Tennessee Debt Relief Programs can help you resolve all of your “unsecured debt” problems. Anything from medical bills to credit card debt can be included. Student loan consolidation, medical debt relief, and credit card debt solutions in Tennessee are all becoming more and more popular, as credit card and student loan debt are both surging right now towards all-time highs. “24% of Tennesseans with a credit report had medical debt on their credit history – the 10th highest rate in the country”.

Considering a debt consolidation loan? Tennesse residents have an average credit score of 682. Part of the reason for such low credit scores is due to medical collection accounts causing damaging effects on credit reports for many Tennesse residents. With a credit score of under 700, you don’t want to resort to a debt consolidation loan. Bad credit loans can be more costly than credit cards that have a 30% interest rate.

Subprime loans are the biggest ripoff when it comes to debt relief. Tennesse residents should avoid obtaining a loan if it comes with upfront fees and interest rates above 20%. If you are planning to get a consolidation loan make sure to review the loan contract with a comb for the words “fee”, “interest rate”, “APR”, so that you can know exactly what costs you’ll have to pay. And the same goes for balance transfer cards. These cards can be an expensive method of dealing with debt when a person’s credit score is low.

Debt Consolidation Loan Vs. Debt Settlement in Tennessee

Debt settlement in Tennessee can save a person up to 35% on their balances. That means if a person owes $20,000 in credit cards, by using a debt settlement program Tennessee residents could resolve $20,000 in credit card debt for only $14,000 in total.

When comparing debt settlement vs. a debt consolidation loan, settlement wins hands down (for consumers with a credit score of under 700).

Last year alone; 28,500+ consumers in Nashville Tennessee became debt-free by using debt settlement.

Try This TN Debt Reduction Calculator to Compare Your Options

How Does Tennessee Debt Relief Works?

- Get approved in under 24 hours, following your approval creditors will all get contacted and notified that you’re enrolled in the plan

- You’re then responsible for making a single monthly payment, instead of paying each individual account every month

- Monthly payments get deposited into a dedicated account, where they continue to accumulate month after month

- While funds grow in your dedicated account, a debt negotiator or lawyer begins negotiating with creditors to reduce each debt down to a fraction of the total owed

- One by one each debt is reduced, settled and paid (the portion of the debt that gets reduced, ends up getting forgiven)

- Become debt-free in 24-48 months on average (you get to choose a payment that is affordable)

Call 423-758-3414 to check if you are eligible for one of the best debt relief, settlement & consolidation programs!

Before we explain the pros and cons of debt relief options for Tennessee residents, let’s first look at a few statistics.

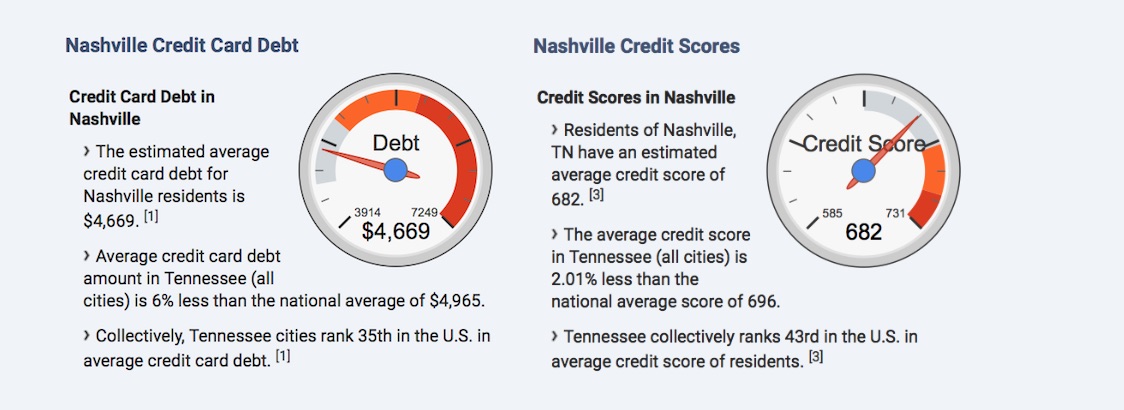

Here are Nashville Tennessee Debt Statistics:

- Average credit card debt in Nashville Tennessee is $4,669 (6% less than the national average

- Average FICO score for Nashville Tennessee residents is “682” (300 the lowest and 850 the highest)

- 24% of Tennesseans with a credit report had medical debt on their credit history

Now you can get an idea of where you stand.

