43 million consumers have medical debt on their credit reports as of 2022, totaling $88 billion dollars, according to a new report by the Consumer Financial Protection Bureau (CFPB). As of June 2021, 58% of this medical debt is in third-party collection status, negatively affecting credit scores. According to the IBD newspaper, “As of June 2021, such debt made up 58% of bills that are in collections and affected Black (28%) and Hispanic (22%) Americans more than whites (17%) or Asian (10%) Americans.”

Medical Debt Relief Guide for 2022

Do you need help with medical bills? Are you interested in learning how to negotiate medical bills on your own? The following medical debt relief guide walks you through everything you need to know about reducing, resolving, and eliminating medical bills. We explain the Medical Debt Relief Act of 2021 and how this law can remove medical bills and medical debt collection accounts from your credit report. Debt settlement and consolidation are medical debt relief programs that can consolidate all of your unsecured debts into one affordable monthly payment, and these plans will also be explained.

Choose a Medical Debt Relief Option to Learn About in Table of Contents:

Ways to Eliminate Medical Debt on Your Own

Before resorting to a medical debt relief program, consider the following steps to help reduce and in some cases eliminate medical bills.

step 1: Request “explanation of benefits”

You receive a medical bill that says you owe $10,000. However, you don’t recall it being that expensive.

Should you pay?

Don’t pay it until you first request an explanation of benefits. The explanation of benefits illustrates how much the insurance company will pay. You should not pay until you first verify the insurance company is paying their portion.

step 2: Appeal the medical debt

Step two: Appeal the medical debt if the insurance company fails to cover everything you feel they should be covering.

step 3: Ask for an itemized copay of the medical bill

Step three: Ask for an itemized copy of the bill to look for mistakes. Sometimes, by asking for an itemized bill, your bill can be cut in half because the medical billing department will take off questionable items. An example of questionable items could be if the hospital is charging you thirty dollars for a bandage.

The Medical Debt Relief Act 2021

The IBD newspaper issued on the week of March 28th, 2022, revealed; “The nation’s largest credit bureaus will remove cleared medical debts from credit reports starting in July 2022. These debts can stick around as a black mark on credit reports for up to seven years, even if they are paid off, making it harder to borrow for things like homes and cars.”

So now’s the time to pay off medical debt collection accounts. You can settle the debt and pay off your medical bills at a fraction of what you owe through debt settlement programs. Prior to this news, debt settlement could leave collection accounts on a person’s credit report for up to seven years.

More details about the Medical Debt Relief Act of 2021:

According to the Senate of the United States and Congress.gov, the Medical Debt Relief Act is: “A bill to amend the Fair Credit Reporting Act to institute a 1-year waiting period before medical debt will be reported on a consumer’s credit report and to remove paid-off and settled medical debts from credit reports that have been fully paid or settled, to amend the Fair Debt Collection Practices Act to provide a timetable for verification of medical debt and to increase the efficiency of credit markets with perfect information, and for other purposes.”

According to Google, thousands of consumers every month are Googling “Medical Debt Relief Act 2021”. So the question is:

What is the Medical Debt Relief Act of 2021, and Was it Passed?

The following medical bills will be removed from your credit report (including Equifax, Experian, and TransUnion) under the Medical Debt Relief Act of 2021:

- (1) Medical debt collection accounts less than one year old will get removed from your credit.

- (2) Medical bills including collection accounts that have been settled and paid off.

- (3) Medical bills under $500

Do you owe medical debt above $500? Do you have other unsecured debt, including credit cards? You have options that can cut your medical bills and balances significantly and remove the medical debt from your credit. You can settle medical debt collection accounts for less than what you owe and then get them off your credit report under the new law after it passes.

Get in touch with a debt counselor to start the debt settlement process. If a collection agency doesn’t first validate the debt, you may not have to pay it. Call today for a free consultation at (866)-376-9846.

And make sure to contact your insurance company before anything and ask what they can cover. You’d be surprised, even medical debt from personal doctor visits that don’t take insurance can still get covered by your insurance company by simply submitting the bill and requesting they cover it.

One client at Golden Financial Services said that they took their child to a psychologist. The doctor was a specialty doctor and didn’t take insurance. It cost the client $500 per visit and they visited the doctor for six months straight on a weekly basis. We instructed the consumer to submit all the bills to their insurance company before enrolling the debt in the program. Sure enough, the insurance company covered it and paid 100% of the bills in full.

The Medical Debt Relief Act of 2021 is a real thing.

step 4: Negotiate the medical debt

First, call the hospital and speak with their financial aid department.

Apply for financial aid.

