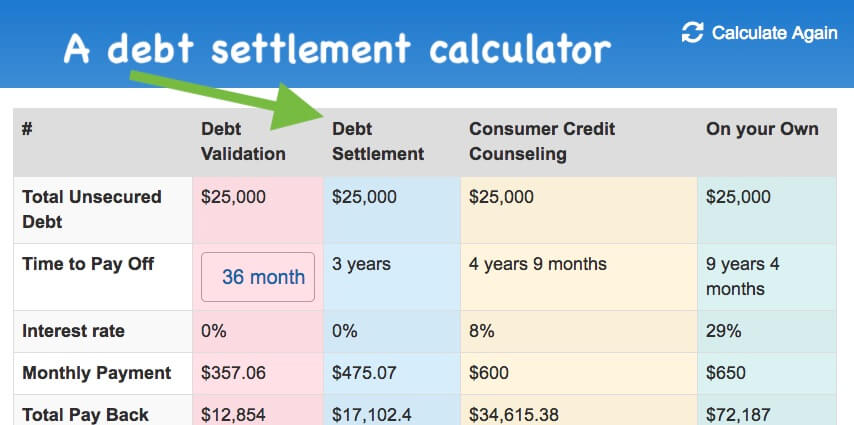

This debt calculator allows you to compare four options to pay off debt. Compare the cost of consumer credit counseling, debt settlement, paying minimum payments, and debt validation. This is a debt relief program calculator, but can also be used to pay off accounts faster on your own by adjusting the interest rate and monthly payment. After trying this debt calculator – you may also want to try the debt snowball calculator tool here. It’s important to understand all of your options to pay off debt and save money.

Here’s how to use the debt relief calculator:

- 1. Enter your total debt amount

- 2. Enter a monthly payment that you can afford to pay (it can be more or less than your credit card minimum payments)

- 3. Enter the average of your interest rates (just an estimate)

- 4. Hit “Calculate Debt” and let the calculator works its magic!

Before using the debt calculator below, please review these disclosures: 1) This calculator will only provide you an estimate of what you can save on each debt relief program. To get an exact figure and check eligibility, you will need to speak with a debt counselor at (866) 376-9846. 2) To qualify for a program, applicants must owe above $7,500 in total debt 3) $250 is the Minimum Payment that we can offer a person on any of the programs.

Whether you want to use the debt snowball method or a debt relief program, the calculator above gives you a summary of all options. After using the calculator, if you are still unsure of your best option, take a step back and start by creating a budget analysis. After you create your budget analysis you’ll have a clear idea of what you can truly afford to pay, and you’ll be able to figure out at that point what your best option is. This free budget tool will help you figure out your quickest path to becoming debt-free.

CALL TO ENROLL IN A PLAN AT (866) 376-9846

Debt Relief Calculator Features:

- Debt snowball calculator

- Debt service calculator

- Credit card reduction calculator

- Debt consolidation calculator

- Consumer credit counseling calculator

- Debt settlement calculator

- Minimum payment calculator

***Disclosure: There is no guarantee that a person will qualify for one of these debt relief options. The calculator is only providing you with an estimate of what you could save on each plan. The only way to guarantee eligibility for one of the programs offered by this debt calculator tool – is to call and verify your eligibility at (866) 376-9846 by an IAPDA Certified Counselor. To qualify for a debt relief program, your payment cannot be under $250. The calculator may show you a payment of less than $250, but due to new program restrictions, “payments under $250 will no longer be accepted“. If you need credit repair, the calculator will not show you a credit repair quote, but you can call (866) 376-9846 and be referred to a licensed credit repair company in your state.***

Confirm Debt Relief Calculator’s Quote at (866) 376-9846

Common Reasons to Use a Debt Relief Calculator

A. Compare debt relief programs

OR;

B. LEARN the best way to pay off credit card debt

But additionally, you can use this debt calculator tool to;

- See how much money in interest you would pay if continuing to pay minimum payments, based on your “average interest rate.”

- Compare your estimated potential savings on a debt settlement, consumer credit counseling and debt validation program. Evaluating each debt relief option — helps you to determine what debt relief program is right for you.

