Wyoming Debt Relief Programs & Statistics

Considering debt consolidation? Wyoming residents have multiple ways to consolidate, but not all options pay your creditors every month. Depending on your goals and current situation will help to determine which plan is right for you.

Wyoming debt statistics recently revealed that Wyoming residents have an average credit card debt of $4,789, which is better than the US average credit card debt of $5,235 per borrower. So kudos to Wyoming! The people in Wyoming have done a much better job managing their finances than in states like Alaska. The average credit card debt is $10,685, and in Virginia, the average balance is $9,120. Unfortunately, since Coronavirus has struck our country, many Americans have fallen deep in debt and need help.

What is the best debt relief program in Wyoming?

Watch this short video by Golden Financial’s CEO, Paul J Paquin:

For consumers with under $7,500 in total balances:

The truth is, if you have under $7,500 in credit cards and are current on monthly payments, don’t fall behind! Do whatever you can do to stay current on your monthly payments because ruining your credit over such a small amount of debt is surely something you’ll eventually regret. After you fall behind on credit card payments, your credit score will drop, and the late and eventual collection marks on your credit report won’t be easy to get off. Instead, use a simple budget calculator to help find some extra cash. You can then start debt snowballing and become debt-free very quickly while simultaneously building excellent credit.

Here’s a free snowball calculator to help you pay off your debt on your own.

Do you owe more than $7,500 in total unsecured bills, including credit cards, medical bills, collection accounts, and unsecured loans? Do you need help with paying off debt?

Not everyone in the state can control their financial situation and maintain balances of $5,000 or less, especially with all of us dealing with the devastating after-effects of coronavirus. Fortunately, for those of you with high balances above $7,500, fantastic programs are available to help you pay off your debt fast!

After fifteen years of offering debt relief in Wyoming, we can confidently say that our programs are among the nation’s cheapest and best. In fact, TrustedCompanyReviews.com rated Golden Financial Services #1 for debt relief programs 2020 (click here to verify rating).

Here are the 4 best Wyoming debt relief, settlement, and consolidation options to consider:

- Wyoming Credit Card Consolidation Loans through a local credit union

- Consumer Credit Counseling with a non-profit and Wyoming licensed company

- Debt validation

- Wyoming Debt Settlement Programs with an IAPDA certified company

Call (866) 376-9846 for a free consultation today! IAPDA Certified Wyoming Debt Counselors are a Phone-Call Away!

Credit Card Debt Relief Services & Debt Help in Wyoming

What is the best debt relief program in Wyoming?

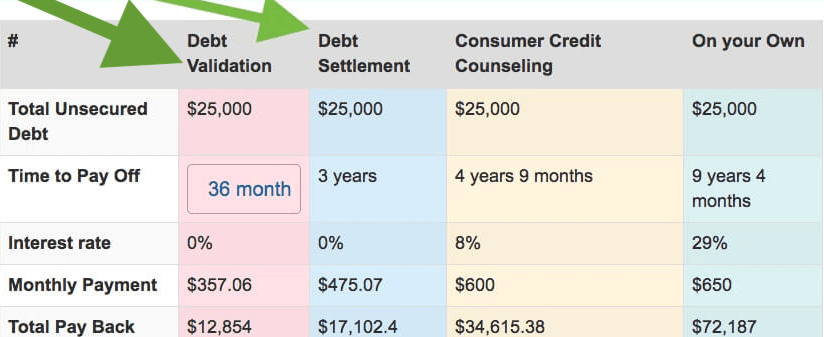

- Debt settlement in Wyoming can reduce balances and help a person become debt-free within approximately three years. The main downside with debt settlement: Wyoming residents can end up with collection accounts and late marks hurting their credit report. All debt settlement programs in Wyoming include “no up-front fees.” Settlement fees are only charged after an account is settled and at least one payment is made to the creditor towards the agreed-upon debt settlement. Wyoming laws make it illegal for settlement companies to charge a fee before an account getting resolved.

- Wyoming residents can use debt validation before turning to settlement, which is less expensive than debt negotiation in many cases and includes credit repair. If an account is disputed and proven valid, clients can then have their debt settled for a fraction of the total owed. But in many cases, clients don’t have to pay collection accounts and only pay the debt relief company fee. If you join a program, the Wyoming debt relief company takes care of most of the leg-work involved, while your main job is to make the single monthly payment that you qualify for, send in any documents that you receive from creditors, and notate any communication that your creditors attempt to make with you.

