Summary of Iowa debt relief programs Post COVID-19

Best Iowa Debt Relief, Settlement, and Consolidation Programs

Iowa debt consolidation programs offer you a way of combining monthly payments into a single payment and reducing interest rates on all types of accounts, including credit cards. Debt settlement programs in Iowa are another option to reduce unsecured debt or credit card balances, but this plan negatively affects credit. Iowa debt relief programs also include debt validation. A validation program uses consumer protection laws to challenge the validity of a debt, similar to how a person could dispute a speeding ticket and get it dismissed. In many cases, validation can successfully invalidate a debt so that the consumer doesn’t have to pay it and can have it removed from credit reports entirely.

Lastly, Iowa non-profit consumer credit counseling programs can consolidate credit card bills into one monthly payment with less interest. Still, this plan takes about five years to complete, similar to how long it takes to complete a chapter 13 bankruptcy repayment plan. There is a multitude of ways available to consolidate debt. Iowa residents can choose between any of the options mentioned above. Just remember, all options include pros and cons no matter what company you use.

What’s the right option for you?

- Get a free consultation from a debt counselor in Iowa. Debt relief programs will be explained during the consultation, including a detailed breakdown of the benefits and downsides of each plan. Call (866) 376-9846.

- Find out what programs you’re eligible for.

- Enroll in the program of your choice.

What’s different about Golden Financial’s debt relief programs in Iowa?

Golden Financial Services can structure a debt relief program that fits your needs and goals. We don’t just offer one program.

We use a multi-stage approach to help consumers get out of debt and improve their financial situation. For example, we will start by using debt validation, and only if an account is validated would we then use debt settlement. Iowans can also use student loan relief options to help them consolidate federal student loans and get approved for one of the federal income-based student loan relief programs.

If your goal is to get credit repair, debt relief programs include credit restoration for no additional cost.

We’ve been in business since 2004.

As of 2021, we’ve maintained less than one complaint per year at the BBB and an A+ rating. Programs include a money-back guarantee. Check us out online to see what clients have to say, and you’ll find most of the reviews to be 5-star rated.

Who qualifies for Iowa debt relief programs?

You must owe above $7,500 in total unsecured loans, credit cards, medical bills, or third-party collection accounts. The minimum monthly payment required for Iowa debt settlement and consolidation options is $250.

From Cedar Rapids to Des Moines, Iowa, debt relief programs in all of these areas are the same. As long as you reside in Iowa, you are eligible.

Qualification Guidelines for Debt Consolidation in Iowa

The simplest way to consolidate debt in Iowa is to pay off high-interest debt with a low-interest consolidation loan. Any less than a 730 FICO score won’t qualify you for a low-interest debt consolidation loan. But don’t stop reading yet; there is good news to come.

Is your credit score under 730? Don’t worry; you have options.

You could qualify for consumer credit counseling, settlement, and validation programs.

If you’d prefer to pay your credit cards in full and have a high credit score, consider a credit card consolidation loan or using our free snowball calculator tool.

Call to check Iowa debt relief eligibility now at (712) 266-3747.

Debt Settlement Iowa Programs Can Lower Credit Scores

Iowa debt relief & settlement plans are hardship programs. Meaning, you have to stop paying creditors every month. Credit scores can temporarily decline before each debt gets resolved, which is the main downside to debt relief programs.

Do any Iowa debt relief programs include credit restoration?

To help combat bad credit, qualified Iowa applicants are offered free credit restoration included with the debt validation program. Part of the credit restoration includes you being granted an installment loan to rebuild your credit score by illustrating positive payment history.

