Whether you live in La Jolla, Chula Vista, or downtown San Diego, debt relief programs are available but you need to make sure that you choose the right plan. Lots of people that are searching for a company to help consolidate bills, end up getting sold on a debt settlement program in San Diego. Debt settlement can lower credit scores, result in a person getting sued and left deeper in debt in some cases.

If you can’t afford to pay your bills, you have options other than settling your debt and bankruptcy. San Diego debt validation programs can result in a debt becoming legally uncollectible, where it does not have to get paid and cannot legally remain on credit reports.

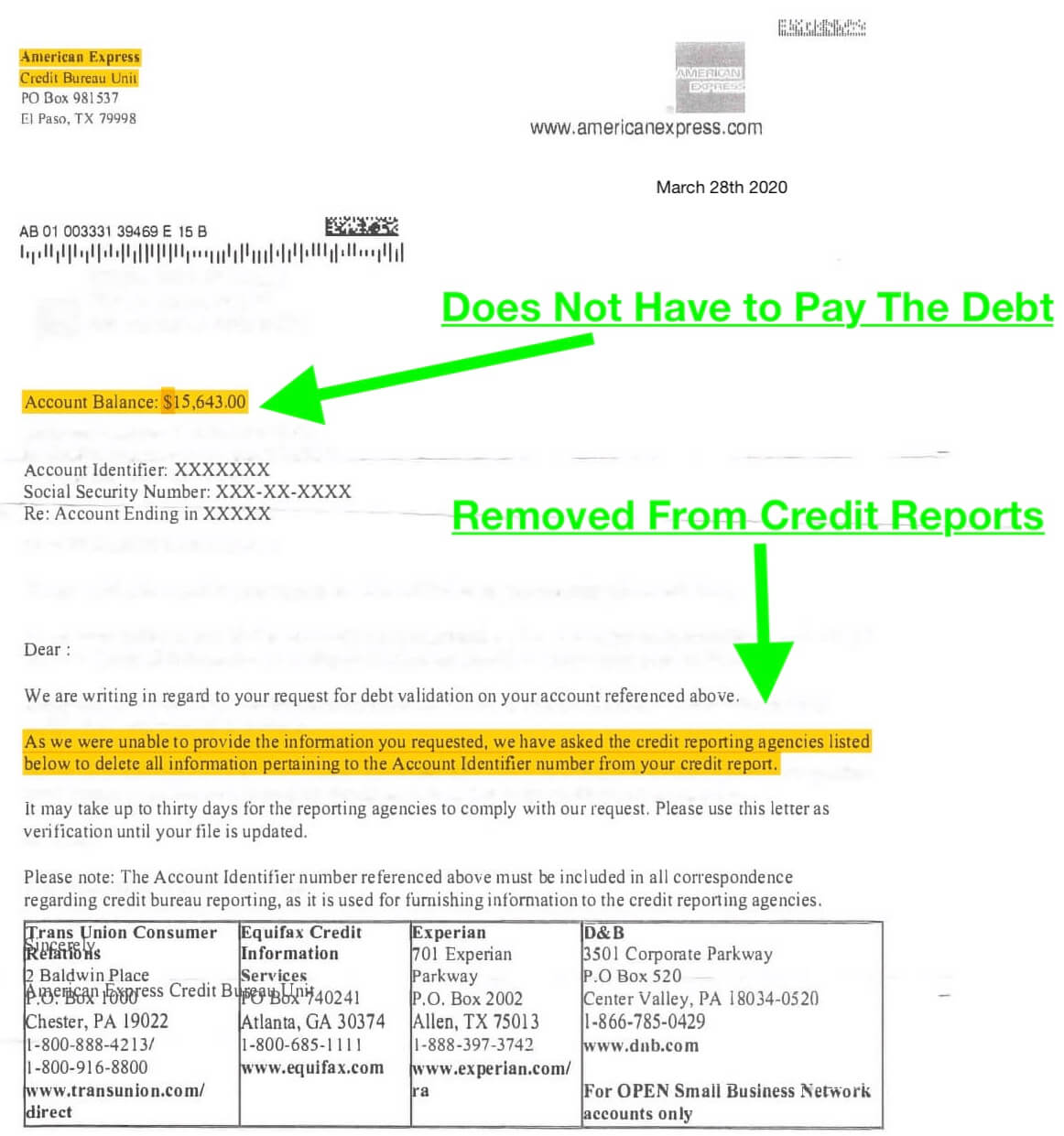

Validation is less expensive than a settlement program, includes a money-back guarantee and credit restoration. Additionally, after a person finishes a settlement program they’re left with late marks and collection accounts on their credit. With validation after an account is invalidated, it’s no longer legally allowed to remain on credit reports. Here’s an example of an American Express credit card with a balance of $15,643, that was sent to collection. Debt validation then disputed the account and within months the collection agency agreed to stop collection on it and remove the debt entirely from the consumer’s credit report.

For people that don’t want any negative affect on their credit, they could consider consolidating debt with consumer credit counseling or using a consolidation loan. San Diego credit unions are known to offer the lowest interest rate on consolidation loans.

A lot of consumers won’t end up even needing any type of program, instead, they just need financial education. Like for example, the snowball method of paying off debt can save a person thousands of dollars and help them get out of debt much faster than when paying minimum payments alone, while simultaneously improving credit scores. The following page will provide you the necessary resources to take control of your finances and help you determine whether or not a financial hardship program is right for you.

SMART Goals to Wipe Out Credit Card Debt for San Diegans

A recent article in The San Diego Union-Tribune explains a new strategy to quickly clear high credit card debt by setting SMART goals. When integrating this debt repayment strategy with San Diego credit card relief programs, here’s how it works:

SPECIFIC: Define a specific goal and details on how you will accomplish it.

You need to decide on:

1. How fast do you want to become debt-free?

2. What is your total budget to accomplish this goal?

MEASURABLE: You have to track your progress which you can do with a pen and piece of paper, excel spreadsheet, an app or one of the following free calculators.

