Over $10,000 in debt qualifies for Florida debt relief.

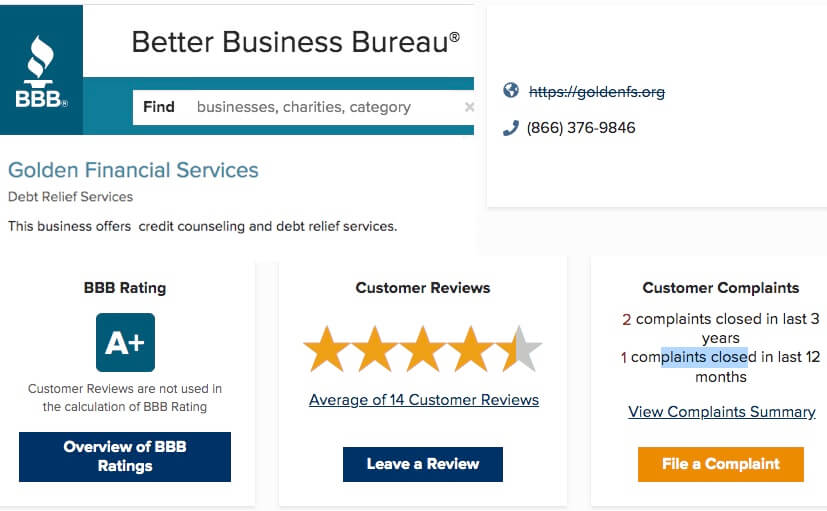

Florida (FL) debt consolidation and settlement programs are available at Golden Financial Services (GFS), an A+ BBB-rated FL debt relief company. Our West Palm Beach and Boca Raton offices have assisted millions of Floridians, going back since 2004. If you owe above $10,000 in total balances, Start by getting a free consultation with one of our statewide IAPDA certified counselors. You’ll be able to learn the best way to get rid of your debt based on your specific financial goals and needs.

If you qualify for a debt relief program in Florida, our counselors can set you up with the lowest possible monthly payment and on the plan of your choice. Our programs were just rated #1 by Trusted Company Reviews for 2020. And there’s not just one plan; you can choose amongst the best credit card debt relief programs in Florida as of 2021.

What if you owe under $10,000 in debt?

If you don’t qualify for a Florida debt relief program, use this debt snowball calculator, a free tool on our website that makes paying off bills easier. Or maybe, all you need to do is make a simple budget analysis to help you find more cash flow so that you can afford to pay off your accounts faster on your own. You can also use the free budget calculator on our website here.

If you need to dispute a third-party collection account with a small balance and you can’t qualify for the program, you may benefit from using this debt validation letter creator to dispute the debt on your own with a simple letter.

What is the minimum debt amount that qualifies?

$7,500 or more in total unsecured debt makes you a potential candidate for multiple options to consolidate your bills and obtain credit card relief. Florida debt relief programs include:

- Consumer credit counseling for reducing interest rates on credit cards

- Debt settlement and validation programs for medical bills, credit cards, collection accounts, car repossessions, private student loans, and unsecured loans

- Student loan consolidation for federal student loans

- Credit card consolidation loans (Compare Lending Club, Avant, Prosper Financial, and many other lenders within a few clicks)

The following page will teach you about all of the different programs available to get debt relief. Florida residents can also call for a free consultation and enroll in a local debt relief service at (754) 301-4495.

Florida Debt Relief Options and Laws

Consumer protection laws prevent credit card companies and collection agencies from taking advantage of consumers without consequences. Florida debt relief programs offered through Golden Financial Services use these federal laws to protect clients’ consumer rights.

