Table of Contents for Texas Debt Relief

- Texas Debt Assistance–Summary of Options

- Licensed Debt Management Companies in TX

- Consolidation Loans for TX residents

- Student Loan Consolidation Programs in TX

- How to Get Out Of Debt on Your Own

- Government debt relief in TX

- Is debt relief a good idea?

- How does a TX debt relief program affect your credit?

- Why use Golden Financial Services for Credit Card Debt Relief?

- Golden Financial Services Reviews and Credentials

- Fees and Cost Associated with debt settlement

- Consumer Credit Counseling Fees

- TX Debt Relief Program Benefits

- How to Qualify and Enroll in TX debt relief

- How to get a free credit report

- How to check program eligibility

- Program Disclosures

- TX Debt Consolidation Program

- TX Debt Settlement Program

- TX Debt Relief Reviews

- Federal Student Loan Relief Help

- Example of how a debt validation program can help improve financial health

- What is debt invalidation, and how can this type of service help?

- How to apply for unemployment

Summary of options for Texas Debt Assistance

Texas, debt relief programs include debt negotiation and settlement services, loan consolidation, debt validation, and consumer credit counseling. Texas residents that can’t afford to pay more than minimum payments may want to consider debt settlement. Texas consumer credit counseling companies can help with reducing high-interest credit card bills.

Texas Debt Consolidation Loans

A loan may help with consolidating all of your high-interest accounts into one low-interest consolidated loan. Texas consumers with a high credit score and low balances on credit card bills may qualify for a low-interest debt consolidation loan. These loans can be used to pay off all of your high-interest accounts, leaving you with one low-interest loan to pay back. You should then keep all of your paid-off accounts open to raising your credit score by showing an improved credit utilization ratio. T

Licensed Debt Management Companies in Texas

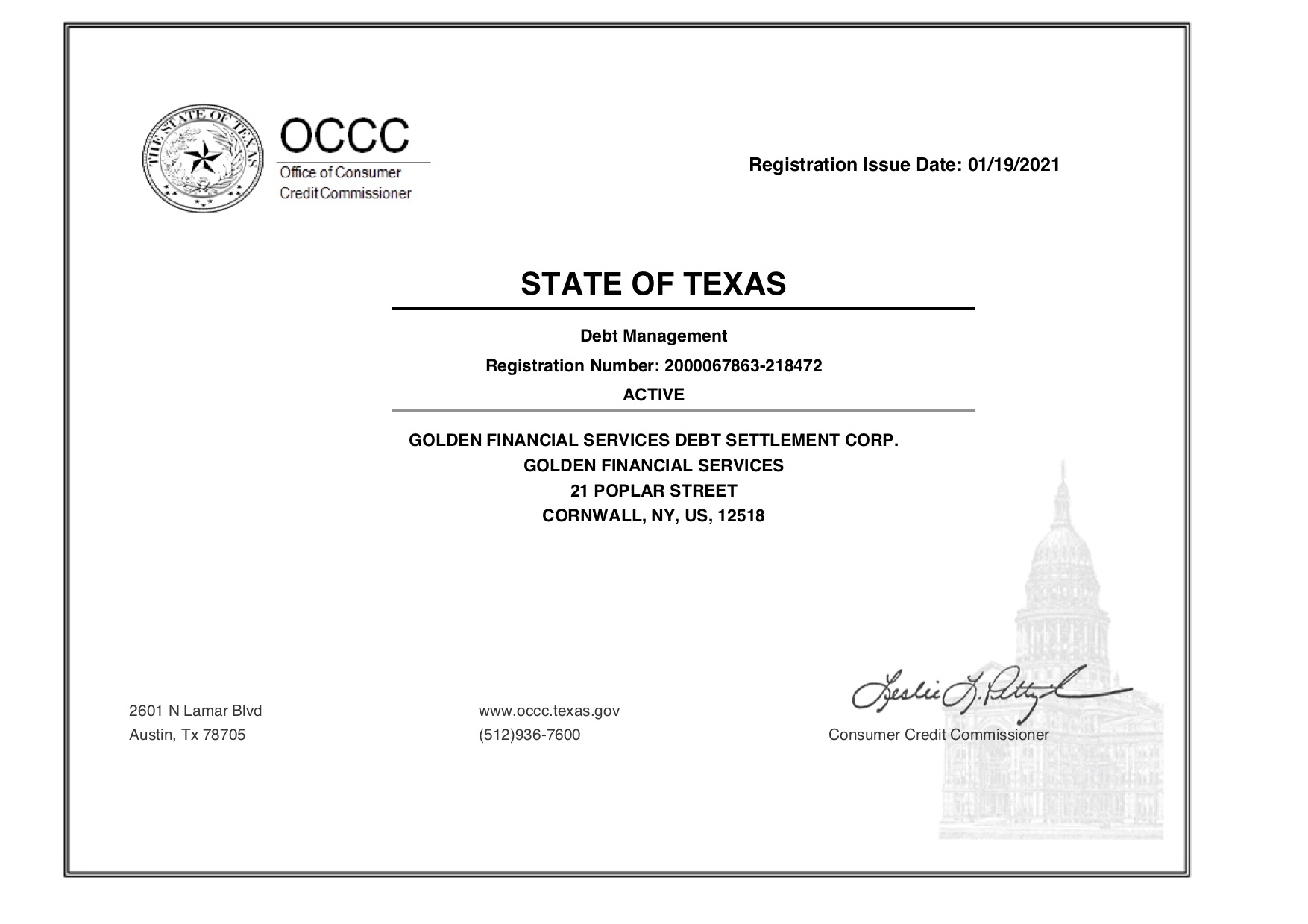

Golden Financial Services is licensed for debt management in Texas (Registration Number: 2000067863-218472). See debt management license:

Call today for a Free Consultation at (866) 376-9846.