- Learn the best way to pay off credit card debt. (without using a debt relief program)

Debt Snowball Calculator

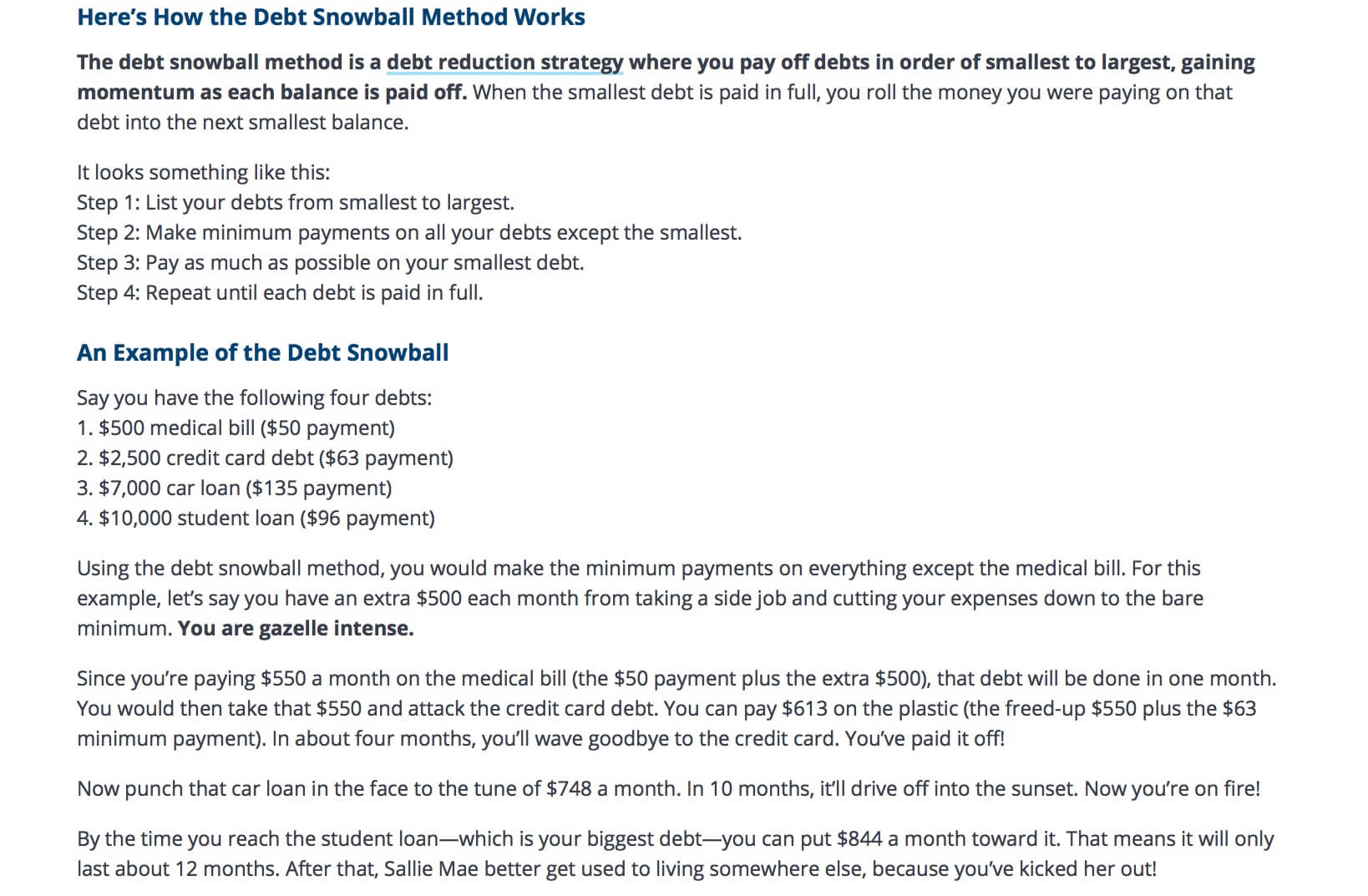

The debt snowball method of paying off debt is an effective method, but it only uses “estimates.” Our debt calculator allows you to integrate a more scientific approach into the equation — seeing exactly how much you can save, rather than just estimates.

