Do you want to improve your credit and have excellent credit scores?

Having an excellent credit score is no easy task to accomplish. Especially if today, your credit is in bad shape and you have high debt. But we’re about to show you exactly how to transform bad credit – into excellent credit. Learn how to improve your credit score from Paul J Paquin, the CEO at Golden Financial Services.

It can take several years to go from bad credit to excellent credit, but I’m going to show you the fastest way to get there. The following post will walk you through 24 tips that I used to boost my credit score when I was young, mixed in with new strategies that I learned over the (close to two decades) of running Golden Financial Services. If your goal is to have the best credit score possible, I warn you this is no easy task, but you can do it. Before we get started, here are some Dos and Don’ts to consider:

Let’s start with a quick story, one that, for many years, I couldn’t reveal because it was embarrassing.

Sometimes, the hardest thing to do in life is to admit something you’re ashamed of when you can block it out and pretend it never happened, right?

My credit score was around 540, back in 2005. I was 25-years old at the time, finally just starting to mature.

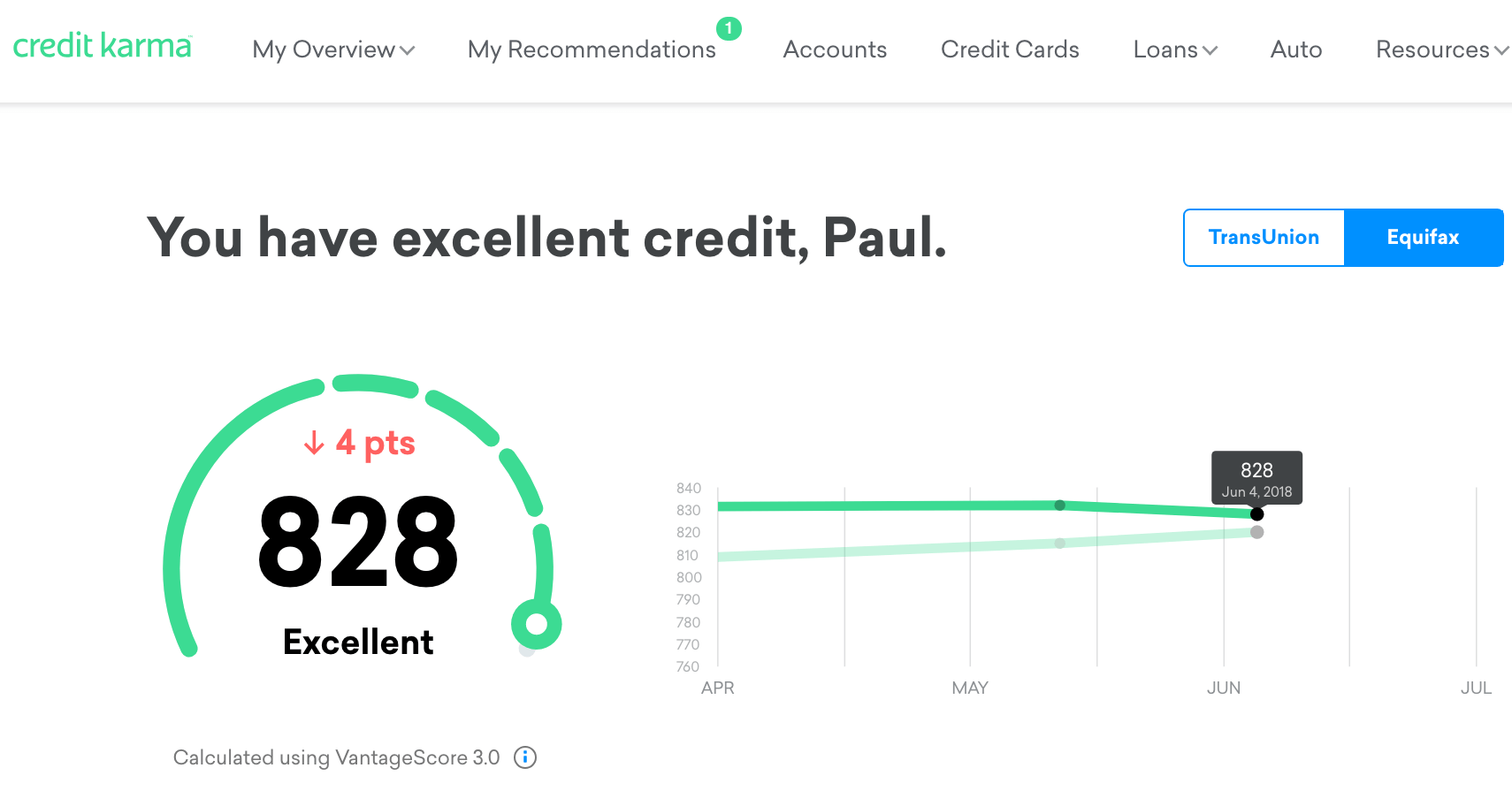

Who’d think the CEO of Golden Financial Services, where we help folks with their finances and getting out of debt – had a lower credit rating than most clients. Looking back at it today, as my credit score sits at just above 820, it’s almost laughable. But the truth is, twenty-plus years ago – my credit score was awful!

My credit report was flawed with collection accounts, late marks, a reckless number of inquiries from over-applying for credit, unpaid medical bills, and even a car repossession.

When I moved from Florida to California, I didn’t close all my Florida utility accounts, like my cable and electric. These unpaid utility accounts eventually became debt collection accounts, making my credit even worse. I had almost every type of negative mark that you could imagine on my credit report.

You’re about to learn how I went from having a 540 FICO score, to now having an 828 FICO score, according to my last credit alert from Credit Karma. No collections. No late marks. And over $500,000 in available credit. In addition, you will learn how to deal with debt that you can’t afford to pay. As of 2021, there are debt relief programs that include credit repair, helping consumers get out of debt, and dealing with bad credit (all in one).

At the beginning of this blog post, I start slow, talking about mindset and secured credit cards. But advanced tips and tricks will get revealed – so just keep reading! But, of course, you have to learn the basics first to have a strong foundation.

Without further ado, here’s my story. And I hope it inspires and helps you.

