Debt relief programs are similar to how with “shoe sizes,” “one size doesn’t fit all.” With debt relief programs, “one debt relief service will never be the solution for all debt problems.”

Depending on your credit score, credit utilization ratio, what creditors you owe, income, payment history, payment status, and financial goals will help to determine what debt relief program is best for you. For example, if you have a high credit score – a debt consolidation loan could be your best option. On the other hand, if you are behind on your monthly payments – a debt settlement or debt validation program could be a better fit for you.

Formulating a plan to get out of debt is never an easy task. There are no government debt relief programs besides federal student loan relief options. Credit card companies will barely work with their clients at this time after COVID-relief ended. And the help the credit card companies offered consumers was only deferring credit card payments – resulting in more debt.

At times, credit card companies may reduce the interest rate and temporarily lower monthly payments, but credit card companies rarely will offer long-term relief. As a result, for consumers experiencing extreme financial hardship, bankruptcy is often the first option they look for.

People are just unaware of how debt relief programs work.

In general, all debt relief programs are designed to;

- Either reduce your interest rates (debt consolidation); or reduce your balances (debt settlement), ultimately saving you hundreds and sometimes thousands of dollars within a short period.

- Make life easier by consolidating monthly payments into one.

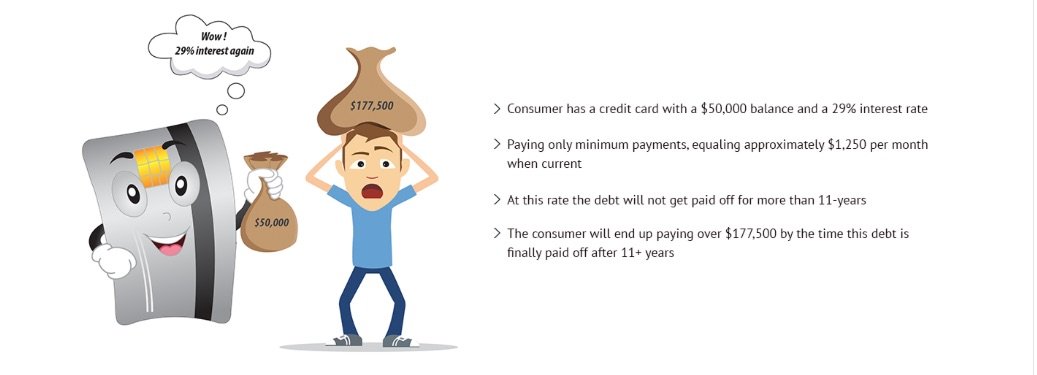

- Give you a date for when you will be debt-free. Debt consolidation, debt validation, and debt settlement programs all allow you to see the light at the end of the tunnel. You will know exactly when you’ll be debt-free after signing up for any one of these plans. But, on the flip side, you could be paying for eternity when paying minimum payments.

Speak to a Certified Debt Relief Counselor at 866-376-9846, where all of your questions can be answered in detail.

How does a debt relief program affect your credit?

When a person gets surgery to fix an injury, is the result always the same? Of course not. Some people still have pain, while other patients are 100% healed.

The same goes for debt relief programs. Again, results will vary, but the goal is to improve a person’s overall financial health and to fix the serious problem, which is – “their debt.”

How a debt relief program affects credit depends on;

A.) what a person is doing outside of the debt relief program (e.g., Do you have a car payment or secured credit card you’re paying on?)

B.) the debt relief company’s level of performance (e.g., will they dispute an invalidated debt from your credit report?)

C.) how the client’s situation was when they joined the debt relief program (e.g., are you current or behind on monthly payments?)

D.) what type of debt relief program a person joins (e.g., debt settlement can leave late marks and collection accounts on credit reports for up to seven years)

Some debt relief programs will affect a person’s credit score more than others.

What is the best debt relief program to help with credit scores?

Golden Financial Services believes in using an integrated approach to helping consumers get out of high debt. Relief can be achieved while simultaneously helping dispute invalidated accounts from credit reports.

But keep in mind, no program can guarantee lower debt by a certain amount and get anything removed from a person’s credit report. The Debt Resolution program’s goal is to get you out of debt for the least amount while removing negative information from credit reports, but no program can guarantee you clean credit in the end.

The approach the Debt Resolution program uses is first to use debt validation to challenge each debt. The program has a high success rate of invalidating most debt, resulting in removing each debit from the consumer’s credit. If a debt needs to get paid, debt negotiation will offer the consumer a reduced balance and repayment plan, so in the end, the consumer saves money.

