Illinois (IL) debt relief, settlement, and consolidation programs at Golden Financial Services (GFS) have helped consumers get out of debt since 2004. Consumers can choose from multiple debt relief programs in IL. Debt settlement and credit card consolidation, consumer credit counseling, and consolidation loans are all viable options to consider.

For free information about Illinois debt relief programs, call Golden Financial Services today at (312) 638-6276. Our IAPDA Certified Counselors can provide you information about debt relief, settlement, and consolidation programs. Illinois residents with over $7,500 in unsecured debt, including credit cards, medical bills, collection accounts, car repossessions, and personal loans – may qualify for multiple options. If eligible for a program that GFS offers, we can get you approved within the hour!

- You can consolidate payments into one.

- You can choose how fast you want to become debt-free

- You can avoid paying interest

- During your consultation, you’ll get free educational information about Illinois debt relief services (including the Pros and Cons of each option)

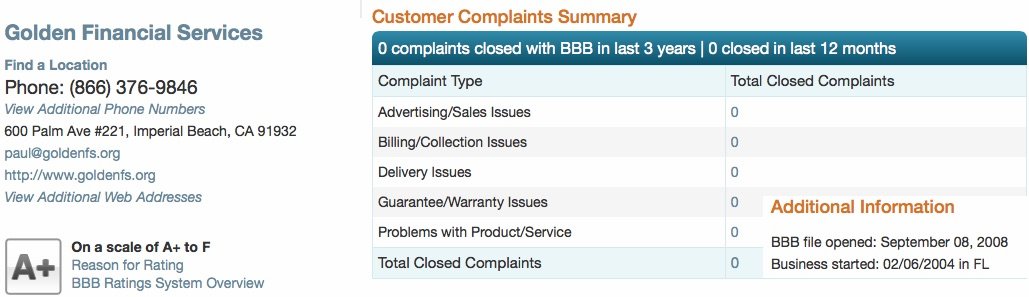

Best Illinois and National Debt Relief Company for 2021:

- GFS is A+ rated by the Better Business Bureau

- GFS was the #1 Rated Illinois debt relief company for 2021 by TCR

- GFS offers the Best-Rated Credit Card Debt Relief Programs (click to verify credentials)

- GFS is 5-star rated on Google for Illinois debt relief program reviews

What are the best debt relief programs in Illinois?

Consumer credit counseling programs in IL can reduce credit card interest rates and consolidate payments. GFS recommends that you start by getting a free consultation from a non-profit and licensed IL credit counselor before making up your mind about signing up for a credit counseling program. Illinois debt settlement programs can save you more money and allow you to become debt-free much faster.