Lesson #1: Use Past Mistakes to Fuel Your Desire to Have Excellent Credit

This first tip is more of a mentality check, but having the right mindset is required before you can start on the path to repairing your credit.

Between 18-24 years of age, I was still young and didn’t truly understand what good financial health meant and the long-term benefits of having a high credit score.

I don’t know about you, but back in my early 20’s, I wasn’t the same person I am today.

Heck, I didn’t even want kids in my early 20’s. I remember saying, “I’ll never have kids”! Then, I’d say, “I don’t even like kids.”

Today, I couldn’t imagine what life would be like without my two angels. My point is, the mistakes you made in your past don’t need to shape your future. You can change the path that you’re going down in life at any time.

Don’t be ashamed of your past; instead, embrace your past mistakes and take the necessary steps to shape your future in a better way. Use negative feelings to fuel the desire to learn and improve your life. Make “negativity” your new positive. What most people see as a negative, you can learn to view as a positive.

Failed to pay your bills on time in the past? Never make that mistake again. In fact, take extra steps to ensure you never make that mistake again! For example, set up automatic bill-pay and pay your entire balance not once but twice per month. Not only will you be guaranteed never to be late on payments again, but you’ll also avoid 100% of interest and establish positive payment history faster.

Without messing up in the past, you may have messed up even worse in the future. See, you can view that past mistake in your life as a positive.

Go the opposite direction from when you went down that wrong path. Write your past mistakes on paper or in a diary, study them and never make the same mistakes again! That’s what I did, and now I am just sharing my diary with the world on how I went from having bad to excellent credit.

I distinctly remember getting rejected for a bank loan that I needed at the time to do a business opportunity of a lifetime—what a dreadful feeling. Today, I make sure to get a credit limit increase whenever I can qualify for one (as I’ll explain below). However, I never want to be in a position where I am restricted on the amount of cash I can borrow if an opportunity in the future arises.

Another experience that stuck with me was when no car dealership would sell me a car due to my bad credit score. Today, I could walk into any car dealership in the country and buy any car I wanted with zero dollars down. I worked hard to be able to say that today.

Let’s dive into the nitty-gritty details of how I was able to accomplish the impossible, transforming my credit from bad to excellent.

How to Have Excellent Credit, Lesson #2: Automatic Bill-Pay

Set up automatic bill-pay on all your credit cards and credit accounts, including your mortgage and car payment. Set up automatic bill-pay to pay your entire balance every month, not just the minimum payment.

If you want to make an extra payment, call the bank or credit card company and do it over the phone. But by having an automatic bill-pay setup, at least if you forget to make a payment one month, the bill will get paid.

Back in 2004, when medical bills would come in the mail, I would completely disregard them. I remember saying;

“I don’t care about my credit report.”

“Who cares if the collection agency reports the debt on my credit.”

Yes, I was implausibly irresponsible at the time.

“Who needs credit? I’ll just pay cash,” I used to say. I’d tear through my mail faster than the speed of light, and when seeing a medical bill, swoosh… slam-dunking it directly into the trash can, faster than I could read the balance on it!

“I’ll just pay cash.” My famous last words would haunt me for many years.

Eventually, I did regret ruining my credit. Like when I was rejected for a loan to expand Golden Financial Services–denied, after racking up 250,000 miles on my old Chevy Nova and desperately needing a new car–denied.

Credit Lesson #3: Get a Secured Credit Card

Let’s start from the very beginning, getting your first secured card.

I’m cheap, so I tried everything to avoid having to hand over my hard-earned cash to a bank as collateral just to be able to get my first credit card. But unfortunately, my only chance of reviving my dying credit was to get a secured credit card. But, unfortunately, nobody would issue me an unsecured credit card. I had applied for an unsecured card with five different banks, and all of them rejected me.

I finally decided to go to Bank of America, hand over $400, and get my first secured credit card.

Credit Lesson #4: Know When to Re-Apply & Strategically Address the Reason

Soon after I applied at five different banks for an unsecured credit card and was rejected by all, I noticed my credit score went even further.

That day I learned another valuable lesson. Don’t keep applying for credit after getting rejected over and over again in a short period of time. You’re only further damaging your score with negative inquiries and won’t miraculously all of a sudden get approved.

Luckily, inquiries only stay on your credit report for two years.

If you get rejected for credit, you must examine the reason for getting rejected. If you know why you were denied credit, you can quickly fix the problem.

There are many reasons why a bank may reject you for a credit limit increase. For example, you could have an 800 FICO score and get rejected for a credit limit. For example, the bank may tell you that you were rejected for a credit limit increase because they didn’t feel that you needed any additional credit based on your spending patterns.

This happened to me once. On one of my credit cards, the credit limit was $80,000, but I only spent a few thousand dollars per month on the card and always paid the balance in full. So, since the bank sees that I never let my balance go above $3,000, why would they need to give me more than an $80,000 credit limit? That was the bank’s claim, which did make sense to me.

Therefore, the solution would be to spend more money on this card before reapplying for another credit limit increase, showing the bank that I did need the additional credit. Or, just apply for another credit card somewhere else, but one that pays better cash-back and reward points.

The point being, know why you were rejected and fix the problem before reapplying for a credit limit increase. For example, the only reason I had even applied for a credit limit increase from $80,000 was to improve my credit utilization ratio by raising the credit limit (which will be explained below).

How to Have Excellent Credit, Lesson #5: Don’t Just Dispute Everything!

I decided to dispute everything negative on my credit, even if it was legitimate.

We hired a credit repair specialist at Golden Financial Services in around 2005. Her name was Marissa. She had a system of disputing derogatory information on a person’s credit report, and I could not believe how well it worked. So I told her, “Marissa, please just dispute everything negative on my credit report!” But, of course, she advised against this and warned me of the potential consequences. Keep in mind, at the time. My specialty was helping consumers get out of debt by settling debt, not repairing credit. Plus, I was still young and naive.

Marissa assisted me with disputing, against her advice – everything negative on my credit report.

Another BIG mistake.

After disputing something on your credit report, the creditor has 30-days to prove that what you’re saying is false.

