Debt Negotiation, (also known as Credit Card Settlement, Debt Arbitration, and Debt Settlement) can be the most cost-effective option to pay off your debts and relieve a person from having to file for bankruptcy. Debt negotiation services offer a solution for debtors experiencing financial hardship.

How Debt Negotiation Works

Can’t afford to pay your unsecured debt and credit cards? Debt negotiation lawyers can intervene. Your creditors will be alerted that you’re enrolled in a debt negotiation program and being represented by an attorney within thirty days. All creditor harassment must stop at that point.

As you continue to make your reduced monthly payments, debt negotiators will start negotiating a debt settlement with each of your creditors one by one. And one by one, each debt will get negotiated, reduced, and settled.

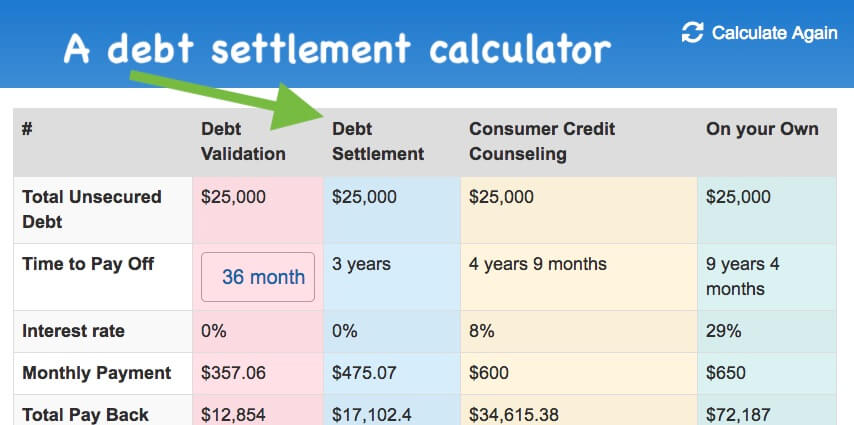

There is no specific order that each of your debts will get settled and results do vary. However, the following debt reduction program calculator tool will give you an estimate of how much you can save on a debt negotiation program, compared to consumer credit counseling and when paying minimum payments on your own.

Speak to an IAPDA certified debt counselor for a free consultation today at (866) 376-9846.

What if creditors don’t agree to settle a debt when enrolled in debt negotiation services?

Creditors don’t have to settle. If a creditor doesn’t agree to a settlement, experienced debt negotiators know to simply wait longer. Time can be your friend. The longer you make a collection agency wait to get paid, the more likely it is that they will accept less.

Over time, a new collection agency may buy the debt and pay less than what the first collection agency paid. Consequently, they will be willing to settle for a lower amount than the first collection agency. As the debt ages and it gets closer to the statute of limitations expiring, the collection agency will get more desperate to collect something fearing that they may never get anything.

There is a chance the creditor will issue you a summons and try to sue you over an unpaid debt, but the chances are less if you continue to illustrate to creditors that you’re experiencing financial hardship and don’t have the funds to pay. If a creditor truly believes that you have no money, they will be less likely to sue you over a debt.

Sometimes, credit card lawsuits are automatically spun out by computer programs and are filled with errors and inaccurate information. In these cases, having a debt negotiation attorney pays off because they can fight the lawsuit and work to get it dismissed.

Debt Negotiation (Settlement Example)

ABC creditor may not be ready to offer you an attractive settlement. However, negotiations with XYZ creditor may be the complete opposite; they’re offering a desirable settlement. Debt negotiation attornies, in this case, would choose to settle ZYZ creditor first.

In the future, ABC creditor may be willing to offer an attractive settlement. The longer they have to wait to get paid, the less likely it is in their eyes that they will ever get paid anything. Consequently, they become more willing to settle. Unfortunately, debt can sometimes sit for 2-3 years before settlements occur.

Keep in mind; eventually, the statute of limitations will expire on a debt, and the creditor knows after that point they can’t legally continue collecting the debt. So as debt ages, collection agencies get more desperate to settle. On the other side of the coin, however, if a debt is about to expire the statute of limitations a creditor may fire the “last effort shot” and file a lawsuit right before the statute of limitations expires.

