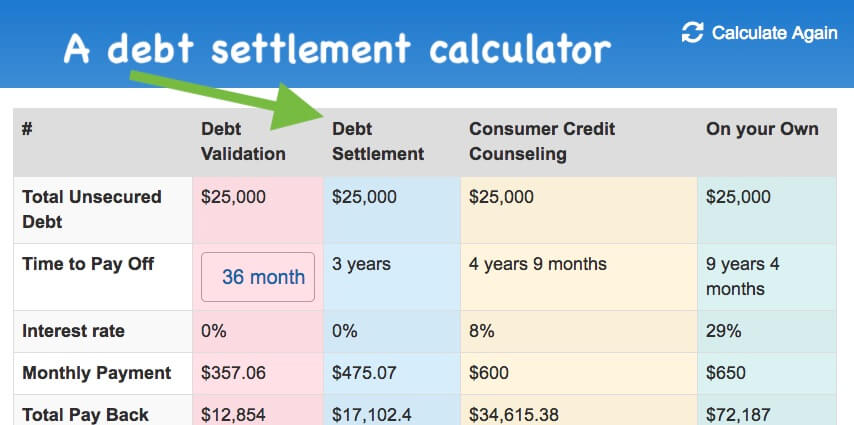

Interested in Nebraska debt relief? Reviews at TrustedCompanyReviews.com rated Golden Financial Services #1 and Better Business Bureau rates GFS A+. So if you’re struggling to pay off debt, you’ve landed in the right spot. Nebraska debt settlement, validation and consumer credit counseling plans can all help you deal with debt. Here’s a summary of what your payment could be (approximate), for each program.

Nebraska Debt Relief Program Reviews (from Clients)

The following page provides an overview of Nebraska debt consolidation and settlement programs, ensuring you understand all of your options. We work for the consumers in Nebraska, not the banks, credit card companies, or government. So we have your best interest!

Here are some interesting statistics about Nebraska:

Nebraska’s credit card debt is lower than most of the other states, ranking number 47 on the list of states with the most credit card debt. So Kudos to you for that! The average credit card debt in Nebraska is $6,180 per household. When it comes to student loans in Nebraska, 54% of Nebraskans have it. The average student loan debt per household is around $25,000. We’re going to show you what options you have for student loan and credit card debt relief in Nebraska.

You can also call and speak to one of our IAPDA trained counselors for free at any point, by calling (866) 376-9846.

Recently there was a study about Nebraska that was called the National Financial Capability Study and the results revealed some interesting statistics. 18% of Nebraskans reported that over the past year, their household spent more than their income. 48% of consumers in Nebraska don’t have a rainy day fund, meaning that they are living paycheck to paycheck. 30% of Nebraska residents with credit cards only pay minimum payments on their cards each month.

COVID-19 then hits Nebraska. Now thousands of additional consumers are now struggling to pay their bills. Debt consolidation and bankruptcy are the only two options that most consumers even know about, but you actually have more options to choose from than just these two. Bankruptcy should be your last route to consider, certainly not the first option that you have to turn to.

Out of all the debt-related statistics about Nebraska, the one that is most concerning of all is that “every year approximately 4,050 Nebraskans declare bankruptcy.” Many of these consumers are unaware of bankruptcy alternatives because nobody informs them of these bankruptcy alternatives for debt relief. Why is that? We will explain!

When consumers are struggling to pay their mortgage, credit cards, medical bills, and unsecured debt, bankruptcy is naturally one of the first things that come to mind. So what do consumers then do? They go online and contact the first bankruptcy attorney that they can find.

Bankruptcy attornies in Nebraska make their money by filing bankruptcies, therefore, they won’t explain other options to people. We all know, most attornies are all about making money, this is no hidden secret.

The only other option a bankruptcy attorney will discuss is consumer credit counseling because they have to, it’s the law. A person has to get a consumer credit counseling certificate by law prior to filing bankruptcy.

Consequently, many consumers end up filing for bankruptcy or using consumer credit counseling, when there were better options that they could have and should have taken advantage of.