- Wyoming consumer credit counseling can reduce credit card interest rates and help people become debt-free within four in half years. The main downside here is that you’ll pay all of your debt, plus interest and credit counseling company fees. Even though most licensed credit counseling companies in Wyoming are non-profit, they can still charge up to $50 per month in fees. Non-profit is not the same as free.

These are the most popular debt relief programs in Wyoming. Consolidation loans can also be used to pay off high-interest accounts, but a consolidation loan is not the same as a debt relief program. Click here to compare the pros and cons of each Wyoming debt relief program.

Is Wyoming debt negotiation a loan?

Don’t confuse using a settlement program with debt consolidation. Wyoming credit unions and certain online lenders like Lending Club and OneMain Financial offer debt consolidation loans.

How does a debt settlement program in Wyoming work?

You make a single payment every month that goes directly into a special savings account. Every month as you make these low payments, the balance in this account grows. As the balance grows, the negotiators negotiate with your creditors to reduce each of your accounts down to a fraction of what’s owed. One by one, your bills get settled and paid.

How much can you save with Wyoming debt settlement programs?

On average, consumers can save around 30% of what they owe. $100,000 in credit cards can end up getting resolved for around $70,000, including all fees.

What’s the downside of Wyoming debt settlement?

Since creditors don’t get paid every month, late marks and collections incur and can lower credit scores, and although it is rare, a small percentage of credit card companies can issue a person a summons to go to court. If you are sued while on a settlement program through Golden Financial Services, the law firm will work with your creditor to settle the debt for less than the full amount owed before the court appearance so that you never have to go to court.

As each account is settled and paid, credit scores may improve, but there’s no guarantee of that. Over the first year of the program, credit scores will almost always go down. A settlement program is not designed to improve credit scores; it’s used to eliminate debt fast.

If your goal is to improve your credit score, Wyoming credit unions can offer you a debt consolidation loan to pay off your debt in one shot. This is the route Golden Financial recommends you take for a consolidation loan.

Need to consolidate federal student loans?

Visit this page next to learn how to consolidate federal student loans.

What if I received a tax bill after getting a debt settled for less than the full amount?

After a person settles a debt, the savings is construed as income. You may get a 1099 in the mail where the IRS asks for taxes to get paid on the savings. In most cases, clients will file a special tax form called a #982 that illustrates they are insolvent to don’t have to pay the tax.

Consumer Credit Counseling – Wyoming

Wyoming consumer credit counseling (CCC) plans are only for credit cards. With CCC, interest rates on credit cards can be significantly reduced, late fees can get waived, and past due payments can get re-aged to show current.

Clients of a CCC program make one payment every month to the CCC company, and the company then disburses the payments to each creditor but at a reduced interest rate. As a result of CCC, consumers can become debt-free in 4.5 years.

Golden Financial Services can refer you to a Wyoming non-profit consumer credit counseling company if this option is one that you choose.

Does Wyoming consumer credit counseling hurt credit scores?

All credit card debt relief programs in Wyoming hurt credit, but with CCC, this negative effect is not until the end of the program when each credit card gets reported closed.

At the beginning of a CCC program, credit scores can actually improve. Late payments get re-aged to show current. As payments are made to creditors every month, a person’s credit utilization ratio improves as their balances go down, resulting in improved credit scores.

What’s the least expensive Wyoming debt relief program?

Last but not least is a debt validation program. Validation can be your least expensive route and the only program that includes a money-back guarantee and credit repair.