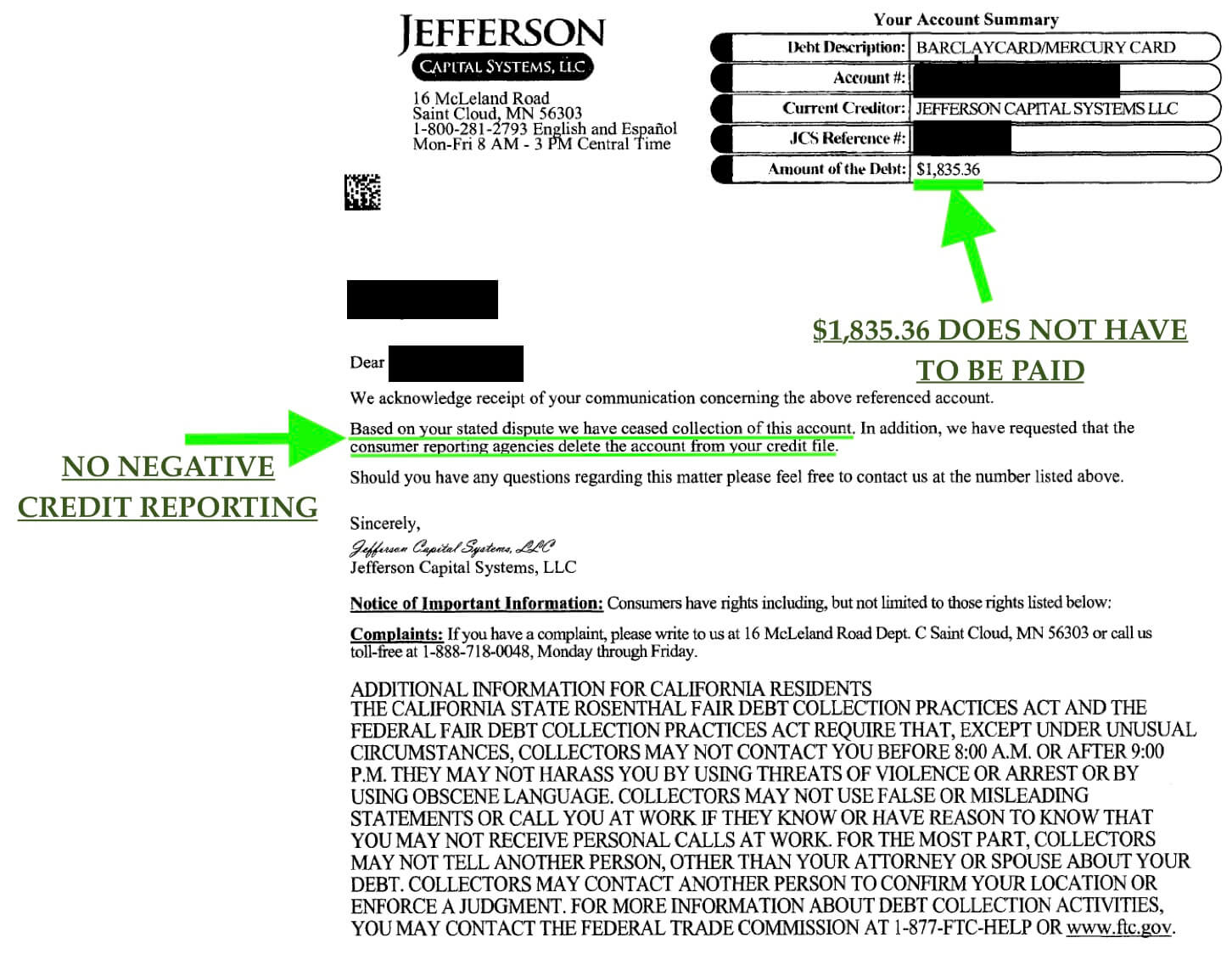

For example, if a creditor or collection agency violates a person’s rights while enrolled in a Florida debt settlement program, an attorney will use the violations as leverage when negotiating the debt or, in some cases, help the client sue the collection agency. With debt validation, legal violations can lead to debt becoming legally uncollectible where it does not have to get paid.

