To settle debt on your own you will need to:

1. Learn the steps to settle debt on your own – What to say when negotiating, what to send to creditors in writing, and the overall order of operations.

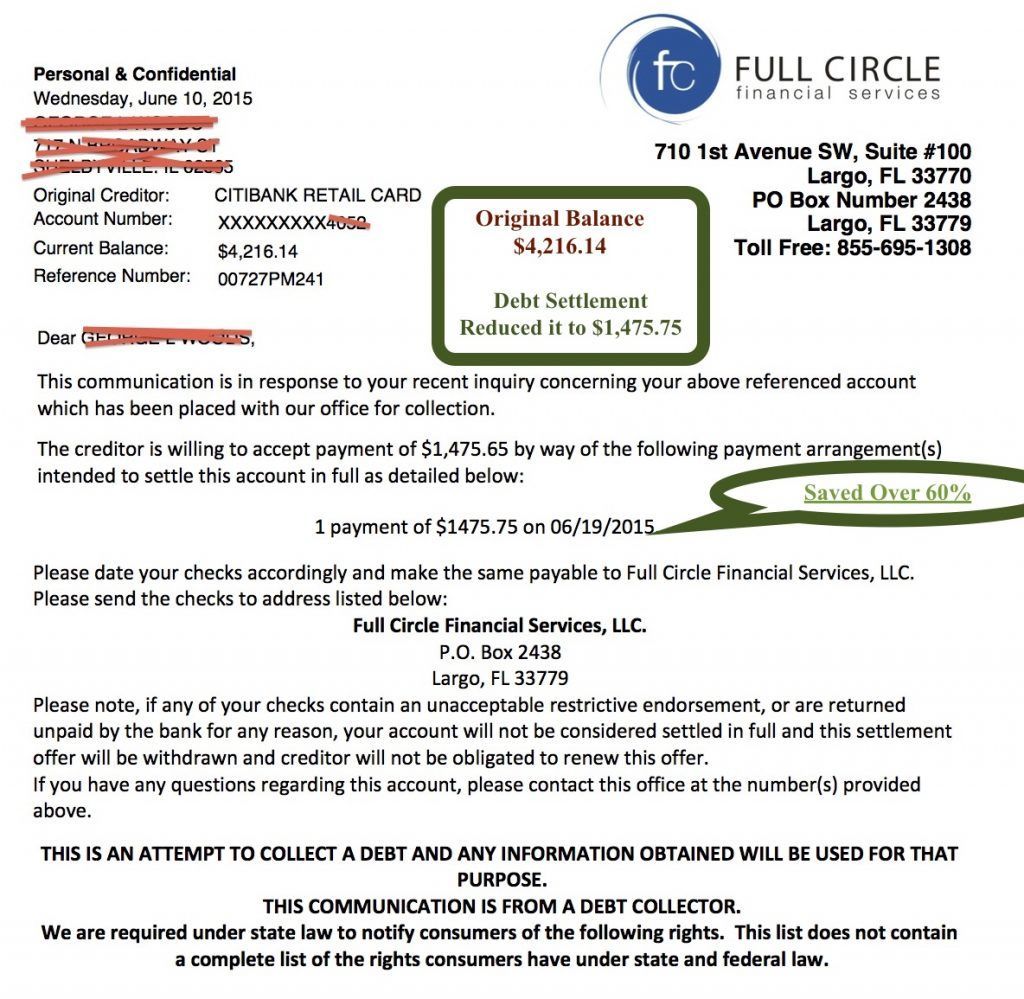

2. Obtain debt settlement letter templates, negotiating letters, counteroffers, settlement acceptance letters and much more. Having a full array of settlement tools is necessary if you are looking to successfully settle your debt. Start by sending each creditor your debt hardship letter which includes your initial offer of 10%-20% (click to get the letter).

3. Understand the pros and cons when settling debt on your own. It is important to weigh your options and figure out if it is better to settle debt on your own or to use a debt settlement service like what we offer here at Golden Financial Services. At times it may cost you less, in the end, to negotiate debt on your own, and at other times hiring a debt settlement company is a safer option that will save you more money.

4. Hire an attorney if things don’t work out and lawsuits arrive at your doorstep. Are legal advice lines available for consumers who are settling debt on their own? Attorney’s that work on an hourly rate can be very expensive, costing a consumer thousands of dollars in fees alone. All this will be covered in the series.

5. Consumer rights – Debt collectors violate consumer’s rights every single day. It is important to understand your rights as a consumer. The Fair Credit Reporting and Fair Debt Collection Practices Act cover your consumer rights in a nutshell. You will need to understand these Acts before settling debt on your own. Our first post on the series “How To Settle Debt On Your Own” has to do with the Fair Debt Collection Practices Act (FDCPA). The post explains the Act in simple terms and offers a summary of the Act in a slideshow version that can be embedded on a website.

To get started on obtaining the knowledge and tools as mentioned in the above steps, check out our series that we just unleashed and started on “How To Settle Debt On Your Own”. This series will be covered over the course of a few months and can only be found in the Golden Financial Services debt relief blog.

Golden Financial Services has been in the debt settlement industry since 2004. We are sharing our expertise and proprietary strategies with the public for the first time. Contact us if you have questions or need help while settling debt on your own, at 866-376-9846. To learn about credit card debt relief programs visit this page next.