- New York (NY) debt relief, settlement, and consolidation programs work by either (1) settling debt, (2) consolidating credit cards into one reduced monthly payment and lowering interest rates, or (3) disputing the debt and negotiating a repayment plan.

- NY consumer credit counseling (and debt consolidation) programs reduce interest rates and consolidate payments. Debt settlement programs in NY do the complete opposite; instead of paying the credit cards every month, you must fall behind on payments, and then settlements can be negotiated to allow you to pay less than the total balance.

- Attorney-based debt resolution programs in NY are also available. These programs focus on using the most cost-effective credit card debt solution and use debt validation to dispute third-party collection accounts. Credit card debt can end up getting disputed and invalidated, even being removed from credit reports by the end of the program. Legal protection is included with NY debt resolution programs.

- Debt consolidation loans in NY are another option if you have a high credit score. A credit card consolidation loan that has a low-interest rate can be used to pay off all of your high-interest balances in one shot. You will only have to pay back the single loan and save thousands of dollars in interest.

But what’s the best NY debt relief program for you?

Here’s where Golden Financial Services comes into the picture. Our NY debt counselors can provide you with free financial advice and, if you’re eligible, assist you in enrolling in the program of your choice. You will learn about the pros and cons of each credit card relief program. New York state residents can pick from multiple debt relief programs. New Yorkers must owe $7500 or more in unsecured debt to qualify for any of the programs. A counselor will provide you with a detailed explanation of how each program works, including the potential downsides that come with each program. You will learn what downsides exist and how the program goes about dealing with downsides if they occur to ensure you make it through the plan successfully and become debt-free in the end.

Free do-it-yourself debt relief options will also be presented if you don’t qualify for a program. For example, use our snowball calculator to pay off debt faster on your own. New York Residents Can Call (929) 437-6155 For a Free Consultation With an IAPDA Certified Counselor. Learn your options for free and enroll in a plan if you qualify. The information you get can be life-changing. Learn how to transform your finances and improve your financial future today. Scroll throughout this page to learn about subjects that interest you.

NY Debt Relief Programs (Table of Contents)

- NY Debt Relief & Settlement Program Potential Benefits

- NY Debt Relief & Settlement Program Potential Downsides

- What type of debt qualifies for NY debt relief?

- Learn About Debt Settlement in New York to Reduce Balances

- See Example Case Illustrating a Settled Credit Card Debt

- Learn About Debt Consolidation in New York to Reduce Interest Rates

- Learn About Debt Validation in New York to Dispute Debts

- A Validation Program Example–Client Saves Around $9,000

- Learn About Consumer Credit Counseling in NY (pre-bankruptcy & credit card interest reduction program)

- NY Property Tax Relief

- Military Debt Relief in NY

- Senior Citizen and Disabled Debt Relief in NY

- New York Debt Collection Statute of Limitations

- New York Rent Assistance Due to COVID-19

Choose From the Best NY Debt Relief, Settlement, and Consolidation Programs for 2022

Whether you live near the pristine waterways and boreal forests in the Adardondex Mountains, next to the iconic skyscrapers in NYC, or in an oceanfront home on Long Island – New York (NY), Debt Relief, Settlement, and Consolidation Programs can help.

These plans have already rescued millions of New Yorkers since 2004. Resolve medical bills, collection accounts including repossessions, credit cards, personal loans (including accounts like Lending Club and Prosper Financial), and just about all unsecured debt.

Do you owe above $10,000 in debt? To learn your options, call (866) 376-9846. Golden Financial Services (GFS) is an IAPDA Accredited and Better Business Bureau A+ rated company. The following page is a comprehensive guide to debt relief, settlement, and consolidation programs in NY.

What Type of Debt Qualifies for New York Debt Relief?

- Federal student loans and sometimes private

- Credit card debt

- Third-party debt collection accounts

- Payday loans

- Almost any type of loan

- Medical bills

- Repossessions

New York Rental Assistance for 2022

New York rent relief is available in 2022. Here are the details: News Alert for NY Rent Help: The State Senate on Monday passed a special bill to address the need for rental assistance for New Yorkers, but you must have a financial hardship. Both the Senate and State Assembly agreed on an eviction moratorium that will extend until May 1st,021. This new bill will also benefit homeowners and small landlords that own ten or fewer units, protecting them from foreclosure and tax lien sales. Financial hardship could include: lost income, increased medical expenses, improved child care and family care costs, unable to obtain meaningful employment, can’t afford moving costs. … Or those with a household member in a high-risk category for COVID. According to Governor Cuomo; “We want to protect tenants, make it simple, we don’t want people evicted, we don’t want them to have to go to court to fight the eviction, but we also want to avoid fraud and don’t want people making false representations.” The bill also protects your credit rating. So your credit report won’t be negatively affected if you fall behind on payments.

Have you ever tried working with unreasonable creditors on your own, asking them to reduce your monthly payment?

Often, they won’t budge on the monthly payment.

