Best Michigan Debt Relief, Settlement, and Consolidation Programs

Michigan debt relief, settlement, and consolidation programs can save people from having to resort to expensive debt consolidation loans (called Fintechs). Fintechs are the new type of online personal loans being offered to subprime borrowers (i.e., people with a low credit score). To justify lending to consumers that banks won’t lend to, Fintechs will charge interest rates above 30%, which is in the “predatory lending territory”. Getting one of these consolidation loans to pay off debt, is a perfect recipe for a financial disaster.

Michigan debt management programs come with downsides. However, consumers can save more money and become debt-free faster with Michigan debt relief programs, compared to using a Fintech online lender. The following page explains the pros and cons of debt relief programs in Michigan. We will teach you about Michigan debt settlement versus validation plans, and consolidation versus consumer credit counseling.

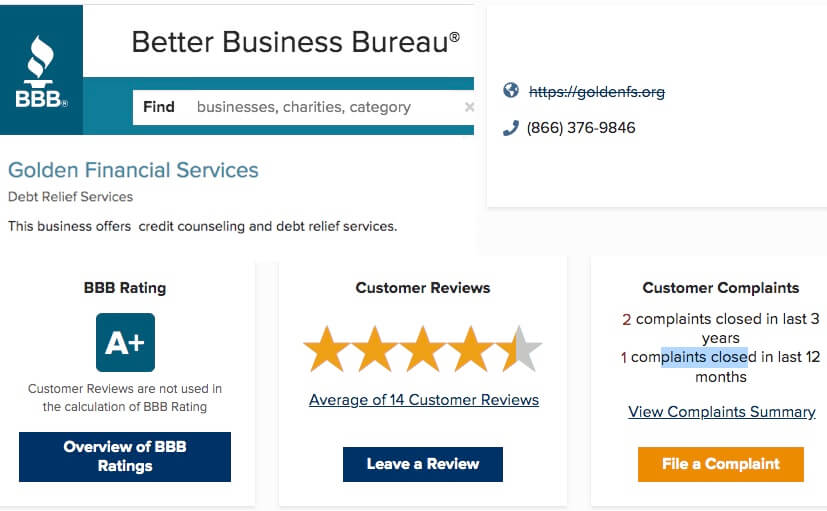

What are the best debt consolidation companies in Michigan? Debt relief, settlement, and consolidation companies that are highly rated at the Better Business Bureau (BBB) are reputable companies. Check at the BBB for how many complaints a company has and what their letter rating is. Golden Financial Services (GFS) is A+ Rated by the BBB and has less than one client complaint per year. GFS has been in business since 2004, making it one of the oldest debt settlement companies in Michigan.

Do I pay my mortgage or credit cards if I can’t afford both?

Many Americans are finding themselves in a position where they can’t afford to pay all of their bills. Do I fall behind on my mortgage payment or credit cards? Michigan debt relief services can reduce high credit card debt that you can’t afford to pay, but if you fail to pay your mortgage you’ll lose your home.

Try not to miss a mortgage payment or if you already did get caught up on your mortgage payments. For your unsecured debt, consider the following programs.

Compare Michigan Credit Card Relief Programs (pros vs. cons)

MI residents who are behind on credit card payments or paying only the minimum payments:

Are you only paying minimum payments on credit cards or behind on payments? Michigan debt relief, settlement, and consolidation programs can offer you a less expensive and faster route to becoming debt-free. Michigan, Illinois, New York, New Jersey, Texas, Florida, and Arizona residents have five effective programs to pick from as of 2020.

Your choices include debt relief, settlement, validation, consolidation, and consumer credit counseling programs. Validation can offer you the best savings, while consumer credit counseling programs can minimize any initial negative effect on your credit.

How to pick what debt relief program in Michigan is best?

There is not a single, “one best Michigan debt relief program.” Each program has pros and cons that you need to understand. What is your goal, looking to save the most money or for just a reduction in interest rates? How’s your credit look today? Do you have low balances or all maxed-out credit cards? How’s your income? Can you comfortably afford to pay minimum payments and higher, or can barely afford to make the minimum payment? All of these factors play into determining what program is best for you.

You can learn your options and pick the best program by calling (866) 376-9846.

What type of debt do you owe?

If you owe credit cards, medical bills, unsecured personal loans, and a variety of unsecured debt, and you can’t afford to stay current on payments, there are also hardship programs available. Debt negotiation can lower the balance on an account. A validation program disputes a debt, and if the collection agency can’t prove it to be valid, the debt no longer needs to be paid.