Attorney Debt Negotiation Program Benefits

Legally, creditors must direct all communication to your attorney. Debt negotiation programs that use a law firm offer extra peace of mind knowing that you have legal protection and lawsuit defense built into your plan. Debt negotiation lawyers can also sue your creditors if they violate laws such as the Credit Card Act, Fair Credit Reporting Act (FCRA), and Fair Debt Collection Practices Act (FDCPA).

At Golden Financial Services (GFS), we’ve seen creditors violate these laws, and clients ended up getting their debt completely dismissed and being awarded financial relief. Imagine not having to pay anything on your debt, getting it off your credit report entirely, and in addition, being paid monetary relief. This type of scenario is not common, but we’ve seen it happen plenty of times in the past. There are benefits to having a lawyer involved with your debt negotiation program versus using a non-law firm company for debt negotiation.

Are you living with an overwhelming amount of debt? Professional settlement programs can reduce that unsecured debt to be affordable to pay off. If you have multiple unsecured debts that you can’t afford to pay, an IAPDA certified debt settlement plan allows you to take control of these debts. You get a monthly payment based on your budget and what you can afford. You can be debt-free in 36-48 months.

You have to be careful because this debt relief program comes with downsides. Every program for debt relief comes with downsides, including debt settlement, validation, and consumer credit counseling. The key is to explore your debt relief options and find the right plan for your specific needs and goals.

To help you figure out what debt relief, settlement, or consolidation plan is right for you – Golden Financial Services offers free consultations to the public at (866) 376-9846. (A+ rated by the Better Business Bureau & IAPDA Accredited)

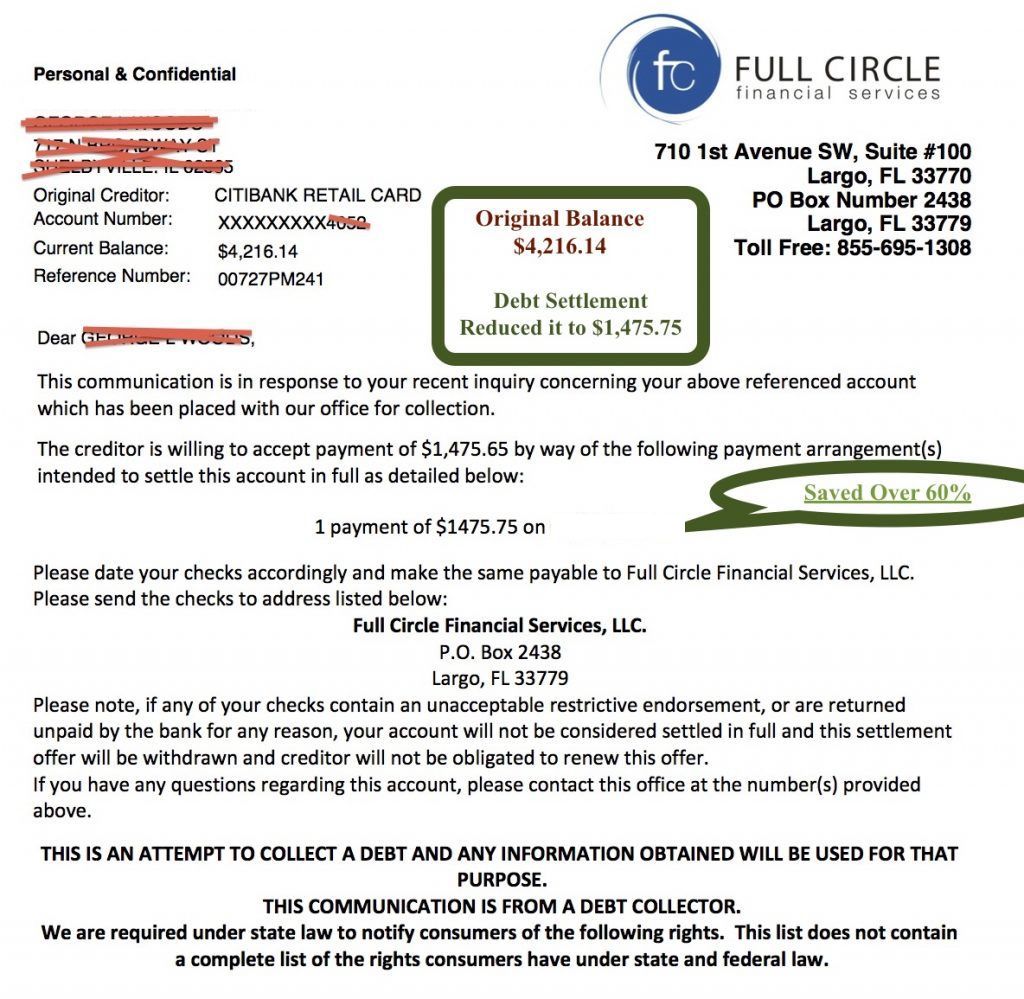

Here is a Debt Negotiation Example Letter

The Cost of Debt Negotiation (Fees)

