Student Loan Debt Forgiveness and Relief Programs are Available as of 2021.

What are federal student loan relief programs?

Federal student loan relief programs are available under the William D. Ford Act. These government student loan relief programs allow students to consolidate their federal student loans into one new loan, with a much lower monthly payment.

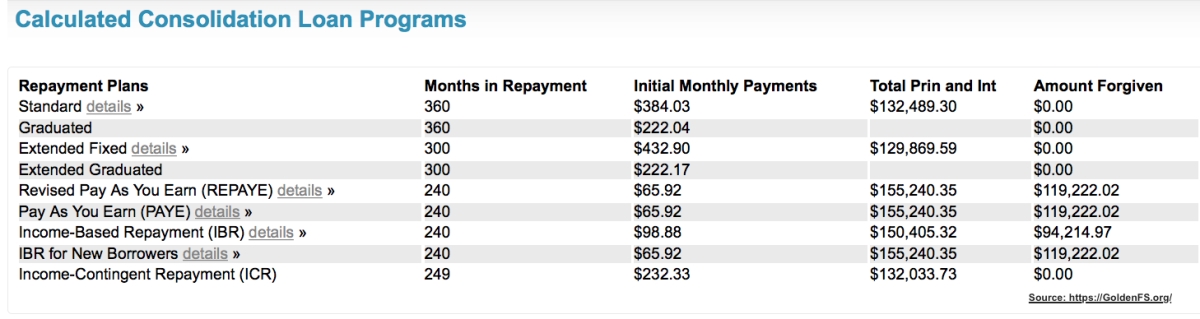

The reduced consolidated monthly payment is made available through income-based repayment plans. Several income-based repayment plans are available to choose from, but only a few of these programs include loan forgiveness. The Standard, Graduated, Extended, and Alternative Repayment Plans do not offer loan forgiveness.

To qualify for loan forgiveness, students need to:

- Consolidate federal student loans

- Get on an Income-Driven Repayment Plan that offers loan forgiveness (i.e., REPAYE, PAYE, IBR)

- Recertify every year until eligible for loan forgiveness

- If you have a Public Service job, submit the Employment Certification form annually

- Track your eligibility for Public Service Loan Forgiveness (PSLF) through FedLoan

- Apply for loan forgiveness after becoming eligible (i.e., after 10, 20, or 25 years)

Additional Resources to help deal with other types of unsecured debt, including credit cards and private student loans

Click here to read about debt relief services (for all other types of unsecured debts)

Click here to read a summary of credit card debt relief programs

How to enroll in a government student loan relief program

Students can complete this process on their own or apply for student loan assistance through Golden Financial Services. To consolidate and get loan forgiveness on your own, visit this page next for instructions. Contact Golden Financial Services for a Free Consultation at 866-376-9846. Ask for a student loan relief expert.

Delinquent on Federal Student Loan Payments?

If you’re past due on monthly payments, you may not qualify for federal student loan consolidation. We will first need to get you approved for a loan rehabilitation program.

After you make nine consecutive monthly payments on the loan rehabilitation program, you’ll graduate and become eligible for federal student loan consolidation and repayment plans. The default, late marks, and collection account will then get removed from your credit report.

Who qualifies for federal student loan relief?

To qualify for an income-based repayment plan and loan forgiveness, students must have some financial hardship. But keep in mind, a financial hardship does not have to be anything extreme. Perhaps after paying all of your monthly bills, you have no extra money to save, and that should be sufficient to get you approved.

A financial hardship could include reduced income, high expenses, or low income. Contact Golden Financial Services today, and we can run the numbers and figure out your eligibility. You may also start by completing our student loan relief online application.

What is the student loan relief program offered by Golden Financial Services?

We will;

- Consolidate your federal student loans.

- Get you approved for the lowest possible monthly payment on an income-based repayment plan that offers loan forgiveness.

- Recertify your income-based repayment plan every year until you’re eventually eligible for loan forgiveness (Public Service Loan Forgiveness is within ten years and for everyone else 20-25 years).

- Handle all communication between you and your creditors.

- Stay on top of your federal student loan relief options as they come available, always having your best interest (for example, if Biden passes additional loan forgiveness, we will make sure to apply on your behalf).

