Debt consolidation for credit cards is what Golden Financial Services (GFS) has been specializing in since 2004, but we are not referring to a loan. If a loan is what you’re seeking, check with Even Financial (a debt consolidation loan comparison site) or TrustedCompanyReviews.com (where the Top 10 Debt Consolidation Companies is listed). GFS does not offer credit card debt consolidation loans. Bad credit and debt consolidation is not usually a smart mix, because if you have a low credit score you’re only going to qualify for a high-interest sub-prime loan. And you don’t want that!

We offer financial hardship plans including debt validation and settlement programs. However, we also provide financial education to consumers about the different debt relief options available, with the goal of helping people make an informed choice about how to get out of debt. And, if you decide you’d rather avoid a program and get out of debt on your own, use this free debt snowball calculator. To learn your options to consolidate credit card debt, speak to an IAPDA certified counselor for free at (866) 376-9846 now! The following page provides you a summary of the ways to consolidate your credit cards, including pros and cons of the different options available.

Ways to Consolidate Credit Card Debt

- 1. Consolidate with a loan (including a home-equity line of credit) through a local credit union (recommended) or online financial lender (not recommended due to high-interest rates with most online lenders). Consolidation loans are only recommended for consumers with a minimum credit score of 700. Why should a person not get a loan to consolidate credit card debt if their credit score is lower than 700? The reason why is due to the fact that with bad credit consolidation loans charge high fees and interest rates, making them one of the most expensive debt-relief options a person could turn to. And when it comes to debt relief, you want to find the cheapest, least expensive route! Unless your sole purpose of getting a loan is to use it to build a higher credit score, which in this case you can apply for a consolidation loan even if your credit score is under 700, just make sure you understand all of the fees and rates included. Credit card consolidation loans can be used to help improve credit scores.

- 2. Consolidate by using debt settlement (negotiation). This type of program does not pay creditors on a monthly basis, but rather through lump-sum settlements paying off one debt at a time. However, debt settlement allows you to make only one payment each month, simplifying the billing-paying process. Settling your credit cards is only recommended if you can’t afford to pay more than the minimum payments on credit cards, and there are downsides that come with debt settlement that you need to understand.

- 3. Consolidate with balance transfer cards: This option is only a viable option for consumers that can afford to pay off the entire balance transfer card within 12-18 months. You must have a high credit score or enough available credit on an existing credit card to be able to use this strategy.

How to Consolidate Credit Cards by Using Debt Settlement (Negotiation)

With debt settlement, even though your creditors don’t get paid monthly, you are set up with a single monthly payment for all of your debts. Just like with a debt consolidation loan, how you are only responsible for a single payment, debt settlement provides you that same benefit.

Technically speaking, debt settlement is not the same as consolidating credit cards. You can save much more with debt settlement in many cases.

The difference is that creditors don’t get paid with debt settlement every month, but rather the money you pay each month goes into an FDIC trust account and accumulates. As the funds accumulate, the debt negotiators are negotiating with creditors to reduce your balances down to a fraction of the total owed.

Late fees and interest continue to grow, making balances larger over the first year of the debt negotiation program. The good news is that in the end, all of the late fees and interest gets mitigated into the settlement and is resolved.

As accounts age on a settlement program, each debt settled and paid off one by one. You only have to pay about half of each debt (not counting fees). Since you only have to pay a fraction of each debt owed, you become debt-free in around 36 – 42 months (on average). With negotiation fees included, clients can save approximately 30% of what they owe in the end, paying no additional interest or even late fees as it’s all mitigated into the settlement.

Consolidate Credit Card Debt With a Loan

Using a loan to consolidate credit card debt requires a person to pay upfront fees in some cases, high-interest rates if credit scores are not optimal, and it takes around five years to become debt-free on average. Credit card consolidation loans are a much more costly option over debt settlement in many cases.

We offer various debt relief, settlement, and debt consolidation programs, allowing YOU to get unbiased information and the optimal help with credit card debt. Here at GFS, you get the power to make an informed choice based on what suits YOU best, NOT what suits your creditors best!

Start by giving this debt calculator tool a quick try. The debt calculator will show you a few of 2019’s preferred methods of getting out of credit card debt, and these are proven plans.

Try Credit Card Debt Consolidation Calculator:

Compare debt relief programs with this calculator. Keep in mind; these programs do not consist of getting a loan.

