BBB Accredited Debt Consolidation Companies vs. Highly Rated Debt Settlement Companies:

There are many horror stories online about debt relief scams and how unreputable companies charged thousands of dollars in up-front fees only to fail to provide the services the consumer paid for, leaving people in worse financial shape than what they started with. In addition, people are often taken advantage of by fast-talking salespeople who paint a perfect picture over the phone, only to mislead the consumer with one goal: to get their sales commission.

Sometimes, a company may offer a legitimate program, but the salesperson or company’s advertising is misleading. As a result, consumers may enroll in a program they don’t fully understand and cancel, making a Better Business Bureau (BBB) complaint and a negative online review. You want to avoid companies that operate with this type of negligence, which is easy to spot at the BBB because they will have poor ratings.

One of the first places angry customers go is to the BBB to post complaints and negative reviews about a company. And as you’ll soon learn, companies with lots of complaints cannot qualify for an A+ rating through the BBB. Debt settlement companies must adhere to a high standard of excellence when issued an A+ BBB rating, or they will lose that rating. And additionally, for debt consolidation companies, BBB accreditation adds another layer of protection.

If you’re searching for a reputable debt relief, settlement, or consolidation company, BBB is the right place to start. However, you need to beware of common misconceptions about the debt relief industry that could lead you astray. The following page will act as your road map to finding the best debt settlement and consolidation companies and choosing the right path to achieve your financial goals. So without further ado, let’s dive in!

BBB Accredited Debt Settlement Companies

Some BBB locations will offer BBB accreditation to settlement companies, and others won’t. So no matter how reputable a company is, its BBB accreditation application could be automatically rejected, all because – it is in the debt settlement industry.

Therefore, when searching for a program to help get debt forgiveness, BBB ratings (e.g., A-F ratings) are critical, but whether or not the company is accredited should not matter. Therefore, if you plan to use debt settlement, BBB A+ rated companies are the ones we recommend you consider. Do not let whether or not the company is BBB accredited sway you in a different direction.

According to NerdWallet.com, “The grade you get from the BBB represents the BBB’s degree of confidence that your business is operating in a trustworthy manner and will make a good-faith effort to resolve any customer complaints.”

Companies like Accredited Debt Relief and Beyond Financial have debt management and settlement licenses and have been in business for over a decade.

Accredited Debt Relief is A+ rated by the BBB. Click Here to View Accredited Debt Relief reviews.

Beyond Financial is an A+ rated debt settlement company and BBB accredited. (Click here to view Beyond Financial’s BBB profile)

How do debt settlement companies become A+ BBB rated?

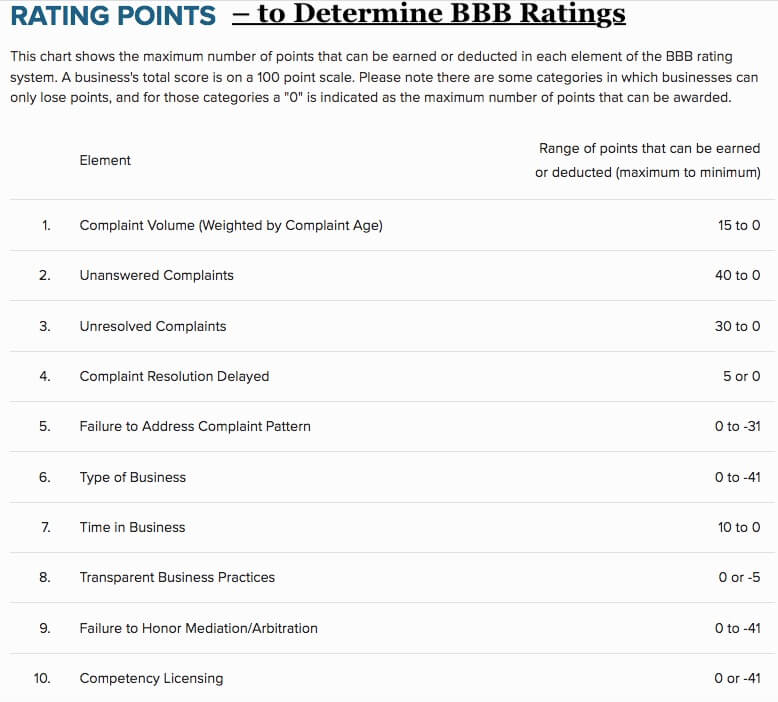

A point system calculates a debt relief company’s BBB rating. A minimum of 97 points is required to earn an A+ rating for debt settlement and consolidation companies. BBB adds and deducts points based on the following criteria.

“Point System Criteria” Used to Determine a Debt Settlement Company’s BBB Rating:

Other critical factors contributing to a debt relief company’s BBB rating:

- A large volume of complaints, especially within a short time, is the fastest way to reduce a company’s rating.