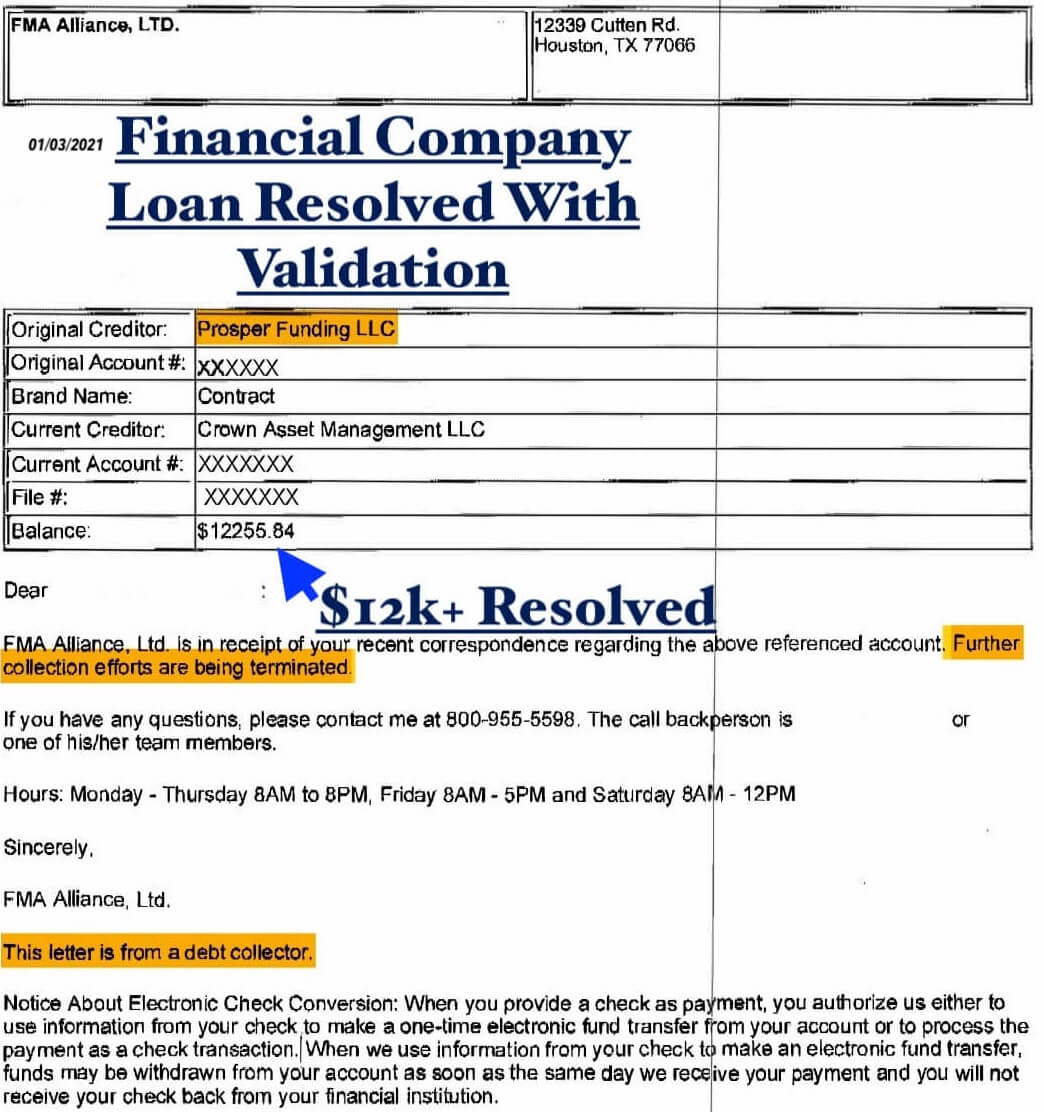

Next, we will illustrate an example of a Prosper Funding personal loan sent to a collection agency and disputed with the NY debt validation program. Before signing up for the plan, the consumer worked directly with the lender to reduce the payment. Unfortunately, the lender rejected their request, forcing the consumer to join a debt relief service.

How long did it take to get results like this on the NY Debt Relief Program?

Approximately one year after the consumer was approved for the program, their debt became invalidated. As a result, the debt no longer needed to be paid and came off the consumer’s credit report, as illustrated in the letter above.

How Much Did This NY Debt Relief Program Cost?

The creditor agreed to stop collecting the debt and remove it from all three credit reports entirely. The program’s cost was under $6,000, resulting in a complete resolution of this $12,000 debt.

How did the consumer go about getting help?

The consumer above had a $12,000 debt that they could not afford to pay. So they contacted Golden Financial Services, and we provided them with an affordable payment, helping them resolve what was originally a personal loan.

Is there a downside, and is the account gone forever?

There is still a chance that the account can get resold to a new collection agency or sent back to the original creditor, and collections can continue. For that reason, the validation program includes a money-back guarantee and will stay with the client until the statute of limitations on the debt expires. So, for example, if a new collection agency were to take over the collection account, the validation program would follow up with the latest collection agency and illustrate to them that the account was invalidated and proven already to be legally uncollectible.