Here are just a few examples of laws that Florida residents can count on:

The Credit CARD Act of 2009

A) Fraud and abuse: forces credit card companies to give a 45-day warning before raising interest rates and prevents them from changing the interest rate more than once per year

B) Transparency: restricts credit card companies on what fees they can charge, preventing unfair, undisclosed, and high over-the-limit fees. The Credit Card Act forces your creditors to provide easy-to-read language on your credit card statement

C) Taking advantage of students: prohibits credit card companies from offering giveaways to college students, trying to entice them to apply for a credit card in ads such as: “Hey, all you need to do is fill out an application – you never have to use the card once you get it.”

D) Fair notice: “Credit card companies have to give consumers at least 21 days to pay from the time the bill is mailed. Credit card companies can not “trap” consumers by setting payment deadlines on the weekend or in the middle of the day, or changing their payment deadlines each month.”

The Fair Debt Collection Practices Act (FDCPA);

A) prohibits collectors from calling you too early in the morning and after 9 pm

B) prohibits collection agencies from implying that nonpayment of any debt will result in the arrest or imprisonment (as that’s a lie)

C) prevents collectors from trying to collect on a debt by using scare tactics that imply a person will be getting sued (unless a lawsuit is really pending)

Debt Validation (verification/invalidation) Services

Debt validation laws give Florida residents the right to dispute a third-party collection account. You can request proof that a collection agency is maintaining complete records and accurate information.

For example, you can request that a collector provide you the original agreement signed with the original credit card company when you applied for the card. By law, the collection agency must have this document and produce it upon request.

Here’s another example: A Florida debt collection agency needs to know the date for the Statute of Limitations on a debt. If you request this information from a collection agency and they can’t provide an accurate answer, the debt could become legally uncollectible.

Surprisingly, Florida collection companies often cannot prove a debt is valid! If you have a collection account under $7,500 and believe that it’s either been involved in fraud, inaccurate or that the collection agency has violated a law, you can use this debt validation letter to dispute it yourself. If you owe above $10,000 in total unsecured debt, you could qualify for a debt validation program.

Talk to an IAPDA Certified Expert Now at (866) 376-9846.

The Best Debt Relief, Settlement & Consolidation Programs (Pros/Cons)

The following infographic explains how Florida debt relief, settlement, and consolidation programs work. It’s important to understand the benefits and downsides of each option.

If you have a question or want to enroll in a Florida debt relief program:

You can also try this debt calculator tool to get a quick quote on each debt relief program (compare your potential saving side-by-side).

Depending on which debt relief program, you will determine how fast you can become debt-free.

Each person’s situation is different. We can tailor a debt relief program to fit your needs and help you accomplish your financial goals.

How fast are you looking to get out of credit card debt?

What is your biggest financial problem?

What is your goal? These are the questions that we need to know to devise a plan to help you live your life without debt.

Summary of Debt Relief Plans in Florida (Click on Chapter to Read it)

- Settle your debt for less with Florida debt settlement services

- How a $5,800 credit card debt can be reduced to $3,500

- Consumer credit counseling services to lower interest rates on credit cards only

- Debt validation services to dispute a debt so that you may not have to pay it (Credit Restoration Included)

- Debt consolidation to eliminate high interest rates

- What is the cheapest debt relief program in Florida?

- What is the statute of limitations on credit card debt in Florida?

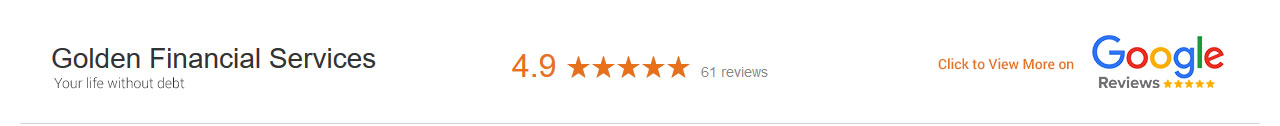

Florida Debt Relief, Consolidation and Settlement Company Reviews

We offer student loan relief, debt consolidation, and credit card relief options at the Golden Financial Services Florida debt relief office.

