Best Kentucky debt relief, settlement, or consolidation programs (watch video)

Kentucky Debt Collection and Credit Card Laws

Kentucky debt relief laws protect you from debt collectors, credit card companies, online lenders, banks, and financial companies that offer loans. For example, the Fair Credit Billing Act gives you the right to request validation of a debt or dispute a charge. In addition, credit card companies can’t charge outrageous or unfair fees or try to take advantage of minors under the Credit Card Act (Credit Card Accountability Responsibility and Disclosure Act of 2009).

After five years since your last payment made towards a delinquent credit card debt, the Statute of Limitations on that debt expires, and the collection agency can no longer sue you over the account. In addition, the Fair Credit Reporting Act gives you the right to dispute inaccurate information from credit reports.

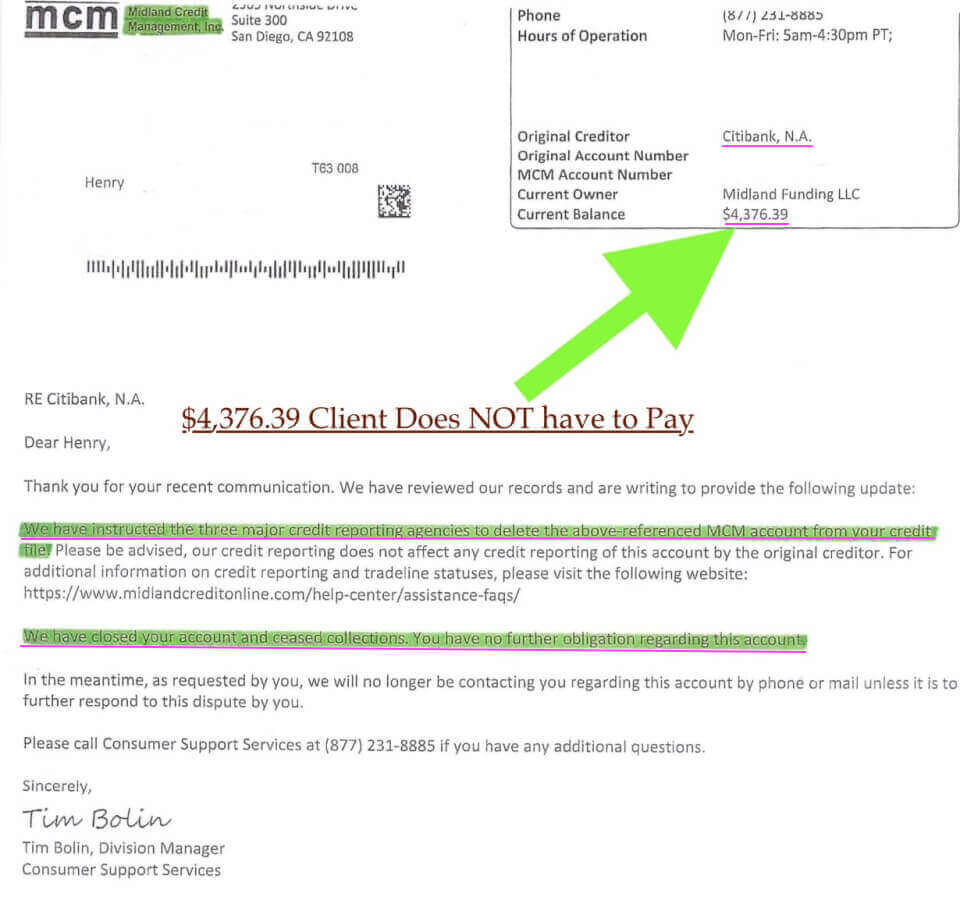

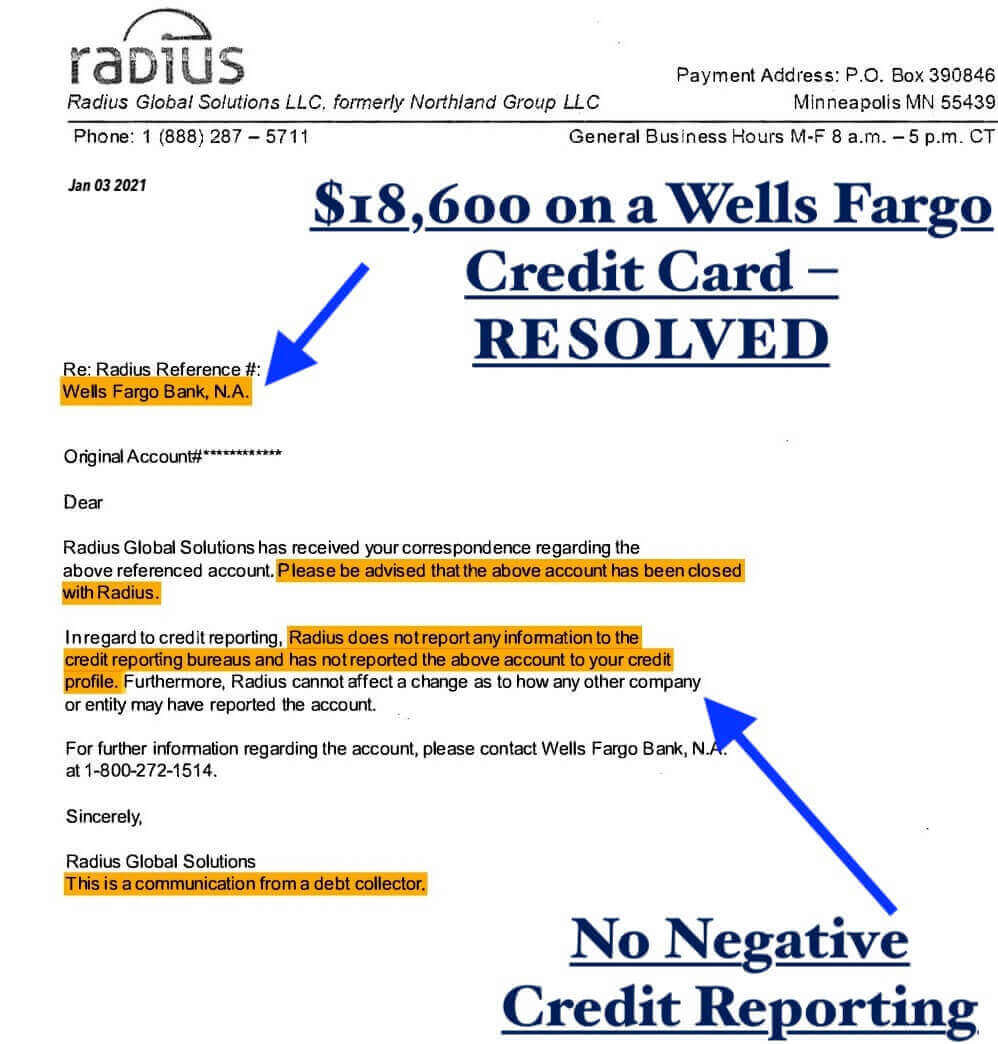

Kentucky debt settlement and validation programs incorporate these consumer protection laws to help consumers get the best debt relief solution. For example, the Fair Debt Collection Practices Act (FDCPA) is used with a validation program to dispute a delinquent credit card bill that went to collections. After the account is invalidated, it can be disputed from credit reports under the Fair Credit Reporting Act. With Kentucky debt negotiation programs, an attorney could use FDCPA violations to negotiate a lower debt repayment plan.

How to deal with credit card debt in Kentucky?

Credit card consolidation loans can reduce interest rates and consolidate credit card debts. Kentucky consumer credit counseling programs can also reduce interest rates and consolidate payments, but doing so in a way that doesn’t require a loan. Debt settlement programs in Kentucky can lower the balances on unsecured debt and credit cards. Debt relief can also be achieved through a validation program, resulting in you not having to pay an invalidated credit card debt.

These are your four most popular credit card relief programs in Kentucky for 2021. Each program includes potential downsides that we will explain throughout this page. In summary, though, if you don’t pay your creditors every month on time, credit scores can go down.

Kentucky Debt Consolidation Programs to Avoid Hurting Credit

Consumer credit counseling programs in Kentucky negotiate a lower interest rate on each credit card. You pay the company every month, and funds get disbursed from the Kentucky consumer credit counseling company directly to each creditor but at a reduced interest rate.

