From Santa Fe to Las Cruces, New Mexico debt relief programs save millions of consumers from bankruptcy.

Consider, as of the end of 2021, the average consumer in New Mexico has $8,094 in debt. Statistics also reveal that 57,327 consumers in New Mexico are unemployed. The average credit card debt in New Mexico is $5,851.

So, you do the math. High debt. Plus unemployment. Equals, high delinquency rates on bills, and a rush of bankruptcies getting filed.

New Mexico debt consolidation loans

Debt consolidation loans in New Mexico only benefit those with high income and high credit scores. The benefit of a loan is if it’s a low-interest loan. Debt can then be consolidated with the low-interest loan, eliminating high-interest accounts and providing one affordable monthly payment.

And best of all, there is no better place to get a debt consolidation loan in New Mexico than right at your local credit union. Unfortunately, most consumers struggling to make their monthly payments don’t have qualified credit for a low-interest loan.

So, what other credit card debt relief, settlement, or consolidation programs in New Mexico are available?

For anyone with high balances, struggling to pay monthly payments, and living in New Mexico: Debt settlement is probably the last option you want to consider because of the negative effect this program has on credit scores.

Instead, you’d be better of starting with consumer credit counseling. New Mexico residents can also use a debt resolution program. The following page explains your options and includes financial education about each program.

Debt Relief Programs – New Mexico (NM)

New Mexico Debt relief, settlement & consolidation programs offer you a way to escape credit cards, medical bills, unsecured personal loans, third-party collection accounts, repossessions, and more.

If you’ve lost your income due to Coronavirus, New Mexico’s debt management options can cut monthly payments and balances to be affordable (based on your budget).

United States Government & State of NM Debt Relief for People Impacted by Coronavirus

The state and government are not offering to waive credit card balances, unfortunately.

However, credit card companies are providing temporary relief (click here to see options).

For most consumers in the state, a temporary solution is not enough.

For a permanent solution, consider one of the following options for debt relief in New Mexico:

Start by calling (866) 376-9846 or locally at (575) 446-4361.

See if you’re eligible for a New Mexico credit card relief program. There are also federal student loan relief options that can be explained. And additionally, you can enroll any type of unsecured debt into a financial hardship plan, also known as debt resolution.

New Mexico residents don’t need to file for bankruptcy (BK). However, BK may be required in some cases.

Bankruptcy in New Mexico

If you can’t afford the lowest monthly payment on a NM debt relief program, Chapter 7 BK may be required.

If multiple creditors have sued you and are garnishing your wages, Chapter 7 BK can wipe away these debts and give you a fresh start.

You may need Chapter 13 BK to save your home from foreclosure.

There are extreme circumstances when BK may be the right choice, but at GFS, we will do everything we can do to help you avoid it.

Student Loan and Credit Card Forgiveness Programs in New Mexico

Federal student loans can get forgiven after consolidating and making a certain number of payments on an income-based repayment plan. These are federal student loan relief options. Visit this page next to read about federal student loan relief programs.

Forgiveness options are not available through the government for credit cards, but consumers can have credit card bills settled for much less than the total balance owed.

Settling credit card bills can hurt credit scores, but if you can save thousands of dollars and pay off your cards faster, it may be worth the temporary decline in credit scores. Visit this page next to read about getting out of high credit card bills.

Before resorting to settling credit card bills, consider a validation program. Many consumers use validation to help them escape high credit card balances that they can’t afford to pay.

Validation Benefits Over Settlement:

- Pay less to resolve each account than if you were to settle.

- Potentially have the past due account and collection notation removed from credit.

- There are no tax consequences on an invalidated debt

Are you considering any New Mexico debt consolidation or credit card relief program? Start by calling (866) 376-9846 or locally at (575) 446-4361.

Get a FREE Consultation from an experienced counselor. Golden Financial Services has been assisting New Mexico residents since 2004 and has an A+ Better Business Bureau rating.

We can help you get from A to Z; from being buried in debt – to becoming debt-free. You can achieve financial freedom within three to four years.

