Credit card consolidation programs can help you escape the grip that high credit card debt can have on a person’s financial well-being.

Is it a good idea to consolidate credit card debt?

Consolidate credit card debt into one low-interest loan if you have a high credit score and can comfortably afford to pay above minimum payments.

Bad credit?

Credit card debt consolidation programs can be a good idea to consider.

How to consolidate credit card debt on your own?

Credit card consolidation loans require (1) a high credit score and (2) enough income to be able to comfortably afford to pay back the loan. Credit card consolidation programs including debt settlement and consumer credit counseling are ideal for consumers with high balances and low credit scores.

Should I consolidate my credit card debt?

Struggling to pay off high-interest credit cards? Consolidation loans can help you by combining all accounts into one lower interest loan. Credit card consolidation helps you pay off debt faster and save money, but applicants must have a high credit score to qualify.

To find out if you should consolidate your credit cards contact an IAPDA certified debt counselor for a free consultation at (866) 376-9846.

Credit card consolidation loans make it easier to pay your bills, having only one monthly payment. Credit card interest rates get reduced by consolidating high-interest cards into a single low-interest loan.

How to consolidate credit card debt without hurting your credit:

Credit scores can improve by consolidating debt with a loan, unlike the negative effect of debt relief programs.

Have other accounts besides credit card debt? Consolidation loans can be used to pay off all of your accounts, including secured and unsecured bills.

Where to get a credit card consolidation loan?

Do you qualify for credit card consolidation? There are hundreds of lenders and credit unions that you could apply with. However, here at Golden Financial Services, we’ve done the research and can refer you to the best lenders that offer the lowest rates. But before applying for a consolidation loan, watch the following video to learn the 10 Best Ways to Clear Credit Card Debt.

Simply click here to compare credit card consolidation loan rates with different lenders.

Call us today at 866-376-9846 to learn about loan alternatives. Debt relief services can reduce your balances to a fraction of what is owed. You may also be interested in learning about the 10 Best Ways to Clear High Credit Card Debt.

Can Golden Financial Services help consolidate credit cards?

Golden Financial Services has been assisting consumers with paying off credit card debt since 2004 and maintains an A+ rating with the Better Business Bureau. In addition, the company has multiple credit card debt solutions available that have been tested and proven to work! For immediate debt consolidation help, give one of our IAPDA certified counselors a call at (866) 376-9846.

What is Credit Card Consolidation?

If you’re ready to learn, grab a cup of coffee and put on your thinking hat, and read this entire page (it only takes about 20 minutes to read)—a short reading, but guaranteed to show you the best way to consolidate your bills.

You have two methods to consolidate your debt: 1. a loan 2. a debt relief program. Each method is made up of 3 debt relief options. So there are a total of six ways to consolidate your debt.

- Method 1: Loan; Use a debt consolidation loan, home equity line of credit, or balance transfer card (method 1 is the most expensive route but does not hurt your credit)

- Method 2: Debt Relief Program; Use consumer credit counseling, debt settlement, or debt validation (method 2 is the least expensive route)

Technically speaking, method 2 of consolidating is not “debt consolidation.” You are using a debt relief program to consolidate your payments into one, but technically speaking, “debt consolidation” is a loan.