- Switch your income-based repayment plan to the one that offers you the lowest payment if your income or family size changes.

- Help you avoid wage garnishment if you’re delinquent on monthly payments.

- Get you approved for the loan rehabilitation program if needed, helping you get the default marks removed from your credit report.

- Submit all necessary forms and applications on your behalf to the Department of Education on an annual basis.

The enrollment cost of student loan relief at Golden Financial Services

There are no up-front fees charged with this type of student loan relief program. You are only charged after your consolidation is completed, loans are paid in full, and you’re approved for the reduced monthly payment. At that point, the enrollment cost of the program will be charged. That enrollment cost is $675.

We are not lenders or affiliated with the government. Our role is to assist you in processing your federal student loan consolidation and then assist you in getting approved for the income-based repayment plan of your choice. We will then assist you over the years by processing your annual recertifications and following all the way up until you’re eligible for loan forgiveness. We will help you navigate the complex processes involved with federal student loan relief, having your best interest all along.

To apply for the Golden Financial Services student loan relief program, start with this online application. If you’d prefer to do it yourself, check out this step-by-step student loan relief and forgiveness guide.

Students can qualify for student loan debt forgiveness after either;

A) consolidating and making a certain number of qualified payments on an income-driven repayment plan

B) After 10-years of making qualified payments under the Public Service Loan Forgiveness (PSLF) Program for teachers, police officers, and anyone working in a public service job

The portion of your student loan debt that is forgiven — does not have to be paid.

“Are loan amounts forgiven under PSLF considered taxable by the IRS? No. According to the Internal Revenue Service (IRS), student loan amounts forgiven under PSLF aren’t considered income for tax purposes. For more information, check with the IRS or a tax advisor.” Source: https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service/questions

Call (866) 376-9846 for student loan relief assistance. Our counselors can help process your consolidation on your behalf, get you on the lowest monthly payment through an income-based repayment plan, and follow up every year recertifying your plan until eligible for loan forgiveness.

Has your income recently been reduced?

Can you barely afford to pay your student loan monthly payments?

We have great news!

Federal and private student loan relief options are available.

For private student loan relief information, visit this page next.

Private student loan relief is also included with a debt validation program.

To learn about COVID-19 student loan relief options and payment suspension – click here. If you have credit card debt, learn your options by visiting this page next.

How to get student loan forgiveness

Almost any student can qualify for student loan forgiveness.

You don’t have to work in a public service job.

If you work in a public service job, you can have your loan balance forgiven in a shorter time frame, but anyone can get student loan forgiveness.

Step 1

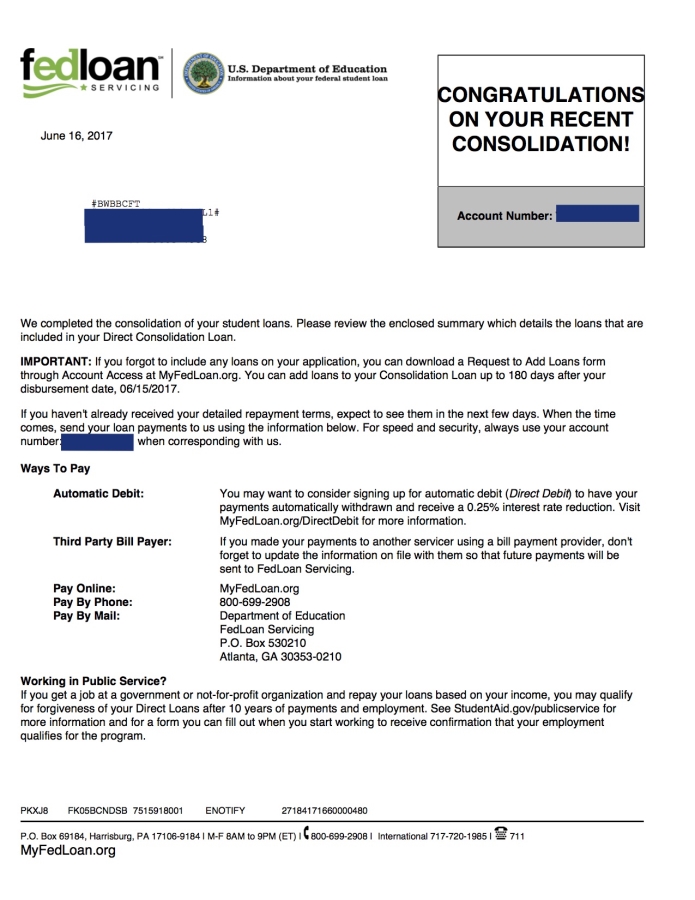

Consolidate your federal student loans.

