Table of Contents

- Idaho Debt Relief Page Summary

- Idaho Bankruptcy Debt Relief

- The 4 Best Idaho Debt Relief Solutions and Consolidation Options

- Idaho Debt Statistics

- Do you owe less than $7,500 in debt?

- Do you owe above $7,500 in debt?

- Idaho Credit Card Debt Relief Services

- Idaho debt negotiation Vs. a loan

- Debt Settlement in Idaho

- Idaho Debt Relief Company Reviews

- Idaho debt settlement program cost

- The downside of Idaho debt settlement programs

- Idaho debt consolidation for federal student loans

- Consumer Credit Counseling in Idaho

- Learn about debt validation, possibly your least expensive option

- What does it mean when an account is invalidated?

- Statute of Limitations in Idaho

- Eligible Accounts for Debt Settlement

- The Idaho Collection Agency Act (ICAA)

- Fair Debt Collection Practices Act in Idaho

Idaho Debt Relief Programs & Statistics

Considering debt consolidation? Idaho residents have multiple ways to consolidate, but not all options pay your creditors every month. Depending on your goals and current situation will help to determine which plan is right for you. Idaho debt relief programs are available statewide, but only through licensed debt management and credit counseling companies. The following page is designed to provide consumers in Idaho with free educational information, helping people understand the pros and cons of debt relief and consolidation programs.

Due to the COVID-19 pandemic, many consumers in Idaho are now unemployed or have had their incomes reduced. Latah, Franklin, Bingham, Jefferson, and Fremont counties have all been struck hard by the pandemic. “According to the New York Times’ interactive COVID-19 dashboard, which tracks city-level deaths and case numbers for metro areas, Idaho Falls and Rexburg were among the worst virus hot spots in the country.”

In many cases, consumers can’t afford to pay their bills even with the help of debt settlement. Idaho Bankruptcy debt relief is projected to hit an all-time high after the additional unemployment benefits come to an end in 2021 and credit card companies stop offering deferment. But there is still light at the end of the tunnel for anyone that can qualify for a debt relief program. Take your time and read through each section of this page to ensure that you understand all of your options and can make the most informed financial decisions.

Idaho Bankruptcy Debt Relief

Chapter 7 Bankruptcy can:

- help you eliminate your debt in under six months

- put a stop to credit card lawsuits

- help you avoid foreclosure

However, your credit report and score will pay a heavy price for seven to ten years after getting bankruptcy on it.

To qualify for Chapter 7 bankruptcy, the preferred bankruptcy option in Idaho, you must pass a means test. Attorney Karra Kingston explains, “If your monthly income, based on an average from the last 6 months, is less than the median income for your family size in Idaho, then you pass the Chapter 7 Means Test. However, if your income is above the median, you don’t automatically fail.”

Idahoans with over $10,000 in unsecured debt; credit cards, unsecured loans, medical bills, and collection accounts – may be eligible for one of four options.

The 4 Best Idaho Debt Relief Solutions and Consolidation Options

- Credit Card Consolidation Loan through an Idaho local credit union

- Consumer Credit Counseling with a non-profit and Idaho licensed company

- Debt validation

- Idaho Debt Settlement Programs with an IAPDA certified company

Idaho Debt Statistics

Idaho debt statistics recently revealed that Idaho residents have an average credit card balance of $5,213, which is better than the US average credit card debt of $5,235 per borrower. In fact, Idaho made a list for the top ten states with the lowest credit card balances, sitting at number six on the list.

New Jersey and Alaska were the two states with the most credit card debt. Consumers in these two states had an average credit card balance of over $7,000.

So kudos to Idahoans!

Unfortunately, since Coronavirus has struck our country, many Americans have now fallen deep in debt and need help. Idaho debt relief, settlement, and consolidation programs can all be viable solutions for credit card debt. Consumer credit counseling programs in Idaho can reduce interest rates. Settlement programs can reduce your balances. Validation can dispute a debt where you may not have to pay it.

Let’s take a closer look at your options!

If you Owe Under $7,500 in total unsecured debt

The truth is, if you have under $7,500 in credit cards and are current on monthly payments, do not fall behind!