- Plug-in your total debt amount

- Plug-in the average interest rate

- Plug-in an affordable monthly payment and “HIT CALCULATE”! If the payment is too small, the calculator will require you enter a more realistic figure, so increase the dollar amount slightly.

Talk to an IAPDA Certified Expert at 866-376-9846.

There are certified counselors available to answer your questions and get you approved if you’re ready to start saving now.

- A+ Rated by the Better Business Bureau

- Ranked #1 by Trusted Company Reviews

- Top reviews on Google, Yelp, and Shopper Approved!

Credit Card Debt Consolidation (TABLE OF CONTENTS)

- Chapter 1: What does it mean to consolidate credit card debt?

- Chapter 2: Is it better to consolidate credit card debt or use a debt relief program?

- Chapter 2A: Benefits of consolidating credit card debt

- Chapter 2B: Downsides of consolidating credit card debt

- Chapter 2C: Debt consolidation qualification guidelines

- Chapter 2D: Benefits of debt relief programs

- Chapter 2E: Downsides of debt relief programs

- Chapter 3: Home equity loan to consolidate credit cards

- Chapter 4: Different ways to consolidate credit card debt

- Chapter 5: Is it smarter to consolidate credit card debt or settle it?

- Chapter 6: Learn about a bank’s credit card hardship program

- Chapter 7: Disputing and settling credit card debt

- Example of a disputed credit card debt

- Chapter 8: Is consolidating credit cards bad for your credit?

- Chapter 9: How to consolidate credit card debt without hurting your credit?

- Chapter 10: Unsecured debt consolidation loans for bad credit

- Chapter 11: Learn about the Truth in Lending Act before applying for a loan

- Section 12: A Good APR on a debt consolidation loan

- Chapter 13: Credit card consolidation calculator

- Chapter 14: Government debt consolidation

- Chapter 15: Use a balance transfer card to consolidate credit card debt

- Section 16: How to consolidate credit card debt

- Chapter 17: Summary of Credit Card Debt Consolidation Quick Tips

- Chapter 18: Best credit card debt relief, settlement and consolidation options near you

What does it mean to consolidate credit card debt?

Technically speaking, “to consolidate credit card debt,” means, “to obtain a loan and use that loan to pay off your existing credit card balances.” You can consolidate debt with a home equity line of credit, a personal loan from a friend, or a bank or financial institution loan.

The point of consolidating debt is to reduce interest rates and save money, simplify the bill-paying process, and get out of debt faster.

What people often consider “consolidating debt” is merely the act of combining credit card debts into one. You can consolidate your debt into a debt settlement program or by using consumer credit counseling, even though these options are not “a loan.” Consumer credit counseling and debt settlement plans are not a loan but rather debt reduction programs.

Some people are better off using a personal loan to consolidate, and other folks may need a hardship program like debt settlement and consumer credit counseling, it all depends on your circumstances, needs, and goals.

Call (866) 376-9846, and one of our IAPDA Certified Experts can guide you through the process. You have multiple options to choose from at GoldenFS.org, not just one!

Is it better to consolidate credit card debt or use a debt relief program?

If you have a high credit score and sufficient income, you’re better off using a personal loan to consolidate credit card debt on your own, overusing a debt relief program, even though you’ll end up paying more over the short-term with consolidation. By combining your credit cards, you’ll avoid needing to fall behind on payments like with most debt relief programs. One of the most significant benefits of using a credit card consolidation loan to pay off debt is that your credit score could improve.

Is your goal to save money and crush your balances as quickly as you possibly can, and you don’t care about a short-term adverse effect on your credit? If that’s your goal, you should explore debt relief programs. Start by trying this debt calculator tool offered by Golden Financial Services to get a quick summary of each debt relief program and a quote on how fast you can become debt-free with each plan.

Credit card debt can get cut in half with a debt negotiation program, and you’ll avoid bankruptcy. Debt can also get disputed, and there’s a chance you don’t have to pay anything on it besides the debt relief company’s fees.

To make your life easy, talk to an IAPDA Certified Counselor at Golden Financial Services, and find the simplest way to get out of debt within minutes at (866) 376-9846.

