How to Negotiate: Credit Card Debt Settlement Yourself

So you’re wondering how to negotiate credit card debt yourself? Debt settlement should be your last resort, whether you plan to negotiate credit card debt on your own or use a service. However, if you’re to the point where you need to settle a few small debts on your own, the following guide will show you exactly how to do so.

Included with this blog post, you’ll get (1) a script on how to talk with debt collectors and negotiate on your own (2) a sample debt settlement, validation, and hardship letter (3) and step-by-step instructions on how to settle debt on your own.

But the truth is, if you have high debt (i.e., over $7,500 in total balances), you’ll be better off using a debt relief program.

Can you negotiate a lower payoff amount on a credit card?

However, you could end up in better financial shape and save more money using a Debt Resolution program versus settling debt on your own. Plus, you won’t have to deal with the abusive stress creditors put on consumers when using a program.

Learn more about credit card debt relief programs and the pros and cons of each plan.

Why use a Debt Resolution program over settling debt on your own?

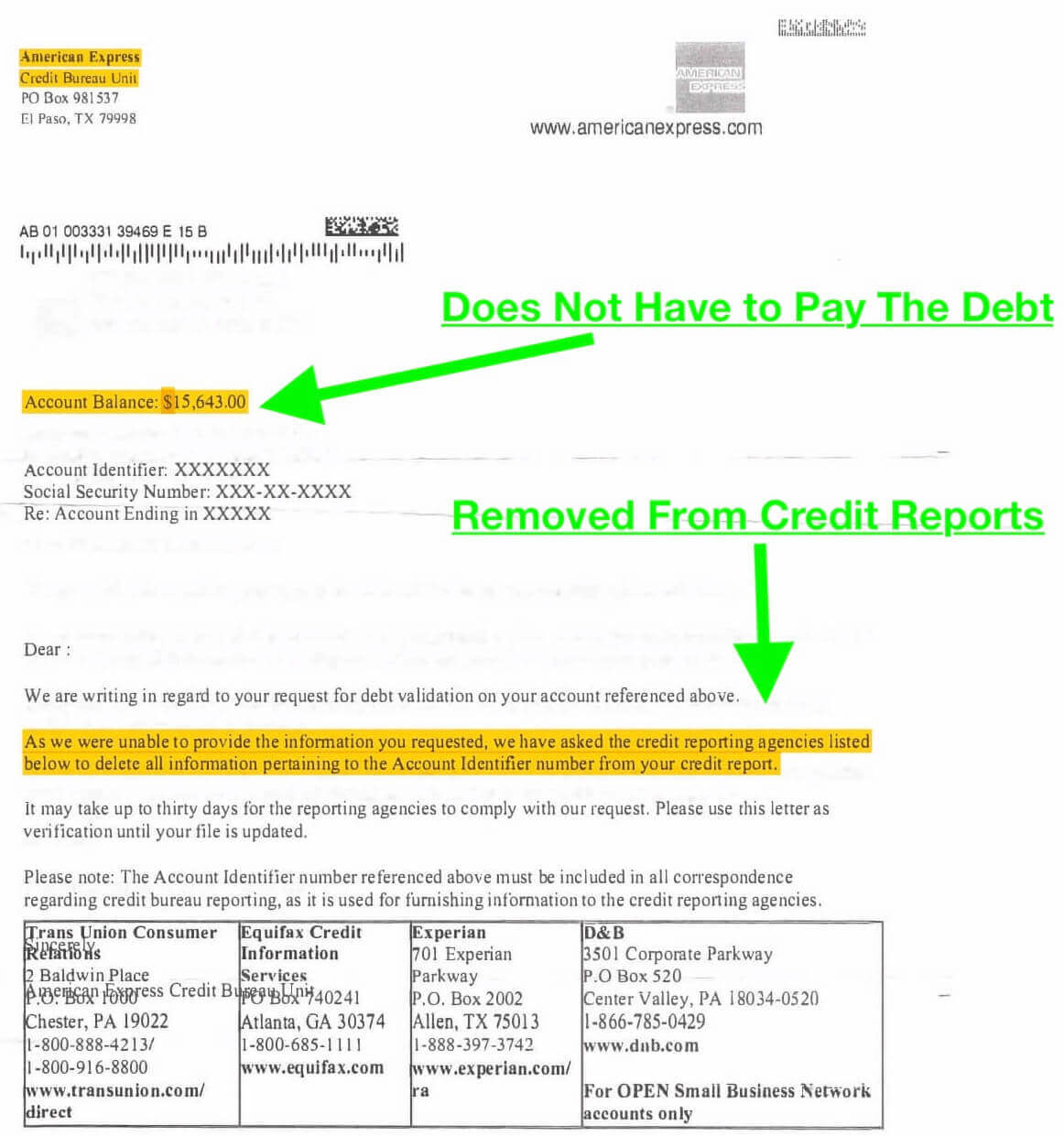

(A) Debt Resolution programs start with validation, often getting a portion of the debt invalidated and removed from credit reports

Example of an invalidated debt:

(B) You don’t have to pay invalidated debts, and they cannot legally remain on credit reports

(C) Creditors all get contacted by a law firm within the first thirty days of the program, requiring creditors to direct all communication to your lawyer

(D) Lawsuit defense is included. An attorney will work to resolve a credit card summons keeping you out of court and still reducing the debt

How Much Does a Debt Resolution Program Cost