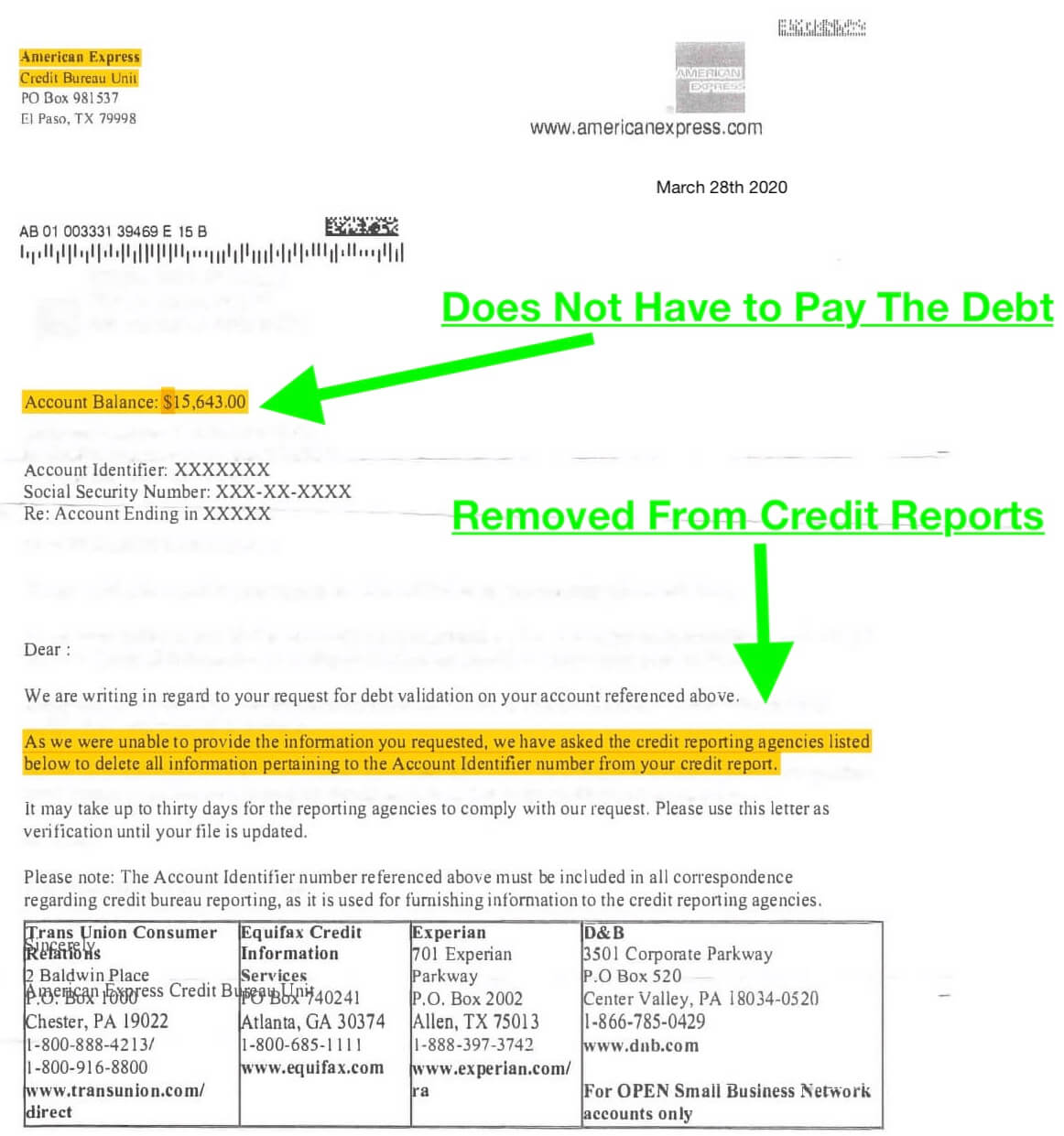

Like when a person gets a speeding ticket and hires a lawyer to challenge it, debt can also get disputed, and surprisingly collection agencies often can’t prove a debt is valid. A validation program gives you the legal right to dispute a collection account, and if it’s proven legally uncollectible, you don’t have to pay it.

How does a validation affect credit scores?

Validation and settlement programs require a person to stop making payments to creditors, so these programs both hurt credit. The difference with validation is that after accounts get proven legally uncollectible, they can no longer legally remain on credit reports. That’s where credit repair comes in. After each debt is invalidated, credit repair then disputes the account from a person’s credit report.

Success Case Example – client used debt validation to deal with this $15,643 AMEX credit card debt

Live in Wyoming? Debt relief services can resolve;

- credit card debt

- private and federal student loans

- medical bills

- financial and bank loans

- third-party collection accounts

Wyoming Debt Collection Laws

In Wyoming, the Statute of limitations is ten years. That means, from the day you stop paying a credit card, it will take ten years from that date before the debt expires past the Statute of Limitations, and at that point, legally, your creditor can no longer sue you over the debt. “Any contract, agreement or promise in writing: 10 years, (WS 1-3-105(a)(i)). Unwritten contract, express or implied: 8 years, (WS 1-3-105(a)(ii)). Recovery of personal property: 4 years, (WS 1-3-1 05 (a) (iv)).” Source:

Fair Debt Collection Practices Act in Wyoming (FDCPA)

Wyoming debt collectors have rules they have to follow under the FDCPA.

