Many students are beginning to panic as COVID-19 forbearance is coming to an end, and student loan payments are about to resume. But don’t panic because private and federal student loan debt relief programs are available.

What are student loan debt relief programs?

Congress passed legislation called the William D. Ford Act, which allows the Department of Education to consolidate student loans.

How many student loan relief programs are there?

There are more than six student loan repayment programs to choose from after consolidating federal student loans, but not all of these programs offer loan forgiveness.

Why students get confused and don’t know how to deal with federal student loans.

The procedures and processes that a person must go through to eventually get approved for loan forgiveness are quite complicated.

What is Student Loan Rehabilitation?

If delinquent on student loan monthly payments a person may have to complete a loan rehabilitation program before they are eligible for student loan consolidation. Collection agencies can enroll you in this type of program. They will ask you questions about your income and family size to determine what your monthly payment will be. The lower your income, the lower your monthly payment will be. If your income was reduced, make sure to give them your lowest monthly gross income amount from the last 90-days, not your income based on your most recently filed tax return. And make sure to include anyone that you’re helping support in your family size, as long as you’re paying at least 50% of their expenses they can be included. The larger your family size, the lower your monthly payment on the loan rehabilitation program.

You are required to make nine monthly payments through a loan rehabilitation program before graduating from the plan. The loan rehabilitation program can provide you a monthly payment that is close to zero dollars per month if you have a financial hardship and reduced income.

How to get student loan late marks and collection accounts removed from credit

After graduating from a loan rehabilitation program you become eligible for government student loan consolidation, debt relief, and forgiveness options. And, the negative default marks from your missed student loan payments will get removed from your credit reports, helping restore your credit.

Consolidate before getting on an Income-Based Student Loan Relief Program

Before getting on an income-based student loan program that includes loan forgiveness, a person must first consolidate.

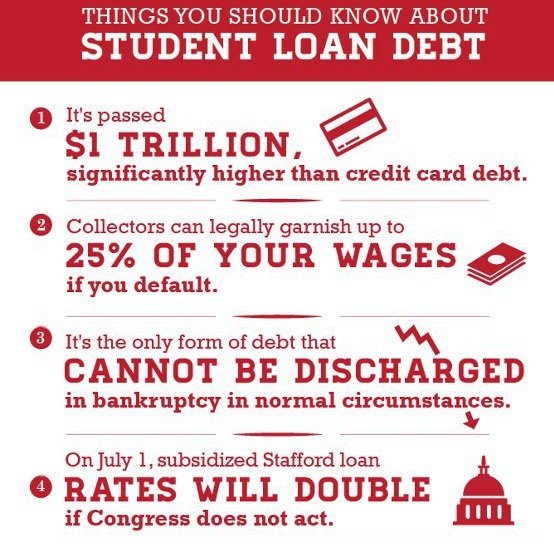

Be careful not to get your wages garnished if late on student loan payments

And if you are late on student loan payments, don’t forget to request at least 90-days forbearance to give you sufficient time to consolidate, otherwise, your wages may quickly get garnished. With federal student loans, creditors don’t have to first take you to court and win a default judgment, they can just garnish your wages with very little warning.

Public Service Loan Forgiveness Employment Certification Form (another requirement)

With Public Service Loan Forgiveness (PSLF) a person must submit an employment certification form every year to their loan servicer. This form is one that your employer must sign to verify that you have a public service job.

What servicer offers PSLF?

Not every loan servicer offers PSLF, only FedLoan Servicing does.

Do Parent-Plus Loans Qualify?

Parent Plus loans only qualify for the Income-Contingent Repayment Plan.

As you can see, it’s easy for students to get confused about how to manage government student loan relief programs.

How Golden Financial Services can help you

Let Golden Financial Services take over the stress of having to deal with these overwhelming loans. We will take that weight off your shoulders and handle the communication, paperwork, and processing of your student loan consolidation. Our job will be to find the best program for you that will cut your payment the most.