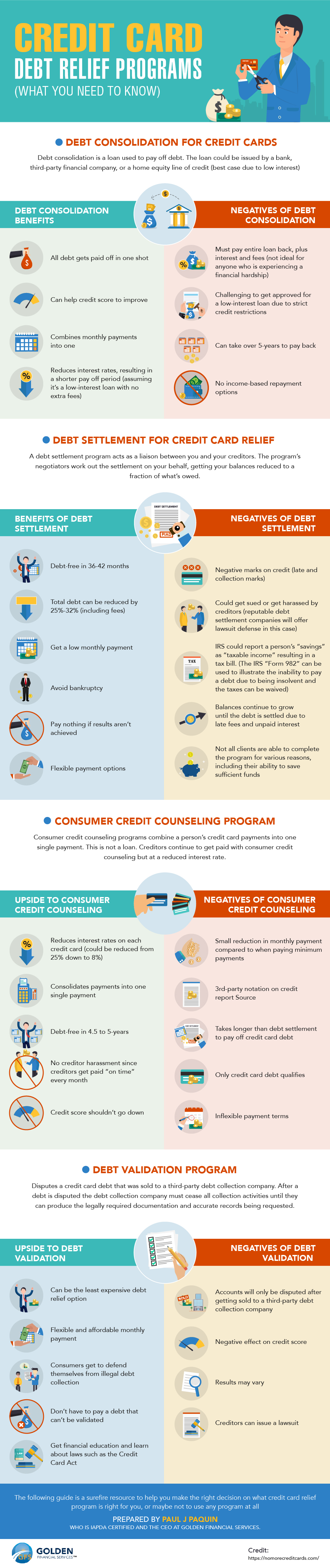

Here’s a Summary of Each Debt Relief Program (INFO-GRAPHIC)

If you have a question or want to enroll in a debt consolidation program:

Where can I consolidate my credit cards?

You can either use the bank, a third-party financial lending institution, or a debt relief company like Golden Financial Services to consolidate your credit cards.

Keep in mind, debt relief options offered by your bank won’t save you as much as if you were to use a debt relief company. Why is that? The answer is simple; a debt relief company is hired to save you money. A bank issues you a credit card to collect the maximum amount. Who do you think will be more motivated to help you save money on debt?

In 2018 and 2019, debt relief companies are strictly regulated. However, the debt relief companies that are thriving right now, like Golden Financial Services, offer reliable and trustworthy debt consolidation options.

The bad companies that were all about collecting fees upfront and not performing are all shut down. However, reputable debt consolidation companies are easy to find these days; check a company’s complaints online, rating at the BBB, if accredited by different organizations, etc…

If you type in your bank name on Google with the phrase “complaints” next to it, you may find 100’s if not 1,000s of complaints against your credit card company.

However, if you can find a debt relief company with few online complaints against them and top ratings, that’s all of the verification you need. If a company’s not performing for clients, people make complaints all across the internet, so it’s easy to find unreputable companies.

Reputable debt relief companies will give you a written guarantee. For example, the programs offered through Golden Financial Services include a written guarantee that says if results aren’t achieved, you’ll be refunded on that account. This type of agreement is in place to protect consumers. But, again, the customer is the priority.

Some of the programs offered through Golden Financial Services include debt validation and attorney debt reduction plans.

Just remember, banks want you to pay as much as they can get out of you to maximize their profit. Using a bank loan or balance transfer card can both be much costlier debt consolidation options over debt relief, but if your goal is to preserve your credit score, a bank loan may be the best route for you to take. I

If your goal is to avoid any type of negativity on your credit score and you can afford to pay more than minimum payments, use a bank loan. If you can barely afford to pay minimum payments and your credit score has already gone down, use a debt relief program.

Either way, start by talking with an experienced credit counselor or an IAPDA Certified debt reduction expert. It’s free to get a consultation from an experienced financial wizard at Golden Financial Services. You can learn how to get out of debt faster than what you’re currently doing. And you’ll hear the truth, not having to deal with some high-pressuring salesperson. You will come out of your consultation as a more financially savvy individual.

Don’t delay the pain; Immediate relief is available Toll-Free at 866-376-9846

Debt relief companies are in business to help you save money on your bills and to help you get out of debt in the quickest possible time frame.

- Is your credit card debt becoming unmanageable?

- Are you struggling with paying multiple credit card bills?

- Are debt collectors calling and harassing you or sending you threatening letters?

If you answered “yes” to any of these three questions, you are a great candidate for debt relief. Possibly debt validation, debt settlement, or even consumer credit counseling could be right for you!

How to consolidate credit cards into one payment?

Credit card consolidation programs include:

- Consumer credit counseling is a program that lets you stay current on your credit card payments and get the interest rates reduced. Non-profit consumer credit counseling companies will offer you a free consultation with a certified credit counselor. We recommend you get that consultation to learn all of your options! Whether you live in New York or Alaska, we have statewide debt relief programs available in almost every state.

