According to a CNBC report, credit card debt in Indiana was the lowest in the nation before COVID-19. Kudos to the Hoosiers for holding this credential! But post COVID-19, in the state of Indiana, many consumers are now jobless or have lost income. Getting out of debt may have been easy two years ago, but now it’s a different story.

Credit card balances are only expected to rise as creditors resume monthly payments over the course of 2021 and 2022. Debt relief programs offer you ways to get out of debt at a much lower monthly payment, but each program comes with pros and cons. Indiana credit card debt relief, settlement, and consolidation programs will be explained on the following page.

In a nutshell, federal student loan relief programs do exist, but no other government unsecured debt relief programs are available. For credit card relief in Indiana, you can use consumer credit counseling and debt settlement. Indiana residents have bankruptcy as a last resort, but it’s definitely not recommended.

If you can’t afford to pay your unsecured debt, validation programs are the most popular choice. With validation, after an account is invalidated it no longer needs to get paid and can’t legally remain on credit reports. Validation can be an effective tool to help fight high credit card debt.

You may also call to speak with an IAPDA Certified Counselor at (866) 376-9846 and get a free consultation at any time.

Best Indiana Debt Relief, Consolidation and Settlement Programs

New statistics reveal that Indiana has the most manageable credit card debt in the country. “In terms of total debt, Indiana ranked eighth lowest behind Iowa, Wisconsin, Vermont, Kentucky, Mississippi, Maine, and Nebraska. The average Iowan had only $2,091 in credit card debt, which was the lowest in the nation. Neighboring Illinois ranked 37th in the study with $2,665, which would take 12 months and 17 days to pay off at the median salary and cost $241 in interest. Michigan was 27th with an average of $2,343 in debt that would take 13 months and seven days to pay off at the cost of $224.”

This study revealed some interesting facts, illustrating Indiana as one of the healthier states financially, but that does not mean everyone’s comfortable paying their credit card debt. Relief is needed for thousands of Indiana residents. Many consumers are considering bankruptcy. Every day people in Indiana are Googling “Indiana debt consolidation loans,” not realizing the danger that comes with these loans for borrowers that have credit scores under 710.

Should I consider a Debt Consolidation Loan for Relief in Indiana?

New fintech companies, including Best Egg, Prosper Marketplace, LendingClub, Avant, SoFi, and Upstart, are ready to loan to subprime borrowers with low credit scores in exchange for high fees and high interest rates that could put someone deeper in debt. Beware of these predatory loans. Instead, consider affordable Indiana debt relief programs.

Are there downsides with Debt Relief Programs in Indiana?

There are downsides with all programs, including loans. What does your financial situation look like today? What is your goal? Only after a debt counselor understands your current financial situation and goals can a prescription to your financial problems be prescribed. You can be completely debt-free in 24-48 months, at a much lower payment than when paying only minimum payments on a debt consolidation loan. Indiana residents can start with a Free Consultation by Simply Calling (866) 376-9846 now.

The following page will discuss the pros and cons of all programs being offered in Indiana. Debt relief programs in Indiana are becoming as popular as the Indianapolis 500. Almost everyone in the state has heard about these new programs. Most consumers are unaware of how they work and the difference between each plan, including debt relief, settlement, and consolidation.

Are you looking for Indiana hardship relief? Apply for the Indiana debt settlement program, and a portion of your balances can be completely forgiven. Can’t afford to pay your debt? Debt validation could prove your alleged debts to be invalid and force your creditors to cease collection. Not only that but after an account is proven to be legally uncollectible, it could even get removed entirely from all credit reports.

Example of how validation could resolve debt and get it off your credit

Need a lower interest rate on credit cards? Indiana consumer credit counseling programs combine all payments into one affordable payment that carries a lower interest rate.

With the other debt relief companies in Indiana, they all offer only a single program, and you may end up getting put in the wrong plan. GFS’s IAPDA certified counselors will go over each program’s pros and cons and give it to you straight. Following your free consultation, you’ll know exactly how to get out of debt and what your best option is. You may find out that you don’t need a debt relief program and instead decide to use our free snowball calculator to get out of debt on your own.

Are Indiana debt relief programs legit?

Reviews all across the internet illustrate how legitimate these programs truly are. Just in Indianapolis alone, more than 2.8 million Indiana residents have used Golden Financial’s debt relief programs to become debt-free, going back since 2004. So, the results speak for themselves!

