Are you searching for a free debt consolidation quote? Before you decide on this expensive move, we recommend you explore all of your options. Consolidation loans can be the most expensive route to pay off debt.

Free quotes for debt settlement and validation are available through Golden Financial Services (GFS). For a consolidation loan, we recommend you visit a local credit union in your area, as credit unions usually offer the lowest APR interest rates.

The following page explains the options that are available to help you consolidate debt. You do have multiple options including; debt settlement, debt validation, consumer credit counseling, consolidation loans, balance transfer cards, and for a complete rundown of your options here are the 10 Best Ways to Clear High Debt (as of 2020).

Can you barely afford making minimum payments? If yes, you don’t want a consolidation loan.

Is your goal to improve your credit score and you can comfortably afford your monthly payments as of today? If yes, a debt consolidation loan may be the right option to help you improve your credit score, but even so, there are other ways to help you improve your credit score. Here are 24 tips to help you improve your credit score.

Do you have low income and high debt? If yes, you don’t want to use a consolidation loan. Debt relief services will be a much better option for you to consider.

Do you have only credit cards and your goal is to lower interest rates? If yes, a consumer credit counseling program can help you accomplish just that!

Many consumers are confused about which direction to turn in, “do I apply for a loan or use a financial debt solution to reduce my balances?” Here’s some thought to consider, but first off:

Who is Golden Financial Services (GFS)?

GFS is one of the oldest and most reputable debt relief companies in the nation. In 2020, the company was rated #1 for debt relief programs by TrustedCompanyReviews.com and made the official list at Inc.com for being one the Fastest Growing Companies in the Nation for 2019.

What separates GFS from other debt settlement companies is that GFS offers multiple options to consolidate debt and is the leader in financial education online. When we say “consolidate debt,” we are not referring to a loan. GFS is not a lender, but instead, GFS offers ways to reduce debt and pay it off at an affordable payment.

When is debt consolidation the wrong option?

If you have a credit score of less than 700 and you’re struggling to pay off high debt, a consolidation loan won’t be your best option. Many consumers that turn to a loan when trying to consolidate credit card bills eventually end up falling behind on payments because they can’t afford to pay off the loan.

If you’re struggling right now just to make minimum payments, getting a loan is a wrong choice. You’d be better off knocking down your monthly payment so that you can easily afford to make it. What is a high credit score if you have no money at the end of the month?

If you eventually have a setback, like if you need a new car or a medical problem occurs, these unexpected expenses could result in you not being able to pay the consolidation loan back. And in life, setbacks occur!

When is debt settlement the right option?

Debt settlement (negotiation), on the other hand, could help slice your monthly payment down to a fraction of what it currently is. A settlement program can lower your credit score but, at the same time, get you out of debt fast. Is it worth it? You have to decide that, but at Golden Financial Services, here’s how we see it. If you can get out of debt in half the time by using debt settlement, you can then start on the path to rebuilding your credit score. Within five years, you could be sitting in a much better financial situation than if you were to use a loan to pay off your debt today, as you may still be paying on that same loan five years from today.

Do consolidation loans hurt your credit score?

If you have bad credit but sufficient income, a consolidation loan can help you improve your credit score. Do keep in mind, bad credit consolidation loans are costly and could result in you paying back close to double what you owe but can be a great tool to help rebuild your credit score.

Isn’t there a better way to consolidate my bills, than using debt settlement and consolidation loans if I have bad credit?

If you have a low credit score and high debt, here’s the best way to deal with high credit card debt– it’s called debt validation.

If you can afford to pay more than the minimum payment and can comfortably afford to pay all of your bills but want to pay your debt faster, another option to consider is the debt snowball method. The snowball method will improve credit scores and save you money! Here’s an article that explains how the debt snowball method can eliminate your revolving debt faster.

You can also use our free snowball calculator tool to help you pay off debt faster.

What is debt validation?

Yes, there may be a better option, but it’s not a loan, and you won’t be paying your debt back in full. You can use debt validation to dispute your debt. With validation, you are not saying, “the debt is not mine.” Validation merely forces the collection agency to prove that they are legally authorized to collect on the debt, making the collection agency to produce complete and accurate records.

