In accordance with the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Billing Act (FCBA), you can challenge the validity of a debt. The following is a sample debt validation letter that you can use to request the creditor/collection agency verify that the debt is actually yours and you are legally bound to pay it.

How to send out a validation letter:

All you need to do is fill in the blanks below and then hit “get pdf version” at the bottom. You can then print the debt validation letter sample pdf out, sign and date it at the bottom. Also, don’t forget to write in the creditor’s name and account number in the body of the letter after printing it out. And make sure you send the debt validation letter in registered mail.

Do you owe $10,000 or more in credit cards or have multiple collection accounts?

Learn about debt relief programs by Calling (866) 376-9846. Speak with a Certified Counselor for Free. You can even join a debt validation program.

Warning: The following debt validation letter is not intended to dispute high debt. This letter should only be used to dispute a small third-party collection account that either expired the statute of limitations or is inaccurate or not yours. For the complete debt validation template that consists of over thirty pages, used to dispute high debt balances, visit this page next.

Debt Validation letter Template/Generator (Free Tool)

,

,

Re: Acct No

To Whom It May Concern:

In accordance with the Fair Debt Collection Practices Act (FDCPA) codified in law at 15 USC §1692 et seq., and the Fair Credit Billing Act, I am disputing this alleged debt (Creditor Name: _______________________ & Account Number: ______________________). This dispute is in response to the phone call/letter received from your agency on (Date), to determine if this alleged debt is a valid, legally owed obligation based on a verifiable debt wherein mutual consideration was provided and a verified and verifiable operational contract exists that is devoid of misrepresentation, mistake, error, or other invalidating causes.

This is not a refusal to pay, rather a statement that your claim is disputed and validation is demanded. (15 USC 1692g Sec. 809 (b)). I have reason to believe that this alleged debt, amongst others, has been involved in fraud, misrepresentation, or illegal collection practices have, or are, taking place.

I do hereby request that your office provide me with complete documentation to verify that I owe the said debt and have any legal obligation to pay you.

Please provide me with the following:

1. Agreement with the creditor that authorizes you to collect on this alleged debt

2. The agreement bearing my signature stating that I have agreed to assume the debt

3. Valid copies of the debt agreement illustrating the amount of the debt, interest charges, and all service fees

4. Proof that the Statute of Limitations has not expired and a detailed explanation regarding how you came up with this information. If you claim the Statute of Limitations has not expired, when does it expire and how did you come up with this date?

5. Complete payment history on this account going back since the day it was opened, including a detailed breakdown of what the monthly payment is made up of and how the funds are allocated each month

6. Proof that you have a valid debt collection license to collect on debt in this state; and

7. Your debt collection license numbers and Registered Agent

If your office fails to reply to this debt validation letter with all the requested documentation proving the debt is a valid and a legally owed obligation, and devoid of errors, within 30 days from the date of your receipt, all instances related to this account must be immediately deleted and completely removed from all three credit bureaus including Experian, Transunion and Equifax. Additionally, all future attempts to collect on this alleged debt must stop immediately.

Your non-compliance with my debt validation request will be construed as an absolute waiver of all claims to enforce the debt against me and your implied agreement to compensate me for court costs and attorney fees if I am forced to bring this matter before a judge.

Sincerely,

Your Signature__________________________

Date___ ___ ___

To Whom It May Concern:

In accordance with the Fair Debt Collection Practices Act (FDCPA) codified in law at 15 USC §1692 et seq., and the Fair Credit Billing Act, I am disputing this alleged debt (Creditor Name: _______________________ & Account Number: ______________________). This dispute is in response to the phone call/letter received from your agency on (Date), to determine if this alleged debt is a valid, legally owed obligation based on a verifiable debt wherein mutual consideration was provided and a verified and verifiable operational contract exists that is devoid of misrepresentation, mistake, error, or other invalidating causes.

This is not a refusal to pay, rather a statement that your claim is disputed and validation is demanded. (15 USC 1692g Sec. 809 (b)). I have reason to believe that this alleged debt, amongst others, has been involved in fraud, misrepresentation, or illegal collection practices have, or are, taking place.

I do hereby request that your office provide me with complete documentation to verify that I owe the said debt and have any legal obligation to pay you.

Please provide me with the following:

1. Agreement with the creditor that authorizes you to collect on this alleged debt

2. The agreement bearing my signature stating that I have agreed to assume the debt

3. Valid copies of the debt agreement illustrating the amount of the debt, interest charges, and all service fees

4. Proof that the Statute of Limitations has not expired and a detailed explanation regarding how you came up with this information. If you claim the Statute of Limitations has not expired, when does it expire and how did you come up with this date?

