California debt settlement programs take time to produce desirable results. Creditors are settled and paid one by one while the other debts remain unpaid for up to three years or longer. Therefore, clients must be committed to the program and its entire length and understand all of the potential downsides that can occur. Clients also should understand the solution to each downside.

The AB 1405, Wicks. Debt settlement practices bill

This new California law requires companies to be more transparent with consumers about the potential downsides of a debt settlement program.

For example, there is a chance that you could get served a lawsuit over an unpaid debt while enrolled in a debt settlement program. How will this lawsuit get resolved?

The California Wicks. Debt settlement practices bill:

- Prohibits a debt settlement provider from engaging in fraudulent, deceptive, or misleading acts or practices.

- Requires California debt settlement companies to provide a consumer with full disclosure of all downsides.

- Allows California residents enrolled in a debt settlement program to terminate their program contract at any time without a fee or penalty simply by notifying the debt settlement provider.

- Upon notice of cancellation from the program, a California debt settlement payment processor must immediately stop accumulating service fees, close the settlement account, and deliver the balance of the settlement account to the consumer within seven days.

- Authorizes a consumer to bring a civil action for violation of any of these provisions within a four-year window.

- Requires that a court award costs of the action and reasonable attorney’s fees for fraudulent claims about a debt settlement company that the consumer makes. So, in other words, this clause aims to protect the debt settlement company from fraudulent complaints.

- Specifies that reasonable attorney’s fees may be awarded to a California debt settlement company or payment processor upon a finding by the court that the consumer’s prosecution of the cause of action was not in good faith. Wrongful accusations from the consumer can result in a penalty on their behalf.

- Does not always include debt settlement lawyers. California law states; law firms that do not charge for services regulated by this title or retained by a consumer for legal representation in consumer debt litigation are not regulated under the Wicks debt settlement services bill.

Debt Settlement in California

Golden Financial Services, one of the best-rated California debt relief companies, has helped thousands of California residents become debt-free through debt settlement (negotiation). California residents that owe above $7,500 in total unsecured debt could qualify for debt negotiation. But before you consider a California debt settlement program, first examine the pros and cons of debt settlement compared to other ways to consolidate.

A debt resolution program that uses debt validation first to challenge the validity of a debt could save a person more money than using a stand-alone debt settlement program—the reason why is because, in many cases, accounts are invalidated through debt validation.

Invalidate means the debt does not have to get paid and can’t legally remain on credit reports. Consequently, the outcome of debt validation can be more favorable for a person over debt settlement. As a result, Golden Financial Services highly recommend California debt relief programs that include debt validation.

Here’s a metaphor:

Should I settle and pay the debt?

Would you plead guilty and pay a speeding ticket if you knew it was inaccurate?

Consider if you get a speeding ticket that says you were going seventy on a road with a sixty-mile-per-hour speed limit.

You know for a fact that you were going closer to sixty-five miles per hour.

Do you plead guilty and pay the ticket, resulting in a flawed driver’s license record and higher insurance rates?

No, your better route would be to dispute the ticket.

If dismissed, you no longer have to pay it, and nothing negative goes on your record. Even though you were speeding, the officer couldn’t prove that the speed limit he alleged you were driving at was accurate.

Similarly, with debt, after accounts are sold to a collection agency, unauthorized fees are added in, information turns inaccurate, and paperwork gets lost. Consequently, debt validation forces the collection agency to prove that the amount they claim you owe is valid. Collection agencies must also prove they are legally authorized to collect on a debt.

Debt collection companies often buy debt, knowing paperwork is missing and information may not be accurate. So it’s a numbers game to debt collection companies. But you’re smarter than that. Now you know.