Benefits of Consolidating Credit Card Debt

- Reduce interest rates

- Get out of debt faster

- Avoid hurting credit

- Get a single monthly payment for all debt

The downside of Consolidating Credit Card Debt

- Must pay the entire debt plus interest

- Takes longer to become debt-free, compared to debt relief programs

- Must pay additional debt consolidation or balance transfer up-front fee

- When using a home equity loan, you’re risking losing your home

Qualification Guidelines for a Credit Card Debt Consolidation Loan

- Should be able to afford to pay at least minimum payments comfortably

- Need a 710+ FICO/Credit Score

- Need to have steady employment

Benefits of Debt Relief Programs

- Choose how fast you want to get out of debt (between 12-42 months)

- Flexible monthly payment plans

- Lower payments than consolidation payments

- Get a single monthly payment

- A portion of balances could get forgiven

- No out of pocket fees

- Get a written guarantee

Downsides of Debt Relief Programs

- Adverse effect on credit scores

- Could owe taxes on the amount saved when settling a debt

- Creditors can issue a summons (only on a small percentage of cases)

- Not all clients make it through the program for various reasons

There are multiple debt relief plans available, which all have a different effect on your credit. Depending on your situation will determine what method is best for you.

The easiest way to figure out what debt relief program you’re eligible for is to call (866) 376-9846 and talk with an IAPDA certified debt counselor.

Home Equity Loan to Consolidate Credit Cards

One of the best ways to consolidate credit card debt is to use a home equity line of credit. A home equity line of credit usually comes with a lower interest rate than a bank loan. Also, a home equity line of credit will offer you a lower monthly payment than your typical bank loan.

You don’t need to use a home equity loan to fix up your house; you can use it to pay off credit card balances, which many, many smart people do every day here in America!

The downside is that you’re switching an unsecured loan with a secured loan that requires collateral. Your property is the collateral in a home equity loan. There’s always that chance where now you could lose your property over credit card debt.

Here are the different ways to consolidate credit card debt:

What’s the best way to consolidate debt? There is not one particular best way because each person’s needs, goals, and circumstances are different. If you have sufficient income and a high credit score, consolidating your credit cards by using a low-interest loan would probably be your best option. You can only get a low-interest loan if you have a high credit score. Don’t be fooled by the hundreds’ of online loan lenders who will approve you for a loan even with bad credit. Bad credit debt consolidation loans carry high fees and interest, which would raise your debt even higher than what it currently is.

If you can barely afford minimum payments on your credit cards, your best option may be to consolidate your debt by using consumer credit counseling. This type of debt consolidation program is not a loan, but rather just a way of reducing interest rates and simplifying the bill-paying-process. Credit card debt can be paid off in about 4.5 years with consumer credit counseling, which we will talk more about below.

Is it smarter to consolidate credit card debt or settle?

Can’t afford credit card payments?

A financial hardship program like debt settlement could allow you to save a significant amount more than consolidation. Credit card debt can get settled for around half of what it’s worth, before company fees.

The downsides to debt settlement include:

1. creditors don’t get paid every month

2. failing to pay credit card companies monthly can lead to adverse side effects to credit reports. (click here to see adverse side effects of debt negotiation & settlement services)

3. the savings (the amount that gets forgiven) could get construed as taxable income. There are tax forms that can be filled out to illustrate insolvency, which is the best solution for eliminating a tax debt owed due to debt settlement programs.

Banks offer an in-house credit card hardship program

Most banks have an in-house credit card hardship program where they’re willing to either reduce a person’s interest rate or monthly payment, but only temporarily. Here’s everything you need to know about a bank’s credit card hardship program and how to get approved.

We recommend trying to work directly with your bank if you are only experiencing a temporary reduction in income. You can stay current on monthly payments and avoid hurting your credit score.

Can’t afford your credit card monthly payments?

Unfortunately, to consolidate your credit cards at this point is not an option. No bank will approve a debt consolidation loan if you’re behind on payments. You’d think that the credit card company would give you a few months of non-payment or work with you until you get your feet back on the ground and increase your income, but besides for a small temporary reduction in your payment, there’s not much else they will do. Credit card companies are relentless and can be heartless at times. Just think about the fact that some consumers pay minimum payments on their credit cards for their entire lives, probably paying back their debt three times and barely seeing the balance go down because of high interest. Is that a crime? No, it’s not a crime, but it’s not right either.

If you can’t afford to stay current on credit card payments, here’s what will happen:

After approximately 120-days of falling behind on payments, your account will get written off and sold to a third-party debt collection company. A debt getting written off is just like if you were to write something off on your taxes. You write-off something when filing taxes as a way of lowering your tax liability and saving money. Credit card companies write off a debt as their way of getting reimbursed, 100% of the loss.