How to remove a debt from credit reports

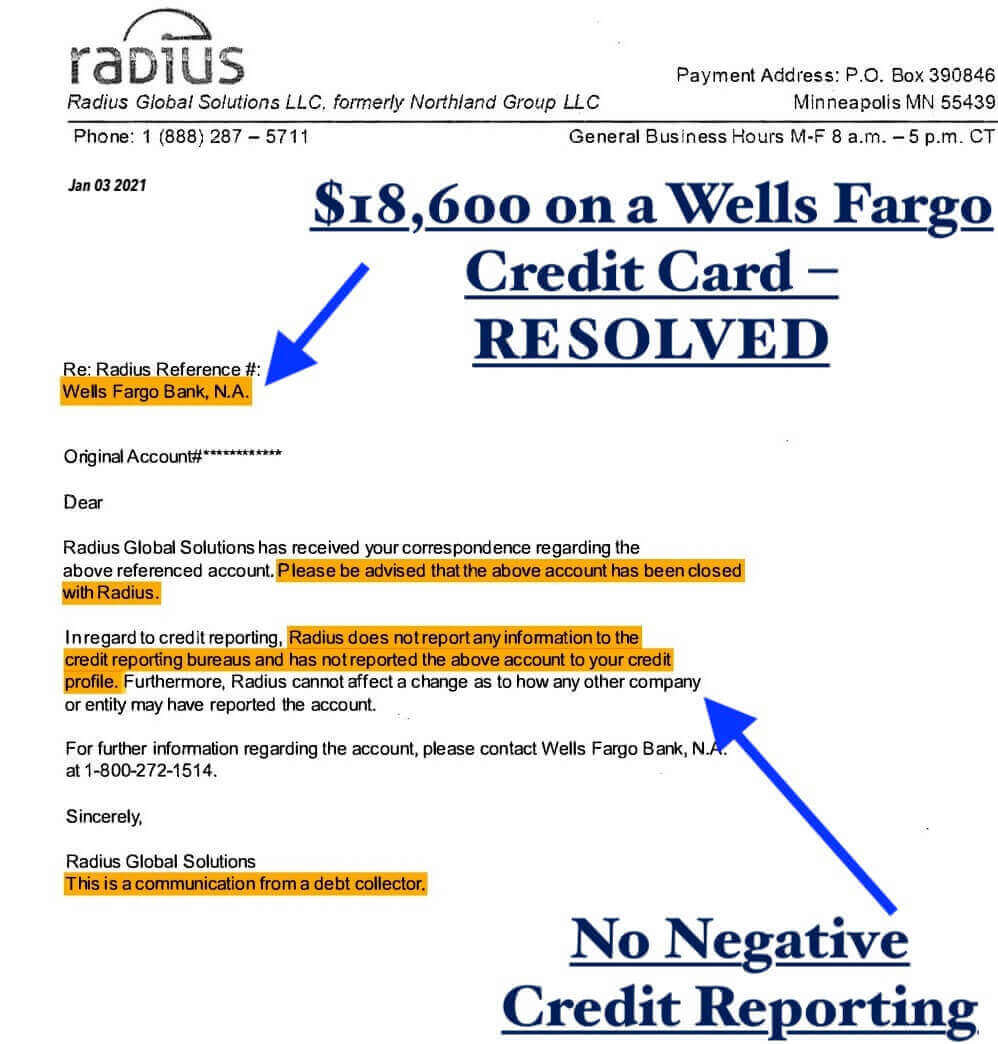

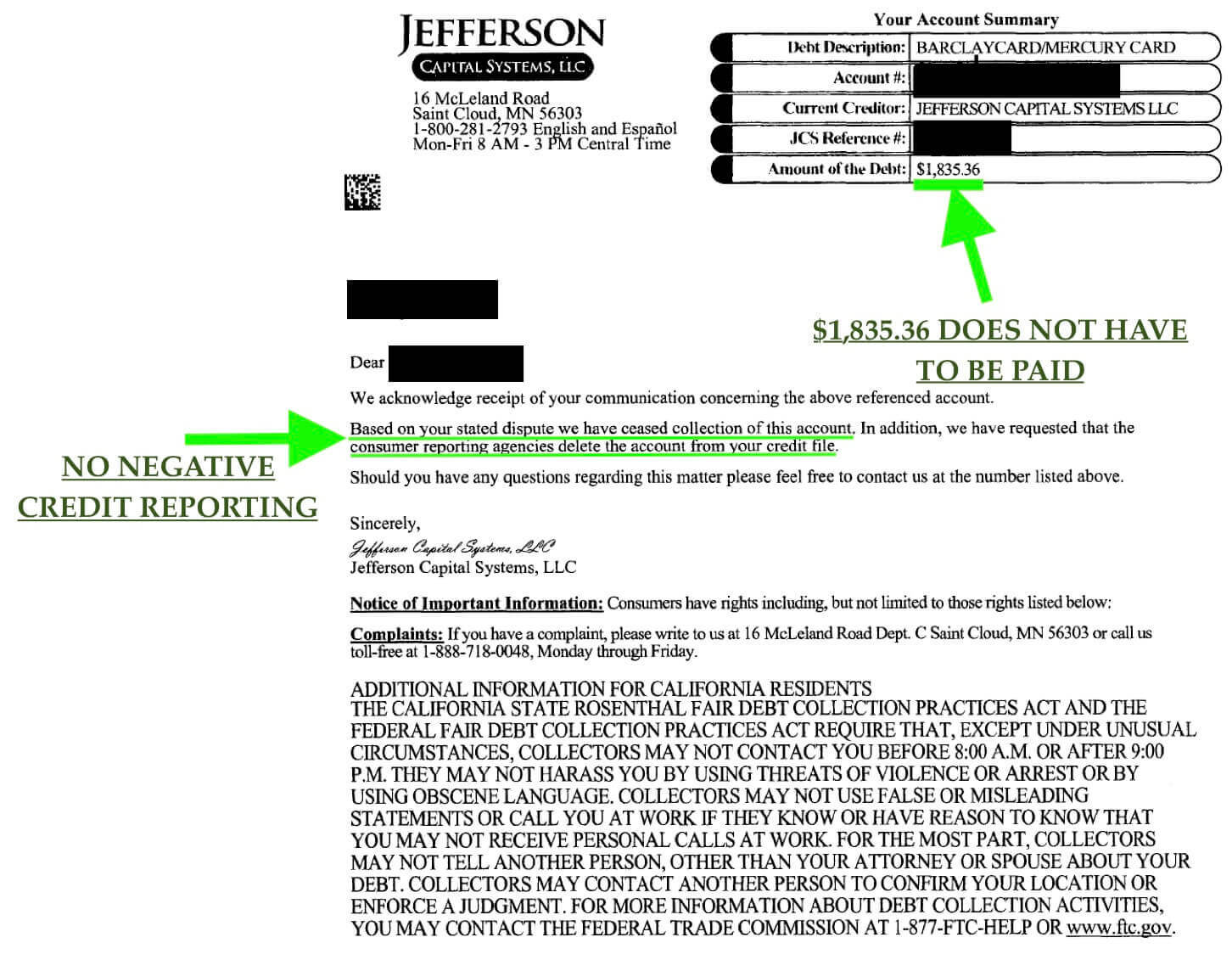

If any debts get disputed on the validation program and proven to be legally uncollectible, by law, debt collection companies can no longer report these debts on a person’s credit report. The credit restoration program will dispute these accounts, requesting they get removed from all credit reports. Here is a debt validation example letter (was a credit card debt): the collection agency agreed to remove the debt from the consumer’s credit report and stop collecting on the debt.

Should I settle a Capital One or Wells Fargo credit card? Before settling most credit card debts, validation can dispute it. Worst case scenario, settlement can be used to resolve the account if the validation doesn’t work. You may not have to pay the debt in the best-case scenario and could get it removed entirely from credit reports. Keep in mind; financial hardship programs can only work for consumers that are delinquent on credit card payments because accounts must go to third-party collection status before being negotiated or disputed.

What does Golden Financial Services offer Iowa Residents?

Golden Financial Services will try to help you avoid having to resort to debt settlement and bankruptcy.

If you have debt collection accounts, we will recommend using debt validation before settling because, most of the time (in our experience), collection agencies can’t prove that they are legally attempting to collect on the debt. They either have inaccurate records, can’t produce all of the legally required documentation, or decide it’s easier to agree to stop all collection efforts. As a result, legally you no longer have to pay the account. And not only that, but also the collection agency can no longer legally report the debt on your credit report.

You are not at the end of the road. You have options to turn to. Golden Financial Services is here to help you find the best debt relief option based on your specific needs. We will make it easy for you to get debt relief. Iowa residents can choose from multiple plans. Let’s take a closer look:

Iowa Debt Consolidation Programs Include:

- consolidate debt with a loan (creditors are paid in full, and you stay current on monthly payments, improving credit scores in many cases)

- reduce credit card interest rates with consumer credit counseling (late payments can get re-aged to show “current,” and you stay current on monthly payments, not hurting credit scores)

- settle almost any type of unsecured debt for less than the full amount owed with debt settlement (temporary negative effect on credit)

- use debt validation to challenge the validity of a debt, where you may not have to pay it (temporary negative effect on credit)

These are all options to help with debt, but technically speaking, “consolidating” is using a loan.