With credit card consolidation loans, the idea is to get a loan with a low interest rate and use it to pay off high-interest accounts. Credit card consolidation loans can be obtained at a local credit union in Kentucky. Be very careful when using an online lender because they usually charge higher fees and interest rates than a local credit union.

Kentucky Debt Settlement

After falling behind on monthly payments, accounts get written off and sold to third-party collections agencies. Debt settlement programs in Kentucky negotiate with debt collection companies so that consumers only have to pay a portion of the balance owed. Still, these plans leave late marks and collections on your credit report.

The preferred method to deal with collection debt is a validation program. Validation can result in the debt becoming legally uncollectible so that it does not have to get paid.

How to deal with medical debt in Kentucky?

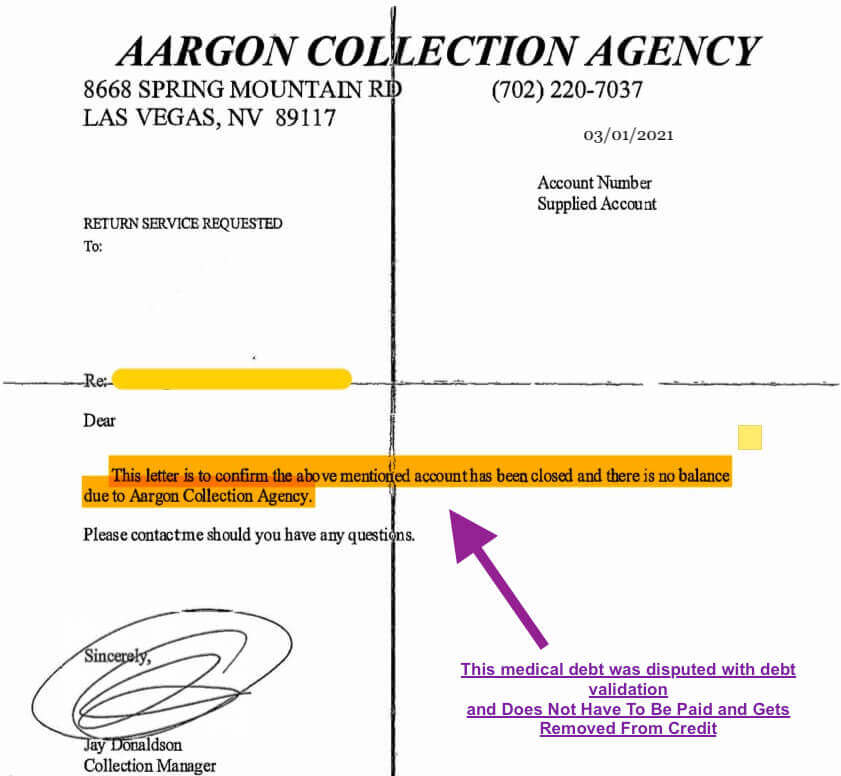

Kentucky debt settlement programs can negotiate a medical bill down to a fraction of what you owe. A portion of the balance would get forgiven, but that portion is considered taxable income so that a person could owe taxes on the savings.

On the other hand, a validation program would result in a medical debt becoming legally uncollectible. A legally uncollectible debt does not have to get paid and can’t legally remain on credit reports.

Example Case:

Kentucky Transitional Assistance Program (KTAP)

If you have low income and reside in Kentucky, financial assistance through the Kentucky Transitional Assistance Program (KTAP) provides financial and medical assistance. For more information about KTAP, visit this page next.

Kentucky HUD approved foreclosure counseling agencies.

HUD-approved agencies in Kentucky can provide homeowners with free or low-cost foreclosure and housing counseling. For more information about HUD-approved programs and grants, visit Hud.gov.