The credit card company does not end up losing money if you stop paying your credit card payments. Why is that? On top of getting reimbursed through tax benefits, the credit card company will then sell your account to a debt collection company and achieve more profit. Your account will get sold for pennies on the dollar, which is pure profit for the credit card company. Since the original creditors are selling credit card accounts for such a low price, they fail to put proper care and transparency into the sale. Documentation goes missing; information turns inaccurate and unjustified fees get tacked on to your balance from the debt collection company.

Banking insurance is applied, and more profit rolls right in! Banks will sell hundreds of credit card accounts at a given time to whichever debt collection company bids the highest. The bank then emails a spreadsheet to the debt collection company who purchases the debts, with your necessary information on it, and hundreds of other debtors’ information on it. You can then settle your debt for around half at that point, where the debt collection company still makes 100+% profit with ease. Think about it, if the debt collection company buys your credit card account for 10% of the balance and then settle with you for 50%, that’s a 400% profit.

If you settle the debt for 50% of the balance, you can save 50% and avoid all interest. However, the late marks and collection account remains on your credit report. If you used the federal laws and put together a dispute package that’s 30+ pages deep, where you’re requesting proof of everything that the law requires a debt collector to hold onto, they rarely can prove the debt to be valid. It would take them half a day to put together the proof that the debt is correct if they could even do it. The thing is, the debt collection company knows at this point, documentation is missing records, information is no longer accurate, and they couldn’t prove it to be valid even if they tried. The debt collector’s best move at this point is to agree to stop collection on the debt and agree to request for each credit bureau to remove it from your credit report.

In rare cases, the debt collection company could issue you a summons. However, if you get proper legal defense and fight the summons, it’s doubtful that it will hold up in court. There’s even a chance the entire debt could get dismissed. Worst case scenario, you could get the debt settled for around 60%-70% of what’s owed.

One judge in Brooklyn estimated that “over 90% of credit card lawsuits are flawed in one way or another and include inaccurate or fraudulent records, and can’t be proven to be valid debts if disputed”. This is why debt collection companies have a difficult time proving a debt to be legally collectible after getting disputed.

When banks sell a credit card debt to a collection agency, it’s a fast and careless transaction that lacks transparency. Credit card debt gets sold and purchased at such a low price (pennies on the dollar) that minimal care is put into the entire process, making debt easily disputable and often can be proven to be invalid.

The debt doesn’t disappear when a creditor can’t validate it, but the creditor can no longer legally pursue collection on that debt. A recent article in Business Insider revealed how “$5 billion in student loans may be dismissed because the lender lost the paperwork”. This is a real problem in America today.

How to settle a credit card debt for less than the full balance owed

Since a debt collection company only pays 10%-20% of the balance on a debt to purchase it, they’re usually willing to settle for a significant amount less than the full balance owed (before debt settlement company fees).

Credit card debt settlement should be one of your last options to consider due to the adverse effect it will have on your credit history, scaring your credit with collection accounts, and late marks.

Also, if a person settles a debt for less than the full balance owed, they could owe the IRS. The IRS considers the amount saved in a debt settlement as income.

If a person was to settle $30,000 of credit card debt for $15,000, that’s a savings of $15,000. That savings of $15,000 could be considered taxable income if a person doesn’t take the necessary steps to illustrate insolvency, which any experienced accountant should be able to do.

This tax liability can be avoided by filing a #984 tax form, showing that a person is insolvent.

After signing up for a debt settlement program, a person’s credit card debts won’t get settled until they get sent to a third-party debt collection agency. While waiting for the accounts to age, creditors may call and harass a person, and credit scores continue to go down until the debt is settled and paid. Creditors can even issue a person a summons and bring them to court for failure to pay a credit card debt.

Why use an attorney debt settlement program?

If you hire a debt settlement attorney, the attorney will put a stop to the creditor harassment because once notified that you have an attorney representing you, now the Fair Debt Collection Practices Act (FDCPA) will prohibit your creditors from continuing to call. If they do contact you illegally, you could sue them for $1,000 per violation.

Once your credit card bills are sent to a debt collection company, now the credit card settlement program will start settling your debts for about half of the balance owed on each account, and one by one, each debt will get reduced and paid off. The main benefit of this plan is that you’ll get to avoid bankruptcy and get out of debt for only 50% of your credit card balances before company fees.