If you dispute a debt collection account saying, “the account is NOT mine” when it indeed is your account, all that your creditor would need to do to verify the debt was yours is send the credit reporting agency the original agreement that you signed when initially applying for the account. Subsequently, a derogatory comment would go on your credit report, illustrating that the debt was disputed and determined to be valid. This type of dispute-related notation will damage your creditworthiness.

I had four disputes that went wrong, resulting in four of these ugly notations on my credit report and more damage.

How to Have Excellent Credit, Lesson #6: Dispute & Remove Derogatory & Inaccurate Information

The good news is, most of the negative marks and debt that I disputed on my credit report were successfully removed because of either being inaccurate, unverifiable, or legally uncollectible. By removing these old collection accounts, my credit score shot up by roughly 40 points.

Woohoo!

Finally, my confidence level began to build. Then, the reality started setting in, “I am doing it, rebuilding my credit score!” It seems impossible at first, but your credit score will eventually become excellent if you’re patient and follow these instructions.

In some circumstances, creditors will ignore a dispute because it’s not worth their time to put together the necessary documentation to prove the legitimacy of a debt. If ignored, the credit reporting agencies will remove the debt from the consumer’s credit report.

The more involved you make your dispute, the more time-consuming it will be for the debt collection company to prove their claim, increasing the likeliness of them just ignore it.

In many cases, a debt collection company won’t validate a debt because they don’t have the required documentation and accurate information on file to do so.

Credit card companies will put a disclosure on the bill of sale when selling debt that specifically states, “records may be missing and inaccurate.” Debt collection companies are willing to take that chance when buying debt, knowing how unlikely it is for the consumer to dispute it.

Noach Dear, a civil court judge in Brooklyn who sees hundreds of credit card lawsuits each day, said that “it could be up to 90% of all credit card lawsuits are flawed, and specifically, they’re flawed because the credit card companies can’t prove the consumers owe the debt.”

Before I continue with my story, let me provide a few technical details about disputing a debt.

Just because you’re disputing a debt doesn’t mean that you’re saying the account was never yours.