Pay a fraction of what you owe with debt negotiation. Settlements can cost around 70%, with debt negotiation company fees included. In other words, you pay less than the total that you owe.

This program is custom-built for each client’s current personal and financial situation and level of debt to make the process as quick as possible and affordable for you.

How to Negotiate Credit Card Debt

The credit card debt negotiation process has been tested and developed over the years by the different servicing companies that we’ve partnered with. Golden Financial Services (GFS) refers to legal counsel and thoroughly investigates each debt relief backend provider before we start referring clients to that backend.

GFS recommends an attorney-based debt resolution program to negotiate credit card debt. This is not a regular credit card negotiation strategy.

Instead, a debt relief attorney will first use debt validation to force the creditor to prove they are legally authorized to collect on a debt. This is a lengthy process that creditors must go through to produce complete and accurate records and validate a debt before collecting on it.

Then, in the best-case scenario, the debt is invalidated and does not have to be paid, and it comes from the consumer’s credit report.

Take a glimpse at this debt validation dispute package to learn more about how to invalidate debt.

Only if a third-party collection account is validated will a debt negotiator start the process to settle a credit card debt. If you owe $10,000 or more in debt, click here to read about a debt validation program to help you fight debt and possibly not have to pay it.

How to Negotiate With Debt Collectors on Your Own

If you have a third-party collection debt, send the collection agency a debt validation request before entertaining a settlement. Debt validation forces the collection agency to stop collection on the debt until they can produce complete and accurate records to prove they are legally authorized to collect on the debt. Sometimes, debt validation can result in a debt becoming legally uncollectible and entirely coming off your credit report. You end up not having to pay an invalidated debt. To dispute a small inaccurate debt – use this one-page dispute letter.

Do you owe above $10,000 in debt?

If you owe above $10,000, including credit cards, medical bills, and unsecured loans, call for a debt relief program consultation at (866) 376-9846.

Tips to Negotiate Settlements (script):

Pretend that you’re negotiating for a friend. You need to take your emotions out of the picture. Remove yourself from the picture. Be cold and calm. Offer the creditor a small amount and let them know that’s all the money you have after paying your necessary living expenses. Click here for an instructional video on how to negotiate debt settlements.

You could say “I’m owed this money from a friend and they plan to pay me back next month. The funds can be used to settle this debt if you accept my offer. Otherwise, I’ll use these funds to pay another creditor that is owed money.”

Let the debt collector come back at you. Don’t seem anxious. And continue to let them know that you don’t have the money if they offer you a settlement higher than you want to accept. Remain calm and show no emotions.

Let them know:

“I don’t have a job.”

“I’m on social security and barely can afford food.”

Tell them; “Take me to court, I’ll show the judge I have no money. Or, give me an offer, a one-time payoff at the lowest amount that you have the power to offer, and I’ll use the funds I’m getting from my friend that owes me money to pay the settlement. But I’m not taking this offer by phone because there are too many scams this day and age, send it in writing by email, fax, or mail. I have a maximum of $____ coming to me from a friend that owes me money, so respond in writing if this is something you’re interested in agreeing to as a settlement and payment in full. And the only way I’m doing this is if you also agree to request to the credit reporting agencies to remove the debt from my credit including the collection account and late marks, otherwise I’m not interested.”

Use Anchoring – Negotiating Tactic

You could use the negotiating tactic called “anchoring”. So if it’s a five thousand dollar debt, you could offer four monthly installments of $500 to settle with the collection agency. This would equal a total payoff of $2,000, saving you $3,000. They probably won’t accept this low settlement offer but it could set the starting point of negotiations at a lower amount. Remember, collection agencies may only pay ten or twenty percent of the balance to purchase the debt. Therefore, they will settle the debt for a significant amount less than the total balance originally owed and still make a nice profit.