We look forward to providing you with options to help you achieve your financial goals.

Student Loan Debt Consolidation Programs in Texas

Need to consolidate federal student loans? You don’t need to hire a debt consolidation company in Texas to consolidate your federal student loans because you can consolidate on your own. The choice is yours. If you’re interested in consolidating your student loans on your own, here’s a step-by-step guide on how to consolidate, reduce your payments, and get loan forgiveness.

We recommend if you’re contemplating getting a consolidation loan, Texas local credit unions would be the place to start because they often offer loans with the lowest interest rate.

Texas residents can get out of debt on their own without using a program in some cases.

Need to pay off your credit cards faster but without using a program or a loan? Here’s a free debt snowball calculator tool to help you out.

Before using the snowball calculator, you may want to start with creating a budget. Here’s a free budget calculator tool to get you started.

Is there a government debt relief program for Texans?

Government programs are available to help with federal student loans, but not for credit cards, unsecured loans, and collection accounts.

To learn about Texas, credit card debt relief programs, call (866) 376-9846. Programs can assist you in dealing with medical bills, credit cards, and most unsecured loans. Get the facts about each program, how they work, and find out what your best option is.

Is Debt Relief a Good Idea?

All debt relief programs come with pros and cons, which will explain the remainder of this page. It is important to learn all options and weigh the benefits and downsides of each. What option benefits you the most and is in line with your financial goals? Depending on your goals and needs will determine whether or not a particular program is a good idea for you.

How does a Texas debt relief program affect your credit?

Depending on what your financial situation looks like today will play a part in determining how a particular program may affect your credit score.

Let’s take a closer look at a few real-client examples to illustrate how TX credit card relief programs can affect a person’s credit score.

Example 1: Texas Consumer Credit Counseling Program to Improve Credit Scores:

If your FICO score is only 650 and you are one month behind on credit card payments, a consumer credit counseling program could re-age payments to be current again, resulting in a slight improvement to credit scores.

Example 2: Credit Counseling lowers your credit score:

On the other hand, if you have a low credit utilization ratio and an 800+credit score, your credit score may go down at some point after joining a consumer credit counseling program because your credit card accounts will end up getting closed out at the end of the program, which can lower your credit score.

So again, whether or not a particular program is a good idea for you depends on what your situation looks like today and your goals.

There are additional factors outside a program that determines whether your credit score continues to go down or improves at some point. Are you staying current on the monthly payments on the accounts you left out of the program, like your car or mortgage payment? This payment history plays an important role in improving credit scores while on a program.

Example 3: Credit score improves after joining a TX debt settlement program:

The client came into the program with all third-party collection accounts. Their credit score was around 550. After joining the settlement program and having 3 out of 4 of their accounts settled and paid, the client noticed an improvement in their credit score.

Example 4: Credit score declines and then improves with a validation program:

A consumer joined the debt validation program after falling behind on their credit card payments by one month. Within six months after joining the validation program, all of their accounts had been charged off and sold to third-party collection agencies.

The consumer’s credit score fell from 675 to 610 within that six-month period after joining the program. By month 18, all of their accounts had been invalidated and removed from all three credit reporting agencies. The consumer’s credit score rose to 690 at that time.

During this 18-month period, while the consumer was on the program, they also opened up a secured credit card and used it for gas every month, paying the bill in full at the end of each month. This positive payment history on the secured credit card was beneficial in raising the consumer’s credit score while simultaneously the collection accounts fell off.

What is debt invalidation?

If a collection agency can’t prove that they are legally authorized to be collecting on an account, the debt becomes invalidated.

