Do You Have High Credit Card Debt? Settlement Programs Negotiate With Your Creditors to Reduce the Balances.

Have over $7,500 in credit cards? Debt settlement programs let you settle your cards for must less than the total amount owed. The credit card settlement program is proven to work, helping millions of Americans since 2004.

You can choose from multiple payment options ensuring that you can afford the monthly payment. The average client becomes debt free in 24-48 months. Almost any type of unsecured debt qualifies. To get started, simply call (866) 376-9846.

You will have multiple programs to choose from, but a credit card settlement service is one of the best options because you can save the most money going this route. If you qualify, we will first set you up to meet with a local law firm near you. At that point, the law firm will go over the client agreement with you and together help you get everything signed and approved.

The following page explains the pros and cons of settling credit card debt.

How much can I save with credit card debt settlement?

You could settle a $10,000 credit card debt, for approximately $6,200. The $6,200 includes debt settlement company fees.

The savings is completely forgiven, meaning, creditors cannot ever come after you for that amount. In addition to saving all that money on your debt, you won’t pay anything additional in interest or late fees. It’s all included in the $6,200. Keep in mind, the debt payoff amount of $6,200 is just an estimate, but based on past client results, this is about what you can save. Results do vary though, in some cases you’ll save more, and in other cases, you may pay less.

Why not just settle the debt on my own?

Debt negotiators will use the power of leverage to solidify the most substantial possible discounts. For example, the negotiators may negotiate based on hundreds of clients worth of debt with the same creditor at a given time, offering a million dollars to settle 2.5 million dollars worth of debt.

Are taxes owed for debt settlement?

The IRS could request that you pay taxes on the amount saved with debt settlement. The law firm that Golden Financial Services sets you up with will talk to you about filing a #982 tax form to eliminate any tax debt if it arises.

Do you need an attorney to settle credit card debt?

With credit card settlement you must let your accounts fall delinquent to the point where they eventually get sold to a collection agency. Creditors get corrupt at this stage in the game, and will often attempt to collect on a debt illegally and harass a person. You are protecting your financial well-being by having an attorney represent you. Your attorney can speak on your behalf, and creditors will know not to use any illegal tactics when dealing with your attorney. Legally, creditors must direct all communication to the law firm after getting notified that a person has an attorney. If they continue to call you that’s an FDCPA violation. FDCPA violations can be used as leverage to get you more significant discounts on debt. Attorneys can sue a creditor for $1,000 per violation, which gets awarded to the consumer. Attorneys can even file for dismissal, where in extreme cases a debt can also get dismissed. A dismissed debt can no longer legally remain on credit reports. There are many reasons why you want to have an attorney representing you when utilizing a credit card settlement program.

Did you know that if your creditors call you before 8am, this is a violation that could result in a fine for $1,000 (payable to you)?

Your attorney could use this violation as leverage when attempting to settle your debt. (e.g., Your attorney will let the creditor know “We have proof that you called ___ at 7:10 am. This violation of the FDCPA would cost you a fine of $1,000. We can drop this today if you are willing to settle this $9,500 debt for $4,200.”)

Make sense?

Call (866) 376-9846 to Check if You Qualify for Credit Card Debt Settlement.

Is it better to pay minimum payments or settle my credit cards?

Unless you can pay more than minimum monthly payments on high-interest credit card debt, there is no light at the end of the tunnel when paying only minimum payments. Try this minimum payment debt calculator to see how long it will take you to become debt-free if you keep paying the amount you are currently paying.