Credit card settlement, validation, and consumer credit counseling programs don’t pay off your debt with a loan.

Are You Drowning in Debt? Dial Us and be Rescued! IAPDA Certified and Accredited Iowa Debt Counselors are Here to Help. Call (712) 266-3747.

What can Golden Financial Services offer Iowa residents?

Golden Financial Services provides you with multiple plans to choose from. You get the power to make a choice based on what suits you best, not what suits the debt relief company or your creditors best. Our mission is to: “Provide our Iowa clients with the highest standards of debt elimination and management solutions for a debt-free tomorrow.”

If you live in Iowa and need a reduction in your monthly payments or want to get out of debt faster, you can start by getting a free consultation.

Benefits of Iowa debt relief, settlement, and consolidation programs

These are the benefits in general that you could receive from any of the programs we offer, but remember each program is different.

- balances can be reduced on credit card debt, medical bills, personal loans, and any unsecured debt

- could pay zero dollars in interest

- student loans can be consolidated and a portion of the balances forgiven

- get a single and affordable monthly payment to take care of all debts

- be debt-free in 24-48 months

- Iowa debt relief plans even come with credit restoration (for no extra cost)

Iowa (IA) Debt and Financial Statistics

— Rated the 9th best state in the nation for its “Financial Health.”

— The state of Iowa owns more than it owes.

— The average credit card debt for an Iowa household is only $6,696, compared to Alaska with $13,048. Alaska is currently the state with the highest credit card debt. The average credit card debt in Alabama was $7,105, and in Illinois, $7,278, these two states came up right around the middle on the list of states with the most credit card debt.

— Iowa is the state with the least credit card debt in the nation. The average credit card debt per household in Iowa is close to 50% less than the rest of the nation.

— The average student loan debt per student in Iowa is $29,732, which is actually on the higher side compared to all of the other states.

What do most Iowa consumers do for Debt Relief?

Iowa debt relief, consolidation, and settlement programs include credit card debt negotiation, debt relief & consolidation services.

These are the preferred debt relief options that Iowa residents turn to.

Let us help you be amongst the other people living in Iowa who we’ve helped become debt-free! Call 866-376-9846 now!

Now — we will walk you thru each debt relief program. Iowa consumers have several outstanding options available for 2018 and beyond…

1. Debt Settlement in Iowa

Iowa Debt negotiation, also known as debt settlement services:

Debt settlement services can allow you to pay off your unsecured debt in anywhere from 3-4 years on average and pay a significant amount less than the total owed on each account. This program is for the person who has a financial hardship and cannot stay current on their accounts. Once you stop paying on your credit card accounts and join this program, all of your creditors are immediately contacted and alerted that you are in the program. You will be represented by a BBB A+ rated debt settlement law firm in Iowa.

As you make monthly payments, your creditors are paid in one lump sum payment after enough money accumulates in your trust account. With debt settlement services, creditors agree to accept a significant amount less than the full balance owed to resolve each debt. There is no guarantee on how much creditors will agree to settle at; companies only can provide you an estimated savings quote with debt settlement. Iowa and federal laws prohibit companies from charging up-front fees for a settlement program. The amount of debt that gets forgiven (i.e., your savings) could be considered taxable income.

You make one payment each month into your trust account; when enough money accumulates to pay your creditor at the reduced amount, you must then authorize the payment. Each creditor gets paid off one by one until you’re debt-free.

Benefits of debt settlement Iowa residents can receive

- pay less than the full amount to get out of debt

- a single low monthly payment for all accounts

- debt-free in 3-4 years

- avoid bankruptcy

Downsides of debt settlement

- creditors could issue a summons to take you to court over an unpaid debt

- there is no guarantee creditors will settle, although they usually will

- IRS potential tax consequences

- negative effect on credit scores

- balances increase over the first year of the program due to late marks and collection fees

2. Most Popular Debt Relief Program in Iowa

Debt validation programs dispute third-party debt collection accounts, forcing third-party debt collectors to prove they’re abiding by all of the federal laws, including the Credit Card Act, Fair Debt Collection Practices Act, Fair Credit Reporting Act, and the Truth in Lending Act. The debt validation program comes with a 100% money-back guarantee and credit repair. If successful, a debt validation can be the least expensive debt relief program. For free, Iowa consumers can find out if they qualify for this type of program by calling Golden Financial Services at 1-866-376-9846.