What is the worst-case scenario that could happen after joining a NY debt relief service?

Sometimes these programs are not straightforward one resolution fits all. That’s where GFS’s twenty years of experience comes in. Here’s an example:

Another worst-case scenario could be if the original creditor were to take back the loan and issue a summons. In that case, the client would be fully refunded and referred over to a settlement department where the account could get settled for much less than what’s owed, still saving the client potentially thousands of dollars. The plans offered for NY residents through GFS stay with the client until the end, ensuring an attractive resolution to their debt. Please don’t take our word for it; check out the Top 10 Debt Relief Programs for 2020, Google reviews from clients, and our BBB A+ rating.

What programs are available to help with credit cards in New York?

New York debt relief, settlement, and consolidation options provide credit card relief. We will find you the lowest possible payment and get you approved in under a day. If you don’t qualify for a program, we will let you know the truth and help point you in the right direction to improve your financial situation on your own. For example, many consumers that don’t qualify for a debt relief program end up using this debt snowball calculator to pay off their debt on their own while simultaneously improving their credit score.

New York Residents Can Call (929) 437-6155 For a Free Consultation With an IAPDA Certified Counselor. Learn your options for free and enroll in a plan if you qualify.

The History of New York’s Financial Problems & Statistics

According to the Office of the New York State Comptroller, “From 2008 through 2013, throughout the Great Recession and the initial recovery, New Yorkers’ credit card debt per capita declined significantly, by 21.7 percent. This decline reflected a nationwide trend for most forms of household debt. However, the trend reversed in 2014, with per capita credit card debt increasing through 2017. From 2014 to 2017, credit card debt per capita increased by more than 14 percent in New York.”

Statistics on Credit Card Debt in NY, Post COVID-19

CNBC explains, “In the months since the coronavirus pandemic hit and sent millions of Americans to shelter at home, consumers’ credit card debt has fallen fast to unprecedented levels. According to a new report released Thursday from the Federal Reserve Bank of New York, the second quarter of 2020 saw a staggering $82 billion decline in credit card balances. Second-quarter declines in card balances, in general, have only been seen during the Great Recession, and a drop this big in the second quarter of the year hasn’t happened since at least two decades ago, the report says.”

Since COVID-19, people are spending less and staying home more. In addition to that, New Yorkers are using stimulus money to pay down credit card balances. “The report also suggests that the federal aid — $1,200 stimulus checks and a $600 boost in weekly unemployment benefits (which ended July 31) — has worked to prevent “large-scale spikes in delinquency” for many borrowers. However, long-term recovery depends on people continuing to limit their credit use, as well as additional government assistance and whether the labor market improves.”

Looking back a few years:

NY had the 8th highest rate of credit card delinquencies in the nation. In addition, 8.3% of credit card borrowers in NY are behind on credit card payments. The total credit card debt in NY exceeds $58.2 billion, the fourth-highest in the nation. In 2018, the Federal Reserve increased its Federal Funds Rate four times, resulting in credit card companies raising interest rates. In 2019, at least two more rate hikes will occur, according to the latest projections. When interest rates go up shortly after, monthly payments also increase, making it even harder for consumers to pay off high credit card balances.

Compare New York to National Debt

Credit card debt affects the entire nation, not only in New York. As of 2019, credit card debt in the U.S. is at $870 billion, an all-time high. “It’s the first time credit card balances have reached the 2008 nominal peak”, according to a recent article in Fox Business.

Total Credit Card Debt Per Each NY County & City

- The average credit card balance in Manhatten is $7,400.

- The average credit card balance in the Hudson Valley area is $6,800.

- The average credit card debt on Long Island is $6,700.

- Kingston’s average credit card balance is $5,500.

- The average credit card debt in Brooklyn is $5,400.

- The average credit card debt in Niagra Falls is $5,100.

NY is the 3rd Most Expensive Place to Live.

Unfortunately, living in New York is expensive. New York is the third most expensive place to live in the Nation, just above California, the fourth most expensive place. The most expensive states to live in the nation are Hawaii at number one and Washington D.C. at number two.

In Manhatten, a can of coffee is $6.14, and a dozen eggs could cost you around $2.14. The average rent for a 1-bedroom apartment in Manhattan is $4,188. However, Manhattan is not the only expensive place to live in NY. The median home value in towns like Kaser, Sleepy Hollow, Nyack, Portchester, and Manorhaven, is over $550,000, and the average income is over $60,000 per year. This middle income of $60,000 or more may sound high, but many New Yorkers can’t even afford their essential living expenses on this income.

How Golden Financial Services Helps New York Residents Get Out Of Debt

In more than 20 states, the Attorney Generals have brought enforcement actions against debt-relief companies since 2004. According to comments filed with the F.T.C., consumer complaints against companies in the industry more than doubled from 2007 to 2009. Post-2009, customer complaints against debt settlement companies in New York started to slow down because regulations were passed, and fraudulent companies could no longer legally charge up-front fees. Golden Financial Services was one of the first debt negotiation companies to offer a program where no fees are charged until AFTER the debt is resolved.