Do your very best to stay current on your monthly payments because ruining your credit over such a small amount of debt is surely something you’ll eventually regret. After you fall behind on your monthly payments, credit scores will drop, and the late and eventual collection marks on your credit report won’t be easy to get off. Instead, use a simple budget calculator to help find some extra cash. You can then use the snowball approach and get out of debt fast while simultaneously building excellent credit.

If you Owe Above $7,500 in total unsecured debt

Not everyone in Idaho can control their financial situation and maintain balances of $7,500 or less. Especially with all of us feeling the after-effects of COVID-19. Thankfully, Idaho debt relief programs are available to help you pay off your debt fast if you can’t afford to stay current on monthly payments.

After eighteen years of offering debt relief programs in Idaho, Golden Financial Services can confidently say that our programs are the least expensive and best in the nation. In fact, TrustedCompanyReviews.com rated Golden Financial Services the Top-Rated Debt Relief Company for 2021.

Disclosure:

Keep in mind; Golden Financial Services does not offer consolidation loans or consumer credit counseling in Idaho. This page aims to provide educational information.

Idaho Credit Card Debt Relief Services

What is the best credit card relief program in Idaho?

- Debt negotiation in Idaho can reduce credit card balances and help a person become debt-free in under four years. The main downside with debt settlement programs in Idaho is that you can end up with collection accounts and late marks, lowering your credit scores. It is illegal to charge fees for debt settlement in Idaho until after a debt is settled and at least one payment is made to the creditor. Not all clients will make it through this type of program. Also, this type of program does not come with a guarantee of results. BBB A+ rated and Accredited debt settlement companies in Idaho do a pretty good job at educating consumers about all of the downsides that come with this type of program and helping people understand how the downsides would get addressed. Over the years, most of the fraudulent companies in Idaho that offered debt settlement programs have been either shut down or have negative reviews about them all across the internet, making it easy for consumers to spot these fraudulent companies.

