Did your luck strikeout in gambling – and now you are buried in debt? Las Vegas is known for gambling – so possibly this could be your case.

However, even if you’ve never gambled a day in your life, you could still qualify for Las Vegas Nevada debt relief programs. Medical conditions, divorce, high-interest rates, unexpected expenses, and many other causes can result in high debt.

Relief can be achieved by anyone with over $7,500 in total unsecured debt, no matter what caused your financial hardship.

The key is to find the right option to help you pay off your bills in the quickest possible time-frame and at an affordable monthly payment. Try our free online debt calculator to compare what you can potentially save on each Nevada debt relief program.

First off, what type of accounts do you have? If you only have high-interest credit card bills and can afford to pay over minimum payments, your best option may be a consumer credit counseling program. Or, you may not need any program whatsoever, and all you need to do is learn a better way to pay off your bills on your own. (Example, try using the debt snowball method)

On the other hand, if you’ve defaulted on credit card payments, debt validation or a debt settlement program could offer you a solution to your debt within four years.

Best Las Vegas Nevada Debt Relief, Settlement & Consolidation Company

Golden Financial Services is one of the best Nevada debt relief, settlement, and consolidation companies, according to TrustedCompanyReviews.com (click to verify rating). Why is that? To start, we give you the truth. If you genuinely need bankruptcy, we will tell you the truth. We will try to do everything we possibly can to help you avoid bankruptcy and find a program to save your future from the devastating effects that bankruptcy can leave.

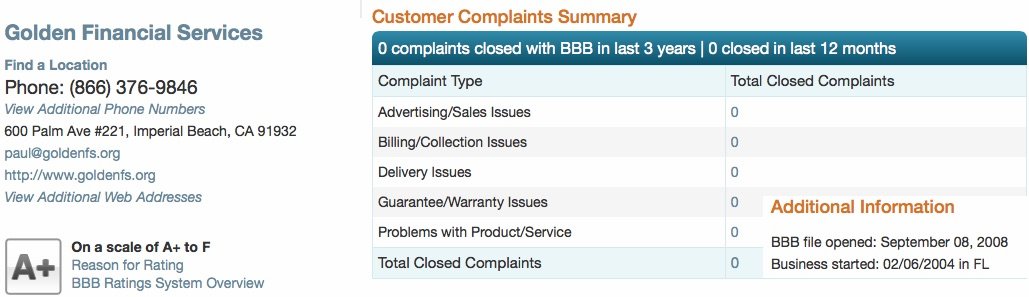

See, Golden Financial Services offers multiple plans and works with the top debt relief firms across the nation. We don’t charge you a penny! The companies that we work with pay us a flat fee. We get paid the same no matter what plan we enroll you in. Therefore our only motivation is to offer you the best plan to help you escape your financial problems and get a fresh start. We depend on the success of our clients and positive reviews to help us grow as a company. Going back since 2004, we’ve maintained an A+ BBB rating and no unresolved complaints.

Here are a few of the best Nevada debt relief programs that you can choose from:

- debt relief with credit restoration on a validation program, where you end up paying around half

- settle your accounts, through a negotiation program

- consolidate student loans into an income-based repayment plan

- combine credit card payments into one, with a non-profit Las Vegas consumer credit counseling agency

- get represented without using bankruptcy, by a highly rated Las Vegas debt settlement law firm

We can get rid of your debts through one of several hardship programs, including consolidation, debt validation, and settlement. Nevada residents can start with a free consultation to check eligibility. If you qualify and choose to enroll in any of these plans, one of our IAPDA certified counselors can get you approved in under 24-hours.

To get your fresh start call (866) 376-9846. Call between Monday – Saturday, 8 am-6 pm, and speak to an IAPDA Certified counselor right away!

Don’t get fooled by a Las Vegas bankruptcy debt relief attorney who tells you that BK is your best solution because 9 out of 10 times it’s not!

Las Vegas Bankruptcy Debt Relief Vs. Settlement

Most Las Vegas residents are required to use Chapter 13 bankruptcy, not Chapter 7, which allows your debt to get wiped away clean.

