Louisiana Debt Relief Programs

Louisiana debt relief programs can eliminate stress and help you sleep better at night. Louisiana debt settlement programs can reduce your balances to be affordable. Non-profit consumer credit counseling companies in Louisiana can consolidate credit cards and reduce the interest rates. In addition, debt consolidation loans from a Louisiana credit union can consolidate your high-interest credit cards and loans into one. But what is your best option for debt relief in Louisiana?

Call (866) 376-9846 to Speak to a Louisiana Debt Counselor for a Free Consultation.

According to Google’s keyword tool, many consumers are asking: “Is Louisiana debt relief legit?” Rest assured knowing, Golden Financial Services (GFS) has provided Louisiana debt relief programs since 2004 and is A+ Better Business Bureau rated. If you go on Google and search for “Louisiana debt relief reviews” you’ll find Golden Financial Services at the top, with hundreds of positive online reviews from happy clients. GFS was also Rated #1 in 2021 on the Top 10 National Debt Relief Companies List at TrustedCompanyReviews.com. You’ll see GFS at the #1 spot, above InCharge Debt Solutions at #2, AARP at #3, Pacific debt at #4, and Care One Services at #5.

How to Choose the Best Louisiana Debt Relief Program?

What does your debt look like – the Longue Vue House and Gardens or more like the swamps of Louisiana?

Consider the following metaphors: Is your financial situation, like the Longue Vue House and Gardens in New Orleans, Lousiana, beautifully put together and lets you sleep well at night?

You may not want to ruin this beautiful picture by using a debt relief program in Louisiana. For example, a low-interest debt consolidation loan could help you save money and consolidate high-interest loans without affecting your credit score. Or, consider either the debt avalanche or snowball method to pay off debt and continue improving your credit simultaneously. However, sometimes payment history can be misleading. Just because you’re “current on monthly payments” doesn’t mean your credit is in good shape. Credit scores are made up of numerous factors. One factor is “credit utilization ratio”. For example, if you have maxed out credit card balances, your credit utilization ratio is hurting your credit score.

According to industry experts, check out the 10 Best Ways to Clear High Credit Card Balances in 2022.

Or, does credit card debt have you stressing at night and feeling as if your financial situation resembles the southern Louisiana swamps, with alligators ready to strike at any moment? And when we say “alligators,” we’re referring to “creditors” and “credit card companies” that are constantly trying to ruin your finances.

And sometimes debt can feel like one of those tall windy oak trees, like the ones in the picture below lying alongside the Mississippi River at Oak Alley. You can get lost looking at these tall trees, with branches that seem to go on forever, with no end in sight. Similarly, credit card debt can keep growing for eternity, and when paying minimum monthly payments, you may never get out of debt. In addition, credit card bills can be challenging to navigate through, especially when dealing with financial hardship.

You may need consumer credit counseling. Louisiana licensed consumer credit counseling companies can reduce credit card interest rates and consolidate payments into one without ruining your credit. In addition, debt relief programs, including Louisiana debt negotiation and resolution programs, can stick it right back at your creditors, knocking balances down to less than what you owe and allowing you to resolve your debt without paying interest. However, there are pros and cons to each debt relief program. Louisiana credit counselors can explain each option to you at (866) 376-9846. Get your free consultation today.