Additionally, no other NY debt relief company offers multiple plans, including validation, credit counseling, settlement, and consolidation. You have the power to make a choice based on what suits you best at GoldenFS.org.

If you are in the early stages of researching debt-relief options, take your time, and read this entire page. The following page explains each debt relief option in detail, including consumer credit counseling, debt consolidation, settlement, and validation plans.

Evaluating each plan’s downsides versus the upsides is essential.

Call (929) 437-6155 For a Free Consultation with an IAPDA Certified Counselor.

The following information is being provided for educational purposes. We cannot guarantee that any of these options are suitable for every individual. You should always compare different options through different companies, not listening to just one company’s advice. GFS does not offer all of these programs, and the available plans are through companies that we’ve researched and believe are the best debt relief companies in NY.

New York Consumer Credit Counseling

New York consumer credit counseling companies work for your creditors. They already have pre-arranged agreements regarding how low your interest rates can be reduced.

NY Consumer credit counseling is not a “financial hardship plan.” You continue paying your creditors every month with this program but at a reduced interest rate. Your creditors get paid back in full, plus interest.

The main benefit of consumer credit counseling is that interest rates get reduced, allowing clients to pay off all credit card bills within 4.5 years on average.

If you can’t afford to pay at least minimum payments, you won’t qualify for consumer credit counseling. You will, however, be eligible for a financial hardship plan. The following two financial hardship programs let you pay a significant amount less than the total owed.

New York Debt Validation Program

Your creditors don’t get paid every month with this first hardship program. When successful, you only end up paying the debt relief company’s fees. Since you are only paying the company’s fees, you can save more money with this plan than any other option.

NY Validation Program Example–Client Saves Over $9,000 on Credit Card Balance.

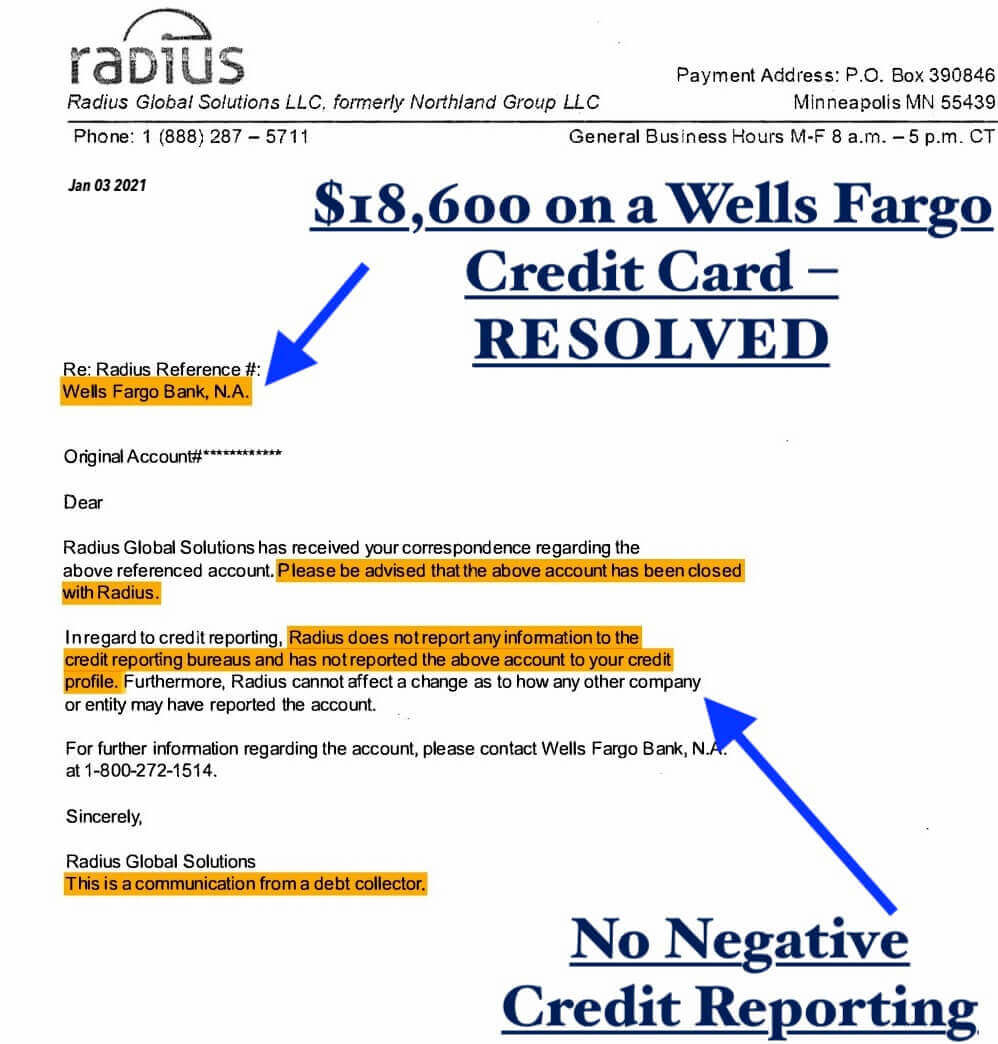

Here’s an example of how debt validation allowed this next client to walk away from what was initially a Wells Fargo credit card debt for $18,600. As a result, the consumer was able to get out of debt without paying.