Chapter 13 bankruptcy forces you to continue making monthly payments on your accounts for around five years, longer than if you were to use debt settlement.

The bankruptcy judge looks at your income and could require most of it to go towards paying debt, locking you into a five-year debt repayment plan.

And additionally, you will have to pay your attorney thousands of dollars in up-front fees. Not exactly what you thought bankruptcy was, hah?

You could end up paying less money with debt settlement services, compared to Chapter 13 bankruptcy. And you won’t have to hand over thousands of dollars in up-front fees to some expensive Las Vegas bankruptcy attorney! If you can avoid settling your debt and instead use validation to prove each of your collection accounts to be invalid, this route could produce even better savings and results.

What hurts your credit more, debt settlement or bankruptcy?

If you graduate a debt settlement program in 36 months, you can start to rebuild your credit score following that period. The downside with debt settlement is that you are left with collection accounts and late marks on your credit report, both of which make building a high credit score very difficult to do. After filing for BK your credit report illustrates that you filed for bankruptcy, and this notation remains on your credit for up to ten years and can have even more of a negative effect on credit.

Debt Settlement – Las Vegas

Las Vegas debt settlement services can reduce the balances on just about all unsecured debts. To learn more about debt settlement services, visit this page next to or give us a call at (866) 376-9846. Our A+ BBB Rating and ZERO customer complaints – speaks for itself.

Debt Validation Relief – Las Vegas

Debt validation has been used by thousand’s of consumers in Las Vegas Nevada.

You would pay one fee – and the debt validation company would do the rest. This program comes with a 100% money-back guarantee ensuring that if you don’t get results – you pay nothing. This is a great first option – and debt settlement can be a second option to turn to if your debt is proven to be legally collectible and valid.

Validation can be the least expensive and most effective option. Give us a call, and we can find out what debt relief options are available for your situation and circumstances – CALL NOW AT (866) 376-9846.

Debt Consolidation – Las Vegas

Las Vegas debt consolidation programs are famous for resolving high-interest debts. At Golden Financial Services, we use debt consolidation for student loan debts. However – technically speaking an actual debt consolidation loan can be used to pay off all of a person’s bills, including secured and unsecured accounts.

Las Vegas credit unions are an excellent place to apply for a debt consolidation loan.

However, if you have high debt and can barely afford minimum payments:

A) the only consolidation loan you’ll qualify for is a high-interest loan, which you don’t want

B) consolidation is swapping out your existing debt with new debt, and often this type of strategy does not work

C) why consolidate when you can reduce your accounts with a debt relief program in Nevada?

When is Nevada Debt Consolidation a Good Option?

Can you comfortably afford to pay at least minimum monthly payments and your only problem is high-interest rates? Consolidating can be a viable option to eliminate the high-interest accounts, replacing them with one low-interest loan. You can then get out of debt much faster.

You can always apply for a 0% balance transfer credit card and now use that to pay off your high-interest accounts. To go this route, you will need to have a high credit score and income. Just make sure to pay off your entire balance on the balance transfer credit card while it’s into-period when the interest rate is at 0%. After the into-period, that interest rate could shoot back up to even higher than what you had been paying previously.

When consolidation can be the right solution:

- if you need one low monthly payment

- have a high credit score

- own your home and have equity on it

In this case, you could take out a home equity line of credit and use that to pay off the high-interest accounts. Just be careful going this path because if you fall behind on payments, you could now lose your property. When using a home equity line of credit to pay off unsecured debt, you are switching unsecured debt for a secured debt – not usually a smart move!

A debt consolidation loan allows a person to pay off all of their debts – then ending up with one low-interest loan to pay back – and at an affordable payment. Learn more about debt consolidation by visiting this page next.

There are a few other Las Vegas debt relief programs. Nevada residents are urged to call Golden Financial Services to get educated and learn all of their debt relief options. Las Vegas consumers are all eligible for a FREE professional consultation. Call today to discover your debt relief options in Las Vegas.