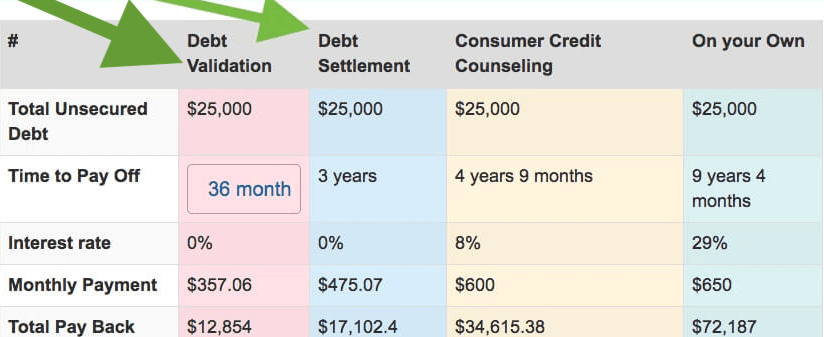

See Credit Card Debt Settlement Calculator Example:

The longer you pay minimum payments, the more fees and interest you will give your creditors, money that could otherwise go towards your retirement. By settling your credit cards with debt settlement you can become debt free in 24-36 months. Your credit score may take a 150 point hit but credit is rebuildable. After using a debt calculator tool like the one I’ve shared above, ask yourself if the money that you could save with debt settlement is worth having your credit score go down by 150 points. Often, the amount you can save with credit card settlement programs will pay for a brand new car in full or could be your down payment on a new house.

Call Golden Financial Services About Debt Relief Programs Now at (866) 376-9846!

The bottom line is this. Consumers with a hardship deserve to get help in order to pay off their unsecured debts. If the creditors are not willing to work with the consumer direct, then credit card debt settlement could be the best option to consider. Credit card debt settlement at Golden Financial Services helps thousands of consumers every single month. Golden Financial Services has the BBB A+ Rating, testimonials, leverage, experience, creditor contacts and a proven track record when it comes to credit card debt relief programs.

See what past credit card settlement clients have to say about the service

Let Golden Financial Services help you with Credit Card Debt Relief.

Benefits of the Credit Card Act & how it can be used for credit card relief

The Credit CARD Act, in a nutshell, helps to protect consumers from unfair rate increases. Credit card companies now must also supply clear disclosures to customers so that people know exactly what fees and interest rates are included. Before a credit card company raises your interest rate, they must give a consumer a notice (at least 45 days in advance).

What to do if creditors violate the Credit Card Act?