There are only a few reputable debt relief companies in Indiana, including Golden Financial Services (GFS), Freedom Debt Relief, National Debt Relief, and Debt Wave Credit Counseling. What’s different about GFS is that you can choose from any of the best debt relief options.

Our job is to find the best savings and the right plan to help you achieve your specific financial goals. Our counselors will then walk you through getting approved in under 24 hours.

Best Indiana Debt Relief, Settlement & Consolidation Company

TrustedCompanyReviews.com just reviewed the best debt consolidation companies in the nation and rated Golden Financial Services #1 (click to check it out). So, yes, you’ve landed in the right spot if you’re buried in debt and need immediate relief. Our debt counselors are certified by the International Association of Professional Debt Arbitrators (IAPDA here at Golden Financial Services). Golden Financial Services is A+ rated by the Better Business Bureau.

You can get a free consultation right now and learn about Indiana debt relief programs for free. If you’re eligible, you can enroll with ease.

To start, call (317) 981-7823 or Toll-Free (866) 376-9846.

- Plans include a money-back guarantee and credit repair.

- You can become debt-free in 24-48 months (average), depending on what’s a comfortable monthly payment for you.

- Recently lost your job, or have had your income reduced? Hardship programs can knock your monthly payment down by near 45%.

- Choose from debt validation, consolidation, and debt settlement programs if you reside in the state of Indiana.

- No Up-Front Fees or High Cost to Get Started!

The biggest fears that people have when contemplating whether or not they should join a debt relief program in Indiana include:

I’m afraid to ruin my credit …

First off, you can always rebuild your credit score. It will not be reported that you joined a debt relief program unless you decide to use consumer credit counseling. Indiana residents are also provided free credit repair on the debt validation program. The credit repair would be for any debts that are proven to be invalid because once invalidated, the collection agency can no longer legally report the debt to each credit reporting agency. Additionally, you are provided an installment type loan to establish a new positive payment history. By showing a positive payment history, that’s how you can improve your credit score.

I can’t afford to pay high up-front fees …

The programs offered through Golden Financial Services offer you an immediate reduction in monthly payments, no out-of-pocket or up-front fee. Your creditors won’t get paid each month even with debt settlement, but you will have one low monthly payment. You can choose to become debt-free in 12 months, 24 months, 36 months, or even 48 months if you need the most down possible monthly payment.

What if the plan doesn’t work and I get ripped off?

With Golden Financial’s plans, no fees are earned until each debt gets resolved.

With validation services, a money-back guarantee is provided, ensuring you only pay if results are achieved.

What if I get sued?

You will be referred to a law firm to settle your debt if you receive a summons while on the program, ensuring the debt gets resolved before it ever goes to court. You would get a refund of any fees paid into the plan towards a particular debt so that these funds can be used to settle that debt immediately, keeping you far away from any courthouse!

How Indiana Debt Settlement Programs Affect Credit

Most people have already had their credit negatively affected before joining a debt relief program. Just by having maxed out credit cards, your credit score is getting negatively affected.

To qualify for debt settlement, Indiana residents must be delinquent on monthly payments. By falling behind on payments, you’ll get late marks and collection accounts on your credit report, which will lower your credit score.

