Do you reside in Missouri? Debt Relief, Settlement and Consolidation Program Consultations are Free. Take advantage of that free consultation with an IAPDA certified counselor from Golden Financial Services. For your free consultation call (573)-545-0030.

Missourians have an average credit card debt of $6,217, which is close to $1,000 more than the average in the nation. That means Missourians are spending more money on credit cards than the average American, but yet the average income in MO is below average. The median household income for Missourians is $37,333, ranking it 39th best in the nation. You’re reading this page right now because you are trying to pay off your debt. So, this puts you a step ahead of most people in Missouri.

Missouri debt relief programs are amongst some of the best in the nation. In Missouri, debt relief programs include debt settlement, debt consolidation, debt validation, and consumer credit counseling. You can also use Bankruptcy (BK), but just know that bankruptcy could have the longest and worst effect on a person’s credit report. Bankruptcy can, at times, be necessary, for example, if a person is getting sued by multiple credit card companies and needs bankruptcy to save their home from foreclosure. Golden Financial Services believes that a person should avoid bankruptcy at all costs.

If you’re interested in learning more about bankruptcy, we recommend that you consult with a Missouri licensed BK attorney, but hopefully, we can help you avoid going that route. The following page will provide you with Missouri debt relief program reviews. Each program will be explained in detail. If you want to join a program, contact Golden Financial Services (GFS) at (573)-545-0030. The company is rated A+ by the BBB. Missouri debt relief programs also come with a money-back guarantee.

- GFS is A+ rated by the Better Business Bureau

- Trusted Company Reviews Rated GFS #1 for Missouri debt relief programs

- One of the highest ratings on Google (with 4.9 out of 5-Stars)

