features and options.

Indoor Straight Stairlifts

An indoor straight stair lift can be customized to your preferred length for stairlifts without curves. A great option is the Harmar Pinnacle Stairlift, offering a wide range of options, including a hinged rail, retractable seat belt, key lock, swivel seat, and the most compact fold in the industry.

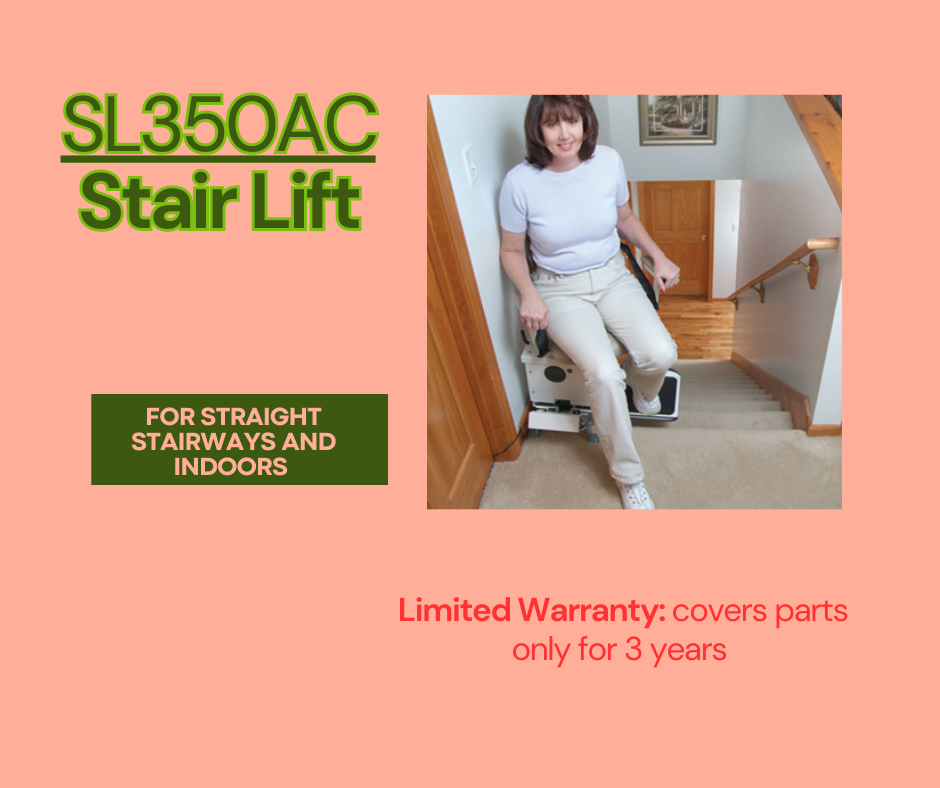

Similarly, their SL350AC is loaded with options, including an optional grocery basket, something not found with other models.

Harmar’s SL350AC Stair Lift

Cheapest Stair Lift Models

If you’re on a budget, AmeriGlide beats Harmar’s starting range of $4,000 by offering–

- the Rave 2 Straight Stairlift starting at $2,095,

- the Horizon Plus Straight Stairlift starting at $1,999.00, and

- the Rubex AC Straight Stairlift starting at $2,545.00.

Indoor Curved Stairlifts

What is the Best Stair Chair Lift for Staircases that Curve and Bend?

For staircases that curve and bend, customizable stairlift models such as the Acorn 180 Curved can be created and fitted specially for your staircase. Trained technicians bend and cut each rail section to the exact specifications necessary for your home, so you never have to worry about fit.

Multiple rail styles are available, including:

- the sleek single-rail of Handicare’s Freecurve stairlift and

- the stylish and durable double-rail featured on their 4000 Double-Rail Curved stairlift.

Acorn 180 Curved Stair Chair Lifts for Seniors

Small-Space, Standing Stairlifts, by Sadler

If your home features a narrow staircase, a compact and discreet stairlift like the Sadler Indoor Stairlift from Stannah only requires that your staircase be 26-28 inches wide.