Almost any type of unsecured debt will qualify for one of the programs.

Store retail cards, credit cards, medical bills, loans, and just about any debt is eligible.

We’ve officially helped more than 2.6 million customers in achieving debt relief. If you’re struggling with high bills and credit cards, your solution is here.

- IAPDA Certified and Accredited Company

- Better Business Bureau A+ Rated

- 15+ Years in Business and Proven Success

- Programs include a Money-Back Guarantee and Credit Repair

- Rated #1 Debt Relief Company by Trusted Company Reviews

- Rated 4.7 out of 5-Stars on Google, almost a perfect rating and one of the best ratings out of all Florida debt relief companies!

Debt Consolidation – Florida

Debt consolidation is when you use a loan to pay off your debt. A consolidation loan is to reduce high-interest rates and simplify the bill-paying process by combining payments into one.

Benefits of Consolidation

- payments get combined into one

- interest rates get reduced

- become debt free in less time

- can improve credit score

Downsides of Consolidation

- not much of a reduction in the monthly payment

- fees and interest are included

- A high credit score required

- only a temporary fix to debt problems

- credit card consolidation loans are not considered a hardship program that can reduce the balances owed. However, interest rates can be lowered with consolidation

- not all clients will be able to pay their entire loan back

We will provide you all of your debt relief options and help you find the quickest path to becoming debt-free. We are not a loan company but can facilitate you in consolidating your student loans and combining your credit card debt into one affordable payment.

As an IAPDA certified Florida debt relief company, it’s our obligation to help you find the right plan to achieve your financial goals. Florida residents are entitled to a free consultation. Call today and take control of your debt!

Florida Consumer Credit Counseling – Reduces Credit Card Interest Rates

Consumer credit counseling is one of the oldest debt relief programs in Florida. Back in the 1990s, consumer credit counseling was the only debt relief program available. Today, consumer credit counseling is one of the best debt relief programs that consumers can turn to.

The point of consumer credit counseling is to lower your interest rates and consolidate your payments into one. Only credit card debt qualifies.

Benefits of Consumer Credit Counseling

- debt free in 4.5 to 5 years

- interest rates get reduced from what it is on your own

- all credit card payments get combined into one

- work with a licensed and non-profit consumer credit counseling company

- only minimal adverse effect on credit

The downside of Consumer Credit Counseling

- entire balance and interest must be paid back

- plans take longer to complete than other popular debt relief programs in Florida (i.e., debt settlement and validation)

- you do get a third party notation on your credit report illustrating that you joined a consumer credit counseling program

- monthly payment stays around the same as what it is when paying minimum payments on credit cards

- only credit card debt qualifies

- not much flexibility in the monthly payment

- not all clients will make it through the program

Golden Financial Services can introduce you to a non-profit and Better Business Bureau A+ rated consumer credit counseling program.

Debt Settlement – Florida Programs to Reduce the Balances

Debt negotiation Florida programs offer you a way to pay back your debt but at an affordable amount. Debt settlement, Florida’s most popular program for reducing unsecured loans, credit cards, collection accounts, and private student loans – are for consumers experiencing financial hardship (i.e., medical condition, divorce, reduced income, unexpected expenses came up, etc…) Financial hardship can be just about any incident that occurred, resulting in stress on your finances, including COVID-19 as of lately.

Americor, a large Florida debt settlement company, recently explained when asked, “What is debt settlement?”:

“This debt strategy attempts to negotiate a settlement with your creditors to get them to accept less than the full amount you owe in exchange for immediate payment of a lesser sum. When it comes to collecting credit card debt, creditors look to creative solutions when it becomes evident that you will be unable to meet your obligations. This creative approach is known as a debt settlement, which allows you to settle credit card debts and other unsecured debts for less than the current outstanding balance. While the deal can be structured differently, one such plan might feature paying half the owed amount in a lump sum. From the viewpoint of the credit card companies, it’s the same philosophy behind the old fishing adage to cut bait if it looks like you are about to lose your financial rod and reel.”

