Understanding California Debt Consolidation and Services

As the cost of living in California continues to rise, more residents are turning to debt consolidation and credit counseling programs to regain financial stability. From skyrocketing housing costs to increasing prices on everyday essentials, managing debt has become a growing challenge for many Californians.

This guide provides insights into debt relief programs, including their pros and cons, and highlights laws and resources to help you make an informed decision.

Pros and Cons of California Consumer Credit Counseling Programs

What Is Consumer Credit Counseling?

Consumer credit counseling consolidates your credit card payments into a single monthly payment. These programs reduce interest rates and aim to help you become debt-free within five years.

Pros:

- Lower Interest Rates: Creditors often agree to reduced interest rates for participants.

- Single Payment: Simplifies debt management with one consolidated payment.

- Minimal Credit Score Impact: Unlike other debt relief options, these programs have a smaller negative effect on your credit score, as payments remain current.

- Late Fee Waivers: Late payments may be re-aged, and fees are often waived.

Cons:

- Accounts Closed: Credit cards enrolled in the program will be closed, which can lower credit scores.

- Credit Counseling Notation: A third-party credit counseling notation may appear on your credit report, which could discourage future creditors.

- Commitment: Plans typically last 4-5 years, requiring consistent payments.

Is It Right for You?

If you’re struggling with high-interest credit card payments but want to maintain your credit score, consumer credit counseling could be a viable solution.

California Debt Consolidation Loans

What Are Debt Consolidation Loans?

Debt consolidation loans combine multiple debts into a single loan, often at a lower interest rate. These loans can be secured (e.g., with a home equity line of credit) or unsecured.

Benefits:

- Preserve Credit Score: Ideal for individuals with high credit scores who want to avoid the credit impact of other debt relief options.

- Flexible Use: Can include both secured and unsecured accounts.

- Lower Monthly Payments: Longer repayment terms often reduce monthly obligations.

Risks:

- Collateral Requirement: Secured loans may put your property at risk if payments are missed.

- Interest Costs: Extending repayment terms may result in higher total interest paid.

California Resources:

Local credit unions and online marketplaces like Credible offer competitive consolidation loan options tailored to California residents.

California Debt Help: Can balances be reduced?

How Debt Help Programs Work

Programs in California designed to help consumers reduce the balances on unsecured debts involve the company’s debt arbitrators negotiating with creditors to reduce the principal amount owed. Participants typically make monthly payments into a dedicated account, which is used to pay creditors once a settlement is reached.

Pros:

- Significant Savings: Can reduce debts by up to 30% or more.

- Shorter Duration: Programs typically last 2-4 years.

- Eligibility: Includes credit card debts, personal loans, and medical bills.

Cons:

- Credit Impact: Late payments and settlement notations can significantly lower credit scores.

- Tax Implications: Forgiven debt may be considered taxable income.

- Legal Risks: Creditors may pursue lawsuits if accounts remain unpaid.

Debt negotiation plans are most suitable for individuals facing significant financial hardship and unable to keep up with minimum payments.

Warnings for California Credit Card Relief Programs

- Beware of Upfront Fees: California law prohibits credit card debt relief companies from charging upfront fees before achieving results. Do not agree to any program that requires payment before your debts are reduced and settled. For instance, if a company offers to negotiate a lower payoff with your creditor, they cannot charge a fee until:

- The creditor agrees to reduce the debt.

- You pay the reduced amount directly to the creditor.

- Only after these conditions are met can the company charge a fee.

- Impact of Debt Reduction Strategies on Credit: Many California debt reduction programs require debts to become delinquent before they are charged off and sold to third-party collection agencies. While this approach can save money for consumers in financial hardship, it comes with significant drawbacks:

- Credit Score Impact: Delinquent payments and collection accounts can severely reduce credit scores.

- Long-Term Negative Marks: Even after paying off the debt, collection accounts often remain on credit reports for years, continuing to harm credit scores.

- Consumer Credit Counseling Limitations: Nonprofit consumer credit counseling programs in California often charge minimal fees, typically under $50 per month. While these programs allow consumers to stay current on monthly payments and avoid drastic credit score drops, there are still consequences:

- Credit Card Closure: Enrolling in a plan results in credit card accounts being closed, which can negatively impact credit scores.

- Credit Counseling Notation: A notation on your credit report indicating enrollment in a credit counseling plan may affect your ability to qualify for future low-interest loans.

- Challenges with Consolidation Loans: For consumers with fair to excellent credit, low-APR consolidation loans can be an effective way to pay off high-interest debt by combining multiple debts into one loan with a lower interest rate. However:

- Qualification Challenges: Consumers with maxed-out credit cards or high debt-to-income ratios may find it difficult to qualify for a low-APR loan.

- Credit Score Dependency: The success of this approach heavily depends on maintaining a strong credit profile.

By understanding these warnings and potential pitfalls, consumers can make informed decisions when exploring debt relief programs in California. Always verify the legitimacy of any company and carefully evaluate the long-term consequences of the chosen strategy.

