Credit Card Refinancing vs. Debt Consolidation Loans

What is the difference between credit card refinancing and debt consolidation? There is no difference between refinancing and consolidating debt.

What is credit card refinancing? Both refinancing and consolidating credit card debt refer to getting a loan to pay off other debts. The point of debt consolidation and credit card refinancing is to consolidate your debt into one lower interest rate or lower monthly payment.

KEY TAKEAWAYS:

- Credit card refinancing and debt consolidation are exactly the same thing

- The point of refinancing your credit card debt is to consolidate your debt into one lower interest rate or lower monthly payment.

- Credible offers a free online marketplace to check loan rates and terms for credit card refinancing. Check out this Credible Loan Review to learn about how to get free pre-qualified loan offers.

- Get pre-qualified loan offers at Credible without any negative effect on your credit. After refinancing your credit card bills, your credit scores can improve over time. The reason for this is due to improve credit utilization ratios and positive payment history.

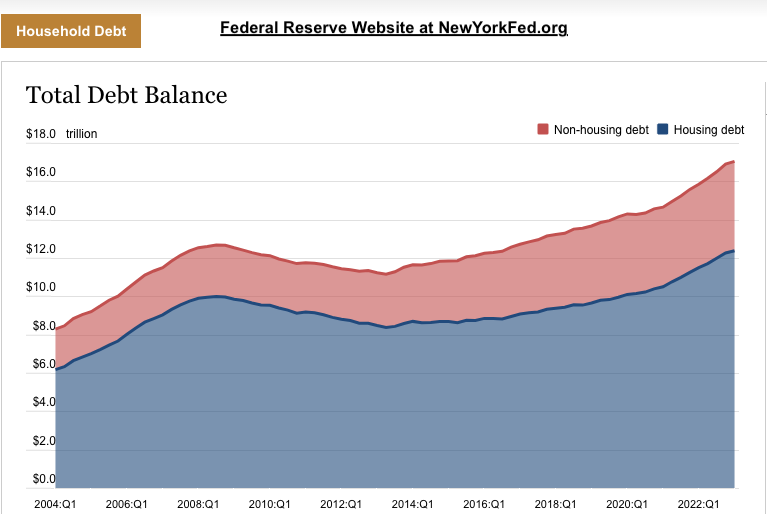

However, as of 2023, loan rates have skyrocketed.

According to the Federal Reserve Bank of New York, credit card debt in America sits at $986 billion as of the first quarter of 2023.

Credit card debt has been on the rise and is expected to continue rising as interest rates are at a ten-year high.

That said, refinancing credit card debt with a lower rate could be a viable route to save money and get out of debt faster.

Is now a good time to refinance credit card debt?

If you have existing credit card debt, interest rates should have stayed the same. Legally, credit card companies are restricted from raising the interest rate for existing credit card balances.

So you may not want to take on a new loan at this point in time. Why is that, you might ask?

It’s likely that your existing interest rate on credit card debt is lower than what you’d get on a new loan.

The good news is that there’s an easy way to find out what loan rate you could be eligible for.

Best way to consolidate or refinance credit card debt in 2023:

After conducting extensive research on the leading lenders in the United States, Golden Financial Services discovered a standout option. Surprisingly, this standout option is not a direct lender but rather an online loan marketplace.

Credible.com offers one of the most favorable methods to assess loan rates and, if eligible, secure a loan swiftly.

In a matter of 5-10 minutes or even less, you can receive multiple pre-approved loan offers from highly regarded lenders. Unlike certain other online marketplaces that bombard you with incessant offers, Credible.com collaborates with a select group of approximately twenty reputable lenders.

To learn more about Credible loans, start by reading online reviews. TrustedCompanyReviews.com released a Credible Loan Review for 2023, which will offer you a good starting point.

Credit score requirements for credit card refinancing:

Based on the review provided by TrustedCompanyReviews.com, Credible’s APR for individuals with bad credit ranges from 4.60% to 35.99%. The loan terms offered by Credible range from 2 to 7 years.

It’s important to note that these figures represent the best-case scenarios.

