Are you interested in exploring a Debt Specialist Job? Debt Advisor, Debt Specialist, and Credit Counselor Jobs are booming as of 2022 as consumer debt is skyrocketing. Debt counselor and debt specialist jobs are available here at Golden Financial Services (GFS), a licensed debt management company. Join our team of the best debt advisors in America!

How much do debt advisors earn?

The debt advisor job pays an hourly rate plus commissions. Top debt specialists at Golden Financial Services earn above $100,000 per year, but the average pay is around $80,500 as of 2022. Health insurance and 401K retirement benefits are included.

If you’re interested in learning more about the debt advisor job send a text to Paul Paquin, the CEO of Golden Financial Services, at 619-840-4626. For debt affiliate programs visit this page next.

Is a credit counselor job the same as a credit repair specialist?

No, credit repair companies focus on analyzing a person’s credit report and disputing derogatory information from it, such as what companies like Lexington Law offer. However, debt counselors focus on helping consumers with debt relief, settlement, and consolidation.

What is a certified consumer debt counselor job?

The focus of an IAPDA-certified debt counselor is not on credit repair. Debt specialists focus on helping consumers with reducing, eliminating, and consolidating debt. A credit counselor position on the other hand focuses on providing financial education and credit card debt relief.

At Golden Financial Services our debt counselors provide consumers with financial education and help people personalize a debt solution based on their individual needs and goals.

We’re looking to hire debt counselors with at least two years of sales experience.

Please read this entire page before applying for the job or calling about the position.

Debt Counselor Job Description:

- Help your fellow Americans achieve financial freedom. Since COVID-19 cursed our country, the demand for reputable debt assistance is heavier than it’s ever been.

- Offer a top-rated program! With happy clients, the referrals keep rolling in.