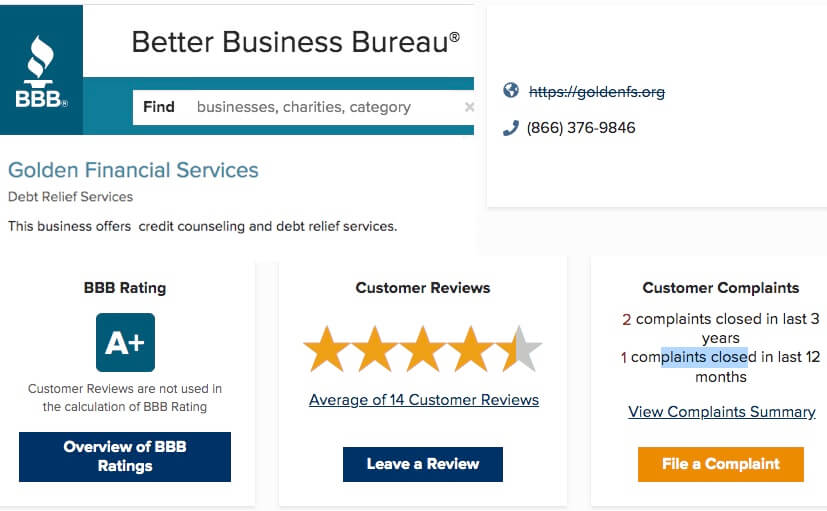

Best Kentucky Debt Relief, Consolidation and Settlement Company

Kentucky debt relief, settlement, and consolidation programs at Golden Financial Services (GFS) are Rated “A+” by the Better Business Bureau (BBB). Golden Financial Services offers unparalleled debt relief services. Kentucky residents can start with a free consultation to learn their options (866)-376-9846.

Thousands of Kentucky residents have used Golden Financial Services to get out of debt and get their lives back on track.

Are you ready to make an improved version of yourself?

You deserve to save money and get out of debt at a comfortable monthly payment.

How to qualify for Kentucky debt settlement programs?

You can legally have your balances discounted down to a fraction of the total owed through a program called “debt negotiation services.” Kentucky residents do need to have at least $7,500 in total balances to qualify for a program.

BBB A+ Rated Kentucky Debt Settlement Company

Kentucky Consumer Credit Counseling Programs

- Kentucky debt consolidation programs can reduce interest rates. A 28% interest rate can get reduced to 10% with consumer credit counseling and debt consolidation programs.

- Late credit card payments can get re-aged to be current. Consequently, credit scores can improve. However, credit counseling also results in credit cards getting closed out, negatively affecting credit scores.

- Become debt-free in four in half years with a Kentucky consumer credit counseling program. Balances must get paid in full, but you’ll save money in interest.

Kentucky residents have several options to choose from depending on what type of debt they have, the severity of their financial hardship, and their goals.

Is Kentucky Consumer Credit Counseling the Best Debt Relief Program?

If you can barely afford minimum payments on credit cards and your income could go down more, consumer credit counseling may not be the right option for you because payments won’t change much. If you can’t afford groceries because you’re paying too much towards credit cards, consider debt settlement. Kentucky consumer credit counseling programs won’t provide much debt relief in terms of your monthly payment compared to when paying minimum payments.

If you choose to fall behind on payments, you could use credit card settlement and validation programs. These plans are designed to help a person address their debt for the least possible amount. Monthly payments are flexible with debt validation and settlement plans.

How to rebuild credit with debt settlement

If you decide to use debt settlement, you will have to fall behind on payments. Make sure to use a Kentucky credit card settlement company that helps you plan for the future to rebuild your credit score. The company should be transparent that your credit score will take a hit and leave derogatory marks on your credit report.

You will need to rebuild your credit score after your accounts are settled and paid. For example, you could get a secured credit card, use it for gas every month and pay the balance in full. Do this throughout your debt settlement program to help establish positive payment history while your debts are being negotiated down and settled.

What programs does Golden Financial Services recommend?

At Golden Financial Services, we will recommend starting you with a validation program over the settlement. If accounts are invalidated, they won’t have to get paid and can come off credit reports. If accounts get proven valid, settlement can then be a last resort to resolve your debt.

—>>> Kentucky debt settlement programs can reduce your balances by around 30%, including company fees

—>>> Validation plans could result in debt not having to get paid. In this case, only the Kentucky debt relief program fees would need to be paid.

If You’re Eligible For Kentucky Debt Relief

- Your only obligation is to make one small monthly payment.

- You will know how many months are left until you’re debt-free.

- You can receive immediate relief.

- You can have the most reliable Kentucky debt relief company take over dealing with your creditors.