Use debt validation over debt consolidation if you have third-party debt collection accounts

Preferably, if an alleged debt gets disputed with debt validation, the debt becomes legally uncollectible. A legally uncollectible debt is one that you may not have to pay, and the debt comes off your credit entirely!

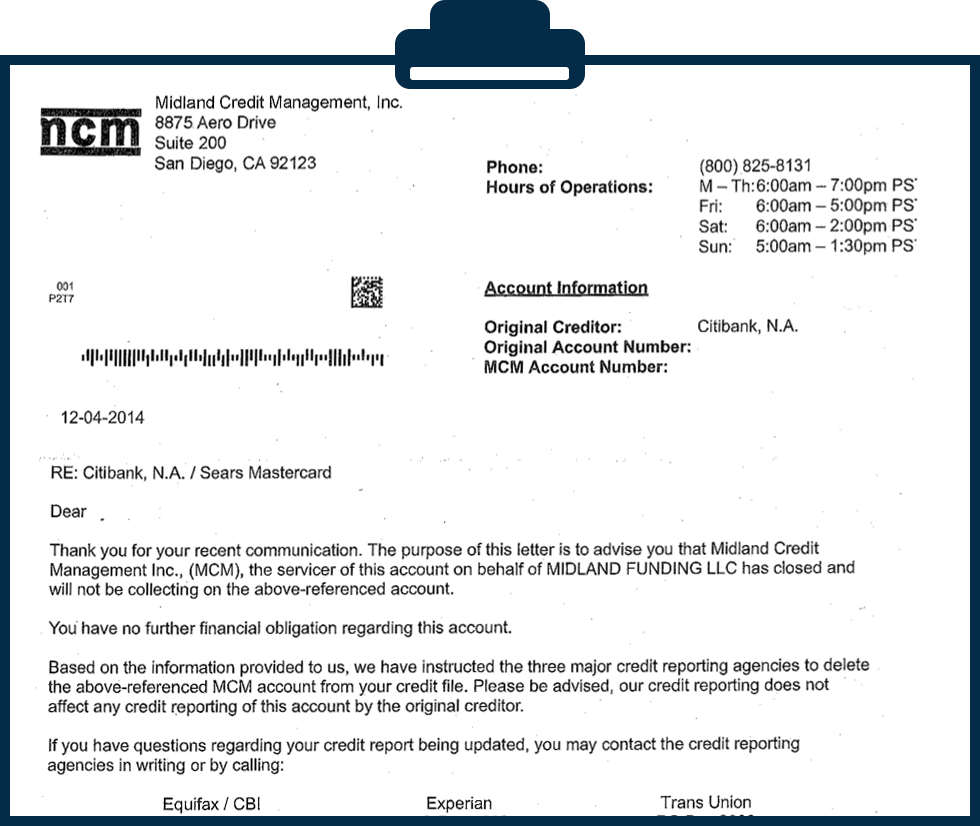

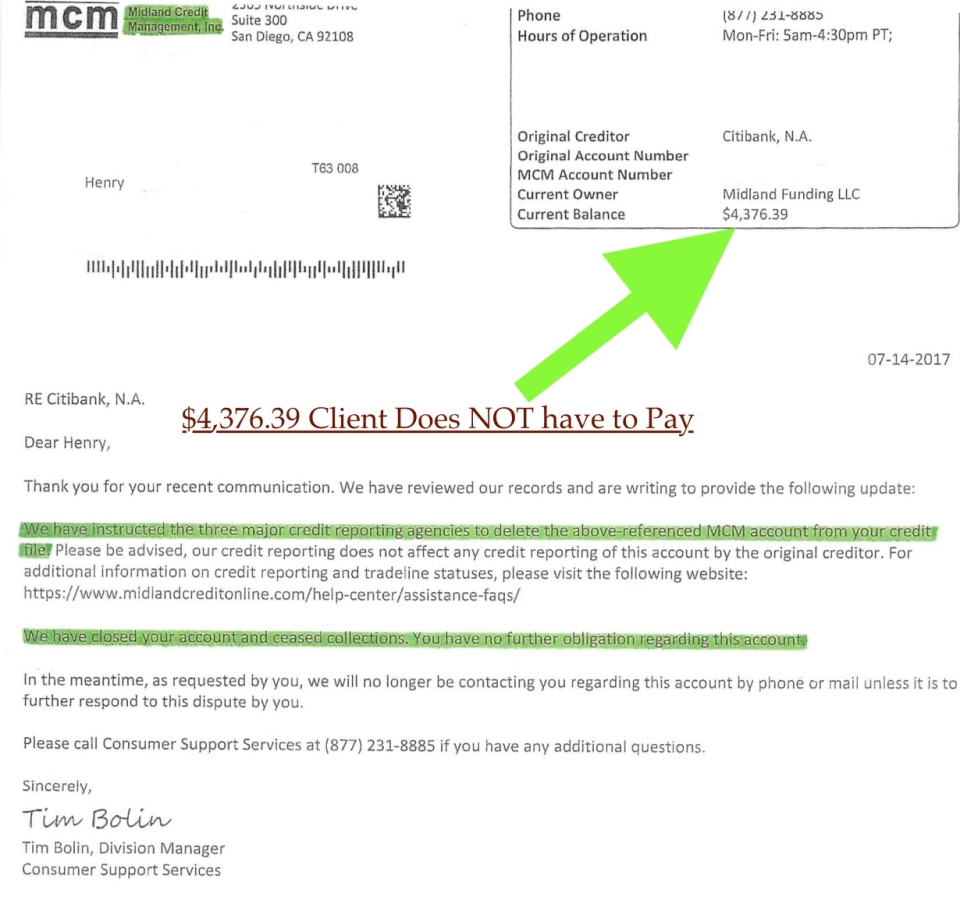

Example of a disputed credit card debt (done successfully)

How Does a Debt Validation Program Work?

The credit card debt in the example above had a balance of just under $5,000.

The consumer does not need to pay it, and the debt is coming off their credit report entirely.

That’s right, gone!

There’s always a chance that the debt could end up in another debt collection company’s hands, and now you have a new debt-collection company calling you for payment. However, when enrolled in a debt validation program, the debt relief company follows up with the latest collection agency making sure they stop collection on the debt right away by providing them proof that this debt was already invalidated.

Now, if the debt collector continues to try to collect on the debt, the collector is illegally trying to collect on an invalid debt and has violated your legal rights. Now, you’re eligible to sue them and get awarded up to $1,000 per FDCPA violation. At that point, when enrolled on a validation program, you’ll be referred to one of the attorneys who will assist you in now suing the creditor for violating your legal rights, and the lawyer will fight to get you a violation fee.

I know, hard to imagine.

After a debt gets invalidated on a debt validation program, the next stage is credit restoration. The credit restoration will start disputing derogatory marks that are remaining on a person’s credit and could even help a person get a line of credit on their credit report to help them produce positive payment history.

Eventually, the debt will expire past its statute of limitations. Learn about your state’s statute of limitations.

Is consolidating credit cards bad for your credit?