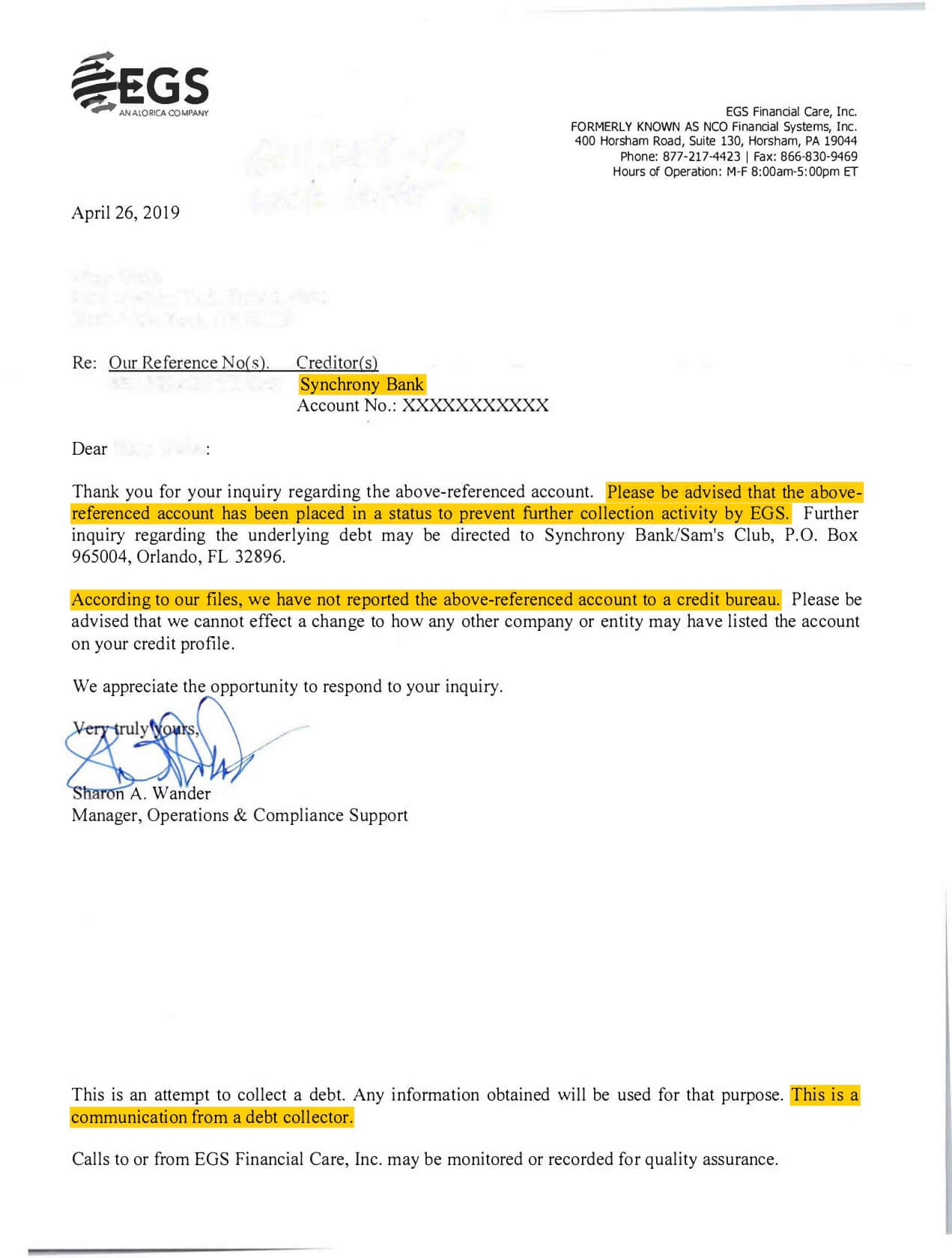

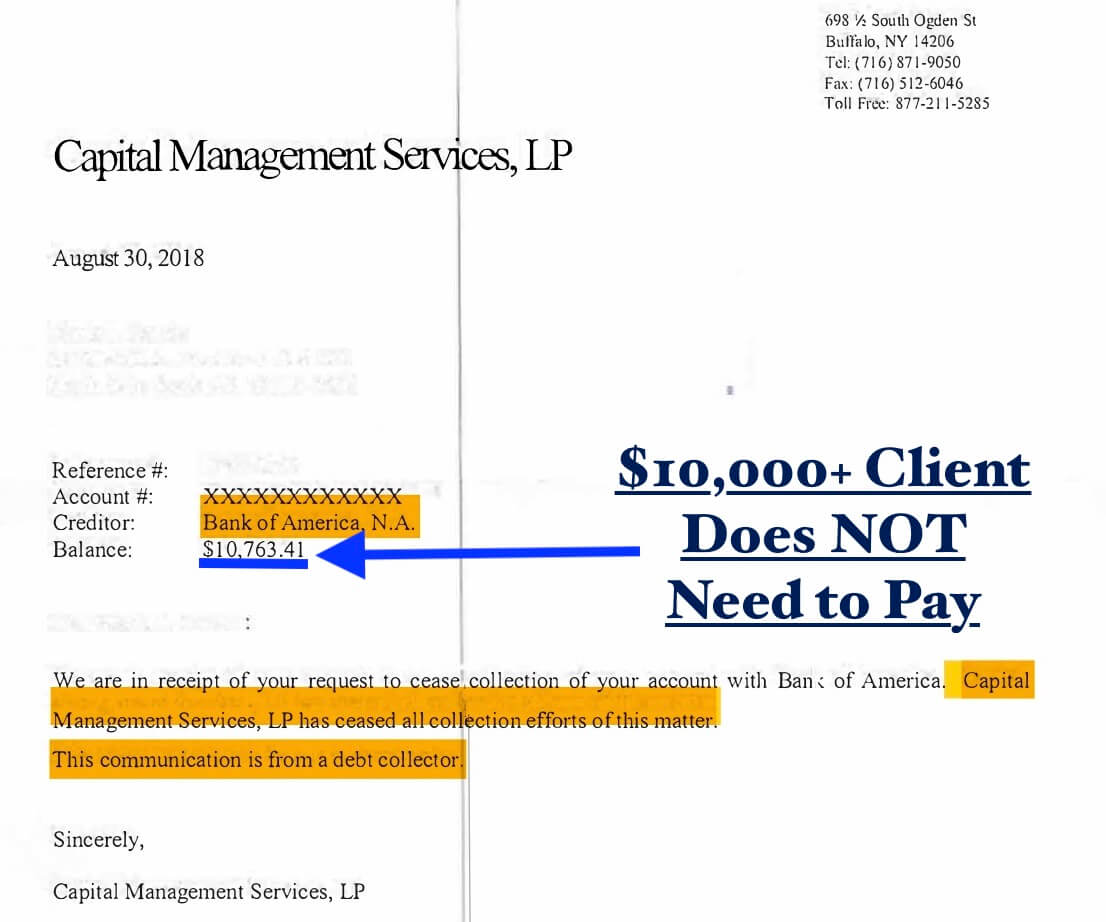

In many cases, professional credit repair and debt validation companies can dispute a debt and get it removed from a person’s credit report. Debt relief companies use debt validation laws to force debt collection companies to prove that they have the legal authority to collect on a debt. And surprisingly, debt collection companies will either ignore a complex dispute or quickly respond with a letter agreeing to stop collection on the debt, and in some cases, even remove it from a person’s credit report.

Example letter: debt validation proves the account to be invalid & it gets removed from credit reports.

Debt Relief Programs are not designed to improve your credit score, but if you have high debt that you can’t afford to pay off on your own, then you may want to start by talking with an IAPDA Certified Counselor at Golden Financial Services. Call for a free consultation today at (866) 376-9846. Golden Financial Services was just rated #1 national debt relief company in 2021 by Trusted Company Reviews and is A+ rated by the Better Business Bureau.

Credit Lesson #7: The Fair Credit Reporting Act (FCRA) Gives You the Legal Right to Request Proof of Accuracy

“A study released by the Federal Trade Commission found that 23% of consumers identified inaccurate information in their credit reports.”

A debt collection company must maintain accurate information, including dates, spelling, and the amount they claim they owe, according to the Fair Credit Reporting Act (FCRA). If you find inaccurate information on your credit report, dispute it right away. Your creditor must correct the mistake within 30-days or remove the account entirely from your credit report.

“Under the FCRA, creditors who furnish information about consumers to consumer reporting agencies must:[11]

- Provide complete and accurate information to the credit reporting agencies;

- Investigate consumer disputes received from credit reporting agencies;

- Correct, delete, or verify the information within 30 days of receipt of a dispute; and,

- Inform consumers about negative information which is in the process of or has already been placed on a consumer’s credit report within one month.”

Credit Lesson #8: The Fair Credit Billing Act to Dispute a Debt

Another aspect of disputing a debt is making the debt collection company prove that what they claim you owe is void of unauthorized charges.

Legally, you can request proof of how a debt collection company came up with the amount they claim you owe. Upon request, collection agencies need to provide a complete breakdown of your past monthly payments, illustrating where each cent of the monthly payment was distributed. When the original creditor writes off a debt and sells it to a collection agency, unauthorized charges may have been tacked onto the balance. As a result, collection agencies can’t prove the debt is valid after it gets disputed using the Fair Credit Billing Act. A person can request the last six years worth of monthly statements and a breakdown of how each statement was calculated, which most likely won’t get produced. But it’s a collection agency’s legal obligation to maintain complete and accurate records.

Here’s what the FCBA law says: The purpose of the FCBA “is to protect consumers from unfair billing practices and to provide a mechanism for addressing billing errors in ‘open end’ credit accounts, such as credit card or charge card accounts.”

Another debt validation example letter

Why did this creditor agree to stop collection on over $10,000 in debt?

The collection agency could not provide:

- a valid license to collect on a debt in this particular state

- the original agreement that the consumer signed when initially applying for the card

- proof that the debt was not expired past the Statute of Limitations and confirmation of when the expiration date was scheduled for

What’s the difference between debt validation and credit repair?

Debt validation deals with the debt collection company, sending the dispute directly to the third-party debt collection company.