California Debt Relief Laws and Regulations

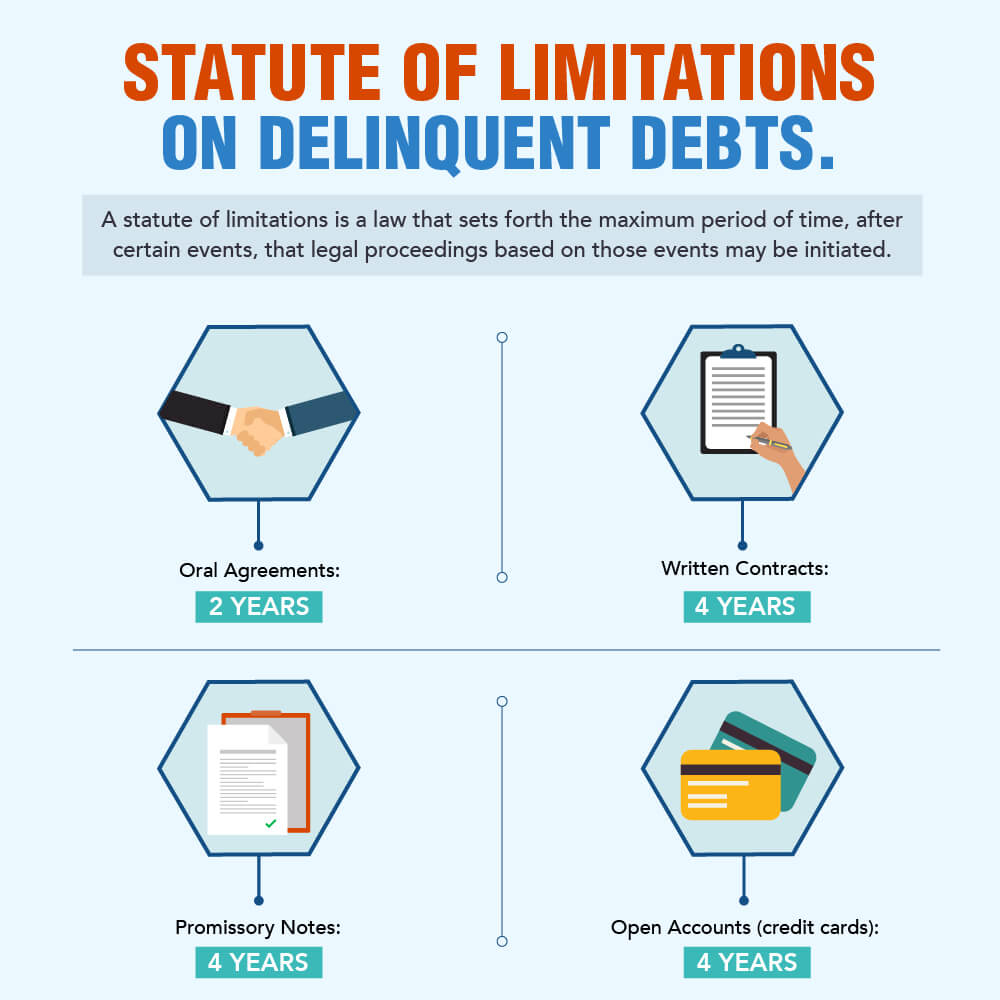

Statute of Limitations on Debt in California

California has a four-year statute of limitations for most consumer debts. This means creditors cannot sue to collect a debt after four years from the date of the last payment. However, making a payment or acknowledging the debt can reset the clock.

The Debt Settlement Consumer Act (SB 708)

Under this law, debt settlement companies in California cannot charge more than 15% of the amount forgiven. This ensures greater transparency and protection for consumers.

Bankruptcy as a Last Resort

When to Consider Bankruptcy

Bankruptcy should only be considered when other debt relief options are not viable. Chapter 7 bankruptcy allows for the discharge of unsecured debts, while Chapter 13 creates a structured repayment plan over five years.

Impacts of Bankruptcy:

- Severe Credit Impact: Bankruptcy remains on your credit report for up to 10 years.

- Potential Asset Loss: Some assets may be liquidated to pay creditors in Chapter 7 cases.

Consulting with a California bankruptcy attorney can provide clarity on whether this option is suitable for your situation.

Making Informed Decisions About Debt Relief in California

Key Considerations:

- Assess Your Finances: Understand your income, expenses, and debt obligations.

- Research Programs: Compare debt consolidation options, considering their benefits and drawbacks.

- Verify Companies: Check reviews on reputable platforms like the BBB and Google to ensure the company you choose is licensed and transparent.

- Understand the Laws: Familiarize yourself with California debt relief regulations to avoid scams.

Additional Resources

- The Department of Justice offers a directory of licensed consumer credit counseling agencies.

- Debt calculators can help you evaluate potential savings under various programs.

By carefully evaluating your options and seeking professional guidance, you can choose a debt relief strategy that aligns with your financial goals and circumstances.

Disclosure: Goldenfs.org does not offer any programs or services. This content is intended for informational purposes only. Always consult with a licensed financial advisor or financial professional before making significant financial decisions.