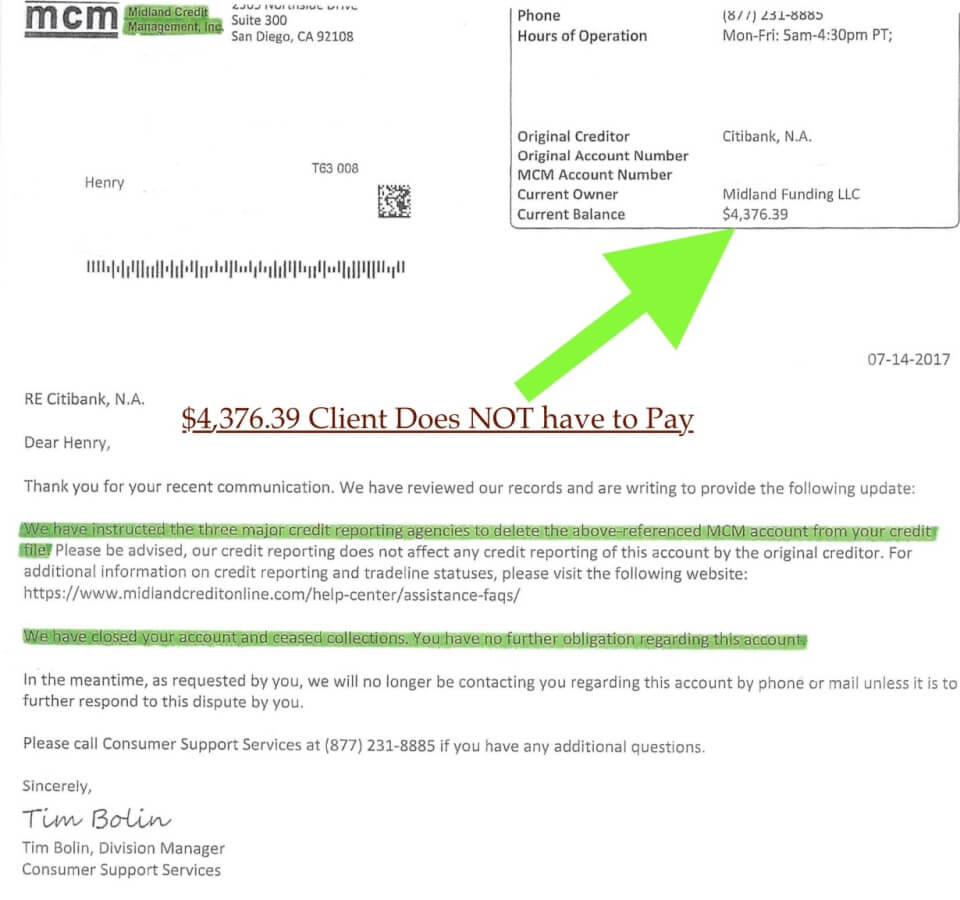

Creditors often violate the Credit Card Act. With a debt validation program, you can dispute a credit card debt and if your creditors violated the Credit Card Act at some point, you may not have to pay that debt. It forces creditors to be accountable for their actions. You can request proof that the debt is yours and that your creditors are abiding by laws, like the FDCPA and Credit Card Act.

Debt often becomes legally uncollectible with the help of debt validation, meaning, consumers don’t have to pay the debt. Also, once a debt is legally uncollectible, it can no longer be reported to the credit reporting agencies. Debt validation is a great weapon that you can use to challenge whether or not your creditor violated a law. Golden Financial Services can help you get started for free.

The downside of the Credit Card Act

A downside to the Credit Card Act is that credit card companies are now charging fees in new ways. They are “getting creative.” You know doing things like charging for a glass of water. Well, it feels that way sometimes. Here’s a serious example: if you use your credit card in another county, you will now pay extra fees for that transaction. If you transfer your balance from one card to another, you will now pay extra fees.

How do you get the credit card companies to LOWER INTEREST RATES without having to join a debt management or credit card debt settlement programs?

Getting credit card relief by working directly with the banks is not always easy. You would think that simply calling the credit card companies and communicating with them would be the best route and it can be at times. However, when calling the credit card companies directly, sometimes they will work with consumers, but other times they will not. Follow these step by step instructions on how to settle credit card debt on your own.

Would you prefer a loan? Next, read about Credit Card Consolidation.

Downsides to Credit Card Settlement Programs

You must be delinquent on monthly payments in order to use a credit card settlement program. Consequently, late fees and interest continue to accumulate even after joining a debt negotiation program. There is a chance creditors will issue a person a summons to go to court. Your credit score will most likely continue to decline over the first year of joining. You could receive a 1099 requesting you pay taxes on the savings from a debt settlement program. Lastly, it’s not free to use a credit card debt settlement plan. Law firms and all settlement companies charge fees that range from 17% – 30% of the total debt enrolled. With the fees included you’ll still save much more than if you were to pay your creditors in full, but be sure to weigh these pros and cons to ensure you make the best decision on whether or not to join a debt settlement program.

If you can afford to pay higher than minimum monthly payments it’s best to avoid settling your credit card debt and instead pay your balances in full by using the debt snowball or avalanche method. You can preserve your high credit score by paying your accounts in full. Building a high credit score is no easy task. So, if you have a high credit score today and can preserve, do so! Not sure what to do? Start by making a budget. After you have a budget analysis you’ll be able to see the entire picture more clearly. Start with this free budget tool here.

Here are your 10 best ways to clear high credit card balances quickly.

Ready to sign up for a plan?

Call to see if you qualify for a credit card debt settlement at 866-376-9846!