Visit this page next to learn about the Debt Resolution program.

Do Debt Relief Programs Hurt Your Credit?

With a debt settlement program, a person may see a decline in their credit score. This is because you must fall behind on monthly payments for the program to work effectively. However, as a person’s debt is “paid off” on a debt settlement program (one debt at a time), debt-to-income (DTI) ratios improve (a positive factor).

Debt settlement should be your last debt relief alternative. Before using debt negotiation, validation can challenge the validity of a debt. Validation isn’t saying you never spent the money. Instead, validation forces the collection agency to prove they are legally authorized to collect on a debt. And if they can’t prove, they no longer can legally come after you or continue reporting the debt to the credit bureaus.

Debt Validation Example Letter:

Additional Resources to get debt relief and how programs affect credit:

Learn how to stop paying credit cards legally

Learn ways to get out of debt without paying

Does Consumer Credit Counseling Hurt Your Credit Score?

Before settling your debt, consider consumer credit counseling. This type of debt relief program has a minimal negative effect on your credit, but it does have a negative effect because credit cards get closed out. However, credit scores can also improve in some cases with consumer credit counseling. If you’re late on credit card payments, consumer credit counseling can re-age your accounts to be current, helping your credit score.

Consumer credit counseling benefits:

- reduce monthly payments

- save money on interest rates

- consolidate credit card payments into one

- become debt free in five years or less

- re-age past due payments to be current

Consumer credit counseling downsides:

- Consumer credit counseling programs can freeze a person’s ability to use credit.

- Results in a third-party notation on a person’s credit report.

- Stuck to a repayment plan that lasts close to five years

- No flexibility in the monthly payment

- Entire debt must get paid back with interest

Keep in mind; consumer credit counseling companies work for the creditors. These companies actually get paid from credit card companies. So, who’s best interest does a credit counseling company truly have?

Does Debt Consolidation Hurt Your Credit Score?

With debt consolidation, a person may see an improvement in their credit score.

The reason why is because debt consolidation lets you pay off all of your debt “in full” within 90-days. Your credit score will increase after your debts are paid in full.

Ok, so you can’t afford to stay current on payments, but you don’t want to resort to settling your debt.

Are there any other options in between?

Yes!

Debt Validation

With a debt validation program, a person’s debt is being disputed.