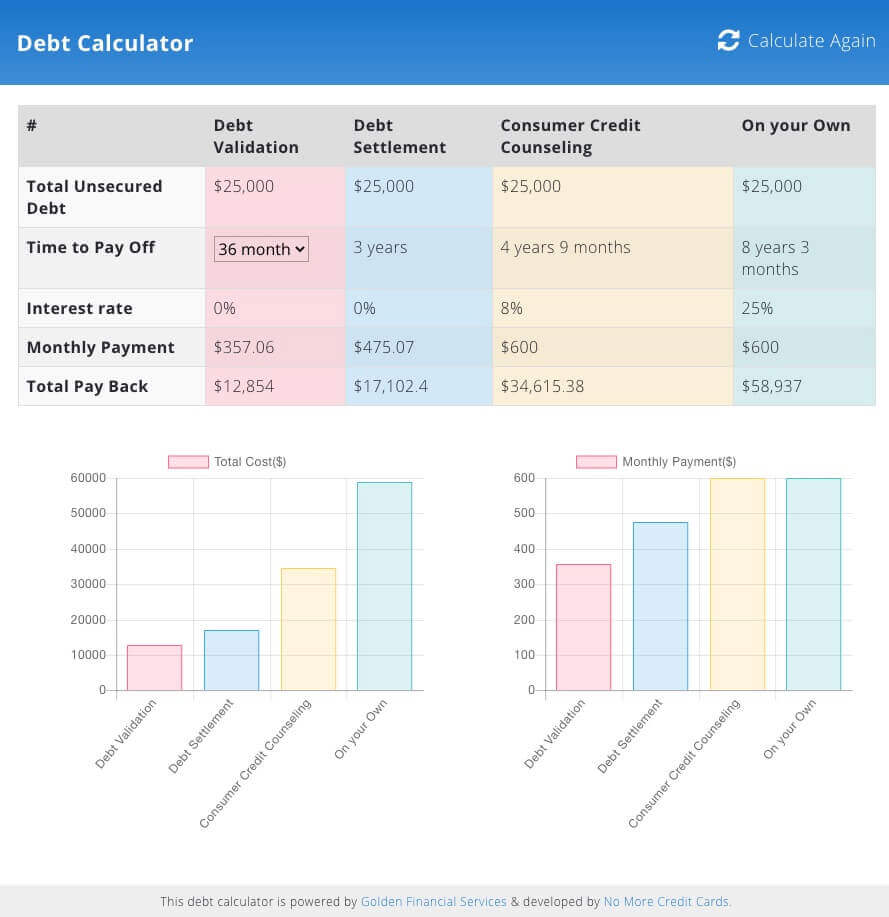

Example of how a Louisiana debt relief program can resolve $25,000 in credit card debt:

BEFORE: PAYING MINIMUM PAYMENTS OF $600 PER MONTH WITH A 25% INTEREST RATE:

- At a monthly payment of $600, you will be debt-free in eight years and three months, paying $58,937

AFTER APPROVAL FOR LOUISIANA DEBT SETTLEMENT:

- Your new monthly payment is $475.07. This new monthly payment will have you debt-free within three years and pay only $17,102.