- Collection agencies in Wyoming can’t call you at any time or place they know is not convenient. So if you told them a time and place that you cannot take a call, like if you’re at school, they can’t call you at that time.

- Collection agencies cannot call you at your place of employment.

- Collectors can’t call you before 8 am or after 9 pm.

- Collectors can’t lie, like tell you that they will sue you when there is really no lawsuit pending.

There are many rules that collection agencies must follow. Part of a debt validation program forces creditors to prove they’re abiding by all of these rules.

If a collection agency knows you have the legal representation, they must direct all communication to your attorney and stop calling you. With the Wyoming attorney-based debt settlement program through Golden Financial Services, you are set up with a Wyoming law firm and attorney so that creditor harassment will stop!

Debt collection companies can continue to sell your old debt over and over again, continuing to add on more and more fees — UNLESS YOU TAKE ACTION. Give us a call for a free consultation at (866) 376-9846 now.

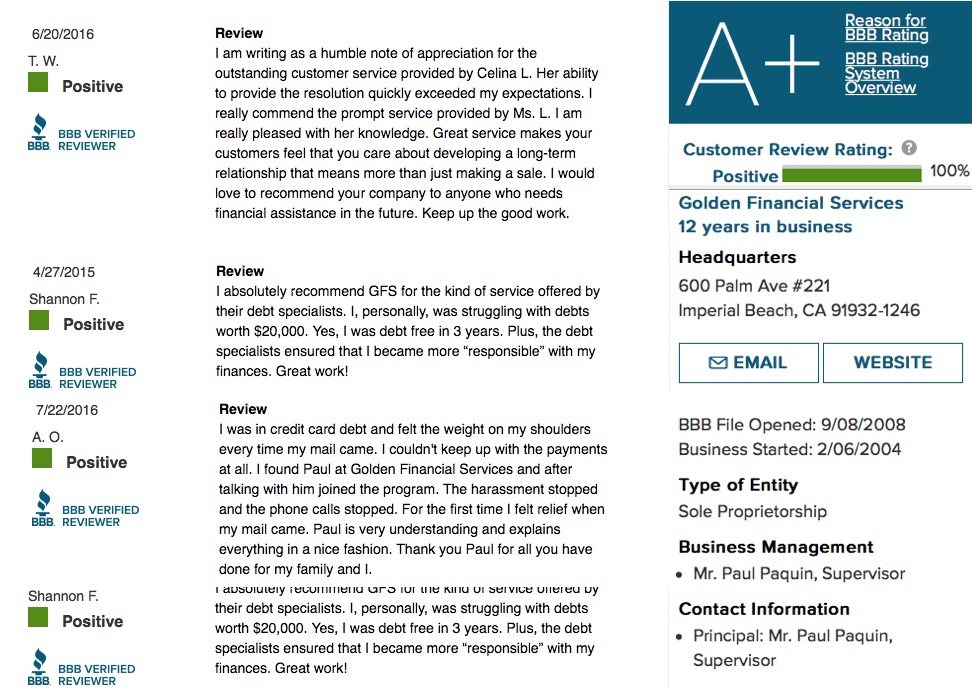

The good news; At Golden Financial Services Wyoming, credit card debt relief programs are extremely effective. Clients can graduate from the program within 18-36 months — Debt-free within three years or less! And work with a company that has ZERO COMPLAINTS and an A+ RATING at the Better Business Bureau.

Student Loan Debt Consolidation – Wyoming

Debt consolidation Wyoming programs are also available at Golden Financial Services, but only for federal student loans. We will start by consolidating your federal student loans into one consolidated loan and then getting you approved for the lowest possible payment, offering loan forgiveness.

Wyoming police officers, teachers, and anyone with a public service job can qualify for loan forgiveness in only ten years.

We will take over all communication between you and your creditors and recertify your repayment plan every year, ensuring we always get you the maximum benefits you’re entitled to.

Best Wyoming Debt Relief, Consolidation and Settlement Company

Golden Financial Services credentials:

- A+BBB Rating

- Hundred’s of positive online reviews (do a few searches on Google)

- Voted Top Debt Relief Company by Financial Product Reviews

Take Action Now – Wyoming Debt Relief Program Quotes Are Available — Call the Debt Relief Hotline at 1(866) 376-9846