Trusted Company Reviews rated Golden Financial Services the #1 rated company in the United States for debt relief. NM is one of the states that we specialize in. So don’t hesitate to give us a call. Learn your options and enroll in the plan of your choice, all with ease!

Qualification Requirements:

Individuals with $7,500 to $200,000 in total bills have multiple debt relief programs to choose from at Golden Financial Services.

You have the power to make a choice based on what suits you best. Depending on your budget, financial goals, and credit score all play a part in determining your best option.

4 Best New Mexico Debt Relief Options (pros vs. cons)

Talk with an IAPDA certified New Mexico credit counselor at (575) 446-4361. Here’s what you can get:

- Access to the best New Mexico debt relief programs

- Check eligibility in a matter of minutes

- Get a personalized plan to save the most money

- An affordable consolidated monthly payment

- Free assistance with enrolling in the option of your choice

- A clear understanding of the benefits and downsides to each option

New Mexico Debt Statistics Let You Understand The Problem

New debt statistics reveal that New Mexico has the highest credit card debt in the nation, just above Louisiana and West Virginia. The average credit card balance for New Mexicans is about $8,300.

Do you have over $8,300 in credit card debt? If the answer is “yes,” and you can’t afford to pay more than minimum payments — you’re a perfect candidate for relief, so continue reading.

What’s the solution to credit card debt for consumers in New Mexico?

There are multiple options

Debt Settlement New Mexico

We can help you consolidate payments into one and settle your bills for a fraction of the balance. This option is through a New Mexico debt relief law firm. Loans are another way to consolidate, but you must have a high credit score and low account balances to qualify for a loan.

Keep in mind; a settlement program won’t pay your creditors every month. However, you will only have to make one payment every month, making it easier for you to manage your bills. That payment gets deposited into an FDIC insured trust account, known as your “special purpose savings account” (SPSA).

Technically speaking, when you settle accounts, you’re not consolidating.

A consolidation is when you use a loan.

With a settlement plan, every month as you make your monthly payments, the funds will continue to accumulate in your special purpose savings account (SPSA). Eventually, there will be enough money in your SPSA for the negotiators to offer to settle your first account.

You can save approximately 30% of what you owe by settling an account. For example, if you owe $10,000 on a credit card, that card could get settled for around $7,000, including New Mexico debt settlement company fees.

You need over $7,500 in unsecured bills to qualify for a settlement program. The New Mexico debt settlement program can relieve you of all bills and any collection accounts in around 3-4 years.

Monthly payments can be cut by close to 50% in some cases, but try to avoid dragging out the program longer than needed to minimize the risk of downsides.

Debt Relief in New Mexico

We can also offer you a validation program that disputes your third-party collection accounts, similar to how an attorney challenges a speeding ticket.

Benefits of Validation over Settlement:

- Less expensive

- Accounts can potentially be removed from credit reports

- Money-back guarantee included

- Taxes are not owed on an invalidated account

- All accounts are contacted and disputed immediately after they are sold to third-party collection agencies, unlike with a settlement plan where accounts are only dealt with one at a time.

This validation plan includes credit restoration for no additional cost.

You need to have over $7,500 in combined accounts to be eligible for the program.

Eligible Accounts Include:

- credit cards

- medical bills

- repossessions

- personal loans.

Want to stay current on monthly payments?

Consumer Credit Counseling Programs in New Mexico Allow You to Stay Current:

Is your goal to stay current on monthly payments?

Consolidate your credit cards with a loan or use a New Mexico consumer credit counseling program.

You can also consider doing the avalanche and snowball method, both options that allow you to stay current on monthly payments.

You could use the snowball method to pay off your bills faster on your own. Dave Ramsey created the snowball method.

Paying off bills by snowballing is one of the fastest ways to pay off high balances without using a program and can help improve credit scores. Golden Financial Services created a snowball calculator tool for New Mexico residents to use for Free.

IAPDA certified counselors who specialize in New Mexico credit card relief programs can help you choose the best plan. Call (866) 376-9846 & Get Your Free Consultation Today!

Here’s what past clients have to say:

Best New Mexico Debt Relief, Settlement & Consolidation Programs

Is your goal to save the most money?

