Pennsylvania (PA) Debt Relief, Consolidation, and Settlement Programs

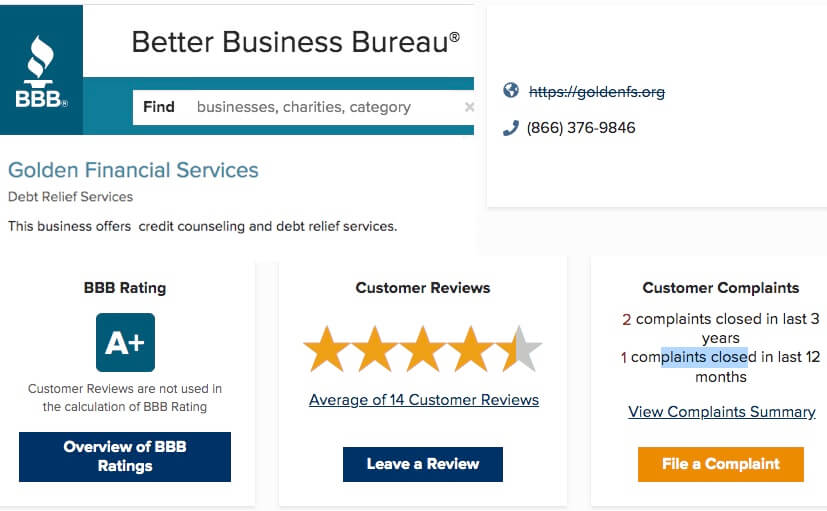

Welcome to Golden Financial Services (GFS), home to Pennsylvania debt relief programs. Debt settlement, validation, and debt consolidation information is easily accessible through GFS and we can offer you multiple options, not just one. Since 2004 we’ve maintained an A+ Better Business Bureau rating and work hard to offer the very best debt relief programs in Pennsylvania. Debt relief programs do require over $7,500 in total unsecured debt to qualify for the plans, including medical bills, credit cards, student loans, unsecured loans, and collections.

All debt relief options in Pennsylvania can consolidate all payments into one low monthly payment, but each program is different. Financial hardship programs are for people that can’t afford to stay current on payments. You also have consumer credit counseling. PA credit counseling programs are for consumers that can afford to stay current and that need a reduction in credit card interest rates. So depending on your specific needs, current financial situation, and goals, that’s what will determine the right option for you.

The following page explains how the programs work and at any point, you can contact one of our IAPDA certified Pennsylvania specialists to enroll in a plan at (866) 376-9846.

PA debt relief programs to help anyone that’s struggling to pay bills due to COVID-19

Has your income been reduced due to COVID-19? Rates and payments are lower than they’ve ever been right now for debt relief programs. Pennsylvania residents can lock-in the absolute lowest possible payment today and make the most of difficult times, getting on the path towards financial freedom. Pennsylvania debt settlement and validation programs are both offering reduced payments, to provide consumers extra relief to deal with these unprecedented times.

As a state, Pennsylvania’s doing better than most of the country. Just take a quick look at these statistics.

Pennsylvania Debt Statistics

- Pennsylvania is rated #8 out of all the states in the nation for having the best financial health.

- The average debt for a Pennsylvania consumer is only $39,100, where the average debt per consumer in the United States as a whole is $47,500.

- Pennsylvania consumers have 18% less debt than the rest of the country.

- Pennsylvania consumers have a higher amount of student loan debt than the United States average, but less of every other kind of debt.

But what these statistics don’t reveal, is that millions of Pennsylvanians are struggling just to make minimum monthly payments, due to the after-effects of Coronavirus. People were already struggling, and now many consumers can’t afford to pay their debt at all.

Credit Scores Get Negatively Effected, but Plans Do Include Credit Restoration

How does a Pennsylvania debt relief program remove a debt from a person’s credit report, if I really spent the money?

