How bad are Chicago’s debt and financial problems? Are there debt relief programs in Chicago to give consumers a fresh start, or are they all a scam? The following page will explain: A. Chicago’s current financial situation and B. what the best debt relief options are in 2018.

Here’s a glance of what Chicago’s financial situation looks like in 2019:

- Chicago residents are now more likely to miss a credit card payment than residents of any other major city, including New York, Los Angeles, Dallas or Miami, according to the S&P/Experian Consumer Credit Default Indices.

- Chicago residents have the highest default rate in the nation on credit cards, home loans, and car loans.

- Chicago owes $31.5 billion to pensioners, up from $5 billion in 2000. Chicago has less money set aside in its pension funds today than it did a decade and a half ago, according to Investors.com.

- Here at Golden Financial Services, a record number of Chicago residents have been approved for debt relief in 2018.

- The Statute of Limitations (how long a debt collection company has to sue an individual over a debt) in Chicago on written contract accounts, like credit card debt, is 10-years. Debt sticks to consumers in Illinois longer than in another state, adding to Chicago’s financial problems.

- “Chicago Mayor Rahm Emanuel’s administration won’t include a $10 billion pension obligation bond issue in his proposed 2019 budget but it remains on the table against a backdrop of rising interest rates that threaten to wipe out potential arbitrage savings. The mayor also said he would set up the framework to issue pension obligation bonds to help reduce the amount of money the city owes the retirement funds in the near term.”

- “Emanuel has issued record property tax increases and other fee and fine hikes to help shore up the city’s four pension funds.” If you are a taxpayer in Chicago and have an overwhelming debt to pay off, this is bad news for you.

- “The city is still considering issuing fund stabilization bonds to increase the funded ratios of our pension funds and lower the cost of our unfunded liabilities,” Chief Financial Officer Carole Brown said Thursday.

People can’t afford to have increased expenses, but then property taxes go up, thanks to Mayor Emanuel’s administration. Interest rates go up four times in 2018, setting Chicago back further.

Credit card minimum payments are supposed to continue rising in 2019, not once but three more times.

You’ve probably heard all this already on the news, but the banks fail to talk about debt relief options.

- Chicago residents can consolidate credit cards into one.

- Chicago residents can reduce balances by up to half on a debt negotiation plan.

- Programs are available besides bankruptcy, to help consumers who can’t afford to stay current.

So, if you’re frustrated over debt and your creditors refuse to lower the payments, just know that you have multiple debt relief options that can help you.

You can achieve financial freedom in 2019.

And there’s a free information line open right now that you can call. Talk with an IAPDA certified debt counselor for free.

Get a personalized plan to get out of debt at (312) 638-6276.

Credit Card Debt in Chicago

Why does Chicago have such a big problem with credit card debt?

The Federal Reserve buried the City of Chicago even deeper in debt after raising interest rates four times in 2018. But the city is not the only one who’s drowning in debt. There are millions of consumers who are struggling just to pay credit card minimum payments. After four rate-hikes, some people won’t be able to stay current on payments for much longer. The Fed projects interest rates to rise another three times in 2019, which will result in people sinking even deeper in debt.

The reason that Chicago residents are struggling to pay their credit card debt, is not because they did anything wrong, it’s because of financial hardship and high-interest rates.

Plus, the average credit score in Chicago is 648, compared to the national average of 699. Low credit scores can make it near impossible to get a low-interest loan or balance transfer card to pay off credit card balances. Consumers in Chicago have lower credit scores on average, compared to the rest of the nation, which puts them at a bigger disadvantage.

Consolidating Debt With a Loan or Balance Transfer Card

A low credit score will lead to creditors issuing loans and credit cards with subprime rates. Subprime is another word for “second chance”. Credit card companies feel that if they issue a loan to someone who has under a 710 credit score, that they’re giving that person a second chance and because of that they can charge outrageous interest rates. Debt consolidation loans are no longer an attractive option because of the high interest rates. And the same goes for balance transfer cards.