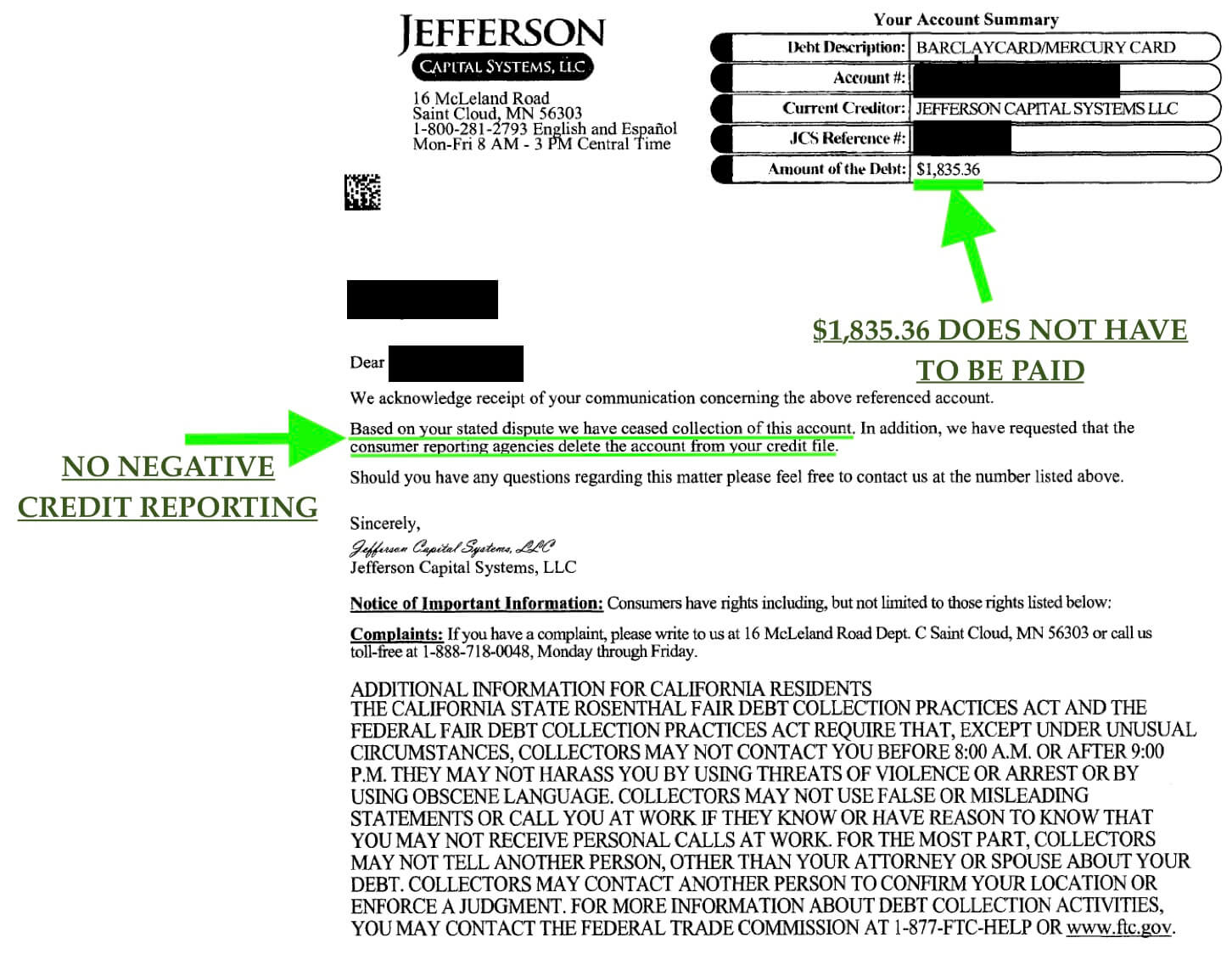

An invalidated debt is one that you don’t have to pay, and it cannot legally remain on a person’s credit report, as illustrated in the example letter above.