Most hospitals offer financial aid for consumers experiencing any financial hardship.

Check to see if you’re eligible for financial aid. Medical bills can be eliminated just by requesting financial aid.

Was your income reduced?

And make sure if your income was recently reduced, use pay stubs from the last thirty days to verify your income, don’t use your most recently filed tax return because it will show a higher income amount than currently. Often, the lower your income, the lower your medical debt repayment plan will be.

Offer a medical debt settlement

Psychological: Whenever you negotiate debt, find out the other side’s goal. In the case of medical debt, they favor a quick payment. For example, on a $10,000 medical debt, offer $4,000 but pay it this month in full. Below, we provide more details on how to negotiate medical debt on your own.

Use leverage when negotiating medical bills.

Leverage: Another point to consider when negotiating is what other providers offer.

Compare cost to Medicare cost for the same medical procedure

Compare the price that Medicare or other government providers pay for the same service.

For example, suppose a hospital charges Medicare $2,058 for the same surgery you received, but they’re charging you $6,050.

You can request the hospital’s billing department charge you the same price that Medicare pays and reference the price from Medicare’s website or a reputable source. Medicare will usually get more favorable terms for the same procedure than a consumer gets charged. And all of this information is publically listed on Medicare’s website.

When medical collections affect credit (180-day rule)

If it’s too late and you have a medical debt collection account, you still have some time before it affects your credit score.

Collection agencies will wait up to 180 days after the medical debt is sent to a collection agency before it’s reported to credit bureaus, so act fast.

Medical debt relief & forgiveness options/programs

Do you need help with medical debt? There are two popular medical debt relief programs.

- Your medical bills can be negotiated and reduced with debt settlement, where a portion of the debt can get forgiven. Medical debt settlement programs can offer you this type of relief. Learn about debt settlement services with an IAPDA Accredited organization.

- Debt validation can dispute a medical debt, where you may not have to pay the debt. As an additional benefit, after a medical bill is proven to be legally uncollectible, the collection agency can no longer report the account on your credit reports. To learn more about debt validation, visit this page next.

Call (866) 376-9846 if you have over $10,000 in unsecured debt and need help. Medical bills qualify!

- After being disputed with a validation program, you may not have to pay the medical debt.

- Get one low monthly payment for all debt

- Pay a significant amount less than the total owed

- Use #1 rated Debt Relief Company

Tips on how to negotiate medical bills.

Review your medical bills in detail & negotiate the debt

If you haven’t fallen behind on your medical bills, it’s essential to do everything you possibly can to stay current. After falling behind on payments, your credit score will take a big hit.

First, contact your insurance provider and ask if they can cover the remaining balance that the insurance didn’t pay on your medical visit.

Bill Fay, a Staff Writer at Debt.org, recommends that “When dealing with a hospital, it’s a good idea to have all of the charges fully explained to you by the billing office. Medical bills can be confusing, and auditing every detail is the best way to protect against honest mistakes or outright fraud.”

Offer to make small monthly payments:

Let the medical billing department or collection agency know that you disagree on the charges but would be willing to make small monthly payments to avoid filing for bankruptcy and preserve your credit score.

Important note: Even after your medical bill is sent to a collection agency. It won’t negatively affect your credit score for another 180 days. So you must act fast!

Let the creditor know that you can provide proof of income to show that you are experiencing a severe financial hardship due to …. “whatever caused your financial hardship.” Explain that you can’t afford the current payment they ask you to pay.

Even though you don’t intend to file for bankruptcy, you can tell your creditor that you’re contemplating bankruptcy, and you hope that they’re willing to offer you an affordable payment plan today to help you avoid having to file for bankruptcy.

The creditors know that if you do file for bankruptcy, there’s a chance your entire medical debt can get wiped away clean, and they won’t get paid anything, so they may be more inclined to work with you at that point.

Can’t afford to pay your medical bills, and creditors refuse to work with you?

In this case, a debt validation program could be your best starting point over debt settlement.

Debt validation is a person’s legal right to dispute the validity of a debt. For example, medical debt can often get invalidated and proven to be legally uncollectible. A legally uncollectible debt does not have to get paid and can’t legally remain on credit reports.

Help With Medical Bills After Insurance

You could potentially resolve the debt with debt validation for around 45% of what you owe. But, first, try this debt calculator on your own and compare each debt relief program. Then, include all of your unsecured debt where it says, “Enter Your Total Debt Amount.”

Do you have high credit card debt and medical bills?

Dispute medical debt

A debt validation program could resolve medical bills and credit card debt, all inside a single payment. However, unlike with a debt settlement program, your creditors don’t get paid a dime with a validation program.