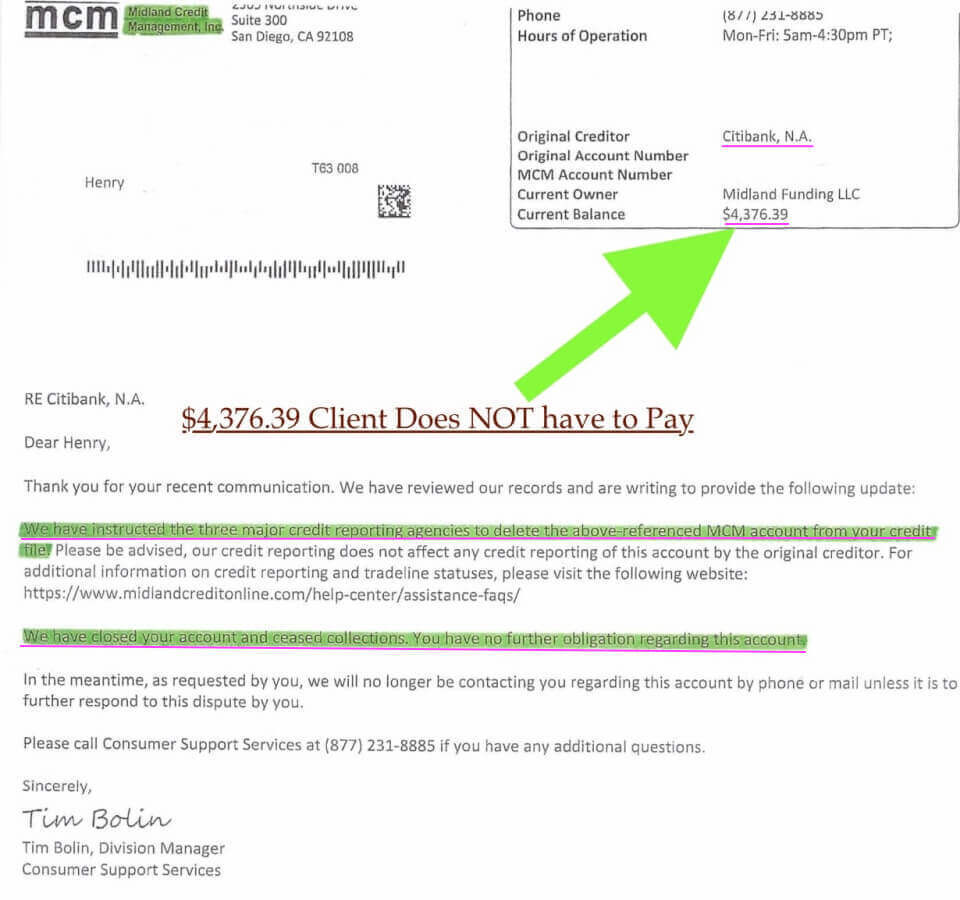

Example of a successful debt validation case:

Note: Take your time when considering a California debt settlement company. Also, check the company’s rating at the Better Business Bureau (BBB) to ensure the company is A+ rated and accredited.