What is the Nebraska bankruptcy consumer credit counseling course and certificate for?

The point of having to get this certificate is to ensure you were educated on your options and to ensure your income qualifies you for bankruptcy. But the truth is, credit counselors, don’t always provide a person with their best options.

To obtain this certificate for bankruptcy the credit counselor will also assist consumers in making their budget analysis.

If a person has high credit card debt and can afford a consumer credit counseling program, the credit counselor will recommend this plan.

What is Consumer Credit Counseling in Nebraska?

Consumer credit counseling programs in Nebraska can reduce credit card interest rates, but not the actual credit card balances. Credit card companies pay consumer credit counseling companies, so they work together. A consumer credit counseling company is not solely on the side of the consumer, so they’re not working for you!

Nebraska Debt Relief: Bankruptcy Vs Debt Settlement

The system is set up for consumers to either do consumer credit counseling or bankruptcy. Nebraska residents are not educated on debt validation and debt settlement. Nebraska residents often miss out on the programs that can save them the most money.

How does Nebraska debt settlement work?

You have to stop paying on your monthly payments so that your accounts get charged off and sold to third-party collection agencies. At that point, credit cards, medical bills, and most unsecured loans can be settled and reduced to a fraction of the total owed. This debt reduction method makes it possible to provide consumers with a much lower payment than what consumer credit counseling could offer them. Credit scores do get negatively affected but as each debt is settled and paid, consumers can begin to rebuild their credit score.

Click Here to Compare the Pros and Cons of Debt Relief Programs.

Does Nebraska Consumer Credit Counseling Hurt Credit Scores?

Credit scores are negatively affected by consumer credit counseling programs. Nebraska credit counselors won’t always tell you this disclosure up-front because the negative affects actually occurs at the end of the program.

Here’s how:

With consumer credit counseling, credit cards get closed out at the end of the program. At the beginning of the program credit cards remain open, and over the course of the plan balances get reduced, all this can help improve credit scores. Late payments can even be re-aged to show current again, improving a person’s credit score. Sounds great right? Until the adverse effect occurs!

Consumer Credit Counseling Can Hurt Credit Scores

In the end, credit cards get closed out. Closing a credit card hurts your credit score.

How much will I save with Nebraska consumer credit counseling?

You still pay the entire balance, plus interest and credit counseling fees. Just because a company is non-profit, credit counselors can still charge up to $50 per month.

What Nebraska debt relief program should I use?

It often comes down to weighing your options, based on your current situation, short and long term goals. The least expensive program can be debt validation because creditors don’t actually get paid anything with this route. If you have medical bills, collection accounts, a repossession and credit cards, and can’t afford to stay current on payments, a debt validation program can be the least expensive and most efficient way of dealing with these accounts.

The validation program offered through Golden Financial Services includes a money-back guarantee, ensuring you get results or don’t pay a fee. If an account is proven valid, you get fully refunded and referred over to a law firm that will help resolve the debt.

Is your goal to save money and avoid bankruptcy debt relief? Nebraska debt settlement programs can be a viable solution, but only if first, you’ve disputed the debts with validation and they were proven valid. Start with validation. If the debt doesn’t get resolved by getting invalidated, use a debt settlement program. Nebraska bankruptcy debt relief could then be a last resort.

How does a validation program work?

This type of program challenges the validity of each debt. Validation forces each collection agency to prove that it is abiding by federal laws and maintaining complete and accurate records.

Surprisingly, after a debt is disputed with validation accounts almost never get proven to be valid.

How is it possible that I may not have to pay a debt?

Banks get paid 100% of their money on a credit card debt even after you stop paying it. They charge the debt off and collect their money through tax credits and banking insurance, then wiping their hands clean of the debt. After a credit card company writes off the debt they will then sell it to a collection agency.