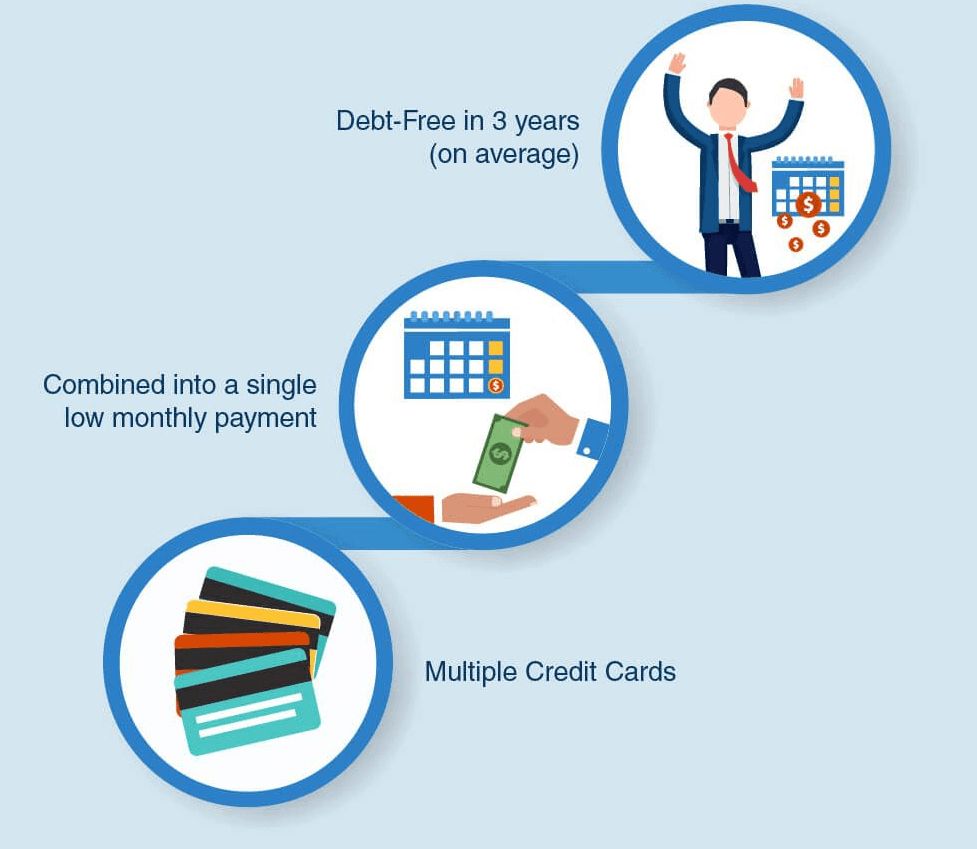

- Idaho residents can use debt validation before turning to a settlement program. Validation is less expensive than debt negotiation when accounts get invalidated successfully. If an account is disputed and proven valid, clients can then have their debt settled for a fraction of the total owed. But in many cases, clients don’t have to pay collection accounts and only pay the program cost. If you join a program, the Idaho debt relief company takes care of most of the leg-work involved, while your main job is to make a single monthly payment, send in any documents (including collection and validation letters) that you receive from creditors, and notate any communication that your creditors attempt to make with you.

- Idaho’s non-profit consumer credit counseling programs can reduce credit card interest rates and help a person become debt-free within four in half years. The main downside here is that you’ll pay all of your credit card balances, plus interest and credit counseling company fees. Consumer credit counseling programs allow a person to stay current on monthly payments, but credit cards are closed out, negatively impacting credit scores. Even though most licensed credit counseling companies in Idaho are non-profit, they can still charge up to $50 per month in fees. Non-profit is not the same as free. For a complete list of non-profit consumer credit counseling companies in Idaho, visit the Department of Justice’s website.

Idaho debt relief, settlement, and consolidation programs all have downsides that you need to consider. Click here to compare the pros and cons of each debt relief program.

Idaho debt negotiation Vs. a loan

Don’t confuse using a settlement program with debt consolidation. Idaho credit unions and certain online lenders like Lending Club and OneMain Financial offer debt consolidation loans.

How does a debt settlement program in Idaho work?

You make a single payment every month that goes directly into a special savings account. Every month as you make these reduced monthly payments, the balance in this savings account grows. As the balance in your savings account grows, the negotiators negotiate with your creditors to lower each of your unsecured debts. One by one, your bills get settled and paid. Settlements can be as low as twenty percent. But in some cases, settlements could be closer to fifty or even seventy percent. The key is to use a reputable debt settlement company that quotes you conservatively, not overpromising and underdelivering. Check whatever company you’re planning to use online. Debt settlement reviews will reveal if a company is trustworthy or not.

Idaho Debt Relief Company Reviews

Companies that help consolidate and settle debt have a hard time accumulating many positive reviews unless they’re truly doing a spectacular job helping people. Consumers are fast to make a negative complaint online, so that makes it easy for consumers to check reviews and find out if a debt relief company in Idaho is reputable and trustworthy or not.

It does not matter if you’re checking credit card consolidation lender reviews or debt settlement company reviews; Idaho clients of these companies will tell you all that you need to know. If lenders are charging high fees and not performing, you’ll see many negative reviews that talk about this problem on sites like the BBB, Yelp, TrustedCompanyReviews.com, ShopperApproved, and Google.

Just make sure you’re checking unbiased third-party review sites when checking reviews, and it’s not a review on the company’s website!

Idaho debt settlement program cost

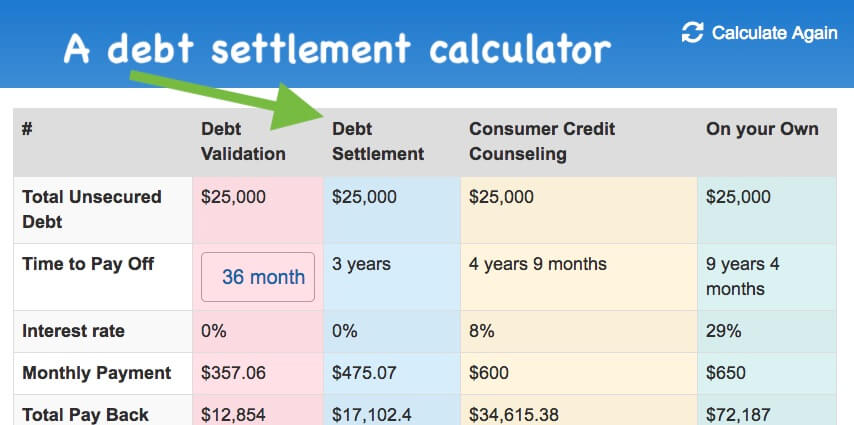

On average, consumers can save around 30% of what they owe. $100,000 in credit cards can end up getting resolved for around $70,000, including all fees. Most debt settlement companies in Idaho charge approximately 20% of the total balances enrolled into the program.