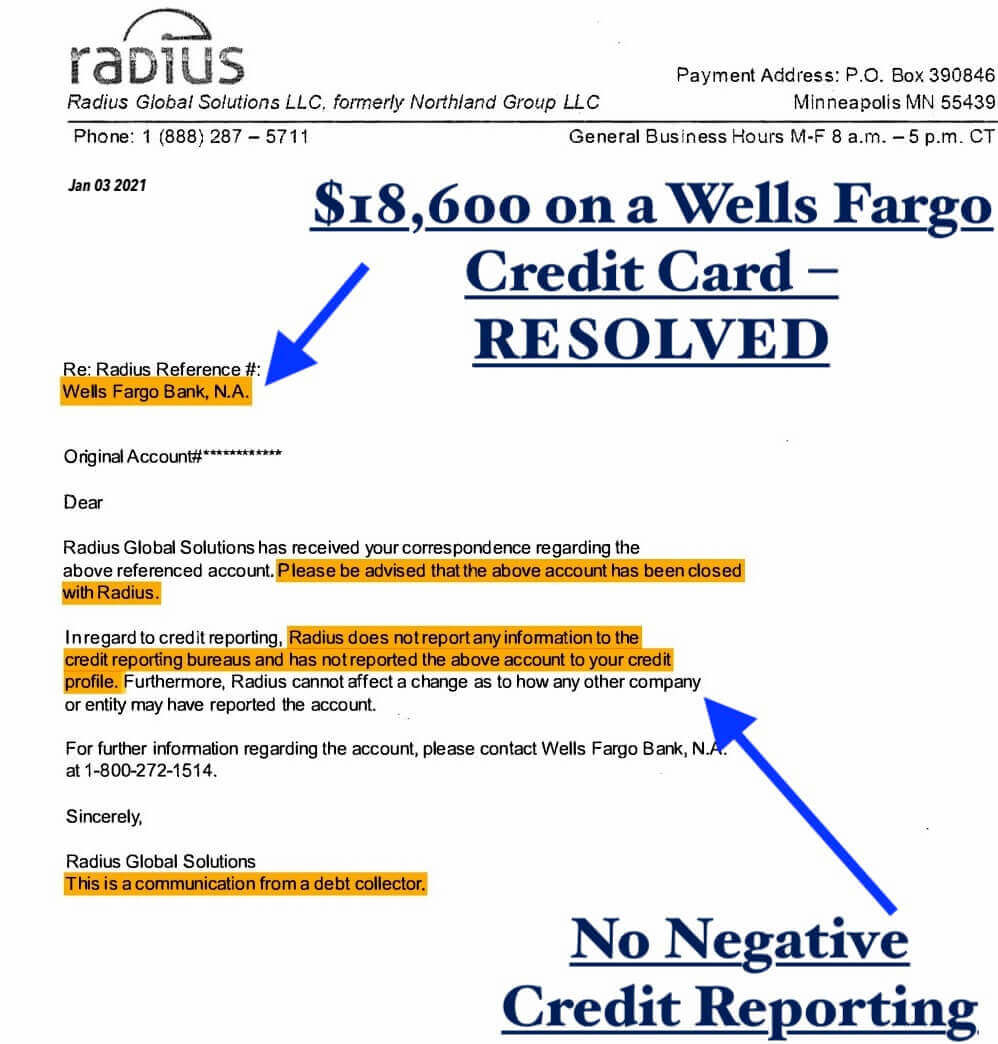

In the example above, the collection account that was originally a Wells Fargo credit card became invalidated and did not have to get paid. As an additional benefit of the debt invalidation services, the account was completely removed from the consumer’s credit reports.

Speak to a debt counselor today at Golden Financial Services to determine if debt invalidation services would be the right option for you. Call (866) 376-9846.

Here are additional factors to consider that can boost or reduce credit scores.

Why use Golden Financial Services for Texas credit card debt relief programs?

We can help you get approved for the lowest payment with one of the best Texas debt relief companies. You will understand how each program works, including the benefits and downside of each. Our experienced enrollment specialists are trained by the International Association Of Professional Debt Arbitrators (IAPDA), ensuring you get reliable and trustworthy information. Our compliance team constantly monitors all phone calls, ensuring our enrollment specialists operate with the highest standards for debt relief.

Golden Financial Services is not a Texas consumer credit counseling company. Instead, we specialize in offering hardship programs, including Texas debt negotiation and validation plans to qualified consumers. Part of what we do is offer financial education to consumers, including education on debt management programs. Ultimately we leave the power in the consumer’s hands, empowering people by providing financial education and options and making it easy to enroll.

We take pride in ensuring full transparency, which means ensuring you understand the benefits and downsides of all options. Based on specific criteria, we will recommend the best Texas debt relief program for each person.

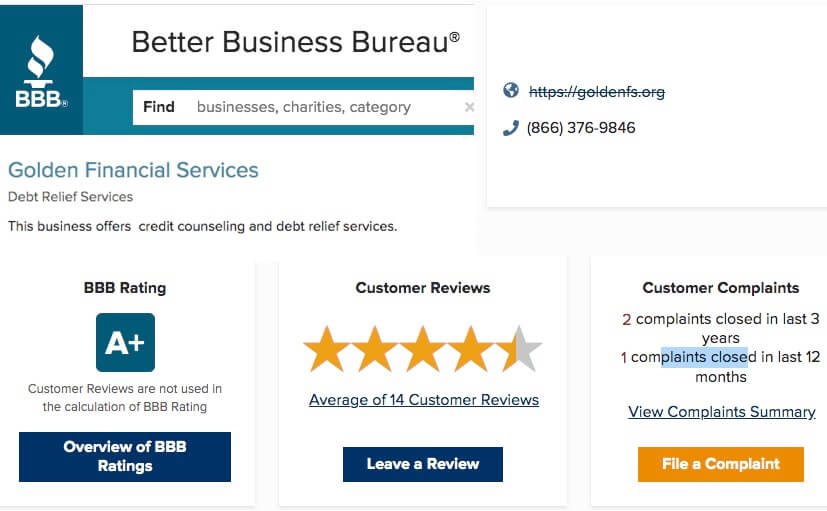

Golden Financial Services Reviews and Credentials

How old is Golden Financial Services?

Golden Financial Services was created in 2004 in Boca Raton, Florida. When first incorporated, we offered debt settlement. Over the years, we realized that we needed to offer more than just one plan. That’s when we started facilitating partnerships with what we believe are the best companies in the nation. We don’t charge consumers. Instead, we get paid by the companies that we work with. Consumers can talk to one of our enrollment specialists for a free consultation.

BBB A+ RATING

Our BBB rating of A+ with less than three resolve complaints in over three years backs up that the advice we provide is trustworthy and reliable.