If you qualify to have your unsecured debt settled for less than the full amount owed, you will get to take control of your debt almost immediately. Some clients say that it feels like “immediate relief,” just knowing that your monthly payment is no longer overwhelming. And knowing that there is a light at the end of the tunnel.

Professional negotiators will take over communicating with your creditors. Now you still may get some phone calls, but that’s one of the downsides to debt settlement.

Your creditors don’t get paid every month, so that they will call you in the beginning. Here’s how it works … each month, your payment is deposited into an FDIC insured trust account that’s in your name. So if the debt settlement company goes out of business or something occurs, you never lose your money. It’s guaranteed safe in your trust account.

As your payments begin to accumulate, negotiations begin.

Debt Settlement Florida Case Example

Let’s suppose you have a Bank of America credit card of $5,800. With a settlement program, that account could be reduced to around $3,500, including fees – giving you a savings of $2,300. On top of the $2,300 savings, you are also saving thousands of dollars in interest.

If your settlement program payment is set to be $300 per month, by eleven months, this debt can be settled and “paid in full.”

As soon as your first account is resolved, payments continue to accumulate for the next account.

The quote we provide you at Golden Financial Services is a conservative quote, which means if there are extra savings in the end – it’s yours to keep.

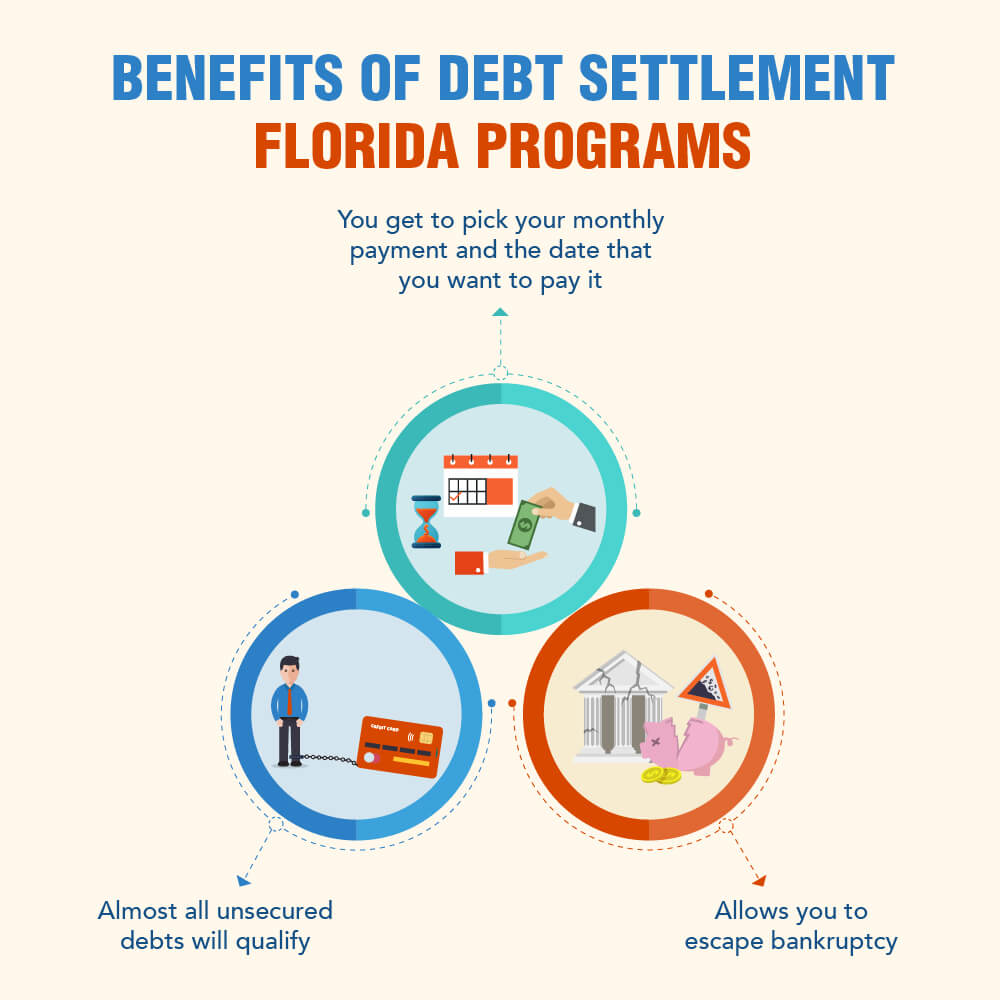

Benefits of Debt Settlement Florida Programs

- you get to pick your monthly payment and the date that you want to pay it

- you can become debt-free in around 24-36 months

- almost all unsecured debts will qualify

- you pay $0 in interest

- A portion of your balance can be reduced and eliminated

- allows you to escape bankruptcy

- your balances are reduced down to a fraction of what you owe

- you get one small monthly payment that you can comfortably afford

The Downside to Debt Settlement Florida Programs

- a negative effect on credit

- potential tax consequences

- potential creditor harassment

- creditors can issue you a summons

- creditors don’t have to settle

- not all clients will make it through the program

Debt settlement is your perfect escape if you are contemplating bankruptcy. You no longer need to worry about bankruptcy as your only option.

You are left with negative marks on your credit report, but your debt all gets paid back. Settlement helps improve your debt to income ratio and proves that you are creditworthy after you finish the program, and your debt gets resolved.

Risks, Danger, Myths, and Misconceptions involved with Florida Debt Settlement Programs