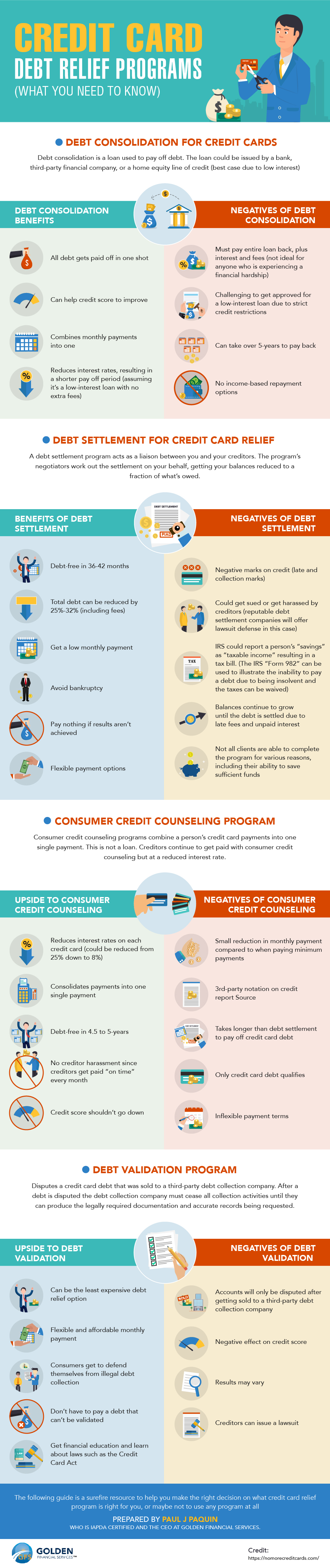

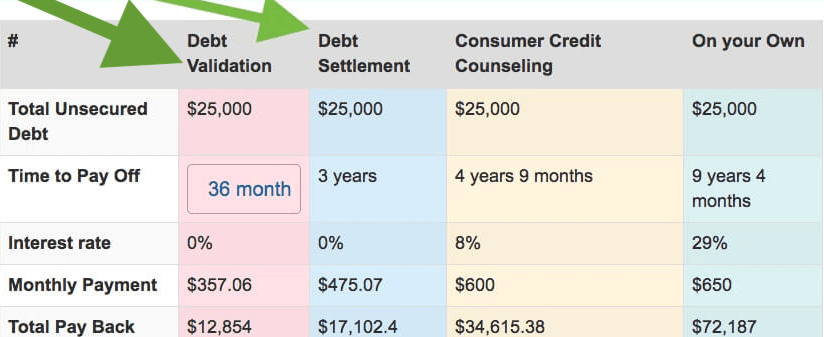

Compare San Diego Debt Relief Programs & Options w/Free Calculator to Help You Figure Out Your Best Path:

Are you interested in signing up for one of these programs mentioned in the calculator?

San Diego Debt Relief Program Reviews

- TrustedCompanyReviews.com rated GFS #1 Debt Relief Company in the Nation for 2020

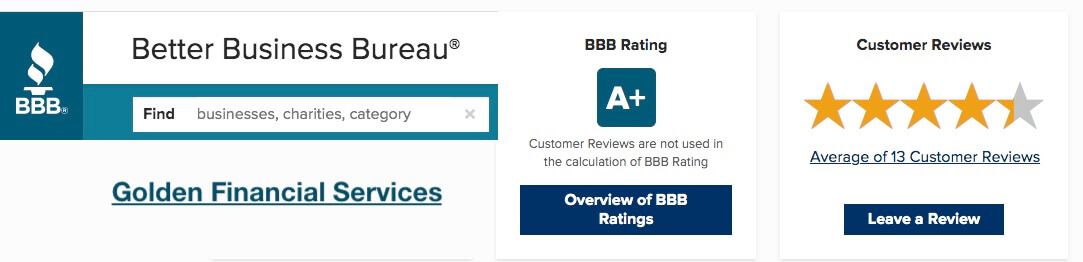

- Better Business Bureau Rates GFS “A+”.

Call (858) 605-6196 to get a free consultation from an IAPDA certified debt counselor in San Diego.

Can you afford to pay more than minimum payments and don’t want to use a debt relief program in San Diego?

You can use this free budget and debt snowball calculator here.

The snowball method helps you get out of debt faster, simultaneously improving credit scores. This method works by organizing your bills from small to large, prioritizing paying off your smallest account first. By going after the lowest debt first, you get the quickest results, and when paying off debt – “quick” – is the name of the game!

ACHIEVABLE: Make sure your goal is realistic so that you can achieve it.

This free budget calculator may help you figure out the maximum that you can afford to pay each month towards achieving your goal.

REALISTIC: Set goals that you can realistically achieve with the resources available. As explained in The San Diego Union-Tribune “You can dream big, but the smaller steps that lead up to that dream should be within reach. At this stage, stop using credit cards while paying down debt to get results. (Some versions replace ‘realistic’ with ‘relevant,’ meaning the goal is worth pursuing.)”

TIME-RELATED: Set a deadline. Based on what you can afford to pay, select a date (deadline) that your goal will be achieved by.

San Diego Consumer Credit Counseling

Do you need to reduce interest rates on credit cards? Non-profit consumer credit counseling agencies can consolidate payments and reduce interest rates.

Debt Settlement – San Diego

Do you need a significant reduction in monthly payments? Debt validation and debt settlement San Diego programs will give you the biggest reduction.

If you need help with unsecured bills and credit cards, San Diego debt relief programs are available. To check eligibility and get free quotes, start by talking with an IAPDA certified counselor at 858-605-6196.

Debt Snowball Method

Do you have a stable income and can easily afford your payments every month? You may only need a better strategy to help you pay off your debt, like this debt snowball method. Dave Ramsey created the snowball method, but Golden Financial Services created the free snowball calculator tool, making this method easy to use.

Keep in mind, all San Diego debt consolidation programs come with downsides. You need to be aware of these downsides.