Is there a downside to Kentucky debt settlement services?

There are some downsides with debt settlement services, such as potentially creditors harassing you and sending letters, negative marks on your credit, and potential tax consequences.

Clients avoid paying taxes on the savings from a settled debt by illustrating that they are insolvent, which a licensed accountant can advise you on.

Not all creditors have to settle. Most of the time, creditors do settle for less than the full balance. If you cancel the program before accounts are all settled and paid, you could end up in more debt than you started with.

Creditors can issue a summons to go to court. In this case, send the summons to your debt negotiator. Kentucky laws provide you the right to respond to the summons on your own or with an attorney. The programs offered through Golden Financial Services will refer you to a law firm to help resolve a summons by either settling it or using laws to fight it.

Are there fees in the Kentucky Debt Relief Program?

Now do keep in mind; fees are included inside a debt relief program. So, for example: if we settle your $10,000 credit card debt at $4,000, add on another 17% for fees, which would equal a total payback of $5,700 (Saving You a Grand Total of $4,300)

To learn more about Kentucky debt relief programs, speak to one of our IAPDA Certified Professionals FOR FREE at (866)-376-9846.

Why Choose Golden Financial Services for Kentucky Debt Relief?

- Kentucky debt relief programs include a 100% money-back guarantee.

- GFS maintains an A+BBB rating with zero unresolved customer complaints.

- No other debt consolidation program in Kentucky comes with free credit repair.

- No other debt settlement company Kentucky-based) offers you a program with NO FEES OWED until debts are resolved!

What is Kentucky Debt Relief? Kentucky residents are entitled to debt relief options that include debt negotiation and settlement services and debt consolidation help. Kentucky debt validation programs can also be extremely effective for delinquent debts and debt collection accounts. All of these options are accessible at Golden Financial Services.

Benefits of Debt Settlement in Kentucky

Debt Settlement Kentucky Program – debt settlement and negotiation services allow Kentucky residents to get;

- one low monthly payment.

- Becomes debt-free in under 4-years. Personalized your monthly payment.

- Pick from a 1, 2, 3, or 4-year program.

If you have a severe hardship, you may want to go with the lower payment. You can always increase your payment as your income improves over time.

TALK TO AN IAPDA CERTIFIED COUNSELOR FOR FREE AT 866-376-9846

Kentucky Federal Student Loan Relief Options

Federal student loans can be consolidated and repaid through a low monthly payment at https://studentaid.gov/.

Suppose your income has been negatively affected due to COVID-19 start by requesting 90 days forbearance to avoid taking a chance of having your wages garnished. You can then consolidate federal student loans at StudentAid.gov.

When completing the consolidation application at StudentAid.gov, you’ll be asked to select an income-based repayment plan. Choose a plan that offers loan forgiveness. Just remember, every year, you’ll be required to recertify the plan until you’re eventually eligible for loan forgiveness.

If you have a public service job like police officers and teachers, you could be eligible for loan forgiveness within ten years. Here are step-by-step instructions on how to consolidate federal student loans on your own.

Need help with federal student loans?

If you’d prefer not to deal with your federal student loans on your own, contact Golden Financial Services or start filling out our student loan relief application online.

Keep in mind, Biden has passed automatic forbearance for federal student loans. This relief will end as of September 2021. If you’re past due on payments, your wages can get garnished after September 2021, so make sure to at least request deferment or additional forbearance by this date.

Kentucky Private Student Loan Relief Programs

Private student loans can be included in Kentucky debt relief programs offered at Golden Financial Services.

What is Kentucky debt consolidation?

Kentucky Debt Consolidation Loans can be used to pay off any debt.

The idea is to give you a low-interest debt consolidation loan. Kentucky laws require banks to abide by strict lending policies, meaning they can’t charge you an arm and a leg on your consolidation loan. The banks must give you a fair interest rate and not overcharge you in fees.

Unfortunately, the banks don’t always abide by the laws. And often, consumers cant get approved for a low-interest debt consolidation loan due to poor credit scores. Bad credit debt consolidation Kentucky programs do exist, but not through the banks.

Talk to an IAPDA Certified Kentucky Debt Relief Specialist at 866-376-9846 Now.