Debt Collection Laws – Nebraska

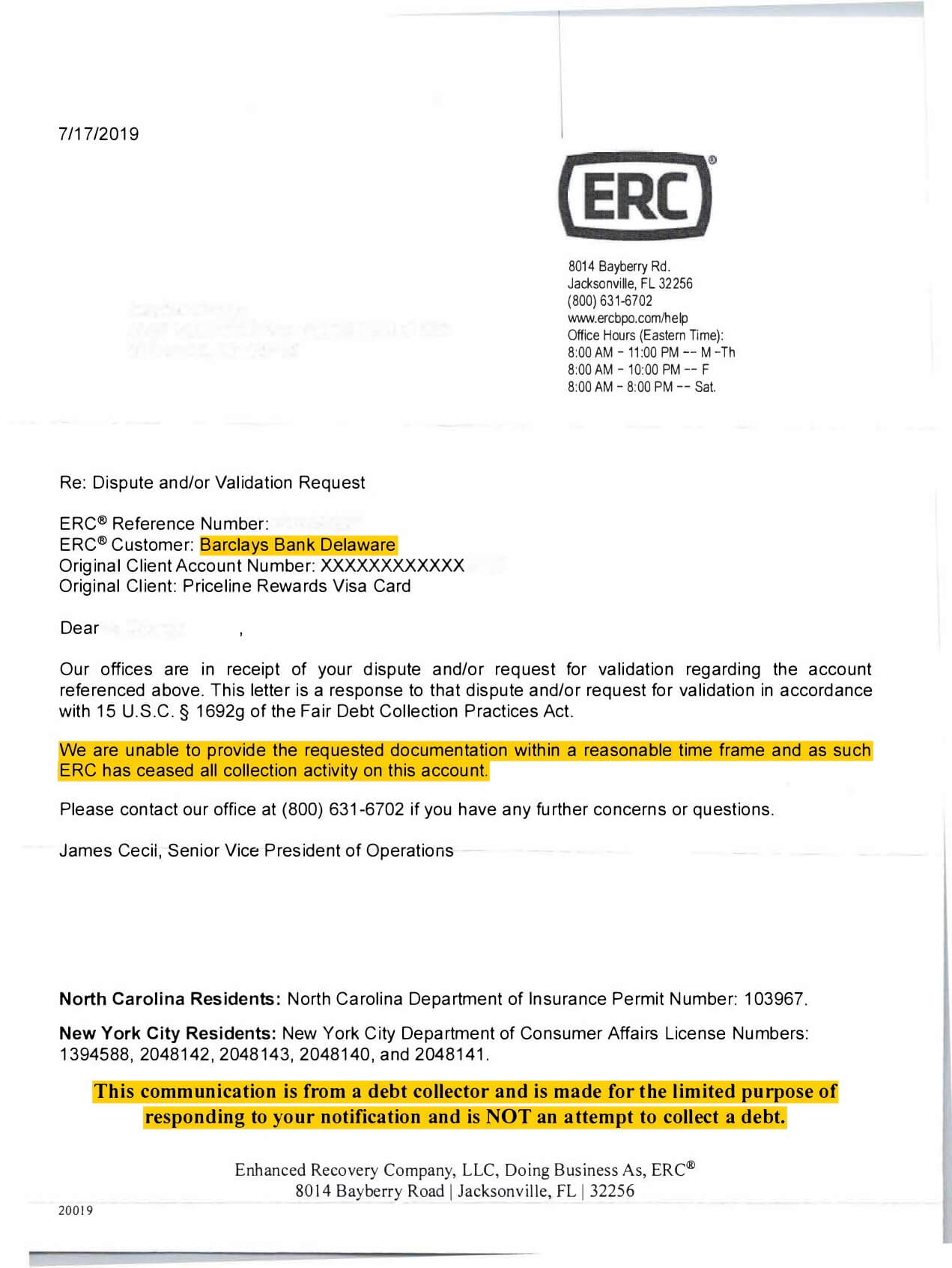

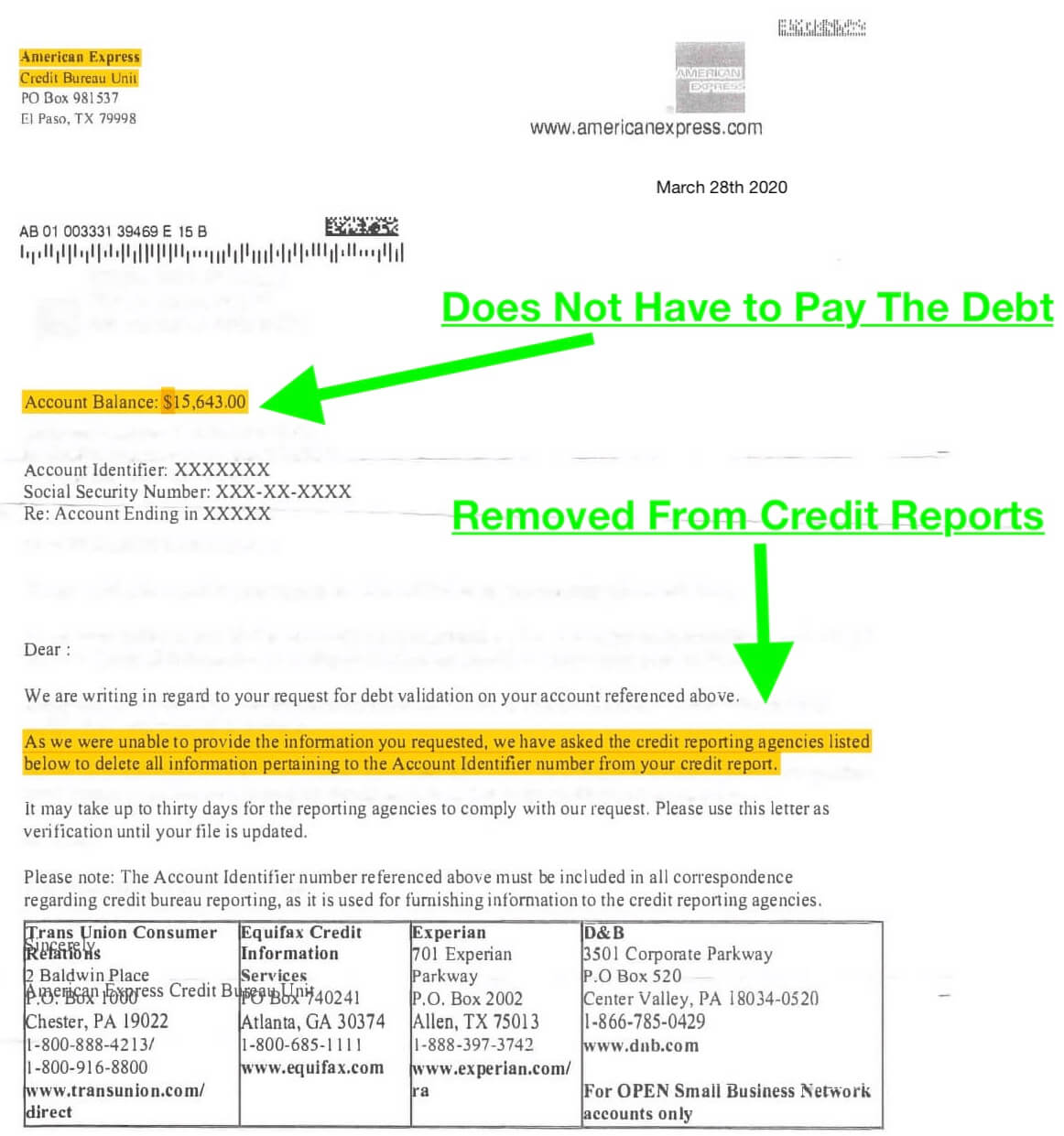

Fair Debt Collection Practices Act – this law protects you from having collection agencies harass you illegally. With validation after the collection account is disputed, all creditor harassment must immediately stop until the account is validated. In many cases, the account is not validated so it becomes invalidated. An invalidated account is one that does not have to get paid and can no longer legally remain on a person’s credit report.