- Debt settlement services are designed for someone who had to stop paying on their credit cards and unsecured debt. Negotiators go in and negotiate a one-time payoff on each of your debts, where you end up paying less than the full balance owed. This program also provides you with a single and consolidated monthly payment for all accounts. When using debt settlement, you are basically choosing to save money over saving your credit. Fortunately, other options can save you even more than settling your accounts. One of these other options is a plan called debt validation. Here’s how these different debt relief programs work:

- Is debt validation right for me? Credit cards that have gone to a third-party debt collection company can easily get disputed and may not need to get paid. Although your debt is not getting paid back through this route, debt validation is one of the most popular debt consolidation options for 2018. Why pay a debt before forcing the debt collector to prove that they are legally attempting to collect on the debt? Especially when statistically, more than 90% of credit card lawsuits are inaccurate, missing documentation, or flawed in one way or another. By disputing an alleged debt, there’s a chance it may not need to get paid and can come off a person’s credit report entirely.

Credit card debt consolidation loans include:

- By transferring your credit card balances over to a low-interest balance transfer credit card, you can reduce or eliminate all of your high-interest rates. Of course, you would have to pay off your entire balance before the introductory rate period ends, but if you can do it, you can save big money when using a balance transfer card to consolidate. Balance transfer cards charge 3%-5% of the total amount you are transferring onto the card. That’s an up-front fee, don’t forget to add this into the equation. All balance transfer cards offer this up-front fee, and sometimes much higher depending on your credit score, so be careful going this route. We often recommend this route, but only for people who have “good to excellent” credit scores (i.e., above 725).

- You can also use a home equity line of credit to consolidate all credit cards. The downside; if you fall behind on payments, you’re now in jeopardy of losing your home!

- If you have top-notch credit and really want a loan, try consolidating through your credit union. Credit unions offer the lowest interest rate when it comes to a debt consolidation loan. Just remember, personal loans need to get paid back in full, plus with interest. Also, do you have a stable income? Ensure that you have a steady income and can afford to pay back your loan; if not, you will only be getting yourself deeper into debt.

All of these consolidation options essentially take your multiple credit card debts and combine them into one affordable payment. However, from there, each program works differently. Click here for a Credit Card Consolidation Program Quote.

Debt settlement services can get you out of debt in under 3-years but will have the worst effect on your credit. Debt consolidation loans can be the most expensive route to consolidate your credit cards because you will pay back the entire loan and interest, but there is no negative effect on your credit through this path. Consumer credit counseling can be a safe way to lower interest rates and become debt-free in under 5-years. The downside with consumer credit counseling is that your payment will be around the same as paying minimum payments on your own.

The question is, what program is right for you? First, make a budget analysis, which any debt relief or credit counseling company can help you do. NerdWallet recently tested all of the free budget tools and listed the best budgeting tools here.

After you put together your budget next, find ways to lower your expenses. Once you figure out how much money you have available each month, you can determine which debt relief program is right. Or just call Golden Financial Services, a one-stop-shop for all your debt relief needs. Call Toll-Free (866) 376-9846.

What is the best way to consolidate my credit card debt?

Now that you’ve gotten a quick summary of each plan, including credit counseling, debt negotiation, debt validation, debt consolidation, balance transfer card, home equity loan, credit union, and a bank loan, I think you’re ready for this next step.

Try this debt calculator to find a payment that is affordable for you to pay.

[gfs-debt-calculator]

Before Golden Financial Services can provide you with a recommendation on how to get debt relief, we need to know;

What type of credit cards do you have? Not all credit cards will qualify. For example, some plans don’t accept Discover, while other plans have a minimum balance requirement.

What are the balances on each account?

What is your payment history looking like? Are you past due on your credit card payments, and by how many months? Plans like consumer credit counseling can waive late fees and re-age accounts to be current, but you can only be behind by 2-3 months at the maximum.

Has your income been negatively affected? Any type of financial hardship such as job loss, medical condition, divorce, or unexpected expenses? If you need to consolidate your student loans, these plans are based on income. If you have a lower income than the average population, you will most likely qualify for an income-driven student loan repayment plan. Income also comes into consideration when a bank is evaluating your creditworthiness and ability to repay the loan. Based on your income, a bank may need to adjust its loan terms to fit your budget.

Has your credit score recently gone down? If your credit score just went down, getting a debt consolidation loan to pay off credit card debt would be a bad idea. Why? Because your interest rate would be astronomically high on a loan.

So what are my options?

Talk to an IAPDA Certified Debt Consolidator For Free at (866) 376-9846.

