The following page explains Montana’s (MT) best debt relief programs. Debt consolidation loans in Montana are also available, but a local credit union will offer you the lowest interest rates for a loan. Montana debt settlement programs are another way to get out of debt for consumers who can’t afford to pay the full amount, but this program can hurt credit scores. Montana credit card debt relief options include credit card settlement and consumer credit counseling programs.

Paul J Paquin, Golden Financial’s CEO, shares general advice and warnings about Montana debt relief options:

“Do everything you possibly can to stay current on your monthly payments because credit scores will take a hit if you fall behind, as most debt relief programs in Montana require. Building good credit is not easy to accomplish. All debt relief programs in Montana will hurt your credit in one way or another. If you want to pay off debt faster and improve credit scores, use the debt snowball method.

Debt consolidation loans in Montana are only replacing existing debt with new debt, so if your goal is to become debt-free faster and save money, be hesitant about debt consolidation. Montana debt settlement companies advertising to ‘eliminate debt’ or ‘erase debt’ and companies that promise to fix your debt without any negative effect on credit scores are misleading and using false advertising tactics that you need to beware of.

No program can eliminate your debt fast without affecting your credit; every option available takes time and comes with downsides. Even options including consumer credit counseling, where creditors continue to get paid every month, will affect credit scores, as we explain below.”

Do you owe above $7,500 in total unsecured bills?

Unsecured bills include credit cards, medical bills, personal loans, and third-party collection accounts.

If you owe above $7,500 in unsecured debt, get a free consultation today from an experienced professional at Golden Financial Services. Learn options and check eligibility at (866) 376-9846.

Montana Debt Statistics

- Montana residents rank #8 in the nation for “highest credit card debt,” according to statistics on ValuePenguin.com.

- The average credit card debt for a Montana resident is $7,526.

- Montana’s average student loan debt for students who graduated with a bachelor’s degree is $26,280.

- As of 2021, credit card companies are ending pandemic-related forbearance options. There are no credit card debt relief services in Montana being offered by the state or government. However, Montana consumer credit counseling and credit card settlement programs are available.

Here are Debt Relief Options to Help Montana Residents:

- Montana debt consolidation loans can be used to pay off high-interest student loans, credit cards, and just about any unsecured debt qualifies.

- Debt settlement services can lower the balances on credit card debt and on just about any unsecured debt qualifies.