Surprisingly, collection agencies often cannot prove a debt is valid, resulting in it becoming legally uncollectible. A legally uncollectible debt is one that you don’t have to pay, and legally it can’t remain on your credit report.

How much does the validation cost?

Talk to an IAPDA certified counselor for a free debt relief program quote today!

- A+BBB rated debt relief services

- IAPDA certified counselors

- In business since 2004

When not to use a debt relief program

If you have a high credit score and can comfortably afford to pay more than minimum payments, you’ve never been late on payments and don’t want your credit score affected; you should not use a debt relief program. In your case, Golden Financial Services recommends visiting a local credit union.

Through a local credit union you can choose from:

- a balance transfer card to pay off high-interest credit cards

- possibly a home equity line of credit to consolidate debt (if you have equity in your home)

- or maybe you can get that debt consolidation loan that you are searching for today.

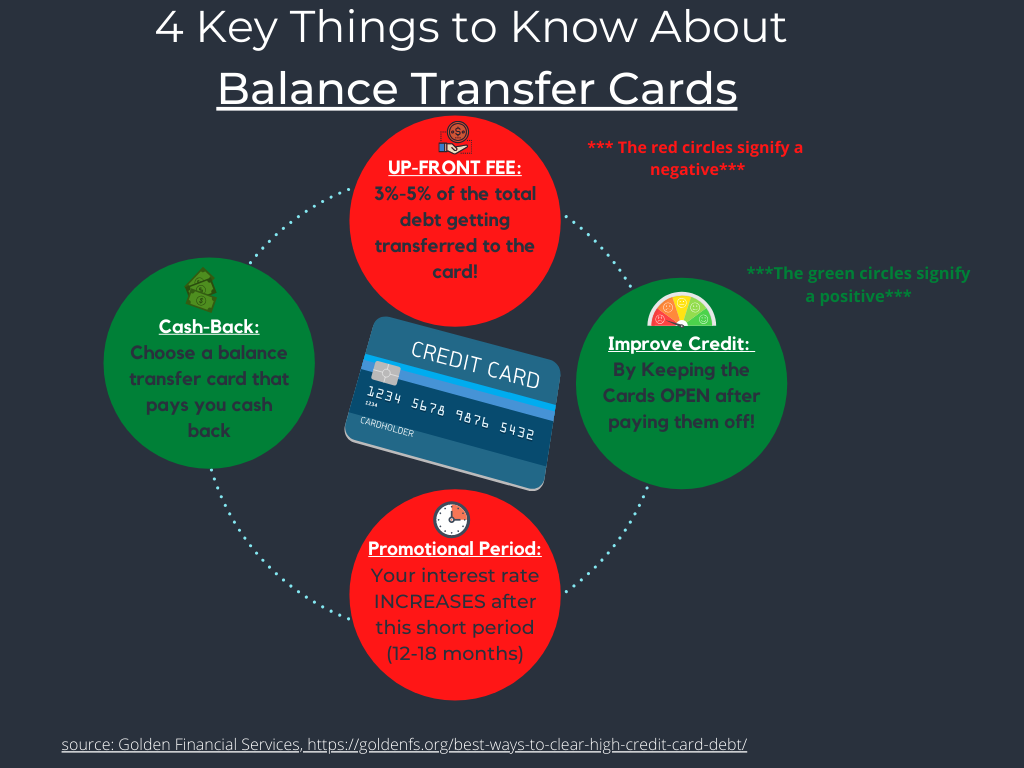

How much does it cost to consolidate with a balance transfer card?

With a balance transfer card, you will be required to pay an up-front fee that costs between 3-5% of the total amount you transfer on to the card. The point of these cards is to get a low-interest rate for a specified period so that you can then move high-interest debt on to the low-interest card and save money. However, the balance transfer card will only offer a low-interest rate for the promotional period, and then the rate goes up, so you must pay off the entire debt within this intro-period (which is often 12-18 months).

How much does a debt consolidation loan cost?

Consolidation loans can cost you anywhere from $3% to 50% interest rates. Some consolidation loans include up-front fees. So be prepared to pay your entire debt back plus interest and fees when using a debt consolidation loan.

A local credit union can also provide you a free debt consolidation quote.