Louisiana Debt Collection Laws

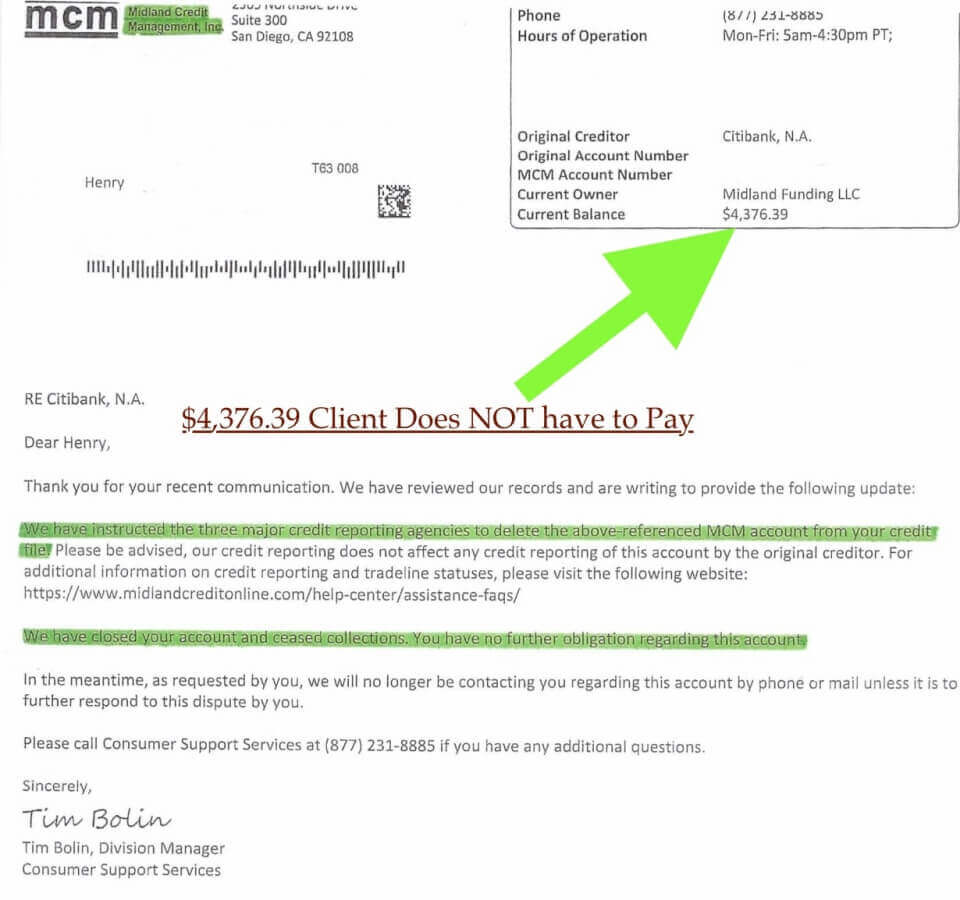

Louisiana debt collection companies can’t prove a debt is valid in many cases. As a result, consumers can walk away from an invalidated debt without paying, aside from only paying the debt relief company’s fees. You may have spent the money, but that doesn’t mean your creditors abided by federal laws. Before ruining your credit by settling the debt for around 70%-75% with a debt negotiation company, use debt validation and potentially save much more.

Citibank: Louisiana Credit Card Debt Relief Example

FDCPA and Credit Card Act of 2009

The FDCPA and Credit Card Act of 2009 protects debtors from illegal debt collection activity and ensures credit card companies treat their clients fairly.

But unfortunately, laws like the FDCPA are often violated, and people don’t even know.

Statute of Limitations for Credit Card Debt in Louisiana

Louisiana law protects consumers from being sued for a credit card debt that has expired the statute of limitations.

The statute of limitations on credit card debt, when creditors can no longer sue a consumer over a credit card debt, is three years in Louisiana. So therefore, if a debt collection company is calling and sending letters in pursuit of collecting on an unpaid debt over three years old – they are illegally trying to collect on that debt, and you don’t have to pay it.

If a debt collector catches you off guard with an unexpected phone call, just let them know that you will not agree to do anything over the phone. Request that they mail you a breakdown of what they claim you owe so that you can see everything in writing. Say “thank you” and politely hang up the phone; it’s that simple.

The Fair Credit Billing Act (FCBA)

The Fair Credit Billing Act (FCBA) ensures that creditors maintain accurate and complete accounting records. A person can challenge a debt collection company, forcing them to prove that you were provided the services you paid for, that you owe what they say you owe and that you made the charges. Once a debt is written off by the original creditor and gets sold to a debt collection company, paperwork gets lost, information turns inaccurate, and debt often can’t be proven to be valid once disputed.

What is the Louisiana Credit Card Forgiveness Act?

The Credit Card Forgiveness Act is another law that Louisiana residents need to beware of, especially if contemplating whether or not to join a debt settlement program. If you settle a credit card debt for less than the total balance owed, the amount of debt that gets discharged could be construed as income. Example: If you owe $20,000 in credit card debt and settle it for $12,000, that $8,000 savings could appear to the IRS as income, and you could be required to pay taxes on it. To eliminate this tax debt, past debt settlement clients used an IRS form #982 to show they were insolvent.

IRS Tax Form #982

Instructions on how to file the IRS Tax Form #982 to prove insolvency and eliminate owing taxes on the amount saved with Louisiana debt settlement programs:

1. #982 Tax IRS FORM for debt settlement (CLICK TO DOWNLOAD FORM)

2. Check the box on line 1a if the discharge was made in a title 11 case (see Definitions, earlier) or the box on line 1b if the discharge occurred when you were insolvent (see Line 1b, later).

3. Include on line 2 the amount of discharged nonbusiness debt excluded from gross income. If you were insolvent, don’t include more than the excess of your liabilities over the fair market value of your assets.

4. Include on line 10a the smallest of (a) the basis of your non-depreciable property, (b) the amount of the nonbusiness debt included on line 2, or (c) the excess of the aggregate bases of the property.

Example of being insolvent and how to file #982 IRS Form

Let’s suppose that you were “released from your obligation to pay your credit card debt in the amount of $5,000. However, the Fair Market Value of your total assets immediately before the discharge was $7,000, and your liabilities were $10,000. Therefore, you were insolvent to the extent of $3,000 ($10,000 of total liabilities minus $7,000 of total assets). Check the box on line 1b on the IRS Form 982 and include $3,000 on line 2.” For instructions on filing the IRS Form #982, visit IRS.Gov here.