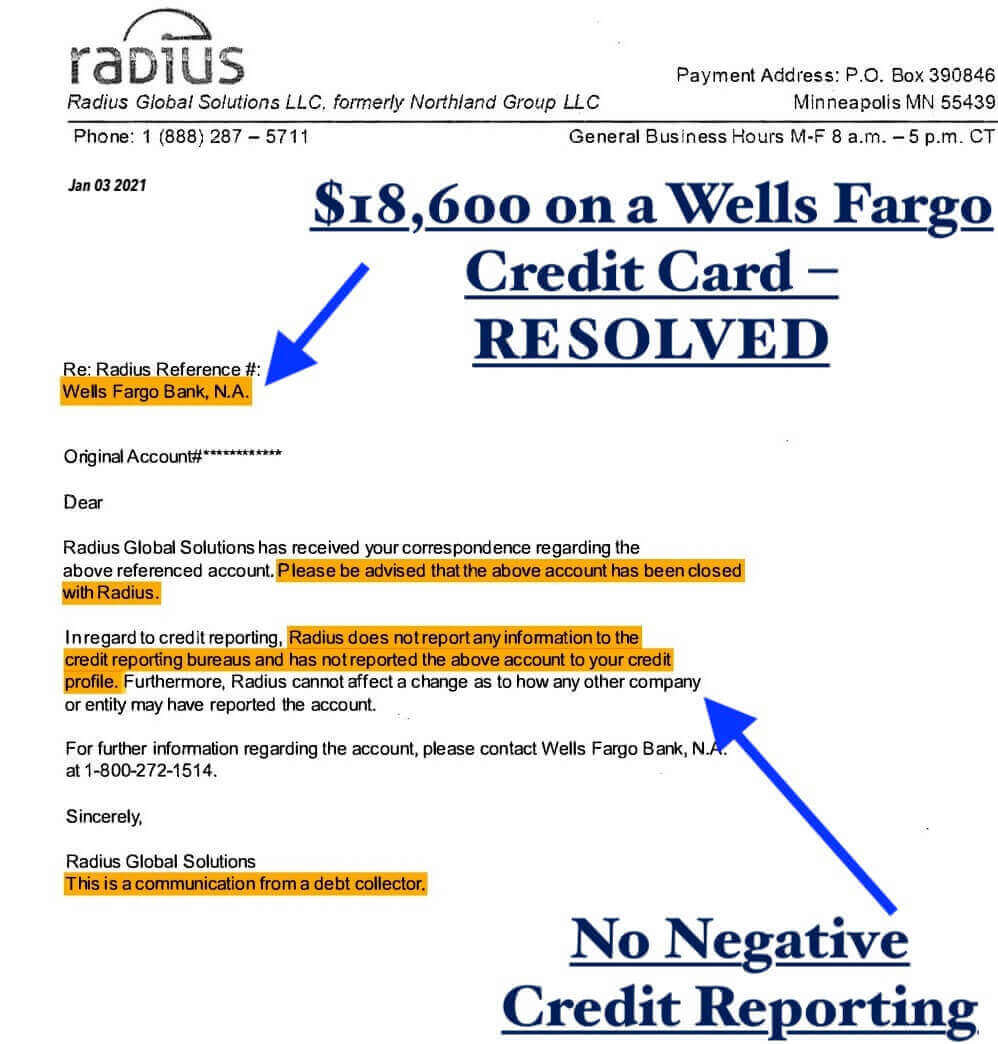

If the debt collection company can’t validate the debt with all legally required documentation and accurate information, they can no longer collect on it or report it to the credit bureaus.

In summary, a credit card debt can get disputed, and you may not have to pay it. As an additional benefit, the account can come off your credit report entirely. As a matter of fact, with a debt validation program, credit repair is included. First, your debt will get disputed. Second, your credit will get disputed.

Once a debt is proven to be invalid, now it’s easy to dispute it and get it removed from your credit.

Debt validation can help a person to dispute and remove a debt collection account from their credit report.

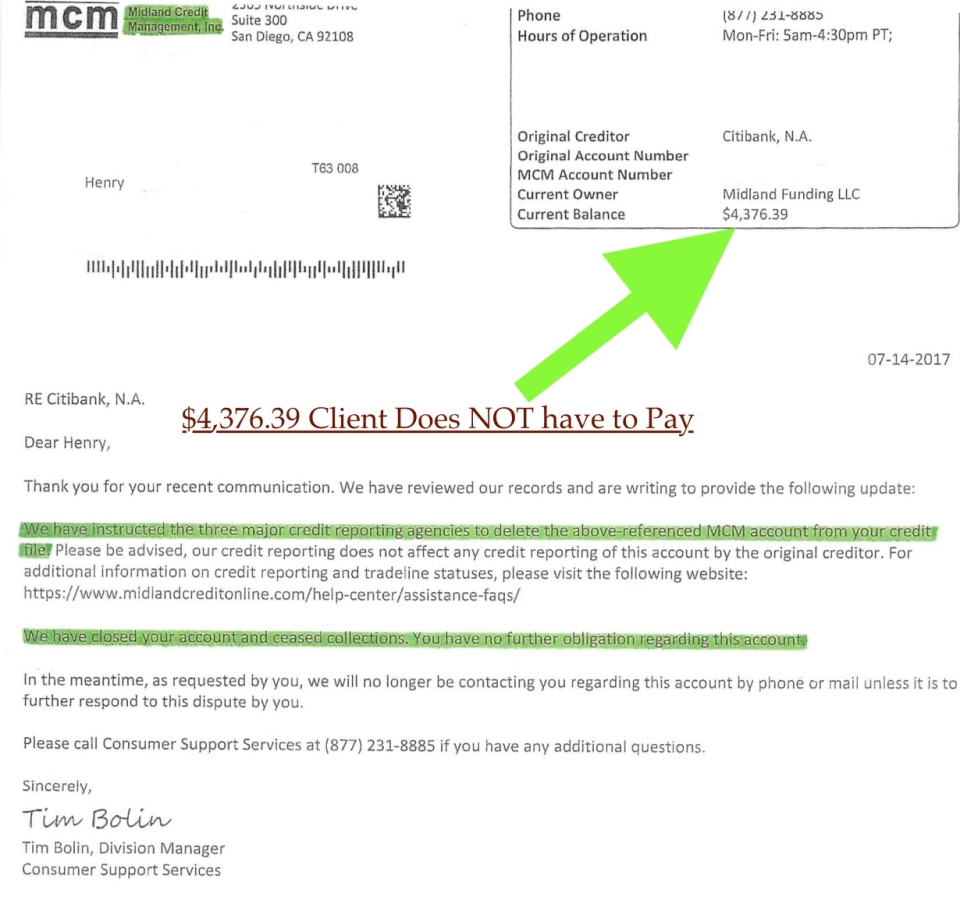

Debt Validation Example Letter: The client owed $4,376.39 and Paid $0 to Resolve the Debt using the debt validation program.

