What is the best way to reduce credit card debt?

Do you want help from a professional debt reduction company?

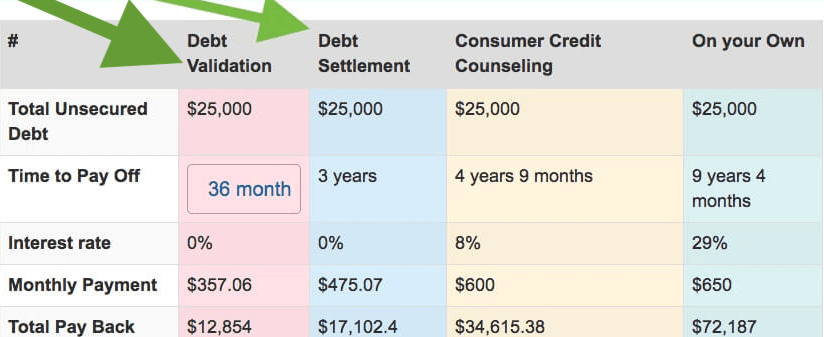

If you are looking for debt assistance it’s important to consider debt relief, settlement, and consumer credit counseling options. These are all different options that can save you a lot of money and help you avoid harsh debt relief options like bankruptcy. Below, we talk about each option in more detail. You can also take advantage of getting a free consultation with an IAPDA certified expert at (866) 376-9846.

- Click to Verify Better Business Bureau A+ Rating Since 2004

- Click to Verify Golden Financial was just Rated #1 By Consumer Reviews

Try Calculator to Learn the Best Way to Pay Off Credit Cards

Here’s how to use it:

- 1. Enter your total debt amount

- 2. Enter a monthly payment that you can afford to pay (it can be more or less than the minimum payment amount)

- 3. Enter the average of your interest rates (just an estimate)

- 4. Hit “Calculate Debt” and let the calculator works its magic!

What are the Qualification Guidelines for Credit Card Reduction Programs?

- Must owe between $9,000 – $200,000 in total debt to qualify

- Eligible accounts include: credit cards, repossessions, medical bills, collection accounts, unsecured personal loans

- You must be motivated to get out of debt

Call to Reduce Your Credit Card Debt Today (866) 376-9846

Can you barely afford minimum payments?

Your best bet is to use debt forgiveness options; including debt negotiation, reduction and settlement plans because these plans can knock your monthly payment way down.

- A portion of your balances could get forgiven, in other words, wipe-away clean

- You could end up paying back much less than the full amount owed, saving up to 30% and that includes fees!

- Your monthly payment could be much smaller than what it is now

- You could be debt-free in half the time

- There are no upfront or out of pocket fees, like with debt consolidation loans and BK

- You get results or won’t have to pay a dime!

Best Rated Debt Relief Company on ShopperApproved

How will my credit get affected?

Have you already fallen behind on payments? Your credit has already been negatively affected.

Are your accounts maxed out? Maxing out credit cards can also negatively affect credit.

If you join a debt settlement program today, over the next year your credit score could fall further. If you are current on payments and considering debt settlement, keep in mind your credit score would most likely go down because on a debt settlement program creditors don’t get paid on a monthly basis.

As your debts get settled and paid off one by one with a debt settlement program, eventually you can start establishing new positive credit history. You do this by getting a secured credit card, using it every month and paying the balance in full. Simultaneously your debts can be getting reduced, settled and paid off through the program. Debt negotiation/settlement plans get clients completely out of debt within 2-4 years on average.

Check eligibility in a matter of minutes at (866) 376-9846.

Can you comfortably afford minimum payments or more?

If so, try using the debt snowball method to quickly pay off your debt. Start with this budget calculator here, it’s free.

Compare Pros Vs. Cons on Each Credit Card Relief Program

If you have a question or want to enroll in a debt relief program:

Credit Card Debt Reduction Disclosures

- When a debt gets reduced the portion that gets forgiven could be taxable. You could use a #984 tax form to show the IRS that you’re insolvent, and would not have to pay the tax debt.

- In a small percentage of cases, creditors could issue a summons. If you receive a summons while enrolled on the program make sure to send it to your debt negotiator immediately. A summons would be treated like any other debt but it would get prioritized to get resolved fast.

- Since creditors are not getting paid every month they continue to add on late fees and interest. The good news is that all of the late fees and interest gets mitigated into the settlement and will get resolved at the time the debt is settled and paid.

- Collection accounts could be left on credit reports.

- There is no guarantee that a creditor will settle at a certain rate, companies like Golden Financial Services quote consumers based on the average savings that is achieved with a debt settlement program.

- With fees included clients can save around 30% of what they owe.