Do you have over $5,000 in credit card debt?

Do you have other unsecured debt, such as medical debt or unsecured debt collection accounts?

Is your credit score preventing you from purchasing something?

If you answered “yes” to any of these questions — the good news is — Tennessee debt relief programs can help!

You have legal rights and options to effectively deal with your debt. Some folks are looking to pay less in interest and get out of debt faster. While other consumers are experiencing a severe financial hardship and need a significant amount of their debt forgiven (reduced), for it to be feasible to pay.

Golden Financial Services is a Better Business Bureau A+ Rated Tennessee Debt Relief, Consolidation, and Settlement Company

Golden Financial Services has been focussing on debt relief options in Tennessee for more than 15 years now. Our goal is to offer the most effective debt consolidation programs on the market.

We’ve partnered with some of the best national debt settlement companies and debt relief firms and can now offer you the best option to resolve your debt.

You can choose from multiple programs when using Golden Financial Services, including debt consolidation, debt validation, and debt settlement.

Golden Financial Services Credentials & Tennessee Debt Relief Reviews

- A+ Rating at the Better Business Bureau (No complaints since 2004)

- Accredited Members of the International Association of Professional Debt Arbitrators (IAPDA Accredited)

- Certified by the Association for Student Loan Relief (AFSLR Certified)

- Offers Debt Consolidation, Debt Settlement, and Debt Validation (all-3-programs

Talk to an IAPDA Certified Debt Counselor to Learn About Tennessee Debt Relief Programs at 866-376-9846

(The Local Debt Relief Tennessee Hotline is: 423-758-3414)

Debt Consolidation in Tennessee

Debt consolidation gives you a low-interest loan to pay off high-interest debt.

The point of a debt consolidation loan is to;

A. Reduce interest rates

B. Simplify monthly payments by consolidating into one

C. Shorten the time-frame that it takes to become debt-free.

Read more about debt consolidation or contact one of our IAPDA Certified Experts Toll-Free at (866) 376-9846

Delinquent on your monthly payments? Your solution is ahead — so keep reading!

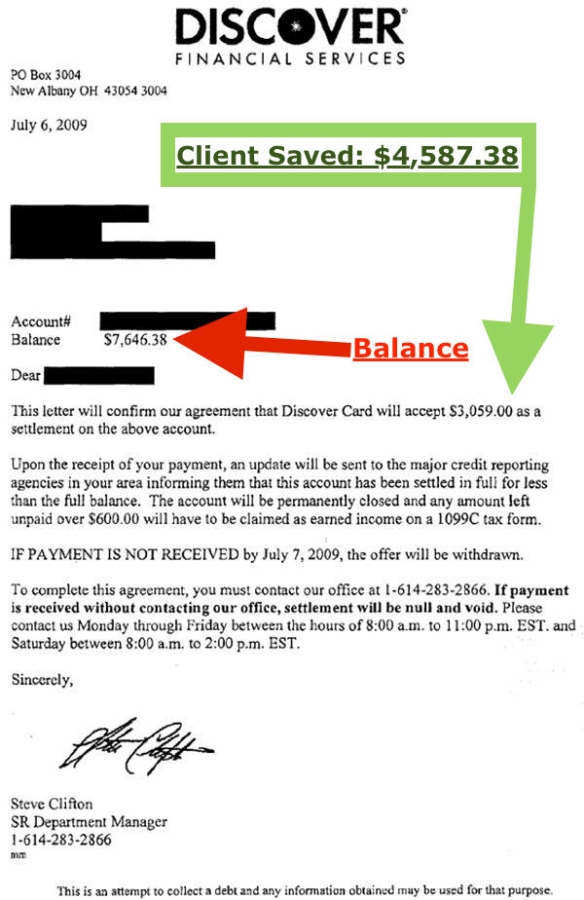

Here is a Discover credit card debt that was settled for less than half the balance (not including debt settlement company fees).

Debt Settlement in Tennessee

After getting approved for a TN debt settlement program, a negotiator or an attorney negotiates with your creditors and works to reduce each of your debts down to a fraction of what you owe. By doing so your debt becomes more affordable to pay off so that you can avoid having to file for bankruptcy.

