Best Debt Relief Solutions for 2020

Debt relief solutions can provide consumers a path to resolve their debts and improve their overall finances. With credit card companies and student loan servicers charging such high-interest rates and fees, debt relief solutions can rescue consumers from being taken advantage of and ripped off by the banks. In many cases; consumers try to work directly with the banks. Unfortunately; the banks often deny their request to reduce payments, postpone payments, and lower interest rates.

If you are current on your credit card payments but barely able to afford minimum payments, give us a call at (866) 376-9846 — and we can discuss credit card debt relief solutions that are available. Prefer not to use a program? Instead, start by using this free debt snowball calculator.

Debt snowball calculators make it possible to pay off your debt much faster without having to fall behind on payments.

Already behind on payments or have your accounts been sold to a debt collection company?

Working with debt collection companies can be even more stressful, as debt collection companies can be manipulative and act with illegal measures without consumers even realizing their legal rights are being violated. An entirely new set of laws kick in once a debt is written off by the original creditor and sold to third-party debt collection companies. For example; The Fair Debt Collection Practices Act is a law that regulates only third-party debt collection companies.

Third-party debt collection companies can purchase debts for as cheap as 4-cents on the dollar, and therefore; they make many errors not putting the necessary time and care into maintaining appropriate documents and accurate information, making these debts disputable and in many cases — unverifiable.

Find out if your debts can be disputed with a service called debt validation — by calling 1(866) 376-9846. If not, debt settlement services may be your second-best solution for debt collection accounts.

Golden Financial Services studies debt collection and credit card laws, making us your ideal go-to company to assist with dealing with any type of unsecured debt. Solutions range from consolidating student loans to settling delinquent debts. Let’s take a deeper look.

At Golden Financial Services during 2020, there are debt relief programs and options to resolve any type of unsecured debt. Whether you have student loans, lawsuits, or credit card debts, our programs can help you. Unlike other companies, we can provide you a consultation that explains all of your options, and you can then pick which option best meets your needs. Our different debt relief programs are administered through a variety of companies that we work with. There is no — one shoe or debt relief solution to solve all debt-related problems — sometimes it takes several debt relief options to address a person’s overall situation. For example; many clients will need us to consolidate their federal student loans, settle or use debt validation on their private student loans and refer them to a credit restoration company for credit repair.

Millions of borrowers are struggling with growing debts. Golden Financial Services helps you establish a debt-free future by determining the best-unsecured debt relief options and credit card debt relief solutions.

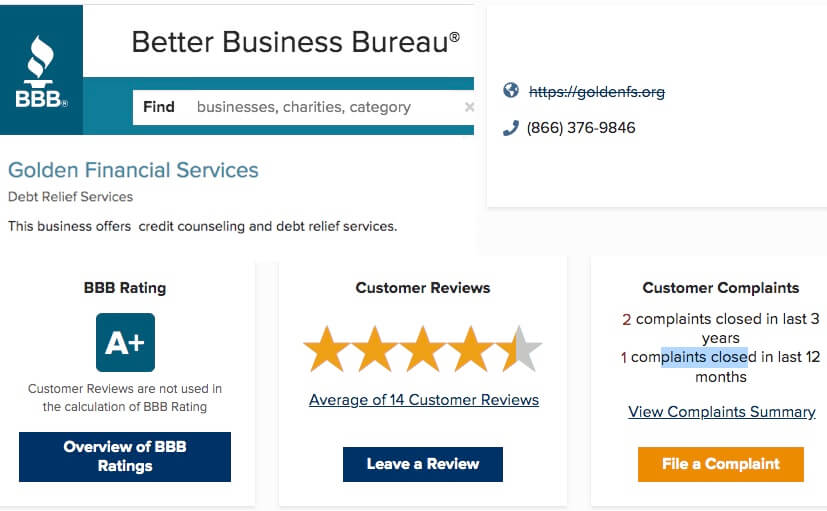

WHO WE ARE — Here is a look at our credentials:

- Has been in the credit card debt relief industry since 2004

- Received an A+ rating with Better Business Bureau

- Has helped over 1.5 million customers with debt relief solutions and financial education programs

- Guarantees free but practical assessment of your financial situation

NEGOTIATING YOUR WAY OUT OF DEBTS DOESN’T HAVE TO BE A SCARY PROCEDURE!

WHAT TYPE OF SOLUTIONS WE OFFER FOR DEBT PROBLEMS – SUMMARY

Golden Financial Services is one of the most trusted debt relief companies in the United States of America. Our Enrollment Specialists and consultants make sure that you get rid of your credit card and unsecured debts in the quickest possible time frame. Our range of services includes:

- Debt Consolidation – a loan to pay off other debts, eliminating high-interest rates and multiple payments.

- Debt Settlement – negotiators work to reduce balances on unsecured debts by negotiating with creditors and third-party debt collection companies

- Debt Validation – a way to dispute debts — proving a debt to be legally uncollectible (as a bi-product of debt validation, third-party debt collection companies can be forced to remove the debts from a person’s credit report if they cannot validate the debt)

- Credit Restoration Options – similar to debt validation — a way to dispute marks on a person’s credit report (debt validation deals with the third-party debt collection companies and not the credit reports)

- Financial Debt Solutions

OUR MISSION

- To reduce the balances on your debts by at least 40% and place you in the program that will help you to achieve your goals.

- To ensure results within 24-48 months at the maximum (we strive to get consumers out of debt in the quickest possible time-frame and save them the maximum amount of money)

- Assisting you to find the perfect debt relief, settlement, or consolidation option based on your personal financial situation