Click here to learn more about the debt validation program offered through Golden Financial Services.

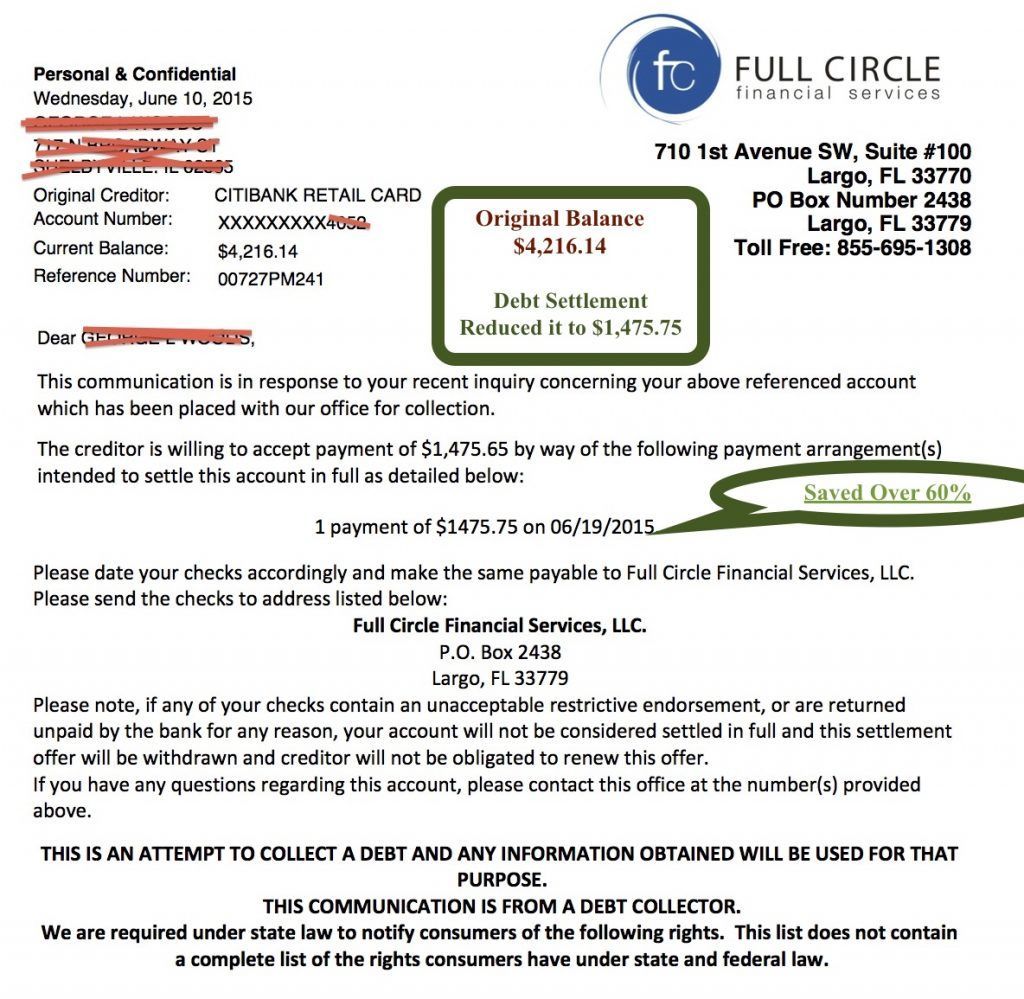

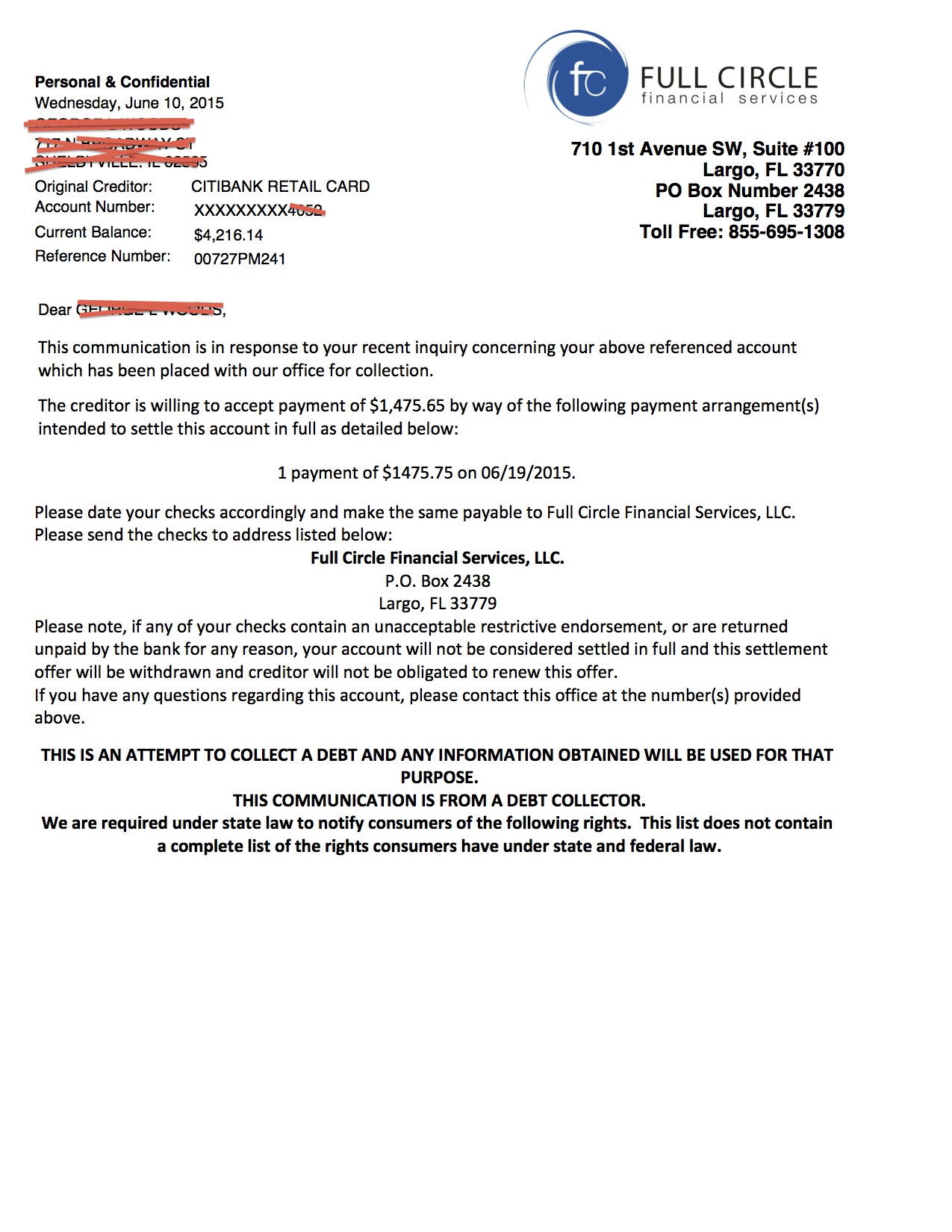

This next client used a debt settlement program to save 60% on a retail credit card debt before company fees. This next debt was worth $4,216.14 and was settled for only $1,475.75.

What can you do to improve your credit while on a debt relief program?

Leave a credit card out of the program.

Use that credit card every month and pay the balance “in full” every month while your other debts get resolved in the program.

This action will help to raise your credit score while on a debt relief program.

Your credit score may still go down over the first year. But as your debts get resolved one by one, your credit score will start to improve at some point.

What is a debt validation program, and how does it work?

Simplest Way to Get Out Of Debt

How does a debt consolidation loan work?

A debt consolidation loan can be obtained at the bank, a third-party loan company like Lending Club, or borrowed from a friend, co-worker, or family member.

When you get a debt consolidation loan, you borrow money and use it to pay off all of your debt. The point of getting a debt consolidation loan is to lower your interest rates so that you can get out of debt faster and save money.

A debt consolidation loan generally won’t hurt your credit score and can actually help your credit score to improve, as mentioned above.

Keep in mind, when trying to get a debt consolidation loan, the bank and different lenders will “run your credit” each time you apply. Having your credit pulled can put a negative inquiry on your credit report and can lower your score.