Golden Financial Services recommends validation and settlement if your goal is to save money.

These plans have a temporary negative effect on credit scores but can save a person more than if they were to consolidate with a loan.

Not everyone will graduate from a settlement or validation plan. Some people can’t afford to continue making monthly payments until the program is complete.

We will do our best to put you on a plan that you can afford to pay, one that you will most likely complete successfully.

Debt Consolidation Loans in New Mexico

Millions of New Mexico residents turn to consolidation loans, one of the most expensive routes to take.

If you decide to use a loan to pay off your credit cards, make sure the loan has a lower interest rate than your current interest rates. Add in all additional fees that come with the loan to ensure you don’t end up paying more than what you are currently paying.

What are the most expensive loans to avoid?

Fool.com warns consumers, “The three most expensive ways to borrow money:

- Payday loans. Payday loans are popular among individuals with poor credit because they give you cash quickly and don’t usually require a credit check.

- Auto title loans. …

- Credit card cash advances.”

Also, we recommend that you be very careful with online lenders (i.e., FinTechs). Companies like OneMain Financial and Lending Club. You could get a low-interest rate loan if your credit score is above 725. However, bad credit consolidation loans in New Mexico can carry interest rates of 30% or higher and upfront fees that can cost up to 5% of the loan.

Click here to learn about the risks of bad credit consolidation loans.

What to beware of when it comes to debt consolidation in New Mexico:

- If you choose to use a balance transfer card to pay off high-interest cards, don’t forget to add up the up-front fee that they are charging. This fee averages around 3%-5% of the amount being transferred onto the card.

- If you decide to consolidate with a home equity line of credit, be aware that you could lose your home if you fail to pay this type of consolidation loan on time.

- And lastly, be careful if you choose an online lender to consolidate. Online lenders often charge high fees and high interest, resulting in your bills becoming more expensive to pay off. Are you searching for a cheap consolidation loan? Credit unions offer the lowest loan rates. Check with a few local credit unions if your balances are low and your credit score is high for a consolidation loan. Notice we say “if your balances are low,” not only if your “credit score is high” because these are the two factors credit unions will check when evaluating whether or not a person is qualified for a loan.

How does debt validation work?

A validation program challenges a collection agency, forcing them to prove:

- they have all of the legally required paperwork to be lawfully collecting on a third-party collection account

- they have accurate accounting and information in their files about the identity of the creditor

- they are a licensed and bonded collection agency

- they are abiding by federal laws, including the statute of limitations, Credit Card Act, FDCPA, FCRA, and more

Often, a collection company can’t prove that they are legally authorized to collect on a debt. The account then becomes legally uncollectible. Legally uncollectible, meaning you don’t have to pay it!

A validation plan is not disputing whether or not the card was yours. This has nothing to do with you.

Additionally, the account can come off your credit after being invalidated. This all makes a validation plan one of the best credit card relief programs in New Mexico.

