Compare the Best Arkansas Debt Relief Programs:

- (1.) Arkansas Debt Settlement Program (also known as debt negotiation)

- (2.) Arkansas Debt Consolidation / Debt Management Programs

- (3.) Arkansas Consumer Credit Counseling Programs

- (4.) Arkansas Attorney Debt Validation and Debt Resolution Program

Whether you live in Little Rock, Bentonville, Hot Springs, Fort Smith, or Fayetteville, Arkansas debt relief programs can help you escape high unsecured loans, medical bills, collection accounts, and credit card debt. Relief in Arkansas can be achieved through debt settlement and consolidation programs.

Arkansas debt collection laws, the statute of limitations, and debt validation make it possible for a person to walk away from a debt without paying and get bills reduced. Credit card debt relief programs, including consumer credit counseling in Arkansas, are another route to help consumers reduce credit card interest rates and consolidate Debt.

Do you need help with Debt and live in Arkansas? Debt relief and consolidation options are explained in the following guide. We will also explain Arkansas debt collection laws. Arkansas residents with over $7500 in unsecured Debt and experiencing financial hardship can qualify for Arkansas debt assistance.

Rated “Best Arkansas Debt Relief Company”

- #1 Rated Arkansas Debt Settlement Program for 2022, according to Trusted Company Reviews

- Offering Arkansas Debt Consolidation Programs Since 2004

- Pay No Fees Until After a Debt Negotiator Settles a Debt

- A+BBB Rated and IAPDA Certified Arkansas Debt Settlement Company

- Get the Best Savings Compared to Other Arkansas Debt Relief Programs

Arkansas debt counselors can provide you with a free consultation by calling (866) 376-9846.

Table of Contents: Arkansas Debt Relief, Settlement and Consolidation Guide:

Financial hardships created by COVID-19 have resulted in millions of consumers across the state seeking debt consolidation. Financial scams in Arkansas are another problem that people need to beware of, which we will discuss.

10 Ways to Spot “Scam Debt Relief Programs” in Arkansas

- Arkansas debt settlement laws prohibit companies from charging fees before settling a debt. Read your contract and ask questions to ensure no fees are being charged before an account is settled.

- Government-backed debt help schemes: Arkansas government credit card relief programs do not exist. There are government programs for federal student loans, but not for credit card debt. Relief for student loans can be achieved at StudentLoans.gov. Arkansas debt relief, settlement, and consolidation companies have no affiliation with the government.

- Check online reviews to spot scams. If you received a phone call from an Arkansas debt consolidation company and did not request them to call you, first check their Better Business Bureau (BBB) rating and profile. On their BBB profile, look for time in business, complaints, and letter rating (i.e., A-F). Do not sign up for a debt relief program in Arkansas if the company has lots of complaints and a poor rating at the BBB.

- Non-profit consumer credit counseling companies in Arkansas can be found on the Department of Justice’s (DOJ) website. Go to the DOJ website and search for Arkansas’s licensed consumer credit counseling companies.

- Ask for information: Before signing up for any credit card relief program in Arkansas, ask the company to send you information by email. Check the email to ensure it was sent from the same domain as the company’s website. So, for example, if Golden Financial Services sends you an email, it comes from @GoldenFS.org., the same as our website.

- In Arkansas, debt settlement companies cannot guarantee to settle your Debt at a specific rate. The settlement savings will vary, and settlement companies cannot guarantee a particular rate that creditors will be willing to settle for. Results will vary if a settlement company guarantees you that they can settle a debt at a specific rate before negotiating with your creditors.

- Debt consolidators and lenders in Arkansas must fully disclose the interest rates and fees associated with a loan. Carefully read the loan contract before applying. Make sure to add up all fees and interest that will get paid throughout the debt repayment period of the loan to ensure the consolidated loan will cost you less than what you’re currently paying. Many lenders will overcharge you for a loan, and although this may not be considered a scam, it is fraudulent, and you need to beware of these types of lenders. In most cases, if a person’s credit score is under 700, it’s not wise to get a consolidation loan because a low credit score will result in high interest and fees unless the loan’s point is to build a positive payment history for building credit.

- No company should offer you a program that is supposed to be helping with Debt before learning about your income and expenses. Think of a financial specialist or credit counselor as a doctor. A doctor would not recommend a medicine before asking lots of questions about your health condition and symptoms. Credit counselors are the same. They should first ask questions about your budget and current financial situation.