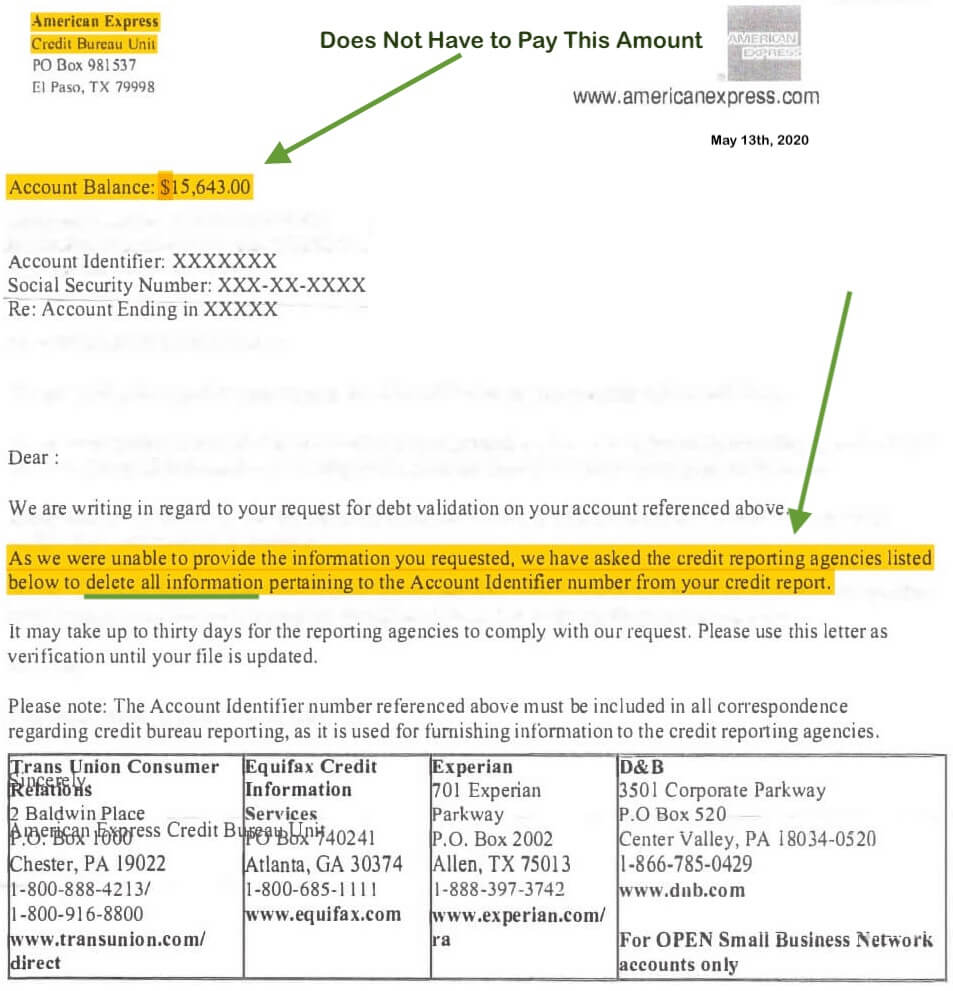

Here’s an example of debt validation getting an account invalidated

What are the negative consequences of a PA debt validation program?

What happens after I fall behind on credit card payments?

After you fall behind on payments, creditors eventually write off your debt. Creditors will then sell credit card accounts for a cheap price to third-party collection agencies. The original creditor gets reimbursed through tax write-offs, insurance and by selling debt to collection agencies. The original creditors wipe their hands clean of the debt after it’s sold to a collection agency.

At this point, you can settle debt for less than what you owe and save money by paying off the balance for less than the full amount, but the late marks and collection accounts remain on credit reports. So an alternative option to using before settling debt is to dispute the account through validation, potentially paying much less and getting the account removed from credit reports. We only recommend using the settlement option as a last case resort, if an account is proven valid or if a summons was to get served (both rare case scenarios).

Or, similar to how you can challenge a speeding ticket and get it dismissed, you can also dispute a debt. The difference is that after disputing a debt, it can become legally uncollectible and is not considered dismissed like with a speeding ticket. So the terminology is not the same, but the results are similar by nature. There are several laws that creditors and collection agencies must abide by that make validation a possible scenario.