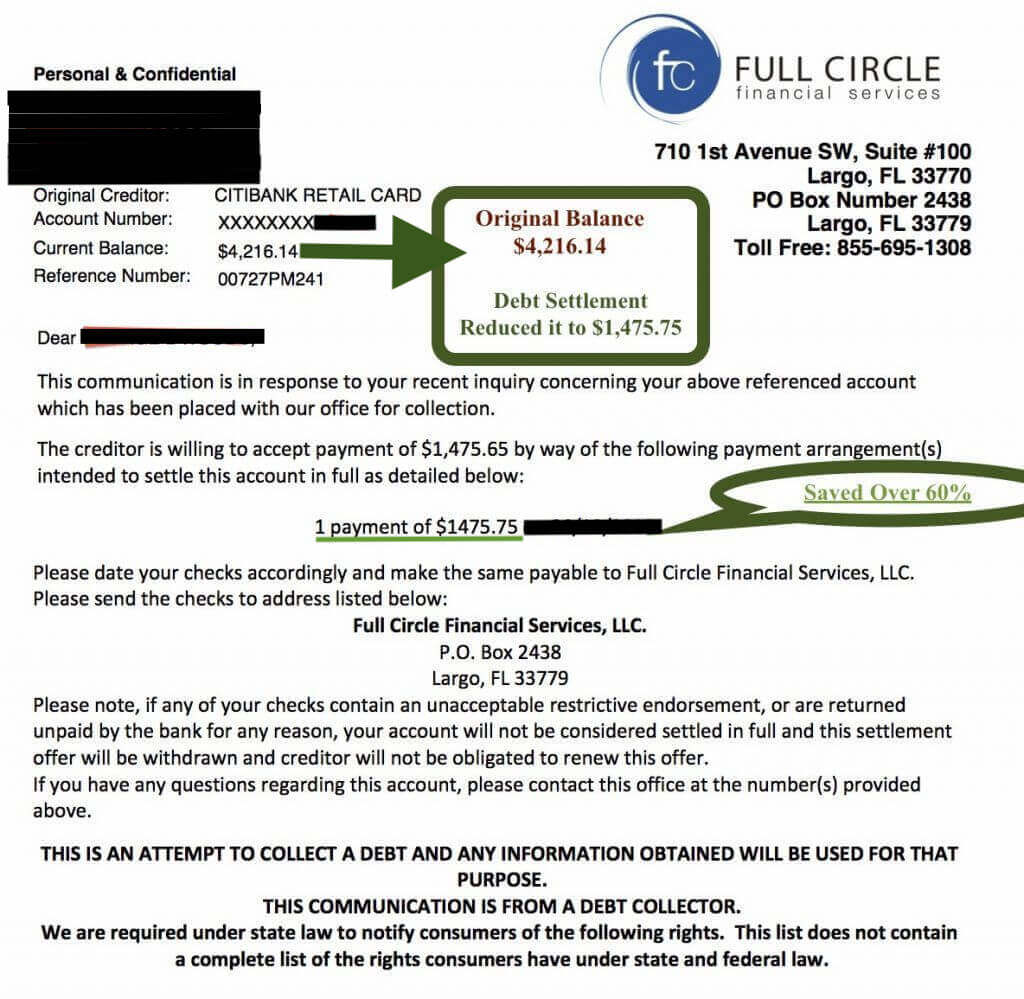

California debt settlement program case example

How likely is it that you could get sued with California debt settlement programs?

California debt settlement companies don’t pay creditors every month. Consequently, creditors could issue a summons, and credit reports are left with late marks and collection accounts.

There is no set number regarding the percent of accounts that end up getting a lawsuit, but as of 2021, some creditors are more likely to sue than others. For example, Discover will often issue a summons over an unpaid debt.

But, in the end, a person can resolve all of their unsecured debts for a significant amount less than the total owed with debt settlement. Californians can become debt-free in around three to four years with debt settlement, even if they receive a summons on an account while on the program.

California Debt Consultations

To explore debt relief programs more, we’re giving you an invitation to get a free consultation. Learn how to get out of debt fast, and leave these stressful days in the past. Call today at (866) 376-9846. Our California debt counselors are available Monday – Friday, 8 AM – 6 PM.

How does a summons get resolved?

A credit card lawsuit can get settled for less than what the consumer owes. And with a competent debt settlement attorney, California debt lawsuits can get dismissed entirely if proven inaccurate or flawed.

How to resolve a credit card summons on your own?

Attend the court appearance. Never skip court.

But before attending court, contact the debt collection agency and offer them a small amount to resolve the debt. They may counteroffer with an attractive settlement. Then, you can settle the debt before the court appearance, just like a debt settlement company would attempt to do on your behalf.

A Credit Card Debt that passed the Statute of Limitations Could Get Dismissed.

Don’t forget to review and respond to a summons right away.

If you believe something is wrong or inaccurate on the summons, make sure to state these details in your response.