Here is an example of what it looks like — after getting your student loans consolidated.

Notice the disclosure at the bottom of the letter where it says “Working in Public Service?”.

As you can see, after accomplishing “step one” — which is consolidating; — Now it’s time to take your second step for anyone working in a public service job. If you work in a public service job, you must register here — proving that you are working in a public service job. If you don’t have a public service job, you don’t have to worry about verifying your employment.

If you would like assistance with consolidating your student loans — Call Golden Financial Services at 1-866-376-9846

Step 2

After consolidating –, You then need to get on the right repayment plan that offers forgiveness options. Your goal should be to get on the repayment plan that offers you the lowest monthly payment and the highest amount of loan forgiveness.

There are approximately nine student loan repayment plans available through the federal government.

Example illustrating student loan forgiveness options

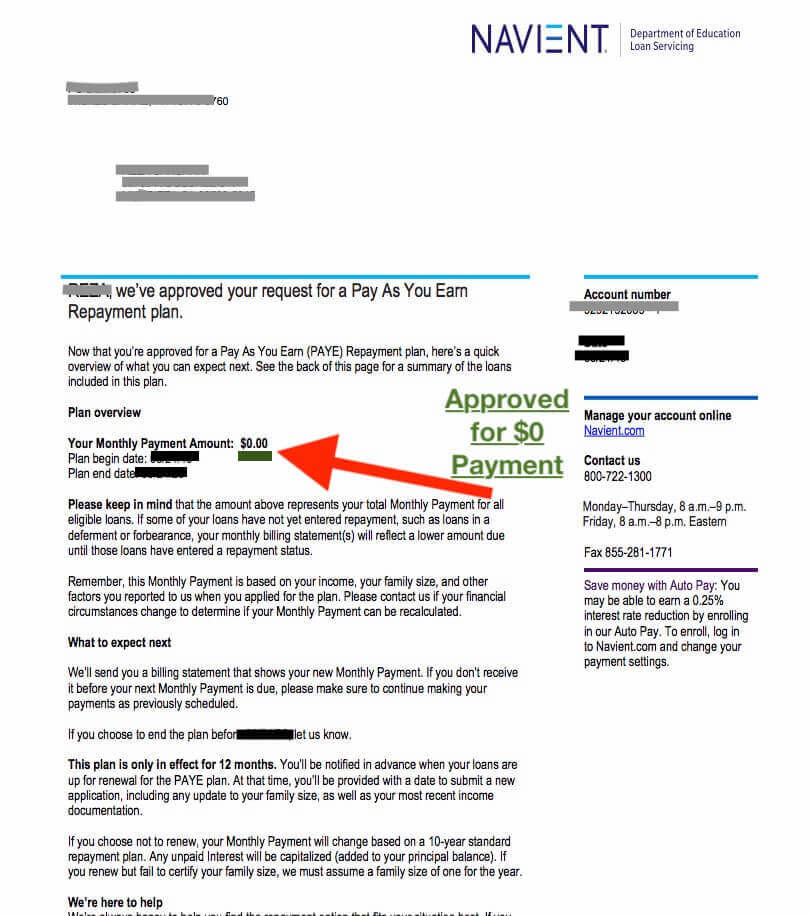

Example of the Pay As You Earn (PAYE), one of the most popular student loan repayment plans.

If you get approved for the PAYE plan, you would have to make 240 payments of $65.92. After your 240th payment, your remaining balance would then be forgiven — meaning, you don’t have to pay it!

Every year you have to prove your income. If your income goes up, you will need to select a new plan that may result in a higher payment.