- If the company uses words to explain their program that includes “quick,” “easy,” “erase,” and “guaranteed to eliminate debt,” – it’s most likely a scam.

- Beware of debt relief lawyers that pitch bankruptcy before exploring other options. First, take a consumer credit counseling bankruptcy course if you’re considering bankruptcy. Credit counseling must occur before you file for bankruptcy; debtor education must occur after you file. A certificate of completion for credit counseling and debtor education is required, but before the filer’s debts can be discharged. source: https://www.uscourts.gov/

Arkansas Debt Relief & Laws

The following page will explain the best Arkansas debt relief, consolidation, and settlement options and discuss consumer protection laws.

Through the Fair Debt Collection Practices Act (FDCPA), Arkansas debt relief protects consumers from abusive and deceptive collection practices. Unfortunately, Covid-19 hit Arkansas, and as a result, many consumers lost their income and are currently experiencing financial hardship. People can’t afford to make their monthly payments. Eventually, creditors will start to harass people into paying their Debt, so you need to be prepared. Understand what creditors can and cannot do.

Under the FDCPA – debt collection companies in Arkansas cannot do the following:

- collectors cannot call you before 8 a.m. or after 9 p.m.

- collection agencies cannot continue to call you after you’ve requested in writing for them not to contact you or after you join a debt settlement program in Arkansas. An attorney notifies your creditors that you have attorney representation

- debt collectors cannot harass you, lie to you, or try to scare you into believing that you will get arrested over your Debt (scare tactics are illegal!) They have to be honest and ethical.

- AR debt collection companies are not allowed to call a person’s place of employment after you’ve informed them “not to call you at your job.”

Keep track of any phone calls that you may receive from an Arkansas debt collection company to report these companies to the Attorney General’s office.

The FDCPA is just one of several laws about debt collection in Arkansas. And by the way, most of these laws are not state specific. So whether you reside in Arkansas, Tennessee, or Florida, you can use these same laws.

Here are a few more consumer protection laws for AR residents:

- Credit Card Act – protects you from credit card companies taking advantage of you and charging high and unfair fees.

- Fair Credit Billing Act – protects you from credit card companies charging you for unauthorized services.

- Fair Credit Reporting Act – protects your credit report from showing inaccurate information that hurts your credit score. In addition, this law makes it possible to make credit disputes.

- Statute of Limitations for credit card debt in Arkansas – after five years from the last payment you made on a credit card, the creditor can no longer sue you over the Debt. Below, we go into a more detailed explanation of this law.

- Truth in Lending Act – Arkansas debt consolidation loans and lenders must include clear disclosures about fees and interest rates included in their loans and cannot charge outrageous fees.

How to use consumer protection laws and protect your consumer rights

Arkansas debt relief and settlement programs use federal laws when settling or disputing Debt.

Golden Financial Services can provide you with a free consultation by calling (866) 376-9846. We will go over each program during your consultation and explain how these plans use federal laws to help you deal with your Debt.

Here’s an example of how, when settling Debt, the FDCPA can create leverage.

- We find out your creditor calls you before 8 a.m.

- The call is documented, so we have proof of this violation.

- The Arkansas debt settlement attorney then contacts your creditor, illustrating the proof of the violation.

- By illustrating proof of the violation, the attorney can use this violation as leverage, saying: “either agree to a settlement, or we will proceed with suing you over the FDCPA violation.”

- In the creditor’s best interest to agree to a settlement over risking getting sued over violating the FDCPA?

Arkansas Debt Statistics

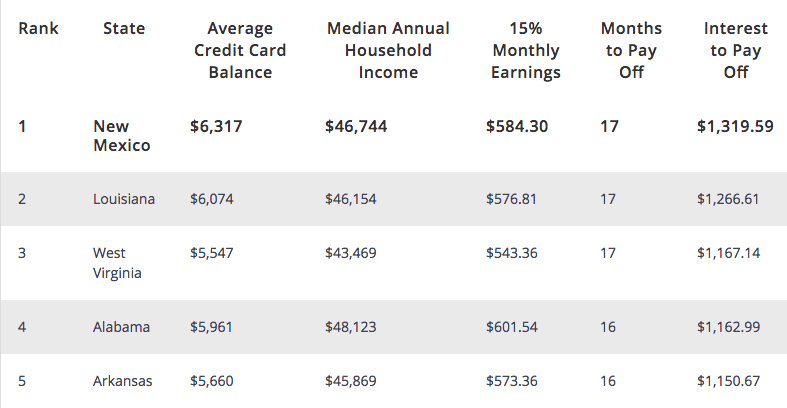

The average credit card balance for a person in Arkansas is $5,660. To pay off this amount of Debt would take 16 months and cost $1,150.67 in interest alone (for someone living in Arkansas). Unfortunately, Arkansas is not only a state with beautiful mountains, rivers, and hot springs. The state is also plagued with high credit card debt and student loans.