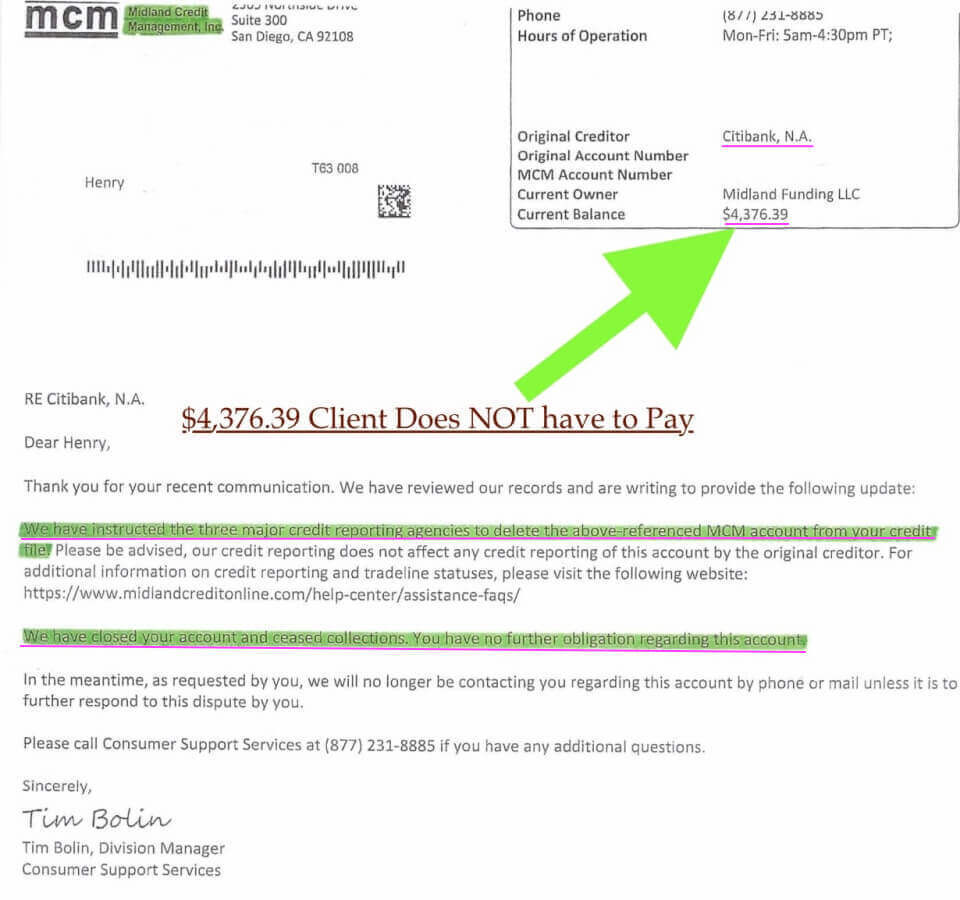

And if you’re looking to save even more, a validation program could offer you the best savings. Validation programs can also result in a debt getting removed entirely from a person’s credit report. Here’s an example of that:

Illinois Credit Card Debt Relief Program Example:

(client resolves a debt for $4,376.39, and the program gets the collection account removed from all three credit reports)

A validation program doesn’t actually pay creditors but can offer you the best way to get out of high credit card debt.

You have two options if you have a speeding ticket. Pay it. Or dispute it, even though you may have been speeding. It’s always worth disputing a speeding ticket because the police officer may have done something wrong, may not show up to court, may have made mistakes when writing the ticket, and many other reasons that could result in dismissal of a speeding ticket. Similarly, with debt, validation gives you the right to dispute it. And in many circumstances, accounts are proven legally uncollectible and don’t need to be paid.

One last point is that we only work with top-rated companies and law firms. The companies that we work with have to meet certain standards and criteria. For example, we will only recommend a law firm or debt relief company in Illinois with a Better Business Bureau rating of “A” or higher.

Illinois residents can speak to an IAPDA Certified expert for FREE, making it easy to get out of debt! Call Today, and We Look Forward to Helping You! This page will act as a guide to Illinois debt reduction programs. GFS does not offer all of these options. The information is being provided purely for educational purposes.

Bankruptcy Debt Relief Illinois

Are you considering bankruptcy? Below we explain how to qualify and how to file. We also show you alternatives to bankruptcy that could save you more money and restore your credit. Illinois bankruptcy lawyers are making a fortune right now off bankruptcy. As a result, most lawyers will tell you that bankruptcy is the right solution, even if it’s not. We will show you the truth about bankruptcy.

- Illinois debt relief options can be explained to you at (312) 638-6276. Take advantage of a free consultation with a certified expert.

- If you qualify for a plan, you can enroll with ease. We can even have a top-rated Illinois debt relief law firm meet with you before signing up to ensure you are 100% comfortable.

- Within 30-60 days, all of your creditors will get notified and will have to start calling the law – and immediately STOP calling you!

- Within 30 minutes from now, you can have one comfortable and affordable payment for all of your debts.

- If you qualify for validation, the negative information will begin to get disputed immediately on credit reports, including late marks, collection accounts, and even negative inquiries. Validation is the only Illinois debt relief program that includes FREE credit restoration, so within 24 months, all of your credit and debt problems could be behind you.

- Want guarantees? The attorney model debt settlement IL plan includes an assurance of performance, which is the language attornies must use since they are prohibited from saying the word “guarantee.” An Assurance of Performance guarantees a certain level of performance based on “your savings.” Validation does include a money-back guarantee, so we have you covered from all angles. You will only pay if results are achieved.

Illinois Debt Relief Program Benefits:

- Monthly payments get consolidated into one reduced payment. How your monthly payment gets allocated depends on if you join a debt settlement, debt validation, debt consolidation, or consumer credit counseling program.

- You can choose how fast you want to become debt-free. Plans range from 1-5 years.