Experienced debt arbitrators can make paying the fees for a debt relief program worth the cost. Plus, the fees are built into the monthly payments. So your payments can immediately get reduced, and that reduced amount includes all costs after being enrolled in a program.

Before you decide to settle credit card debt on your own, speak to a debt counselor about debt validation. The consultation is free, allowing you to compare your options before diving in with the sharks! And trust us, debt collectors are just that, sharks!

Validation can be a much cheaper method of dealing with high credit card balances. Debt Validation is rated #1 by TrustedCompanyReviews.com. Not only is validation cheaper, but additionally, you could end up getting the debt removed from your credit report entirely.

Call (866) 376-9846 for a free consultation now! Our counselors are all IAPDA trained, and we’ve been assisting consumers with debt relief programs since 2004. You must have over $7,500 in total unsecured debt to qualify for a program.

Debt Settlement Negotiations: A Do-It-Yourself Guide

Start with sending out a debt validation letter before settling.

Only settle the debt if the collection agency can prove they are legally authorized to collect on it. Here’s a debt validation letter creator. This validation letter template can help you deal with small debts, but if you have high debt that is over $7,500, you’ll most likely need more than just a one-page dispute.

How to Settle Debt On Your Own

At this point, I’m sure you’re ready to learn how to negotiate credit card debt on your own. So here we go!

If the collection agency proves a debt is valid, then it’s time to settle.

This first video shows you the mindset required when attempting to settle a debt on your own, provided by Paul J Paquin – the CEO at Golden Financial Services. But, first, you must understand the mental aspect of negotiating credit card debt; it’s half the battle.

How to Talk With Creditors (Video)

How to negotiate credit card debt on your own (do it yourself debt settlement)