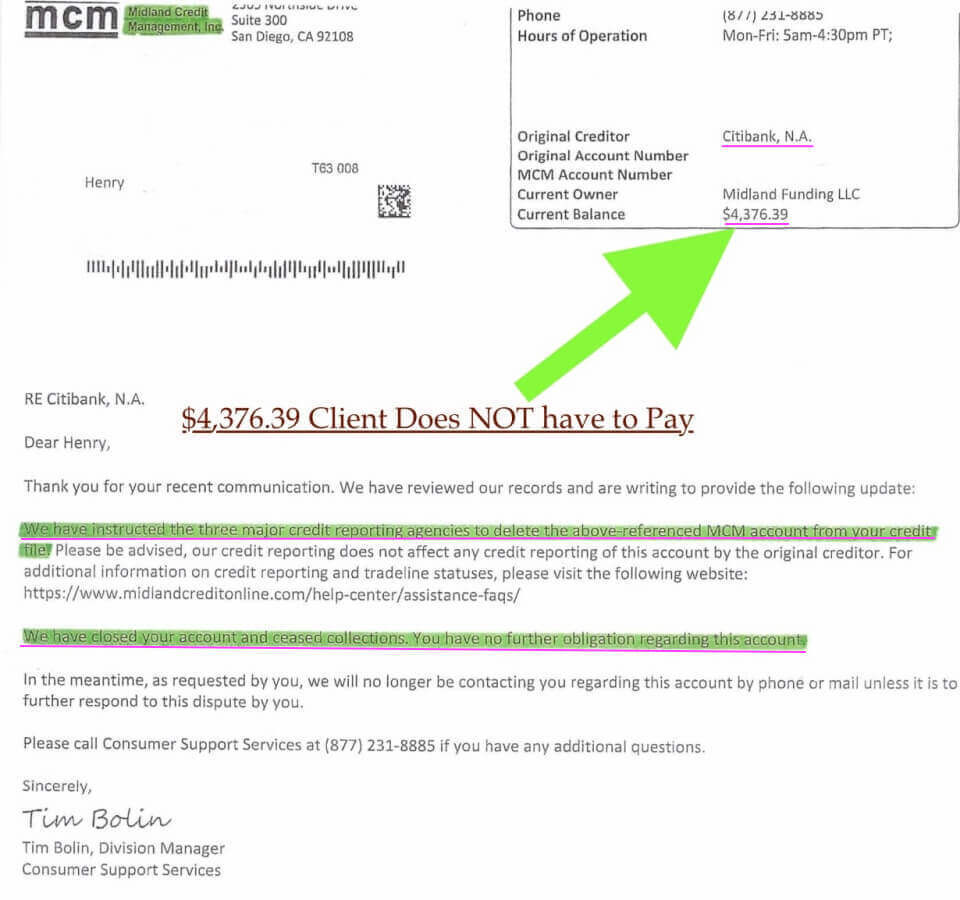

Example Letter, Showing How a Validation Program Resolved a Citibank Credit Card:

Example Letter – Illustrating a Successful Debt Validation Case. New Mexico consumers can use this option as the first line of defense to their debt issues.

Example Letter – Illustrating a Successful Debt Validation Case. New Mexico consumers can use this option as the first line of defense to their debt issues.If the collection company proves the debt to be valid, you will be refunded the program fees and referred to a New Mexico debt settlement law firm to negotiate a settlement on the account.

How does a New Mexico debt settlement program work?

Debt settlement programs can lead to a portion of your credit card balances getting forgiven.

You could resolve $20,000 in credit cards for around $14,000 with a New Mexico debt settlement program, and this includes settlement fees. New Mexico residents are eligible for a free settlement consultation by contacting Golden Financial Services today (866) 376-9846.

Learn more about debt settlement here.

Validation Vs. Debt Settlement in New Mexico

Late and collection marks can stay on credit for up to seven years with the settlement:

After a settlement program, the late marks and collection marks remain on your credit for up to seven years.

Collection and late marks may come off credit with validation:

The good news is that if a validation program can successfully dispute your account and prove it to be legally uncollectible, this can lead to derogatory marks coming off your credit. After an account is determined to be legally uncollectible, a collection agency can no longer legally report the account on a person’s credit report.

Tax consequences come with the settlement:

A settlement plan can also lead to tax consequences.

If you settle a $20,000 credit card for $10,000, the $10,000 in savings will appear as income. You can avoid paying taxes on the savings in a settlement by filing an IRS form 984.

No tax consequence with validation:

With validation, if a collection account is proven to be legally uncollectible and invalid, there’s no tax liability.

Creditors can issue you a summons if you don’t pay your bills in full and on time every month:

There is a chance your creditors can sue you on both settlement and validation. If you receive a credit card lawsuit, you need to either attend court or make sure the settlement company that’s helping you responds to the summons on your behalf. The only time a credit card summons can turn into a judgment where your wages could potentially get garnished is if the summons gets ignored entirely, which no reputable New Mexico credit card consolidation company would let happen.

What happens if I get sued while on a New Mexico debt relief program?

With validation, you’d get refunded on the account that receives a summons. You would then be referred to an attorney who will help resolve it by either settling the account for less than the full amount or by using legal violations to fight the summons and get it dismissed.

How fast do accounts get disputed with a validation program?