Use this online calculator to get a savings estimate of what you could save on a validation program.

NY Debt Validation Program

- The total cost is around 48% of your total balances (and that’s all you would end up paying when successful).

- After the debt is invalidated, it could entirely be removed from credit reports.

- The plan comes with a money-back guarantee and credit repair.

- You get to choose an affordable monthly payment.

- The entire program takes around 36 months (average).

- There are no tax consequences after an account is invalidated.

- Debt negotiation can be a backup plan to resolve an account if it’s proven to be valid.

Validation Downsides

- Chance of creditors issuing a summons to go to court

- Temporary negative impact on credit

- Creditors could validate the debt

- If current on accounts before joining, clients will experience a period where the original creditor calls and sends letters demanding payment

- After a debt is invalidated, the debt doesn’t disappear or go away until the Statute of Limitations expires on it. However, after an account is invalidated, the third-party collection agency can no longer attempt to collect on the debt or report it on the consumer’s credit report. As a bi-product to a validation program, debts can get removed from the consumer’s credit report. Credit restoration disputes the accounts after they are proven to be legally uncollectible.

New York Debt Settlement Companies

Here are a few tips to help you choose the right debt settlement company in New York. Golden Financial Services can also assist you with enrolling in an attorney-based debt settlement program.

- Debt settlement companies in NY can only charge a fee after resolving a person’s debt. It is illegal to charge up-front fees for California, Florida, and NY debt negotiation programs. Fees can be charged after an account gets reduced and at least one payment is made to the creditor.

- Also, check a settlement company out at the BBB before joining their program. The BBB shows you if a company has any government action against them. Please stay away from a company with government action or class action lawsuits against them.

- Make sure the company is A+BBB Rated, Certified by the IAPDA, and check a company’s reviews on Google and other review sites so that you can see what actual clients have to say.

- Most importantly, make sure the debt settlement company abides by New York laws and does not charges up-front fees. Reputable NY debt settlement companies will only charge the settlement fee after each debt is settled and paid.

- There are also downsides to beware of with debt settlement, which we will go over below. Ensure that whatever company is helping you highlight these downsides in detail and go over how you will overcome these obstacles if they occur while enrolled on the plan.