- Complaints must be resolved within a specified timeframe to maintain an A+ rating. Unresolved and unanswered complaints can result in losing points, lowering a company’s BBB rating.

- Time in business: A minimum of one year is required to get a rating. And the longer a company has been in business, the more points BBB will assign to that company’s rating.

- Companies must provide compliant advertising on their website, including complete disclosures: Credit scores can be adversely affected. Before settlements occur, accounts must fall delinquent to the point where they eventually get sold to third-party collection agencies. Due to late fees and interest accrual, account balances will rise before settlements occur. Creditors may pursue legal action against a consumer over an unpaid debt resulting in a lawsuit. There are no guarantees that creditors will settle at a certain rate or percentage, and results can vary.

- BBB reviews the content on a company’s website thoroughly to ensure the company provides a clear explanation of how debt settlement works. For example, it must be made clear that creditors are not paid monthly. Creditors get paid in a one-time lump sum payment that is less than the full amount owed in exchange for settling the debt. And companies need to provide an estimate of when settlements will occur.

- BBB A+ rated debt relief companies must be transparent about the program’s cost and when fees will get charged. How much goes to creditors, and how much goes towards the company’s fee? And when are these fees considered earned?

- Debt settlement agencies must be licensed in every state they operate. It is not excusable for a company to claim they couldn’t figure out how to get licensed or didn’t know they needed a license. Getting licensed for companies can be challenging because every state has different rules, regulations, and processes.

- A+ BBB rated debt relief companies will educate consumers on consumer credit counseling, debt consolidation, and bankruptcy before enrolling them into a settlement program. The pros and cons of all programs will be explained in detail. Without this financial education, consumers are often unprepared to choose the right option and get out of debt successfully.

A+ BBB rated debt management companies can provide a reliable route to becoming debt-free. Companies like Accredited Debt Relief or Beyond Financial fit the bill. These companies are highly rated at the BBB and have had a long history of proven success. Check out Accredited Debt Relief reviews.

Requirements for Debt Consolidation Company BBB Accreditation:

- Lenders must adhere to state and government laws and advertising compliance laws.

- Time in business must be at least six months.

- No unresolved complaints or governmental ethics violations.

- Appropriate bonding and licensing must be obtained, including a lender’s license in every state the company offers loans. (License number must be illustrated on the company’s website)

- BBB-accredited lenders must provide full disclosure and transparency on their website about loan rates, approval rates, and details about all the fees associated with their loan products, including average APR, loan origination fees, payment terms, credit score requirements, and approximate timeframe on how fast loans are funded.

These are just a few examples of the criteria used by BBB to determine if a consolidation company qualifies for accreditation. BBB also uses the same point system for consolidation companies as they do with settlement companies to assess their letter rating.

How does debt consolidation work?

Debt settlement and debt consolidation are not the same programs – a huge misconception people have. Unfortunately, people often confuse the two methods to get out of debt, as the same. And it’s not their fault; companies need to be more transparent on their website about explaining the differences between a consolidated loan versus settlement options.

Debt consolidation is when a consumer uses a loan to pay off other debts. As a result, the consumer has one consolidated loan to pay back rather than multiple monthly payments.

A consolidated loan can benefit consumers when used to pay off other high-interest accounts. As a result, consumers can save money with debt consolidation, get out of debt faster, and improve credit scores.

You can get a consolidation loan through a credit union, bank, or one of many debt consolidation lenders. If you’re looking for an honest and reputable lender, start by contacting a BBB A+ rated and accredited debt consolidation company.

How debt consolidation affects credit score:

Debt consolidation can improve a person’s credit score because all accounts included in the consolidation get paid in full—consequently, credit utilization ratios and payment history improve.

However, applicants must have good credit to qualify for a low-interest consolidation loan, unlike debt settlement, where bad credit is acceptable. And good credit can refer to more than just your credit score. A person’s debt-to-income and credit utilization ratios are both factors used to determine whether an applicant is eligible for a loan.

Beware of sub-prime credit consolidation loans that charge higher fees and interest rates in exchange for approving applicants with a low credit score.

How does debt settlement work?

Debt settlement companies negotiate with clients’ creditors to reduce the debt to an affordable amount for the consumer. Each debt enrolled in a settlement program is settled for less than the total balance owed. There are many benefits of using a professional company to settle debt rather than doing it alone.

An article on the FTC website explains: “It is common for debt settlement company representatives to have a relationship with specific contacts at creditor offices or collection agencies they work with in the negotiation process. Some creditors and collection agencies have developed, or are in the process of developing, specific departments that work exclusively with debt settlement companies. Working with debt settlement companies allows these creditors and collection agencies to handle a large number of accounts with a limited amount of manpower, minimizing the costs associated with collection activity and maximizing liquidation percentages. ”

Clients get set up with a single monthly payment based on what their budget illustrates is affordable. Every month clients’ payments go directly into an FDIC trust account or a “special purpose savings account.” This account is in the client’s name; they own it.