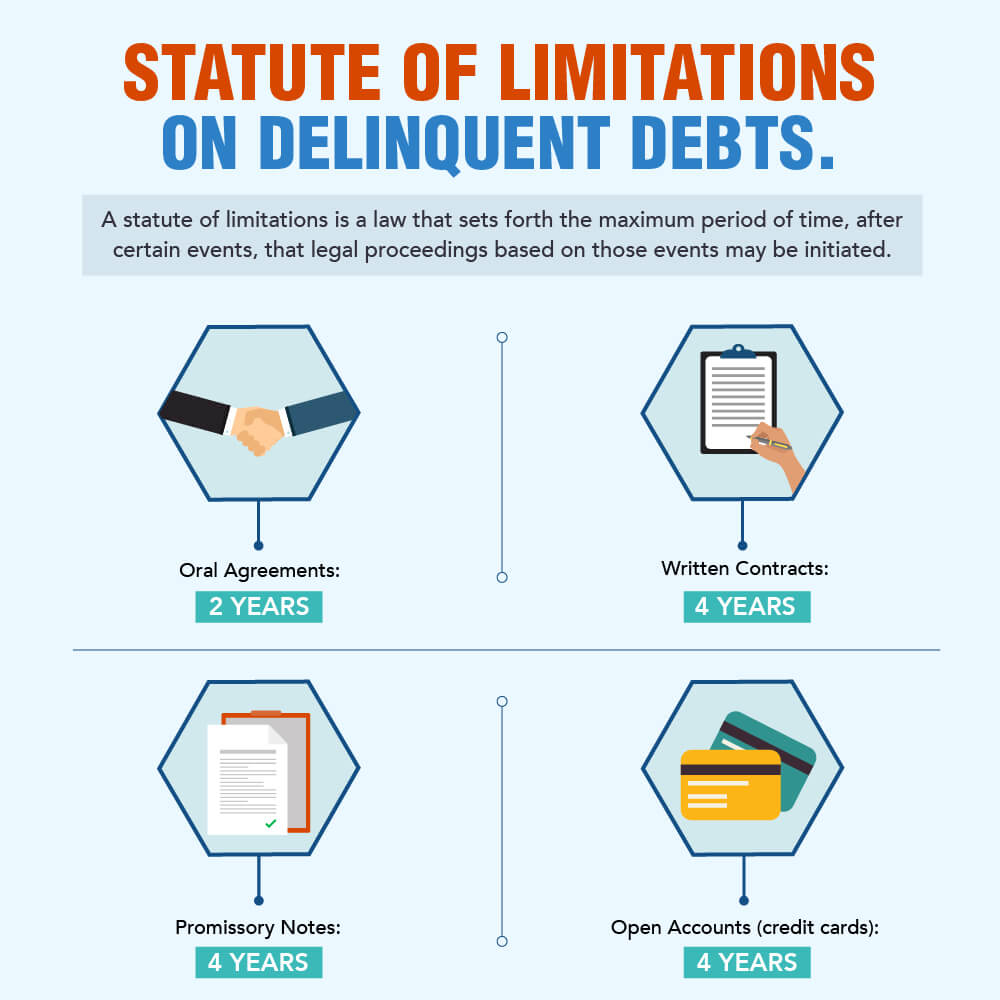

For example, if the last payment towards the debt was over four years ago in California, the debt may have expired past the Statute of Limitations.

State these details in your response to the summons.

How to deal with a summons at court

- Provide the judge proof of income and explain your financial hardship if you couldn’t afford to pay the debt, and your goal is to get a reduced payoff plan. Present evidence to the judge if you’re disputing it.

- Whatever you do, don’t skip court or fail to respond to the summons because you’ll get an automatic default judgment against you. A credit card judgment can result in wage garnishment.

- The judge will most likely be lenient with you and remain on your side, especially if the creditor skips court themselves, which commonly occurs.

Why settle a debt with a collection agency that can’t legally prove it’s authorized to collect the debt?

Why settle a debt when you can dispute it and possibly not have to pay it and get it off your credit entirely?

The answer is – because you were never informed of debt validation options until today. Your debt won’t get erased with debt validation, but it could get invalidated. And an invalidated debt is one you don’t have to pay, and it can’t legally remain on your credit report.

For many consumers, it’s hard to imagine that the debt collector won’t prove the debt is valid, but the truth is, most of the time, they can’t. After all, it was your credit card.

The laws don’t ask if you spent the money. The regulations don’t dispute whether or not you ever had the credit card.

And keep in mind, debt validation is not disputing your credit report. Debt validation has nothing to do with your credit report.