If the debt collection company can’t prove they’re following all of the state and federal debt collection laws — they must stop collection on the debt immediately and can no longer report the information on your credit report. In some cases, debt collectors remove any late or collection marks that hurt your credit score after the debt is invalidated. With debt validation, you get credit repair included for no extra cost.

What if debt validation doesn’t work?

If your creditors and third-party debt collectors prove they are abiding by federal laws (i.e., prove they are legally authorized to collect on the debt), your debt can be settled as a last resort. At Golden Financial Services, we will connect you with the best debt validation agency in the nation. If your debt needs to be settled, our program will help you settle the debt so that you’re not left on your own trying to figure out what to do. Our affiliated customer service departments across the nation will stay in touch with you each step of the way until you’re debt-free.

Our IAPDA Certified debt counselors will help you to enroll in whichever plan offers you the maximum savings. With debt settlement, you could end up paying back a significant amount less than the full balance owed on each account. We’d prefer to see you start with validation because it’s potentially a less expensive and more beneficial route.

Benefits of debt validation

- get a single monthly payment to deal with all unsecured third-party collection accounts

- pay less than what you owe for the cost of the program and nothing else to creditors

- potentially get the collection account and late marks removed from credit reports

- money-back guarantee included

- credit restoration included

- potentially the least expensive route to dealing with collection accounts

- no tax consequences or penalty like with debt settlement programs in Iowa

The downside of a validation program

Since your creditors don’t get paid on a monthly basis, creditors can issue a summons, and like with debt settlement credit scores are adversely affected over the first year of the program. If you do receive a summons while on a validation program the account can be settled for less than the full amount to resolve the debt.

Iowa consumers can call 866-376-9846 and get a free debt relief program quote now.

If you’re current on your payments when joining an Iowa debt relief program — your credit score will most likely go down, but you can rebuild your credit score upon graduation from the program. Keep in mind, with debt validation; you get free credit restoration included.

3. Iowa Credit Counseling

Iowa Consumer Credit Counseling programs will cut interest rates on credit cards and combine monthly payments into a single payment. Iowa non-profit credit counseling companies are a safe bet if you’re only looking for a reduction in interest rates. Iowa credit counseling companies have pre-established relationships with almost all major credit card companies, including Bank of America, Chase, Citibank, and even Discover. Most debt relief companies have difficulty working out a deal with Discover.

Discover is willing to work with a consumer credit counseling company because they know they’ll be paid the entire debt back.

You will pay your full debt amount back, but less interest, after getting approved for an Iowa non-profit consumer credit counseling program.

Always ask the company what lenders are willing to reduce the interest rates and which ones are not. Sometimes a less reputable company will fail to tell their clients what creditors didn’t agree to reduce the interest rates, so make sure to ask this detail.

Besides having to pay your entire debt back, plus interest;– another downside to Iowa debt consolidation and consumer credit counseling programs is that it shows up on your credit report as a “CC” or “CCC” — which illustrates that you needed assistance with paying off your debt. Future lenders see that you were on a consumer credit counseling program, and because of that — they may not issue you credit.

Iowa consumer credit counseling Benefits

- no initial negative effect on credit

- allows you to stay current on payments

- debt free in under five years

- pay a single monthly payment for all credit cards

- save money on interest rates

Iowa consumer credit counseling Downsides

- must pay entire credit card balance back

- must pay interest and consumer credit counseling fees

- credit is negatively affected due to credit cards being closed out

- credit report illustrates the consumer needed a consumer credit counseling program to pay off credit cards

4. Debt Consolidation Iowa

Debt consolidation for credit cards is when you use a loan to pay off multiple credit card debts. You can obtain this type of debt consolidation loan at a local credit union bank or online financial company (Fintech).

The point of a consolidation loan is to cut interest rates by replacing your current debts with a low-interest loan. Iowa residents prefer debt consolidation over debt settlement due to the lesser negative impact on credit scores when using debt consolidation. Iowa residents who are experiencing financial hardship will rarely qualify for a consolidation loan due to strict credit requirements from banks, which is why debt relief alternatives are so much more popular than debt consolidation help, not by choice but because consumers can’t qualify to consolidate credit cards in most cases.