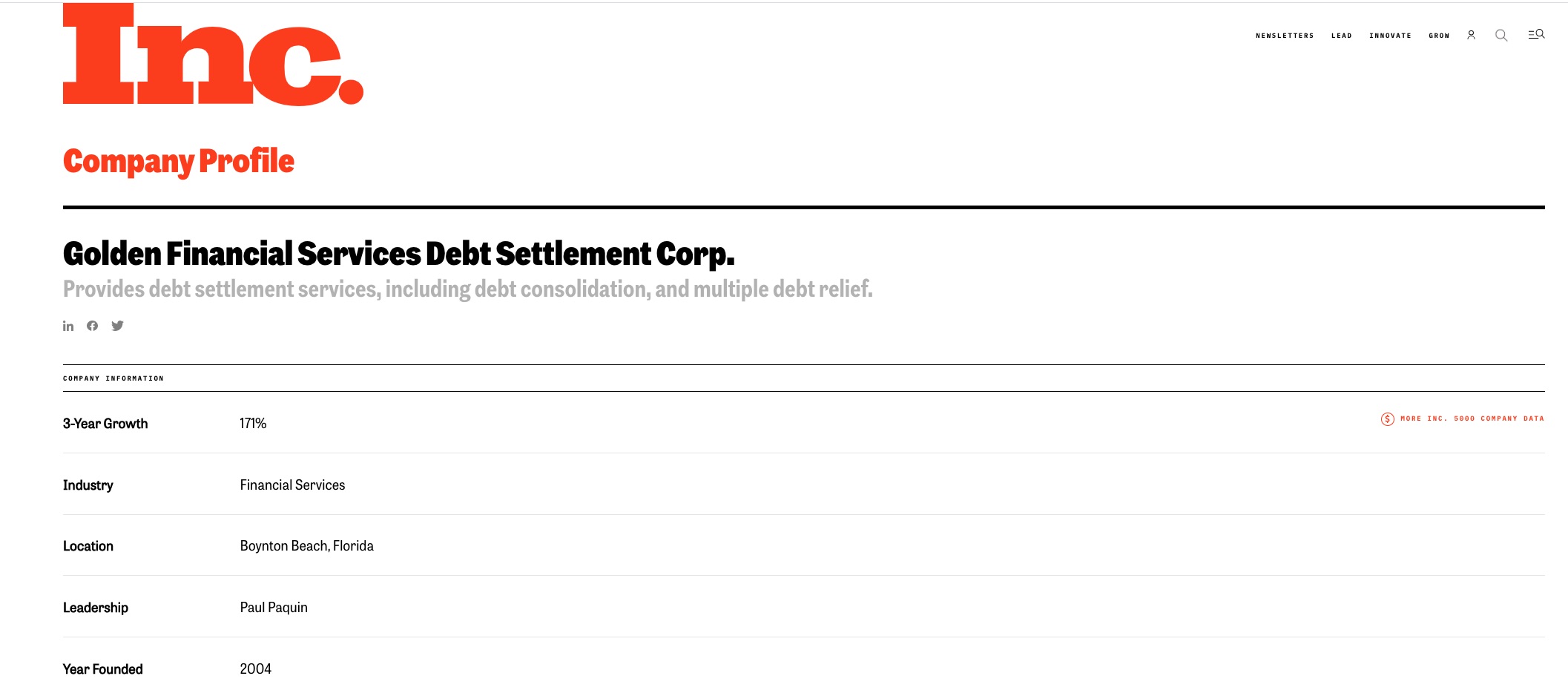

- Join one of the fastest-growing companies in the nation, according to Inc.com. Made the Inc.com list in 2019! https://www.inc.com/profile/golden-financial-services-debt-settlement-corp

- Work from home using state-of-the-art equipment and CRM (Debt Pay Pro CRM)

- No Cold Calling: Consumers contact GFS for help with debt relief.

Would you be a good fit for the debt counselor position?

Not everyone will be the right fit for Golden Financial.

You must:

- Have a strong work ethic

- Operate with integrity at the forefront of what you do

- Have a willingness to learn

- Have a desire to succeed

- Be a team player

GFS made the list at Inc.com of the Fastest Growing Companies in the Nation

What competitive edge does GFS’s program have over its competitors?

- the program offers the best savings

- plans include a money-back guarantee and credit repair

- potential downsides are effectively addressed

- a five-star customer service department

- better online reviews

- clients can choose from multiple programs

GFS Credentials

- a nationally recognized debt relief company just made the list at Inc.com for the Nation’s Fastest-Growing Companies.

- A+ Better Business Bureau rated

- #1 Rated Debt Relief Company by TrustedCompanyReviews

- 5-Star Rated on Google and ShopperApproved

Debt Specialist Job Requirements

-what we are looking for:

- Applicants with 2+ years of experience in sales

- Applicants with strong written and verbal communication skills

- Applicants who can handle ambiguous and chaotic times with composure and while staying incredibly organized

- Applicants with emotional intelligence who can empathize with customers

- The type of person that realizes feedback is a gift

Bonus Skills:

- Speech, debate, or door-to-door selling experience

- Applicants from the financial services and insurance industry

How to Start?

To apply for the debt specialist job, email:

jobs@goldenfs.org

Or: Text Paul Paquin at 619-840-4626.

Sales Jobs Near Me

We’re hiring for sales positions in Arizona, Illinois, New York, Florida, Texas, and California. Debt relief programs are available in over 40 states!

How Much Can Golden Financial Services Sales Executives Earn?

Sales executives at Golden Financial Services earn between $6,500 to $10,000 per month on average. You get an hourly rate to start, but your commissions will begin to exceed this hourly rate shortly after. When your commissions exceed the hourly rate, you will be paid based on the commission amount. This is a W2 position.

What’s Different About GFS?

Unlike the typical debt settlement or consumer credit counseling jobs from home, debt advisors at GFS are authorized to offer multiple debt relief options. Consumers can choose from debt settlement, student loan consolidation, and debt validation programs. Credit counselors at non-profit consumer credit counseling companies are restricted to offering only consumer credit counseling, resulting in most of the time not being able to offer the right solution for the consumer.

Consequently, many consumers that sign up with consumer credit counseling companies end up canceling due to a variety of reasons, including not being able to afford to make all of their scheduled monthly payments. At GFS, we get calls every day from consumers who were enrolled in a consumer credit counseling program with another company and need to cancel that program because they can’t afford it. Fortunately, we have debt relief options available that offer a lower payment, including validation and settlement.

To understand how our services are different from state to state, check out a few of our location pages. Visit GFS’s New York, California, Missouri, and Arkansas pages. Also, check us out on Trusted Company Reviews and see why we’re rated #1. Trusted Company Reviews provides the Top Ten Debt Relief Companies every year and illustrates a side-by-side comparison of each company and program.

Training

Complete Golden Financial’s credit card debt relief product training and be ready to start enrolling clients in the program within 3-6 weeks. (depending on your experience)

Get paid training by an IAPDA-certified expert.