Your credit card balances get paid in full when consolidating with a loan. By paying off your credit card balances, this action improves your credit utilization ratio, which makes up 30% of your credit score. Now, there will be a negative inquiry that goes onto your credit history from when applying for the new loan, but the benefits achieved from paying off multiple credit card balances at a given time outweighs the downside of the negative inquiry.

Paying off credit card debt with an unsecured debt consolidation loan has minimal impact on credit scores, and at times can benefit your credit score. Still, debt relief and settlement programs do hurt credit scores.

How To Consolidate Credit Card Debt Without Hurting Your Credit

- Use a home equity loan to consolidate credit card debt (won’t hurt credit scores)

- Use a personal loan or balance transfer card to consolidate credit cards (should not lower credit scores)

- Consumer credit counseling program to combine credit card payments into one and reduce interest rates (not a loan, but a way to consolidate credit cards without hurting credit scores). Keep in mind; your credit score shouldn’t go down with credit counseling. However, a third-party notation will show up on your credit, illustrating that you’ve joined a consumer credit counseling program, and some lenders look down upon this mark.)

Unsecured debt consolidation loans bad credit

Debt Consolidation & Bad Credit are two attributes that don’t mix well. If you have bad credit, debt consolidation is the last thing you want to consider because it will cost you more money than what you’re currently paying. Only those fly by night lending institutions and PayDay loans that overcharge consumers for debt consolidation will approve someone for a loan if they have a low credit score. A low-interest debt consolidation loan for poor credit does NOT exist.

Lenders use “poor credit” as an excuse for why they’re allowed to charge astronomically high-interest rates. The lender’s mindset is, “if I loan to someone with poor credit, who nobody else will loan to, that justifies us to charge the highest interest rate.”