Instead, laws require third-party debt collection companies to prove, upon written debt validation request, that;

- A.) the collection agency has all of the legally required paperwork to be collecting on a debt (e.g., the original signed credit card agreement and a debt collector’s license to collect on a debt in any particular state)

- B.) the collection agency can produce accurate information on behalf of the consumer (e.g., the dates in which the statute of limitations expires and the date of last payment)

- C.) the alleged amount the collection agency claims the borrower owes is valid (i.e., void of any unauthorized charges with documentation to back up their claims, including each month’s worth of statements dating back to the first monthly payment owed to the original creditor)

These are just a few examples of how debt validation works. It’s not about you; it’s about the collection agency. Before agreeing to a settlement, resort to debt validation – a less expensive option to result in getting the debt off your credit entirely potentially. Because after a debt is invalidated, it can no longer legally remain on a person’s credit report.

As many as fourteen federal laws can be used inside a debt validation request, including the Credit Card Act of 2009, Fair Credit Billing Act, Fair Credit Reporting Act, Fair Debt Collection Practices Act, just as a few examples.

Additionally, debt validation is used in the Debt Resolution program offered at Golden Financial Services. To learn more about the Debt Resolution program, visit this page next.

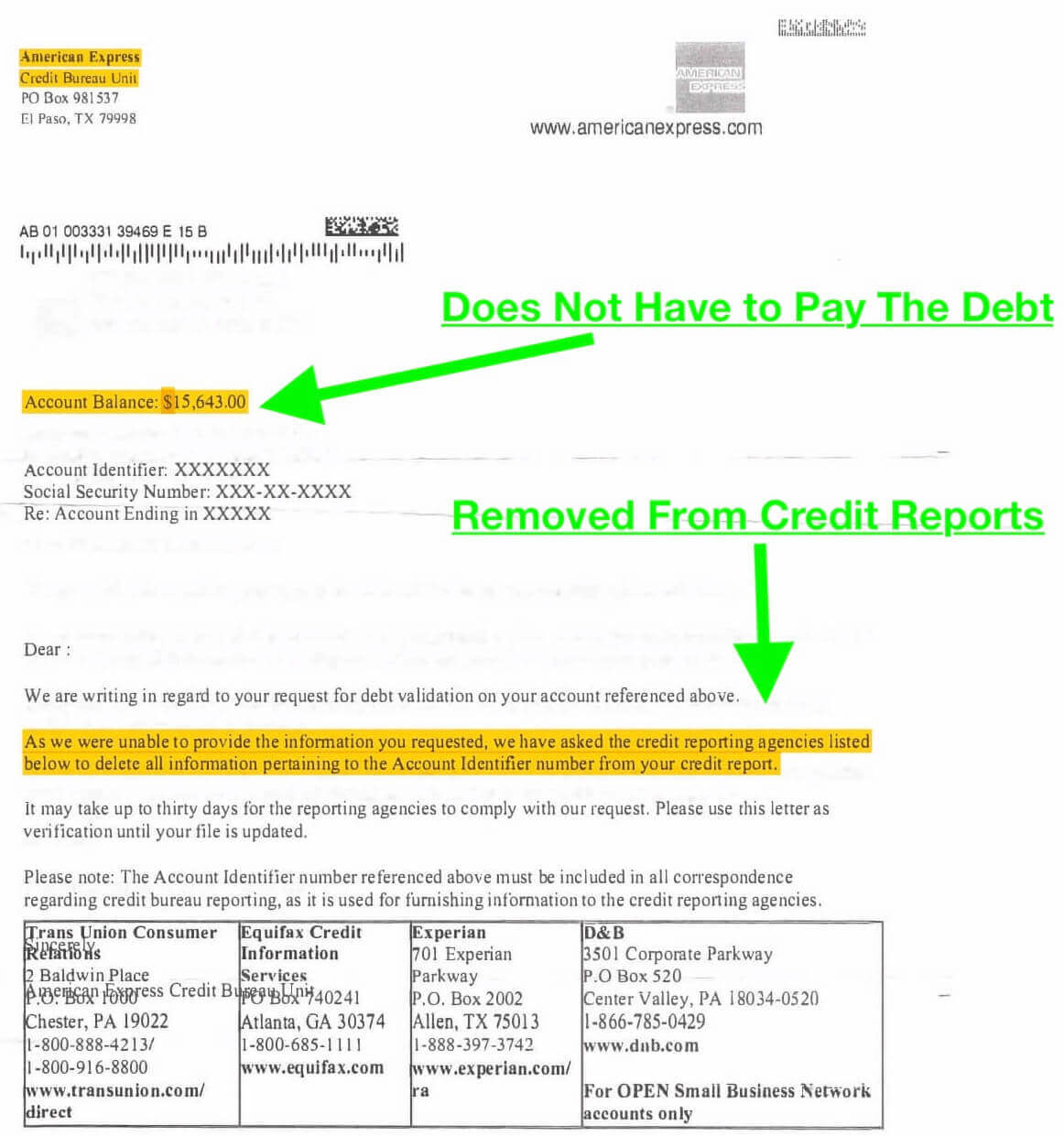

Example of an invalidated account:

- Give Golden Financial Services a call at (866) 376-9846 for free and learn your California debt relief options.

- Make sure you understand how to succeed in a debt settlement program by understanding the pros and cons. In addition, you must be prepared for potential downsides to occur and know how to deal with each circumstance.

- Explore all credit card relief programs before deciding on debt settlement.

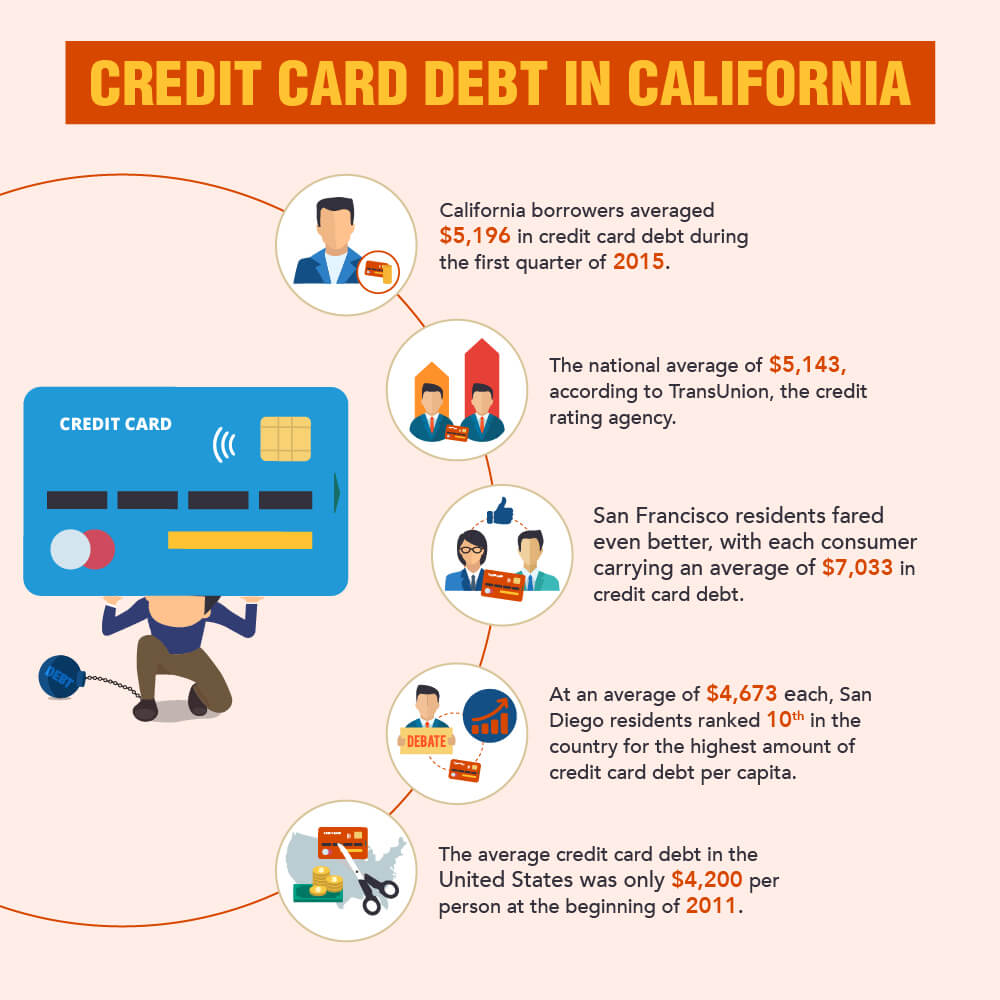

California Debt Statistics

California borrowers averaged $5,196 in credit card debt during the first quarter of 2015. As of 2021, that number has only gone up slightly, to $5,120.