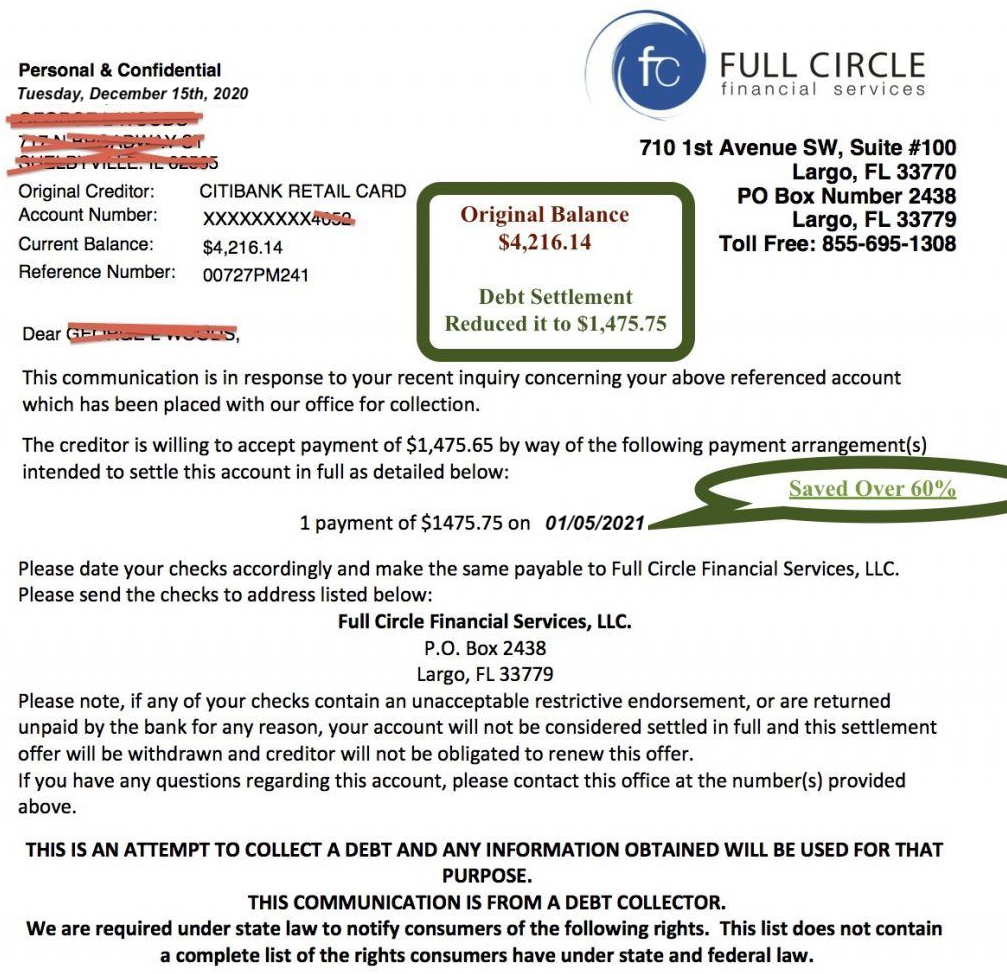

Debt Settlement – Ny Client Example Case

The following example illustrates a debt collection account (initially a Citibank Retail Credit Card) settling for under 50% of the balance. In total, this client ended up paying less than 60% of the total balance on this account, including debt settlement company fees. In addition, this next consumer was enrolled in an attorney-model debt settlement program through Golden Financial Services.

Results vary with a settlement program. For example, clients can have results like the above, but other clients may not save even 40% with the same creditor.

New York Debt Settlement Program Benefits

GFS recommends an attorney-model program to settle debt because clients get additional benefits when using a lawyer under the Fair Debt Collection Practices Act (FDCPA). NY Debt settlement programs that don’t include an attorney can still work but are ineffective because the FDCPA law does not apply in the same beneficial way. Not only that but also, when represented by a NY debt settlement law firm, you also get the legal protection that could be required while on the plan. Here are some of the benefits of an attorney-based debt negotiation NY program:

- You can save around 25% (including fees)

- A top-rated law firm will be assigned to assist you, ensuring your consumer rights are defended. For example, if you’re served a summons while enrolled in the program, the lawyer will intervene and help settle the summons keeping you out of court.

- All creditor phone calls must get directed to your lawyer, according to the FDCPA law.

- You get to choose an affordable monthly payment that extends out up to four years.

- Become debt-free in 12-48 months

- A viable option to avoid bankruptcy

Debt Settlement Downsides

- Credit scores can be negatively affected because creditors are not paid every month through NY debt settlement companies. Debt to income ratios can improve while on a settlement program, but even after a debt is settled and paid, past collection and late marks remain on credit reports most of the time.

- There is no guarantee that creditors will settle for less than the entire balance, but they do most of the time.

- Debt settlement does NOT include credit repair.

- The IRS could require you to pay taxes on the amount saved. However, accountants can help a person avoid paying taxes on a settled account if they are insolvent.

- Creditors could issue a person a summons to court over an unpaid account. In 2020, approximately 3%-5% of creditors enrolled in the settlement program issued a subpoena. After a summons is served to a client over an unpaid credit card, the NY debt settlement law firm representing the client prioritizes negotiating that balance next. Consequently, the account with the summons quickly gets resolved for a significant amount less than the total owed, and the client doesn’t have to attend court. In the end, as long as clients stick with the program, they can still become debt-free successfully even after they receive a summons on an account.

- Not all clients will graduate from the program for one reason or another. For example, a client may not afford the monthly payment.

- Late fees, interest, and collection costs accrue after a person stops paying on accounts, resulting in balances growing after joining NY debt settlement programs. Additionally, if clients cancel the program before finishing it, they could have higher balances than what they started with.

Keep in mind that these are both financial hardship plans. Meaning your creditors are not getting paid every month. Creditors could potentially serve you a summons to go to court.

Debt settlement companies in NY, like Freedom Debt Relief and National Debt Relief, can only settle your debt. But the truth is that before paying a debt, you should challenge its validity because, in many cases, this can be your least expensive route to resolving debt. Credit card debt can also get disputed, like how a speeding ticket attorney would fight a speeding ticket.

The debt becomes legally uncollectible if the debt collection company can’t validate it. A legally uncollectible debt does not need to get paid and can’t legally get reported to Experian, Transunion, or Equifax. As a result, millions of New Yorkers can walk away without paying anything on a debt besides the debt reduction company’s fees.

Owe Above $10,000 in Credit Card Debt?

A $10,000 credit card debt could get resolved for around $4,500 with debt validation if proven to be legally uncollectible.

You are probably thinking, “but it’s my debt; I spent the money.” Yes, you did spend the money, but that doesn’t mean your creditors are abiding by the laws and maintaining complete and accurate documentation.

A debt negotiation program could settle this debt for around $7,000, including program fees. What happens to the other $3,000? This is amount is completely forgiven.

One downside of debt settlement is that creditors must report the amount forgiven as taxable income. As a result, you could receive 1099 from the IRS asking you to pay taxes on the amount saved. To fight this tax liability, clients resort to a simple resolution in most cases. You can file an IRS Tax Form #982 illustrating insolvency and eliminating any taxes owed.

New York Debt Relief Program Reviews for Golden Financial

- A New York Chamber of Commerce Member

- Rated #1 by Trusted Company Reviews (click to verify)

- Better Business Bureau A+ rated company

- IAPDA Certified

- Ranked #1 on the Top 10 Debt Relief Companies List (for 2019)

Getting harassed by creditors or a debt collection law firm? New York debt relief programs can help prevent creditor harassment.