How do Michigan debt relief programs affect credit?

If you want to minimize any adverse effect on your credit report, then consider consumer credit counseling. Michigan residents do need to have a minimum of $7,500 in eligible accounts to qualify for debt relief, settlement, and consolidation programs. Settlement and validation programs don’t pay the creditors on a monthly basis, resulting in an adverse effect on credit scores over the first year. However, did you know that paying only minimum payments on maxed-out credit cards can also hurt a person’s credit score, along with hurting their wallet?

What Golden Financial Services can offer Michigan residents:

Our job is to educate consumers on their financial debt solutions and help people enroll in the right debt consolidation program. Michigan debt relief and settlement programs are available. In total, there are four programs to choose from including; settlement, validation, consumer credit counseling, and debt consolidation.

Before we enroll you in any program, we want to make sure you understand all of the pros and cons. Just like when you go to a doctor and get medicine, the doctor warns you of potential side effects and instructs you on what to do if a side effect occurs. Our team of counselors will do the same. You will need to understand the potential adverse effects that can occur with each program so you’ll know exactly what to do if any of these negative consequences did occur.

Our goal is to make sure no obstacle hurts the end program result of becoming debt-free. We won’t recommend any Michigan debt relief company or law firm that is not 100% transparent with its clients and fully equipped to deal with all potential downsides. If you receive a summons, you’ll be equipped with a law firm to help you resolve it for less than the full amount owed. All programs include credit education to help you rebuild your credit.

What is Michigan debt relief?

“Debt Relief” is the process of:

- reducing balances or stopping the growth of debt

- reducing interest rates to make a person’s debt affordable to pay

- dealing with debt in a more affordable way that’s in line with the consumer’s financial goals

Depending on how much relief you need and your current financial situation, plays part in determining what plan is best for you. Let’s run through a few scenarios:

Can’t afford to pay minimum payments any longer? Michigan debt settlement and validation programs will offer you a single monthly payment that can be much lower than when paying minimum payments. These two programs are hardship plans, meaning your creditors don’t get paid every month. Michigan debt settlement companies negotiate with your creditors to settle each account for a fraction of what’s owed. Validation programs force collection agencies to prove an account is valid by requiring them to produce complete and accurate records. Collection agencies often can’t validate a debt, resulting in it becoming legally uncollectible. A legally uncollectible debt is one that does not have to get paid and can’t legally remain on credit reports.

Here’s an example: A Citibank credit card gets disputed with validation and proven legally uncollectible. The client does not have to pay the debt and it’s been removed from the client’s credit reports.

Debt Consolidation Loans in Michigan – When is the good and what’s the bad?

Is your credit score above 730? You could qualify for a low-interest debt consolidation loan, which can be used to pay off all of your existing debt. Michigan credit unions are known to offer the lowest interest rates on loans. Just make sure the interest rate on the new loan is lower than the average interest rate on your existing debts (and don’t forget to add in all of the loan’s related fees, including origination fees).

If you’re trying to get out of debt, using a loan is only taking on more debt to get out of debt? Does this truly stop the bleeding? Debt consolidation is not the same as debt relief. Debt relief is used to stop the bleeding, meaning, the debt from growing. Debt consolidation loans can end up being more costly.

Loans that are used to pay off credit cards can be a positive if the new loan has a low-interest rate and low fees. Use a debt calculator to figure out what you’re paying now and compare it to what you’ll pay with the new loan, does it make sense? How much are you saving, is this in line with your financial goal?

Before getting a loan to consolidate:

- Check the small print

- only use a reputable lender

- do the math.

Golden Financial Services feels that before using a consolidation loan to pay off credit cards, try using the snowball method. We even provide a free budget and snowball calculator to help.

Where to apply for a low-interest Debt Consolidation Loan in Michigan?

Michigan credit union debt consolidation loans come with the lowest interest rates in most cases. Credit unions are highly regulated and work locally. Credit unions know that they will see you on a regular basis and they don’t want to have angry clients in the neighborhood. Consequently, credit unions are known to offer low-interest rate loans with attractive terms.

Dangers of consolidation loans through a Michigan credit union:

However, not everyone qualifies for a credit union loan. Secured loans may also be required by many Michigan credit unions. They may want to secure the loan with your car or mortgage, so be very careful about getting a consolidation loan if you don’t truly believe that you’ll pay back the loan with ease. Even if it’s not a secured loan that you get through a local credit union, if you do your banking at the same bank they could freeze up your bank funds if you fail to pay back the loan on time. Likewise, if you have a car loan or mortgage at the same credit union bank they could come after your secured assets if you fail to pay the loan on time.