If you have all collection accounts, with validation all of your accounts are disputed immediately. After a collection agency receives the validation package, all collection activity must stop until they prove they are legally authorized to collect on the account, which they often can’t do. That means after accounts are disputed, creditors can’t sue you until they prove the account is valid and that they are legally authorized to collect on it. Collection agencies must produce all of the accurate and complete records being requested through the validation package.

Worst case scenario:

If you join a validation program when current on payments, you’d have to let your accounts fall past due for 60-120 days or until the original creditor decides to write off the account and sell it to a collection agency. During this period, while waiting for accounts to get sent to a collection agency, there is a chance the original creditor could issue a summons on both settlement and validation plans. Discover is known to issue a summons quickly, and for this reason, Discover does not qualify for a validation program.

Are you more likely to get a lawsuit with settlement or validation?

With a settlement plan, one account at a time is dealt with, giving more time for creditors to issue a summons on the accounts that are just sitting with no action.

Should I fear getting sued while on a program?

Reputable credit card relief programs include lawsuit defense. So no, you have nothing to fear. Make sure you understand the company’s policy on how a credit card lawsuit will get handled.

Golden Financial Services credit card relief programs in New Mexico include lawsuit defense.

Call today to learn more. Our certified counselors are available and ready to assist you today!

Attorney Model Debt Settlement Program in New Mexico

Golden Financial Services can offer you an attorney-based plan. Your attorney will provide you legal protection while on the program. Legal protection is especially important to have when enrolled in a financial hardship program because creditors don’t get paid monthly. Creditors could issue you a lawsuit while on the plan.

Creditors will be required to direct all communication to your New Mexico attorney. If a summons is received, your attorney will respond to it and work to settle it for less than the full amount owed, just like any other settlement.

If you choose debt settlement, make sure only to use an attorney-based settlement program. Golden Financial Services can introduce you to a highly rated New Mexico debt settlement law firm. Loans can also be obtained to help you consolidate your bills, but we recommend using a local credit union when exploring consolidation loans.

Give us a call today, and we look forward to helping you explore all of your options.

How to get help with debt if you live in New Mexico?

New Mexico residents can call the free help hotline at (575) 446-4361.

You can get a consultation with an IAPDA certified counselor specializing in New Mexico debt relief, settlement, and consolidation options.

What happens during a consultation?

A consultation is purely informational. If you decide to move forward with one of the programs, we can get you signed up or referred to the right department.

How fast does it take to get approved for a New Mexico debt management program?

You can be approved within 24 hours or less.

How long does the program take to finish?

You can graduate from the program within 18-42 months, depending on your situation and budget.

Can I get sued?

It is rare for a client to get sued, but it could happen. If it does, the account can still be settled. In some cases, an attorney will use legal violations that your creditor committed and file for dismissal of the account.

Can I be current on payments and still get approved for a validation or settlement program?

Yes, you can be current on your accounts and still qualify.

If you have a real financial hardship and cannot stay current, these circumstances are sufficient to qualify.

Your credit score will go down over the first year of the program because you’ll have to fall behind on monthly payments.

Is the program anything like bankruptcy?

Our programs are the solution to avoiding bankruptcy, so no, this is not a bankruptcy or anything like it. We don’t recommend or promote bankruptcy unless you have no other options.

Bankruptcy shows up on your credit report as “bankruptcy.” Having a bankruptcy on your credit report is what brings all of the adverse side effects.

Can I rebuild my credit?

Credit can always be rebuilt. However, it is most difficult to rebuild credit with a bankruptcy on it. In the United States, more and more consumers are turning to bankruptcy (post-COVID-19 days). Consequently, the average credit score will go down in the United States as 2021 approaches. If you read this message, do not file bankruptcy until you check if you qualify for a settlement or validation program. You can rebuild your credit score much easier after a settlement plan versus bankruptcy.

How much can I save on the program?

Results vary, but clients who complete making all of their scheduled payments will pay less than the full balance owed on each account.

Does a guarantee come with New Mexico debt relief programs?

Yes, clients do get a money-back guarantee.

Contact Golden Financial Services today and find out if you qualify for a New Mexico debt relief program.