Multiple Ohio debt relief programs are available as of 2021, including popular options such as debt settlement, validation and consolidation. Ohio residents must owe above $7,500 in unsecured debt to qualify for debt settlement and consolidation options.

Consumer Credit Counseling in Ohio:

Ohio consumer credit counseling programs are another option that can help a person consolidate credit card bills. Only credit cards are eligible for this type of consolidation plan.

Credit counseling programs in OH make it possible to become debt-free in under five years, but at an affordable payment because of the fact that you pay less interest with this type of program.

Debt Settlement in Ohio:

OH debt settlement programs make it possible to become debt-free in around three years, while getting one low monthly payment. Debt settlement is the most popular credit card relief program in OH, but not the most effective. In fact, a settlement program can leave a person with trashed credit.

Ohio Debt Validation Programs:

With debt validation (invalidation) a person may not have to pay the debt, and in the end it could come off credit reports entirely. This type of program works by using consumer protection laws to dispute third-party debt collection accounts. For more information about how debt validation programs work visit this page next.

Are you ready to take action and make it through to the other side of COVID-19, but with less debt and more money? Get one consolidated and affordable monthly payment today. We can help you get out of debt much faster! Call (866) 376-9846. Golden Financial Services is an A+ Better Business Bureau rated Ohio debt relief company, providing Ohioans with financial education since 2004.

If you owe federal student loan debt, relief programs are available that you can learn about on this page here.

Choosing the right option may be the most difficult decision that a person makes. The following page explains how Ohio debt consolidation alternatives work, including pros and cons to each option.

Our experts are all highly trained on Ohio debt relief options and just the phone-call itself can be an eye-opening and educational experience. Whether you decide to sign up for a debt relief program or not, after getting your free consultation you’ll be educated on your options.

The Current State of the Economy in Ohio

Ohio (the Buckeye State) is the nation’s 4th largest interstate system, has the 2nd largest inventory of bridges and the 6th highest number of vehicle miles traveled. What’s great about Ohio is that we are the crossroads of America, within a one day’s drive of 60% of the United States population. However, the Buckeye State has its problems ahead due to scarce funding and our inability to continue maintaining these beautiful bridges and more importantly ensuring they remain safe. Additionally, consumer debt is at an all-time high, with credit card debt passing the $1-trillion mark!

In 2018, Ohio experienced its wettest year on record. Southeast Ohio is known for landslides due to heavy rain. Bridges, which were once amongst the most beautiful bridges in the world, are starting to deteriorate and the state, local government, and ODOT don’t have the appropriate funding to fix these bridges. The deterioration of bridges in Ohio is leading to dangerous roadways.

Due to inflation, our dollar won’t carry us the same. For consumers in Ohio, inflation has caused expenses to become more of a burden, including consumer debt like credit cards and personal bank loans. How can we afford to pay off all of this debt as a state and as individuals, without sufficient local government and ODOT funding?

The reality is that our dollar from 2003 is now worth just 58 cents.

And additionally, consumers in the state who were just barely making minimum monthly payments on credit cards and personal loans, and who were just barely making their mortgage payments, are now faced with a situation, should I fall behind on payments? If I do fall behind on monthly payments, what options can I turn to?

To compound the problem, Ohio’s motor fuel tax rate is not indexed – meaning it does not automatically increase with inflation as it does in neighboring states such as Michigan and Indiana.

Do Government Debt Relief Programs in Ohio Exist?

Unfortunately, government debt relief programs do not exist for most unsecured debts in Ohio. The only government debt relief programs available are for federal student loans, which are accessible at StudentLoans.Gov.

Students can consolidate federal student loans into one affordable payment, get on an affordable repayment plan and get loan forgiveness after a certain number of qualified payments. Students who are experiencing financial hardship can qualify for a zero dollar per month payment and get student loan balances forgiven within 10-25 years, depending on if you are employed by a public service or non-profit company. Here is step by step instructions on how to consolidate federal student loans.