Credit card debt is everywhere – it DOES NOT discriminate! “Consumers in key metro areas around the Natural State are carrying an average credit card debt ranging between $4,700 in Springdale and Pine Bluff to a high of $6,783 in Bentonville from CardHub. According to the study, the lowest Debt in the state was found in West Memphis at $4,370”.

Arkansas is doing pretty well compared to New Mexico, where the average credit card balance is $6,317!

In front of Arkansas, you can see the average credit card balance per person in Alabama is $5,961; in West Virginia, it’s $5,547, and in Louisiana, it’s $6,074. Have you heard enough of these depressing statistics? Let’s talk about solutions next!

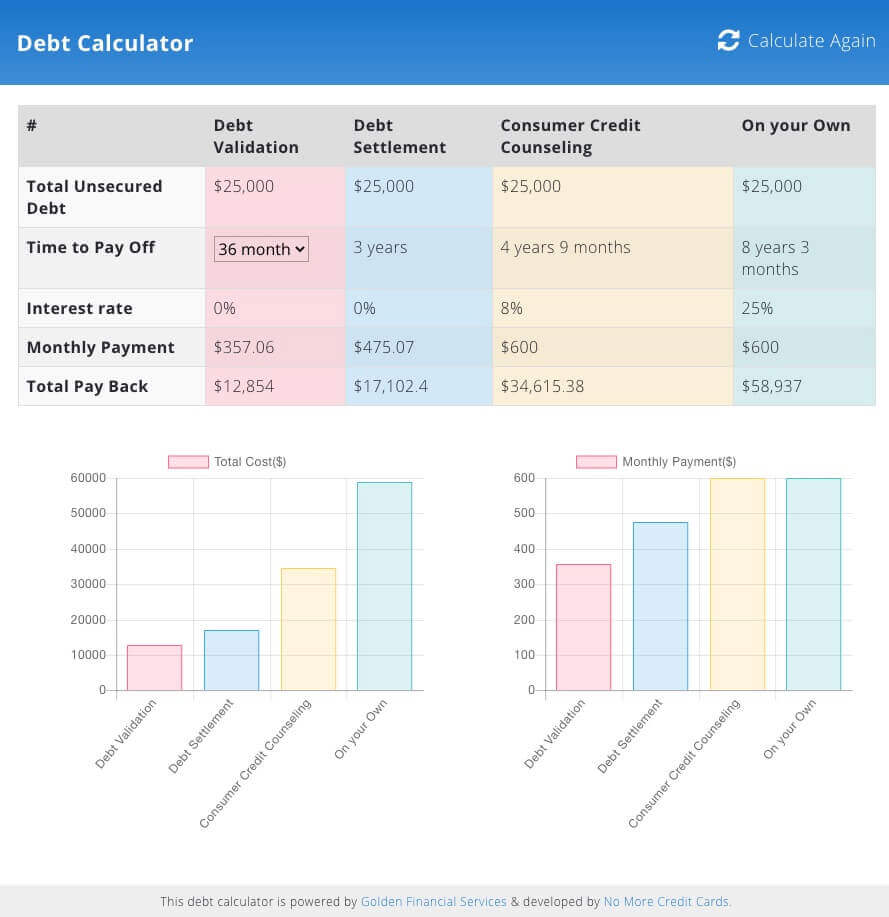

With a debt settlement program in Arkansas, it would only cost around $4,245 to pay off that same $5,660 in credit card debt, and maybe even less. This amount includes all costs and fees.

Keep in mind, this is just one Debt, and we are using it as an example to show how much a person can save with debt settlement.

You need to have over $10,000 in credit card debt to qualify for Arkansas debt relief.