Most Iowa residents get rejected for a debt consolidation loan due to a low credit score and a high credit utilization ratio. Your credit report could be flawless, void of any inaccuracies, negative marks, and perfect payment history. Still, because your balances are close to maxed out, no bank is willing to approve you for a debt consolidation loan. Iowa debt relief programs, including settlement and validation options, don’t require a person to have a certain credit score, and bad credit won’t get a person denied for approval.

What’s the Best Iowa Debt Relief, Settlement & Consolidation Company?

- Golden Financial Services has been assisting consumers in Iowa since 2004 with debt consolidation, settlement, and financial relief programs.

- A+ rated with the Better Business Bureau and Voted #1 Debt Relief Company by Trusted Company Reviews

- Our program includes 24/7 online account tracking, monthly updates, award-winning national customer service department.

Call us 866-376-9846

Our goal is to get you out of debt fast and make you feel comfortable every step of the way. We teach you about the ups and downs of the program, what to do when certain situations occur and what to watch out for ensuring that debt collectors are not violating your rights. In the welcoming package, we will provide you with educational material and information on debt collector laws. Our customer service department will also go over all of this information during the welcoming aboard phone call.

We teach you about the downside and upside of each program, what to do when certain situations occur and what to watch out for ensuring that debt collectors are not violating your FDCPA rights.

We are proactive. If a debt can’t be disputed, it will be settled. If a creditor issues you a summons, we resolve it right away. If you have student loans and credit card debt, we know how to separate the two and ensure everything gets properly addressed since it can’t all be lumped into one Iowa program. We prepare you ahead of time to deal with any potential issues that could arise during the program to ensure that you are successful and ultimately become debt-free.

Do you have any of these fears holding you back from joining a debt relief program?

– Afraid of paying high fees and not getting results? Our debt settlement program and student loan assistance fee is already included in your payment on both debt relief programs, not extra, and we only earn it when your debt is resolved.

– Are you afraid that there is no guarantee on this type of program? Ask, and Golden Financial Services will give you a 100% Money Back Guarantee on one of our debt relief programs. We have programs that include either an attorney and legal protection or no attorney but with a 100% written guarantee.

– Afraid to get sued? My credit card company may sue me, right? On average less than 3% of the credit card companies will sue our clients after their programs begin. If one of your accounts is one of the 3% or less who receives a summons, we can refer you to an attorney to resolve it. You would get credited for that account, not having to pay anything extra. We have you covered in every possible way.

– You can be confident in our services knowing that our company is A+ rated with the BBB and has NO complaints after 15-years of providing debt relief in Iowa.

– Afraid your credit will be negatively affected when you stop paying on your accounts. You will be fully educated on credit, and we will teach you how to rebuild your credit score. Plus, credit restoration can be included.

– Are you afraid that a debt relief company will sell you on a program to make money and then giving you a biased presentation, just trying to sell you on their product?

At the Iowa Debt Relief Golden Financial Services Office –– you get to pick the program of your choice out of all the debt relief programs. Iowa debt settlement, student loan relief, consumer credit counseling, and debt validation services are all available. We try to present all debt relief options for consumers to best serve people in Iowa. Not one program is right for everyone. When contacting Golden Financial Services, an experienced and IAPDA Certified debt specialist will evaluate and review each option, helping you to determine what the best program for you will be. We have aligned ourselves with different attorneys and highly BBB-rated companies all across the United States, making sure that you’re in great hands no matter what option you decide on.

Call 866-376-9846

See Iowa debt relief program disclosures by visiting this page next.

Learn about debt relief programs in other states:

National hardship debt relief program, Arizona debt relief, California debt relief, Florida Debt Relief, Maryland Debt Relief, New York Debt Relief, Georgia Debt Relief, Texas Debt Relief, San Diego Debt Relief, and Wisconsin Debt Relief.

Sources:

State Data Lab, http://www.statedatalab.org/state_data_and_comparisons/detail/iowa, August 7th, 2017

Iowa House of Republicans, http://www.iowahouserepublicans.com/iowa-tops-list-of-most-debt-free-states, August 7th, 2017

Value Penguin, https://www.valuepenguin.com/average-credit-card-debt, August 7th, 2017