How to Get Rid of Your Debt Fast

Are you ready to get rid of debt? The insight you’re about to read can be the starting point to a new direction, leading you to financial freedom. Hundreds of thousands of other consumers have used these same debt relief programs and options to get out of debt fast. Just do a few searches on Google and find hundreds of positive consumer reviews illustrating how these programs have worked miracles.

You have multiple programs to choose from as of 2021 to get rid of your debts fast.

- Debt Validation

- Debt Settlement/Negotiation

- Consumer Credit Counseling (to consolidate credit cards)

- Debt Dismissal Programs

- Federal Student Loan Consolidation

- Credit Card Consolidation

Unlike other companies in the nation that offer one program for consumers to choose from, at Golden Financial Services we offer multiple programs. Getting rid of debt is not always a one-step approach.

You will need to consolidate your federal student loans with programs available under the William D Ford Act. Validation will act as a first approach to force collection agencies to validate a debt before our clients pay it. Only if an account is validated will the settlement option then be needed. As you can see, getting rid of debt is not always as simple as one plan.

All Debt Relief Programs –

- Combine monthly payments into “one low payment.”

- Offer flexible monthly payments. You can become debt-free in 1, 2,3,4, or 5 years.

Aside from these two similarities, the details of how each debt relief program works, vary.

With consumer credit counseling creditors get paid every month and you remain current on payments, only saving money by getting interest rates reduced. Debt is not paid on a monthly basis with debt settlement and validation.

Validation disputes a debt’s validity, while settlement plans negotiate a lower payoff on collection accounts. Credit card consolidation is a loan that is used to pay off your other accounts that you’re looking to get rid of.

And all programs designed to get rid of your debt include potential downsides. Hardship plans that don’t pay creditors monthly, resulting in a negative effect on credit scores and the potential to get sued.

Consumer credit counseling programs result in credit cards getting closed out, which also hurts credit scores.

Understand all of the potential downsides of each program and make sure the company helping you is equipped to deal with potential downsides, ensuring you will make it through the program successfully and actually get rid of your debt as intended.

Call 866-376-9846 to Find Out Your Eligibility for a Program.

You no longer have to suffer in debt and can finally take control of your finances, it’s easy, and these programs make it affordable.

Now before you continue reading this page, let’s make sure this is the right page for you. This page is only for people who are struggling financially and need a reduction in their monthly payments.

If you are comfortable with your monthly payments and have a high credit score but feel that your balances aren’t going down, this page is not right for you. Instead, debt consolidation would be a better option for you to explore. You can learn about debt consolidation and how it affects your credit score by visiting this page here.

If you’re searching for a credit card debt reduction strategy, check out the 10 Best Ways to Clear Credit Card Debt.

For everybody else — Let’s dive in…

At Golden Financial Services, we’ve been helping people like yourself for more than fifteen years now — with our proven debt relief programs. As a result, there are programs available that may reduce your balances down to a fraction of what it currently is. And in 2021, programs are available to help get rid of credit card debt that comes with credit repair, included for free.

How can I erase my debt?

Technically speaking, you can’t erase your debt, but here are your next closest options.

DEBT SETTLEMENT PROGRAMS — can get rid of credit card debt, and just about any accounts can be included in a debt settlement program.

Firstly, you can settle your debt, and a portion of the balance will be forgiven. You can get rid of all your debt quickly with this option. You won’t have to pay the portion of your debt that gets forgiven. The downside with this option (debt settlement) is that late and collection marks will then be left on your credit report. You may owe taxes on the amount saved (i.e., the amount of debt forgiveness).

DEBT VALIDATION PROGRAMS — can help you resolve just about any unsecured debt and, at times, address derogatory information on your credit report.