If you have a high credit score (i.e., over 715) and no derogatory marks on your credit – Apply for a debt consolidation loan at a local credit union in Michigan. Online lenders will overcharge you, PERIOD!

Compare Michigan Debt Relief Programs (Try Debt Calculator)

Over $7,500 in Unsecured Debt? Apply for Michigan Debt Relief

The process is straightforward for residents of Michigan to start.

- Start with a free consultation from an IAPDA certified debt counselor. Just call (866) 376-9846. The counselor will ask you a series of questions and get you a free credit report.

- The debt counselor will go through each debt relief option that you’re eligible for, reviewing how much you can save on each plan, how fast you can become debt-free, along the pros and cons of each plan.

- You get the power to make a choice based on what suits you best at GoldenFS.org. You can choose an affordable monthly payment and how fast you want to become debt-free.

- You will be sent an agreement via email, where you can electronically get approved within minutes. Your counselor will spend approximately 30 minutes going through each page of the agreement, ensuring you understand all of the potential downsides. There are many great benefits to all debt relief programs, including saving money, smaller payment, and become debt-free faster. However, there are also downsides, and you need to understand all of them, so if any downsides were to occur, you know how they will get handled, and you’ll be able to overcome them, becoming debt-free in the end.

- Your last step is to do a compliance call with a Michigan debt relief program manager to ensure you understand how the program works (and again, that you know the downsides). Following that call, you’ll get approved and locked into one low monthly payment. It’s that easy.

Best Michigan Debt Relief, Settlement, and Consolidation Company

Here are some of Golden Financial’s decade+ worth of credentials:

- #1 Rated National Debt Relief Company

- Certified by the International Association of Professional Debt Arbitrators (IAPDA)

- A+ Better Business Bureau Rating

Michigan Debt Statistics

- The city of Detroit, Michigan, filed for Chapter 9 bankruptcy — the largest municipal bankruptcy filing in the U.S. history by debt, estimated at $18-$20 billion.

- The state debt per capita was $3,352. This ranked Michigan 10th among the states in debt and 23rd in per capita debt.

- Pennsylvania, New York, and Michigan have amongst the highest student loan debt per capita in the nation. The average student in Michigan graduates with roughly $30,000 in student loan debt.

- Michigan finished 43rd in a study by the website 24/7 Wall St. examining average credit card debt among residents of the 50 states. The average credit card balance in Michigan was $5,622, according to the analysis. In contrast, Americans, on average, owed $6,354 on credit cards issued by banks. The average credit card score in the state stood at 677, and the cost of living in the state was 6.7 percent less than average. Scores that exceed 720 are considered excellent, while those under 630 are viewed as low.

Source: https://www.thecentersquare.com/michigan/by-the-numbers-michigan-has-8th-lowest-average-credit-card-debt/

Debt Consolidation Michigan (Program Pros and Cons)

Are you searching for the top debt consolidation company in Michigan? The truth is, start with a local credit union near you. Debt management companies can’t offer you a low-interest loan, but your bank may be able to. Typically, it would be best if you had a high credit score (above 730) to qualify for a low-interest loan. You may be able to find an online lender to offer you a low-interest consolidation loan, even if your credit score is under 700, but it’s unlikely. If something sounds too good to be true, take a closer look at the paperwork and especially the small print.

You can pay off both secured and unsecured accounts with a consolidation loan, making it an attractive option, but only if you have a high credit score. Subprime loans for consumers with a low credit score may end up being more costly in the end. In many cases, this ends up being the case.

According to one report, “Many fintech companies (which is the new type of online lender) offer loans in four and five figures while charging interest rates that can range up to 25 percent, 30 percent, or more per year — at a time when the cost of funds to bankers remains at near-historic lows. Some fintech charge annual interest rates between 160 and 299 percent, in payday lender territory. But the fintech industry is operating at a scale that rivals the storefront payday lending industry. Their expansion has been driven by firms that position themselves as consumer-friendlier alternatives, with names such as Best Egg, Prosper Marketplace, LendingClub, Avant, SoFi, and Upstart, which lend larger sums of money: often $15,000 or more, to be paid back over three or five years.”