DISCLOSURE: These are 100% genuine reviews that Golden Financial Services has NO CONTROL OVER. TrustPilot.com is a third-party review company, similar to Yelp.

Want to see more reviews on Golden Financial Services?

Click to see reviews on Google

Advantages of Using a Consumer Credit Counseling Program to Consolidate Credit Cards;

- 1. lower interest rates

- 2. debt free in 4.5-years

- 3. one single monthly payment

- 4. remove late fees

- 5. re-age accounts to show “current” for payment status

- 6. no creditor harassment

- 7. no negative effect on credit

How does Consumer Credit Counseling Work?

Here’s how it works: You pay the consumer credit counseling company every month. Then, out of your monthly payment, they disperse the funds to each of your credit card companies but at a reduced interest rate.

Disadvantages of Consumer Credit Counseling

- 1. Monthly payments are not flexible

- 2. You still need to pay interest

- 3. You must pay the entire debt back

- 4. Only credit card debt qualifies

- 5. A third-party notation, known as a CCC, goes on your credit report after enrolling in this type of plan (indicating that you needed a debt management plan to help manage your debt)

- 6. Even if you enroll through a non-profit company, you still will have to pay extra fees to the consumer credit counseling company (they can be as high as $50 per month, on top of interest and paying your debt)

- 7. Not all creditors work with a debt management plan (DMP). You may get approved for the consumer credit counseling plan and pay their fee, but meanwhile, some of your creditors rejected the DMP

- 8. Consumer credit counseling companies work for your creditors, not only you. Creditors will also pay the consumer credit counseling company additional fees for helping them collect money from you. Whereas, with debt relief programs like what is offered through Golden Financial Services, the debt relief company works exclusively to help YOU SAVE MONEY.

Advantages of Using Debt Negotiation (Settlement) to Consolidate Credit Cards;

- 1. pay less than the full balance owed on each credit card

- 2. debt-free in 3-years on average

- 3. a single monthly payment

- 4. credit cards and almost any type of unsecured debt can be included

- 5. the portion of your debt that doesn’t get paid gets completely forgiven (wiped away and never has to get paid)

- 6. attorney legal protection included

- 7. only pay a fee if results are achieved

- 8. flexible monthly payments and no penalty for paying off your debt settlement program faster

- 9. attorney representation then requires creditors to stop calling a person and direct all communication to the attorney (making life easier)

- 10. get your consumer rights defended and sue a creditor if they violate the FDCPA

How Does Credit Card Debt Settlement Work?

Golden Financial Services sets you up with a BBB A+ rated debt settlement attorney in your state. Your debt settlement plan offers you one low monthly payment to take care of all your debt. After getting a complete budget analysis, you can then choose the plan that fits your budget best.

The entire debt settlement enrollment phone call takes about 45 minutes. First, your credit report will be retrieved and everything reviewed with you. Then, following your phone call and pre-enrollment into debt settlement, you will be required to meet with a local law firm representative to finalize your approval.

The funds you pay each month go directly into an FDIC insured trust account that’s in your name, and you have total control of the funds at all times. As money accumulates in this account, the law firm starts negotiating with your creditors to reduce the balances on each of your debts. So, one by one, your debts will get reduced and paid off in one lump-sum payment.

You could have a $2,500 credit card debt reduced to $1,200. The debt settlement company will notify you of the good news, and once you approve the offer, only at that point would the funds be released from your FDIC insured account. The funds will get paid directly to your creditor, avoiding any type of third-party notation intervention.

As soon as your creditor agrees to reduce the balance, the law firm will call you and go over the details. You can then accept or deny the settlement offer. If you reject a settlement offer, that creditor will get re-negotiated again in the future.

You also get an assurance of performance on this attorney debt settlement program, similar to a money-back guarantee. However, attorneys can’t use the word “guarantee,” so it’s called an assurance of performance in the attorney world. Basically, this guarantees that the law firm saves you at least a certain amount, and if they can’t, then their fees will get reduced accordingly.

Disadvantages of Debt Settlement

- Credit score will go down.