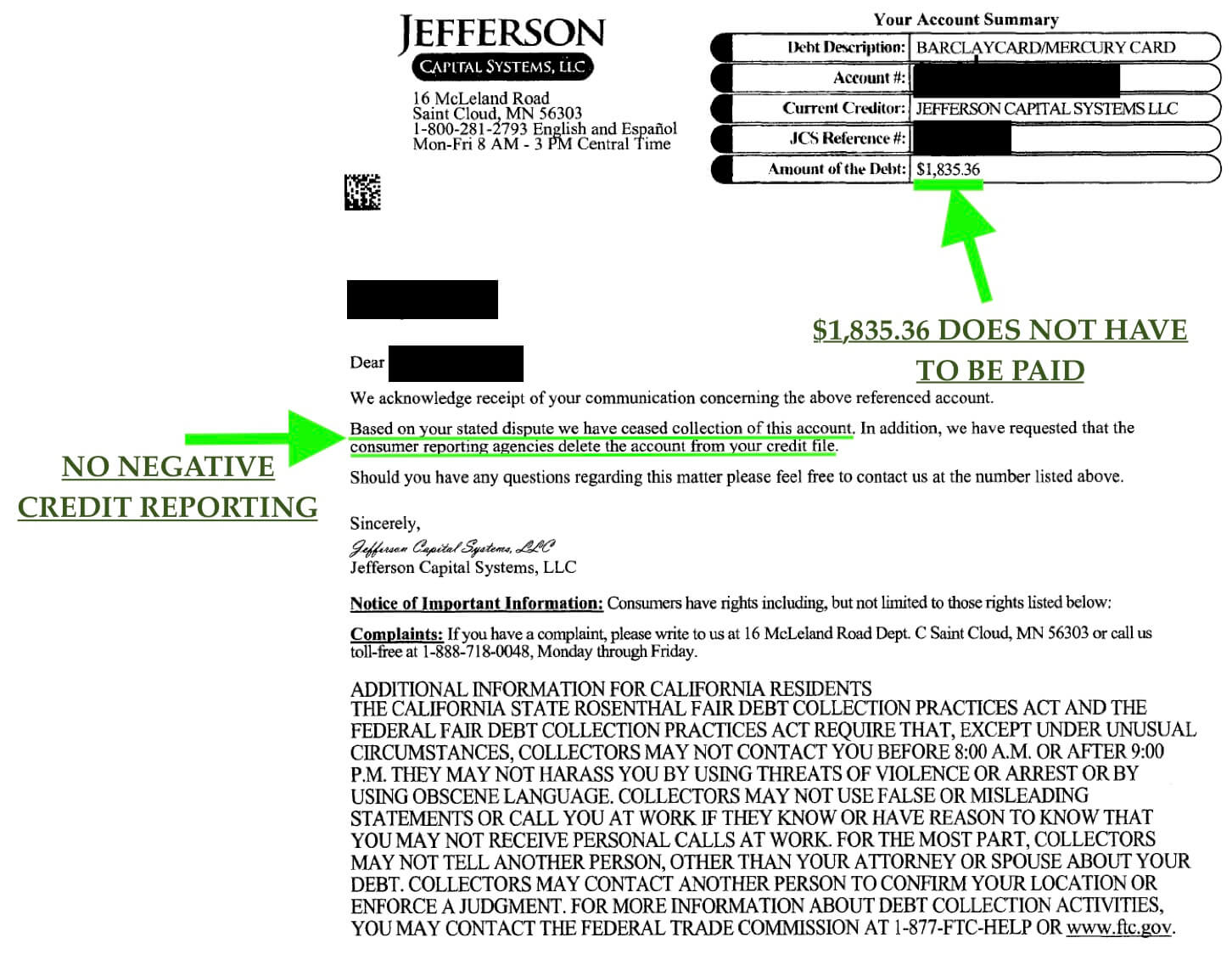

- Debt validation disputes third-party debt collection accounts and, in some cases, get derogatory marks removed from credit.

- Consumer credit counseling programs can consolidate credit card debts into one single and affordable payment, reducing interest rates by more than 50%.

- Federal student loan relief and consolidation options are available at StudentLoans.Gov.

Talk to an IAPDA Certified Professional About Debt Relief in Montana by Calling Toll-Free (866) 376-9846!

Golden Financial Services does not offer all of these options in the state of Montana. Non-profit consumer credit counseling companies can be located on the Department of Justice’s website. Visit DojMT.Gov to locate a licensed debt settlement company in Montana.

Fight a Debt Collection Account Before Paying it.

More and more consumers are searching online for how to get out of debt without paying. Incomes have been negatively affected by the COVID-19 pandemic, and as a result, people cannot afford to pay for their credit cards. Government debt relief programs for credit cards are currently not available, so what options do you have?

Montana credit card relief programs include debt validation.

With all of the debt collection fraud occurring in the United States, validation is becoming more and more popular. Thousands of consumers are walking away from debt because debt collection companies are operating in illegal ways, including; not being properly licensed to collect on a debt, not abiding by federal and state laws, not reporting accurate information, and not maintaining legally required documentation that debt collection companies must maintain.

Once a debt is disputed, the collection agency has thirty days to verify and validate the account or must stop collection. And in many cases, debt collectors can’t produce what’s legally required to prove they are legally authorized to be collecting on a debt, so consumers get to walk away without paying.

Here is a MT debt relief program example resulting in a client being able to walk away from debt without paying and having the debt removed from credit reports.

If a collection agency verifies that they are legally authorized to be collecting on the account and that it’s a valid debt, settling for less than the full balance can be a last resort.

Debt Settlement Montana

Debt settlement programs have been around since the early 1990s in Montana. Debt settlement can provide you with a low monthly payment and get you out of debt in 24-36 months. However, debt settlement is not for everyone.

How does a MT debt settlement program work?

Consumers are set up with one monthly payment that they can afford to pay. Creditors don’t get paid monthly, but that single debt settlement program payment accounts for all enrolled debts. One by one, each account is negotiated down, settled, and paid. But a person’s savings on this type of program varies because settlements are not always for the same rate. No settlement company can guarantee that a creditor will settle for a certain amount.