Credit repair is disputing a debt through the credit reporting agency, not the debt collection agency. Debt validation programs first dispute debt through the collection agencies and then disputing the accounts through the credit reporting agencies.

Credit Lesson #9: Switch a Secured Credit Card to an Unsecured Credit Card

After six months of using my secured credit card and paying the bill in full, not once but twice per month, it was finally time to request that Bank of America switch my secured credit card to an unsecured credit card.

Bank of America approved my request, and within 60-90 days, my credit score increased.

I now had my first unsecured credit card and could see the light at the end of the tunnel, and having excellent credit was getting closer quickly!

I switched from a secured credit card to an unsecured card because secured cards don’t carry as much weight on your credit score.

Positive payment history on an unsecured credit card increases a person’s credit score faster than that same payment history on a secured card.

Lesson #10: Pay Your Credit Card Balances Twice Per Month

As I’ve mentioned above, you want to pay your credit card balance twice per month to build your “length of credit history” faster.

“Length of credit history” makes up 15% of your credit score. Think about it; if you pay your bill twice per month, you can get a year’s worth of payments completed within six months.

“To make multiple payments (also called micro-payments), you can either log onto the credit card issuer’s website or use your bank’s online bill-pay system. If you have an account set up, you can pay in seconds. It may take a few days before the payment is posted, but when it does, your credit card balance will be lowered by the sum you sent”, explains Erica Sandberg, a prominent personal finance author.

Erica says the benefits of using and paying off your credit card multiple times in one month include:

- 1. “Your credit rating should increase. By constantly borrowing and repaying with your credit card, you are proving that you are a responsible person. It’s an indication that you don’t rely on credit cards to make ends meet, but instead, are using plastic like a savvy professional. Credit scores are based on credit activity, and since you’ll have a robust history of perfect payments and no carried over-balances, your scores should rise. Any new lender will view you as a low-risk customer and preferred accounts will soon be available to you.

- 2. You will always remain in the black. It’s absurdly easy to overcharge with a credit card, and many accounts come with large limits that can be too tempting. However, if you delete each charge as it happens, you will avoid racking up unmanageable card debt. All you have to do is ensure you have enough money in your checking account to cover your charges.

- 3. You’ll never pay interest or late payment fees.

- 4. Rewards! (which I talk about later in this post)

- 5. You will always be in control. I can’t tell you how many thousands of people I have spoken to over the years who have felt as if their credit cards and resulting debt have taken over their lives. It’s a terrible way to live, and also unnecessary. With the as-you-go payment method, you’ll enjoy an extra sense of control. You’ll never be shocked by the size of your monthly bill.”

Credit Lesson #11: Avoid Restarting the Statute of Limitations

The quickest way to see your credit score increase is to get a collection account removed, but even if a collection account remains on your credit report as it ages, it has less of an adverse effect on your credit score.

In some cases, it’s better to just naturally let the account fall off rather than disputing it and potentially creating an action that could restart the statute of limitations. Click here to see what the statute of limitations on debt is in your state.

“Certain actions can restart a debt’s statute of limitations, including:

- acknowledging that you owe the debt, so if a collection agency contacts you about the debt just let them know that “I know nothing about this debt that you claim I owe and if you are a legitimate collection agency calling me, please just send any documentation that you are referring to in the mail so that I can review it”.

- making a payment

- entering a payment plan

- making an agreement to pay

- making a charge on the account

- accepting a settlement offer

If you know the debt is about to fall off your credit report within 1-2 years based on what your credit report illustrates, you may want just to ignore the debt and let it fall off. Having said that, there is no guarantee that the collection agency won’t issue you a summons to go to court, and if that happens, you’d need to deal with it. So never ignore a summons and skip court because that will only result in you getting a default judgment against you where your creditor could eventually try to take one of your assets or garnish your wages.

Before challenging a debt on your credit report, check the date that the account is scheduled to fall off.

Every debt collection account on a person’s credit report illustrates the projected fall-off date.

Credit Lesson #12: Establish & Build New Positive Credit

After disputing everything negative on my credit report, and the creditor verifying four of the debts to be legitimate, I was stuck with a few of these collection accounts on my credit report for another four years.

Over that four-year period, I focused on what I could control;

- establishing new credit

- using my new credit and paying the bill in full two times per month

- increasing my credit limits when possible

- And collecting lots of free income through cash-back baby!

My last collection account would fall off my credit report within four years, and I would finally have excellent credit!

I came up with a plan to either establish new credit or increase my existing credit limit every six months.

Instead of paying my credit card balances once per month, I paid them twice per month.

If I had only paid my balances in full once per month, it’s doubtful that I would’ve been approved for new credit every six months due to insufficient positive payment history.

Credit Lesson #13: Have the Right Mixture of Credit

Gerri Detweiler explains the importance of having the right mixture of credit accounts in an article on Credit.com:

“When these accounts report on your credit records they are coded very accurately so that not only consumers and lenders but also credit scoring models can quickly identify them. Statistical analysis has determined that the type of accounts you have is predictive of your future credit risk. So, what does all of this mean you the consumer? Consumers with the best credit scores, including FICO credit scores, tend to have a mix of different types of accounts.”

At this point, I had my first unsecured credit card, but the road to building an 800+ FICO score would require me to have the right mixture of credit accounts that I pay on every month.

- 4-6 credit cards

- mortgage payment

- car payment

- installment bank loan

Lesson #14 on Building Excellent Credit: Bad Credit Installment Loans

After getting my first unsecured credit card, I visited the bank and opened a secured loan.

Anyone can get approved for an installment loan because you’re guaranteeing the loan with the funds from your bank account. The bank still reports positive payment history on a secured installment loan. Installment loans are an excellent tool for credit newbies to use when trying to build excellent credit.

An installment loan is very similar to getting a secured credit card. The difference is that one’s a credit card, and the other’s an installment loan. Why is this helpful? Remember, by paying on a variety of credit accounts, your credit score will increase faster.

Credit.com explains, “Your types of accounts or ‘credit mix’ accounts for roughly 10% of the points in your credit score. Credit scoring models want to see that you can manage all different types of financing, most notably revolving accounts, like a credit card, and installment accounts, like a mortgage or auto loan. When these accounts report on your credit records, they are coded very specifically so that consumers and lenders, and credit scoring models can easily identify them. Statistical analysis has determined that the type of accounts you have is predictive of your future credit risk. … Consumers with the strongest credit scores, including FICO credit scores, tend to have a mix of different types of accounts. Of course, the key is to manage these accounts responsibly.”