See how quickly you can become debt-free with this Arkansas debt reduction calculator tool:

Arkansas Debt Reduction Calculator (compare savings on each program)

Here at Golden Financial Services, you can choose from multiple debt relief programs. Arkansas consumer credit counseling, debt settlement, and consolidation programs are available. You get the power to make a choice based on what suits you best.

To start, call (870) 568-2928 for a free consultation with an IAPDA certified counselor.

Credit Card Debt Laws in Arkansas

According to state law, the statute of limitations on credit card debt in Arkansas is only five years, the state law (statute 4-3-118). So if you’ve stopped making payments on a credit card, after only five years from the date of delinquency, the Debt expires.

Your creditors can no longer pursue any legal remedy to collect on the Debt. But what most people DON’T know about is that even if you’ve recently fallen behind on monthly payments, you too have options.

Consumer Credit Counseling Arkansas

Are you only 2-3 months behind on monthly payments?

If so, credit counseling may be your best solution.

Consumer credit counseling agencies in Arkansas can:

- reduce credit card interest rates

- waive late fees

- re-age your late payments to your current status, helping your credit score improve in some cases

Are you behind on monthly payments by more than three months?

If this is you, there’s a good chance your Debt was already written off and sold to a third-party collection agency.

If a debt collection company can’t prove the Debt’s validity, it can become legally uncollectible. A legally uncollectible debt does not have to get paid and can’t be reported on a person’s credit.

Hardship debt relief programs can challenge your Debt and force creditors to prove that they are legally authorized to collect on it. It’s hard to believe that debt collection companies often can’t prove a debt is valid.

The Fair Debt Collection Practices Act is another law that protects Arkansas residents. Collectors are limited on what they can say to you over the phone and even on the hours they are legally allowed to call you.

Often, collection agencies violate these federal laws, and consumers are unaware of the violation.

Debt Settlement Arkansas

Debt settlement programs in Arkansas are through an Arkansas local law firm. That means an attorney will represent you. If credit card companies call you after you get approved for the program, they violate the Fair Debt Collection Practices Act.

Your creditors can get sued for $1,000 per violation under the FDCPA. This money gets awarded to you. Also, an Arkansas attorney will use any legal violations that credit card companies commit as leverage when settling a debt.

Golden Financial Services can introduce you to an A+ Better Business Bureau-rated law firm that can settle your Debt for around half of what you owe before fees. A portion of your Debt can get forgiven entirely. Even if you have ten debts, once approved for the plan, you only need to make one affordable monthly payment.

- Personalized plans

- Tailored to fit your needs

- Choose how fast you want to get out of Debt

- Pay only a single monthly payment for all debts

- See the light at the end of the tunnel and know when you’ll be debt-free

- Get credit restoration and a money-back guarantee on select plans

Is your total debt amount above $10,000?

You may be eligible for debt relief. Arkansas residents can call (870) 568-2928 for a free consultation with an IAPDA certified counselor.

Arkansas Debt Relief Reviews

- TrustedCompanyReviews.com rated Golden Financial #1 for Debt Relief.

- In addition, the better Business Bureau rates Golden Financial A+.

- One of the few debt relief companies on Google has an average rating of 4.9 out of 5-stars.

Arkansas Debt Relief Eligibility Guidelines

- credit cards (current or past-due qualifies)

- private student loans qualify

- almost all unsecured Debt will qualify

- must have over $10,000 in unsecured Debt to qualify

If you have a financial hardship, you can take advantage of a debt settlement program. Arkansas residents can save up to 35% on their balances with debt settlement and become debt-free in around 36-months.

You can have a plan tailored for your specific needs and financial goals; plans even include credit repair and a money-back guarantee – ensuring you get results or don’t pay!

There’s a reason why Golden Financial Services was rated #1 by Trusted Company Reviews and is A+ rated by the Better Business Bureau.

If you only have high-interest credit card bills, you can use consumer credit counseling to reduce your payment and interest rates without hurting your credit.

Have debt collection accounts and creditors harassed you? You can stop the harassment and force your creditors to prove the Debt valid before they continue coming after you.

You can get immediate relief and breathing room, become debt-free and achieve financial freedom as quickly as 18-months.

Are you drowning in Debt? Swimming Upstream? Oh, buoy! Dial us. Be rescued. Call to find out what plan is right for you. Arkansas IAPDA certified debt counselors are a phone call away at (870) 568-2928.

You can compare multiple debt relief programs available in Arkansas during your free consultation.