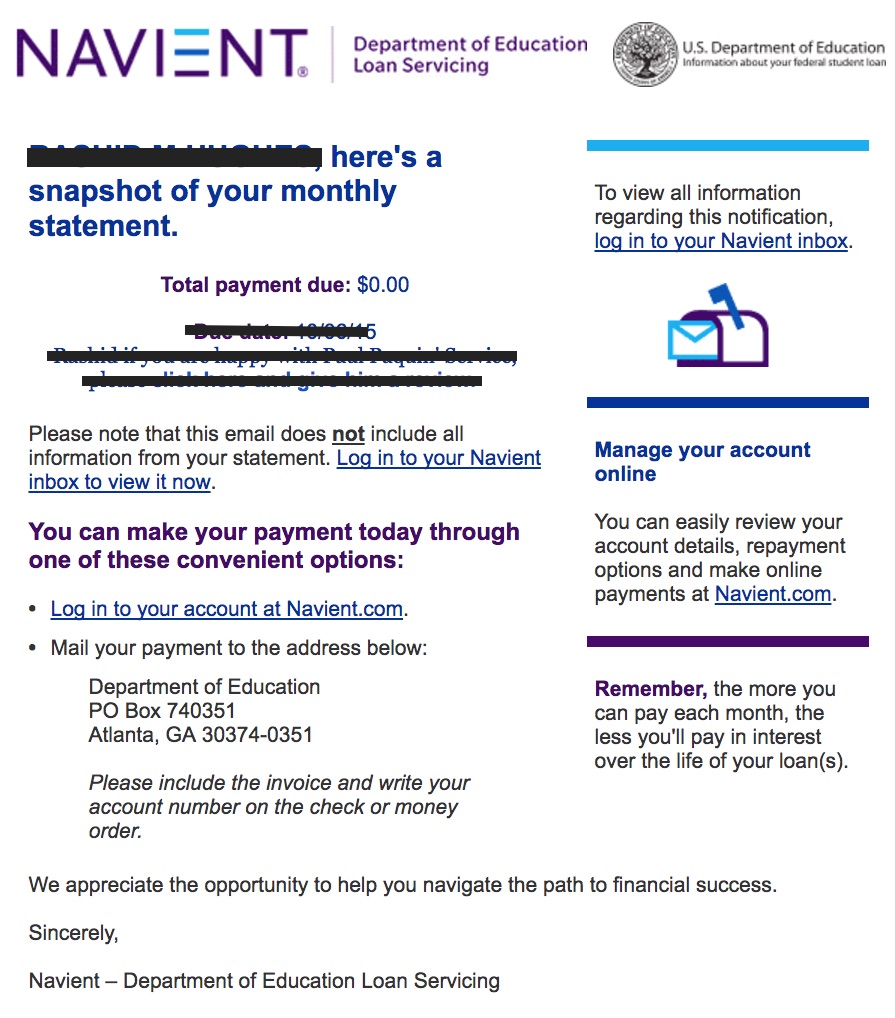

Student Loan Relief $0 Monthly Payment Case Example

EXAMPLE ONE: HERE IS AN APPROVED STUDENT LOAN CONSOLIDATION (NOTICE THE CLIENT’S NEW MONTHLY PAYMENT IS SET AT $0 PER MONTH. THEY WERE PAYING $550 PER MONTH.