Louisiana State and Government Debt Relief Assistance

Unfortunately, state and government debt relief options do not exist. There are federal student loan relief programs available at StudentLoans.gov, but that’s about it. If you are looking for a credit card debt relief program in Louisiana, you’ve landed at the right spot. Golden Financial Services offers multiple debt relief programs in 2019 that can resolve credit cards, student loans, and almost all unsecured debts.

Talk To An IAPDA Certified Louisiana Debt Relief Counselor & Learn How To Get Out Of Debt For Free At (866)-376-9846

Louisiana-based hardship programs are available at Golden Financial Services, a Highly Rated Better Business Bureau Company. (Click Here to VISIT THE BBB to See Our Perfect A+ BBB Rating with NO CUSTOMER COMPLAINTS & 13+ Years in Business)

Golden Financial Services has one goal in mind when it comes to helping Louisiana consumers: “Our goal is to save you the most money while helping you to become debt-free and start fresh in the fastest time frame.” (A statement from Paul J Paquin, the CEO at Golden Financial Services)

How Fast Can I Get Out Of Debt With Louisiana Debt Relief Programs?

Debt relief programs in Alabama, Iowa, and Oklahoma can quickly get you out of debt.

But how quick?

You can become debt-free within 18-42 months with the Golden Financial Services Louisiana debt relief programs.

Some clients graduate within 18-months, while other customers take 30-40 months to complete the program. Golden Financial Services can give you a time frame once they learn more about your needs, situation, and debts.

Louisiana residents are eligible for a free debt relief quote at 866-376-9846.

Louisiana residents won’t be required to pay high, out-of-pocket fees at Golden Financial Services, like with other companies such as Freedom Debt Relief, Louisiana Debt Relief, and InCharge Debt Solutions.

We won’t try to help you if we can’t, but we will provide you with honest and accurate debt relief advice.

Live in Louisiana? GET FREE Credit repair, FREE credit report & score, and FREE debt consolidation consultation

- Credit Repair could be included for free, depending on what program you qualify for.

- You automatically qualify for a free credit report and score upon request if you live in Louisiana.

- Free Consultations are always provided to residents of the state.

Debt Relief – Louisiana Office

Golden Financial Services can rescue consumers drowning in high bills through Debt Settlement Louisiana Programs. Golden Financial Services is rated A+ by the Better Business Bureau and has been helping consumers in this state for more than 18-years now.

You can get immediate relief. Louisiana debt relief is a right that consumers in this state deserve to have if they indeed have a legitimate hardship.

It takes lots of willpower, self-control, courage and helps to cure the debt plague. No magic wand will make your bills disappear. What we can do is provide you with a blueprint to quickly pay off your credit card and unsecured accounts in the least painful way. Call 1-866-376-9846 for a FREE QUOTE TODAY!

Do I qualify for Louisiana Debt Relief?

If you answer YES to any of the following questions, you could qualify for our Debt Relief Louisiana Program.

***Are you unable to pay off your entire balance on any of your unsecured accounts at the end of each month?

***Do you ever buy items with your credit card because you don’t have the money to pay for them without your card?

***Do you notice that your health is negatively affected by high bills?

***Are you fighting with your spouse or family members over money?

***Are there times where you can only pay the minimum payment on your accounts?

***Have you ever been turned down for credit in the last year?

***Have you ever considered taking out a loan to pay off your bills because your monthly payments are overwhelming?

***Are you living paycheck to paycheck?

Debt settlement – Louisiana

Louisiana debt settlement is the preferred program over consolidation. However, debt Consolidation Louisiana Programs are also available. At the Golden Financial Services office, we specialize in saving our customers the most money and time, where settlement services and debt validation are the preferred options.

Debt settlement Louisiana programs are for consumers experiencing adversity and require assistance with paying off their unsecured accounts to avoid bankruptcy.

Consumers that have more than $10,000 in total unsecured bills could qualify.

Talk To An IAPDA Certified Louisiana Debt Settlement Counselor At (866)-376-9846

What exactly will the Debt Settlement Louisiana program do for me financially?

This type of program allows consumers to GET A SMALL & SIMPLIFIED monthly payment, smaller than what they would be paying when paying minimum payments on their own. In addition, professional debt negotiators will contact your creditors, letting them know you have legal representation, and direct all calls to your attorney.