INDUSTRY-LEADING MANAGEMENT TEAM

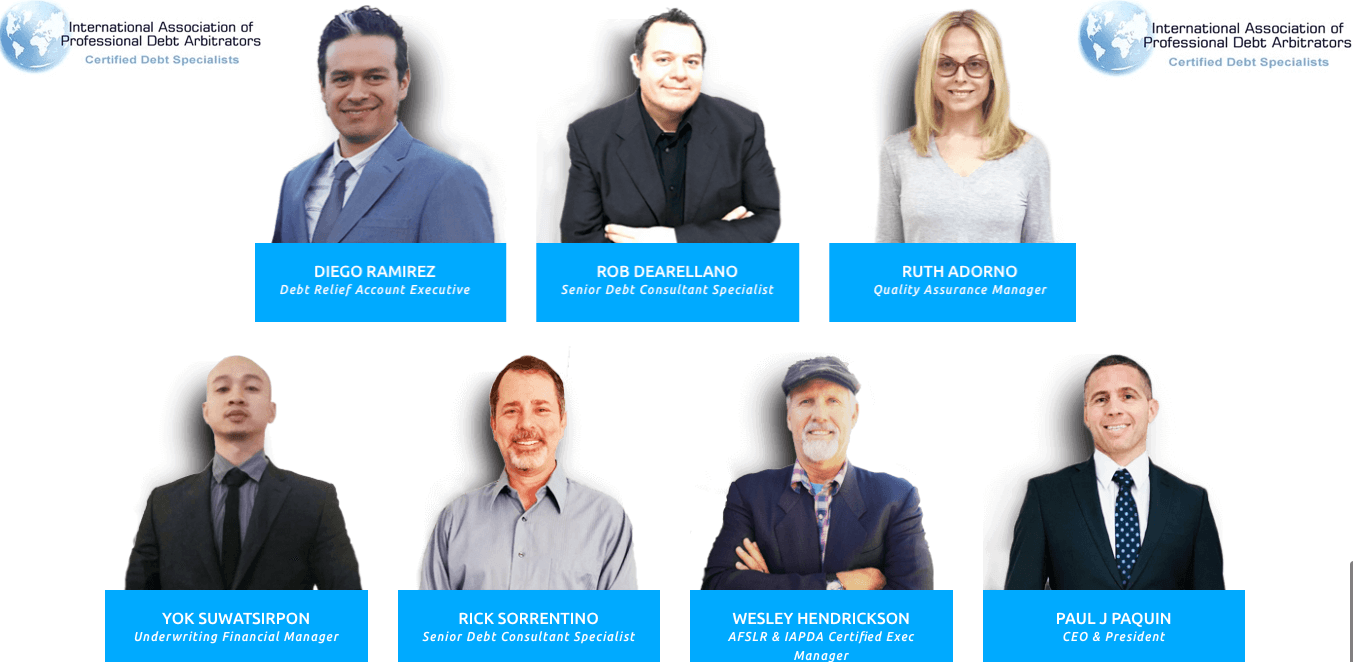

Our management team of counselors, including well-known leaders in the debt relief industry, includes Rick Sorrentino, Wesley Hendrickson, and Paul J Paquin, the CEO.

Part of the criteria that we base our recommendations on including Texas debt relief companies that:

- offer the lowest payment for Texas debt relief and settlement programs

- abide by rules and regulations, including charging no up-front fees and offering full disclosure for clients

- maintain a high Better Business Bureau rating with few complaints or that are BBB accredited

- have a long track record of success

- are proactive in dealing with Texas debt relief programs’ potential downsides, like if a consumer is served with a credit card lawsuit (–Will the company defend the client?)

Texas consumer credit counseling, debt relief, settlement, and consolidation programs all have a negative side associated with them, so you must understand each negative so that you know how to deal with situations if they were to occur and can successfully make it through whichever program you choose to join, not letting obstacles prevent you from being successful.

At Golden Financial Services, we are A+BBB rated and IAPDA Accredited.

Talk to one of our Debt Enrollment Specialists Today for Free at (866) 376-9846.

Texas Debt Negotiation & Settlement Fees

With debt settlement programs in Texas that we recommend, the maximum fees that any debt settlement firm will charge equals 15% of the total debt enrolled. No fees get charged until after each debt gets settled and at least one payment has been made to the creditors, per federal laws. With fees and all interest included, Texas debt settlement programs allow you to pay a significant amount less than the total amount owed. But, is the savings worth the adverse effect the program could have on your credit? The answer to this question is not the same for everyone. How is your credit score today? Do you have maxed-out credit cards that you can’t afford to pay? Have you been late on monthly payments in the past? Do you have creditors calling you and harassing you over debt collection accounts?

Texas Consumer Credit Counseling Company Fees

When it comes to consumer credit counseling programs in Texas, the only fee that is allowed to get charged is the monthly fee that cannot go above $50 per month, but you will pay your entire credit card balance back in full, plus interest. In the end, consumer credit counseling programs in Texas will cost more than debt settlement, even though the fees are much less because all of your balance must get paid in full.

Texas Debt Relief Program Benefits Include:

- Become debt-free faster (within 18-48 months with debt settlement) (within around 54 months with consumer credit counseling)

- Save money and eliminate a portion of your high interest rates with consumer credit counseling.

- Get one lower monthly payment (with all settlement and consolidation options)

- Have your balances negotiated down to an amount that you can afford to pay

Texas Debt Statistics

Before learning about Texas debt relief options, it’s important to know a few facts about the state’s overall debt problem.