- A risk that Credit Karma explains, “Although it may be tempting to use a debt settlement service to reduce your debt, it’s important to keep in mind that you could end up deeper in debt or with a negative impact to your credit.” When does this occur? If you use an unreputable company that charges up-front fees, they may not perform. Check any company’s BBB rating and online reviews before signing up with them. Do your due diligence. If you cancel a program like this before the end, your debts won’t all get resolved, and you’ll end up in worse shape, so take your time before signing up to make sure you’re with the right company that has a long track record of success.

- A misconception is that: “You pay the Florida debt settlement company, and they pay your creditors.” False! Your monthly payments will go into a special purpose savings account that you own, and the settlement company is only authorized to manage. Make sure to check all service fees and costs associated with this account. Debt settlement programs in Florida can be expensive, with companies charging more than 20% of the total balances enrolled into the program. Know and understand all fees and the total cost associated with the program. Also, recognize that what they quote that you will pay back on each negotiated settlement is only a quote based on past client results. With fees included, most settlement companies will save you around 25%. Freedom Debt Relief, one of the largest settlement companies in the nation, put in the disclosure on their website that the program’s cost can come out to around 75%, including program fees. So make sure to include the fees on top of the settlement. Companies are not supposed to be legally claiming they can settle your debt at 30% – 40%, although they may get settlements as attractive as that, it’s not guaranteed. For that reason, if they save you more money than expected, that money is yours to keep. According to the American Fair Credit Council, “the average settlement amount is 48% of the balance owed” (not counting company fees.”

- Myth: “Florida debt settlement hurts credit scores”: Unless you’ve reviewed the applicant’s credit report in detail, nobody can say if joining a settlement program will hurt a person’s credit score. ConsolidatedCredit.org does an accurate job explaining how a settlement program affects credit: “When you settle a debt, the account status will be noted as “settled in full” rather than “paid in full.” When an account is closed with a settled in full notation, it stays on your credit report for seven years from the date of final discharge. That notation is a bad mark on your credit history, which is the number one factor used in calculating credit scores. So, each debt you settle will damage your credit score.” When settlement programs don’t hurt credit scores: If your accounts are already in collections, they already count negative remarks on your credit report. If you already have multiple collection accounts listed in your report, the damage has already been done to your score. Essentially, it’s the adage that you can’t fall off the floor. If your credit score is already bad, there’s less risk to settling your debt. On the other hand, if you have a good score – or even a fair one – then you should expect the settlement to drag your score down.”