How much does a MT debt settlement program cost?

Consumers end up paying about half of what they owe on each debt, and on top of that, fees cost around 20% of each account’s balance. So in total, debt settlement programs can save a person around 20-30% of what they owe.

Do creditors get paid monthly with MT debt negotiation plans?

Every month clients make their single payment that goes directly into a savings account. The funds accumulate in this account until there is enough money available for a settlement offer to be made. Debt negotiators will then contact the client when they have a settlement offer and accept it before settlements are finalized.

How does a debt negotiation program affect credit scores?

Montana debt negotiation programs are designed to help people pay off their bills for less than what’s owed but don’t positively affect credit scores. In the end, late marks and collection accounts are left on credit reports.

Downsides of debt settlement programs in MT

Since creditors don’t get paid monthly, credit scores can be adversely affected. Creditors may file a lawsuit, and if ignored, wages could get garnished.

If a client drops out of the program before having all of their accounts settled and resolved, debt balances could increase and a person ends up in worse shape in the end.

Make sure to join a MT debt settlement program that charges fees after accounts get settled and resolved.

Debt Consolidation Montana

If you have stellar credit and sufficient income, debt consolidation loans may benefit you because you could qualify for a low-interest loan. Do the math. Will the new loan cost less than your existing accounts? Make sure to incorporate all fees and interest into the equation. Use an online debt calculator to compare options side by side.

Debt consolidation loans can come with high interest and fees, so be careful to select only a top-rated lender who charges low fees and interest. Debt consolidation loans to pay off credit card debt only make sense if the interest rate is lower on the new loan than the “average interest rate” on your existing credit cards.

FinTech companies online will often charge higher fees than a credit union or bank loan because they only process the loan through a bank. Fintech companies will often facilitate the loan through a bank, marking up the loan cost considerably compared to if you were to have just borrowed directly from the bank yourself. For that reason, Golden Financial Services recommends visiting a local credit union nearby your area, preferably one that you bank with.

Consumer Credit Counseling Montana

Montana non-profit consumer credit counseling companies offer a program that reduces interest rates on credit card debts. You make one monthly payment to the consumer credit counseling company, and the company then disburses the funds to each of your creditors but at a reduced interest rate.

By reducing the interest rates, your overall monthly payment gets reduced. You can become debt-free in around four to five years, versus taking five years or longer on your own.

How MT consumer credit counseling programs can affect credit scores:

Not all creditors will agree to reduce the interest rate and work with a consumer credit counseling company. Credit cards get closed with this type of program, resulting in a derogatory effect on credit scores.

How to get debt relief in Montana?

No matter what state you live in, debt relief is all about;

- being able to afford your monthly payments

- getting set up on a plan to get out of debt, where you can see the light at the end of the tunnel

- and using a debt relief option that helps you to achieve your long-term financial and credit-related goals

Some people in Montana try negotiating with their creditors on their own. And succeed! While other folks choose to use professionals like at Golden Financial Services, we live for our clients, and saving them money is our number one focus!

Montana Debt Relief Programs (Fees & Total Cost)

Debt consolidation loans will come with interest and fees. Find out what the interest rate is; you can then plugin the payment and interest rate into a debt calculator like this one here and see the total cost of the loan over the long term.

Debt settlement programs offered through Golden Financial Services can result in a total savings of around 30%, including fees. Fees are only earned at the time a debt is settled, and resolution is obtained.

All debt relief programs in Montana come with fees. Even non-profit consumer credit counseling programs include fees. It’s imperative to always check the “client agreement” on any debt relief program that you’re considering joining — with a magnifying glass — and understand all fees involved.

About Golden Financial Services

Golden Financial Services is a licensed debt management company in Texas, originally incorporated out of the state of Florida. The company is A+ rated by the Better Business Bureau and top-rated for National debt relief programs by Trusted Company Reviews.

Additional References for Montana Debt Relief:

Want to try calling your creditors to get them to reduce the interest rate? Learn how to negotiate with creditors on your own and get approved for a credit card hardship program directly through your bank by visiting this page next.

See the upside and downside to each debt relief program by visiting this page next.

Talk to an IAPDA Certified Professional About Debt Relief in Montana by Calling Toll-Free (866) 376-9846!