Benefits of Validation of Debt Settlement in PA

- If proven legally uncollectible through validation, legally the debt can’t remain on credit reports

- If proven legally uncollectible through validation, there are no tax consequences

- Pay less with validation, as the debt is not getting paid. With the settlement, a portion of the debt does get paid back

Debt validation can often be a less expensive route and help you achieve better results than debt settlement, but still, both programs require you to fall behind on payments. Credit scores can go down over the first year and there’s always a chance that creditors can sue. If creditors do sue you while on the program, all plans offered through Golden Financial Services have a solution in place to assist you in dealing with a lawsuit and getting the debt resolved. With validation, if you receive a summons while on the program you get a 100% money-back guarantee and referred to a local law firm to help you settle the debt (as the back-up plan).

Apply For Pennsylvania Debt Relief Today

Call Toll-Free (866) 376-9846, or for Local Assistance, Call (717) 484-9032.

An IAPDA certified Pennsylvania debt relief expert would analyze your current financial situation and customize a plan to help you quickly get out of debt.

Debt validation is not the only plan you can choose from. Some consumers are better qualified for debt settlement or consumer credit counseling. You can choose from multiple options, allowing you to get the help that you need today.

Pennsylvania Debt Relief Program Benefits Include:

- Resolve debt in 2-3 years on average with a settlement and validation plan

- Reduce balances on credit card debt, medical bills, personal loans, and any unsecured debt

- Get one affordable payment each month through any type of Pennsylvania credit card relief plan

- See the light at the end of the tunnel: so you’ll know exactly how many monthly payments are left until you’re debt-free!

Consumers can get their debt and credit problems behind them, all inside one plan. Let us help you to be amongst the other Pennsylvanians who are debt-free!

How’s Golden Financial Services different from other Pennsylvania debt relief companies?

Plans include a money-back guarantee and credit repair, two attributes that no other company offers.

If you compare the savings that we can offer you compared to any other Pennsylvania debt relief company, we can save you around 10% more!

- Over $7,500 in unsecured debt is required.

- Must reside in Pennsylvania.

- To check your state’s debt-relief options, Click Here and Choose Your State:

Debt Negotiation / Settlement in Pennsylvania

Debt settlement services can allow you to pay off your unsecured debt in anywhere from 2-3 years on average. You’ll pay a significant amount less than the total owed on each of your debts.

This program is for anyone who’s experiencing financial hardship.

What qualifies as a financial hardship? Anyone who can’t afford to stay current on credit card monthly payments are experiencing “financial hardship”. Maybe you lost your job or income has been reduced. Maybe a medical situation occurred and now you’re left with high medical bills. These are all valid financial hardships.

It’s not your fault that you are behind on credit card payments. Legitimately, hardship in your life has set you back. You deserve a break. Getting your debt settled could be that break.

After getting approved for a debt settlement program in Pennsylvania:

All of your creditors are immediately alerted that you joined the program.

Since you will have a Pennsylvania debt settlement lawyer representing you, by law, all creditor phone calls get directed to your attorney. The Pennsylvania law firm will negotiate with each creditor one by one to reduce the balance on all of your debts.

If any creditors decide to call you directly, they will be in violation of the Fair Debt Collection Practices Act (FDCPA). You could then be awarded up to $1,000 for each creditor violation.

How Much Does The PA Debt Settlement Program Cost?

You will only pay around 70% of your total debt (including fees). There’s no additional interest or late fees, everything’s included in that 70%.

With debt settlement, you don’t pay interest and late fees get mitigated into the settlement.

How Does a Pennsylvania Debt Settlement Program Work?

You make one affordable monthly payment that gets deposited directly into your trust account. This single monthly payment goes towards taking care of all of your debts. As payments are made, money starts to accumulate in your trust account.

When enough money accumulates to pay a creditor at the reduced amount, the law firm will notify you of the good news. You must approve the settlement offer before it becomes finalized. Only after you approve will the settlement get finalized and funded.

Each debt will get settled for around 40% of the balance, before adding in the debt settlement company fee.

The creditor will give us a settlement offer in writing. You will have the option to reject or accept the offer. Of course, 9 out of 10 times clients will accept. Occasionally, a client will opt to wait on a creditor settlement so that we can try to get a better deal in the future. One by one each creditor gets settled, reduced, and paid off.

Debt Validation for Pennsylvania Residents (Least Expensive)

On a debt validation program, the plan starts by issuing a Notice and Demand For Verification of Debt to each debt collection company enrolled in the plan. This is the fancy way of saying that your debt is getting disputed.