There are no federal credit card relief plans currently available, but the good news is … Ohio credit card debt relief programs offered through Golden Financial Services could be the solution that Ohioans are searching for, offering a way to achieve a fresh start financially. These plans have proven to work, going back since 2004.

Do I qualify for Ohio debt relief?

Ohio residents with over $25,000 in total unsecured debt, could qualify for debt relief, settlement and consolidation programs. If you are just under the minimum requirement of $25,000 worth of total debt, we will try to get you approved but there is no guarantee on that!

The most popular Ohio debt relief programs in 2019 are an attorney-based debt settlement program, debt validation and consumer credit counseling. Let’s take a closer look:

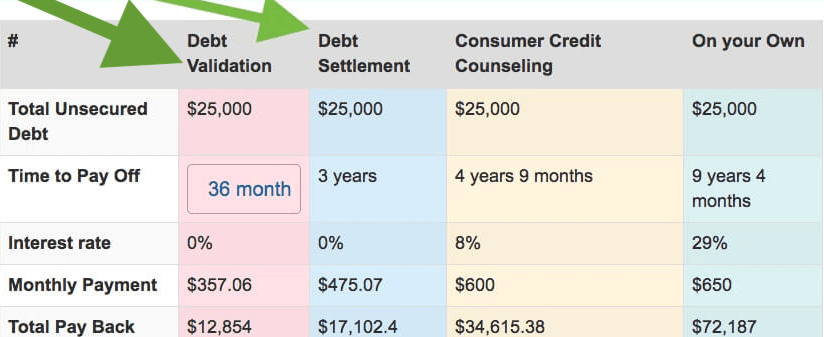

Compare Ohio Debt Relief, Settlement & Consumer Credit Counseling Plans

We will go through each of these debt relief programs, explaining how they work and showing you the benefits and downsides to each plan. But first, let’s look at some interesting statistics from a study that Golden Financial Services conducted last year.

Ohio Debt Statistics & Financial Study

Golden Financial Services conducted a research survey in Akron, Ohio (the rubber capital of the world). We wanted to figure out the average credit card debt in Ohio, compared to the rest of the United States (U.S.). The results were that Ohio residents have about 20% more credit card debt, compared to the rest of the nation.

The average credit card debt in the U.S. is $5,235, but for Ohioans, it’s $6557. We took things a step further and figured out that the average credit score for Ohioans is 690, which on a scale from bad to excellent, is good. So overall, consumers in Ohio had about 20% higher credit card balances than the rest of the nation but were still able to maintain fair to good credit.

The Conclusion

Many Ohioans are just paying minimum monthly payments on maxed out credit cards, keeping their credit score in that 690 range. Weekly wages in Ohio were $70 under the national average, making it hard for most people to afford to pay more than minimum payments.

But the problem is that a person’s credit score may be good at 690, but if you have maxed out credit card debt your credit won’t do you any good. You don’t want to apply for any type of credit with a 690 credit score. To get a low-interest car loan or any type of loan, you need to have a minimum of a 715 credit score. So unless your credit score is above 715, don’t apply for a debt consolidation loan.

When it comes to student loan debt, Ohio is ranked 9th in the nation. The average Ohio student loan debt stood at $29,353.

Are you paying only minimum payments on maxed out credit cards?

Owe student loan debt?

So, what are your options?

Best Ohio Debt Relief, Settlement and Consolidation Programs

Debt validation:

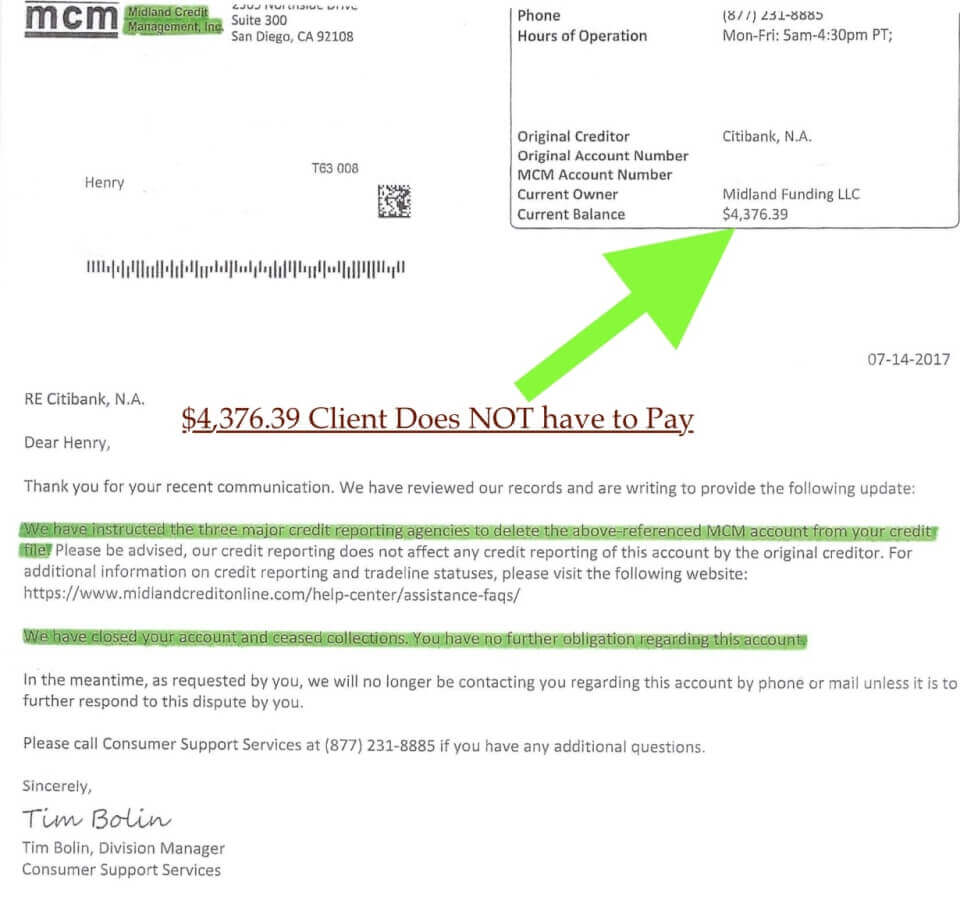

Debt can get disputed. If debt collection companies can’t prove it’s valid, the debt becomes legally uncollectible and you don’t have to pay it. A legally uncollectible debt is one that does not have to get paid and it can’t get reported on a person’s credit report. Debt validation can be one of the least expensive and most effective Ohio debt relief programs. Validation is one of the newer debt relief options in 2019 but proven to be very effective, due to credit card companies keeping sloppy records. At GFS we’ve been offering debt validation for six years now, and it’s been our most effective program.

See, to prove a debt is valid, debt collection companies must provide all of the requested paperwork and documentation required by federal laws (and there’s a lot) to prove that they are legally authorized to collect on the debt. The original creditor is supposed to ensure the debt collection company has complete and accurate records upon selling the account to them, which often they fail to do. Just recently, the New York Times revealed: “500,000 Chase accounts had been dismissed due to Chase losing legally required paperwork.”

“Tens of thousands of people who took out private loans to pay for college but have not been able to keep up payments may get their debts wiped away because critical paperwork is missing.” Read Entire Article on the New York Times Website

For this reason, here at GFS, we recommend using debt validation as a first approach to dealing with delinquent credit cards, student loans and unsecured debt in general, before resorting to debt settlement. Ohio residents can choose debt settlement or debt validation right here through Golden Financial Services, but in many cases debt validation is what our IAPDA certified experts will recommend. If the debt gets proven to be valid, you can use debt settlement as a last resort. The most popular debt relief program in Ohio is debt settlement, but that’s only because most debt relief companies only offer debt settlement. Here at Golden Financial Services, we’re here to provide you the truth and all of your options.