Compare Pros & Cons of Each Program to Help Get Out Of Debt–San Diego

Best San Diego Debt Relief, Settlement and Consolidation Company

Since 2004, Golden Financial Services (GFS) San Diego debt relief, settlement, and consolidation programs have assisted over 800,000 San Diego residents in getting out of debt. San Diego Better Business Bureau (BBB) rates GFS A+. Debt settlement companies have to work hard for an A+ rating and GFS has been able to maintain this high of a rating since 2004. GFS also made the list for one of the Fastest Growing Companies in America by Inc.com.

Is Golden Financial Services a San Diego Accredited Debt Relief Company?

Golden Financial Services is IAPDA Accredited. Debt relief companies that are IAPDA accredited are companies that have been trained extensively on debt settlement and understand what settlement companies can and cannot do.

Additionally, GFS was awarded Top Debt Relief Company for 2019 and 2020 (not just for San Diego, but for the entire United States), by Trusted Company Reviews (TCR).

One of the Factors that TCR uses when rating companies is what real clients say through online reviews across the internet, along with accreditation and certification factors, licensing, and more.

Debt Relief Services & the Telemarketing Sales Rule (TSR):

IAPDA accredited companies also agree to abide by specific laws, like the Telemarketing Sales Rule (TSR).

IAPDA certification includes training on these laws, ensuring accredited companies understand each requirement. For example, San Diego debt negotiation companies cannot charge settlement fees until after a debt is settled and at least one payment has been made. Companies can’t Robo-dial out to consumers and then leave pre-recorded voicemails. Companies need to disclose the potential downsides of debt negotiation (e.g., negative affect on credit, the total cost of the program, the potential of getting served a credit card summons, and there are several other disclosures that we will discuss later in the page).

IAPDA accredited debt relief companies must adhere to the highest standards of moral and ethical values and principles. Consumers can contact the IAPDA and make a complaint about a company. IAPDA will not tolerate companies that get lots of complaints and aren’t upholding to the highest standards of moral and ethical values.

To become an accredited San Diego debt relief company, it’s similar to getting a college diploma. Debt relief companies need to study and train for a certain period and then take a test and pass. After a company passes the test and can show that they understand all of the most critical aspects of settling debt and debt-relief-related laws, San Diego debt settlement companies are then granted an “accreditation logo”. Click here to see that Golden Financial Services is Accredited and Certified by the IAPDA.

Consumer Credit Counseling – San Diego

San Diego’s consumer credit counseling (CCC) programs are through a non-profit company. Only credit card debt qualifies. CCC is the one program that won’t have any adverse effect on your credit score because you’ll remain current on payments. Of course, CCC also comes with its downside, including the fact that monthly payments won’t change from when paying minimum payments on credit cards.

PROS

- Save money on interest rates

- Only have to pay one monthly payment to the credit counseling company

- No adverse effect on credit score

- Debt-free in 4.5 to 5 years

- Only need above $5,000 in credit cards to qualify

CONS

- A minimal reduction in the monthly payment

- Locked into a 4.5 to a 5-year plan, lasting longer than the other debt relief programs in San Diego

- Only credit cards qualify

Debt Settlement – San Diego

How Debt Settlement Works:

Debt Settlement is a process that involves negotiating with creditors or third-party collection companies to reduce the balance owed on unsecured debt. An individual must go delinquent on their monthly payments for a San Diego debt negotiation program to work effectively.

A typical debt settlement program requires the client to make monthly payments into a special savings account where the funds accumulate each month. Once about half of what is owed on a particular debt is available in this savings account, at that point, the debt negotiator will offer the creditor a one-time payoff. Creditors often accept about half of what’s owed to resolve a debt. Even though only about half of the debt gets paid back, the creditor also agrees to report the balance settled in full or satisfied.

Once the collection company agrees to the reduced amount and confirms this in writing, the funds will get paid directly to the debt collection company from the client’s savings account. The balance will reflect zero dollars owed in the end.