Here’s an example letter of how debt validation resulted in a debt collection account becoming legally uncollectible (and does not have to get paid, also coming off the consumer’s credit):

Fair Credit Reporting Act – This law ensures your credit report shows accurate and complete records. A validation program will also utilize this federal law.

Here’s another example letter showing how an AMEX credit card was disputed and proven invalid, also coming off the consumer’s credit report:

Statute of Limitations for debt in Nebraska – a debt collector has five years to sue you over a debt after your last payment was made on an account. Debt validation will also include this law in the dispute. For example, debt validation forces the collection agency to prove that they know the date of the statute of limitations for a particular debt. If a Nebraska collection agency can’t provide accurate information pertaining to the statute of limitations on a particular account, the account becomes invalidated and does not have to get paid.

Downsides of Debt Settlement in Nebraska

When you negotiate and reduce debt, the amount saved can be treated as taxable income. So if you reduce a $10,000 debt to $5,000, you save $5,000. That $5,000 is just like ordinary income, you have to pay taxes on it. A person can avoid having to pay taxes on a settled debt by filing certain tax forms that illustrate insolvency, which most accountants know how to assist with.

Since a person has to fall behind on payments with a settlement program, credit scores drop significantly and there’s a chance a creditor issues a lawsuit.

Nebraska Debt Settlement Lawyers can defend a person if sued, settling a credit card summons and avoiding court.

Golden Financial Services only recommends an attorney-model debt settlement program, through a Nebraska law firm. Nebraska debt negotiation lawyers can provide lawsuit defense. If a client receives a credit card summons while enrolled on a debt settlement program, the lawyer will negotiate the debt and settle it prior to court, so the consumer never has to actually go to court.

Not all clients will finish a settlement program for various reasons, for example, their income may drop further and they can’t afford to finish the plan.

Nebraska Debt Settlement Company Fees

No matter what program you use to get out of debt, all programs have fees. With settlement plans, clients pay around 70-75% of their balance, including settlement company fees. These fees are included in the consumer’s monthly payment but not earned until after an account is settled and paid.

How does a Nebraska debt settlement program work?

The Nebraska debt settlement programs recommended through Golden Financial Services require clients to use a trust account. A client’s monthly payment gets deposited directly into a trust account (also known as a special purpose savings account).

Creditors don’t actually get paid on a monthly basis with a settlement program. As money accumulates in the trust account, the negotiators begin negotiating with each creditor. The debt negotiator may try to settle an account for 30-50% of the balance, so depending on how much money is available in the trust account often determines what account gets settled first.

One by one each account is settled and paid and this process continues until the client is completely debt-free.

After a deal is worked out to settle a debt for less than the full amount, the law firm contacts the client and reveals the details. If the client agrees to the settlement deal, the funds get released and paid directly from the client’s trust account to the creditor.

Following the settlement, the debt settlement company charges its fees. However, their fees will already be accumulated inside the trust account so no additional fees are owed.

Debt settlement programs in Nebraska can be more affordable than bankruptcy in many cases because Chapter 13 bankruptcy merely reorganizes a person’s debt to get paid back over a five year period and will charge thousands of dollars in up-front fees. The difference is, with debt settlement bankruptcy will not get reported on a person’s credit report, and that’s a major plus!

For more information on bankruptcy, check out this page next.

Debt Consolidation in Nebraska

Debt consolidation loans are another method of eliminating high-interest debt. At Golden Financial Services we recommend only using a consolidated loan if your credit score is above 675 or your goal is to increase your credit score. If you’re living paycheck to paycheck, you don’t want to get a consolidated loan because it’s not fixing your debt problem.

And only use a local credit union for debt consolidation because credit unions offer the lowest interest rates.

Alternatives to Nebraska debt relief programs

Here are the 10 Best Ways to Get Rid of High Debt.

Compare Nebraska’s programs to programs in New Mexico, California, and New York.

Not sure about what Nebraska debt relief program to use? Start of talking to an IAPDA Certified Debt Counselor at Golden Financial Services. Check if you’re eligible for a Nebraska debt relief, settlement, and consolidation program by calling (866) 376-9846.