The City of Chicago is filled with subprime borrowers who are being overcharged in interest and who can only afford to pay minimum monthly payments or less. When paying only minimum monthly payments on high-interest accounts, balances may never get paid off, but that’s what the banks want because that’s how they maximize profit.

What can Chicago debt relief programs do for you?

- Chicago debt reduction services let you choose how fast you want to get out of debt.

- To be a compliant debt relief company, Golden Financial Services will give you a quote on how much you can save on each plan based on last years success rate. For example: “what was the most that consumers had to pay on a certain credit card last year”. When it came to debt settlement Chicago plans, credit card debt could get settled for around half of the balance.

- Most of the time, “debt collection companies can’t prove that you owe the money”. Where the debt becomes, legally uncollectible – because creditors fail to maintain legally required records and accurate accounting, amongst other things.

Paul J Paquin, the CEO at Golden Financial Services said the following; “Chicago debt relief, settlement, and consolidation programs give you control and the power to make a choice based on what suits you best. You can pick from multiple plans and get an affordable payment, and you can even switch to another plan over time if your income changes, depending on what’s feasible for you. You’re not stuck in one plan. Some Chicago residents start out on a three-year program but then end up getting out of debt in 18-months because they decided to speed up their program after their financial situation improved. This type of flexibility is allowed with debt relief programs – you truly take back that lost control and the power is shifted back to you.”

Chicago Debt Relief, Settlement, and Consolidation Programs can resolve just about any type of unsecured debt, including credit cards, third-party debt collection accounts, medical bills, bank loans and student loans.

There are different programs – designed to deal with different circumstances. Today we will take a look at a few examples of the various types of programs and actual client results obtained.

Here are 3 examples of how debt relief programs in Chicago can help resolve credit card debt:

$20,000 of credit card debt with an average interest rate of 30%

- a monthly payment of $301.50, could resolve your debt in 36 months

$25,000 of credit card debt with an average interest rate of 30%

- a monthly payment of $357.06, could resolve your debt in 36 months

$30,000 of credit card debt with an average interest rate of 30%

- a monthly payment of $412.61, could resolve your debt in 36 months (click here to try debt calculator and get more quotes)

[njt-gpr location=”Golden Financial Services” place_id=”ChIJo17S0FtM2YARRQNurWXFB68″ review_filter=”5″ review_limit=”5″ review_characters=”20″ column=”1″ btn_write=”Write a review” cache=”None” ]