Just make sure you are a good candidate for a debt consolidation loan before you start applying everywhere. If you apply in multiple places for a debt consolidation loan and get rejected several times, now you take a beating on your credit score for no reason. If you get rejected more than once, stop, and analyze your situation before going any further.

Before applying for a loan, check your credit for free at AnnualCreditReport.com. Make sure you don’t have any late payments, collections, and negative things of this nature. If you do, contact Golden Financial Services. Let us find you a financial debt solution.

Give a counselor at Golden Financial Services a call at 1-866-376-9846 to discuss your debt relief options. (You can get a Free Credit Report & Score!)

How can a debt consolidation loan raise my credit score?

Your credit score will go up after you get a debt consolidation loan and use it to pay off other debts.

You are paying off possibly five or more debts at once.

Your credit utilization and debt-to-income ratio will both improve. In addition, your credit score should go up within 30-60 days after paying off all of your other debts with the new loan.

If you pay down the balance on any particular debt showing up on your credit report, your credit score will almost always improve. So, if you pay off multiple debts at once — imagine the positive effect this action will have on your credit scores.

Just stay away from online lenders, like Avant, Lending Club, and any PayDay loan. These lenders offer loans for bad credit applicants, but the cost of these loans is way too high. In addition, you will pay high interest and fees.

Balance Transfer Credit Cards – Good or bad idea?

Transfer your high-interest credit card debts onto a 0% balance transfer card and eliminate all interest. Of course, you would have to pay an upfront fee of 3%-5% of however much debt you transfer to the card, but if you avoid all interest, then it’s worth the price.

You need to pay off the entire balance during the introduction period, usually 6-18 months. If you fail to pay off the balance during this period, the interest rate shoots up, and now you’ve defeated the purpose of getting a balance transfer card.

You must have a high credit score to qualify for this type of debt relief option.

When is a debt consolidation loan a bad idea?

A debt consolidation loan is a bad idea if you get charged high interest and fees or are already struggling to make your monthly payments. How will you repay the loan? In your case, you may need a hardship debt relief program.

The monthly payment on a debt consolidation loan is around the same as when you pay minimum payments, so if you are barely making your minimum payments each month, a debt consolidation loan may not be your best route to take. On average, it takes five years to pay back a debt consolidation loan. Can you go another five years of paying minimum payments?

Additional Resources:

Side by side comparison of every debt relief program available in 2017 (Includes; Pros VS. Cons)

Try this debt relief program calculator here

How much will a credit card company settle for?

If you settle the debt with a third-party debt collection company that buys the debt from your original creditor — you can reduce the balance at that point by as much as 30%-80% (on average). A credit card debt can be settled for a fraction of the total balance owed in most cases, but not while you are still current on payments. If you try to settle a credit card debt directly with the original creditor, they probably won’t agree to any debt reduction.

Would they rather I fall behind on my payments and not pay them at all?

Don’t fool yourself. Your creditors are getting paid one way or another. The banks have ulterior motives. They have a plan to victory, regardless of if you make the payments or not.

The longer credit card debt sits unpaid, the more leverage to settle the debt for a low amount. Creditors feel that they may never get paid. Or even worse, what if you file for Chapter 7 bankruptcy? In this case, your creditors could get $0. Therefore, they’re often willing to settle for a fraction of the balance owed.

After 6-months of being delinquent on payments, your account gets charged off and sold to a debt collection company. You can get large discounts on what you owe when negotiating with debt collection companies versus if you try to negotiate with the original creditor. This is why debt settlement companies wait until the debt collection company takes over the debt before they start negotiating.

Keep in mind that your credit score goes down after you stop paying your credit card bills, and potential lawsuits could arise. Therefore, before you stop paying your creditors, make sure that you’ve retained a lawyer or a debt settlement company to help you resolve your debt.

Now that we’ve talked more about debt negotiation, take another look at this example letter.

The upside to debt settlement is that you can get large discounts on your debt. See Debt Settlement Example (Citibank Credit Card Balance of $4,216.14, Reduced to $1,475.75, Saving the Client $2,740.39)

There is no set amount that a creditor will settle for; each debt collection company may have its own policies, and what it comes down to is — how good you are at negotiating debt. An experienced negotiator may settle a debt at 20-cents on the dollar. Here are some helpful resources to help you settle debt on your own.