Technically, here’s what debt validation does:

Debt validation is used to demand proof that a debt is a valid, legally owed obligation, devoid of invalidating causes such as mistake, misrepresentation, concealment of material fact, and the like, pertaining to a specific actionable contract or other instrument bearing the signature of the Purported Debtor.

Additionally, the debt collection company must provide a full accounting of the debt, including where the funds lent originated. Absent such proof, the debt collection company must cease all collection activities and can no longer legally report the debt to the credit reporting agencies.

If a creditor doesn’t respond to the debt validation dispute, the debt becomes invalid, and it’s considered a “stipulation of non-authority” on their part.

Legal action can then be taken should they proceed with collection activities without having first provided the specifically requested proof of verification, validity, and legality of the alleged debt.

In simple terms, here’s what debt validation does:

- Each debt collection company must prove they’re abiding by all of the federal laws.

They do this by providing complete records and accurate information, verifying the debt is valid and that they have the legal authority to collect on it.

- You get set-up with one low monthly payment to dispute all debts.

- If debt collectors can’t prove they’re abiding by all of the federal laws, your debt can become legally uncollectible. A legally uncollectible debt doesn’t have to get paid and can’t be legally reported on your credit.

- The debt and its associated negative marks can then come off your credit report.

- You could only end up paying the debt validation company fees and nothing else on each debt.

Here are a few paragraphs cut directly out of an article in the NY Times, pertaining to debt validation:

“The same problems that plagued the foreclosure process — and prompted a multibillion-dollar settlement with big banks — are now emerging in the debt collection practices of credit card companies.

As they work through a glut of bad loans, companies like American Express, Bank of America, Citigroup and Discover are going to court to recoup their money. But many of the lawsuits rely on erroneous documents, incomplete records and generic testimony from witnesses, according to judges who oversee the cases.

Lenders, the judges said, are churning out lawsuits without regard for accuracy, and improperly collecting debts from consumers. The concerns echo a recent abuse in the foreclosure system, a practice known as robo-signing in which banks produced similar documents for different homeowners and did not review them.

‘I would say that roughly 90 percent of the credit card lawsuits are flawed and can’t prove the person owes the debt,’ said Noach Dear, a civil court judge in Brooklyn, who said he presided over as many as 100 such cases a day.”

What is debt validation asking for when disputing a debt?

Here are a few examples of what is being requested:

- a copy of a debt collector’s license

- the original agreement that was signed when opening the credit card

- Debt validation will also test the creditor to make sure they have accurate details: Legally, debt collection companies must produce accurate answers to questions including, “when does the statute of limitations expire on the debt?”, “What is the name and address of the original creditor to whom the debt is currently owed?”, “if purchased from a previous debt collector, what was the date of the purchase and the amount?”.

The actual dispute package consists of over 30-pages of disputes, line by line requesting answers and documentation! The above-mentioned information is just a few examples pulled out of the dispute package.

If any documentation can’t get produced or if any of the information is wrong, a debt can no longer legally be collected on or reported to the credit reporting agencies.

As a result, a legally uncollectible debt is one that you don’t have to pay and it can no longer legally get reported to Equifax, Transunion, or Experian.

Talk to a Pennsylvania Debt Relief Expert for FREE at (717) 484-9032

Included in the debt validation program is credit repair.

The credit repair program is taking place simultaneously, as your debts are getting disputed.

After the credit repair program starts on month number one, your credit report gets reviewed for any derogatory information that does not belong. If inaccurate information appears on your credit report, this information will get disputed. There’s no maximum number of disputes that you’re allowed. If you have 100+ inaccurate marks on your credit report, they will all get disputed for the same exact price as someone with two inaccurate marks.

What if a debt is proven to be valid on debt validation?

If a debt collection company proves a debt to be valid, you would get refunded on that particular account. Your debt could then get settled for much less than the full balance owed. Your refund would most likely cover the settlement, costing you nothing extra out of pocket from what was already paid.

That’s a BIG IF. In many cases, once credit card debt goes to a third-party debt collection company, it is often proven to be invalid after getting disputed.

Just look at Golden Financial’s track record and online customer reviews.

We’ve had less than a handful of complaints over the last six years. This huge success is mainly attributed to the fact that we offer multiple debt relief options for Pennsylvania residents to choose from.