5. Complete payment history on this account going back since the day it was opened, including a detailed breakdown of what the monthly payment is made up of and how the funds are allocated each month

6. Proof that you have a valid debt collection license to collect on debt in this state; and

7. Your debt collection license numbers and Registered Agent

If your office fails to reply to this debt validation letter with all the requested documentation proving the debt is a valid and a legally owed obligation, and devoid of errors, within 30 days from the date of your receipt, all instances related to this account must be immediately deleted and completely removed from all three credit bureaus including Experian, Transunion and Equifax. Additionally, all future attempts to collect on this alleged debt must stop immediately.

Your non-compliance with my debt validation request will be construed as an absolute waiver of all claims to enforce the debt against me and your implied agreement to compensate me for court costs and attorney fees if I am forced to bring this matter before a judge.

Sincerely,

Your Signature__________________________

Date___ ___ ___

What is debt validation?

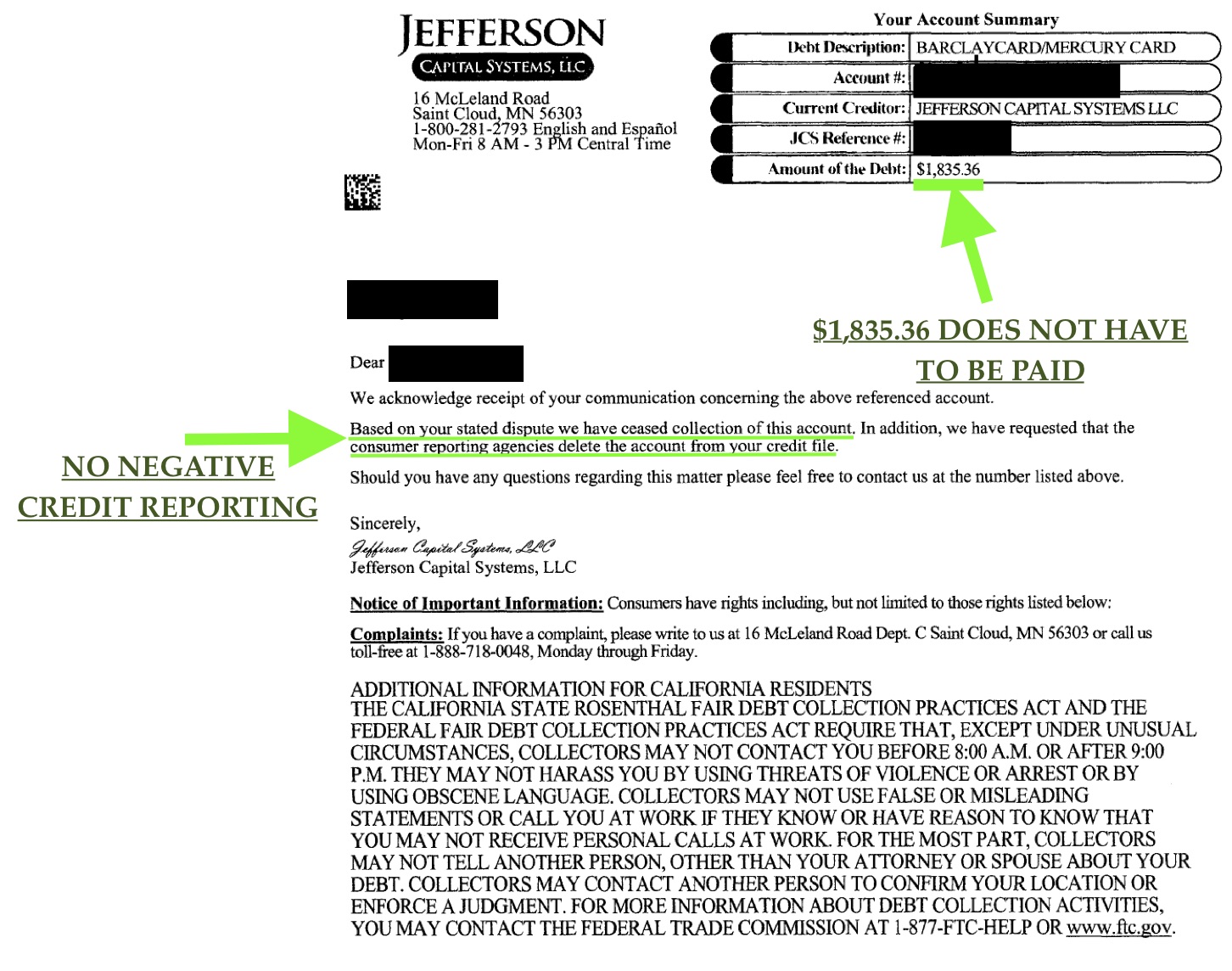

Debt validation is your legal right to use consumer protection laws to challenge a collection agency on whether or not they have the legal authority to collect on a debt. If a collection agency fails to prove a debt is valid by providing all of the information being requested in the letter above, they must immediately stop all collection activity and can no longer legally report the debt to credit reporting agencies. A consumer could then walk away from paying the collection agency and indirectly save thousands of dollars.

For more information on debt validation visit this page next.