- The debt relief company takes over communications with your creditors, giving you immediate relief. If you choose the Illinois debt settlement program, your creditors must direct all correspondence to your attorney–letting you live in peace. If you select debt validation, third-party collection companies must immediately stop calling you until proving the debt to be valid, which surprisingly they often cannot do. If you choose consumer credit counseling, your past-due payments can get re-aged to “current on payments,” putting a quick halt to all creditor phone calls.

Summary of Illinois Debt Relief Programs (includes Pros Vs. Cons)

What type of debt qualifies for Illinois debt relief programs?

Illinois debt relief programs can resolve credit cards, student loans, medical bills, financial loans, bank loans, debt collection accounts, and store cards. Pretty much any type of unsecured debt will qualify.

Make a quick call and learn your options.

Call for Illinois Debt Relief Eligibility 866-376-9846!

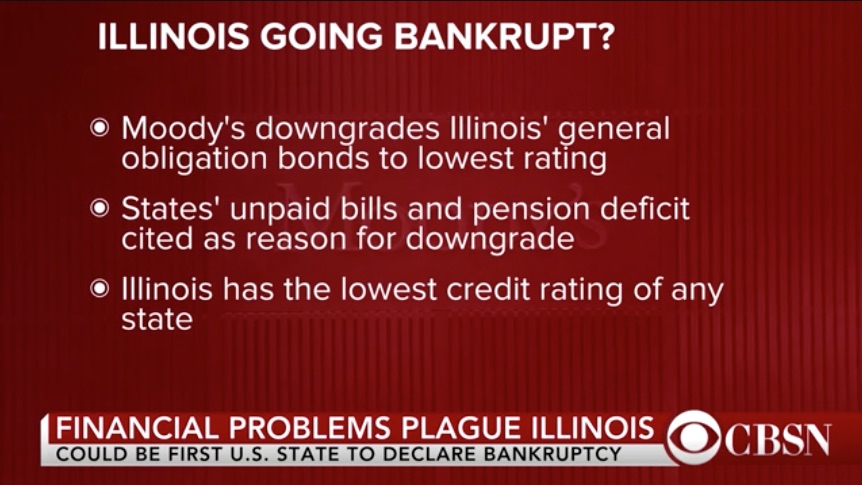

Could Illinois be the first state to file for bankruptcy debt relief?

Consumers in Illinois are not the only ones struggling financially. As a state, Illinois is drowning in debt.

- According to the conservative-leaning Illinois Policy Institute, the state’s pension debt burden stands at $27,000 on a per-household basis. https://www.cbsnews.com/news/could-illinois-be-the-first-state-to-file-for-bankruptcy/. Meaning, the state of Illinois is promising people a pension that they can’t afford to pay. The state government alone owes $83 billion to its pension funds. On top of this, the state also owes 54.2 billion towards retiree health benefits.

- The state of Illinois can’t afford to pay all of its bills, partly because hundred’s of consumers have moved out of Illinois, resulting in fewer taxpayers and a -$50,800 Taxpayer Burden.™

- “Illinois only has $28.8 billion of assets available to pay bills totaling $244.9 billion.” https://www.statedatalab.org/state_data_and_comparisons/detail/illinois

- Illinois is currently experiencing a $216.1 billion financial hole. To fix it, every taxpayer residing in Illinois would have to send $50,800 to the state.

- What about consumer debt? Illinois ranked 24th in the country for having the most credit card debt, just ahead of Indiana, Iowa, and Alabama. The average credit card debt per household in Illinois is $7,278. This is high compared to states like Pennsylvania, where the average credit card debt per household is only $6,065.

- The average credit score for a consumer in Illinois is 683.

- The average student loan debt in Illinois is $29,214,

Should I file Bankruptcy?

Attornies will promise that bankruptcy will give a person a fresh start and wipe away all of their debt. However, they fail to explain the long-term devastating effect that bankruptcy puts on a person’s credit report.

If you want to rent a home, buy a new car or even apply for a new job in the future, bankruptcy could get you turned down and rejected. Bankruptcy can lower a person’s credit score by close to 200 points. Debt settlement programs can do the same, but what’s worse about bankruptcy is the fact that it stays on your credit report for up to ten years.

What Illinois, debt relief program improves credit scores?

Bankruptcy may seem like a quick and cheap fix for your debt problems, but in reality, it’s the most expensive debt relief option in Illinois. Debt relief programs are a much less costly route and can leave you in healthy financial shape.

Consumer credit counseling is the one Illinois credit card debt relief program that can improve a person’s credit score. Past-due payments can get re-aged to show “current status.”