- Average Debt Per Consumer in Texas: The average citizen in Texas carries around $13,500 in debt.

- Credit Scores: Texas residents have among the lowest credit scores in the country.

- Identity Theft in Texas: Texas has one of the highest rates of identity theft in the country.

- Student Loan Debt: The average student in Texas has $22,140 in student loan debt.

- Credit Card Debt in Texas: Three Texas cities rank in the top ten for consumers with the highest credit card debt. San Antonio ranks first at $5,177. Dallas ranks fifth with $4,936. Austin comes in eighth with $4,791.

- Bankruptcy: Bankruptcy filings in Texas dropped in all three federal judicial districts in the state. The Northern District saw a decline of 2.4 percent, while the Western District saw a decline of 8.4 percent. The Southern District had the biggest drop with 11.4 percent fewer filings between 2011 and 2012.

What Golden Financial Services offers that other debt relief companies in Texas don’t offer:

- At Golden Financial Services, IAPDA Certified Debt Counselors will give you a FREE credit report analysis to spot identity theft.

- You get to learn all of your options within a single phone call. Many Texas debt relief companies offer you only one program, so you would have to call multiple companies to get the same information you can get in a single phone call at Golden Financial Services.

- Golden Financial Services is one of Texas’s debt relief companies that maintain zero unresolved Better Business Bureau complaints and an A+ rating (click to verify at BBB.org).

Do you qualify for a Texas debt relief program?

To find out if you’re eligible for a debt relief program, TX residents must follow these few quick steps:

Step 1: Talk to an IAPDA Certified Texas Debt Relief Professional

You start with a free consultation with one of our IAPDA Certified Texas debt relief counselors. IAPDA stands for the International Association of Professional Debt Arbitrators.

Talk to an IAPDA Certified Expert for FREE @ (866)-376-9846

Step 2: Texas residents can get a free credit report and score

You can get a free credit report from Golden Financial Services if you’re a qualified applicant for debt relief. Texas residents can also get a free credit report on their own at annualcreditreport.com.

One of our IAPDA certified counselors will review your credit report with you. We need to see what creditors you owe, the balances on each account, and your payment history. On our end, we will plugin your creditors’ names and all of the information into a password-encrypted software that will give us all of your debt relief options in a matter of seconds.

Your private data remains safe and confidential in our software and will only be accessed by our team at Golden Financial Services and our approved partners that help get you out of debt.

Step 3: Learn what Texas debt relief program you qualify for

Your monthly payment options will be presented to you for each program. Whichever program you qualify for will offer flexible monthly payment options. You can pick how fast you want the plan to go, ranging from 18-48 months (depending on how fast you can afford to become debt-free). Keep in mind, with settlement programs, you can choose a plan (i.e., 24 months, 36 months, 48 months), but these are just estimated timeframes based on past results. That means you may become debt-free faster with debt settlement than originally quoted, but on the other side of the coin, there’s no guarantee that all creditors will even settle.

Before we recommend a settlement program, collection agencies must prove that they are legally authorized to collect on an account. Debt validation programs offer consumers the ability to dispute a debt, forcing a collection agency to prove that they are legally authorized to collect on a debt. If a collection agency can’t validate a debt, it can become legally uncollectible. A legally uncollectible debt does not have to get paid, and it can’t legally remain on a person’s credit report. A validation program can be an effective method for dealing with third-party collection accounts and making it easy for consumers to act on available consumer protection laws.

What if I get sued while enrolled in a Texas debt relief program?

We will go over exactly how each program works, including the benefits and downsides of each plan, so that you can intelligently pick your best option. If you understand the potential downsides and the solution if a negative consequence was to occur, you have a much better chance of making it through the program successfully and becoming debt-free.

For example, if you get sued, will lawsuit defense be provided? What are you supposed to do after getting served with a summons for a credit card debt? Are you clear on the process? Any Texas debt relief company helping you should get in front of the fact that you could get sued while enrolled in a program if your creditors are not being paid in full every month. They should address the steps that will take place following you getting served with a summons. How will the company resolve the lawsuit? Are they putting all the work on you, or will they actually be the ones responding to the summons and working on getting it settled or dismissed? Will you be required to pay additional legal fees to an attorney?

Transparency and disclosures are at the forefront of what we do here at Golden Financial Services. Here’s why: We’ve found that, for clients to be successful in resolving their loans and bills, they need to understand what potential consequences could occur and how these potential consequences will be dealt with if they were to occur. This brings us to step four:

Step 4: Get TX debt relief program disclosures & compliance call

We send you the paperwork to review and sign electronically. You then need to complete a thirty-minute phone call where one of our compliance managers evaluates your program and all disclosures, ensuring you understand all aspects of the plan. Each page of the client agreement will be reviewed with you by one of our enrollment specialists here at Golden Financial Services.

Texas debt settlement and validation program disclosures

- With debt settlement and validation programs, accounts must go to third-party collection status before each debt can be negotiated down, settled, or disputed. Consequently, a person’s credit score will go down over the program’s first year, and late marks and collection accounts will get inflicted on credit reports. Settling debt will not remove late notations and collection accounts from a person’s credit report. On the flip side, if an account is disputed with validation and becomes legally uncollectible, the account can no longer legally remain on credit reports.