- Late and collection marks will remain on credit for up to 7-years

- Creditors can issue a person a credit card summons (on the debt settlement plan offered through Golden Financial, an attorney would resolve the credit card summons for you, but the settlement could be higher than the other debts enrolled)

- Creditors may illegally harass you

- If in the military, debt settlement could affect your military status

- The IRS could consider a person’s savings on a settlement as income, where the IRS sends a client a form 1099, asking them to pay taxes on the amount saved. This tax liability can often get resolved by simply sending the IRS a Form 982 (showing a reduction of tax attributes due to a discharge of indebtedness.

Getting Harassed by Debt Collectors?

Debt validation is another program that can be extremely effective if your payments are past due.

With all of the financial fraud in the United States as of 2018, debt validation is emerging as a necessary program for debt relief. You can’t intelligently settle a debt unless it’s first proven to be legally collectible.

Debt validation forces the debt collection companies to prove they’re abiding by laws, maintaining accurate paperwork and accounting, maintaining legally required documentation, and abiding by all of the debt collection rules. Unfortunately, when it comes to debt collection accounts, often inaccurate information is found, records are missing, creditors are trying to collect on a debt that’s expired past the statute of limitations, there have been unauthorized fees added in, and the list goes on and on of potential flaws and legal violations that can be attached to a debt. The point is, debt can easily get disputed and become “legally uncollectible.” A legally uncollectible debt does not have to get paid. Also, a legally uncollectible debt can’t legally get reported on your credit report.

Have you ever heard of someone getting a speeding ticket and getting it dismissed?

Even if they were speeding, a competent speeding ticket attorney could get the ticket dismissed. What the attorney would need to do is to dispute the ticket. The attorney will basically go line by line in the law book and just start asking for papers that need to be provided by law from the police officer. The attorney will ask for information, which needs to be accurate. If the information provided by the police officer is not accurate, the ticket can be dismissed. Eventually, the police officer slips up. Maybe he can’t produce some legally required record or can’t provide a sufficient answer to the lawyer’s question. And – TICKET DISMISSED!

Debt validation is similar in nature to how a speeding ticket can get dismissed, even if the person was speeding. However, when it comes to debt, many laws regulate debt collection companies. In addition, there is a multitude of debt collection and credit card-related laws available to use when disputing a debt, like the Credit Card Act, FDCPA, Fair Credit Billing Act, and the FCRA. All of these laws make it fairly easy for a debt validation program to dispute a debt and prove it to be legally uncollectible, especially when it comes to credit card debt, where statistically, more than 90% of credit card lawsuits can get dismissed after being disputed, due to flaws in the paperwork, according to a Brooklyn Judge.

Talk to a Counselor Now Toll-Free (866) 376-9846

How to consolidate credit card debt without hurting your credit?

The only way to consolidate your credit cards without lowering your credit score is to pay your balances “in full” and on time. You can do this with a debt consolidation loan. Simply get a loan. Use that loan to pay off your existing credit card balances. Now you only need to pay back the one loan.

The problem for many consumers is that they can’t get approved for a low-interest consolidation loan due to credit issues, or they can’t afford to pay the loan back due to a loss of income.

So the second-best debt relief option would be to use a debt relief program. You could then follow the debt relief program with a credit repair program, where credit education is included to help you build your credit score.

At Golden Financial Services, we can teach you about debt relief programs that come with credit repair, all-in-one.

Advantages of Using a Debt Consolidation Loan to Consolidate Credit Cards;

- 1. all of your debt is paid “in full” right from the get-go, so there’s no adverse effect on your credit score besides the initial credit inquiry, which appears

- 2. no creditor harassment

- 3. one single monthly payment because you are only paying back a single loan

- 4. lower interest rate (depending on loan rate and if other fees are charged)

- 5. get out of debt faster

Disclosure: Many ripoff debt consolidation companies in the nation overcharge consumers in fees and interest. Carefully read the debt consolidation loan agreement and carefully examine all rates, fees, and interest included.

Disadvantages of Using a Loan to Consolidate Credit Cards

- Pay all of your debt, plus interest (depending on loan rate) and additional loan fees.

- Some loans come with pre-penalty fees (the reason is that if you pay off your loan early, you’ll pay less of the lender’s monthly fee, so to make up for this, they charge pre-penalty fees)

- No reduction in the monthly payment

- You are swapping debt, not addressing your debt problem

- Negative inquiry when applying for a loan

How To Find The Best Credit Card Consolidation Companies

It’s hard not to toot our own horn when answering this question.