The funds accumulate there month after month. As the funds accumulate, a debt negotiator works on reducing each debt one by one. When a settlement offer becomes available, the client receives a phone call from the negotiator with the details. Clients can then accept or reject the offer. After a written offer is accepted by the client, the funds get paid directly to the creditor, resolving the debt with no further payments owed. The balance gets satisfied for less than the total owed.

How long does it take to complete a debt negotiation program?

One by one, each debt gets settled and paid until the client becomes debt-free. The entire process can take approximately 36-48 months.

The cost for debt settlement programs:

On average, settlement companies charge a debt settlement fee of 15% – 25% of the total debt enrolled in the program. In addition, creditors may accept anywhere from 35% to 60% of the balance on an account as payment in full.

However, a person can save even more than this when adding up the “true cost” of paying minimum payments on their own on high-interest credit cards and loans. For example, paying $550 per month towards $25,000 in credit card debt with an average interest rate of 25% could cost a person over $78,000, including interest, and take close to twelve years to pay off.

Compare that to debt settlement. For $25,000 in credit card bills, at a monthly payment of $475.07, a person can be debt free within three years, paying a total cost of less than $18,000. Source: GoldenFS.org Debt Calculator, 12/08/2022

Disclosure of potential tax consequences:

The IRS expects a person to pay taxes on the savings from a settled debt. However, someone who is insolvent can file an IRS Form 982 and not owe taxes.

Ask a licensed account for more information on this subject. GoldenFs.org is not affiliated with or run by licensed accountants.

Creditor harassment:

If you sign up for a settlement program through a debt negotiation law firm, creditors will not be allowed to contact you after being notified that you have attorney representation.

Non-attorney debt settlement programs can result in creditor harassment after first enrolling because creditors don’t get paid monthly. However, these calls should fade after creditors get notified with cease and desist letters.

Debt settlement effect on credit score:

Credit scores can be adversely affected no matter what settlement company a person signs up with if they’re current on monthly payments when enrolling in the program. However, if a person is already behind on monthly payments when enrolling in the program, they may not notice a decline in credit scores.

Original creditors eventually get written off and sold to third-party collection agencies, leaving collection accounts and late marks on credit reports even after accounts are settled and paid.

However, as each debt gets settled and paid one by one, debt-to-income ratios start to improve, and over time so could credit scores.

Clients can keep one or two credit cards out of the program and use and pay the balance on these cards in full every month. Using these credit cards outside the program every month establishes positive payment history while enrolled in a settlement plan. And positive payment history is the fastest way to increase a person’s credit score.

Additional factors to consider when searching for the best debt relief services:

A. How long has the company been in business and offering debt relief services? Look for companies with over ten years in business; the longer, the better. Consider that the average debt relief and consolidation plan takes 3-5 years to complete, so only do business with companies that have a minimum of 3-5 years in business.

B. Do they have any unresolved BBB complaints? If a company has unresolved BBB complaints, it did not adequately respond to a BBB complaint. You want to avoid companies with unresolved BBB complaints.

C. Does a debt relief company charge up-front fees? Debt settlement companies cannot charge up-front fees according to federal laws. Reputable debt settlement companies will charge fees only after an account gets settled and paid. Do not work with a law firm or debt relief company attempting to charge up-front fees.

D. Is there an assurance of performance or guarantee included with the debt relief program? Nothing is worse than a debt relief company that fails to perform according to its contractual agreement with a client and still charges a fee. Verify that a company only charges fees after accounts are settled; this is better than a guarantee because you either get results or don’t pay a dime. Some law firms may charge fees upfront and offer a guarantee with the services, but clients often find themselves fighting with the law firm over a refund being justified.

E. Does the company have positive online reviews? Check the ratio of positive to negative reviews on sites like Yelp, Google, BBB, and TrustedCompanyReviews.com. Stay away from companies that have a high number of negative reviews and complaints.

F. Did the company disclose the negatives? Debt settlement companies should explain all potential downsides of the program clearly and have solutions available for each. For example, clients can receive a summons over an unpaid debt. If clients do receive a summons while on the program, how will it be handled? The best settlement companies will have a lawsuit defense plan to help clients settle and resolve a summons, and they are comfortable explaining the details about this subject because they’ve handled many situations like this in the past.

G. Is the company accredited with IAPDA or USOBA? This is just another blanket of protection ensuring the company and its staff are all highly trained and true industry experts.

Can a Company Pay for an “A”?

The last point we’ll clarify is a common misconception that people have.

Can you pay for your “A” with the BBB? Thankfully, paying the BBB for a high rating is not possible. Otherwise, if it were, we’d have a lot of corruption going on!

“BBB accreditation”; debt consolidation and debt settlement companies must qualify for and pay an annual fee to get and maintain.