Instead, medical debt is disputed with debt validation. In the end, it can become proven to be legally uncollectible. A legally uncollectible debt does not have to get paid.

Golden Financial Services offers a debt resolution program that uses debt validation and settlement to get clients the best savings and results.

Debt Relief Program Case Example:

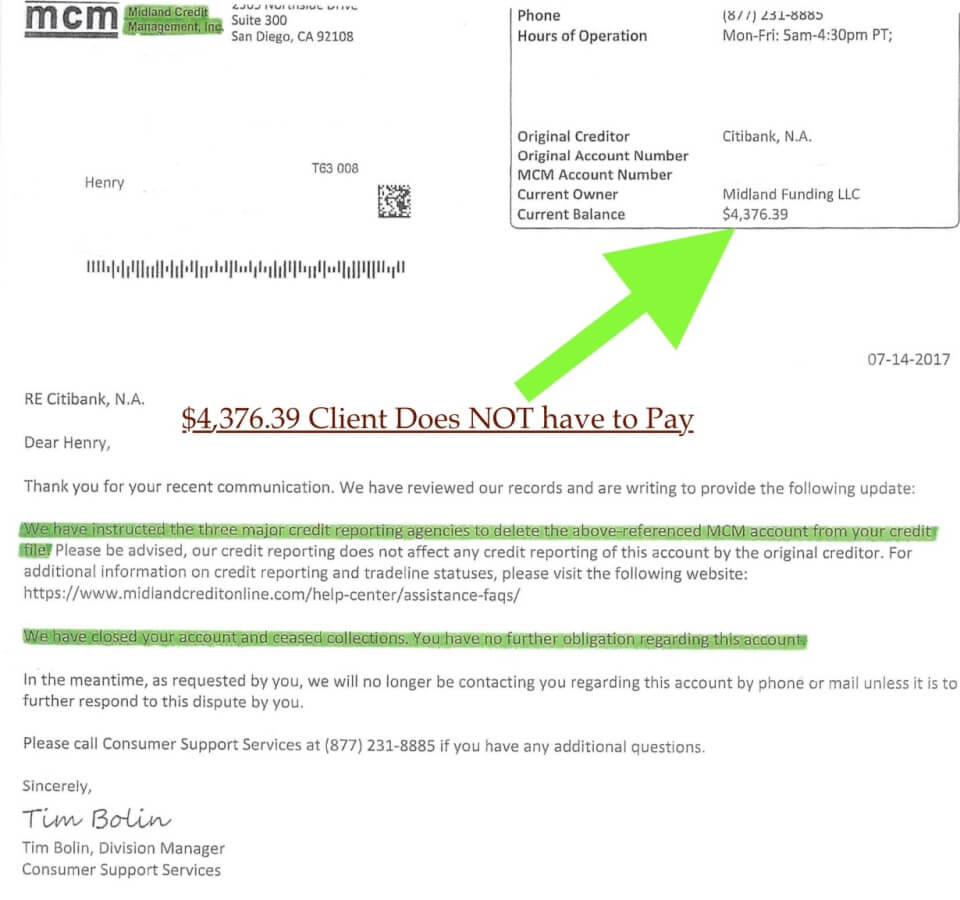

Below is another example of a successful debt validation case. The consumer paid off $4,000 in medical bills on a credit card but couldn’t afford to pay off the credit card debt.

As a result, he went delinquent on payments, and it was eventually sold to a collection agency. That $4,000 medical debt rose to $4,376.39 after adding collection and other unauthorized fees to the balance.

What was the solution?

Debt validation disputed the debt, and within thirty days, the consumer received a letter from the collection agency agreeing to stop collection on the medical bill and remove it from the consumer’s credit.

Medical debt collection disputed and invalidated (case example)

How Debt Settlement Works (with Golden Financial Services)

If medical debt is valid, debt settlement can settle the account for around half. You can use debt settlement as a last resort to avoid bankruptcy.

A portion of your medical debt could end up getting forgiven with debt settlement, making your balance more affordable to pay off.

A few of the main downsides of debt settlement include derogatory notations left on credit reports and potential tax consequences.

With debt validation, when successful, the debt and its associated negative marks can get removed from credit reports, and there are no tax consequences on an invalidated debt.

There is always the chance of getting sued over an unpaid medical debt. However, you can avoid a lawsuit by settling the summons before the court date, which a reputable debt relief company would facilitate.

Help With Medical Bills For Low-Income Applicants

If you don’t have sufficient savings built up to offer a lump sum payoff, you can get approved for a debt settlement payment plan.