WARNING:

If you forget to recertify or incorrectly fill out the application — you can quickly get kicked out of the program and lose your loan forgiveness.

You can see some of the options, such as the standard student loan repayment plan, don’t offer student loan forgiveness.

Only the income-based student loan relief programs offer student loan forgiveness.

For Student Loan Relief Assistance, CALL TOLL-FREE 1-866-376-9846

Student Loan Forgiveness Public Service (AKA: The Public Service Loan Forgiveness (PSLF Program)

If you work over 30 hours per week in a “public service job,” such as teachers do, you can have your loan balance forgiven after only 120-qualified payments. For everyone else, you must wait 20-25 years. However, soon, this could change. During the Trump Administration, new legislation is being discussed that could offer loan forgiveness for everyone in only fifteen years.

The most significant mistake students make is that they forget to fill out this form validating that they have a full-time public service job.

Step 1.

Your first step is to consolidate your federal student loans into one student loan.

Step 2.

Get approved for a repayment plan that fits your budget.

Step 3

WARNING: Thousands of qualified consumers won’t be getting student loan forgiveness on the public service program because they forgot to fill out that form each year!

What jobs qualify as public service jobs?

Public service jobs include:

- If you work for the government at a state, local or federal level.

- If you work for a 501(c)(3) non-profit company.

- Ask your employer!

Examples of public service jobs include:

- Teacher

- Americorps or Peace Corps Volunteer

Private Student Loan Forgiveness

A bank or private lending institution funds private student loans, and therefore, private student loan forgiveness is not something offered through the government.

Private student loans CAN BE reduced and settled in a debt relief program. Learn how debt relief programs work by visiting this page next.

For Private Student Loan Relief Assistance, Call TOLL-FREE (866) 376-9846.

Obama Student Loan Forgiveness Act of 2016

The Obama Student Loan Forgiveness Act of 2016 is another name for the William D. Ford Direct Loan Program. This William D. Ford Direct Loan Program (FDLP & FDSLP) enables students to consolidate federal student loans — with a low-interest loan. The William D. Ford Act was passed right after the Health Care and Education Reconciliation Act of 2010.

Student Loan Forgiveness for Teachers

Let’s use this same image again.

Look at the column labeled “Months in Repayment.” Notice that it says — after 240 payments on the Pay As You Earn and Income-Based Repayment Plan is when a student can qualify for student loan forgiveness.

Again, to qualify for PSLF, you must prove you work full-time in public service (over 30 hours per week) when you sign up, and you must verify your employment every year for ten years.

To play it safe, we recommend you submit this form every year.

Trump Student Loan Forgiveness

As of 2017, there is no such thing as the Trump Student Loan Forgiveness Program. Many people call Golden Financial Services asking about this type of program, but it does not exist.

Laws could change now that Donald Trump is President, so we recommend you take action quickly and consolidate your student loans as soon as possible. Get on a repayment plan that potentially can give you the most significant amount of student loan forgiveness.

What to do if you are behind on student loan payments

Student loans are the one type of unsecured debt where the creditor can garnish your wages without first having to take you to court.

Don’t be late, and if you are new – take immediate action towards resolving your student loans.

The good news is–You can quickly resolve the balance owed and consolidate your loans.

Step 1

Request 90 days forbearance from your student loan servicers — giving you enough time to consolidate.

WARNING:

The forbearance will put your balance to zero, but interest will continue accruing each month — which is why we recommend only requesting 90 days worth of forbearance.

Step 2

Consolidate your loans. Visit StudentLoans.Gov to consolidate on your own, or contact Golden Financial Services for a free debt relief quote at 1-866-376-9846.

Step 3

Get on a repayment plan that offers you the lowest monthly payment and the most student loan forgiveness. APPLY ONLINE

Student Loan Debt Relief & Forgiveness Disclosures:

Not all states have the same rules and regulations, and programs vary from state to state. For example, learn about the new debt relief programs in Alabama.

Student loan relief programs do come with fees.

Golden Financial Services is not the government or affiliated with the government.

Students must make all of their qualified payments before being eligible for student loan forgiveness.

One comment on “Student Loan Forgiveness Help”