The cost of each Idaho debt consolidation option and alternative:

Notice the settlement option, where the green arrow is pointing. We’re providing an estimate of what you’d pay for this type of program, but this is just an estimate. You could save thousands of dollars more, or the program could cost more. These estimates are based on past results.

The downside of Idaho debt settlement programs

Since creditors don’t get paid every month, late marks and collection accounts are inflicted on credit reports and lower credit scores. Although it is rare, a percentage of credit card companies issue a summons to go to court. If you are sued while on a settlement program through Golden Financial Services, a law firm will work with your creditor to settle the debt for less than the full amount before the court appearance so that you never have to go to court.

As each account is negotiated down and paid off, credit scores may improve. Over the first year of the program, credit scores will almost always go down. A settlement program is not designed to improve credit scores; it’s used to eliminate debt fast.

If your goal is to improve your credit score, Idaho credit unions can offer you a debt consolidation loan or balance transfer card to pay off your debt in one shot. Using a local credit union is the route Golden Financial recommends you take for a consolidation loan.

Most settlement programs are available for consumers nationally. Canceling debt settlement programs before finishing can leave a person in worse shape than when they started. You could be left with increased balances and more debt than when you started the program.

Tax consequences are another downside that comes with debt settlement. Idaho residents that can illustrate they are insolvent (i.e., unable to pay their debt) can avoid paying taxes on a forgiven debt. See the IRS sees that savings on a settlement as taxable income. To avoid paying taxes on your savings from a settled account, you can fill out a #982 IRS tax form.

Idaho debt consolidation for federal student loans

Students can go to studentloans.gov and consolidate. After consolidating, get on an income-based repayment plan that includes loan forgiveness. These income-based plans require recertification every year. If students forget to recertify, they can be kicked off the program and lose eligibility for loan forgiveness. Like teachers and police officers, anyone with a public service job can get loan forgiveness in as quick as ten years. Disabled military veterans also may be eligible for special loan forgiveness options.

Visit this page next to learn how to consolidate federal student loans.

Consumer Credit Counseling – Idaho

Idaho consumer credit counseling (CCC) plans are only for credit cards. With CCC, interest rates on credit cards can be significantly reduced, late fees can get waived, and past due payments can get re-aged to show current.

Clients of a CCC program make one payment every month to the CCC company. The company then disburses the payments to each creditor but at a reduced interest rate. As a result of CCC, consumers can become debt-free in 4.5 years. For a complete list of non-profit consumer credit counseling companies in Idaho, visit the Department of Justice’s website.

Does Idaho consumer credit counseling hurt credit scores?

All credit card relief programs in Idaho can lower a person’s credit score. However, with CCC, credit scores can actually improve in some cases at the beginning of the program because late payments can get re-aged.

Credit counseling can hurt a person’s credit score if they’re current on payments before joining because their cards will get closed. And when a person closes a credit card, it negatively affects their credit utilization ratio, resulting in a reduction in credit scores.

What’s the least expensive Idaho debt relief program?

Last but not least is a debt validation program. Validation can be your least expensive route and the only program to include a money-back guarantee.

Like when a person gets a speeding ticket and hires a lawyer to challenge it, debt can also get disputed, and surprisingly collection agencies often can’t prove it’s valid. A validation program gives you the legal right to dispute a collection account, and if it’s proven legally uncollectible, you don’t have to pay it.

How does a validation affect credit scores?

Validation and settlement programs both require a person to stop making payments to creditors, which is the action that hurts a person’s credit score. The difference with validation is that after accounts get proven to be legally uncollectible, they can no longer legally remain on credit reports. After each collection account is invalidated, legally, the collection agency cannot continue reporting the account to the credit bureaus.