You can learn how to get out of Debt from a Certified professional. You can then choose the route you want, and we will help you get approved with ease.

For student loan debt – Arkansas consolidation and settlement services can help.

Federal student loans can be consolidated into a single and affordable payment. We will put you on the plan that offers the most loan forgiveness and the lowest possible monthly payment.

These can be reduced and settled for less than the total amount owed for private student loans.

For credit card and unsecured debt relief help

Arkansas residents can use debt settlement to reduce their balances.

Debt consolidation can be used to consolidate payments and reduce interest.

And debt validation can be used to dispute a debt before paying it because the debt collection company often can’t validate it — meaning — you may not have to pay it.

Debt Relief – Arkansas

Here at Golden Financial Services, Arkansas, debt relief programs can rescue consumers who are suffocating in Debt.

Resolve credit cards, bank loans, debt collection accounts, personal loans, finance company loans, and any debt.

Afraid to check your mail because you may find a bill you can’t afford to pay?

Are you sick of creditors treating you — like you did something wrong?

Are you ready to become debt-free?

And start saving again?

We can give you an affordable monthly payment that gets you out of Debt — completely debt-free — all within 3-years (give or take a few months).

What’s your financial goal?

Our specialists can tailor a plan that allows you to achieve your financial goals.

You have debt relief programs available, ranging from debt consolidation to debt settlement. Arkansas debt relief programs are proven to work at Golden Financial Services.

Do I qualify for Arkansas Debt Relief?

If you answer YES to any of the following questions, you could qualify for our Debt Relief Arkansas Program.

- Are you unable to pay off your balances at the end of the month?

- Do you have over $7,500 in total unsecured Debt? ($7,500 to $300,000 in debt OK)

- Do you ever buy items with your credit card because you don’t have the money to pay for them without your card?

- Do you notice that your health is negatively affected by high bills?

- Are you fighting with your spouse or family members over money?

- Are there times when you can only pay the minimum payment on your accounts?

- Have you ever been turned down for credit in the last year?

- Are Arkansas debt collection companies harassing y0u?

- Are you living paycheck to paycheck?

TAKE ACTION — THE CALL & CONSULTATION IS FREE.

Do debt relief programs in Arkansas affect credit?

Debt settlement and validation programs can leave your credit in bad shape over the program’s first year. There’s no way around that. But if you’re deep in Debt, your credit might already be in bad shape. Just the fact that your credit utilization ratio and Debt income ratio are in the wrong way right now can bring your entire credit rating down. Lenders won’t issue a person any credit with a low-interest rate if their credit score is less than 700 in most cases, but you probably already know that. As debts are either settled and resolved or disputed and removed from credit reports, credit scores may improve. However, when you join a program to get out of Debt, there’s no guarantee that your credit score will improve. Improving your credit score establishes new and positive credit once your existing debts are eliminated.

When a debt is settled for less than the total balance owed, late marks and collection marks can remain on credit even after the Debt gets paid. To improve your credit score, you’ll need to establish new credit once you become debt-free, make payments on time every month, and your credit score will improve! Contact Golden Financial Services today if you’re sick of struggling to pay Debt. We will help you to achieve financial freedom fast!

Does debt consolidation in Arkansas affect credit?

Using a debt consolidation loan to pay off existing debts can improve your credit score. You are almost instantaneously improving your credit utilization ratio by paying off all of your current credit cards and other unsecured debts.

The new debt consolidation loan could cause a negative inquiry on your credit when applying for it. Still, the positive action of paying off multiple existing credit cards with the debt consolidation loan at once outweighs the negative inquiry that will show up on your credit. Just be careful not to contact just any Arkansas debt consolidator. Avoid lenders that charge high upfront fees and interest.

Another popular way to consolidate Debt in Arkansas is to use a balance transfer credit card. Unfortunately, balance transfer cards come with upfront fees that cost between 3%-5% of the debt amount you transfer onto the card. For example, if you transfer $30,000 of credit card debt onto a balance transfer card, the upfront fee will cost you $1,500. A better option is to use Arkansas debt relief programs rather than using a loan or a debt consolidation credit card to pay off existing credit cards. You can permanently fix your problem by eliminating a portion of your balances, making Debt – EASY TO PAY. Call for Arkansas debt relief today!

2 comments on “Arkansas Debt Relief”

Comments are closed.