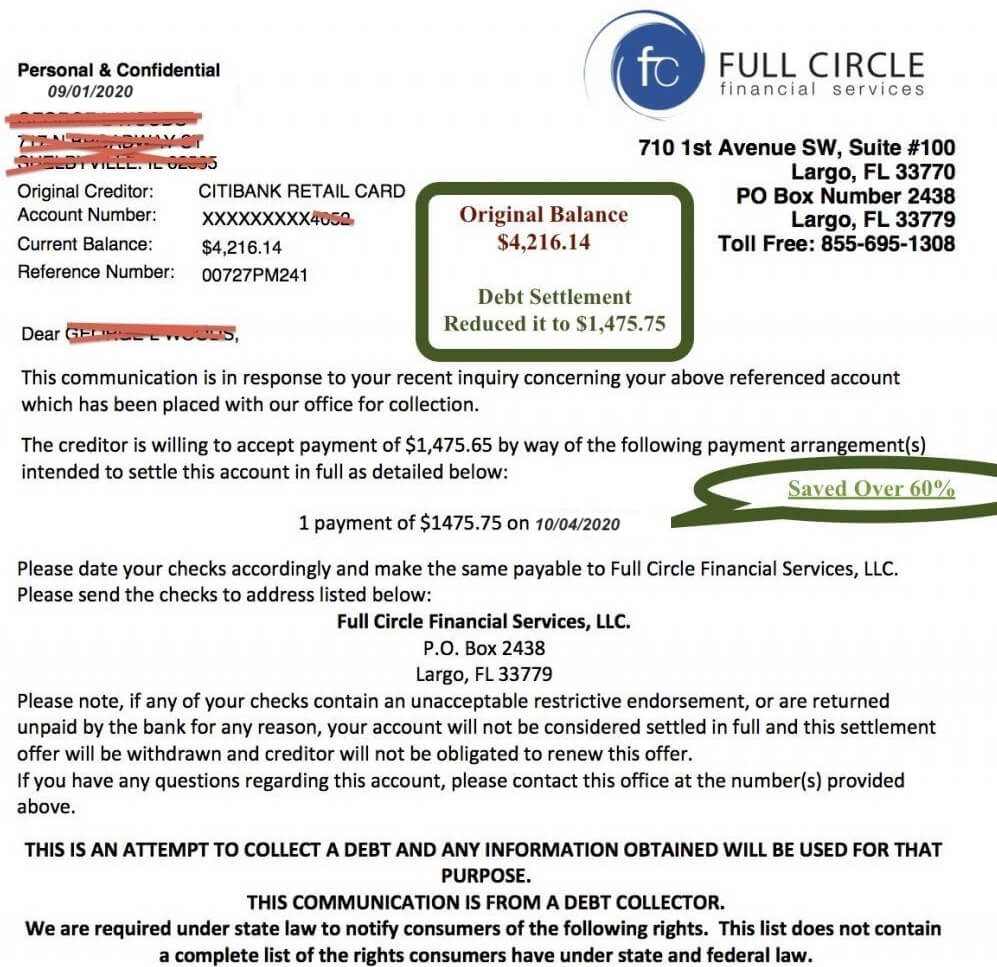

One by one, throughout your debt settlement plan, each debt will get reduced, settled, and paid off. As the debts are paid off one by one, your debt to income ratio improves (DTI). This is one factor that could help your credit improve, but there’s no guarantee of this. The only way to guarantee your credit score improves is to establish new positive payment history and ensure you are not late on any future payments. Unfortunately, debt settlement programs in Indiana don’t include credit repair or a money-back guarantee. However, this next option does!

You May Not Owe The Debt, Once Disputed With Validation

Millions of dollars in delinquent credit card debt get forgiven or, in many cases, proven to be invalid and legally uncollectible every single year. A legally uncollectible debt is one that you don’t have to pay, and it can no longer legally remain on your credit report. It’s hard to imagine, but often debt collection companies can’t prove a debt is valid. This is not because you didn’t spend the money; it’s due to their inability to prove that the debt is valid by providing complete records and evidence that they claim a person owes is 100% accurate.

Can I get out of debt without paying if I live in Indiana?

Debt validation is your legal right to dispute a debt. The debt validation program disputes each debt for you, forcing each debt collection company to prove it is valid. Most of the time, the debt collection companies quickly agree to stop collecting the debt because they cannot prove it’s valid. In many cases, they even agree to remove the debt from all three credit reports. Due to this phenomenon, debt validation can be your simplest and most effective route to dealing with credit card debt.

Credit Card Debt Relief (Indiana Program/Case Example)