Negotiators will then work to settle your accounts one by one. EacAs a result, each of your bills can be satisfied by paying back a significant amount LESS than the full balance owed.

Negotiators will bulk together sometimes hundreds’ of clients worth of accounts when negotiating, which creates leverage to solidify the most substantial reductions for our customers.

Debt Validation – Louisiana

Debt validation challenges your debt, similar to how a lawyer disputes a speeding ticket trying to get it dismissed.

The difference is that with debt if the debt collection company can’t validate an account, you may not have to pay it, and it could come off your credit report at that point.

The debt becomes “legally uncollectible” if the debt collection company can’t prove that they abide by all of the laws and maintain accurate paperwork on your behalf.

What’s a legally uncollectible debt? It’s one that you don’t have to pay.

Once a debt is invalidated, it’s “proven to be invalid” — and at that point, the debt cannot get reported on your credit reports.

It would be illegal for a debt collection company to continue collecting money from you on an “invalidated debt.”

Credit repair is provided for free on a debt validation program to ensure if debt gets invalidated that, it gets removed from your credit report.

How’s Golden Financial Services different from other Louisiana debt relief companies?

InCharge Debt Solutions is a 501(c)(3) non-profit consumer credit counseling company in Louisiana. Incharge Debt Solutions can consolidate credit card debt into one payment with reduced interest rates. Your monthly payment will stay around the same as when paying minimum payments on your own.

Freedom Debt Relief and National Debt Relief in Louisiana are debt settlement companies. These companies are reputable debt settlement companies, but that’s the only program they offer. Clients can expect to pay around 75% of their total debt with these companies’ programs. Again, debt negotiation plans will lower credit scores, produce potential tax consequences and require you to stop paying monthly payments for the plan to work. Creditors don’t get negotiated down until they are with third-party collection agencies. Once the debt is reduced and settled, collection and late marks remain on credit reports for seven years.

At Golden Financial Services, we try to keep people away from debt settlement by using debt validation to invalidate the debts and, in some cases, get them removed from credit reports entirely. Consumers can save more money with debt validation over debt settlement when validation results are successful. If a debt is proven valid, a debt settlement would be used as a last resort. Also, consumers can use consumer credit counseling through a non-profit company that Golden Financial Services recommends for each applicant’s state if that’s the plan they choose. Golden Financial Services works with the top-rated debt relief, settlement, and consolidation companies throughout Louisiana, ensuring consumers get enrolled in the right strategy. Within minutes, Golden Financial Services can run an applicant’s credit report through a software and find the program that will save that applicant the maximum. Unlike companies like Incharge, Freedom Debt Relief, and National Debt Relief, every applicant is restricted to only one plan because it’s all the company offers.

Learn more about debt validation. Louisiana residents can call for A FREE CONSULTATION AT (866)-376-9846 NOW.

Louisiana Debt Relief Program Disclosures and Laws:

- Golden Financial Services is not a licensed Louisiana credit repair company. In some cases, after disputing something on your credit report, it can appear that the creditor proved the notation to be accurate, lowering your credit score further. Golden Financial Services may refer consumers to a Louisiana law firm to dispute invalidated debt from their credit reports.

- Golden Financial Services does not offer Louisiana debt consolidation loans but will assist a consumer with consolidating their federal student loans through StudentLoans.gov. The information about debt consolidation on this page is for educational purposes only.

- Golden Financial Services specializes in educating consumers on credit and financial debt solutions and enrolling them with top-rated debt relief companies in Louisiana.

- Debt validation and debt settlement programs require a person to be delinquent on monthly payments. Accounts will eventually get written off and sold to third-party collection agencies, leading to potentially adverse consequences to a person’s credit score. Creditors can issue a summons; credit scores can go down, balances can grow before a debt is resolved due to interest and late fees. There is no guarantee that these plans will work 100% of the time and that creditors will agree to settle a debt at a certain percentage. Based on extensive research and many years in business, Golden Financial Services has identified the best debt relief companies in Louisiana, allowing the company to offer multiple programs for Lousiana residents.

- FTC rules and regulations restrict Louisiana debt settlement companies from charging up-front fees. As a result, fees can only get charged to Louisiana residents after settling and resolving the debt. In total, debt settlement Louisiana law firms will resolve a person’s debt for around 70%-75% (including all legal and program fees).