How to Settle Debt on Your Own

You can file your own taxes. You can consolidate federal student loans on your own. And you can do just about anything on your own in this world.

If you choose to settle your own debt, here are some tips:

Learn more about joining a debt negotiation program.

Call 1-866-376-9846 to speak with an IAPDA Certified Counselor who can advise you on what your best option will be.

What happens when I stop paying my credit card bills?

Once you fall behind on a credit card payment by more than 4-6 months, the bank will write off the debt as an “uncollectible debt.” By writing the debt off, the bank financially benefits through tax breaks, essentially getting reimbursed. Plus, banks use insurance to recoup lost revenue, like your debt was an asset that went bad.

Your debt will then get sold to a third-party debt collection company so that the banks can make additional profit. The debt collection company will also add additional fees. Debt collectors then start calling and harassing you. And it’s a vicious cycle designed to make the banks rich.

Get Your Free Consultation with an IAPDA Certified Debt Expert at 1-866-376-9846. (We’ll Help You Fight It)

How does a debt settlement program work?

A debt settlement program can help you pay off unsecured debt, including credit card debt, store and gas card bills, medical bills, utility bills, and personal loans. However, you cannot settle secured debt such as home mortgages and car loans in a debt settlement program.

Once you are approved for a debt settlement program, the company takes over dealing with your creditors. You only have to make one monthly payment. At Golden Financial Services, if you have a hardship situation pop-up one month, call in, and we will reduce your payment for that month or let you skip a payment.

Since your debt is getting reduced by a substantial amount, your overall monthly payment will be significantly lower than what you were paying minimum payments. You can be debt-free within around 3-years on average by using a debt settlement service.

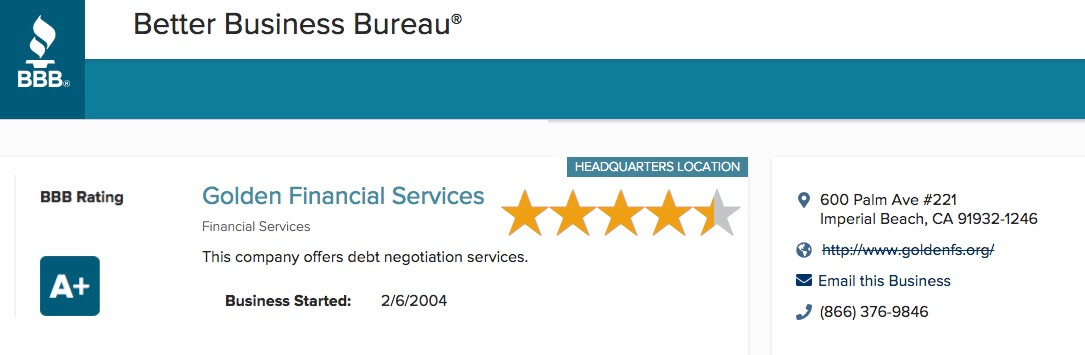

Debt relief companies that are highly rated by the Better Business Bureau and who have no complaints — will usually quote their clients conservatively and always perform better in the end.

BBB A+ Rated Debt Assistance Programs

Click here to continue reading about how a debt settlement program works.

How long does a debt settlement stay on your credit report?

After paying off your debt with a debt settlement program, the negative marks could stay on your credit report for several years. In some cases, a debt settlement company will demand the negative marks get removed as part of the deal before agreeing to a settlement.

Sometimes the creditors will refuse to remove the negative marks even after the debt is paid off because that would require extra work, and banks can be lazy.

Can a credit repair program get “negative marks” and “debt collection accounts” removed from a person’s credit report after debt settlement?

A person could use a credit repair program to dispute the negative marks and get them removed in many cases. Here’s the trick, dispute the debt through the credit reporting agencies (Experian, Equifax, and Transunion). Don’t try to dispute the debt with the debt collection company. If you dispute a debt through the credit reporting agencies, you essentially let the credit reporting agencies deal with your creditors.

The credit reporting agencies will request for the debt collection company to provide proof of the debt and that the derogatory information being reported is accurate. If the credit card company doesn’t provide the credit reporting agencies with verification and evidence of the debt and its validity within 30-days, the negative marks will come off your credit report.

Creditors will often ignore a dispute if the balance on debt is at $0. What do they have to gain, right? As a result, the marks will fall off a person’s credit. Banks don’t want to deal with the extra work when there is no profit involved. If you call a debt collector and ask them to remove the collection mark from your credit report, they will say “no,” guaranteed.