Here’s an example of what debt validation can do:

Consumer Credit Counseling Ohio

Ohio consumer credit counseling programs have been around since the 1990s. The credit counseling company has arrangements already in place with almost every credit card company. You can reduce interest rates on credit cards with consumer credit counseling and consolidate monthly payments into one. Ohio residents only need over $25,000 in credit card debt to qualify. GFS can refer you to a non-profit consumer credit counseling company in Ohio if this plan is the one you choose.

The main downside to consumer credit counseling is that monthly payments don’t change much. You will continue paying around the same as when paying minimum payments. You will become debt free in around 4.5 years, versus, being able to get out of debt in around three years with debt settlement.

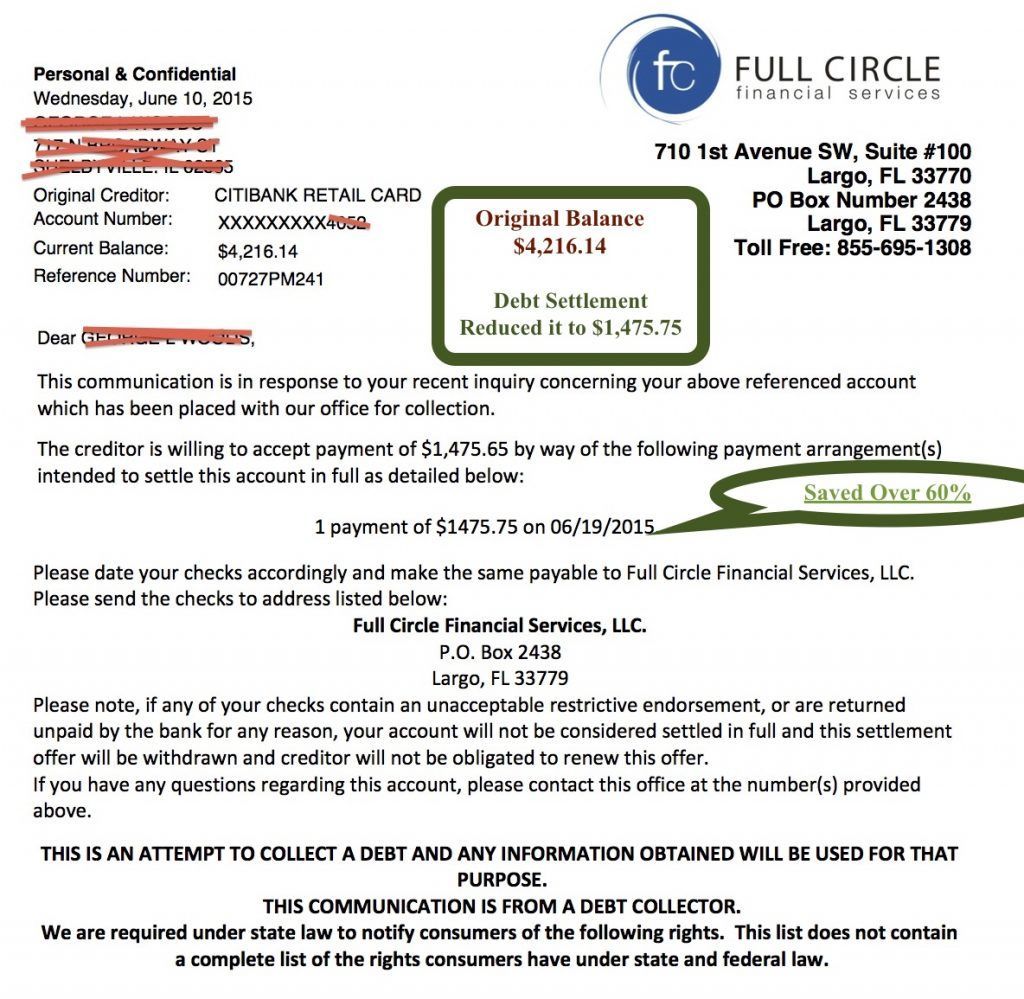

Debt Settlement Ohio

Ohio debt settlement programs are the next step down from consumer credit counseling. This type of program was designed for the consumer in Ohio who could not afford to pay at least minimum payments. An additional benefit to debt settlement is that you can include almost any type of unsecured debt, including repossessions, credit card debt, personal loans, and medical bills.