The truth is, if you have bad credit, debt consolidation should be a last resort. First, consider consumer credit counseling, debt settlement, or possibly debt validation. Just call toll-free (866) 376-9846 & get a free consultation. Learn what debt relief program is best for you!

Truth in Lending Act & Advertising

Ads are all over the internet that read, “debt consolidation loan for poor credit.”

Here’s what the law says; if a lender, bank, or creditor is offering a loan of any type, including credit card consolidation loans, the lender must clearly illustrate the annual percentage rate (APR) details on its website, including best and worst-case scenarios.

If you’re applying for a debt consolidation loan, read the web page carefully where you found out about the loan and make sure the interest rates and associated disclosures are visible on its website. If not, this is a red light and should warn you to stay away from that company.

Should you consolidate credit card debt with poor credit? The answer: Not if the interest rate is higher than what you’re currently paying. According to the Truth in Lending Act, this information needs to be clearly illustrated on the advertiser’s website to help the consumer make an intelligent decision.

Talk to an IAPDA Certified Debt Specialist Toll-Free (866) 376-9846 & learn about paying off debt faster!

Annual percentage rate (APR) on loans

Considering using a bank to consolidate credit cards? First, search around at different banks, and compare interest rates on personal loans, don’t just choose the first bank because it’s closest to your home. You can even try to negotiate with the bank, let them know that you won’t move forward at that high of an interest rate and that another bank is offering you a lower APR.

Some people consider 10% to be a high APR, while other consumers may find above 20% to be a high APR, it’s personal preference and should be based on what your current interest rates are costing you.

Take all of your credit card debts and figure out your average interest rate. If you have three credit cards, a Bank of America credit card with a 30% interest rate, a Chase card that has a 20% rate, and your Citibank card that has a 10% interest rate, your average interest rate is 20%.

Credit Card Consolidation Calculators

On average, credit unions offer lower interest rates than a regular bank, like Chase or Citibank, but that’s not always the case. Most banks make it easy for you to explore your credit card consolidation options by using a debt calculator tool.

You can try Chase’s credit card debt consolidation calculator by clicking here:

You can try the Navy Federal Credit Union debt calculator by clicking here:

If your credit score is under 700 and you’re interested in a debt relief program, try the Golden Financial Services debt reduction calculator by clicking here.

Don’t forget to thoroughly review the debt consolidation loan application with a magnifying glass, don’t skip a line – before signing up for any debt relief or consolidation program. Debt consolidation loan applications will sometimes have small print that talks about fees and disclosures, that small print you want to read carefully!

Add up all fees and interest to figure out the total cost of a loan, and ultimately don’t consolidate your debt if it’s going to cost you more in the end than what you’re currently paying.

Credit Card Debt Relief Government Program

Student loan debt consolidation is available through the federal government. Just go to studentloans.gov and hit consolidate to start the process. Here are step by step instructions on how to use government debt consolidation for student loans, get approved for the lowest possible payment and loan forgiveness.

Unfortunately, credit card debt relief government programs don’t exist. There is no such thing. That is why Golden Financial Services was invented, to help consumers who are struggling with credit card debt and other unsecured debt that government grants and assistance are not available for.

To learn the simplest ways to consolidate debt, call Toll-Free (866) 376 9846. (IAPDA Certified Debt Counselors are ready to help you for FREE)

Use a Balance Transfer Card to Consolidate Credit Card Debt

Balance transfer cards, also known as debt consolidation credit cards, can offer an excellent way to consolidate credit card debt and save money, but only if:

- Balance transfer cards provide a low-interest rate but just for an introductory rate period that usually lasts from 6-18 months. During that period is when the interest rate is zero. You need to pay off whatever credit card debt you transfer to that new balance transfer card during the introductory rate period when the interest rate is at zero. After the introductory rate period, the rate goes back up! Only use a balance transfer card if you can pay off your entire balance within this introductory rate period.

- Balance transfer cards carry a balance transfer fee that will cost you between 3%-5% of the amount of credit card debt is transferred to it. If you transfer $50,000 in credit card debt to a balance transfer card, you may have to pay a $2,500 upfront fee (that’s the average balance transfer fee that these cards carry, so make sure to implement this figure into your debt payoff calculation). Only use a balance transfer card if you can still save money even after adding in this additional fee!

How to Consolidate Credit Card Debt?