You would make one affordable payment each month based on what your budget illustrates you can afford. The funds you pay each month would accumulate in a trust account. So, rather than paying your creditors each month, you would be making one reduced payment into a trust account. As the funds grow, the law firm will begin negotiating with each of your creditors to settle your medical bills one by one.

How to Qualify for Debt Settlement for Medical Debt?

You need to have at least $5,000 of unsecured debt to qualify.

Eligible accounts include medical bills, credit cards, personal loans, and just about any unsecured debt.

Debt Validation to Help With Medical Bills For Low-Income Applicants

Debt validation forces each of your debt collectors to prove that they are legally authorized to collect on the debt and that you owe what they claim you owe. Collection agencies must produce complete and accurate records to prove a debt is valid after receiving a debt validation dispute package, which often they don’t have.

Consider that banks will sell delinquent medical bills for pennies on the dollar. At that price, do you think they put much care into transferring the debt and its related documentation to the collection agency? No, they don’t!

Banks will email a spreadsheet of hundreds of debtors’ names to whatever collection agency bids the highest, selling this data as “leads.” Once your account is sold to a collection agency, the original creditor is done with it.

What happens when I fall behind on medical bill payments?

Eventually, a bank will write the debt off as a loss on their books and get reimbursed 100% of the monetary loss through tax credits, but banks get compensated before their clients even fall behind on payments. When a bank issues a loan, it illustrates it as an asset on its profit and loss statement.

Banks use assets to show depreciating value and assume a certain percentage of borrowers default on monthly payments before it even occurs. Banks do this to show less profit, getting reimbursed for projected losses before they happen. Just like if you get in a car wreck, your car insurance covers it. Well, banks have banking insurance to protect them from losses.

Using Debt Collection Laws to Dispute Medical Bills

By law, the information a collection agency maintains on behalf of debtors needs to be accurate and void of any unauthorized fees and charges. However, collection agencies will add on all types of fees that you never agreed to after taking over the debt. So look at the debt they say you owe. Is this what you agreed to?

Unauthorized fees get added to your balance over time that you never signed for initially, making it nearly impossible for the debt collection company to prove the debt is valid if disputed. Therefore, debt validation requests that the collection agency provide the original agreement you signed and a copy of all monthly accounting records to validate the alleged balance. The debt becomes legally uncollectible if the collection agency can’t produce these records.

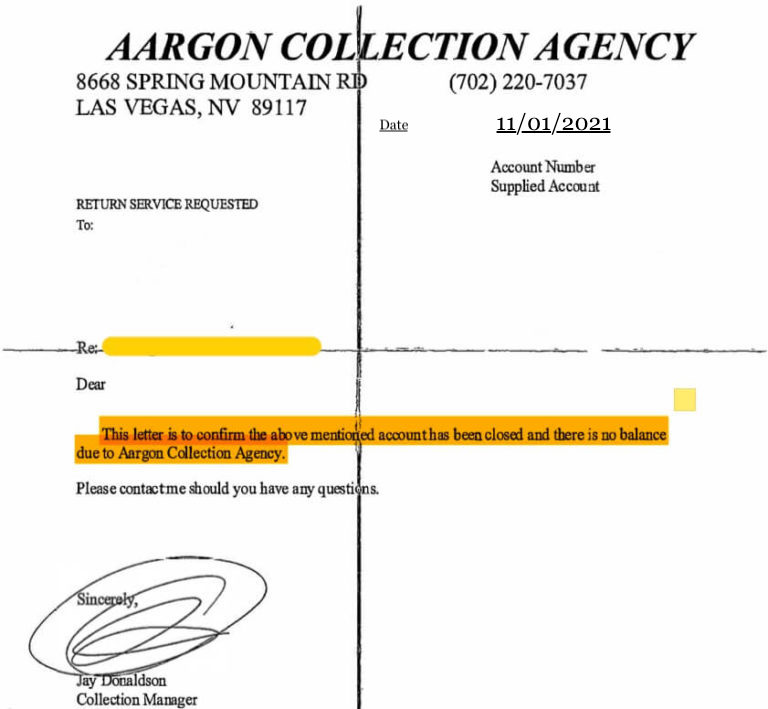

After a debt gets disputed, collection agencies will often quickly respond with a letter agreeing to stop collection on the debt. This letter is a defensible record proving the debt to be invalid. It’s the icing on the cake to the program, meaning you don’t have to pay for it.

This is really awesome information to help with medical debt. I followed the advice and it worked.

Thanks for sharing this useful information. Personally, I found Golden Financial Services is great for medical debt relief programs. They handle your medical accounts and reduce the amount you own on your medical bills.