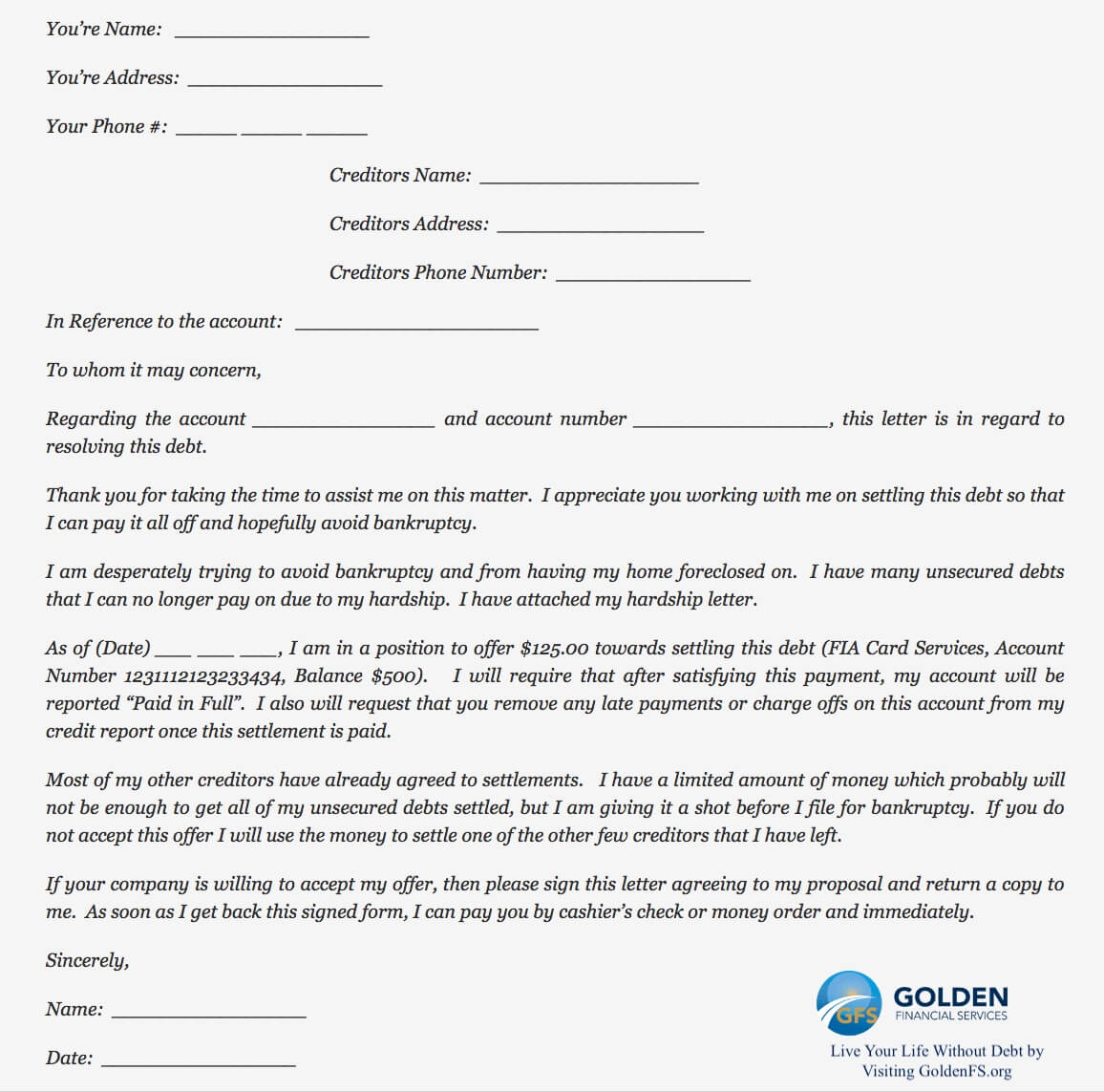

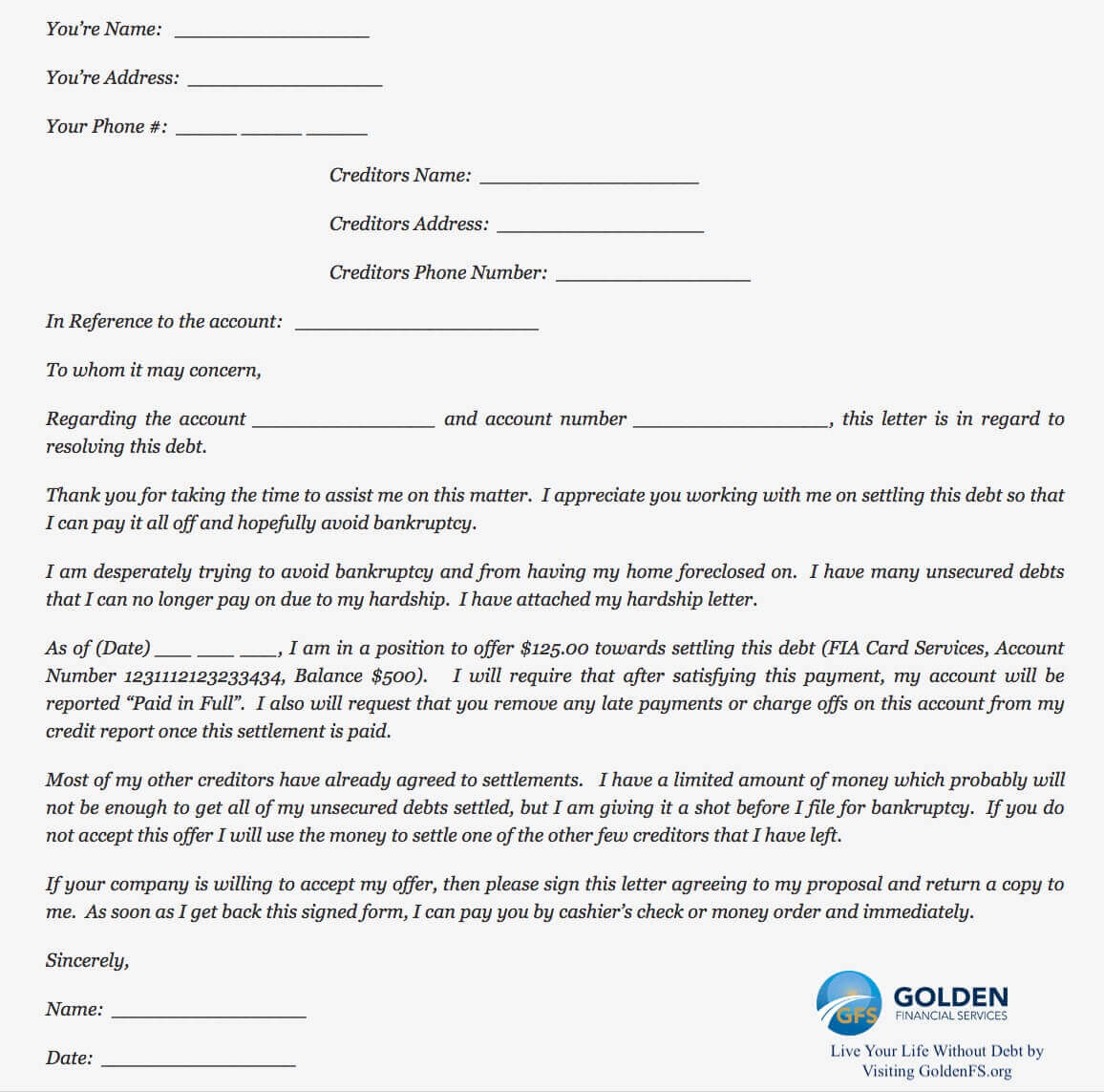

1. Copy the debt settlement letter template that we are providing you. Fill in the blanks with information relevant to your situation.

What percentage should you offer to settle a debt?

You want to offer 10%-20% in your initial offer, as it’s only a low-ball offer that’s objective is to be an anchor and produce an initial shock. The goal is to get your creditor to respond with an acceptable settlement offer. If they settle at around 50%, that’s what you want.

Debt Settlement/Negotiation Letter Template

2. Fax and mail a copy of that letter to the collection agency, along with your debt hardship letter, budget, proof of income, receipt of all medical bills, and proof of whatever you are saying in the letter. You can acquire the fax number and mailing address of the last collection letter that you received. Certify the mail to have tracking and confirmation that your letter was received. You may also call your creditor and ask to speak to a supervisor. Once the supervisor gets on the phone, get their information so that you can provide them everything in writing by either mail, fax, or email. At least you’ll have the name of a supervisor to address in your letter.