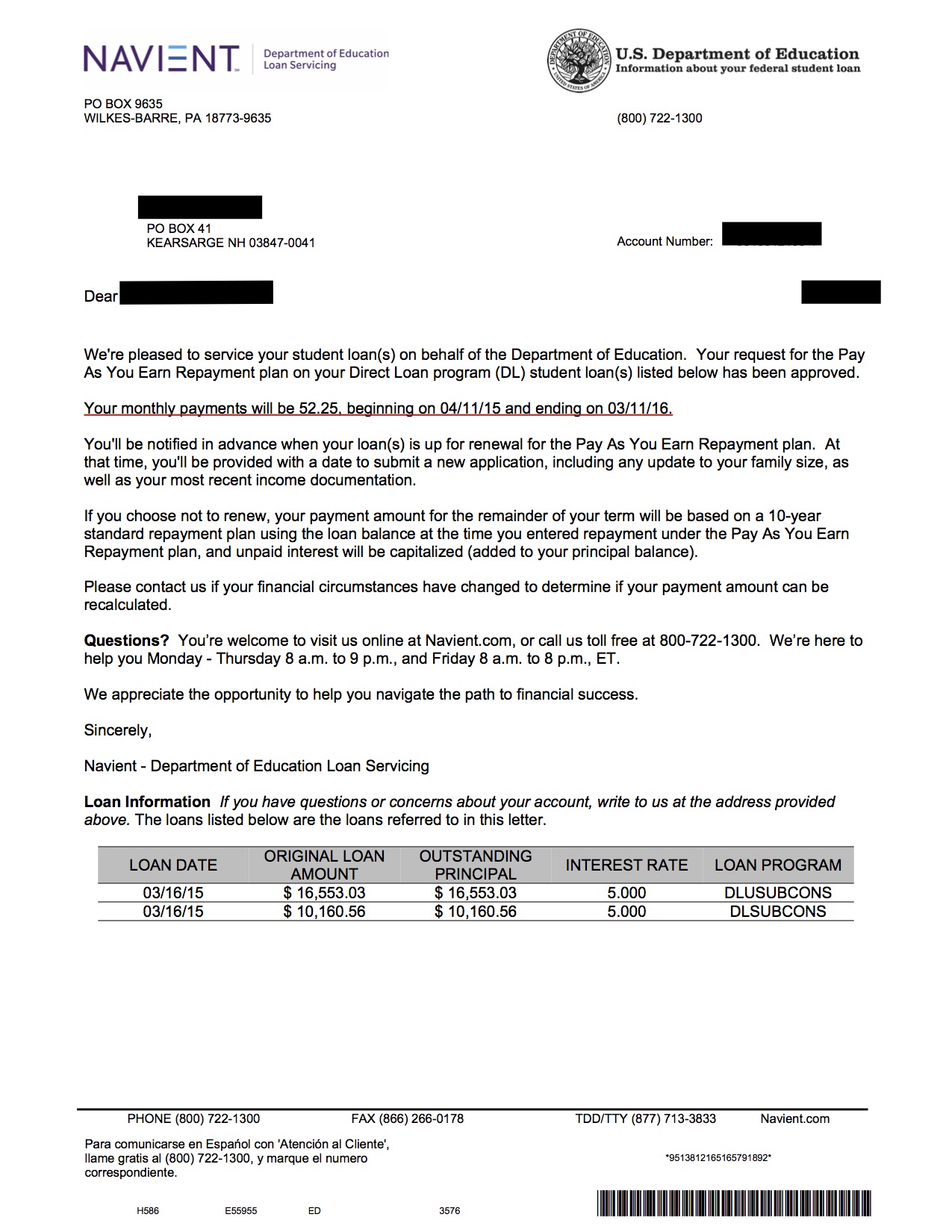

Student Loan Debt Relief Case 2 Example

EXAMPLE TWO: $26,713.59 IN FEDERAL STUDENT LOANS CONSOLIDATED AND PAID IN FULL – LEAVING THE CLIENT WITH ONE PAYMENT OF ONLY $52 PER MONTH

What is the student loan relief program offered by Golden Financial Services?

We will;

- Consolidate your federal student loans.

- Get you approved for the lowest possible monthly payment on an income-based repayment plan that offers loan forgiveness.

- Recertify your income-based repayment plan every year until you’re eventually eligible for loan forgiveness (Public Service Loan Forgiveness is within ten years and for everyone else 20-25 years).

- Handle all communication between you and your creditors.