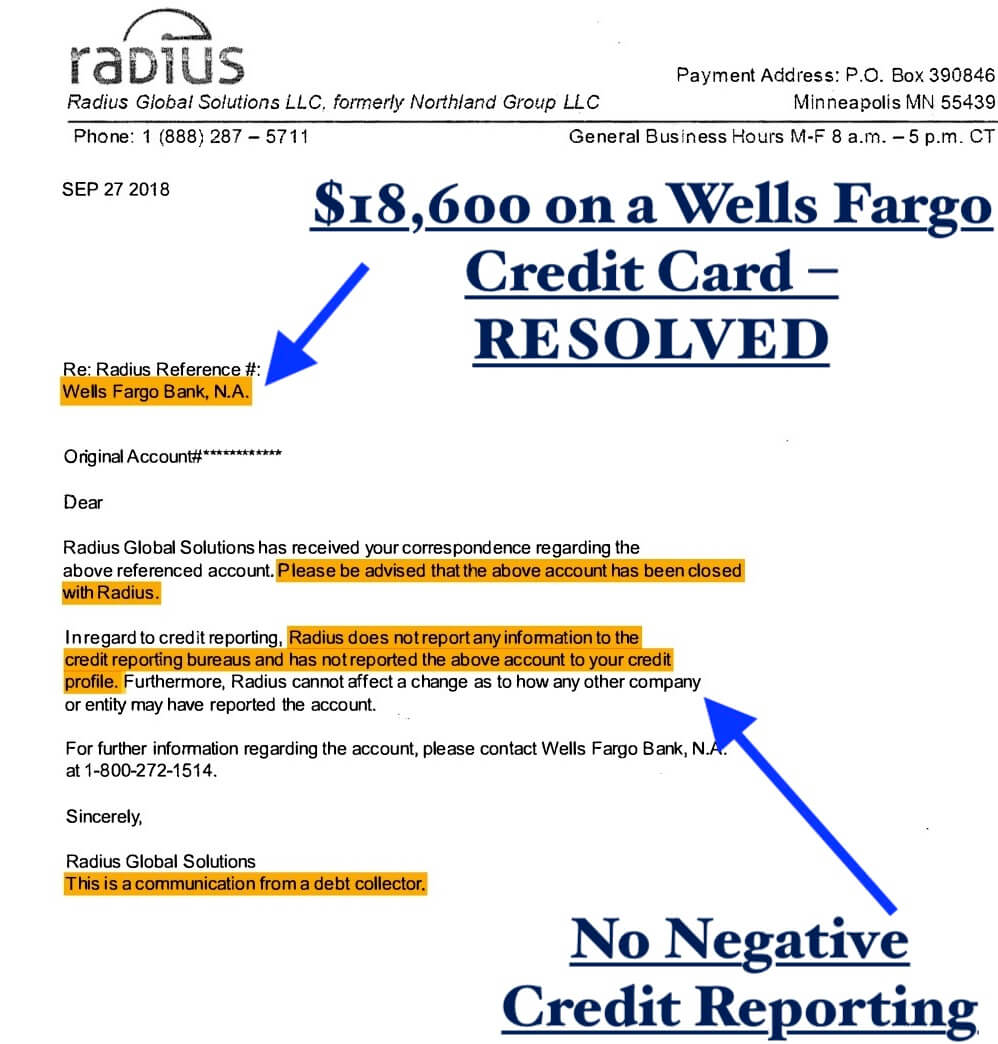

This client used the validation program to resolve this credit card account. The alleged balance was $18,600. Once disputed with validation, the collection agency quickly turned around, agreeing to stop collecting on the debt and immediately removing it from the consumer’s credit report.

The collection agency could not prove that the account was valid. Collection agencies often don’t have all of the documentation that a validation program requests and that federal law require them to maintain in their office. For example, debt validation requests that the debt collection company provides the original agreement that the consumer signed when initially applying for the credit card. If the collection agency can’t produce this document, the debt becomes legally uncollectible (invalid).

Perhaps, the collection agency couldn’t prove the amount was valid that they claimed the consumer owed. Often, collection agencies add unauthorized fees to the balance that you never agreed to, where now they could not prove the debt is valid even if they attempted to.

Or perhaps the collection agency violated the Fair Debt Collection Practices Act, Credit Card Act, or Fair Credit Billing Act, and in this case, they would instead release the consumer of the debt.

Indiana State Debt Relief Laws

Aside from the federal laws we mentioned above, there are also Indiana state laws.

Statute of Limitations on Debt

For example, the Statute of Limitations on Debt (including credit cards and medical debt) in Indiana is six years. Often this law is violated by collection companies trying to collect on expired credit card bills. Relief is quickly provided to consumers once approved for debt validation if their creditors have violated the Statute of Limitations because each debt gets disputed right away. Following the dispute, creditors must cease all collection activity until they prove that the debt hasn’t expired past the Statute of Limitations.

Once the account is disputed, collection companies need to provide a response where they detail their knowledge on when the Statute of Limitations for that particular account is, ensuring Indiana residents get their consumer rights protected. If they can’t provide accurate and complete records, here’s what happens to the debt.