Lesson #15: Improve Your Credit Utilization Ratio & Your Credit Score Will Improve

I started to notice a trend over the years. Every time my credit limit would increase, so would my credit score.

Within 30-60 days after getting a credit limit increase, I’d receive an alert from my credit monitoring service with Credit Karma saying that my score went up another 10 points (on average).

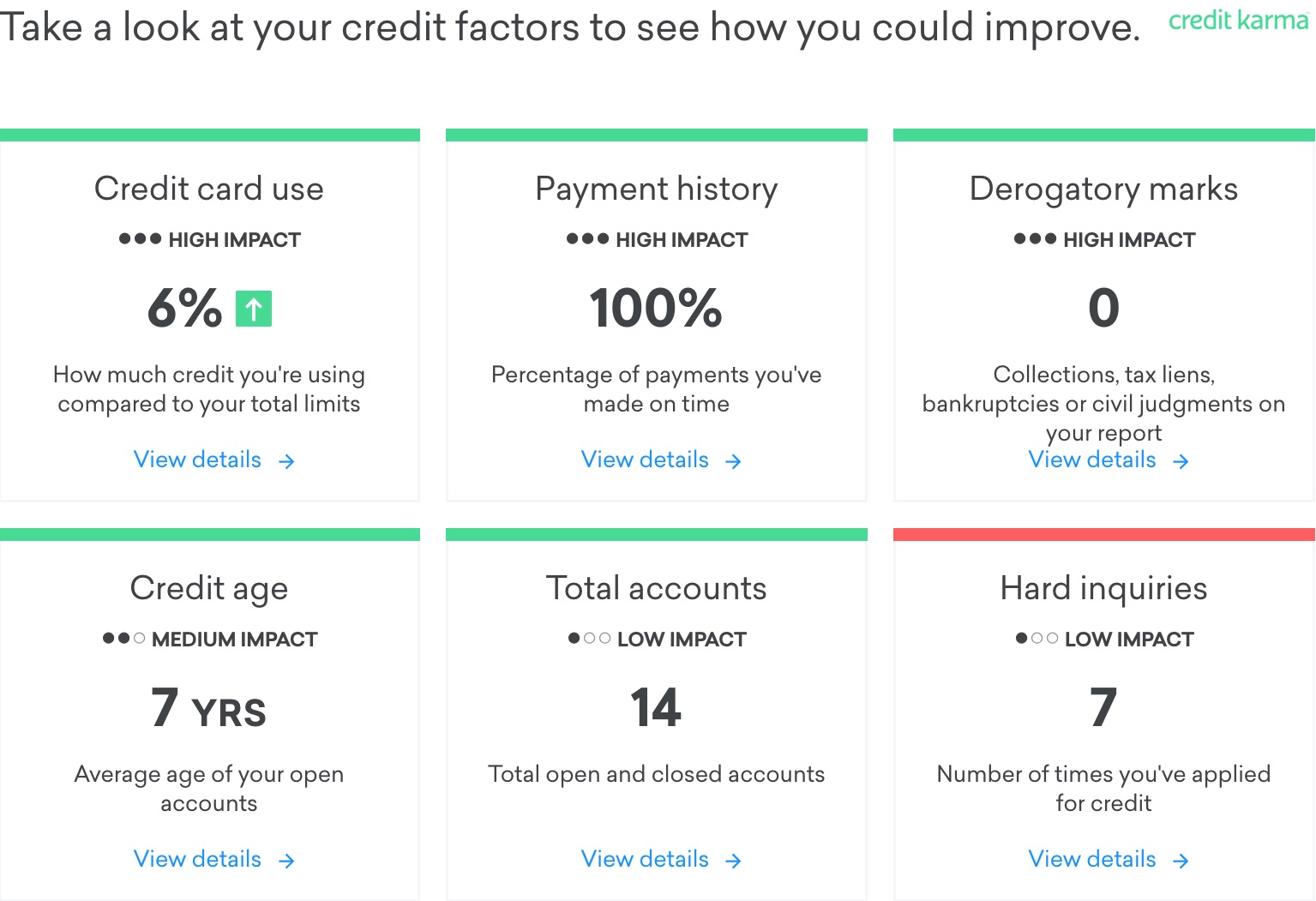

You can improve your credit score by increasing your credit limit – assuming your balance doesn’t also increase. Your credit utilization ratio makes up 30% of your credit score.

Here’s a simple example explaining what credit utilization ratio means, from CreditCards.com, “If you owe $100 on your credit card and have a $1,000 credit limit on it, your credit utilization ratio is 10 percent.”

How does credit card debt affect your credit score?

As credit card debt (your balances) goes down, your credit utilization ratio improves, and your credit score goes up. And vice versa.

If you have high credit card debt, you need to prioritize paying off your balances. As your credit card balances are getting paid down, simultaneously, your credit utilization ratio and credit score improve. You can quickly clear your credit card debt by using the debt snowball method here. The debt snowball method is a do-it-yourself debt relief option created by Dave Ramsey. Can’t afford to get out of debt on your own, check out this top-rated debt relief program for 2021.

To learn more about Dave Ramsey, check out this Summary of his Book, The Total Money Makeover.

If you’re behind on monthly payments and have high credit card balances, before your credit gets repaired, you’ll need to resolve these debts. If you can’t afford to pay off your debt on your own, at Golden Financial Services, we can tailor a program to get you out of debt in the quickest possible timeframe and include credit repair for no extra cost. You need to have more than $7,500 in unsecured debt to qualify.

Video on how debt relief programs work

Call (866) 376-9846 for a free consultation and get debt relief advice from an IAPDA certified debt counselor. Our debt counselors will go over all of your debt relief options and explain the positive and potential negative consequences that come with each debt relief program. For example, all debt relief programs will negatively affect your credit score. Therefore, if you join a debt relief program, make sure that you have a complete game plan to get out of debt and repair your credit score.