- Penalties and interest continue to accrue and be prepared for potential tax consequences: Bev O’Shea, an authority figure in the debt relief industry, explains, “You’ll likely be hit with late charges and penalty fees as well. Interest will keep racking up on your balance.” Bev goes on to explain: “You should also be aware that the Internal Revenue Service generally regards forgiven debt as income. You may want to consult a tax professional about additional tax obligations you’ll be taking on if you settle your debt.” The truth is, there are tax forms that can help you eliminate any tax bill over a settled debt – IF you’re insolvent and can’t afford to pay your bills.

Golden Financial Services is one of the oldest Florida debt settlement companies in the nation. Since 2004 the company has been A+ rated by the Better Business Bureau and has settled millions of dollars in debt. But our approach is much different when it comes to debt relief. Florida residents can be set up on a debt resolution program that uses debt validation to dispute unsecured debt as a first approach. In most cases, the accounts end up becoming legally uncollectible, meaning they don’t have to get paid and can no longer legally remain on credit reports.

The program stays with the clients all the way up until the statute of limitations on the account expires, ensuring the consumer does not have to pay an invalidated debt. If an account can’t be invalidated, a Florida debt relief attorney and law firm take over dealing with the debt. The client does not pay any money for the validation program towards that one account. In most cases, the debt relief lawyer will negotiate a lower payoff for the account, saving the client money in the end.

Over 90% of the consumers that we enroll in any one of our programs are successful, and less than one percent of our clients make a complaint. In fact, no matter what site you’re checking Golden Financial Services reviews on, Yelp, Google, BBB – you’ll find that we have at least a 4.0 out of 5-star rating, a testament to the services being offered.

Why do creditors agree to accept less than owed to satisfy an account?

In the early days, we needed to illustrate to creditors that our customers had a hardship and were about to file for bankruptcy. If consumers file for bankruptcy, creditors lose money.

Nowadays, we use a similar approach, but we also have established creditor relationships. On top of that, we use proprietary strategies designed to make the negotiating process more useful.

The original creditors get paid 100% of the money owed through tax write-offs, banking insurance, and bringing in more profit from the sale of the account to third-party collection agencies. The collection agencies pay less than 50% of the balance when purchasing delinquent credit card accounts. Consequently, they are willing to settle for less than the full amount.

Why contact Golden Financial Services for Florida debt relief?

Over the years, the demand increased for debt relief. Florida consumers needed somewhere to turn to as our economy deteriorated. Florida debt relief companies started opening up all over the place. Consequently, creditors modified their policies and methods to combat settlement businesses and collect efficiently from consumers.

Here at GFS, we advanced and enhanced our program infrastructure over the years, to always stay one step ahead of the creditors.

Our servicing negotiators will bulk together hundreds of client’s worth of accounts at a given time, then base negotiations on a higher dollar amount. This debt negotiation method allows us to have more leverage to solidify superior discounts for our clients.

Debt Validation – Get Out Of Debt Without Paying

A validation program is designed to protect a person’s rights and help them avoid harm due to fraudulent or unfair collection practices based on the Fair Credit Reporting Act, the Fair Debt Collection Practices Act, the Credit Card Act of 2009 three other federal laws.

Once challenged, a debt collection company must verify, validate, and prove that a debt is valid and that the debt collection company is abiding by all the laws.

Once an account is invalidated, the collection company must now cease all collection. Delinquency marks can no longer be reported on an invalidated account.