Instead of paying your creditors every month, you begin making payments into a dedicated account, also known as a trust account. Every single monthly your agreed-upon payment gets deposited into this dedicated account. The money starts to build up in this account, just like if you save money in a savings account every month. As this money grows, the debt negotiator starts making settlement offers to your creditors. Eventually, the creditor accepts an offer, which on average will sit at around 40% of what you owe (not counting settlement company fees).

You’ll be notified about the good news. If you accept the settlement offer, immediately after the funds will get released from your dedicated account and paid directly to the creditor. You will receive written proof of the transaction so that your creditors can’t ever come back after you for the amount they agreed to forgive. That’s right, a portion of your debt gets completely forgiven, wiped away clean!

However, the IRS could send you a 1099 wanting to get paid taxes on all that money saved. To them, it’s extra income that you’ve just earned. Is that truly what it is? No, of course not. So, next, you’ll need to file a Form #982. IRS Form 982 is “the reduction of Tax Attributes Due to the Discharge of Indebtedness. This form is used to determine under the circumstances described in section 108 the amount of discharged indebtedness that can be excluded from a person’s gross income.”

A debt negotiation program comes with pros and cons. It’s important to understand both the pros and cons before joining on a debt settlement program in order to proactively deal with certain situations and make the best of your program.

Tennessee consumers can read more about debt settlement (pros and cons) — by visiting this page next.

Or just call one of our IAPDA Certified Tennessee debt settlement enrollment specialist’s to learn more at (866) 376-9846.

Downsides of Debt Settlement Programs in Tennessee

Most of the downsides related to a debt negotiation program have to do with the fact that a person’s creditors are not paid on a monthly basis. As a result, credit scores can get negatively affected. There is a chance your creditors can issue you a summons to go to court. In many cases, credit card lawsuits are fraudulent and inaccurate, where if disputed they can easily get dismissed. So for that reason, if you join a debt settlement program and get sued, don’t fear the lawsuit just send it to the attorney right away so that the law firm can deal with it for you. Just like a debt can get settled and resolved, in most cases a summons will have the same solution.

As far as a person’s credit getting negatively impacted, this happens because late fees and collection marks can get reported on a person’s credit report. If a person is already delinquent on payments before joining this type of program their credit may not have any negative impact on it because it’s already been adversely affected. The settlement program itself is not what negatively impacts a person’s credit score, like how bankruptcy would affect credit scores. The act of falling behind on monthly payments is what affects credit scores. With debt settlement, you must be delinquent on payments for the plan to effectively work.

No matter what debt relief company is helping you, and no matter what state you reside in, NY, Iowa, New Mexico – all debt settlement programs have the same potential adverse consequences that consumers need to be aware of. A top-rated debt settlement company knows how to deal with negative situations, is transparent with clients, has a large customer service center to properly communicate with clients and deal with creditors, and specializes in settling debt or works with the best debt settlement attornies.

Debt Validation in Tennessee

Debt validation challenges the debt collection companies, forcing them to prove a credit card account is valid.

Even though you may have purchased items on a particular credit card at some point, it doesn’t mean the debt is valid. There could be unauthorized fees that were added in for services that you never agreed to, and if that’s the case the collection agency can’t prove the amount they claim you owe is accurate. Even if what they claim you owe is off by $5, that can result in a debt become legally uncollectible.

Debt collection companies must abide by the laws and collect on debt in a legal way, but do they always? No!

In fact, it’s common for Tennessee debt collection companies to illegally collect money on debt. When these unreputable debt collection companies get challenged and a debt is disputed, often they can’t produce accurate records and documentation to prove they’re “legally collecting” on the debt.

In other words, we can offer you a solution where your debts get disputed and if proven to be invalid you may not have to pay the debt and it could get removed from your credit reports.

Debt validation can be the least expensive route to deal with debt.

Read more about how a debt validation program works.

Special Tennessee Hotline: Call 423-758-3414 for free information about Debt Relief, Settlement and Consolidation Programs in Knoxville, Memphis, Chattanooga, Gatlinburg, Murfreesboro, Franklin, Johnson City, Jackson, Cleveland, Kingsport, Oak Ridge, Cookeville, Maryville, Bristol, and Gallatin Tennessee.