You can choose to get out of debt in 18, 24, 36 and 42 months and anything in between. Debt settlement offers flexible payment options, making it an affordable way to pay off your debts.

You are set up with an A+BBB rated Ohio debt relief law firm. Golden Financial Services is in charge of getting you approved for this plan. We will first retrieve your credit report and run it through our debt relief software. The software then notifies our agents on your debt relief options. At that point, an IAPDA certified debt counselor will go over the plans with you. You get the power to make a choice based on what suits you best and enroll in your favorite plan at GoldenFs.org.

Attorney-based debt settlement – Ohio

Clients are set up with an Ohio debt settlement lawyer who represents them throughout the plan. If there are any creditor fraud or FDCPA violations, including creditor harassment, the lawyer is there to protect you. All creditor communication must get directed to the law firm.

With Ohio debt settlement plans, you only end up paying a fraction of your balances. If you owe $20,000 in total debt, it can all get resolved for around $15,000 (including all lawyer fees). People are often surprised to hear that there is no up-front fee or cost to debt settlement. They often express to us that “lawyers are expensive, I can’t pay my bills right now as it is.” The Federal Trade Commission prohibits debt settlement companies, including law firms, from charging up-front fees. Fees can only get charged after your debt gets resolved.

Here’s how debt settlement fees are charged

Your creditors don’t get paid every month with debt settlement. Ohio debt negotiation companies use what’s called a “trust account.” Each month your monthly payment is deposited into the trust account, and as you continue to make payments, these funds add up in your trust account. As soon as you accumulate about 20% of what you owe on one of your debts in your trust account, the law firm’s debt negotiator will begin negotiating to settle your debt for around 40% of the balance.

As soon as your creditor agrees to reduce the debt, you’ll receive a phone call from the law firm congratulating you on the good news. You then approve the settlement, and at that point, the creditor will get paid. Since you are only paying a fraction of the balance, the remaining of the debt gets forgiven. This savings often gets construed by the IRS as earned income, but in reality, that’s not the case. So clients will be instructed to file an IRS Form #982, showing the IRS that they are insolvent and that will often wipe away any tax debt owed.

How do Ohio Debt Relief Programs Affect Credit Scores?

Consumer credit counseling can improve credit scores because past-due payments can be re-aged to show “current on payments.”

Debt settlement and validation both require clients to stop paying on creditors. Accounts must go delinquent, which will temporarily lower credit scores in most cases.

Debt settlement could leave collection and late marks on credit, which will make it hard to rebuild credit scores.

With validation, credit repair is included. Clients are given an installment loan with validation, used to show new positive payment history. If debt validation can get a debt removed from a person’s credit report in many cases, this is considered a positive action on credit. No debt relief company can promise to dispute and remove a debt from a person’s credit, but if a debt collection company can’t validate the debt and prove that they are legally authorized to be collecting on it, in this case, they can no longer continue reporting it.

Try Ohio Debt Calculator For a Quick Debt Consolidation Quote

Best Debt Relief, Settlement, and Consolidation Company in Ohio (for 2019)

Golden Financial Services offers debt relief programs in Michigan, Pennsylvania, Indiana, New York, Ohio, and almost all 50 states. Due to all of the success our programs have brought to consumers, hundreds’ of positive client reviews have accumulated all across Google. TrustedCompanyReviews.com just rated Golden Financial Services #1 out of all debt relief companies in the nation. Check it out on your own, here are the Top Ten Debt Relief Companies in the Nation for 2019.