When is bankruptcy debt relief the right option for an Illinois resident?

There are certain circumstances that only bankruptcy can resolve, but these cases are rare. If you have multiple lawsuits against you and are on the urge of foreclosure, in these cases, bankruptcy can be your best option.

Chapter 7 bankruptcy won’t save your home, but Chapter 13 can. However, with Chapter 13, you must pay at least half of your debt. Having said that, why would anyone choose Chapter 13? Chapter 13 bankruptcy can save a person’s home from foreclosure.

How can I find out my best debt relief option?

Debt relief programs in Illinois offer you the ability to consolidate all of your debt into one low monthly payment.

Illinois debt relief options consist of:

- Financial hardship programs, like debt settlement and validation

- Chapter 7 and 13 bankruptcy (as a last case scenario)

- Debt consolidation loans

- Consumer credit counseling.

Let’s run through a few scenarios to help you figure out the best route for your situation.

Do you have multiple credit card lawsuits?

Chapter 7 bankruptcy can wipe away credit card lawsuits. Right after filing for bankruptcy, an automatic stay is filed. The automatic stay puts an immediate stop to ALL collection activities, including creditor harassment, foreclosures, and lawsuits.

On the other hand, if you don’t have any credit card lawsuits:

- Consumer credit counseling Illinois plans will lower interest rates and consolidate payments into one.

- Debt settlement Illinois plans can reduce balances by up to half before fees and eliminate interest.

Do you owe more than $10,000 in credit card debt and (no lawsuits filed against you)?

You are a perfect candidate for a credit card debt relief program. You have three options to choose from, including debt settlement, debt validation, and consumer credit counseling.

Example of how credit card debt relief programs work:

If you owe $20,000 in credit card debt:

When paying minimum payments on your own, you are paying around $500 per month.

Once approved for an Illinois debt relief program, your payment could get reduced to as low as $301.54.

With debt validation, if you owe $20K in debt, you only need to make a total of 36 payments of $301.54. Your total savings would be $9,146.10.

Debt validation is only for consumers who can’t afford to keep paying minimum payments or higher. Credit scores can go down after joining a validation program if current on monthly payments before joining. If you are already behind on monthly payments, your credit has already been adversely affected.

Need credit card debt relief? Illinois offers three options:

- The Illinois debt settlement program can resolve credit card debts in around 36 months.

- Debt validation can dispute the validity of credit card debts. There is a chance you may not have to pay the debt back and can get it completely removed from your credit reports.

- Consumer credit counseling can reduce credit card interest rates while consolidating payments into one affordable payment.

Illinois credit card relief programs are available at (312) 638-6276. Call now!

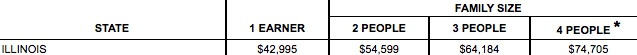

To qualify for Chapter 7 bankruptcy, you MUST PASS the means test

To be eligible for Chapter 7 bankruptcy, your family’s income needs to be lower than the median family income in Illinois (based on “household size”).

Median Family Income by Family Size in Illinois:

Do you project your disposable income to be higher than $10,000 over the next five years? If so, you won’t qualify for Chapter 7 bankruptcy.

Is your disposable income over the next five years less than $6,000 (or $100/month)? You could get approved for Chapter 7 bankruptcy.

How to file for bankruptcy in Illinois:

- You must pass the means test. A means test will show the bankruptcy judge that your income is too low to afford any other debt relief option. Your income is based on the last six months when it comes to filing for bankruptcy. For example, if you submitted your bankruptcy paperwork on November 20, 2019, you must include all income received starting May 1, 2019, and continuing through October 31, 2019.

- The Bankruptcy Abuse and Consumer Protection Act of 2005 (BAPCPA) requires consumers who file for Chapter 7 or Chapter 13 bankruptcy to complete a Bankruptcy Credit Counseling session with an approved non-profit counseling agency.

- To file for bankruptcy, you need to hire an attorney.

- Fees can range from $1,800 to $3,000.

Chapter 13 bankruptcy for Illinois residents:

Chapter 13 bankruptcy is the most common type of bankruptcy and the most expensive to file. Everybody wants to do Chapter 7, but most consumers only qualify for Chapter 13.

With Chapter 13, you are paying a portion of your debt back, but chapter 13 offers protection from foreclosure. Chapter 7 can wipe away all of your debt, including lawsuits, but you may not be able to save your home.