Senior Outdoor Stairlifts, by Bruno

Outdoor access is equally important to indoor access, allowing you to maintain your freedom and enjoy time outside your home. Whether your stairway leads to a garden or the street, a motorized stair lift can give you the independence you deserve.

Your outdoor stairlift cost will be higher than indoor lifts, and you can expect a shorter warranty. Still, the customization and options are similar to that of indoor models.

Bruno Elite Straight and Curved Models

Bruno offers the Elite Straight or Elite Curved outdoor models, each boasting a 400-pound weight limit, wireless remotes, power folding footrest and seat, and power-folding rail.

Stair Lift Prices

The cost of stairlifts can vary widely among manufacturers and dealers. The average price of stairlifts starts at $1,500-$11,000 and increases based on your chosen options.

Indoor, straight stairlifts are the most affordable, particularly if you purchase a DIY stairlift kit from AmeriGlide. Curved or standing stairlifts and outdoor stairchairs cost significantly more.

Best Companies for Financing Stair Lifts

A residential stairlift is a major home modification, and for some consumers is the only way they can continue to age in their multi-level homes.

Unfortunately, stairlifts can cost anywhere from $1,500 to over $15,000, and most insurance policies will not cover the cost. There are options, however, such as purchasing used stairlifts, renting a stairlift, or purchasing a stairlift from a company that offers financing.

- Bruno offers direct financing options subject to credit application approval. You can also rent a stair lift from them for short-term use without the long-term financial investment of a purchase.

- AmeriGlide offers financing plans directly to the public through a partnership with Bread.

- Stannah does not currently offer financing but maintains a program that makes refurbished stair lifts available at a deep discount. They also offer rentals if you’re looking for a temporary stair lift.

For stairlift manufacturers such as Harmar, who sell only through authorized dealers, rental programs and financing options are specific to the dealership.

Additional resources are available if financing your stairlift through the dealer is not an option. The VA, HUD, and some Medicare Advantage Plans all offer stair lift financial assistance.

Rating Breakdown

Frequently Asked Questions

ARE STAIR LIFTS TAX DEDUCTIBLE?

Tax deductions are dependent upon each individual’s tax situation. There are some situations in which a stair lift may be tax deductible. If you can prove that your stairlift has been installed as a medical necessity through letters from your physician or medical reports, you may be able to claim it as a tax deduction.

WHERE CAN I BUY STAIR LIFTS?

Some manufacturers sell their stair lifts directly to the public. Acorn, Handicare, and Stannah sell directly to the public. You can find information on purchasing their lifts on their website. Manufacturers such as Harmar, AmeriGlide, and Bruno only offer their lifts through independent, certified dealers like Lifeway Mobility and Arrow Lift.

WHERE CAN I FIND STAIR LIFT DEALERS NEAR ME?

Stairlift dealers are located throughout the country and can be found by searching for “stair lift dealers near me” with your internet browser or searching for “stairlift” in your local yellow pages.

WHERE CAN I PURCHASE STAIR LIFT BATTERIES?

Each stairlift uses batteries specific to its model. If your stair chair needs new batteries, check with the dealership from which you purchased the model. They may offer to send a technician to change it for you. If you prefer to buy and change the battery, you can purchase batteries at atbatt. Be sure to check your user manual for information on how to make the change safely.

WHAT ARE THE STAIR LIFT INSTALLATION REQUIREMENTS?

Stairlift requirements for installation vary depending on the style and model of the stair lift you’re purchasing. Before installation, most manufacturers will send a certified technician to your home to measure and decide if a stair lift is right for your staircase. In some cases, such as when purchasing a DIY kit, you’ll measure independently according to the manufacturer’s instructions.

A home outlet must also be near the staircase to allow the stair climber to be plugged in at all times. If you do not have an outlet close enough, you will be required to pay for and coordinate the installation of an outlet before installation.