Chicago, Illinois – Debt Settlement

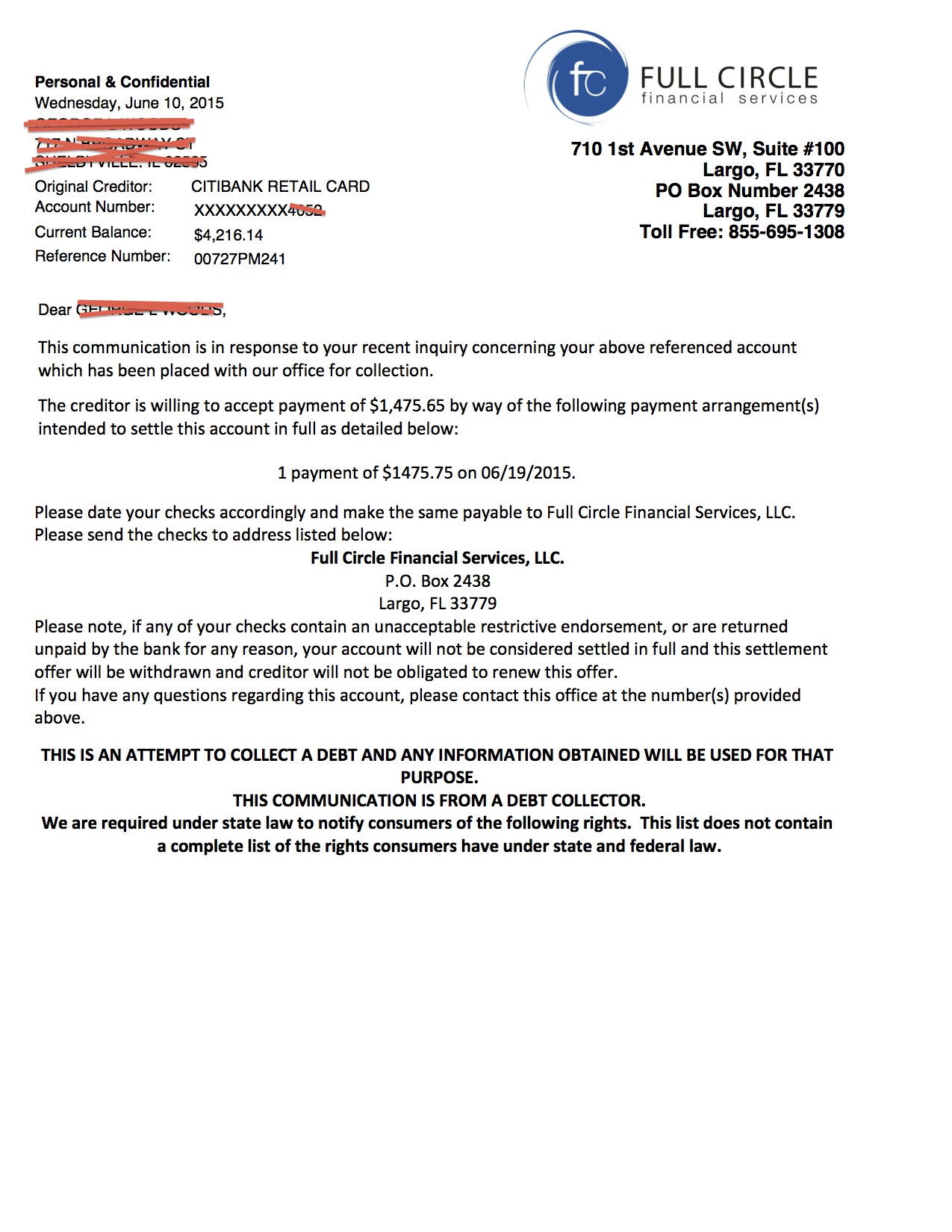

Golden Financial Services doesn’t recommend or currently offer debt settlement for consumers in Chicago, there are much more effective options available that even include credit repair. However, in some cases, a debt will need to be settled. For example, this debt was settled for $1,475.65, saving the consumer $2,740.39.

Debt settlement programs in Chicago come with negative consequences and a person should try to avoid this type of debt relief option if possible. Credit scores will go down, creditors can sue a person while on a debt settlement program, and when a debt is settled for less than the full balance owed there are potential tax consequences.

The preferred debt relief programs in Chicago are either debt validation, consumer credit counseling with a licensed company or debt consolidation.