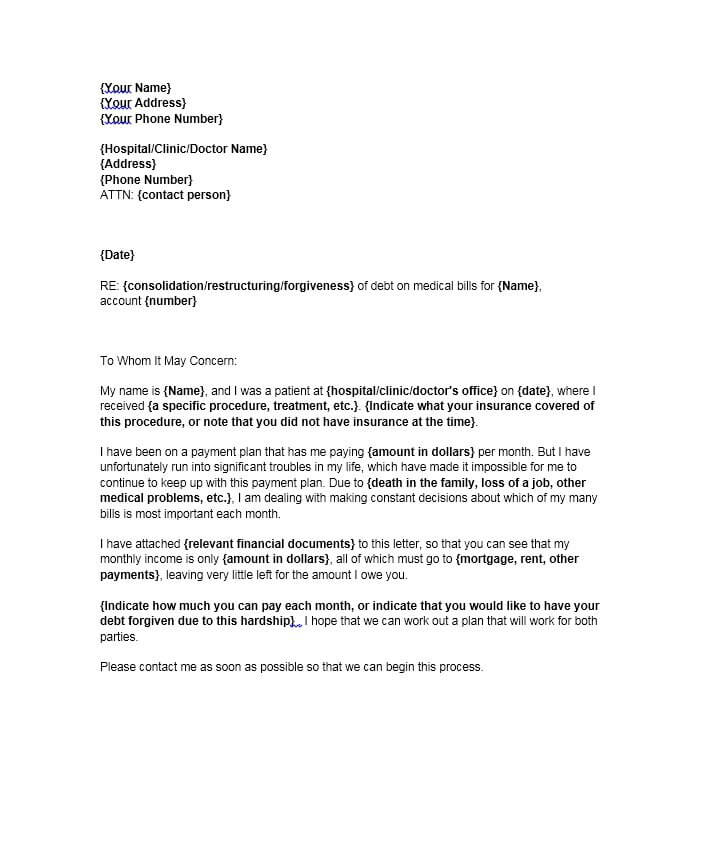

3. As suggested in step two, fax a debt hardship letter to each creditor. Write a hardship letter that is approximately 300-400 words long. Include in your letter why it is becoming near impossible to pay your accounts and that you are contemplating bankruptcy. Explain to the creditors that bankruptcy is your only option left if they don’t work with you, and this is your final attempt to settle the debt. Dialogue about how you lost your income, your medical condition, job loss, or whatever your real hardship is.

Debt Hardship Letter Template (Copy and paste this and then personalize it for your situation)

Your Name

Your Address

Your Phone Number

Debt Collection Company Name

Address

Phone Number

Attention (Supervisor’s Name)

Date:

RE: Settling a (state the type of debt, like a credit card debt or medical bill). Creditor Name and Account Number

Dear (Supervisor’s Name or Creditor Department Name),

My name is (your name). I am currently going through challenging times health-wise and financially, which I’m about to explain.

EXPLAIN YOUR HARDSHIP: I was diagnosed with Lime Disease on (date). I incurred $15,000 in medical debt, and my insurance covered only half. Included with this letter are medical receipts. I stayed at the (include hospital name) on (include dates), and this hospital visit cost (amount) and insurance covered only (amount). This situation has caused me to fall deeper into debt, making it impossible to continue paying on anything besides my mortgage/rent, groceries, etc.… (include a copy of your budget)

I have not been to work in 15 days, and my income has gone from (amount) down to (amount).

I have been on a payment plan with your firm, paying (amount) since (date). Unfortunately, due to this unexpected circumstance in my life, it’s now impossible to continue paying this amount.

This letter includes a settlement offer that I am willing to pay today to resolve this debt in one lump sum payment. The funds that I am eager to offer you today were borrowed from friends and family members who have all contributed all they are willing to provide to help me address my debt.

I’ve also attached my income to illustrate that it’s gone down from (amount per month) to (amount per month). I hope you are willing to work with me to resolve this debt so that I am not forced to file for bankruptcy. I even plan on giving you guys an excellent review online if you can help me out today.

Be sure to get in touch with me as soon as possible to begin the process.

Here’s a 2nd Debt Hardship Letter (specifically for medical debt)

4. Wait for the collection agency to respond in writing or follow up with a phone call.

If you follow up via phone, click here to get instructions on how to negotiate a settlement with your creditors over the phone.

Some people may only need a temporary reduction in credit card payments. If this is the case for you, learn how to negotiate with creditors to reduce payments temporarily.