California Credit Card Debt Relief Act, Laws & Protections for Consumer Debt

Post COVID-19, a new California Consumer Financial Protection Law could be passed, primarily aimed at debt consolidation, PayDay loans, and debt settlement companies.

“Assembly Bill 1405 wouldn’t change how debt settlement companies work, but it would add more regulation. Existing federal regulation is limited to companies servicing customers across state lines. The state bill would mimic some of those federal rules, applying them to California-based companies, as well as adding new rules like giving customers a three-day cooling-off period before the contract takes effect.”

This law will force California debt settlement companies to be more transparent. According to Nguyen Orth, “The bill would address some of the more egregious practices, like promising unrealistic outcomes without advising customers of the possible risks or offering predatory loans that can lead to further debt.”

Existing laws already do exist protecting consumers from illegal debt settlement operations. For example, the Debt Settlement Protection Act from 2010 prohibits debt settlement companies in California from charging a settlement fee before a debt gets settled. In addition, California law states that at least one payment gets paid towards the settlement before debt settlement fees get charged. To learn more about the Debt Settlement Protection Act from 2010, visit Congress.Gov.

Credit card regulations in California go to great lengths to protect consumers from illegal debt collection.

For example, the statute of limitations on credit card debt in California is only four years in length. This limits the time that debt collection companies have to harass borrowers about their unpaid credit card debts.

Do you believe that your debt may have expired past the Statute of Limitations?

Force the collection agency to prove that it’s within the legal time frame to collect on the debt before agreeing to a settlement.

According to NewEra Debt Solutions:

“California’s version of the Fair Debt Collection Practices Act (FDCPA) extends further legal protection to consumers than the federal law as it prohibits anyone trying to collect on a debt from harassing or misleading the debtor rather than just the original creditor as with the national law.”

California residents also have the right to dispute a credit card bill if their statement has errors on it. Just like under the Fair Credit Reporting Act, you can fight inaccurate information on your credit report.

Is a California Debt Settlement Program the best way to get out of debt?

At Golden Financial Services, our best debt relief program uses a combination of settlement and validation.

Debt validation uses federal laws, including the Fair Debt Collection Practices Act, Fair Credit Reporting Act, Fair Credit Billing Act, amongst several others, to force creditors to prove that they are legally attempting to collect on a debt.

Eligible Accounts:

- Credit card debt

- Personal lines of credit

- Private student loans in default

- Department store credit cards

- Signature loans

- Car repossessions

- Old judgments

- Other unsecured debts

Ineligible Accounts for a Settlement in California:

- Home mortgages

- Federal student loans (ask about debt consolidation for your student loans)

- Car loans

- Other secured debts

- Credit Union debts

Our California Debt Settlement Locations:

- Imperial Beach California debt relief office

- Los Angeles debt settlement office

- San Diego debt relief headquarters

- San Francisco debt consolidation office

Of course, Golden Financial Services can help consumers throughout the entire state of California. Debt settlement programs are available from Chula Vista to San Jose!

Compare Options for Debt Relief in California

Debt Settlement Programs in San Diego, Santa Clara, and San Jose have had good results for clients in the past. Still, settlement is not the only option for debt relief that is available to California residents.

Consider all of the following options.

1. Continue making minimum payments to creditors monthly

Don’t pay just minimum payments because it’s your most expensive route and can prevent you from building good credit. If you have the income to pay more than minimum monthly payments, use the debt snowball method.

The debt snowball method, created by Dave Ramsey, is your best route to paying off credit card bills fast and improving your credit score simultaneously.

2. California Credit Counseling or a Debt Management Program (DMP)

Consumer credit counseling (DMP) programs are only for credit card bills. Debt management programs reduce credit card interest rates, then consolidating payments. But DMP is not a loan.