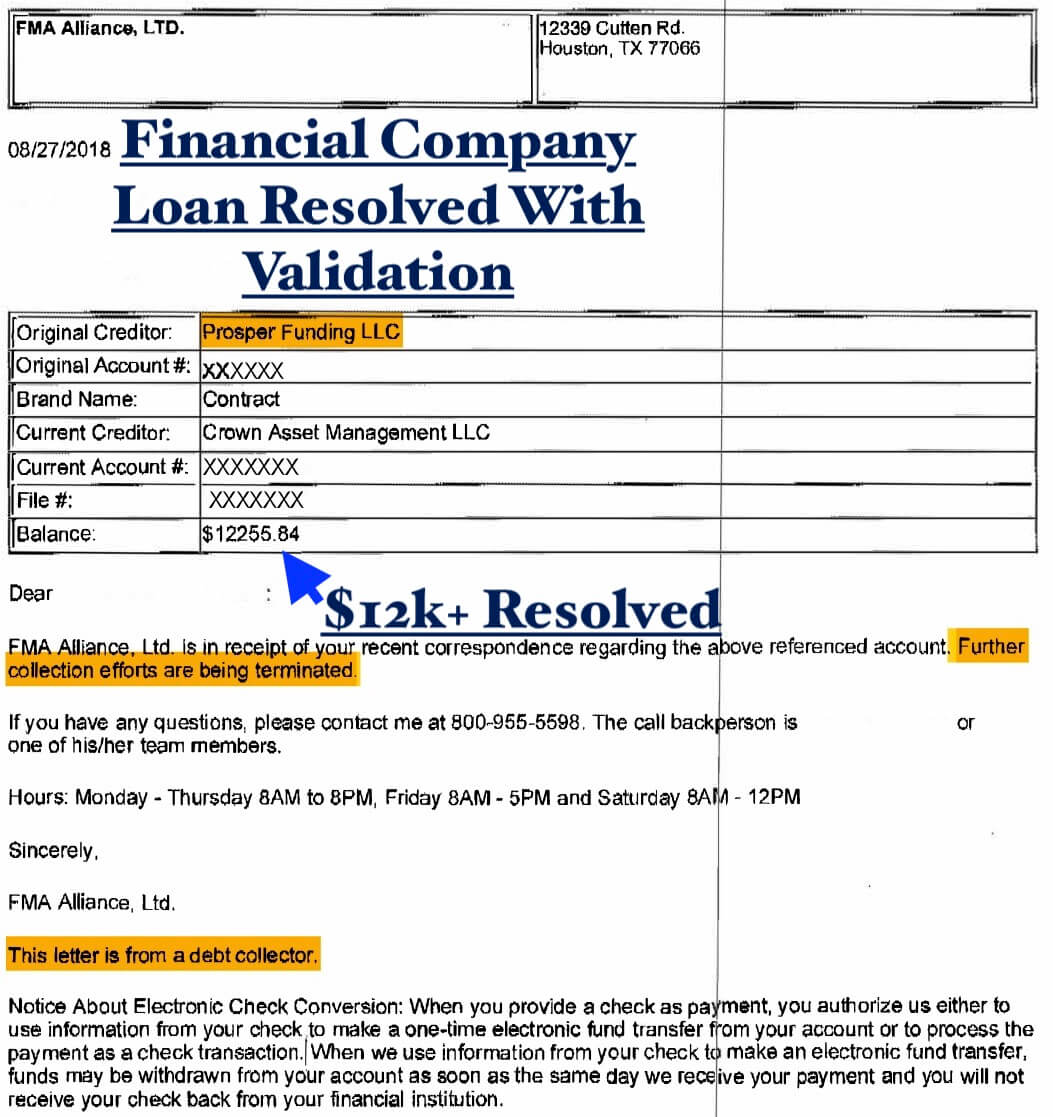

… Unsecured Loan Gets Resolved w/ Validation

Validation was used to prove this account invalid, where the consumer is no longer legally required to pay it. A balance of $12,255.84 DOES NOT HAVE TO GET PAID.

What if I have a high credit score? Should I use an Indiana debt relief program?

If your credit score is around 800 or higher right now, you are better off not even using a debt relief program. Try to find a way to pay more than minimum payments and get out of debt on your own. Having that high of a credit score is not easy to achieve.

Best way to get credit card relief without using Indiana debt management programs

- You can use the debt snowball or avalanche method.