Student Loan Relief in Michigan

Michigan student loan consolidation plans can reduce and combine your student loan payments. Golden Financial Services can help you get approved for a federal student loan consolidation loan through StudentLoans.Gov. We can process the consolidation for you, assisting with all applications, annual recertification, and following up every year until eligible for loan forgiveness. We charge a flat fee to provide this student loan relief service of $700, only earned after results are achieved.

How Michigan Debt Consolidation for Student Loans Works

To provide you a quote for student loan consolidation, we will need your FSA-id. This allows us access to your federal student loans.

We can provide you a quote for what your new consolidated payment will be for your student loans. If we don’t get you the payment we quoted you after you sign up for our program, there are zero fees charged. You only get charged after results are obtained.

Our job is to consolidate your student loans, then getting you approved for the lowest possible monthly payment. The payments are based on your income and family size. Every year you’ll need to get recertified, which we handle for you. If your income changes, so could your payment. If you have a public service job, like police officers and teachers, you could even qualify for loan forgiveness within ten years, versus 20-25 years for everyone else.

After joining the Golden Financial Services student loan consolidation program, we handle all communication between you and your student loan servicers. Your job is only to provide the items when we need them, including proof of income and updated family size annually.

- Plus, old defaulted student loans can be paid off in full.

- High interest rates can be absorbed in the consolidation loan.

- You can choose a very low monthly payment (as low as zero dollars $50 or less per month)

If you choose to consolidate your student loans on your own, here are step-by-step instructions on how to do so, including pitfalls to beware of.

Michigan student loan debt relief programs range from income-based hardship programs to private student loan relief plans to loan forgiveness options — giving students a full array of choices.

To learn more about Michigan’s debt consolidation for student loans, contact Golden Financial Services at (866) 376-9846!

Credit Card Debt Relief and Debt Settlement Michigan Programs

Golden Financial Services can provide you information on disputing a debt, also known as debt validation — an especially useful option if third-party debt collection companies are harassing you.

Before settling a collection account, make sure the creditors can prove that it’s a valid debt through validation services. The collection agencies must produce legally required documents and accurate information after you request it. These are your consumer rights. In many cases, collection agencies give up their right to collect on a debt because they fail to prove it’s valid. See real client examples of debt validation here.