Debt Invalidation Services Example Case

Benefits of Florida Debt Validation Programs

- could walk away from an account without paying it

- lowest monthly payment compared to any other program

- debt and its associated negative marks can be removed from credit

- pay nothing if results don’t get achieved

- no tax consequences if a debt is proven to be invalid

- can be the quickest way to deal with a collection account

- the collection company must stop harassing you immediately after receiving the validation dispute package until they validate the alleged debt

The Downside to Florida Debt Validation

- could get sued by a creditor

- technically, the debt doesn’t disappear or get paid until the statute of limitations expires

- a debt could get validated and would then need to be paid or settled

- temporary negative effect on credit

We have a proven track record of saving our clients the most money and time than any other debt relief company in Florida.

What is the Statute of Limitations on Credit Card Debt in Florida?

What does the Florida statute of limitations mean?

The statute of limitations is an expiration date on a debt.

Three things happen after a debt expires and the Florida statute of limitations is reached:

- your creditors can no longer pursue legal remedies to collect on an account. (i.e., a creditor can no longer sue you over the account)

- The debt becomes legally uncollectible, and you never have to pay it.

- The debt comes off your credit.

Technically, since credit card debt is an open-ended account – the statute of limitations on credit card debt in Florida is only four years.

The statute of limitations for written contracts, such as a personal loan – is five years.

Debt Consolidation Loans Vs. Consumer Credit Counseling in Florida

There are too many misconceptions about these two completely different debt relief options.

Consolidation loans can be used to pay off high-interest accounts in one shot, leaving you with a single new loan to pay back. The debt does not go away, but hopefully, on the new loan, your interest rate is lower than what it is now, and you can save money in interest.

Consumer credit counseling is NOT a loan; it’s a debt relief program. Negotiators contact your creditors and work out a smaller payment, with a reduced interest rate, on each of your credit card debts. Only credit card debt qualifies for consumer credit counseling.

Talk to an IAPDA certified Florida debt counselor for free at Golden Financial Services and learn more about consumer credit counseling. Florida residents can get a free consultation today.

Chapter 7 Bankruptcy Florida (Title 11)

Wikipedia explains: “Chapter 7 of Title 11 of the United States Code (Bankruptcy Code) governs the process of liquidation under the bankruptcy laws of the United States, in contrast to Chapters 11 and 13, which govern the process of reorganization of a debtor. Chapter 7 is the most common form of bankruptcy in the United States.[1]”

Bottom line: You could qualify for Chapter 7 bankruptcy if your income level is below the average (median) income for the state of Florida, which for an individual is $27,936. Chapter 7 bankruptcy can wipe away almost any type of unsecured debt besides federal student loans but has the worst effect on a person’s financial health and credit scores.

Chapter 13 Bankruptcy Florida

Chapter 13 bankruptcy could benefit someone who’s behind on mortgage payments and about to lose their home to foreclosure. With Chapter 13 bankruptcy, the judge reviews all of your sources of income, including any assets you may own, and then reorganizes a debt repayment plan over a five-year span to help you pay at least half of your debt back. Assets could get sold through Chapter 13. Golden Financial Services will only recommend a Chapter 13 if it’s being used to save your home from foreclosure. Otherwise, Florida debt settlement and validation programs can be a more cost-effective solution.

Before filing for BK, you will be required to speak with a non-profit consumer credit counseling company to do a budget analysis and check if credit counseling is a viable option. However, they may not explain all of your options. Therefore, it would be in your best interest to also contact a Florida licensed debt management or settlement company, or Golden Financial Services, to get all of your options before filing for BK in Florida.

Chapter 11 Bankruptcy Florida

Chapter 11 bankruptcy is for a business that can’t afford to pay its expenses. This type of bankruptcy can be a viable option for a small business owner that needs a debt reset. Donald Trump is best known for Chapter 11 bankruptcy because he used it several times to get a fresh start for his businesses.

” Source:

Bankrate, 2019