PROS

- Pay a significant amount less than the full balance owed

- Debt-free within 24-42 months on average

- Get one single and affordable monthly payment

- Legal protection included from San Diego debt settlement law firm

CONS

- Creditors and debt collectors may call

- Results may vary

- Negative impact on credit

- Potential tax consequences can occur

Debt Consolidation – San Diego

Debt Consolidation (synonyms: debt consolidation loan, credit card consolidation, and consolidated loan): is a loan used to pay existing debt, leaving the borrower with a single loan to pay back.

In most cases – these loans are used to pay off high-interest accounts – leaving the borrower with a single low-interest loan to pay back within a shortened time-frame.

PROS

- No adverse impact on credit

- Flexible terms

- Have a single payment each month

- Federal student loans qualify

- Can save you money on interest rates

CONS

- Must pay the entire loan amount back with interest

- May not see a reduction in the monthly payment

- Some consolidation companies charge high fees

Bankruptcy – San Diego

Bankruptcy (synonyms: Chapter 7 bankruptcy, Chapter 11 bankruptcy, Chapter 13 bankruptcy, Chapter 9 bankruptcy, Chapter 12 bankruptcy, and Chapter 15 bankruptcy) – consumer bankruptcy refers to when a debtor files a petition with the bankruptcy courts.

Chapter 7 bankruptcy can eliminate a person’s debt in as fast as six months. This is the fastest way to get rid of high debt, but also has the worst effect on a person’s credit report and score.

Consumers can end up only paying the attorney and court fees, and nothing else on any of their debt with Chapter 7. Most consumers won’t qualify for Chapter 7, though. A Judge will want to see you pay at least half of your debt back through Chapter 13, making bankruptcy a lot less attractive.

Chapter 13 bankruptcy is used to reorganize debt payments to be more affordable based on a person’s disposable income – and determined by the court-appointed judge. Unfortunately, Chapter 7 and 13 equally affect a person’s credit score and report.

PROS

- Creditor harassment must stop

- Debts could be wiped away (Chapter 7)

- The entire process takes six months or less

CONS

- A small percentage of bankruptcy applicants will qualify for Chapter 7

- Long-term adverse effect on credit (7+ Years) – for all bankruptcies

- Shows up on public records

- Could prevent a person from financing a new car, renting an apartment, refinancing their home and even getting a job

- Monthly payments for around five years on average (Chapter 13)