Instead, you pay the DMP company every month, and they pay your creditors at a lower interest rate. As a result, monthly payments get reduced, and consumers get out of debt in around five years.

Golden Financial Services feels that if you can afford a DMP, you’d be better off using the snowball method on your own.

3. California Debt Consolidation Loan

California debt consolidation loans can save you money and lower monthly payments. However, you will only save money if the interest rate on loan is less than the average interest rate of all the accounts you are consolidating.

If you have a high credit score, you could qualify for a low-interest loan to consolidate debt. Check with your local credit union for low-interest loans.

You can also use a balance transfer card to consolidate debt. However, you must be able to afford to pay the entire balance within the card’s introduction rate period. Otherwise, interest rates go up.

4. California Debt Settlement or Debt Negotiation

California debt settlement programs reduce the balances on each debt owed.

Because you end up owing less, debt settlement can provide you a lower monthly payment.

You can become debt-free faster with a settlement plan. Average plans last for three to four years.

Unfortunately, settlement programs leave consumers with bad credit, including late marks and collection accounts on credit reports.

5. Debt Resolution programs

Debt Resolution uses federal laws to dispute each debt.

In many cases, collection agencies can’t validate the debt.

Accounts that get invalidated don’t have to get paid and can no longer legally remain on credit reports. So after accounts are invalidated, they can then get disputed from credit reports.

It makes sense to start with a Debt Resolution program before resorting to debt settlement. You will potentially save more money with Debt Resolution, over a settlement program, and get your credit repaired.

Figure Out Where You Stand

Do you have a financial hardship condition?

Many consumers in California get buried in debt because of a loss of income, medical issues, or divorce. Especially since COVID-19 plagued our country, many consumers who could pay their bills before COVID-19 now have a financial hardship and can’t afford it today.

Financial hardship could include:

- Divorce

- Medical

- Not enough income

- Loss of employment

- Increased interest rates

- Late payments

- Increased family size

All of these financial hardships qualify as legitimate financial hardship. These financial hardships are not your fault.

A Debt Settlement program is not a “magic wand that can eliminate your debt.” However, a debt negotiation program can provide you an honest and ethical debt relief alternative to bankruptcy.

California Debt Settlement Plans Require Your Full Commitment

Debt relief programs are an aggressive approach to reducing debt in California. Debt negotiators will aggressively settle one debt after the other. So that means you need to stick with the plan until the end, or else you could end up with more debt than you started with due to late fees.

Make sure to ask questions if you’re uncomfortable at any point while enrolled in a debt settlement program. Customer service departments should offer knowledgeable representatives.

Debt settlement and Debt Resolution programs require your total commitment.

If you choose to join a debt settlement program in California, stay committed until the end. If not, you could end up in worse financial shape.

Understand how California credit card settlement programs deal with a summons:

Debt relief programs don’t pay your creditors monthly.

So what will you do if a creditor issues you a lawsuit?

How will the company resolve it?

For those willing to stick with the program, California debt settlement can get you financial freedom more quickly and at a lesser cost than other forms of debt relief.

Why is Golden Financial Services One of the Best Debt Settlement Companies in California?

Golden Financial Services offers free financial education as the first step for consumers through GoldenFS.org/blog/, Instagram, and YouTube. Golden Financial Services recommend debt settlement only if consumers truly determine they can’t afford to pay their bills.

By the time a consumer enrolls in a program, they fully understand the pros and cons of each debt relief option and how potential downsides would get addressed if they were to occur. Transparency and performance are two metrics that set Golden Financial Services above the rest of the debt negotiation companies in California.

- 5-Star Rated Debt Settlement Company in California on Google

- 5-Star rated on Facebook

- Featured on CardRates.com

- A+ Better Business Bureau Rated

- #1 Rated on TrustedCompanyReviews.com for the Top Ten Debt Relief Companies in 2021

- In Business Since 2004

- Consumers can choose from multiple programs and use free tools on the website to help deal with paying bills and improving credit scores.

- Plans include credit restoration and a money-back guarantee

- The Debt Resolution program uses debt validation and California debt negotiators that settle the debt as a last case scenario