WARNING: Don’t just start disputing everything negative on your credit report because that would make your situation worse, adding the extra notations on your credit report showing all of your debts “being disputed.”

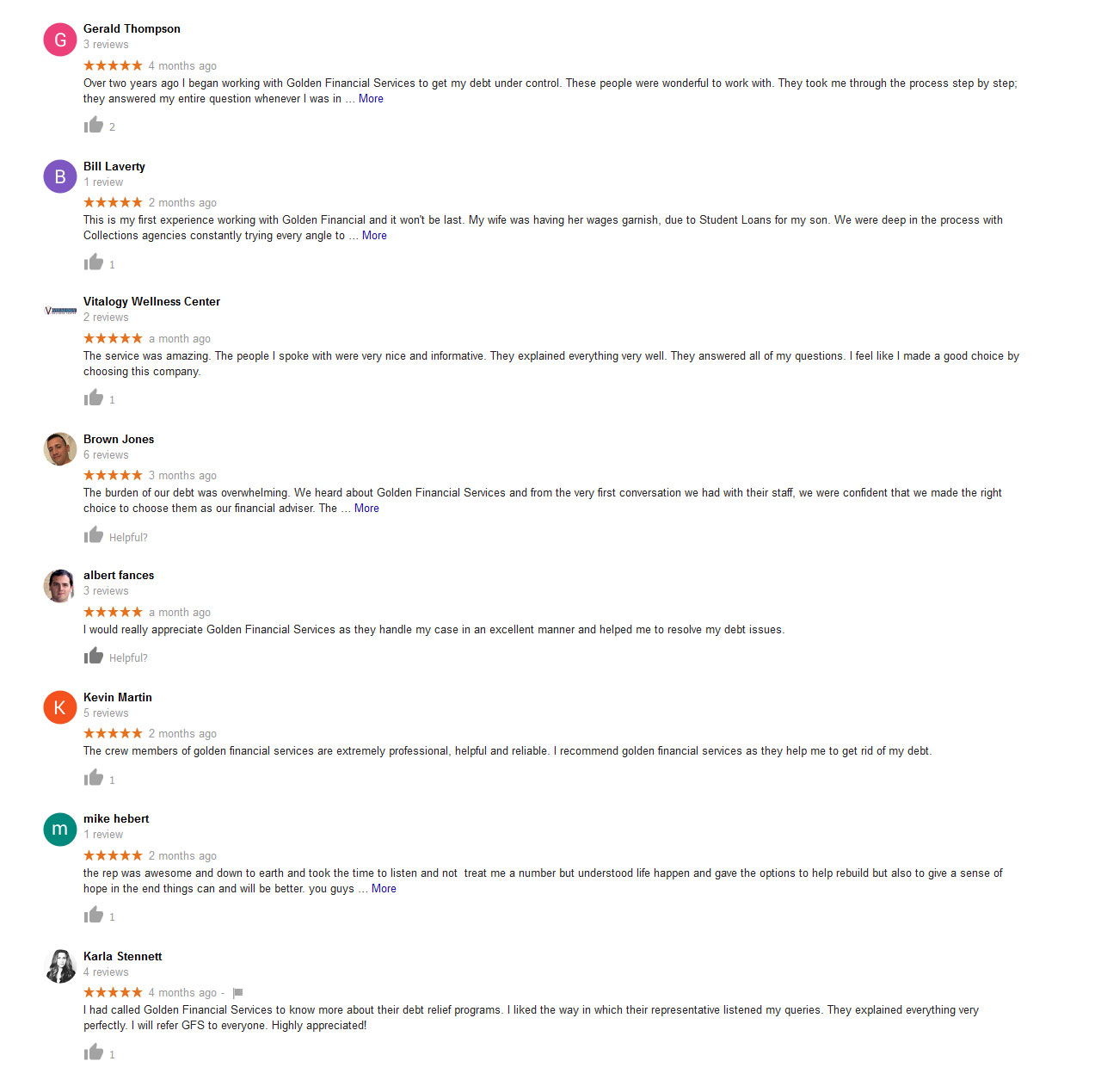

About Golden Financial Services:

Golden Financial Services was created in Florida but shortly after opened offices in New York and California. As a result, debt relief programs today are available in almost all 50-states. In addition, GFS maintains a perfect A+ rating at the Better Business Bureau and is certified by the International Association for Professional Debt Arbitrators (IAPDA).