How to Start?

To apply for the job, email:

jobs@goldenfs.org

(please do not call about this job, as our counselors are busy assisting consumers)

Is this a full-time sales job?

Yes, this is a full-time job.

If you’re looking to maximize your earnings, you can even work on Saturdays.

To apply for the job, email:

jobs@goldenfs.org

As a Debt Counselor, What is My Job?

Counselors at GFS teach consumers about their debt relief options.

You will first need to pull the consumer’s credit report, import the creditors into our program system, and then provide the consumer with their debt relief options.

If a consumer qualifies for a debt relief program, you will enroll them into the appropriate plan as a counselor.

The two best options available include an attorney-based debt settlement program and debt validation.

How do people find Golden Financial?

Consumers find GFS online, by Googling “Credit card debt consolidation” or “California / NY debt relief programs .”

Consumers will also get referred to our company regularly from Yelp, Better Business Bureau, ShopperApproved, TrustedCompanyReviews.com, Google Places, and many other websites that rate Golden Financial Services as one of the Best Accredited Debt Settlement Companies.

What is the average commission earned?

The average debt amount enrolled in the program as of 2020 is $31,488.12. Therefore, the average commission earned for a debt counselor is $472.32 per sale. Debt counselors at Golden Financial Services are paid 1.5% of the total debt enrolled. In addition to the flat fee commission rate, bonuses are also paid monthly.

Perks Included

- gym membership

- retirement benefits including a Sep-IRA

- enjoy time off (as part of the monthly prizes for monthly team bonuses)

What Account Executives Love Most About Working at Golden Financial Services?

When we asked this question to our account executives — here were a few of their answers:

- “A comfortable working environment that allows for a stable income with room for growth.”

- “The opportunity to help people that are struggling financially.”

- “The gratification of being able to bring real-life solutions to people that are financially stressed and often hurting from life events, while working in a culture inspired by a team of people with a common vision.”

- “Defending consumers from the abusive practices of the banks and financial institutions really brings “Peter Pan-like” satisfaction especially after being a victim of their practices.”

- “I love being able to work at home. I get to work more hours, not having to drive in San Diego traffic every day!”

- “If you’re looking for the workplace where your co-workers will ALWAYS encourage, motivate, and inspire you to be your very best, you can be every day, look no further… It’s us, GFS!”

- “Everything is just top-notch, clients get the best service … sales executives get the best technology, from being able to text consumers, easily navigate from one software to another as it’s all integrated, click to dial … awesome leads, multiple options, honest people with strong ethics and morals, and I could go on and on here…Our CEO is so down to earth, and he cares so much about each of us, always paying close attention to what we need to be happy and how we can earn more income, providing solutions to our problems, promoting health and fitness by offering free gym memberships, always offering to buy us new equipment…”

Level of Education Required

You must be a high-school graduate, but no college degree is necessary. You don’t need to have experience in the debt relief industry either; in fact, we prefer hiring applicants with no experience in the debt relief industry. The most successful sales executives come from the insurance industry and have had past jobs where they’ve conducted door-to-door sales.

Credit Check

We will run your credit to check for collection accounts, bankruptcy, judgments, and any adverse credit. You can be rejected for employment due to these matters per the Fair Credit Reporting Act.

Background Check

You will have to pass a background check. You can be rejected as an employee due to a misdemeanor or felony charge showing up. GFS can overlook traffic violations like speeding or parking tickets.

Equal Opportunity Employer

We are an Equal Opportunity Employer and encourage women and all nationalities to apply. However, you must be fully proficient in the English Language.

Please email us a copy of your resume, but more importantly, tell us about you and your experience and goals. (Email us at Jobs@GoldenFS.org)

What other jobs are available at Golden Financial Services?

You can write for GFS, including becoming an author in our famous debt blog. Web developers can apply for a job to assist with creating financial tools. For example, financial tools include our debt snowball calculator here, budget calculator here, and debt relief program calculator here.

Do you know SEO? We love SEOs! SEO is how we’re able to rank on the top of Google for keywords like Illinois debt relief, California debt settlement, and New Mexico debt consolidation. Our CEO, Paul J Paquin, is a well-known SEO guru that’s featured on sites like SemRush.

However, if your goal is to maximize your earnings potential, the debt advisor job is the best paying job, although also the most challenging job that’s available through Golden Financial Services!