Debt Consolidation – Missouri

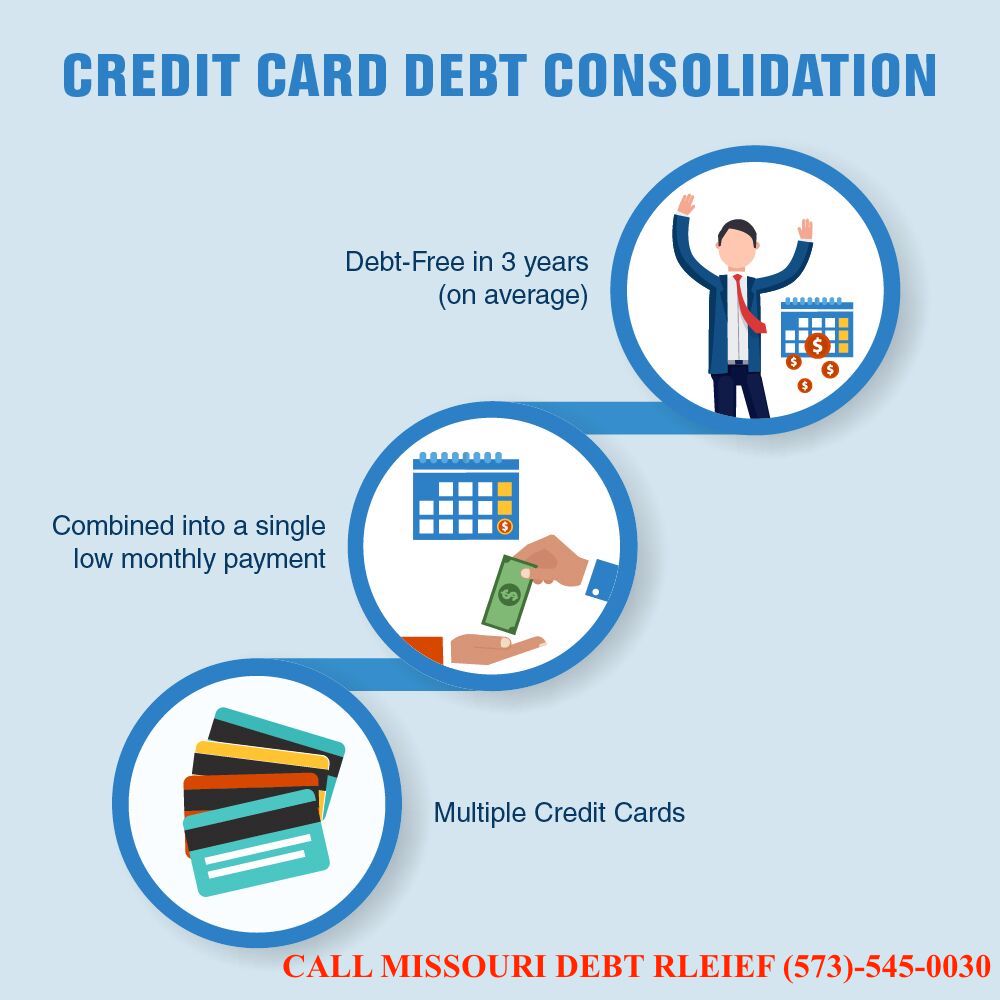

What is debt consolidation? Missouri consumers with a high credit score can consolidate debt with a loan in order to pay off all of their existing accounts and get a new low-interest loan to pay back. Consolidated loans can be a viable option to resolve high-interest debts, but to get a low-interest loan a person must have; A. a low debt to income (DTI) ratio B. a low credit utilization ratio.

That means, even if your credit score is above 700, if you have high credit card debt and all of your cards are maxed out, most lenders won’t issue you a low-interest loan. Here at GFS, we don’t offer debt consolidation loans, but can help you consolidate your bills through one of these next programs.

Debt Settlement – Missouri

What is debt settlement? Missouri residents that have overwhelming debt and who are contemplating bankruptcy may want to consider a debt negotiation program.

Picking the right debt negotiation company is essential. In the past, settlement companies have taken advantage of consumers by charging upfront fees and failing to settle all of their debt.

Settlement programs can be a risky option if not executed correctly. Creditors can sue a person, issuing them a summons to go to court. Creditors are not required to settle a debt, so there’s no guarantee that all of your debt will get settled.

When choosing a debt negotiation company, make sure to select one that offers:

- a written guarantee ensuring you don’t have to pay any fees if results aren’t achieved

- No up-front fees

- lawsuit defense to protect you if served with a credit card summons

Client’s become debt-free in under four years with Missouri debt settlement programs. Read more about debt settlement.

Debt Validation – Missouri

Last but not least, is debt validation. This can be your least expensive route to dealing with almost any type of unsecured debt.

What is debt validation? Missouri consumers have been reaping the benefits of a debt validation program for many years now. Debt validation allows a person to challenge the legal authority of a debt collection company. If the collection agency can’t prove the debt is valid, the debt becomes legally uncollectible. Also, after a debt is invalidated, the debt can no longer legally remain on a person’s credit report.

Click Here to Learn more about a debt validation program.

Consumer Credit Counseling Debt Relief – Missouri

What is consumer credit counseling? Missouri consumers are advised to visit the Department of Justice and select a non-profit consumer credit counseling company in Missouri or visit the Better Business Bureau (BBB) to find a highly rated company. With consumer credit counseling, a person’s payment will be about the same as what it is when paying minimum payments on their own. When using a consumer credit counseling program, credit card interest rates can get reduced to 8% in many cases. By reducing the interest rates on credit cards, that makes it possible to get out of debt faster.

Here’s how it works. Start by getting a free consultation with a non-profit Missouri consumer credit counselor. You will get a quote on how much your payment will be and find out if you’re even eligible. After being approved, you’ll then only have to make one monthly payment to the credit counseling company every month. The company will then disburse your payment to each creditor every month.

You can qualify for a consumer credit counseling plan even if you are 1-2 months past due on payments today. After approval for the program, the past due payments can be re-aged to show current again, in some cases helping your credit score.

What is the best debt relief program in Missouri?

Finally, all of these options exist as of 2020 because no one program is right for everyone.

For example, here are two different perspectives:

If your goal is to save money and resolve your collection accounts in the quickest possible time-frame, debt validation could be the best option for you.

If you don’t qualify for validation because you have a Discover debt and private student loan collection accounts, use debt settlement.

If your goal is to keep your credit score as high as possible and save money on credit card interest, use consumer credit counseling.

Ready to take action? Missouri debt relief and settlement programs are a phone call away, call (573)-545-0030 now.