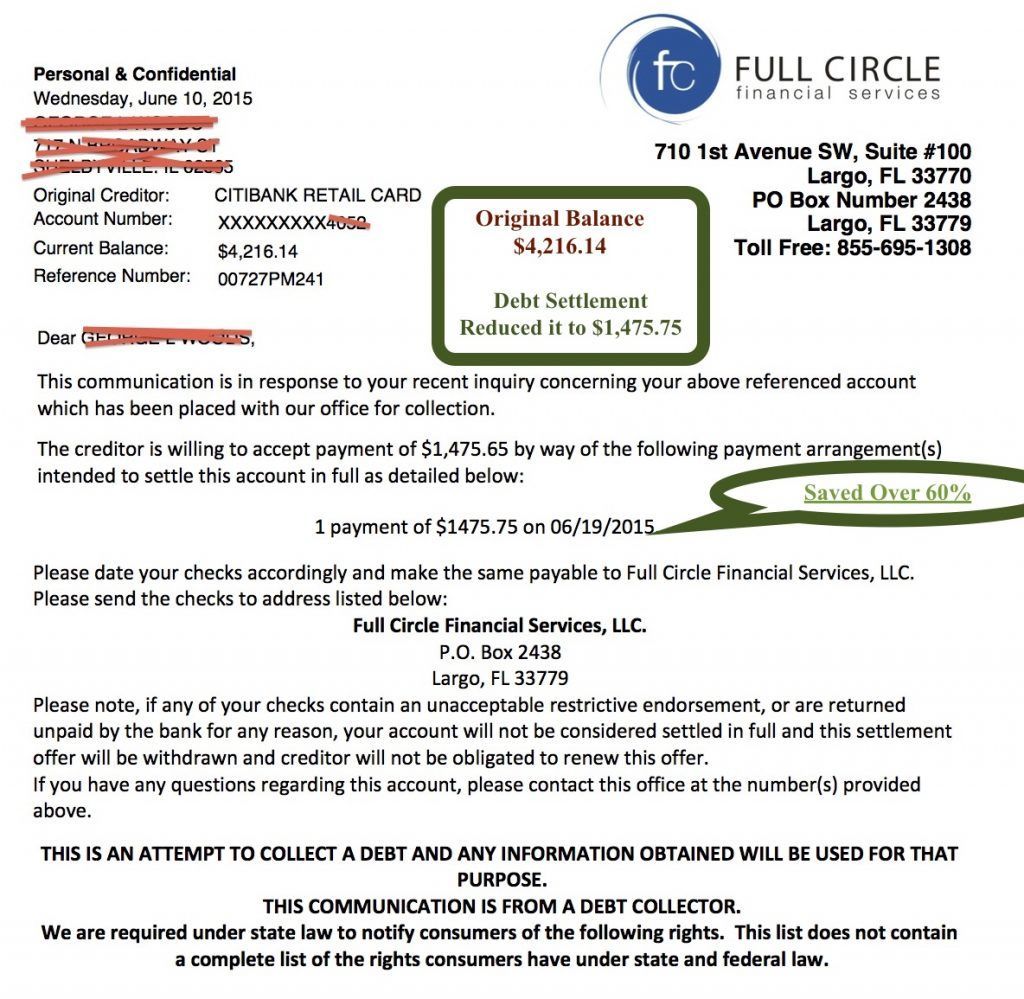

Success Case: (Debt Settlement Negotiation Letter Saving 60+%)

Settling Small Debts

If you have an account with a small balance (e.g., $400), it’s less likely that the creditor will try to sue you over the creditor you owe $4,000. This is because it costs money for creditors to take legal action. Consequently, if you owe less, there will be less motivation involved in the creditor to sue.

Complications transpire when consumers have numerous accounts or high balances, attempting to settle all debts on their own.

Before you attempt to settle a debt on your own, try this national debt calculator. It is a free tool that will show you all of your debt relief options. You may decide that one of these debt relief programs is affordable and a more natural route for you to take.

Also, check out this article illustrating the ten best ways to get rid of credit card debt. Inside the article, you’ll find a script that you can use to call your creditor and negotiate with them on your own.

By using an attorney debt settlement service;

A.) you have legal representation if your creditors decide to issue you a lawsuit

B.) only an attorney can get the debt dismissed if your creditors break the law and violate your rights

C.) creditors must stop calling and harassing you after being notified that you have attorney representation

If you use a debt settlement program to get out of debt, I recommend using an attorney debt settlement service. Give us a call, and we can recommend a debt settlement law firm in your state.