Here’s how the Dave Ramsey method works–explained by Dave Ramsey himself!

The only problem with Dave Ramsey’s debt snowball method is that he says; “in about four months you’ll wave goodbye to the credit card”.

Our debt calculator takes the “about” out of the sentence and allows you to see exactly how fast you will pay off a debt.

Example of how to use the debt calculator to pay off a debt with the debt snowball method:

If you’re planning to use the debt snowball method … let’s suppose you can pay $800 per month on your first debt–until it’s paid “in full.”

Plug in your total balance on that first account, its interest rate, and then $800 into the “monthly payment that you can afford”–and hit calculate.

Now you can see exactly how long it will take to pay off that first debt and what you will pay/save in interest. The debt relief process becomes more efficient when you use a scientific approach.

Debt Validation on the Debt Calculator

Debt validation is a program that aggressively disputes each of your debts.

On a debt validation program you don’t pay back your debt, what you would be paying are only “program fees.”

Similar to how you would pay a lawyer to fight a speeding ticket.

If the lawyer wins, you pay nothing besides the attorney fees… no points go on your license, you don’t have to take any online class, your insurance premiums stay the same — and you’re free!

Debt Validation Pros:

- Harassment stops.

- You get a written guarantee. (Only pay if results are achieved)

- The only program that includes credit repair, disputing invalidated accounts from credit reports.

- Negative marks can be removed from credit.

- The fastest and least expensive program to resolve your debt.

Talk to an IAPDA Certified Debt Counselor Toll-Free 866-376-9846

Debt Validation Cons:

- Creditors can sue a person if they stop paying their monthly payments.

- If you have “good credit,” your credit score could take an initial hit before getting successful results with validation.

- Debt could be validated and would then need to be paid.

Debt Settlement Calculator

Debt settlement is where credit card debt balances are settled for less than the total amount owed. On a debt settlement program, you get set up with one monthly payment to take care of all your debt.

The debt settlement portion of this calculator is based on the “average settlement rate and fees” for debt settlement companies across the nation. Fees are already included in the calculations.

On average, debt settlement companies can lower your debt by about 50%. After adding fees into the equation, consumers end up paying back around 75% of what they owe, getting a 25% savings.

At Golden Financial Services debt settlement can save a person more than 25% of their total debt because fees are less expensive compared to other companies.

Debt Settlement Pros:

- You can settle a large debt for less than the balance owed.

- You get one simplified monthly payment to take care of all debts.

- You can become debt-free in half the time, compared to when paying minimum payments.

- You can save more money on debt settlement than on consumer credit counseling.

Debt Settlement Cons:

- Creditors can sue a person if they don’t pay their bills.

- Credit remains negatively affected for up to 7-years.

- There could be tax consequences to deal with (IRS considers the amount forgiven when a debt is settled, as your “savings,” which is also classified as “income.” There are simple IRS forms that you can fill out to help you avoid having to pay any taxes on your savings, as it’s not truly earned income if you’re an insolvent individual.)

- Not all creditors have to settle.

- Interest and late fees will incur–on top of your original balances when enrolling in the program.

Consumer Credit Counseling Debt Calculator Tool

Our consumer credit counseling portion of the debt calculator is based on figures from a non-profit consumer credit counseling company.

Consumer credit counseling programs reduce interest rates and consolidate payments into one.

Your creditors continue to get paid each month, but at a reduced interest rate.

Consumer Credit Counseling Pros:

- Debt-free in under 5-years, faster than if you continued paying minimum payments.

- Only one consolidated payment each month to worry about.

- You stay current on payments, avoiding any type of creditor harassment and serious damage to credit reports.

Consumer Credit Counseling Cons:

- Third-party notation goes on credit illustrating you joined a consumer credit counseling program.

- Takes 4.5 to 5-years to complete, versus 2 to 3.5-years with debt validation and debt settlement.

- The payment stays around the same as what it was when paying only minimum payments.

- Only credit card debt qualifies.

We hope our Debt Payoff & Debt Relief Program Calculator Tool has helped you to find a more cost-effective way to pay off your debt in a faster time frame. If you have a WordPress Website, Try Our 5-Star Debt Calculator WordPress Plugin.