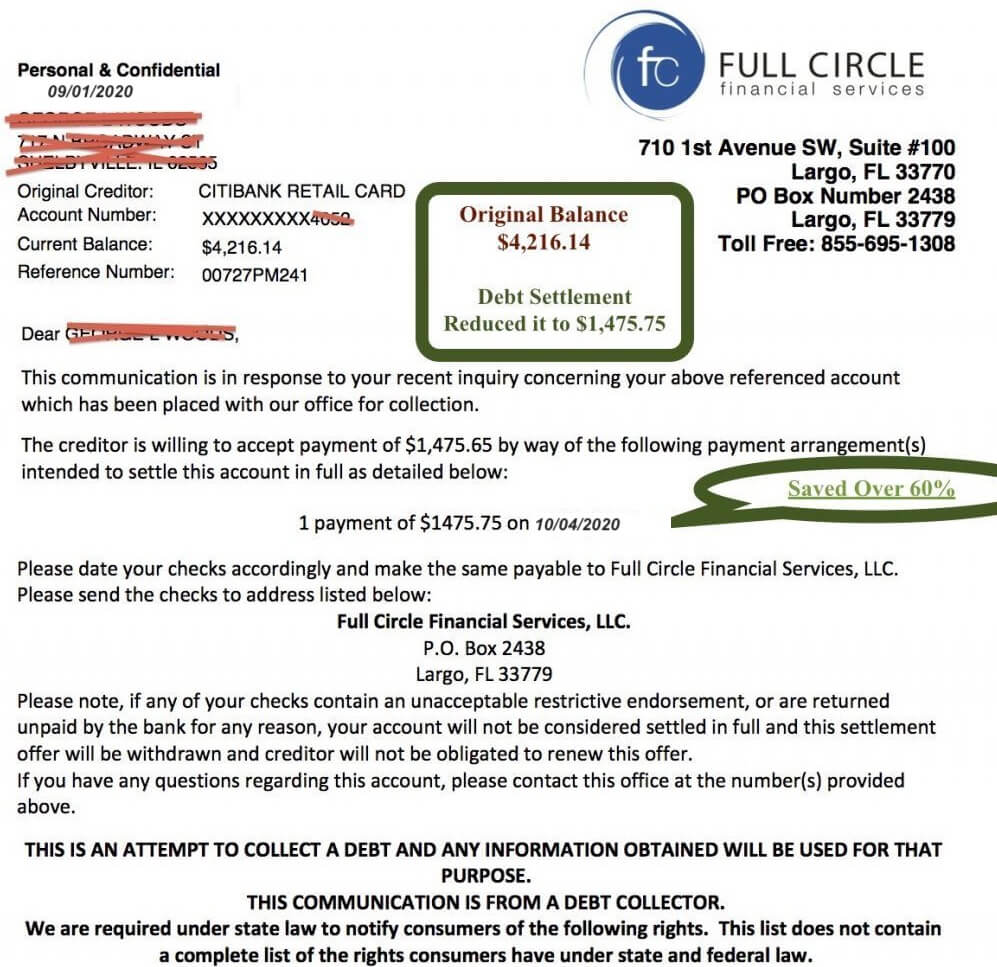

If a debt collection company does validate your debt as “legally collectible,” your next option could be debt settlement. With debt settlement, you can pay a significant amount less than your balance owed.

Michigan debt settlement programs have been saving consumers thousand’s and thousands of dollars for decades now. To a debt collection company, getting a portion of the balance owed is still hugely profitable. Ask our debt experts why creditors are willing to settle. Educate yourself on Michigan debt relief information. Education is power.

How does a Michigan debt settlement program work?

Through Golden Financial Services, we can refer you to a Michigan debt settlement law firm. The law firm will provide you legal protection and make sure your creditors are not violating your consumer rights, including the Fair Debt Collection Practices Act. If the law firm finds any violations while negotiating to settle each debt for less than the full amount owed, a lawyer will get involved and, in some cases, may even sue a debt collector on the client’s behalf. Creditors will often be quick to settle and offer the client an “attractive savings” on a settlement after the law firm presents the creditor with proof that they violated the consumer’s rights.

With debt settlement, Michigan residents can pay only a single monthly payment for all of their unsecured debt. No payments will get made to any of the creditors involved in the program. Instead, monthly payments get deposited into a trust account (similar to your savings account). The payments accumulate in this account monthly. As the savings build-up, the law firm starts negotiating with your creditors to reduce the debt. The longer the debt sits unpaid, often results in a better settlement because creditors see it as unlikely that they will ever get paid, so they’re willing to settle at a more affordable amount.

Creditors are often willing to lower the debt near half, but there’s no guarantee of what rate they will be willing to settle at, and that does not include debt settlement company fees. The law firm is motivated to get you fast results and the best possible savings because the law firm will only get paid a settlement fee after they settle a debt. Michigan debt settlement companies are legally not allowed to charge a fee until after the debt is settled and at least one payment is made to your creditor.

Do I have to pay income on a forgiven debt?

Another point to be aware of is that after an account is settled for less than the full balance, the savings can be construed as income. An accountant can help you file a special IRS form showing that you’re insolvent and that the savings were not income so that you don’t have to pay it. GFS is not a licensed accountant, so please do refer to an accountant with any questions regarding taxes owed on a forgiven debt and what options are available to eliminate this tax liability. Another benefit of using a validation program is that after an account is disputed and proven invalid, no taxes are owed.

If a client gets sued while on a Michigan debt negotiation program, here’s how it’s handled:

If a creditor sues a client while they are enrolled in a debt settlement program, Michigan clients get full legal representation from the law firm handling their debt settlement. Michigan consumers won’t have to go to a court appearance if the law firm can settle the debt before the court, so that’s precisely what the law firm attempts to do if a summons is received while enrolled in the program. Most of the time, a summons is settled for less than the full balance owed, allowing clients to save money still and become debt-free in 3-4 years with debt settlement.

When debt settlement companies in Michigan don’t explain the possibility of clients getting served a summons and how it would be handled, that’s when problems occur. People get scared of the word “summons,” but there’s nothing to be scared of if it’s dealt with correctly because again, the debt gets settled and paid off after a summons occurs.

What if a client receives a summons while enrolled in a validation program?

If you receive a summons while on a validation program, you’ll get fully refunded on that account and referred to a law firm to settle the debt for less.

Call (866) 376-9846. We look forward to helping you find the right Michigan debt relief program to fit your needs and goals.

Source:

Michigan Capitol Confidential, https://www.michigancapitolconfidential.com/16572

Golden Financial Services, https://Goldenfs.org

2 comments on “Michigan Debt Relief”