Can I settle debt on my own?

When is it safe to settle a debt on your own?

Golden Financial Services feels that if you have one or two minor debt collection accounts, go ahead and try to settle them on your own. (i.e., if it’s under $5,000 in credit card debt or unsecured debt collection accounts, you could try to settle the debts on your own, and your chances of getting sued would be small.) For example, if you owe a Discover credit card debt, Discover is likely to issue you a credit card summons. That is why most debt relief programs in the nation don’t even accept Discover in the plan.

Before resorting to settling debt, consider debt validation. Here’s why:

- More consumers complete a validation program compared to settlement.

- Validation is less expensive.

- You could end up getting the debt off your credit report entirely with validation.

- There are no tax consequences after an account is invalidated, with debt validation.

Here’s a detailed article explaining debt validation and providing evidence as to why it’s one of the best ways to deal with credit card debt. And we’re not biased here at Golden Financial, as we offer both programs. Our only goal is to ensure consumers get placed in the best option, depending on each person’s needs.

To qualify for a debt validation or settlement program, you must have over $7,500 in total debt. For a free consultation with an IAPDA certified debt counselor, call now at (866) 376-9846. In addition, you can choose from multiple programs through Golden Financial Services to help you pay the least possible amount on your debt. We will go over the pros and cons of each option with you to make an informed choice.

Best Debt Settlement Alternatives

Most of the time, you won’t need to use debt settlement to resolve your debt.

Is your credit score above 730?

You can use a debt consolidation loan that includes a low-interest rate to pay off high-interest debts, including secured and unsecured debt. These loans can be obtained at a local credit union. In addition, you can use a 0% balance transfer card to consolidate credit card debt and even a home equity line of credit in some cases.

Is your credit score below 730?

There are programs to consolidate credit card debt that are available and even come with credit restoration and are less expensive than debt settlement. States like Michigan, Illinois, Indiana, New York, and Iowa offer a debt validation plan. However, credit card debt can get disputed before being settled, and often creditors can’t prove the debt is valid.

Here is a summary of all credit card debt relief programs.

Related posts:

What happens to debt when you die?

How to build credit without a credit card

Reduce Debt With These 7 Outside The Box Ideas

Possibly you like to perform solitary or multi-player mode in, you can use

my gun 3d that is pixel hack on them.

Hi friends, how is the whole thing, and what you desire

to say regarding this paragraph, in my view its really awesome designed for me.

Here is my web blog: top email management agency in Los Angeles CA

I was able to find good info from your blog posts.

I came across your Do it Yourself Debt Settlement – Debt Settlement Letter | GoldenFS.org website and wanted to let you know that we have decided to open our POWERFUL and PRIVATE website traffic system to the public for a limited time! You can sign up for our targeted traffic network with a free trial as we make this offer available again. If you need targeted traffic that is interested in your subject matter or products start your free trial today: http://priscilarodrigues.com.br/url/v Unsubscribe here: http://acortarurl.es/97

Oh my goodness! Incredible article dude!

Many thanks, However I am having troubles with your RSS. I don’t understand the reason why I cannot subscribe to

it. Is there anybody having identical RSS problems?

Anyone who knows the answer will you kindly respond? Thanks!!

Why is it that the creditors must stop calling once notified that I have an attorney? I am contemplating if I should use an attorney debt settlement program or a non-attorney plan. And do you guys offer attorney debt settlement?

What if I prefer to let you guys settle my debt. I have about $32,000 in credit cards. How much would my payment be?

These guys are wonderful. I used their service many years back and was able to resolve over $45K in credit cards. Unfortunately, now I have a Cox Cable debt collection account that appeared on my credit. The balance is only $400 so it’s too small to use the program, but this article will help me settle the debt on my own. Thanks guys so much.

Very great post. I just stumbled upon your blog

and wished to mention that I’ve truly loved browsing your blog

posts. After all I’ll be subscribing for your rss feed and I’m

hoping you write again very soon!