- Stay on top of your federal student loan relief options as they come available, always having your best interest (for example, if Biden passes additional loan forgiveness, we will make sure to apply on your behalf).

- Switch your income-based repayment plan to the one that offers you the lowest payment if your income or family size changes.

- Help you avoid wage garnishment if you’re delinquent on monthly payments.

- Get you approved for the loan rehabilitation program if needed, helping you get the default marks removed from your credit report.

The cost for student loan relief programs

There are no up-front fees charged with this type of program. You are only charged after your consolidation is completed, loans are paid in full, and you’re approved for the reduced monthly payment. At that point, the enrollment cost of the program will be charged. That enrollment cost is $675.

We are not lenders or affiliated with the government. Our role is to assist you in processing your federal student loan consolidation and then assist you in getting approved for the income-based repayment plan of your choice. We will then assist you over the years by processing your annual recertifications and following all the way up until you’re eligible for loan forgiveness. We will help you navigate the complex processes involved with federal student loan relief, having your best interest all along.

We GUARANTEE A FULL REFUND if you are not 100% satisfied with the student loan relief consulting and processing service we provide.

Click Here to Visit the Better Business Bureau Website and see our Company Rating. We are A+ Rated with the BBB!>

Call us to see if you qualify for student loan debt relief NOW!

Student Loan Debt Relief – Frequently Asked Questions

How does the Golden Financial Services Student Loan Consulting and Processing Service Work?

- We gather all of your student loan information right from our software. Within minutes we can find out how much you owe and what accounts qualify.

- We prepare the documentation for the Department of Education.

- We will get you approved for the program that will give you the lowest monthly payment.

- We will take care of getting you re-approved (recertified) annually – for the income-based hardship programs.

It is required to get recertified every single year when enrolled in an income-based hardship student loan program. Since variables may change, such as your income, family size, and other factors, this is required.

What are my options for a student loan in default?

- Pay it off in full.

- Leave it as is and eventually get your wages garnished.

- Consolidate your loans; in 45-90 days, the loan will be taken out of default and reported: “paid in full” to all the credit reporting agencies.

- When you are in default on student loans, your credit report will be negatively affected, leading to you possibly getting denied in the future for a mortgage, car loan, credit card, and nearly all kinds of credit that you apply for.

What if my monthly payments are too high to afford?

Our goal is to reduce your monthly payment to as close to zero dollars per month as we can get.

We will most likely find you a student loan relief solution that fits your budget.

Are private loans eligible for consolidation?

Private student loans are ineligible for the Federal Student Loan Relief Programs. Debt relief programs are available where private student loans can be included. If you need help with private student loans, visit here.

If you owe above $15,000 in federal student loans and other unsecured debt, Call 1-866-376-9846 and speak to one of our debt relief professionals FOR FREE.

What are accounts NOT eligible for the Federal Student Loan Debt Relief Programs?

Loans made by a state or private lender (not government-backed), primary care loans, law access loans, medical assist loans, and PLATO loans are ineligible for federal student loan consolidation.

What is the Public Service Student Loan Forgiveness?

This program was created to encourage full-time public service employment. If you are employed full-time by a public service agency and qualify for this program, you can have your debt forgiven after making 120 payments on your consolidation plan.

What public service jobs qualify for the Public Service Loan Forgiveness?

Any government entity qualifies – including The U.S. military, teachers, public transportation employees, etc…

Organizations that are tax-exempt under the 501(c)(3) of the internal revenue code also qualify.

Call us at 1-866-376-9846 if you need student loan debt relief!

DISCLOSURES:

- You can consolidate your federal student loans on your own without the help of Golden Financial Services.

- We are not the government, nor do we work for the government.

- There are fees included with this program. The total enrollment cost is $675. This fee is not charged until after your consolidation and income-based repayment programs are approved. This $675 fee is paid to Golden Financial Services and completely separate from the monthly payments that will go directly to your student loan servicer.