- If you don’t pay your creditors in full every month, there is a chance that they can attempt to sue you. All debt relief programs in Texas that we offer at Golden Financial Services include some lawsuit protection or method to resolve a summons, where a negotiator that specializes in settling lawsuits will go in and attempt to negotiate an attractive settlement before the court date. The downside with settling a debt after legal action has occurred is that settlements won’t be as attractive and will cost more, but you’ll still likely save more than by paying the account in full and on your own. Suppose you get sued while on a program, you’ll need to send the summons over to the TX debt negotiator handling your case so that they can prioritize settling the lawsuit and help you resolve it quickly. Just make sure whatever Texas debt relief company you’re talking to is being upfront and transparent about the fact that you could get sued and make sure they have a clear plan of action to take if a lawsuit was to occur. Now do keep in mind, one of the main benefits of using Texas consumer credit counseling programs is that creditors do get paid every month, so when enrolled in this type of plan, you should not get sued.

- With Texas debt settlement/negotiation programs, after an account is reduced and paid off for less than the full amount, a portion of the debt gets forgiven. The IRS sees the amount that gets forgiven (your savings) as “taxable income.” Talk to your accountant about this aspect of the program. Still, solutions are available that most accountants can help you illustrate insolvency so that you don’t have to pay the tax liability. For example, IRS Form 982 has been used by clients to determine under certain circumstances (as described in section 108) “the amount of discharged indebtedness that can be excluded from gross income.” In other words, clients who have received a 1099 over a settled debt asking them to pay taxes on the savings have been able to use this Form 982 to avoid paying the taxes.

- To reiterate, your creditors are not paid every month with debt settlement programs in Texas. Instead, your payments go into a special savings account (also called an FDIC insured Trust Account) that you have full control over. After a deal is made with one of your creditors to settle a debt for less than the full amount, you’ll get notified about the deal and must approve it before the settlement gets finalized and funds are released from your savings account. When one of your creditors agrees to reduce a balance, and you agree to the terms, at that point, the funds get released directly from your savings account and paid to the creditor. If you cancel your program before an account is settled and resolved, 100% of the funds in your savings account are returned to you. After the deal is finalized with one of your creditors and at least one payment is made to that creditor towards the agreed-upon settlement amount, at that point, the debt settlement company’s fee gets charged and comes out of your savings account. This fee will already be available inside your savings account; it’s not an additional fee that you’ll have to pay on top of your regularly scheduled monthly payment. It’s already been incorporated into your scheduled monthly payments.

- There’s no guarantee any creditor will settle for a certain amount; what we provide you is a quote based on past client results. No Texas debt settlement company can tell you an exact amount creditors will be willing to settle for. Your creditors are not legally obligated to settle a debt for less than the full amount owed. Still, in most cases, they will agree to a settlement because we’re dealing with collection agencies that have purchased the debt for a low price, and the original creditors have already written off the debt.

- Not all clients make it through debt validation or settlement programs for various reasons. They can’t afford to continue making payments for the entire plan and end up canceling and filing for bankruptcy debt relief. Texas residents are legally entitled to canceling any debt relief program in Texas at any point. We do not offer any type of bankruptcy referral services at Golden Financial Services. If you cancel a program before finishing it, you may have higher balances and end up in worse financial shape than before you started. After joining a settlement or validation plan, interest and late fees continue to accumulate, making balances grow even higher, so if you drop out before finishing the program, you could end up with more debt than you started. However, late fees and interest get mitigated when the debt is settled and paid, so nothing is owed after the debt is settled.

Consumer Credit Counseling – Texas Disclosures

Texas consumer credit counseling programs do hurt credit scores, but this adverse effect occurs when credit card accounts get reported closed at the end of the program. Also, after joining a credit counseling program, it is reported on your credit report that a consumer credit counseling company is managing your accounts, and some creditors frown and look down upon this type of credit notation.

Therefore, even though payments are made on time every month to creditors, consumer credit counseling will still harm credit.

Credit scores can also improve after joining a credit counseling program because accounts can go from being delinquent to getting re-aged to show current payments. In many cases, consumer credit counseling programs have less of a negative effect on credit scores at first compared to financial hardship programs that require you to stop making payments to creditors each month.

The bottom line:

Texas residents with a high credit score that can afford to pay more than minimum payments comfortably should avoid debt relief programs at all costs because high credit scores are not easy to build. Check out the 10 best ways to clear high credit cards for 2020.

Step 5 – Your TX debt relief program starts.

You get approved or denied for the TX debt reduction plan at this point.

Your monthly payment won’t start immediately; it will be scheduled for 1-3 weeks out.

It is important at this point that you send in all correspondence, including any documentation and collection letters sent to you from creditors to your Texas debt relief company.

Debt Consolidation Texas

Consolidation programs allow the consumer to combine all credit cards into one monthly payment.

Often with consumer credit counseling programs in TX, the credit counselors work with your creditors already. Consumer credit counseling companies have arrangements with most credit card companies to lower the interest rates.