Build Excellent Credit, Lesson #16: Don’t Apply for New Credit, Too Soon!

Every six months, I would either apply for a new credit card or request an increase in the credit limit on one of my existing credit cards. And continued to get approved each time.

But I followed a few rules:

- I would never apply for two credit limit increases within a six-month period.

- I would always alternate the cards that I would be requesting the increase on

For example, today, I may request an increase in my Bank of America credit card. Six months from today, I could request an increase on my Citibank card. In a year from today, I could request an increase on my Best Buy card, and so forth.

However, I felt confident because I had continued to get approved for credit limit increases. So, I decided to apply for a credit limit increase twice in the same month but on two different cards – and was denied!

Now, I had another ding on my credit report that set me back a few points.

I was denied because I requested too much credit within a short period. Creditors see that type of behavior as “risky behavior.”

Credit Lesson #17: How to Raise Your Credit Score by 100 Points (in Less Than 5 Months)

I promised you all a trick, so here it is!

The trick is called the “Credit Piggyback.” Clients of mine have told me that this trick raised their credit score by as much as 100 points in under six months.

Here’s how it works:

Get added to someone’s credit card as a joint account holder (NOT an authorized user). It could be your mom, husband or wife, or anyone.

Here’s what’s most important: The credit card you get added on should be:

- A card with a high credit limit

- A card with a low balance

- A credit card that the person had for many years

By getting added as a joint account holder to that card and not just an authorized user, you equally share the risk and rewards associated with that card.

My mother added me to her eight-year-old Chase credit card, which had a $25,000 credit limit and an $8,000 balance.

My credit score jumped from 630 to 710 in 120-days. This strategy increased my credit score faster than any other tip on this list.

To be honest with you, this very same credit card is the worst credit card on my credit report right now. My mom has never been late on the card or anything like that, but she tends to carry a 2-$3K balance on it, and on my credit cards, the balances all get paid in full every month, so yeah, this card is actually hurting me more than it’s helping me as of today. Without this card on my credit report, I believe my score would be around 845. So my point is, this trick could come back and bite you in the future if one day you have excellent credit, but the person who helped you in the past decided to rack up high debt on the card they added you on.

Here’s why the piggyback credit trick works like magic:

“VantageScore combines two factors; how long you’ve been using credit and what types of credit you have — into a single factor and considers it ‘highly influential.’ FICO scores break it out a little differently, with the length of your credit history accounting for 15% of the score and the mix of accounts making up 10%. So whether you’ve had credit for six months or 20 years can make a big difference in your credit score.” So overnight, you go from having no credit history to having a positive payment history on a credit card that goes back many years.” Your credit score skyrockets!

Credit Lesson #18: Keep Your Balance Under 30% of the Credit Limit (myth or fact?)

The credit experts always tell people, “it’s best to keep your balance under 30% of the credit limit”, but here’s better advice, the lower your balance, the higher your credit score. As your balance goes down, your credit score will go up.

“FICO has noted that below 20% is good, below 10% is better, and that people who have the highest credit scores average 7% credit utilization. Want the most benefit? Pay your balance in full every month.

And most importantly, why waste your money on interest? By paying your balance in full every month, you avoid all interest and can save thousands of dollars over your lifetime. Plus, if you have a card that pays you cashback, you could actually start earning money and increasing your income from credit cards. We will talk more about that soon!

Lesson #19: You Need a Home Mortgage Loan to Build Excellent Credit

At 27 years of age, I bought my first home. By this time, my credit score was about 730.

A 730-credit score is sufficient to get a home loan. You may not get the lowest interest rate, but you’ll get approved for a home loan and can use it to establish excellent credit.

According to Nick Clements, who worked at Citibank and currently owns MagnifyMoney.com, “To get the best interest rates on mortgages, most lenders will require a FICO score above 740.”

At first, purchasing a home lowered my credit rating, but after eight months of paying on my mortgage, my credit score went up higher than ever. Then, I received an alert from my credit monitoring service saying, “your score just went up to 750, congratulations and keep up the great work.” Over the years, I continued to see my credit score improve, thanks to my on-time mortgage payments.

Now keep in mind, I still had some collection accounts on my credit report, which required me to put a hefty 20% down payment on my home purchase and suffered from a near six percent interest rate.

At that point, I applied for a third credit card with Best Buy, six months later a fourth credit card – and then a fifth.

At this point, what else could I do to increase my credit score?

Take a look.

Credit Lesson #20: Use Credit Cards for All Purchases

My Bank of America credit card pays me over 2% cashback on ALL purchases. Why would I pay cash when I can get a discount on the purchase if I pay by credit card?

I use my Chase card and get 3% cashback on all travel-related expenses if I travel for work.

By using your credit cards on all purchases, you can either get a discount or earn reward points on all purchases, and simultaneously you’ll be racking up miles of positive payment history. Why is payment history important? Eventually, you could walk into any bank in the nation and borrow enough money to purchase an apartment building if that’s what you wanted to do. Wouldn’t it be a good feeling to know that any bank in the nation would loan you money and lots of it, just in case you needed it? This feeling is called “financial freedom.”

Lesson #21: Earn Tax-Free Income

By using your credit cards on all purchases and paying the balance in full two times per month, you’ll:

A) build excellent credit fast

B) pay no interest

C) increase your income, thanks to “cash back.”

Do you want to know what the best part about cashback is?

The IRS considers cashback to be tax-free. This is huge! Where else can you find tax-free income besides your retirement accounts? You can simply transfer the funds into your personal bank account and not have to worry about paying the taxes on the money.

That is, of course, if you have credit cards that pay you to cashback. But, again, you may or you may not.

If you don’t have credit cards that pay cash back, contact your creditors one by one and let them know that you are switching to another credit card offering you 2% cash-back on all purchases, unless they can match it. In addition, your creditor may upgrade your card to a new card that they have available that offers reward points and cashback. Just make sure they don’t close out your old credit account when doing so.

Credit Lesson #22: Carefully Evaluate Credit Cards Before Applying

One last vital mistake I made during my journey from bad to excellent credit is that I didn’t carefully evaluate them before applying on my first three credit cards. I was just so excited to get approved for my first few credit cards and was only focussing on the fact that I needed 4-6 cards to build excellent credit. These three cards don’t pay me a single penny in cash-back, still to this day. They’re a waste.