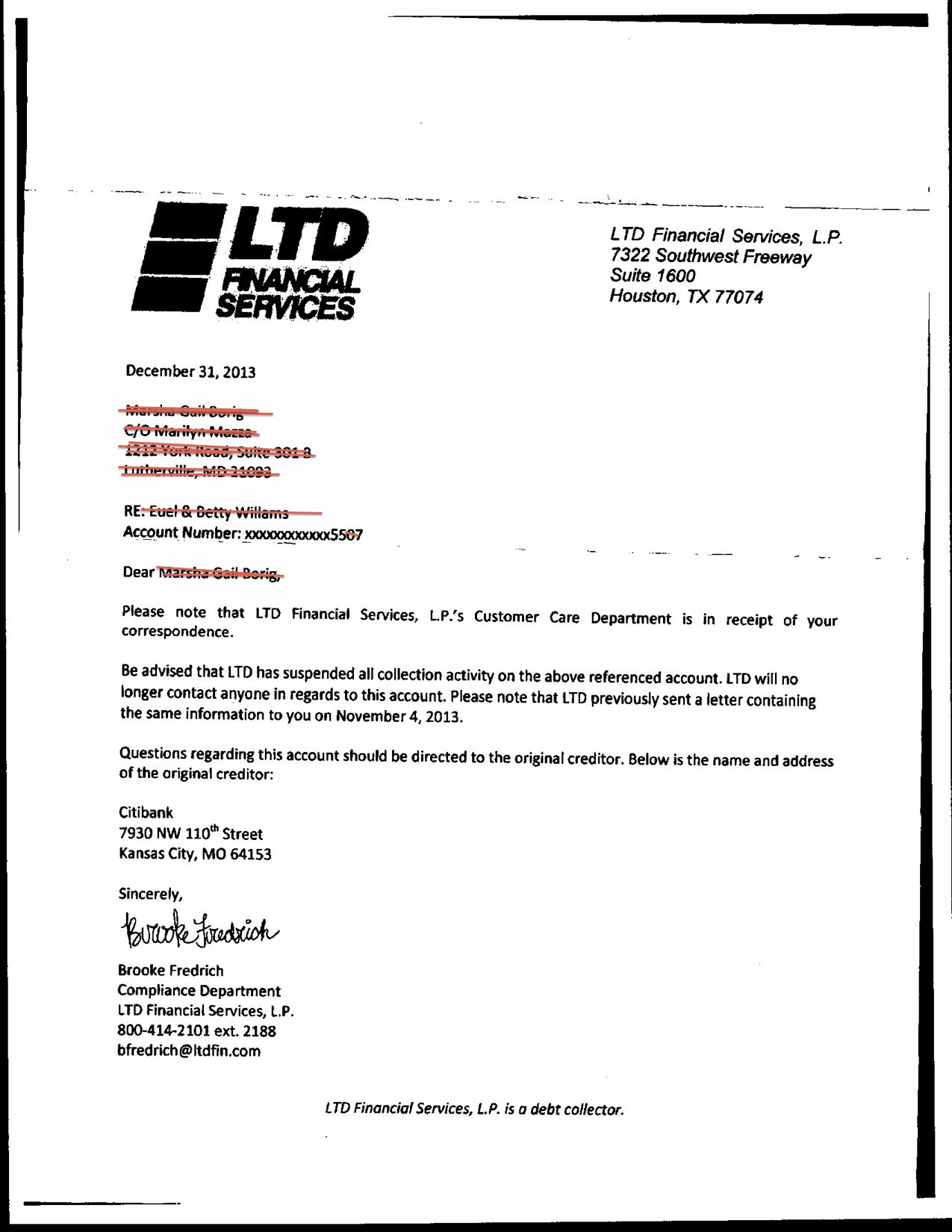

Chicago, Illinois – Debt Validation Client Example

With debt validation, a consumer has the legal right to challenge a third-party debt collection account, where the debt collection company must now provide verification and proof that the debt is valid and legally collectible. If the debt collection company can’t provide all of the necessary documentation and accurate information that federal laws require them to maintain – then you don’t have to pay it. On top of that, if a debt is invalidated the debt collection company cannot report it to the credit bureaus. Click here to learn more about debt validation in the state of Illinois. Chicago debt validation may be the least expensive route to deal with your debt and credit issues.