IAPDA certified debt counselors are available to talk with NY residents for a free consultation from (Monday–Saturday, 8 am–9 pm) at (866) 376-9846, and call locally at (929) 437-6155.

Option 1: Debt Settlement New York

- Debt settlement in New York, also known as debt arbitration or debt negotiation, involves negotiating with creditors to accept a lower balance as “paid in full.” For example, your debt could be discounted to only around half of what you originally owed before debt settlement company fees. A portion of the balance could be completely wiped away and forgiven.

- Not all clients can make it through a debt settlement program. Keep that in mind. Some clients lose their income and drop out because they can’t continue making payments.

- Clients end up paying only approximately 70%-75% of their total debt, including fees.

- Although the practice may temporarily result in a lower credit score, your debt to income ratio should improve throughout the program because each debt is paid off one by one.

- Debt settlement can save a person from having to file for bankruptcy. Bankruptcy has the worst long-term effect on a person’s financial situation, negatively affecting everything from their ability to purchase a car, rent a house, buy a home, and even get a job.

- A debt settlement program includes only one monthly payment. That payment is deposited into a trust account and remains in the client’s control. As money accumulates in the trust account, one by one, each creditor is settled and paid until a person is debt-free.

- Creditors don’t get paid monthly, like with consolidation services, but instead in lump sum payments. Fees and settlement funds are all included in the monthly payment.

- You will immediately start paying less money each month after getting approved on a debt settlement program in New York – putting extra savings in your pocket.

- You will receive a date of completion, so you will see the light at the end of the tunnel – knowing when you’ll be debt-free!

- Results vary but expect only the best when a top-rated NY debt relief company represents you.

Ready to take action?

Important point: Make sure to fully understand the potential negative consequences that can arise from a debt settlement program, such as; creditors can pursue legal action, negative marks can remain on your credit report, balances will increase before getting settled, and potential tax consequences may occur. We will fully disclose and discuss each possible adverse effect and offer advice on how to deal with each result if it was to happen.

Talk to a New York IAPDA Certified Debt Counselor Now (it’s FREE) 866-376-9846.

Option 2: Debt Consolidation New York

- Debt consolidation is a loan used to pay off your existing debts.

- You could even use a home equity line of credit to consolidate and pay off your debt, and that’s probably one of the smartest options available due to its low-interest rate.

- The point of getting a debt consolidation loan is to reduce your interest rates, lower the monthly payment, and get out of debt faster.

- You can use a debt consolidation loan to pay off any debt.

Important point: Closely examine the interest rates and fees associated with a debt consolidation loan before signing up for any loan.

What about NY debt consolidation programs for student loans?

- Golden Financial Services can assist you with consolidating your student loan debt, getting them paid off within the next 90-days, and following up on your consolidated loan until you’re eligible for loan forgiveness. We will process your student loan consolidation through the government-offered student loan programs. New York residents can either consolidate their student loans on their own or use a company to do the work for them, like what we offer at Golden Financial Services.

- We can help you navigate the complex processes of student loan consolidation, getting on the right income-driven repayment plan, and loan forgiveness.

- To consolidate your student loans on your own, visit studentloans.gov and click on “repayment and consolidation.” However, maintaining your income-based student loan repayment plan after reducing it can be a timely and often confusing process. For example, you could forget to file a particular form, check a wrong box on the application and forget to recertify on time one year – and bam, you get kicked out of the plan, lose eligibility for loan forgiveness, and can even get your wages garnished.

- Here are step-by-step instructions to consolidate your student loans and get loan forgiveness.

What about using a debt consolidation loan to pay off credit card debt?

- In New York, using a debt consolidation loan to pay off credit card debt is a popular option for consumers with a 700 or higher credit score.

- If your credit score is under 700 and you have over $7,500 in credit card debt, you won’t have a good credit score to get approved for a low-interest debt consolidation loan in New York.

- Golden Financial Services does not offer a consolidation loan for credit card debt. Local credit unions usually provide the lowest interest rate for a consolidation loan. If you own a home and have equity in it, your best-case scenario would be to get a home equity line of credit. A home equity line of credit can be used as a consolidation loan and often comes with the lowest interest rate.

Talk to a New York IAPDA Certified Debt Counselor Now (it’s FREE)866-376-9846.

Option 3: Debt Validation Program in New York

- Disputes your alleged debts and includes credit repair FOR FREE – you may not have to pay the debt, and it could come off your credit report entirely.

- Debt validation can be the least expensive method to resolve an unsecured debt and get it completely removed from your credit report. Think about if you were to get a speeding ticket. You could plead guilty, where you would pay a fine, go to traffic school and earn points on your license. You could also hire an attorney to fight the ticket and, in many cases, get it completely dismissed – as if it never existed.

- Debt validation is similar to getting a speeding ticket. You can fight the debt and prove it to be legally uncollectible, where legally, the debt collection companies can no longer report the debt and negative marks on your credit report, and you wouldn’t have to pay the debt.

