The 6 Best Georgia Debt Relief, Settlement, and Consolidation Programs as of 2021

- 1.) Georgia debt settlement companies will offer to lower your payment and get you out of debt in around 3-4 years but know that you must fall behind on payments to qualify, and credit scores can take a hit.

- 2.) Georgia debt validation programs will dispute third-party collection accounts in an attempt to prove them to be legally uncollectible, rather than settling the debts. A legally uncollectible debt is one that you don’t have to pay, and it can’t legally remain on credit reports. Over the first year of the program, expect similar results as debt settlement. Georgia residents current on monthly payments before joining a validation program will end up with late marks and collection accounts on their credit report. After accounts are invalidated, the collection agencies can no longer legally continue reporting the debt on credit reports.

- 3.) Georgia consumer credit counseling programs consolidate credit cards into one monthly payment. This type of program will have the least effect on credit scores because payments remain current. You can become debt-free in around five years with this type of plan.

- 4.) In Georgia, Federal student loan debt consolidation programs are available through StudentLoans.Gov.

- 5.) Georgia debt consolidation loans are another popular choice, which can be used to consolidate secured and unsecured debts. These loans can be helpful if they are low-interest loans. Low-interest credit card consolidation loans can reduce a person’s payment and get them out of debt faster. Local credit unions in Georgia are the best place to get a debt consolidation loan because, on average, credit unions offer the lowest interest rates.

- 6.) The debt snowball method allows you to pay off your accounts faster on your own by simply prioritizing paying off the smallest accounts first. This method was created by Dave Ramsey and is known as one of the most effective ways to pay off debt as of 2021. You can use this free snowball calculator tool at Golden Financial Services to assist you.

Golden Financial Services does not offer all of these programs, and not all states will qualify. The following information should be used purely for educational purposes. Call (866) 376-9846 for eligibility. To learn more about the pros and cons of credit card debt relief programs, visit this page next.

Now, let’s take a look at some interesting Georgia debt, unemployment, and poverty statistics. These statistics help to explain why so many people in Georgia are experiencing such extreme financial hardships.

Georgia Unemployment VS. US Unemployment Averages

Georgia: As of late 2013, 8.8% of the labor force was unemployed. (8th highest unemployment rate in the nation. 422.5 thousand people in Georgia were unemployed.)

Nationwide: 8.1% of the labor force was unemployed as of late 2013.

Georgia Poverty VS. Total US Poverty

Georgia: 14.7% of families in Georgia live below the poverty level. (6th worst state in America)

Nationwide: 11.7% of families are below the poverty level.

Georgia Student Loan Debt VS. Total US Student Loan Debt

Georgia: The average student loan debt for College graduates is $22,443.

US: The average student loan debt for college graduates is $24,854.

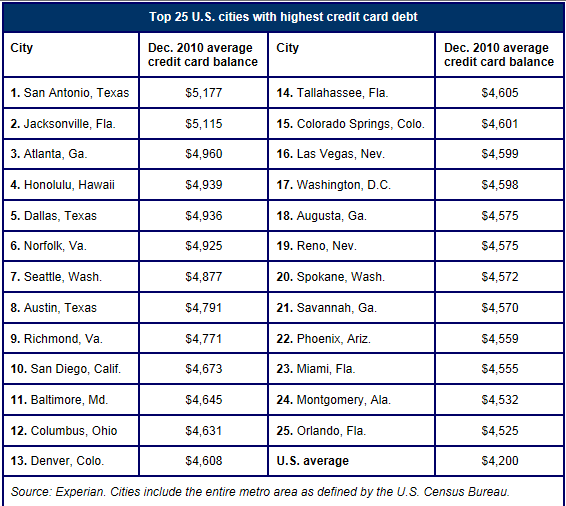

Georgia Makes #3 on the list for the Highest Credit Card Debt

Bankruptcy Statistics for Georgia

Georgia: 72,198 people filed for bankruptcy in 2011 in Georgia.

US: Just under 1.37 million people filed for bankruptcy in the US.

Georgia Debt Relief Statistics

The following data has been collected from our internal software at Golden Financial Services.

Debt Relief, Consolidation and Settlement Companies

Understand Georgia Debt Relief Options:

1. Debt Settlement GA programs are a popular option to pay off unsecured debt. This option can lower a person’s credit score, but in the end, you could end up paying less than the total balance owed on each account. GA Debt settlement programs can help consumers avoid bankruptcy, and that’s a huge plus. Average settlement plans last for around 36-48 months. With debt settlement, one creditor at a time is settled and paid off until the consumer is debt-free. The downside is that consumers must fall behind on payments until accounts are eventually written off and sold to third-party collection agencies, resulting in account balances growing, potential lawsuits, and an adverse effect on credit scores. If a person cancels the settlement program before finishing it, they can have more debt than what they started with.

2. Credit card debt consolidation using a GA consumer credit counseling company is another popular option. A consumer credit counseling program can reduce your interest rates and consolidate your credit card payments into one. You don’t have to fall behind on payments either! In fact, late payments can get re-aged to show current again, helping improve credit scores in some cases. The downside with this type of plan is that consumers must pay the entire debt back, plus interest and fees.

3. Bankruptcy should be a consumer’s last option that they consider for debt relief. Consumers often cannot qualify for debt settlement or consumer credit counseling, where bankruptcy is their only option left. To learn more about the different types of bankruptcy, visit this bankruptcy debt relief infographic.

4. Student Loan Debt Relief includes 6 different government programs. To learn about student loan debt relief services, visit here.

Georgia Credit Repair Companies

“According to Georgia law (O.C.G.A. § 16-9-59), the practice of credit repair, which is the marketing or selling of services aimed at improving a buyer’s credit record, history or rating, with unpredictable results, is generally illegal in the state of Georgia.” source: https://allongeorgia.com/, 03/05/2021

Georgia Licensed Debt Management and Non-Profit Consumer Credit Counseling Companies

You can check if a company is licensed in Georgia for consumer credit counseling by visiting the Department of Justice’s website. Here is a list of Licensed consumer credit counseling companies in Georgia. Debt settlement companies will not be on that list because debt settlement companies in Georgia are for-profit agencies. Having said that, consumers often end up saving more money with debt settlement programs in GA because consumers often end up paying much less than the total balance owed by using a settlement program.

Sources: Bureau of Labor Statistics

Rebuilding your credit after debt settlement in Georgia

If you use a debt settlement program in Georgia, you’ll be left with late marks and collection accounts on your credit report; therefore, make sure you have a plan to rebuild your credit score after debt settlement. You can do this by getting a secured credit card, using it every month for gas, and paying the balance in full immediately after the bill arrives. The key here is to use your credit card every month but pay the balance in full that same month; that’s the key! Paying on a car payment and mortgage payment every month is another way to rebuild your credit score.