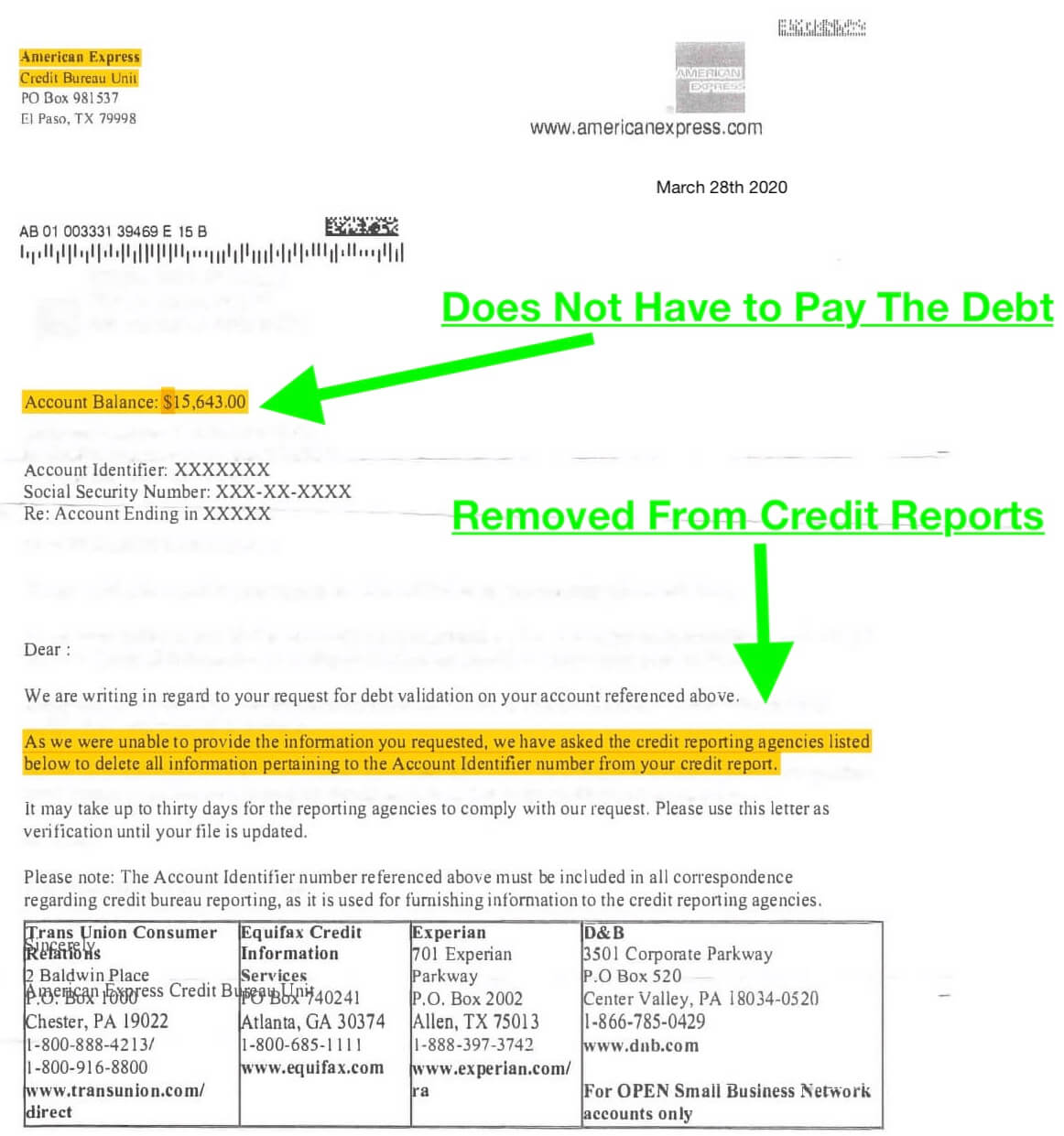

AMEX Credit Card Disputed and Invalidated

What does it mean when an account is invalidated?

Invalidated means that the collection agency could not prove they were legally authorized to collect on a debt. An invalidated account does not need to get paid. An invalidated account cannot legally remain on credit reports.

