IS GETTING A LOAN A GOOD WAY TO CONSOLIDATE MY BILLS?

“I’ve got too many bills and store credit cards, and can’t afford to pay them all,” consumers often tell Golden Financial Services after calling in for help with consolidating bills. “Is there a way to consolidate my bills into one single and lower payment?” Applying for a consolidation loan to pay off unsecured credit balances is a debt relief option that many people consider. But continuing to borrow money, to pay off your bills, makes it even more challenging to get out of debt. Using a loan to pay off debt, that’s like putting a small bandage on a bleeding wound that needs stitches.

When consolidating bills with a loan, make sure the APR is low

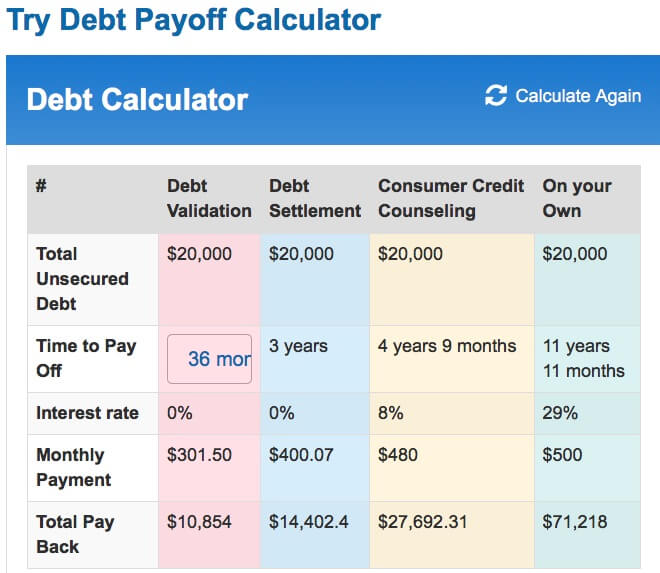

If you do decide to get a loan, make sure the APR is lower than what the average rate is on your existing cards. What is APR? The term “annual percentage rate (APR)” “refers to the annual rate of interest charged to borrowers and paid to investors.”If your APR is under 12%, that’s a good APR for credit card debt. But also don’t forget to check for other related fees, like loan origination fees for example. Use a reliable debt calculator to compare the cost you’ll pay when consolidating bills with a loan, versus what you’re paying now on your own. Use this debt calculator here:

The best debt consolidation loans can be found through Even Financial. This is not a lender but rather a loan comparison site, that lets you compare hundreds of lenders at once and get pre-approved within minutes.

Generally, the more money you borrow, the more you spend, and the more your debt continues to grow. As your debt balances continue to grow, your credit utilization ratio becomes negatively affected, resulting in a reduction in your credit scores. Not only is your credit score adversely affected as your debt grows, but also your ability to borrow and creditworthiness is severely hindered.

Avoid the dangers of using a loan

Let’s say you take out a credit card consolidation loan. You use the consolidation loan to pay off all of your credit cards. Then, while you’re making monthly payments on the loan, you start to use those credit cards again to charge new purchases. Now you have more unsecured debt than when you started with. All of a sudden, you find yourself drowning in debt.

IS THERE A BETTER WAY TO CONSOLIDATE MY BILLS?

So the question is, “How can I consolidate my bills if I don’t borrow any more money?”

The key to getting out of debt is to change your perspectives about money and using credit cards. This can be painful at first, but when spending habits change, money management becomes easier. Start by making a budget. You can use this free budget calculator to create a budget. Be aware of where your money is going, and then you can reorganize these funds to pay off debt.

After your budget is complete, you can then decide how much you can afford to pay. A debt management program through a non-profit credit counseling agency can help you consolidate your credit card debt into one lower interest payment. Your creditors will get paid monthly but at the lower interest rate, allowing you to become debt-free in under five years. You may decide not to use a program at all, and instead, use a do-it-yourself debt repayment plan, such as the debt snowball method. Here’s a free snowball calculator to help you with the debt snowball method.

Is your goal to save money? Debt can also get settled for a fraction of the total owed. $50,000 in credit cards can get reduced to less than $40,000, including interest. Just try our debt calculator to see what your savings could be. Can’t afford to stay current on payments? Debt settlement and validation programs can be a solution! Please read about the pros and cons of these programs by visiting our credit card debt relief programs page next.

Golden Financial Services can further discuss all debt relief programs with you at (866) 376-9846. Talk with an IAPDA certified counselor for free. Choose from debt settlement, consumer credit counseling, debt consolidation and validation programs.

You have several ways to consolidate bills, not just one.

SO WHY SHOULD I CHOOSE GOLDEN FINANCIAL SERVICES (GFS) TO CONSOLIDATE MY BILLS?

“GFS’s debt management program sounds great,” you say, “but why should I choose them to consolidate my bills?” The answer is simple: Our experience shows. We’ve been assisting Americans in becoming debt-free since 2004. Our BBB rating has not changed since that date; it’s A+. We’re IAPDA certified and accredited. TrustedCompanyReviews.com rated Golden Financial Services #1 out of all of the national debt relief companies.

You can also check for an approved credit counseling agency with the U.S. Department of Housing and Urban Development for reverse mortgage counseling and foreclosure counseling.

DISCLOSURES:

Debt settlement disclosures

-creditors are not paid monthly, so balances can rise before getting settled and paid

-negative effect on credit

-potential to get sued

-no guarantee creditors will settle

-debt settlement fees cost between 15-25% of the total debt getting settled, but fees are only earned after a debt is settled and at least one payment is made towards the settlement

-monthly payments are deposited into an FDIC insured savings account in the client’s name, and that’s where the funds go each month until it’s time to pay a settlement

Debt validation disclosures

-creditors don’t get paid and accounts only get disputed after they are with third-party collection agencies (similar to with debt settlement)

-like with the settlement, there is a chance creditors can sue

Consumer credit counseling disclosures

-credit cards get closed out, which can lower credit scores

-all programs include fees, even with non-profit debt management programs (up to $50 per month)