Before proceeding with a loan application, it is widely advised by financial experts to first consult with a credit counselor or a reputable debt relief company. Accredited Debt Relief is recognized as one of the top debt settlement programs available.

Therefore, we also recommend checking with Accredited Debt Relief about your options to get out of debt faster.

Is your goal to have good credit?

If you find yourself in a situation where you have maxed out credit card debt and can barely afford the minimum payments, obtaining a loan may not be the most suitable option. It’s important to consider that high balances on your credit cards can have a negative impact on both your credit utilization ratio and credit score.

In this case, a more effective approach would be to focus on eliminating all of your interest and reducing the balances on each of your accounts rather than acquiring a loan.

By eliminating interest charges and actively reducing your balances, you can save money and accelerate your journey toward becoming debt-free. Once you have successfully cleared your debts, you can then shift your focus toward building and maintaining a good credit standing.

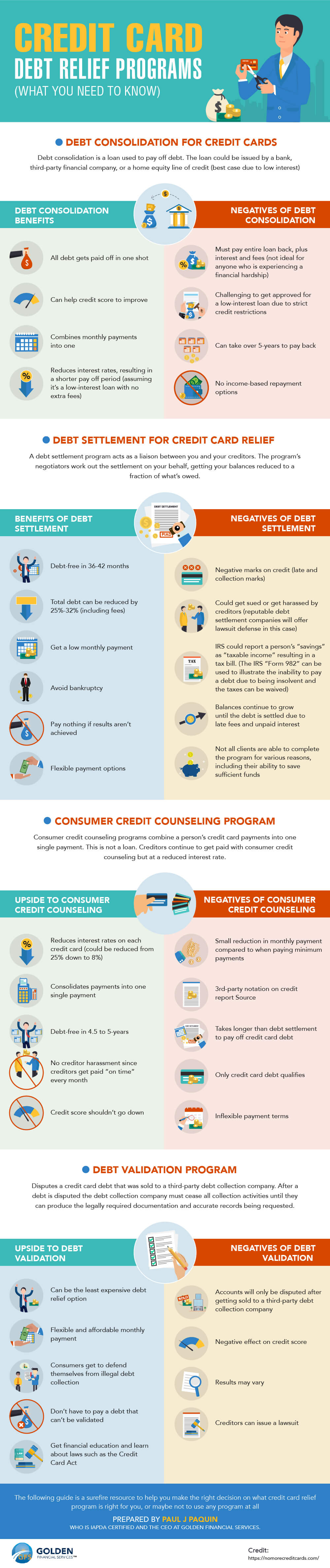

Before you get a credit card loan, check out the following debt relief options.

Downsides of Refinancing Credit Cards with a Loan:

Be aware of potential downsides when considering refinancing credit cards with a loan.

Here are a few points to keep in mind:

- Hidden Fees: When exploring loan options, be cautious of any hidden fees that may be associated with the loan. Carefully review the terms and conditions to understand the complete cost of borrowing.

- Counterproductive Debt: While paying back a loan can have a positive impact on your credit score, it’s essential to assess whether taking on additional debt to pay off existing debt is a wise decision. This approach may not be beneficial, especially if you are struggling to afford the minimum payments.

- Affordability: Consider whether you can comfortably manage the monthly payments associated with the credit card loan. Typically, the monthly payment for a credit card loan will be similar to what you are currently paying towards your existing credit cards. Ensure that you can meet these payments consistently without financial strain.

By being aware of these potential downsides, you can make an informed decision regarding the refinancing of your credit cards with a loan.

Does credit card refinancing hurt credit scores?

Using an online loan marketplace such as Credible.com enables you to receive loan offers without any negative impact on your credit score.

You might be curious about how this is achievable.

Credible.com employs a soft pull credit check during the pre-qualification process for borrowers. As a result, checking loan options at Credible does not have any adverse effects on your credit.

If you qualify for a loan and use it to repay your debt, your credit score has the potential to improve over time. Here’s why:

Paying off credit card balances enhances your credit utilization ratios.

Maintaining a positive payment history contributes to an improved credit score.