- Try negotiating directly with your creditors to reduce the monthly payment temporarily.

- Use a balance transfer card to eliminate the high interest.

- Transfer that high-interest debt onto a low-interest home equity line of credit

Click here to learn about each of these debt relief options in more detail.

Indiana Bankruptcy (BK) Relief

If credit card companies have sued you already and you lost 90% of your income, in this case, you may qualify for Chapter 7 bankruptcy. Indiana residents can use the Indiana State Bar Website to find a reputable attorney. Chapter 7 bankruptcy wipes away your bills, where the only fees you pay are the attorney fees (which can be around $2,000).

“According to the Census ACS 1-year survey, the median household income for Indiana was $54,181 in 2017.”

If your income is above this median household income, you definitely won’t qualify for Chapter 7 bankruptcy. You would be required to file Chapter 13 bankruptcy. With Chapter 13, you will end up paying back at least half of your balances on each account. For that reason, Chapter 13 bankruptcy is rarely worth filing. The only case where Chapter 13 bankruptcy is worth filing will be if you are on the urge of having your home foreclosed on. In some cases, Chapter 13 bankruptcy can save your home. The judge will reorganize your bills so that they are affordable to pay them off over five years.

Click here to learn more about bankruptcy.

Indiana residents must also take a consumer credit counseling class and obtain a bankruptcy certificate from this class with a certified credit counseling company. This class is designed to educate you on debt relief programs in hopes of keeping you out of bankruptcy. Bankruptcy will have the worst effect on a person’s credit, so you want to try to avoid filing for BK at all costs.

Indiana Debt Relief Program Guidelines & Requirements

- Over $5,000 in debt is required to qualify for debt settlement, including medical bills, collection accounts, credit cards, car repossessions, and unsecured personal loans. Just about any unsecured bills will be eligible.

- Debt validation plans require over $7,500 in unsecured bills, and like with debt settlement, almost any type of unsecured debt qualifies.

- Consumer credit counseling requires over $5,000 in credit cards only.

Debt Consolidation Indiana

Consolidation loans offer Indiana residents a way to transfer high-interest unsecured debts onto a low-interest loan. You would then have only one loan to pay back.

To qualify for a low-interest loan, you must have a 700 or higher credit score. Click here to apply for an Indiana debt consolidation loan through various online lenders.

We recommend, check with a credit union near you for a low-interest loan if your credit score is near 700 or higher. Credit unions have a reputation for providing the lowest rate on consolidation loans.

The downside with using a consolidation loan is that you will be required to pay off the entire balance on each account, plus interest and loan origination fees.

Consumer Credit Counseling Indiana

Generally speaking, any non-profit consumer credit counseling company in Indiana A+ BBB Rated is a safe company to work with.

Consumer credit counseling programs won’t lower the amount you owe or even the monthly payment but will lower credit card interest rates.

Instead of paying 25% interest rates, you can get the rate reduced to 8-12% (average), allowing you to become debt-free in half the time.

Try this debt calculator tool to compare your payment on consumer credit counseling versus all other credit card relief programs.

Downsides and Disclosures for Debt Settlement Indiana

- Since creditors don’t get paid every month, credit scores can be negatively affected, and creditors can issue a summons on an account. Golden Financial Services sets clients up with an Indiana law firm to provide legal protection if creditors decide to pursue legal action. While enrolled in a debt negotiation program, a creditor could issue a summons to a client. But reputable settlement law firms and companies will immediately fight that summons and either get it dismissed or settle the account for less than the full balance owed. If a summons gets ignored, it could turn into a default judgment, have a more severe effect on credit, and even result in garnishment if ignored long enough. Therefore, if you are that 2% of cases who get served a credit card summons, the most critical action you can take is to send it over to your law firm immediately.

- When an account gets settled for less than the full amount owed, the savings can come to the IRS as income. The solution: file a #982 IRS Form, illustrating to the IRS that you are insolvent, eliminating the tax liability.

- With fees included, clients will end up paying only around 68% of what they owe with settlement services. Each account gets settled for approximately 40-50% of the balance, and fees come out to approximately 17% of the total debt enrolled. Keep in mind that interest rates and late fees will accumulate while on the settlement program, causing balances to rise before settling. Once the settlement occurs, all late fees and interest get mitigated into the reduced payoff amount. For more information on debt relief, settlement, and consolidation programs in Indiana, call (317) 981-7823.