- Golden Financial Services can introduce you to a debt validation program that comes with a money-back guarantee and stays with you until your debt is completely removed from your record due to the statute of limitations.

- Debt validation will cost less than a settlement in most cases because the account is not getting paid with validation.

Important point: The debt still exists after it gets invalidated and could be sent back to your original creditor, where collection activity continues. If the debt can’t be invalidated, it could be settled for less than the full balanced owe. At Golden Financial Services, we usually recommend using debt validation before settling a debt.

Talk to a New York IAPDA Certified Debt Counselor Now (it’s FREE)866-376-9846.

Option 4: Consumer Credit Counseling New York

- You start making one consolidated payment to the consumer credit counseling company each month instead of paying the credit card companies.

- In New York, consumer credit counseling programs consist of credit counselors working with your creditors to lower interest rates and create lower, consolidated monthly payments that are more affordable for the consumer. (this is not a loan)

- Consumers have more disposable income for savings or retirement with more manageable payments.

- All credit card balances get paid in full within 4.5 years due to lowered interest rates.

- The company will then disperse the funds to each credit card company but at a reduced interest rate.

- Your monthly payments get consolidated into one lower monthly payment, and you can become debt-free in around four to five years, compared to six or more years on your own.

Important point: Consumer credit counseling programs are reported to the credit bureaus. Credit reporting agencies will then illustrate that they are enrolled in a consumer credit counseling program inside a person’s credit report. Therefore, future lenders may deny credit to a person because of this third-party consumer credit counseling notation.

Talk to a New York IAPDA Certified Debt Counselor Now (it’s FREE)866-376-9846.

NYC & New York Property Tax Relief Options

If you can’t pay your property taxes in New York, this debt can become a “delinquent property tax lien.” Investors will then purchase a delinquent property tax lien. But before a property tax lien is sold to an investor, the homeowner will have a chance to pay off the debt. An investor can buy a property tax lien in NY if the homeowner doesn’t attempt to pay back their property taxes and has been given four warnings. The homeowner is then responsible for paying the investor back. If a homeowner can’t afford to pay the investor back, plus with additional interest, at that point, the investor can take the property through foreclosure.

For an investor to legally foreclose on a property, they must serve the homeowner with a certain number of documented warnings explaining exactly what’s going on and how they could avoid having their home taken away. Therefore, homeowners need to make sure to keep track of these warnings. In addition, the warnings must be in writing. Usually, a homeowner will receive a letter in the mail. That letter must clearly explain the situation at hand.

Military Debt Relief Programs & Delinquent Property Tax Exemption

Millions of active military members have had their homes taken away from them due to unpaid property taxes, which could have been avoided if they were to have taken just a few small steps to protect themselves. Here’s what you need to know: Anyone who is an active military (U.S. Army, Navy, Marine Corps, Air Force, Coast Guard, or National Guard) can request debt relief for delinquent property taxes, including the spouses and kids (in most cases) all active military members. In addition, active military New York residents get legal protection from the Soldiers and Servicemembers Civil Relief Act and the NYS Soldiers’ and Sailors’ Civil Relief Act.

Due to these laws, active military homeowners can get their property taxes removed from a tax lien sale by completing this short form. So avoid having your home foreclosed on by taking immediate action if you’re active military and behind on your property taxes.

Credit card debt relief NY programs are available for anyone who’s active military and resides in NY. Military credit card relief programs require you to get permission from your commanding sergeant. You could qualify for a New York debt relief program offered through Golden Financial Services with permission. Give one of our IAPDA Certified debt relief professionals a CALL at (866) 376-9846 (start with a free consultation)!

NYC & NY State Senior Citizen & Disabled Debt Relief & Homeowners’ Exemption

You can keep your home out of a delinquent property tax sale and avoid foreclosure if you are OVER 65 years of age and own a home in New York. Debt relief for credit cards and homeowners’ exemption offer you debt relief options.

There are some other qualification factors to qualify for a homeowners exemption, to avoid having your delinquent property taxes sold at an auction, that include; your annual adjusted gross income must be under $58,399, and you must have lived at the address for at least 12 months (and it must be your primary address).

To avoid losing your property due to unpaid property taxes, you must complete this form here:

If you are a senior citizen with credit card debt, relief programs are available at Golden Financial Services. Give one of our IAPDA Certified New York debt relief professionals a call at (866) 376-9846 (start with a free consultation)!

New York Debt Collection Statute of Limitations

According to Civil Practice Law & Rules, 2-213, the Statute of Limitations for credit card debt in the state of New York is six years. That means that your creditors only have six years to sue you over a credit card debt. However, if you have a third-party debt collection account and you decide to make a payment on it out of fear that you will get sued, now you’ve extended the period that your creditor can come after you.

About Golden Financial Services

Golden Financial Services has offices in New York, Florida, and California. Debt relief programs are accessible for consumers in almost all 50-states. IAPDA certified, top-rated by Trusted Company Reviews, and rated A+ by the Better Business Bureau.

Address: 21 Poplar Street, Cornwall, New York, 12518; Serving all of New York state and New York City since 2004. Apply for Debt Relief Today!