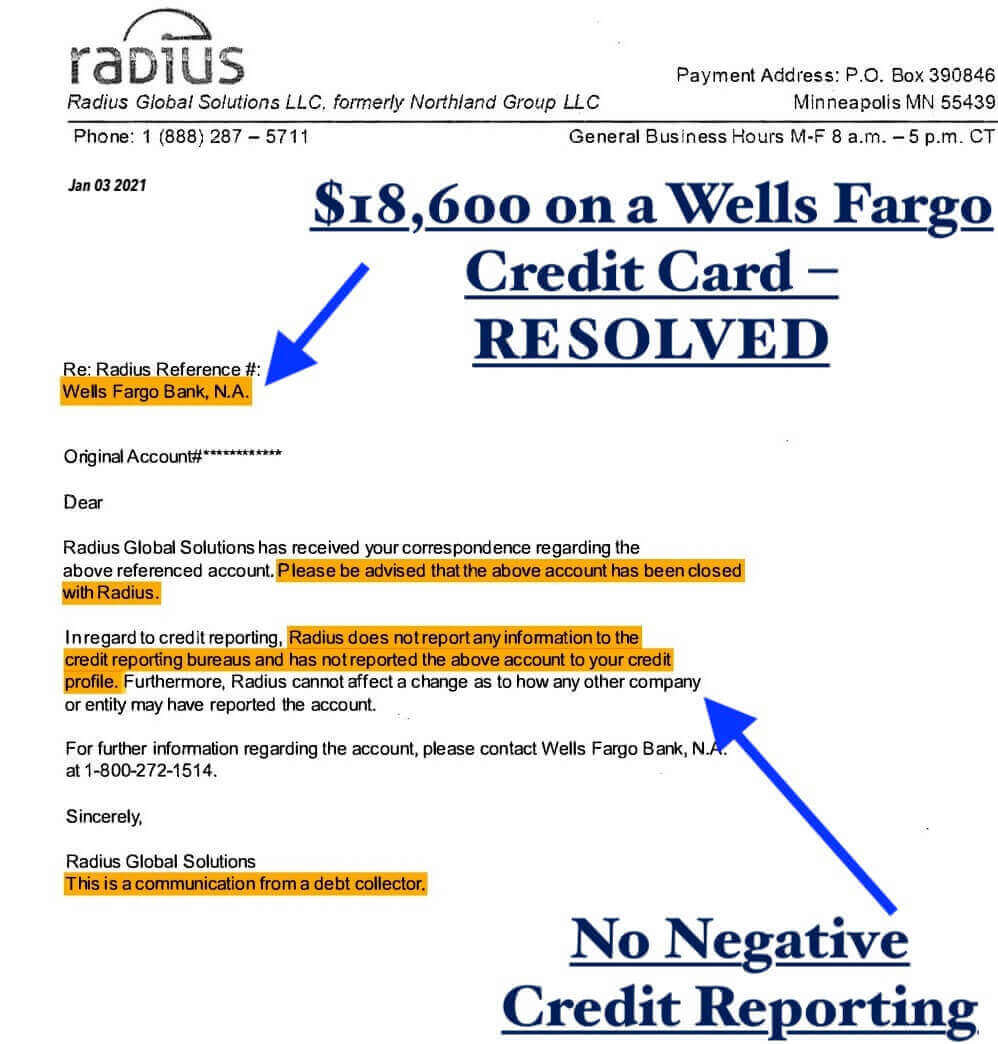

Debt validation example letter one:

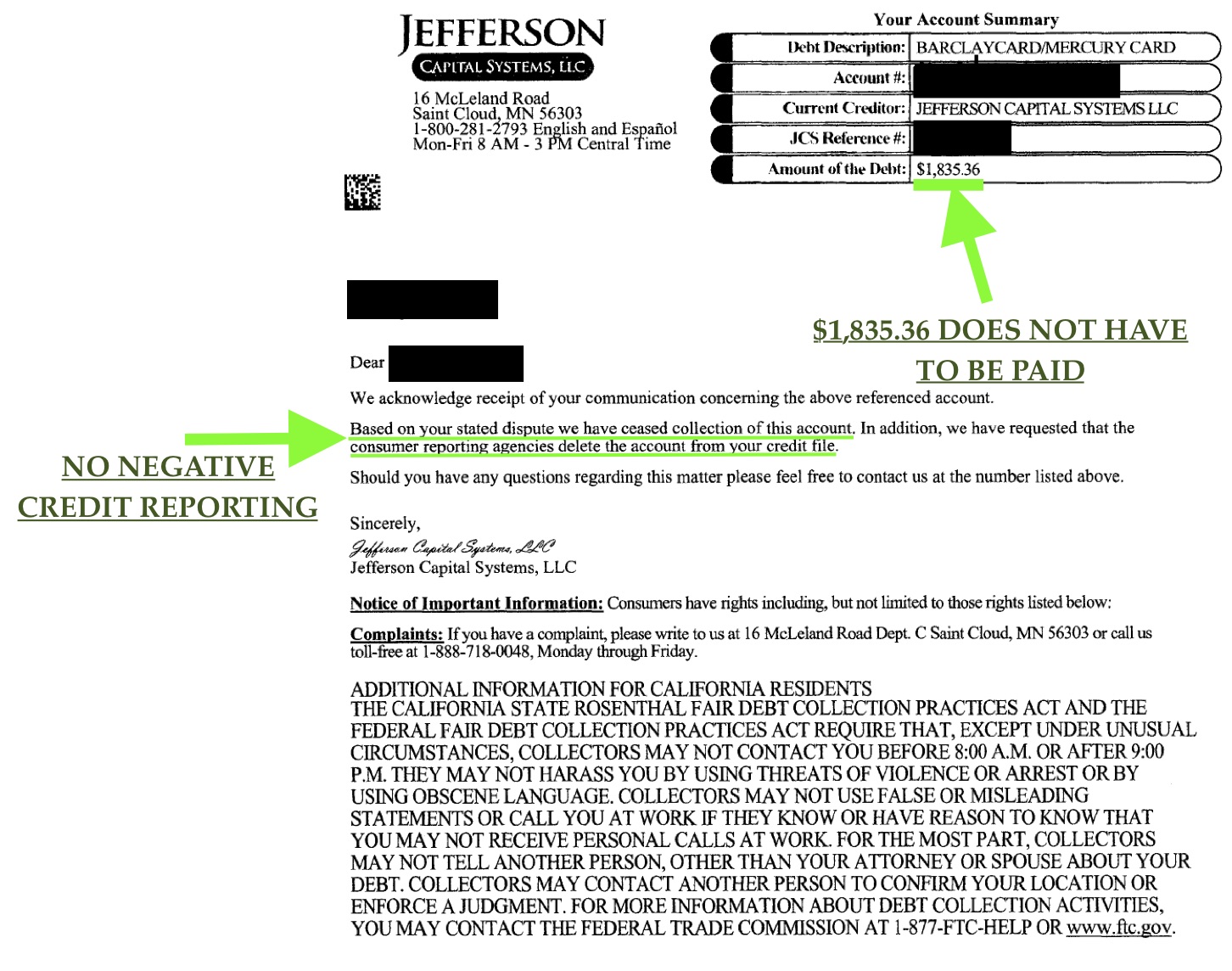

Debt validation example two:

Secondly, you may dispute your debts with a program called debt validation. You are not paying your debt with validation. DEFINITION OF DEBT VALIDATION:— You are disputing your debt with a debt validation program so that it becomes “legally uncollectible” — and you may not have to pay it. Also, a debt collection company cannot report a debt on your credit report once it becomes legally uncollectible. That is the goal of a debt validation program; — dispute it, you don’t have to pay it, and it comes off your credit report (best case scenario).

DEBT DISMISSAL PROGRAMS — This may help eliminate credit card debts and just about any debt.

Thirdly, debt can be dismissed — like how a lawyer challenges a speeding ticket and gets it dismissed. You could get your debt completely dismissed in some cases, almost as if it was wiped clean. For example, when the credit card company or a creditor violates federal law, such as the Fair Debt Collection Practices Act (FDCPA), a lawyer can pursue legal action against that creditor and sue them. To avoid getting sued — the credit card company will dismiss the debt. That is how your credit card debt could get dismissed.

If you would like to read more about how debt relief programs work, CLICK HERE — to see an extensive summary explaining each program.

If you are ready to take action — and start getting rid of your debt today…

…Contact one of our IAPDA Certified Specialists at 1-866-376-9846. You are entitled to a free consultation where you can find out all of your debt relief options. Call Now!

See what plan you qualify for and find out how much money you can potentially save in a matter of minutes. Then, after speaking with you & discussing your situation, we can detail a program to fit your specific needs.

No magic wand can be used to get rid of your debt, but viable options range from paying off debt on your own to debt relief programs.

When working with Golden Financial Services, you will be working with industry leaders in creating an exit strategy to your debt problem & seeing that there indeed is light at the end of this tunnel. Getting rid of your debt doesn’t have to be just a dream; make it your reality.