Having said that, debt validation is by far the most popular plan.

At times, creditors know that they’ve violated rules and regulations so they will quickly agree to stop collection on debt and remove the debt from a person’s credit report.

Here you can learn more about debt validation and see success case examples.

Why Validation Over Debt Settlement?

On average you will pay back around 70% of your debt if it gets settled, including all fees and the total cost. If a debt is invalidated, you will pay around 45% of your total balance in total.

If you are current on your accounts when joining a debt validation or debt negotiation program, your credit score will go down because your creditors don’t get paid on a monthly basis on either plan.

The good news is that credit scores can be rebuilt, and as part of the debt validation program you will be assisted on this task. Our debt validation partner company has recently established a deal with one of the major banks, to issue clients an installment loan for the purpose of rebuilding their credit score.

- Could end up paying much less with validation

- Get written guarantee with validation

- Includes credit repair with validation

- Can still use debt negotiation as a second alternative if needed

- Debt validation can lead to a debt and its associated marks getting removed from credit reports

- With debt settlement, you could owe taxes on the amount saved, but if the debt is proven to be invalid there are no taxes owed

- Creditors must stop all harassment and cease collection on the debt immediately after receiving the dispute

- The average plan is 24 months on validation, versus 36 months on debt settlement

Consumer Credit Counseling PA

A Pennsylvania Consumer Credit Counseling Program can cut your interest rates in half. With this type of credit card relief plan, you make one single consolidated payment each month.

Do you need good credit to qualify for PA consumer credit counseling?

You will still qualify for consumer credit counseling with bad credit. In contrast to consumer credit counseling, getting a debt consolidation loan will require a high credit score.

People often get debt consolidation and consumer credit counseling confused.

Debt consolidation is a loan.

Consumer credit counseling is an interest rate reduction program for credit cards only.

Golden Financial Services does not offer any type of loans.

Pennsylvania Student Loan Relief

Federal student loans can get consolidated at StudentLoans.Gov. You can consolidate your student loans on your own or let Golden Financial Services consolidate them for you.

After consolidating, you will need to get approved for the right income-driven repayment plan in order to get an affordable payment and loan forgiveness.

The process can be confusing, timely and you must remember to get recertified every single year. Maintaining your student loan repayment plan is a long-term commitment and responsibility. You need to stay on top of it or you can easily get kicked out and your payment shoots back up.

To learn more about Pennsylvania student loan relief options, just give us a call! We are happy to talk and at the very least, give you some free advice.

How Consumer Credit Counseling Works?

You pay one monthly payment to the consumer credit counseling company.

The consumer credit counseling company then disburses the funds to each of your creditors but at the lower interest rate and payment.

Can you be past due on credit card payments and still qualify for consumer credit counseling?

With consumer credit counseling, you can be up to two months behind on monthly payments and still qualify.

Your credit will benefit from consumer credit counseling by re-aging late payments to current.

Do my creditors get paid every month on consumer credit counseling?

The consumer credit counseling company pays your creditors every single month out of the payment you make to them.

What’s the biggest benefit of consumer credit counseling?

You can get out of debt faster since you will be paying less in interest. The average consumer credit counseling program takes 4.5 years to complete and get you out of debt.

Pennsylvania consumer credit counseling plans are an excellent option if you can easily afford to pay at least minimum payments each month, but just want to pay less in interest. And you’ll preserve your credit score by using this type of plan.

What to watch out for with consumer credit counseling:

Not all creditors work with a non-profit consumer credit counseling company.

Ask the company which of your lenders are willing to reduce the interest rates and which ones are not.

Sometimes a less reputable company will fail to tell their clients that a certain creditor rejected the debt management plan (DMP).

Golden Financial Services can connect you with a non-profit Pennsylvania consumer credit counseling company if you qualify for this option. Call today!

Getting Sued for Credit Card Debt in Pennsylvania

The Pennsylvania Statute of Limitations on written contracts, including credit cards, medical bills, and personal loans, is four years (42 Pa. C.S. 5525(a)). This four-year statute of limitations in Pennsylvania also includes open-end accounts, oral contracts, and promissory notes. Below, we will explain the difference between open-end and closed-end accounts.

