If you can’t afford to pay your bills in full, what options do you have?

- file for Chapter 7 Bankruptcy (BK)

- file for Chapter 13 BK, where at least half of your debt gets paid back

- ignore the debt altogether, ruining credit for 7-10 years and possibly get sued

- join a debt settlement program and settle all debts paying only around 70% of your total debt

- dispute unsecured debt with debt validation, perhaps not having to pay it back and getting it removed from credit

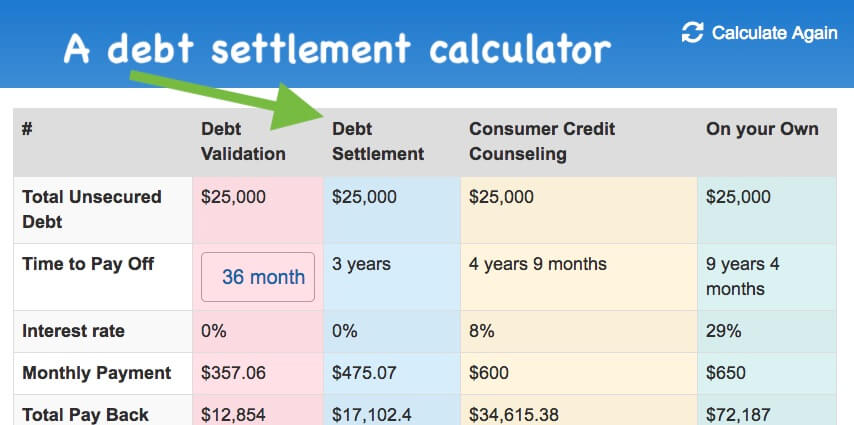

Debt consolidation and consumer credit counseling programs won’t lower your monthly payments, compared to when paying minimum payments on your own. If you genuinely can’t afford your monthly payments, your best options are debt settlement and validation.

If you can afford to pay minimum monthly payments but need your interest rates reduced, consumer credit counseling and debt consolidation could help.

Depending on how your budget looks will determine what your next best step will be. Try this free budget calculator to help you figure out what your next best step will be. You can also get a free consultation right now with an IAPDA certified debt counselor by simply calling (866) 376-9846. Through Golden Financial Services you have the power to choose from multiple debt-relief options, depending on which plan offers you the lowest possible payment. Enroll with ease!

Often, consumers believe that they can’t afford to pay above the minimum payments. However, after creating a budget analysis, they find money that they didn’t even know they had. It is important to try to avoid falling behind on monthly payments because it can take years to rebuild your credit score.

What is a debt settlement program?

A debt settlement program is for a consumer who can’t afford to pay their unsecured debts in full. According to Wikipedia: Debt settlement, also known as debt negotiation, arbitration or credit card debt settlement, is an approach to debt reduction in which the debtor and creditor agree on a reduced amount that will be considered as payment in full.[1] During a debt negotiation period, all monthly payments by the debtor are made to the debt settlement company, not paying the creditors on a monthly basis.

Do debt settlement programs work?

In order for a debt settlement program to work, first, you have to stop paying your monthly payments so that accounts go delinquent.

After 4-6 months your original creditors will write off all of the debts.

Accounts then get sold to collection agencies for around 10-20 cents on the dollar.

Don’t worry; your creditors always get paid back! The reason creditors write off a debt is so that they can show it as a loss on their balance sheet, getting reinbursed for the debt through tax credits.

A debt settlement program then comes in and settles that debt for around half, before debt settlement program fees get charged.

Debt Settlement Program Fees and Costs

Debt settlement programs cost between 17%-30% of the total debt enrolled. The debt settlement program offtered by Golden Financial Services charges 17% of the total debt enrolled, which costs less than what most debt settlement programs charge.

It is illegal for debt settlement companies to charge fees up front, before settling a debt. Fees can get drafted into an escrow account but not earned until after a debt is settled and resolved. If a debt does not get settled or resolved all fees are 100% refundable to the consumer. Make sure if you use a debt settlement company other than Golden Financial Services that they do not charge you any up-front fees.

Debt Settlement Program Example

If you owe $20,000 in credit card debt, you could resolve this debt for around $14,000. That $14,000 does not have to be paid today, you can make small monthly payments at $333 per month over 3-4 years.

A settlement program is considered a financial hardship plan. What that means is that it can be personalized to fit your budget. If the $333 per month payment is too high for you, then try stretching your plan out to 48 months. There is no guarantee that at a payment of $333 per month, you’ll be debt-free in 42 months, which is why above I said at a payment amount of $333 per month you’ll be debt-free in 3-4 years.

Reputable debt settlement companies quote consumers conservatively and base the quote on past client results, often performing better in the end. If you save extra money in the end, that money is yours to keep, and you’ll finish the program faster than what you were quoted!

How much does debt settlement affect your credit score?

Since you have to fall behind on monthly payments, expect your credit score to go down by anywhere from 100-200 points, assuming you are current on payments as of now.

There is no way to give you an exact amount on how low your score will fall. However, credit is rebuildable, and with the money that you can save on a settlement program, it can often be worth the hit.

Is Debt Settlement Really Worth It?

If you can’t afford to pay your accounts in full and don’t qualify for a debt validation program, yes debt settlement programs are worth it. As mentioned above, your other options include bankruptcy and potential lawsuits. Keep in mind, after you sign up for a settlement program, you could still get served with a summons. If a summons is ignored, it could turn into a default judgment. The good news is that Golden Financial Services can set you up on an attorney-based debt settlement program that includes lawsuit defense. If you get served a summons while on the program the law firm will respond to it on your behalf and work to resolve the debt quickly by settling it outside of court.

Often credit card lawsuits are filled with errors and are fraudulent. As a result, it could end up even getting dismissed completely.

Can I buy a house after debt settlement?

You could buy a house after graduating on a debt settlement program, but your interest rate on the home loan will be high. Buying a house is probably one of the best things you could do after debt settlement. The reason why is because paying your mortgage every month will help you quickly rebuild your credit score. As your credit score improves, you can always refinance your home loan in the future to get a lower interest rate.

Should I settle or pay my debt in full?

If you can pay your debt in full, do so! If you are struggling to pay above minimum payments, try using this free budget tool to help you figure out a way to pay more. You can then use this debt snowball calculator to help you pay your debt in full but faster!

Ideally, you want to try to pay your debt in full every month, avoiding 100% of interest and maintaining the highest possible credit score.

Should I hire a lawyer for debt settlement?

Yes, you should have a lawyer included on your debt settlement program for multiple reasons.

- Creditors are required by federal law to contact your attorney, not you, after getting enrolled in an attorney-based debt settlement program. If you don’t have an attorney representing you, the creditors can continue to call you over and over again!

- Attornies can help you deal with a summons if you receive one while enrolled in a debt settlement program

- Attorneys have to abide by strict rules and operate with the highest level of ethics and morals

- Attornies can sue your creditors if they violate your rights (FDCPA violations equate to $1,000 per violation, paid to you!)

How do I rebuild my credit after joining a debt settlement program?

Here are 24 expert tips on how to go from having bad credit, to having excellent credit.