WHERE CAN I SELL MY USED STAIRLIFT?

Check with nearby dealerships if you no longer use your stairlift and wish to sell it. Many offer removal services, will recycle your stairlift, and may even offer to pay you for it if it is under ten years old and in good working condition.

WHERE CAN I FIND A TECHNICIAN TO PERFORM STAIRLIFT REPAIRS NEAR ME?

Finding a technician near you is as easy as typing “stairlift repairs near me” into your internet browser search bar. Your local stairlift dealership should be able to assist you in getting the necessary repairs done to your senior stairlift.

IS A STAIRLIFT THE SAME AS A SHAFTLESS STAIRLIFT?

While similar, a stairlift and a shaftless stairlift refer to different products. A stair lift is a stair climber that allows the rider to journey over the stairs on rails while standing or seated on a chair. A shaftless stairlift refers to a style of elevator.

CAN I USE MY SENIOR STAIR CHAIR AS A DOG STAIRLIFT?

It is not recommended that you use your senior stairlift as a dog stairlift, as it has no safety features specific to the canines. However, the Paw Lift is a wonderful option if your pet requires a stair lift! This lift is created with dogs in mind, featuring a safety basket that climbs the stairs on rails similar to human lifts.

WHERE CAN I GET A FREE STAIRLIFT?

Stairlifts are expensive and often an unexpected expense. Unfortunately, free stairlifts are not easy to come by. If you need a stairlift and hope to obtain one on a budget, search classified ads for used lifts. You may find consumers who want the lift removed. If you or a loved one is a certified technician and can remove the lift from the previous owner’s home and install it in yours at no cost, you may score a free stairlift. However, each lift is created to the specifications of its intended staircase. You’ll need to find one that is exactly the size you need, or you may run into some serious safety hazards.

DOES AARP COVER STAIRLIFTS?

No, at this time, there are no programs through AARP that assist with purchasing a stairlift. For financial assistance, see our “Financing Your Stairlift” section above.

Do Walk In Bathtubs Leak:

If you search online for “walk-in tub leak complaints,” you’ll find plenty of stories to read. For instance, take a look at Safe Step’s BBB profile and read reviews mentioning “leak.”

While leaks in walk-in bathtubs can happen, they are not common. Here’s what you should know:

Choose quality: To minimize the chances of leaks, select a well-built walk-in bathtub from a reliable manufacturer.

Professional installation: Proper installation by certified installers and experienced plumbers helps prevent leaks.

Regular maintenance: Check seals and connections regularly, following the manufacturer’s maintenance guidelines, to keep them in good condition.

Seek assistance if needed: If you notice any leaks or water seepage, reach out to a professional plumber or technician for help.

Remember, reputable walk-in tubs have effective sealing mechanisms to reduce the risk of leaks. By choosing a quality tub, ensuring proper installation, maintaining it regularly, and seeking professional assistance when necessary, you can minimize the chances of leaks.

It’s worth noting that while leaks can occur, most issues can be easily resolved by replacing a part. Therefore, it is essential to purchase a walk-in tub from a reliable manufacturer that offers a strong warranty covering parts and labor for at least 10-15 years. This ensures peace of mind and customer satisfaction.

Can the VA Pay for a Walk-In Tub?

If you’re a veteran needing a walk-in tub and require financial assistance, the Department of Veterans Affairs (VA) offers programs to help. Here’s what you should know:

Specially Adapted Housing (SAH) Grants: SAH grants assist eligible veterans with service-connected disabilities in making home modifications for enhanced accessibility. Walk-in tubs can significantly improve bathing for individuals with mobility issues, making them potentially eligible for this program.

Home Improvements and Structural Alterations (HISA) Grants: HISA grants support veterans in making necessary home modifications for medical treatment or disability-related accessibility. To be considered for coverage, obtain a letter from your doctor explaining the necessity of a walk-in bathtub for your health condition.