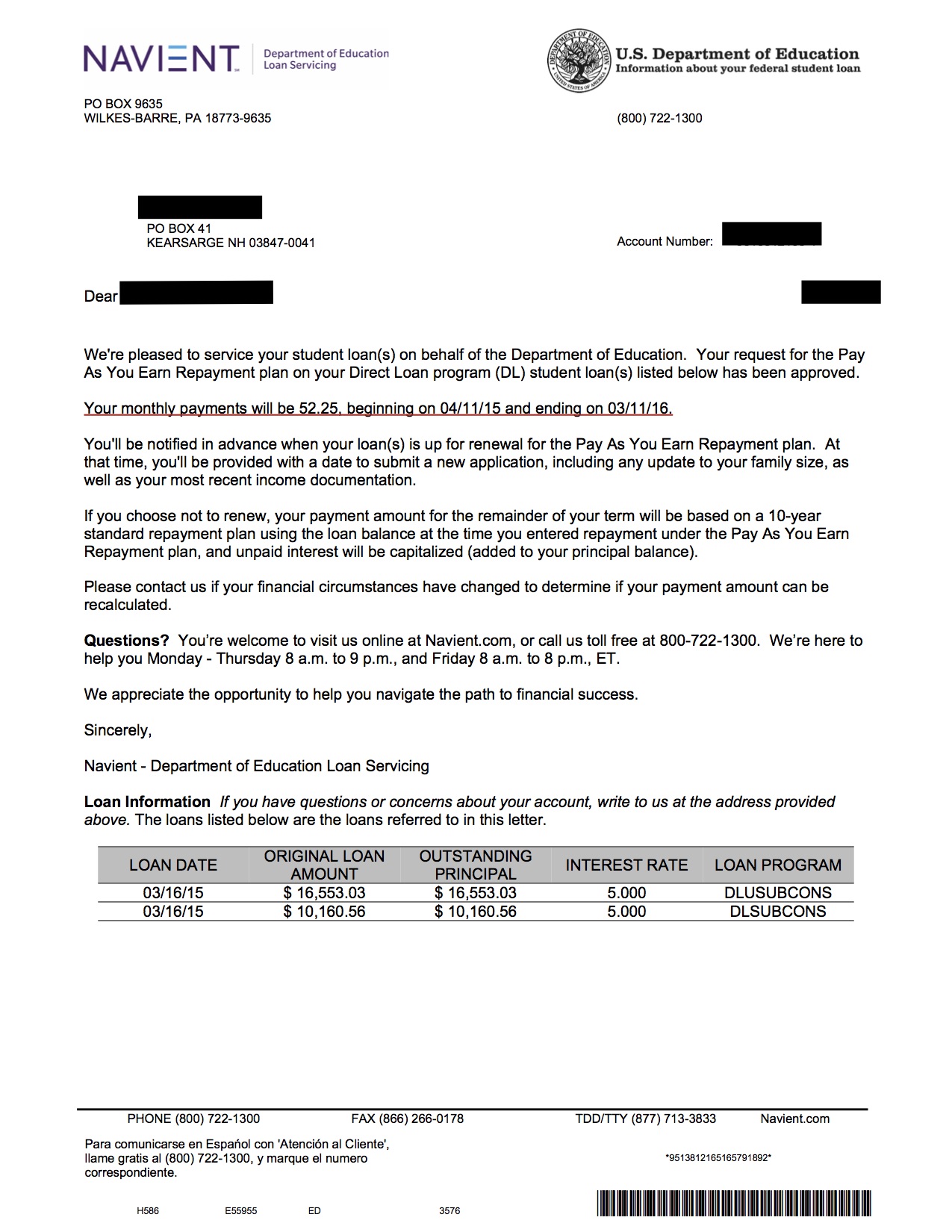

Student Loan Debt Consolidation in Chicago, Illinois

Student loan debt consolidation is a public option. Visit this page next to learn more about student loan consolidation.

Golden Financial Services – A Chicago Debt Relief, Consolidation, and Settlement Company

After 15 years in business and maintaining an A+ BBB rating – Golden Financial Services has extremely effective debt relief programs. Chicago residents can feel confident in knowing that Golden Financial Services will provide honest and accurate debt relief information.

Before you retain a bankruptcy attorney in Chicago, apply for debt relief through Golden Financial Services. We will make sure to do everything in our power to save you from having to file for bankruptcy and going down that dark road.

If there is a chance of providing assistance to a consumer with high unsecured debt issues – Golden Financial Services is the Chicago debt relief company to do so!