On top of that, if you check Golden Financial Services at the Better Business Bureau’s website, you’ll find the company is A+ rated with less than three customer complaints (going back since 2004)! Over $25,000 in debt and reside in Ohio? Debt relief programs are a phone call away, call now!

Ohio Debt and Credit Related Laws

- The Statute of Limitations on Debt in Ohio: debt collection companies can only sue you over a debt for up to six years, regardless of the debt type.

- Fair Debt Collection Practices Act (FDCPA): regulates what a debt collection company can and can’t do while trying to collect on a debt. This law protects Ohio residents from illegal and unfair debt collection activity. For example, if you tell a debt collection company that you are not allowed to get personal calls at work, and they continue to call you, they are breaking the law, and you can sue them. The law gives you the right to win $1,000 per FDCPA violation.

- The Fair Credit Billing Act (FCBA): requires debt collection companies to maintain accurate billing and gives debtors the right to dispute a bill if they believe it to be inaccurate. This Act is similar to the FCRA, but it’s dealing directly with the debt collection company, not the credit reporting agency.

- Fair Credit Reporting Act (FCRA): requires credit reporting agencies to report accurate information, and gives consumers the right to dispute something on their credit report if they believe it to be inaccurate.

- The Credit Repair Organizations Act: requires credit repair companies to operate honestly and ethically, disclosing vital information such as the fact that nobody can promise to get something removed from your credit report.

- The Credit Card Act of 2009: this law is directly tied to the credit card companies, not debt collection companies, requiring that credit card companies charge fair interest rates and reasonable late fees, and also be transparent with their clients.

Ohio Debt Relief Program Disclosures:

- Golden Financial Services is not a loan company. The information relating to debt consolidation loans in Ohio on this page is purely educational. Our objective is to educate consumers on all options.

- Ohio debt settlement programs: There is an adverse effect on credit in many cases, due to creditors not getting paid every month. Late fees and collection accounts can remain on credit for up to seven years, making it difficult to rebuild credit scores. Creditors can issue a summons over unpaid bills, where a consumer would be required to go to court. If that occurs while enrolled on the attorney-based debt settlement program offered by Golden Financial, in this case, the Ohio law firm that you signed-up with will provide lawsuit defense where they will attempt to settle the debt before the court date, keeping you out of court. Creditors are not required by law to settle a debt at a certain percentage, but in most cases, they will agree to settle. The quote provided by Golden Financial Services is based on the Ohio law firm’s average settlements. When a debt is settled for less than the full balance owed, the IRS could require a person to pay taxes on the amount saved as it appears to the IRS as earned income. To avoid paying taxes, consumers can file an IRS Form #982, illustrating insolvency. Fees are included in the debt settlement program. Ohio residents can expect to pay around 75% of their total debt, including fees. Not all consumers in Ohio will qualify for debt settlement. Expect your balances to rise throughout the debt settlement program due to interest and late fees. These added fees will get mitigated into the settlement and resolved at the point the debt gets settled.

- Golden Financial Services is not a credit repair or consumer credit counseling company. We do partner with both non-profit consumer credit counseling and credit repair companies, so can refer Ohio residents to these agencies.

- Debt validation is a debt relief program that also requires a person to fall delinquent on monthly payments. Once a debt gets written off by the original creditor and sold to a third-party debt collection company, at this point the debt gets disputed with debt validation. Credit scores can be negatively affected if a person is current on monthly payments before enrolling in a debt validation program. If a debt is invalidated and proven to be legally uncollectible, in this case, there is no tax consequence like with debt settlement. Also, once an account is determined to be invalid, no longer can the debt collection company legally report the debt on the consumer’s credit report. Like with debt settlement programs over the first six months of a validation plan creditors are not getting paid, so potentially creditors can issue a person a summons to go to court. Certain creditors such as Discover, commonly issue credit card lawsuits, and therefore Discover is not an eligible creditor for this program.

The source: The Ohio Department of Transporation and House of Finance Committee, https://beta.transportation.ohio.gov/budget