Before consolidating through a bank, using consumer credit counseling or any debt relief program, first understand the pros and cons of each debt relief option. Click here to view the benefits vs. downsides of each debt relief option.

Call Golden Financial Services at (866) 376-9846 and let one of our IAPDA Certified Debt Counselors provide you with a free consultation. During this consultation, we will help you to find the simplest way to resolve your debt in the quickest time-frame.

If you’d prefer to get a personal loan to consolidate, make sure to shop around and find a low rate loan at a credit union bank and then apply, it’s that simple. Once the money lands in your account, immediately use it to pay off your credit card debts in full.

Some Final Credit Card Debt Consolidation (Quick Tips)

- To consolidate credit card debt with bad credit, don’t just run to the first bank that says yes, first explore all debt relief programs and compare the APR with at least three different banks.

- Read the small print on the consolidation loan application before signing, to check for all fees (including the loan origination fee), and make sure to understand the downside of each plan (all debt relief options have a disadvantage!)

- What’s the best credit card debt consolidation company? If using a debt settlement company or debt relief program, make sure there are no upfront fees (which would be illegal due to the FTC rules and regulations) and ask about if there’s any guarantee. Lawyers and debt settlement attorneys are not allowed to use the word “guarantee,” but what a reputable debt settlement attorney will offer is an assurance of performance, similar to a guarantee. Also, check a company’s online reviews, BBB rating, and complaints, and time in business.

- Go to AnnualCreditReport.com and pull your credit report for free before applying for a debt consolidation loan. Check out your credit history first. The bank will check your credit before approving you for a personal loan, so, know what’s on there before the bank runs your credit!

- If you’re looking for a debt consolidation loan for poor credit, we strongly recommend that you consider debt relief programs as an alternative option.

Best Credit Card Debt Relief, Settlement & Consolidation Options Near You

The following states offer various debt relief, settlement, and consolidation programs. Here are some references to help you find the best debt relief option near you.

- Click Here for Alabama debt consolidation & debt relief program information

- Click Here to read about Alaska debt relief, settlement and consolidation programs

- Click Here to learn about debt consolidation for credit cards in Arizona

- Click Here for Arkansas’s best alternatives to credit debt consolidation

- Live in California? Click Here before applying for a debt consolidation loan with bad credit

- Click Here to learn how to consolidate credit card debt if you live in Florida

- Click Here to learn about Illinois’s best debt relief options

- Click Here to see what debt relief options the City of Chicago’s been using for debt consolidation

- Click Here to learn about Indiana debt relief options for bad credit. Debt consolidation in Indiana could be your most expensive option!

- Click Here for Kentucky credit card debt consolidation programs

- Click Here for Massachusetts debt relief, settlement and consolidation options

- Click Here to learn about Michigan’s best ways to consolidate credit & debt

- Click Here for Missouri credit card consolidation information

- Click Here for NY credit card debt relief, settlement and consolidation programs

- Click Here for Oklahoma’s best ways to consolidate credit card debt

- Click Here for Las Vegas debt consolidation information for credit card debt

- Click Here for Pennsylvania credit card relief & consolidation program information

- Click Here for Texas credit card consolidation information

- Click Here to learn about Nashville Tennessee’s newest options to pay off credit card debt

- Click Here to learn about Wyoming’s best credit card debt consolidation program

Any other questions? Call Golden Financial Services Toll-Free at (866) 376-9846, and we can help you find the best debt relief, settlement, or consolidation plan nearest you!

Disclosures:

Golden Financial Services is IAPDA Certified and Accredited and offers unbiassed front-end debt relief advice, making it easy for consumers to make the best choice on how to consolidate and pay off credit card debt in the most efficient way. We are not a back-end debt relief company. We work with several of the top debt relief companies in the nation, and our role is to provide you with all debt relief options and help you to enroll in the program of your choice. Our front-end agents will give you a savings estimate of each debt relief option available, including debt settlement, debt validation, and consumer credit counseling. Each company we work with is highly rated by the Better Business Bureau and has minimal complaints. Our objective is to help consumers maximize their savings and get out of debt successfully. We are not a credit repair company or licensed financial advisors. There are fees on all of the programs offered through Golden Financial Services. We are not a lender, so interest rates are irrelevant to any of the programs we provide. The purpose of this page is to help consumers better understand the different ways available to pay off credit card debt, including debt settlement, consumer credit counseling, and consolidating credit cards.