This means payments become more manageable and allow consumers to have more disposable income for savings or retirement by using consumer credit counseling services. There is also a reduced risk of credit-damaging late payments and the late fees that come with them due to “forgetting” one of the many different debt payments the consumer is dealing with without debt consolidation.

For many consumers, debt consolidation Texas programs offer a simple, easy solution to managing debt.

Debt consolidation loans are also available to consolidate debt. Here at Golden Financial Services, we recommend checking with a local credit union for the lowest rate loan. If you plan to apply for a consolidated loan, make sure your credit score is high, or else a loan could end up being more costly than what you’re currently paying. Do the math, and don’t forget to check the small print! Ensure that you know all of the fees (including the interest) involved in a loan. Figure out the true cost of a consolidation loan before deciding on this route.

Many consumers call Golden Financial Services needing help with a consolidation loan that they can’t afford to pay. They originally applied for the loan to help with debt relief, but in the end, that loan ended up putting them deeper in debt, and now they can’t afford to pay it.

Debt Settlement Texas

Debt settlement in Texas is different from consolidation. Also known as debt arbitration or debt negotiation, the practice involves negotiating with creditors to accept a lower balance that the creditor accepts as a balance paid in full. Many TX credit card relief programs touted online merely offer a program to settle your debt.

Although the practice of settling debt may result in a lower credit score temporarily, the debtor pays off the balance sooner at less than what is owed. TX debt settlement programs often help consumers avoid bankruptcy.

How the settlement process works:

A settlement program includes only one monthly payment for each client. That payment is deposited into a trust account (also known as a “Special Savings Account or SPA). As money accumulates in the SPA, one by one, each creditor is settled and paid until a person is debt-free or until all accounts included in the program are satisfied in full. Creditors are not paid monthly, like consolidation and credit counseling services, but rather paid in lump sum payments. Fees and settlement funds are all included in the monthly payment.

Once the negotiators have reached an agreement with each creditor (that the client also approves of), the money in savings is then sent to the creditor, and the balances are considered “satisfied in full” or “settled.” Each creditor varies in what percentage deduction they will accept for a settlement. No reputable or qualified debt settlement company in TX will guarantee a certain percentage deduction.

Texas Debt Relief Reviews about Golden Financial Services

Check out the Top 10 Debt Relief Companies by Trusted Company Reviews.

Check out the Top 10 Debt Consolidation Companies for 2020.

Check out Texas consumer reviews at the Better Business Bureau (BBB.org).

Check out debt relief program reviews by consumers in Texas on Google.

Check out Yelp reviews.

See what Texas clients had to say on Facebook.

See Texas debt relief program reviews on Shopper Approved.

Check out TrustPilot.com reviews on Golden Financial Services (more than 90% of reviews are positive)

Student Loan Debt Relief in Texas

Owe federal student loans? You can consolidate them through StudentLoans.gov and then apply for an income-based repayment plan that offers a low monthly payment and loan forgiveness. These plans are primarily based on family size and income. If you have a low income, your monthly payment could be as low as zero dollars per month. Police officers and teachers in Texas can get loan forgiveness in only ten years with the Public Service Loan Forgiveness Program (PSLF). There are some fantastic income-based student loan debt relief and consolidation programs for Texas residents to turn to that you can learn about by visiting this page next.

For more information on how debt relief programs work, including Texas options, visit this page next.

Texas Unemployment Benefits due to COVID-19

“The American Rescue Plan that passed Congress in March comes with third stimulus checks for up to $1,400 and child tax credit payments. Along with that, it also includes an extension to the $300 bonus checks for unemployed workers that will last until Sept. 6. The $1.9 trillion stimulus package also includes a $10,200 tax exemption for people who receive unemployment insurance benefits.”

Source: https://www.cnet.com/

“The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) established The Pandemic Unemployment Assistance (PUA) program. This program temporarily expands unemployment benefit eligibility to self-employed workers, gig economy workers, part-time workers, and others impacted by the COVID-19 pandemic who might not otherwise be traditionally eligible for unemployment benefits. PUA benefits are available to individuals who continue to meet the program’s requirements or until the program expires on September 4, 2021. PUA claimants are eligible to receive a $300 Federal Pandemic Unemployment Compensation (FPUC) payment in addition to their weekly benefits from BWE March 20, 2021, through September 4, 2021.”

Source: Twc.Texas.Gov

To apply for unemployment benefits, visit the Twc.Texas.Gov.

If you are unemployed and have no income, you may not be able to afford a Texas credit card relief program. Bankruptcy may be your only option. To figure out the lowest possible monthly payment that you can get with a Texas debt relief program, call 866-376-9846.

Federal Stimulus for Credit Card Debt

Unfortunately, the Biden Administration has not passed any type of credit card debt relief. Stimulus money could be used to pay down credit card balances, though, a smart move to consider.

Use the extra money to pay off your smallest account first with the snowball method. One by one, you can quickly knock off each credit card balance, similar to how dominos fall one by one. You can also try our free snowball calculator to help you get out of debt faster on your own.

If you’re a client on any of the TX credit card relief programs, you may also want to consider using stimulus funds to pay off the program’s cost faster.