These VA programs provide financial support to make walk-in tubs more accessible to veterans. For detailed information, including any available discounts for veterans, contact the VA directly or consult with a Veterans Service Organization.

10,351 users

found a medical alert device this month

Editorial Reviews

ADT Company Review

Home Security Industry Expert Reviews ADT This ADT review will cover everything you need to know about the company, its products, and the experience you might expect owning them. The company is one of the most well-known and largest in the industry, offering a wide...

Ring Home Security System Review

A 2024 Ring Security System Review (tried and tested) Searching for reviews on Ring home security systems? This Ring security system review will cover everything you need to know about the company, its products, and the experience you might expect owning them. I...

Emma Mattress Review

Home Security Expert Reviews SimpliSafe vs. Alternatives (2024)

This Simplisafe review will cover what you need to know about the company’s home security products, services, and background. We touch on its installation procedures, including that it offers both DIY and professional options, and we talk about the SimpliSafe app,...

Vivint Home Security System Review

Our Rating System

Our reviews come from industry expert authors!

The star ratings are based on the overall rating of each brand. Some reviews are provided via third party suppliers.

Must Reads

How To Get a 100K Business Loan

If you're starting a new business or expanding an existing one, we don't have to tell you about the massive number of moving parts involved. Funding the transition is just one part—albeit a big one. As expected, entrepreneurs often spend most of their time honing...

Can I Refinance My Private Student Loan? Learn Options for 2024!

The weight of student loan debt can feel overwhelming, especially for graduates of professional programs like law school and medical school. According to the latest data from the American Bar Association, the average law school graduate owes approximately $130,000 in...

Review Liberty Home Guard Vs. American Home Shield Warranties

Overall, Liberty Home Guard offers top-rated service with its affordable and comprehensive home warranty plans. Detailed Comparison of American Home Shield vs. Liberty Home Guard AHS vs Liberty American Home Shield Liberty Home Guard Monthly Price $29.99 to $69.99...

Best Egg Vs. SoFi Which A+ Graded Company is Better for You?

Best Egg Loan Reviews Vs. SoFi Personal Loan Reviews Examining Best Egg loan reviews Vs. SoFi personal loan reviews reveals two similar approaches to online lending from two very different types of companies. Where SoFi offers full online banking services and lending,...

Debt Consolidation Vs Personal Loan

The primary difference between a personal loan and a debt consolidation loan has little to do with the loan itself and more to do with how consumers use the funding. The application processes can differ slightly in that when consolidating debt, it's wise to account...

Fitting Hearing Aids: All You Need To Know, by Dr. Ruth Reisman

How to Correctly Fit Hearing Aids Properly fitted hearing aids can significantly improve sound quality, enhance comfort, and optimize the efficiency of your hearing devices. This is particularly crucial for seniors with tinnitus, as correctly fitted hearing aids can...

Medical Guardian vs. Life Alert: Which Medical Alert System is Better?

Welcome to our comprehensive showdown between Medical Guardian and Life Alert – two titans in the world of medical alert systems. If you're seeking the ultimate safeguard for your loved ones or yourself, you're in the right place. We're about to dive deep into this...

How to Choose a Mattress With Confidence: Everything You Need to Know

You've heard it said that we'll spend somewhere around a third of our lives in bed—And the math works out. While we're mostly awake for life's larger portions, taking care of ourselves all the time is essential—Not just the two-thirds we remember best. Learning how to...

Happy Head vs. Hims vs. Keeps: Best & Worst ways to regrow hair!

Happy Head vs. Hims vs. Keeps: What is the best product to regrow hair? Are you ready to stop hair loss and regrow a thick head of hair? Happy Head, Hims, and Keeps offer effective hair loss and regrowth treatments for men and women. Harnessing the power of...

Which is Better?: Identity Guard Vs. LifeLock

Which is Better?: Identity Guard Vs. LifeLock At first, an Identity Guard vs. LifeLock comparison may look like a toss-up. Both companies have been in the game longer than most, and both offer solid identity theft protections and plans with variable coverages to allow...