If a creditor is trying to sue you over an unpaid credit card debt in PA and its been over four years since you last paid it, legally, the collection agency can no longer sue you over the debt. Of a matter fact, you can now sue the debt collector for illegally attempting to collect on the debt, and under the Fair Debt Collection Practices Act (FDCPA), you could receive up to $1,000 per violation.

Golden Financial Services can advise you on what options you have and set you up with a debt validation plan to help you dispute any debts where your creditors may be illegally trying to collect on the debt. Merely Call Toll-Free (866) 376-9846 for Assistance!

Open End Accounts

What is an open-end account? You can continue using an open-end account. For example, a credit card is an open-end account; you can use it over and over again as long as you stay under your credit limit and pay your bill on time.

Credit card debt does qualify for debt relief because it’s an unsecured debt.

Another example of an open-end account would be a home-equity line of credit and a debit card. These secured debts will not qualify for any of the debt relief programs available at Golden Financial Services.

Closed-End Account

A closed-end account would be a loan that gets closed after you pay the entire balance in full. With a closed-end account, the lender gives you a term. Within that term, your entire balance must be paid in full, along with a set amount of interest and fees. When you sign for a loan, all of the fees and interest legally must get disclosed. Make sure to ask the lender questions in order to clearly understand all loan terms. Verify the information the lender provides you verbally with the agreement they have you sign.

If you buy a new bed or even a car on credit, the lender may issue you a term of five years of payments. Once the five years of payments are complete, the account will get closed. After your car loan is paid-in-full, you cannot charge anything else on it.

Do you have any of these fears holding you back from joining a debt relief program?

Afraid of paying high fees and not getting results? Your debt settlement program monthly payment already includes the program fee, it’s not extra. However, only until after your debt gets resolved is the debt settlement fee earned. The purpose of your special purpose program account (also known as a trust account) is just to hold the funds before any party is paid. The debt settlement fee sits in your program account.

Scared of getting sued?

My credit card company may sue me, right?

Less than 3% of the credit card companies will sue the debtor.

If you do receive a credit card summons, your Pennsylvania debt relief lawyer will settle the debt prior to court. A settlement on a summons account will be costlier than the average debt settlement, you could pay around 75% of the debt.

With debt validation, you would be refunded any money paid into the program for that particular account that received a summons. With the refund, you can pay the attorney that you are then referred to who will be resolving the summons for you. Therefore, if you receive a credit card summons send it to customer service immediately. Customer service will assign the summons to a Pennsylvania attorney. Just like any other debt, a credit card summons will get settled and paid. 90% of credit card summons’ accounts are either fraud, composed of inaccurate information, or flawed in some way or another. There are times when a summons could get dismissed.

Scared of ruining your credit?

If you don’t pay your credit cards on time every month, your credit score will go down.

With debt settlement, accounts must be with a debt collection company for the program to work effectively. For this to happen, you must stop paying on your credit cards. Consequently, your credit score takes a hit.

You can rebuild your credit score after debt settlement. And you won’t have “debt” holding you back. Keep in mind, having high balances on credit cards, also negatively affects a person’s credit score.

If you have maxed out credit cards, lenders may not issue you any more credit. You will have a difficult time obtaining any type of credit if you have maxed out credit cards, no matter how high your credit score is. Your credit utilization ratio makes up 35% of your credit score. So, ask yourself, “is my credit score helping me right now?”

Afraid to sign up on the wrong debt relief program?

Debt settlement, consumer credit counseling, and debt validation services are all different programs that you can choose from at Golden Financial Services. Need helping with consolidating your federal student loans? Student loan consolidation is here. Need a lower interest rate on credit cards? Consumer credit counseling will offer you reduced interest rates on all of your credit cards. Can’t afford to pay your credit cards any longer? Debt settlement and validation plans could allow you to pay only a small amount to deal with each debt. Not one program is right for everyone. Contact Golden Financial Services for a free consultation and talk to an experienced and IAPDA certified debt specialist for free.

Call to See if You Qualify for Pennsylvania Debt Consolidation & Debt Relief Programs @ 866-376-9846.

Located at: Serving South Central Pennsylvania, Philadelphia, Harrisburg, Lancaster, York metropolitan areas, Pennsylvania Dutch Country and debt relief programs are available throughout the entire state of Pennsylvania. Don’t Live in Pennsylvania?