Get Everything in Writing

Say “thank you,” and hang up the phone when you’re done making your offer. Wait for their counter-offer via “in writing” and then plan for your counteroffer. Continue negotiating until you are happy with the offer. Get everything in writing prior to paying the funds for the settlement.

Remember: The original creditor gets reimbursed and paid back through tax credits, so they would have wiped their hands clean of the debt. Collection agencies could pay anywhere from 10-30% of the balance to purchase the debt. Knowledge is power!

Check out this Do It Yourself Debt Settlement Guide.

Learn about attorney-based debt resolution programs

If you’d like to learn more about the laws and methods to dispute credit card collection debt, visit this page next.

If a collection agency violates the FDCPA law, use these violations as leverage when negotiating a settlement. Check out this FDCPA guide.

Debt Negotiation Vs. Debt Consolidation

Debt negotiation services reduce your debt Vs. Consolidation options that only reduce the interest rates. This approach also assists you by reducing the time it takes to repay your debt. Read next: Compare Debt Negotiation Vs. Settlement.

Debt negotiation is a way to get out of debt in the shortest time and with the least money without filing for bankruptcy. There are some drawbacks, though.

Debt negotiation and taxes

The IRS considers a forgiven debt as taxable income. Therefore, the IRS expects taxes to be paid on the settlement at the end of the year. So, for example, if you settle $5,000 of credit card debt for $2,500, you’ll have to pay taxes on the $2500 savings, just like you would any other income. However, the IRS form (#982) is available for debt settlement situations. So illustrate insolvency by filing the IRS form 982 and avoiding paying taxes on the savings.

With debt consolidation, you get a loan to pay off your debt. By paying off your debt with a loan, your balances get “paid in full.” Debt consolidation is more costly than debt settlement but better for your credit score. Debt consolidation does not usually negatively affect a person’s credit score like debt settlement.

Debt settlement is aimed to help someone with financial hardship. Debt consolidation is geared for someone with a high credit score and not suffering from financial problems.

Debt Negotiation Program Qualification Guidelines

The following accounts DO qualify for a debt negotiation program:

- Credit Cards

- Unsecured Loans

- Unsecured Personal Loans

- Unsecured Personal Lines of Credit

- Collections / Autos in Repossession

- Medical Bills

The Following Accounts DO NOT Qualify:

- Lawsuits / IRS Debt / Taxes

- Utility Bills / Auto Loans

- Government Loan

- Student Loans

- Secured Debts

- Home Loans / Mortgages

Debt Negotiation Alternatives

Before settling a debt, it can be disputed through debt validation. Debt validation forces third-party debt collection agencies to prove that the debt is valid. Take a look at some of the paperwork that gets sent out through a validation program when disputing a collection account.

You’ll be pleasently surprised to see how much power the consumer truly does have when it comes to consumer protection laws. Consequently, often debt collection companies can’t prove a debt valid, and the debt becomes legally uncollectible. A legally uncollectible debt is one that you don’t have to pay.

Debt validation can dispute your debt and, in some cases, get it off your credit report.

Can I Negotiate Debt on My Own?

Can you file your taxes? Do you file your taxes? Most people don’t.

It can be cost-effective to hire an accountant to file your taxes in many cases.

Accountants are familiar with the tax laws.

A debt negotiation program is similar to using an accountant.

The only difference is that instead of trying to save you money on your taxes, a debt negotiation plan will focus on saving you money on your unsecured debt.

A reputable debt negotiation company uses the laws and experience to settle a debt. Lawyer debt negotiation plans provide the added benefit of forcing creditors to direct all communication to the attorney. Under the FDCPA law, after a creditor is notified that the attorney represents a consumer, that creditor must immediately stop calling the consumer.

You can settle your own debt. Learn how to settle a debt on your own by visiting this page next.

Debt Negotiations DISCLOSURES & Potential Negative Consequences:

- 1. IF CLIENT HAS BUSINESS ACCOUNT ENROLLED: Some financial institutions have an offset-clause related to business accounts. The clause states that if you default on your payment with any credit accounts and have an active bank account with the same creditor, the creditor can seize funds from you. If you don’t remember whether or not you signed this document, please either review your contract with your financial institution or open a new bank account.