However, just because an account is invalidated does not mean it gets erased or eliminated. The account could re-appear until after it has expired passed the statute of limitations in Idaho.

Statute of Limitations

- Mortgage debt: 5 years

- Medical debt: 5 years

- Statute of limitations on credit card debt: 5 years

- Auto loan debt: 4 years

Idaho Debt Settlement Programs can resolve:

- private and federal student loans

- medical bills

- financial and bank loans

- credit cards

- third-party collection accounts

Fair Debt Collection Practices Act in Idaho (FDCPA)

Idaho debt collectors have rules they have to follow under the FDCPA.

- Creditors in Idaho can’t call you at any time or place they know is not convenient. So if you told them a time and place that you cannot take a call, like if you’re at school, they can’t call you at that time.

- Collection agencies cannot call you at your place of employment.

- Collectors can’t call you before 8 am or after 9 pm.

- Collectors can’t lie, like tell you that they will sue you when there is really no lawsuit pending.

- Collection agencies are required to be licensed and bonded in Idaho.

There are many rules that collection agencies must follow. Part of a debt validation program forces creditors to prove they’re abiding by all of these rules.

Collection agencies must have a permit to do any of the following, according to The Idaho Collection Agency Act (ICAA)

- Operating as a collection agency, debt counselor, credit counselor, credit repair business, or debt buyer

- Engaging, either directly or indirectly, in the business of collecting or receiving payment for others of any account or bill

- Soliciting or advertising for the right to collect or receive payment for another of any account or bill

- Selling or distributing any system of collection letters in which the name of any person other than the creditor to whom the debt is owed appears.

- Engaging in the business of credit counseling

- Engaging in the business of credit repair

All collection agencies must file an annual report of activity, surety bond calculation form and pay an annual fee before March 15 of each year. Collection agency licensees must file a license renewal application annually before March 15 (paper) or December 31 (NMLS).

Idaho Wage Garnishment Laws

Attorney Baran Bulkat explains:

“In Idaho, creditors are limited in how much they can garnish from your wages. Idaho law limits the amount that a creditor can garnish (take) from your wages to repay debts. Both Idaho and federal wage garnishment laws (also called wage attachments) place the same limits on how much of your paycheck may be garnished. For the most part, creditors with judgments can take only 25% of your net wages after required deductions.”

When it comes to credit cards and unsecured debt, before your wages can be garnished, a creditor must issue you a summons, take you to court, and win a default judgment. When enrolled in a settlement or validation plan, lawsuit defense is included, so if you do receive a summons while on a program, notify the company immediately so that they can help you resolve it before the court date.

However, on defaulted federal student loans, unpaid income taxes, and past-due child support, your wages can be garnished without the creditor needing a default judgment. For that reason, if you’re behind on any of these types of accounts take action fast to avoid wage garnishment. Idaho residents with defaulted student loans should immediately request forbearance. While in forbearance, then apply to consolidate and after that get on an income-based repayment plan. You will find step-by-step instructions on how to consolidate, get on an affordable student loan relief plan, and loan forgiveness by reading this page next.

Free Idaho Debt Relief and Food Resources for Low Income

Food Resources for Low Income Idaho Residents

Community Action Partnership Association of Idaho (CAPAI) is a private, non-profit association dedicated to fighting the causes and conditions of poverty in Idaho. Address: Community Action Partnership Association of Idaho 5400 W. Franklin Rd. Suite G, Boise, Idaho 83705. Phone: 1-208-375-7382; 1-877-375-7382

Website: https://www.capai.org/

THE IDAHO FOODBANK

The Idaho Foodbank provides free food to hungry people through partnerships with nonprofit agencies, the food industry, government, volunteers, corporations, and individuals by serving as a central clearinghouse for donated and purchased food. Address: Idaho Foodbank 3562 So. TK Ave. Boise, ID 83705. Phone: 208-336-9643

Website: http://www.idahofoodbank.org/

Federal Resource – Supplemental Nutrition Assistance Program (SNAP)

SNAP provides nutrition benefits to supplement the food budget of needy families to purchase healthy food and move towards self-sufficiency.