Golden Financial Services only works with the best credit card consolidation companies in the nation that are all “A+” rated by the Better Business Bureau (BBB). As a result, we can offer you debt validation, debt settlement, and consumer credit counseling plans with the top companies in the nation.

- Use Golden Financial Services to get approved for an attorney-model debt settlement program with a top-rated and local law firm near you.

- Our debt relief plans have all been extensively researched and tested before becoming available to the public. We will research a debt relief program for up to two years before offering it to the public.

- You can also get referred to a non-profit consumer credit counseling company when going through Golden Financial.

- Golden Financial Services has ZERO BBB complaints and is top-rated by Trusted Company Reviews.

- When using Golden Financial Services, you can get a money-back guarantee and have credit repair included for no additional cost.

Paul J Paquin, the CEO at Golden Financial Services, stated in a recent interview that… “Our clients deserve top-of-the-line treatment. Credit card debt needs to be dealt with through an aggressive and laser-focused approach. Our clients trust us, so we need to protect their financial well-being with everything we have and get them out of debt successfully.”

We make sure to help every consumer who contacts us, even if it just gives them honest and free advice.

Contact Golden Financial Services at (866) 376-9846 to determine the best credit card debt service for you.

How To Consolidate Credit Card Debt On Your Own?

You have many options, but here are your best options if you can consolidate credit cards on your own.

A. Go to a credit union bank and apply for a debt consolidation loan to pay off your credit cards. First, add up the balances on each credit card account. Second, make sure to get a high enough loan to cover paying off all of it. Finally, make sure the interest rate on the new loan is lower than your average interest rate on your current credit card bills.

B. An even smarter option is to take out a home equity line of credit and use that to pay off your credit cards. A home equity line of credit offers the lowest interest rate compared to any other type of loan.

Credit Card Consolidation Calculator: (four debt-relief options included)

Click Here to try our credit card relief program calculator:

How to Schedule a Free Consultation at Golden Financial Services?

To schedule an appointment — SIMPLY EMAIL — (INFO@GOLDEN FS DOT ORG).

During your free consultation with a Golden Financial Services counselor, we help you choose the best debt relief program for your needs.

A debt relief counselor will review and analyze your financial situation and credit report and educate you on the various debt relief options available to you.

With Golden Financial Services, we give you honest and truthful information. We will never pressure you into a debt relief program that isn’t right for you.

Call in for immediate assistance between Monday–Saturday (8 am–8 pm)

Talk to a Counselor Now Toll-Free (866) 376-9846

Consolidate credit card debt with bad credit

If you have bad credit, you won’t get a low-interest loan, no way and no how. Don’t fall for any debt consolidation loan scams. If your credit score is under 675, your best chance of getting a loan is to use the credit union where you have your bank account. Don’t use Lending Club, Avant, or any PayDay loan companies. All of these types of debt consolidation lenders offer only high-interest rate loans that include additional fees. Stay away from this route.

And if you are looking for government credit card relief?

Government credit card relief does not exist. Only student loan government relief exists, but not for credit card debt.

Your best credit debt relief options with bad credit are to settle your debt for less than the full amount owed through debt settlement or to use validation services. To qualify for a debt relief program, you will need to have some income.

We Can HELP! Call Toll-Free (866) 376-9846

As the last option to eliminate credit card debt, you may want to talk with a bankruptcy attorney. A downside with bankruptcy is that; in the future, if you apply to purchase anything on your credit, you’ll have a difficult time getting approved, or you will get charged the maximum interest rate. With a bankruptcy on your credit, you could be paying the price for a very long time ahead. You’ll have a difficult time using your credit, even for simple purchases. With bankruptcy on your credit, you may not be able to rent a home or buy a new car. Future employers will also see that you filed for bankruptcy when evaluating whether or not to hire you.

Bankruptcy is not a good option for resolving your credit card debt. Still, it may be a viable option for someone who has a mixture of secured and unsecured debt that they are delinquent on, or if you have several lawsuits from creditors that sued you. One positive thing about bankruptcy is that it forces all of your creditors to cease collection efforts, putting a stop even to credit card lawsuits and creditor harassment. Click here to learn more about bankruptcy. Ready to consolidate your credit cards? Contact Golden Financial Services today!