Today, my income would be higher if I selected cards that paid me cash back on those first three credit cards I obtained. So don’t make that same mistake.

Consider carefully evaluate a credit card before applying for it, and only get credit cards that pay you cash-back. Or, reward points can be just as good. Many consumers use their reward points to get free vacations and things of this nature, but personally, I prefer cash back!

Credit Lesson #23: Don’t Cancel or Close a Credit Card

You may be wondering, why don’t I just close the credit cards that aren’t paying me in cash-back and replace them with another?

According to an article on Money.Cnn.com,

“Closing an old credit card can hurt your credit utilization and your length of credit history. First, the former. For your credit utilization ratio to help your score, it needs to stay at or below 30%. This means that if your total line of credit is $10,000, you shouldn’t owe more than $3,000 at any given point in time. Therefore, if the card you’re thinking of closing gives you a $5,000 limit, and a replacement card only offers a $2,000 limit, you could end up in a scenario where you exceed that 30% threshold and wind up hurting your score. The same holds true if you cancel your credit card and don’t get another one in its place.

Then there’s the length of your credit history. Having, say, a 15-year-old account in good standing will help your score, but if you cancel that account, it’ll typically get removed from your credit record after about 10 years. Therefore, while you won’t necessarily feel the impact of closing that credit card right away, it could come to hurt you over time.“

On my Bank of America credit card, they offered me an upgrade. The upgrade would be for a newer credit card for their preferred customers and paid a higher amount in cash-back. I agreed to this upgrade because the bank guaranteed that my credit limit would stay the same and did not close out my existing card, where I’d lose all of that valuable history that I’ve worked so hard to establish over the years.

Lesson #24 on How to Build Excellent Credit: What’s the Interest Rate?

“35% of credit card users don’t carry a balance – they pay off their bill every month.”

The other 65% of consumers who carry a balance are paying thousands of dollars in interest and just giving their hard-earned money away to the banks. Plus, credit cards come with variable rates, so if the Federal Reserve votes to increase the Federal Funds Rate, your credit card interest rates will also rise – making your credit card debt harder to pay off. The Federal Reserve already increased interest rates twice this year, and two more rate hikes are still expected to come.

The average card APR climbed to a record high of 16.47 percent after the Federal Reserve raised its benchmark interest rate by a quarter of a percent, prompting many card issuers to do the same.

Statistically, more people carry a balance at the end of the month than those who pay their balance in full.

WHO DO YOU WANT TO BE?

Do you want to be the person who gets paid by the credit card company every month?

OR:

Do you want to be the person who pays the credit card company every month?

You can earn thousands of dollars in extra income just by getting the right credit cards. At CreditRatings.com, there are credit cards that pay up to 10% cash-back.

Here’s an excellent post on how to benefit from credit cards and monopolize on using cash-back.

About the author: Paul J Paquin

Paul J Paquin is the CEO of Golden Financial Services (GFS), a top-rated national debt relief company with an A+ rated by the Better Business Bureau. GFS started offering debt settlement services in 2004, and over the years, added debt validation and consumer credit counseling debt relief options to its infrastructure. As of 2021, consumers have the power to choose from multiple debt relief programs at GoldenFS.org. Depending on the state you live in will determine what plans are available. You can also listen to Paul’s Podcast on credit repair by clicking here.

Paul is an aspiring writer and author, publishing multiple books and contributes editorial content on industry-leading websites, including ValueWalk.com and SemRush.com. Check out Paul’s last article called “10 Best Ways to Clear High Credit Card Debt“.

I have a 25th Tip (pertaining to medical bills on your credit report), from Darby Sweeney, assistant vice president and loan officer at Peoples Bank in downtown Kankakee. “Starting this past September, the three major credit reporting agencies changed their rules on medical debt. In the past, a late medical bill could damage your credit in a manner of weeks, but there’s now a 180-day grace period and debt that is later paid by your insurance company will be erased from your score altogether.

When it comes to old bills you might not have realized weren’t paid, Sweeney says there’s nothing wrong with calling up and asking for a “pay for delete” arrangement.

“You can say ‘I’ll pay you in full, but you will you delete it?’ Some companies have the authority to do that,” she said. “They might say heck no, but why not ask?” source: http://www.daily-journal.com/news/local/tips-to-improve-your-credit-score/article_51cbbe74-3ec3-11e8-9862-bf8bc317decf.html

What an amazing story. Some of these tips are awesome. Easily the best guide I’ve found on how to build credit. Thank you so much and I will be sharing this with my friends on Facebook!

Wow this is an amazing story, and super educational. I’ve learned more about how to have excellent credit in this post, than I’ve learned over my entire lifetime (36 years old). I always thought that by having a higher credit limit, that look bad because future lenders would see me as a higher rise, being able to go out and spend all this money on credit cards, but now I get it, only if you abuse it and rack up debt will they see you as a high risk, but if you keep your balances low this proves that you are a responsible borrower. I passed this article on to my classmates that the University of San Diego and will be sharing on social media. Thanks so much for divulging your story and showing everyone how to master a high credit score. And by the way, I was reading about your debt relief programs here https://goldenfs.org/credit-card-debt-relief-programs-summary/, and I’m really surprised at some of these options, especially the fact that they include credit repair and a guarantee because in my research in the past when I needed to consolidate some credit card debt, all of the companies told me that my credit would be ruined and there’s no guarantee of results, so I decided against consolidating, but if I had seen your programs I would have definitely signed up. I can see you guys also have an A+ BBB rating and no complaints so that tells me that your programs are the real deal. How do I go about referring friends and people your way?

Thank you for your kind words. As far as referring people to Golden Financial Services, you can have them call our main number listed on this website and one of our IAPDA Certified and Accredited representatives can provide them a free consultation. If anyone signs up for our program you will receive a gift card (as good as cash) and your refferal will receive $50 off their next monthly payment – as our way of thanking you for the referral, so make sure to let your referral know to make it clear who they were referred by and you can even get in touch with us at that point to make sure your gift card is mailed out.