- Student loans can be settled if they are not government-backed, but they cannot be discharged in bankruptcy, and they can garnish your wages 15% of your net pay without a court order.

- If a client is “active military,”: This debt negotiation program may hurt your credit, that negative effect may conflict with your security clearances. This can quickly be resolved by a simple conversation with your commanding officer, or we can provide you with a letter explaining that you are in a debt negotiation program and its impact on your credit. Furthermore, if you do not wish to notify your commanding officer of your involvement in this program, they may still be alerted by the negative impact on your credit score.

- Golden Financial Services does not clean up, fix, or repair credit, but once a settlement has been completed, you will no longer owe that debt, and your credit report will reflect a zero balance for that account. Does debt negotiation affect your credit score? The debt negotiation program will have a negative effect on your credit while on the program since your creditors will not be paid every month. However, your credit score can be rebuilt easier than if you filed for bankruptcy. Learn more about how a debt settlement program can affect your credit score.

- 5. Golden Financial Services cannot stop interest, late fees, and penalties that may accrue on your accounts during a debt negotiation program. Still, we will settle for the total amount listed by your creditor at the time of settlement. Your monthly payments in the debt negotiation program will not change based on your balances from the creditors. There are fees charged for the program, but they will be included in your monthly payment.

- 6. You should be aware that any amount over $600 which is forgiven at the time of settlement may be taxable by the IRS. You may receive a 1099-C form from your creditor at the end of the year for the account that has been settled; ask your CPA or tax professional to review this. The IRS may also allow you to exclude the tax as “income” if you are insolvent.

- 7. Your creditors could take legal action while in the debt negotiation program. If this happens, it is essential to immediately send over any paperwork to Golden Financial Services or the law firm that we set you up with so that the summons can be responded to, settled and resolved before the court date.

- 8. IF CLIENT HAS LINKED ACCOUNTS ENROLLED: Some financial institutions and credit unions have what is called an offset-clause related to accounts. The clause states that if you default on your credit account payment and have an active bank account with the same creditor, they can seize funds from you. Therefore, it is suggested you close that account and open a new bank account.

- 9. The Restricted States: Golden Financial Services does not offer debt relief, settlement, or consolidation programs in certain states, including Rhode Island, Connecticut, and Wisconsin.

How a Debt Negotiation Program Works

- You will get set up with a “special purpose savings account.” This is just a savings account that the negotiators can monitor, but you control. This is an FDIC insured account, where your funds are safe.

- You will accumulate funds in this special savings account for settlement by making a monthly deposit.

- Every month you will be responsible for a single monthly deposit (i.e., your monthly payment) no matter how many creditors you have enrolled into the program.

- The debt negotiators will track the Settlement Funds that are accumulating and negotiate on your behalf based on what is available. The debt negotiation fee will be earned only after a debt is reduced and settled. Negotiators may offer 20% as the first offer, so in that case, you would need to have at least that much money accumulated in your special purpose savings account. If possible, try to make larger deposits into your program account to speed up negotiations. In addition, debt settlement companies may offer a loan at some point to fund your program account, allowing the negotiators to speed up settlements.

- You will be made aware of all settlement opportunities and, at any time, can agree with the settlement terms negotiated. After you agree to a settlement, you’ll get everything in writing, and the funds will then be released from your program account and paid directly to the creditor.

Golden Financial Services has been in the debt negotiation industry for over fifteen years. We have maintained an A+ Rating with the Better Business Bureau and have zero unresolved customer complaints.

Golden Financial Services can help you get rid of your debt problems and start fresh!

To set up a free debt negotiation consultation with Golden Financial Services or learn more about our debt negotiation services, call 1-866-376-9846.

How Debt Negotiation Services Effect Credit Scores

After enrolling in the program, a debt arbitration and negotiation notation are never reported on a person’s credit report. However, the action of not paying your creditors each month will lower your credit score and cause your accounts to go into default.

You get the biggest discount on a debt after it’s sold to a third-party debt collection agency. At this point, your accounts are debt collection accounts. Having collection accounts on your credit report is one of the worst marks for your credit score.

At Golden Financial Services, we feel it’s much easier to recover financially after a debt settlement program than if you were to file for bankruptcy. The key is to have a complete financial plan before debt negotiation. Then, you can start rebuilding your credit score and establishing new credit as your debts get negotiated down and settled one by one.