Debt Validation – San Diego

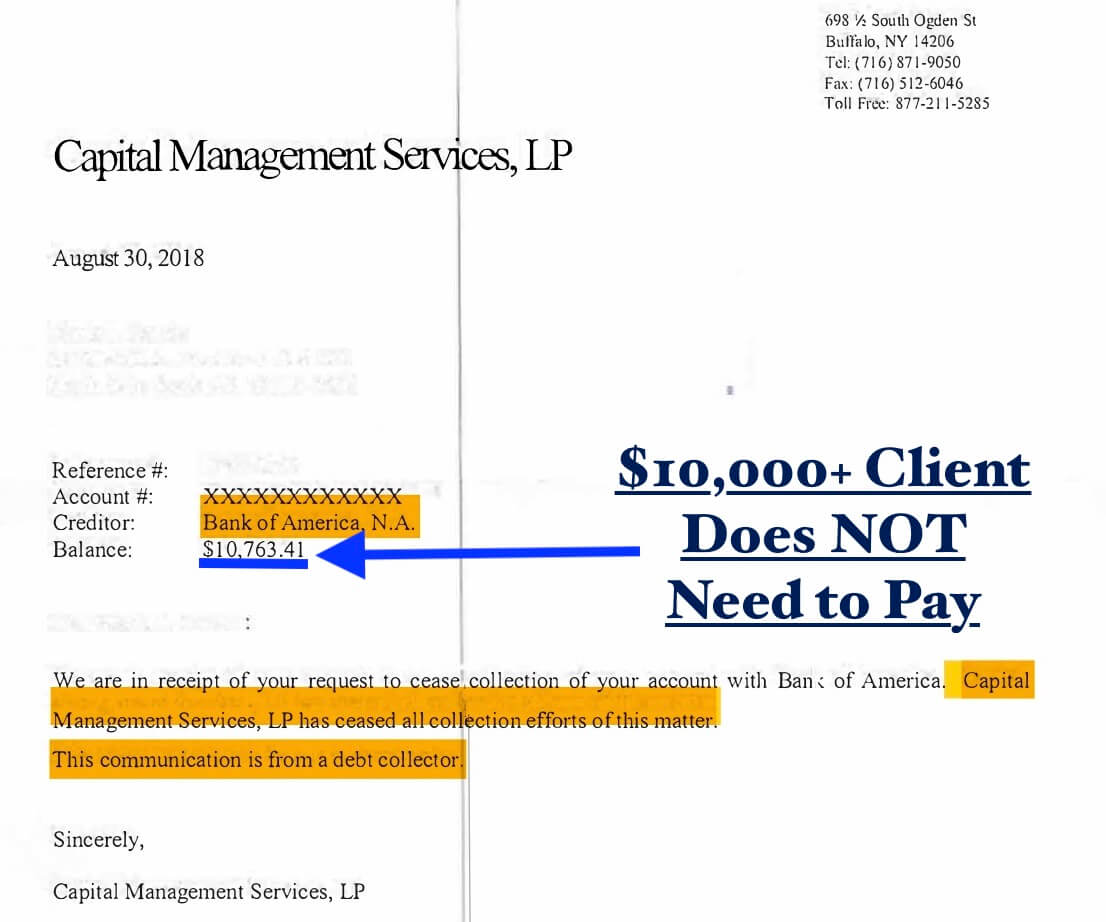

Debt Validation (synonyms: debt dispute, debt defense, and debt verification): Under the Fair Debt Collection Practices Act (FDCPA), the Credit Card Act, and the Fair Credit Reporting Act (FCRA), a consumer has the right to challenge or dispute an alleged debt. Disputing a collection account is merely requesting written verification and validation of it from the debt collector. Often, collection agencies can’t prove a debt is valid. How can validation be possible when I did spend the money?

In many cases, the original creditor or collection agency may have been involved in fraud, charged unauthorized fees, or failed to abide by federal laws. Collection agencies often fail to maintain complete and accurate records due to a variety of reasons. Paperwork can get lost, or the original creditor fails to transfer fu and accurate documentation to the collection agency at the time the debt gets sold. Information turns inaccurate over time due to the continuance of new fees that you never agreed to that get added into the equation. There are many reasons why debt can’t always get validated. Golden Financial Services has never seen a collection agency prove a debt to be valid, which is just shocking! If you are having a financial hardship, take advantage of using debt validation laws. Debt can get disputed and proven invalid, where it doesn’t have to get paid. If a debt is proven valid, Golden Financial Services can help you get it settled for only around half of the debt (not counting company fees). Debt can always get settled for much less than the full amount owed, as a back-up plan to the validation program if needed.

Any law firm or third-party collection company must abide by these validation laws and provide the necessary documentation and accurate information to validate, verify, and prove the validity of an alleged debt after it’s disputed. 90% or more of the clients we set up in a validation program don’t end up needing debt settlement, as collection agencies rarely can validate a debt.

PROS

- Can be the least expensive option

- Disputes accounts that may not be legally collectible

- Uses consumer laws to deal with unverifiable debts

- If proven to be invalid or lawfully uncollectible, the debt could get removed from credit entirely

- This program has a higher success rate than debt settlement

- The validation company stays with the consumer until the statute of limitations on an account expires

CONS

- Not all accounts will be eligible

- Accounts must be with a third-party debt collection company before disputing

- Creditors and debt collectors may call

- Like with debt negotiation, creditors could issue a person a summons to go to court

We look forward to explaining your debt relief options to you and helping you to become debt-free. Call 866-376-9846 to Speak to a Debt Expert at Golden Financial Services San Diego. Debt Help is literally one-call away!