Debt Validation in Illinois

Before you pay a debt collection company, use debt validation to ensure that they are legitimate and abiding by the laws.

Debt validation is when you dispute a debt.

If your original creditor sold your debt to an unscrupulous debt collection company, we would find out after disputing the debt and seeing if the debt collection company can validate it.

When we say “validate,” we refer to; Provide the necessary documents to prove the debt collector can legally collect on an alleged debt.

Examples of what debt validation can require debt collection companies to provide:

- their Illinois debt collector license

- the original credit card contract that was signed

- a 15-page debt collector disclosure statement

- accurate accounting statements to ensure there are no unauthorized charges

If the debt collection company can’t provide any of these requested items:

- they can no longer legally collect on the debt

- they can no longer come after you

- they can no longer report it on your credit

- they can no longer call you

- you can no longer mail stuff to you

Find out if debt validation is right for you by calling toll-free (312) 638-6276.

There are federal laws, including the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, the Credit Card Act, and several other laws that protect consumer rights – and that debt collection and credit card companies must obey.

Debt Settlement – Illinois

Benefits of Debt Settlement in Illinois

- Reduce the balances on credit cards and unsecured debts – which no other Illinois debt relief program does.

- Provide one single monthly payment – typically lower than the debt consolidation or consumer credit counseling program.

- Resolve all unsecured debt within 24-42 months on average – one of the quickest routes to becoming debt-free if a client makes all of their scheduled monthly payments.

Downsides of Debt Settlement

- Since only one debt at a time is settled and paid off, it is essential to make sure your budget is carefully reviewed to ensure that you can make it through the 24-42 month program.

- Creditors don’t have to agree to a settlement, and they could file with the court to issue a summons. In this case, what is the debt settlement company’s plan of action if either of these cases occurs?

- Creditors may call and harass if the debt settlement program is not an attorney model plan.

- While waiting for all debts to get settled and resolved, interest and fees will continue to accumulate, growing your balances. When accounts do get paid, all interest and fees get mitigated into the settlement and resolved.

- Payments must be delinquent for debt settlement to work – and not paying your bills each month can lower credit scores. Therefore, if a person has a high credit score and low debt to income ratio, debt consolidation may be a better route.

To see a full list of Illinois debt settlement program disclosures, visit this page next.

Debt Consolidation – Illinois

Debt consolidation is a loan used to pay off all other debts – allowing debtors to have only one new low-interest loan to pay back.

Benefits of Debt Consolidation Loans in Illinois

- You get one single monthly payment. Having to manage multiple monthly payments can be challenging to maintain.

- Can reduce interest rates.

- Pays off past due accounts and all balances in full.

- Can be debt-free in around 4-6 years on average.

- It could help credit scores.

Downsides of Debt Consolidation

- Some debt consolidation companies charge high fees and interest, defeating getting a debt consolidation loan.

- Illinois debt consolidation lenders often charge high fees, leading to a person paying much more than they owe.

- The new loan’s monthly payment will not be much or any lower than if the debtor was to continue paying minimum payments.

- Low-interest debt consolidation loans are challenging to get approved for, especially if a person has high utilization of credit ratio, low credit score, and high debt. Check with a local credit union over any other financial company if you search for a low-interest loan. Credit unions will be your best bet.

Debt Relief Scams in Illinois

The best way to avoid getting scammed is to do your research on the company. Do they have complaints at the Better Business Bureau? Do they have an “A,” “B,” “C,” or worse rating? Does the company have any government action against them? Do they have good reviews online? Is there any assurance of performance or guarantee included?

Top Illinois Debt Relief, Consolidation and Settlement Company

In 2017, Golden Financial Services was rated #1 Debt Relief Company in the Nation by Trusted Reviews (click here to verify)

Most companies offer one or two programs and often try to force applicants into those programs even if they are not right for an individual to make a sale.

At Golden Financial Services, we’ve aligned ourselves with industry-leading debt relief partners to assist consumers in debt settlement, debt validation, debt consolidation, and consumer credit counseling.

Golden Financial Services has Zero BBB Complaints because we give our clients the right program to accomplish their specific goals and needs. We set our clients up to become debt-free and repair their credit.

Illinois Debt Relief Programs are a Phone Call Away, Call (312) 638-6276 Now.

4 comments on “Illinois Debt Relief”